Published on November 18th, 2020 by Nate Parsh

Snowflake Inc. (SNOW) held its initial public offering on September 16th, 2020. Since then, the company has been on a rollercoaster. The stock’s IPO price was $120, but it quickly shot up to $245 after being made available to the general public.

Since then, shares have hit a bottom of $208.55 and topped out at $319. Currently, the share sit just below where they finished their first day of trading. The stock already has a market cap above $70 billion, making it a large-cap stock.

We have compiled a list of over 400 large-cap stocks in the S&P 500 Index, with market caps of $10 billion or more. You can download your free copy of the large-cap stocks list, along with relevant financial metrics like price-to-earnings ratios and dividend yields, by clicking on the link below:

Snowflake, like many young technology companies, is spending heavily to grow its business. Analysts don’t expect the company to produce positive earnings-per-share for several years. Companies without positive earnings can’t afford to distribute dividends to shareholders.

That doesn’t mean that Snowflake will never pay a dividend. Technology giants Apple Inc. (AAPL) and Microsoft Corporation (MSFT) didn’t pay a dividend for many years as they were also focused on increasing the size and scale of their business.

But after many years of steady earnings and free cash flow growth, these companies found themselves secure enough financially to return cash to shareholders with a dividend. This article will examine Snowflake to determine if the stock might one day distribute dividends to shareholders.

Business Overview

Snowflake, originally known as Snowflake Computing, provides a cloud-based platform to customers. The company allows customers to centralize data in a single source, build data-driven applications and share data. Snowflake employees more than 2,000 people and has both domestic and international operations.

Snowflake is trusted and used by more than 3,000 small, medium, and large customers around the world.

Source: Investor Presentation

Snowflake’s customers include companies in the healthcare industry like McKesson Corporation (MCK), tech companies like Adobe Inc. (ADBE) and financial services companies like Capital One Financial Corporation (COF).

According to the company, Snowflake’s platform has been a boon to its customers as they average a 612% return on investment over a three-year period. Snowflake has more than 250 petabytes, or 250 million gigabytes, of data under management. 515 million data workloads run each day on the company’s platform.

Growth Prospects

The potential for Snowflake’s growth is immense, as the demand for cloud computing has just begun to scratch the surface. It is estimated that the global cloud computing market size is $371 billion currently. That figure is expected to grow at a compound annual growth rate of 17.5% over the next five years. This is a massive increase that is starting from an already sizeable amount.

The COVID-19 pandemic has likely accelerated the transition to cloud computing for many companies are finding that it easier and cheaper to give employees cloud access, than it is to keep and maintain a physical work location.

Therefore, it is even possible that the CAGR listed above might be underestimating the potential growth for cloud computing. If so, then the market for cloud-based platforms is even bigger, which offers leaders in this space an even bigger opportunity for growth.

Competitive Advantages

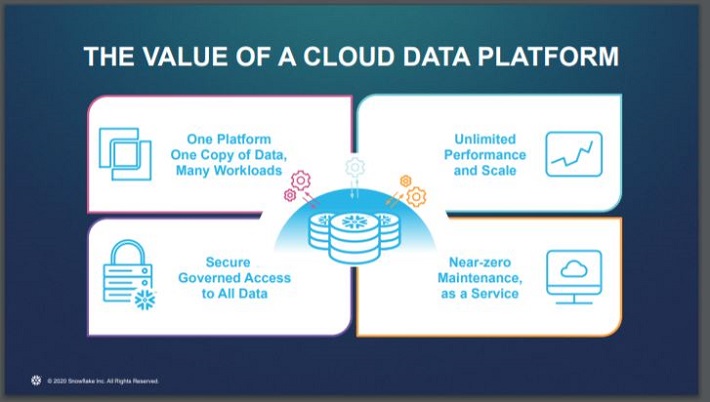

The size of this market places Snowflake in the enviable position of being able to provide customers a one-stop shop for their cloud computing needs.

Source: Investor Presentation

Snowflake allows customers to place all of their work data in one secured location. The platform can be scaled to any size business in any industry. This is why there is such a wide variety of industries use the company’s cloud platform.

The ability to appeal to customers of various sizes and in different industries doesn’t limit Snowflake’s potential customer base. If anything, this makes it likely that the company will win new business at a higher rate than peers because it can adapt its platform to meet the needs of customers in any industry.

In addition, Snowflake is compatible with Amazon Web Services, Azure and Google Cloud. These platforms are already widely used and trusted by customers.

Will Snowflake Ever Pay a Dividend?

Companies that are able to pay and raise dividends are those that have proven to generate consistent earnings-per-share and free cash flow. Shareholders expect companies that pay dividends to continue paying a regular dividend. Most even expect the dividend to grow on a regular basis.

Companies with inconsistent earnings or significant capital investments are those most likely to experience a dividend cut. It often takes companies multiple years of growing earnings and increasing cash flows before they feel comfortable enough to initiate a dividend payment.

As previously mentioned, Snowflake is projected to lose money this year. In all likelihood, the company will lose money for at least a few more years as it invests to build out its platform and grow its business. Over the last twelve months, the company had free cash flow of a negative $137.8 million. In 2019, free cash flow was a negative $199.4 million. Clearly, Snowflake has a high cash burn rate as it looks to grow its business. This is not unusual for tech companies, as it takes time and investment to scale higher.

The stock is also incredibly expensive. Currently, it trades with a price-to-sales ratio of almost 129. This is high even for high growth stocks. Investors in the company clearly own shares for the potential capital appreciation.

This doesn’t mean that investors interested in the company should avoid the name altogether. There are many large cap technology stocks, such as Alphabet (GOOGL), Netflix (NFLX), and Amazon (AMZN) that do not pay a dividend, but have generated excellent returns. These companies also produce an abundance of cash flow and still do not distribute dividends. Snowflake, which has negative free cash flow, is even less likely to pay a dividend any time soon.

Final Thoughts

Snowflake has only been a publicly traded company for a short time, but the stock has quickly become a favorite of investors seeking growth. The company is not yet profitable as it is in the infancy and needs all available capital (and then some) to increase the size of its business.

With negative free cash flow and a projected loss for at least this year, Snowflake is not in a position to even consider paying a dividend. It will be many more years before the company is in a secure enough financial position to start considering paying a dividend.