Published on December 22nd, 2020 by Aristofanis Papadatos

NIO Limited (NIO), the Chinese manufacturer of electric vehicles, has undoubtedly attracted the focus of investors this year. Despite the impact of the pandemic on the automotive industry, NIO stock has rallied more than 1200% this year, from $3.72 to $49 a share. The impressive rally has resulted from the enthusiasm of investors about the growth potential of the company, which is in the very early stages of a multi-year growth trajectory.

The huge increase in NIO’s share price has lifted its market capitalization to over $70 billion. It is now a large-cap stock, many of which pay dividends to shareholders.

We have compiled a list of over 400 large-cap stocks in the S&P 500 Index, with market caps of $10 billion or more.

You can download your free copy of the large-cap stocks list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Income investors may have missed NIO’s 2020 rally, as the company does not pay a dividend. The absence of a dividend is fairly common among growth stocks, particularly in the early phases of their growth.

Income investors who are attracted by the impressive return potential of NIO probably wonder whether the company will pay a dividend anytime soon. This article will examine NIO’s business model, growth prospects, and competitive advantages in an attempt to answer that question.

Business Overview

NIO manufactures and sells electric vehicles in China, Hong Kong, the U.S., the U.K., and Germany. It is also involved in energy and service packages, such as battery packs and components.

The cost of production of electric vehicles has significantly decreased in recent years. In addition, manufacturers have managed to greatly improve the autonomy of these vehicles thanks to technological improvements in batteries. As a result, the electric vehicle business has become a high-growth industry.

NIO benefits not only from the high growth rate of the electric vehicles, but also from the immense growth potential of the Chinese market. The Chinese economy has grown by more than 6% per year for more than a decade. In addition, it has recovered strongly from the pandemic thanks to its drastic measures which contained the pandemic much more efficiently than many other countries that are still struggling against the pandemic. Moreover, NIO is in the very early phases of the expansion of its business.

In the third quarter, NIO delivered 12,206 vehicles and thus grew the number of vehicles sold by 154% over the prior year’s quarter and by 18.1% over the previous quarter. Its ES6 model has been the fastest selling electric SUV in China for 13 consecutive months.

Moreover, the ES8 model, which has a price above $60,000, has reached the number one position in the category of premium electric SUVs.

Thanks to the strong growth in its sales, NIO improved from a gross loss of $30.2 million in the prior year’s quarter to a gross profit of $87.9 million, which corresponds to a gross margin of 12.9%. Nevertheless, NIO is still far from becoming profitable, as it posted a net loss of $154.2 million. On the bright side, its net loss decreased 58.5% over last year’s quarter, thus signaling that NIO could become profitable if it continues growing sales at its recent pace.

NIO has provided positive guidance for the fourth quarter, expecting the strong business momentum to remain in place. The company expects to deliver 16,500-17,00 vehicles in the fourth quarter. If it meets its guidance, it will more than double its sales over the prior year’s quarter and will achieve 35%-39% growth over the third quarter. It is evident that there are no signs of slowing down on the horizon for NIO.

Growth Prospects

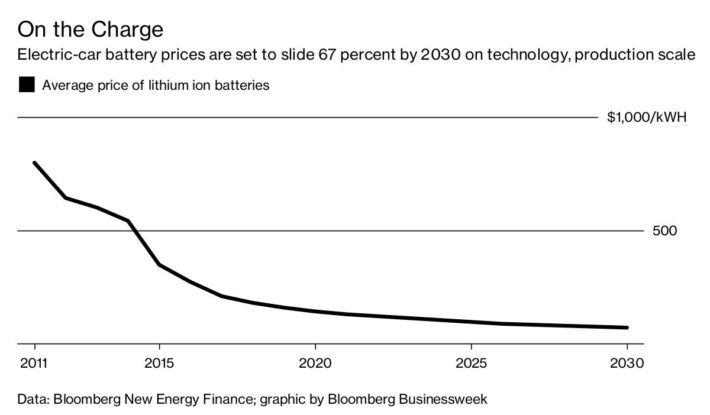

The production cost of electric vehicles has greatly decreased in recent years, thanks to the sustained decrease in the cost of batteries, which comprises approximately one-third of the total production cost.

Source: Bloomberg

In addition, the autonomy of these vehicles has remarkably improved in recent years.

Given also that consumers are attracted by the minimal operating cost of electric vehicles, with no need for gasoline or diesel, the electric vehicle industry has become a high-growth industry.

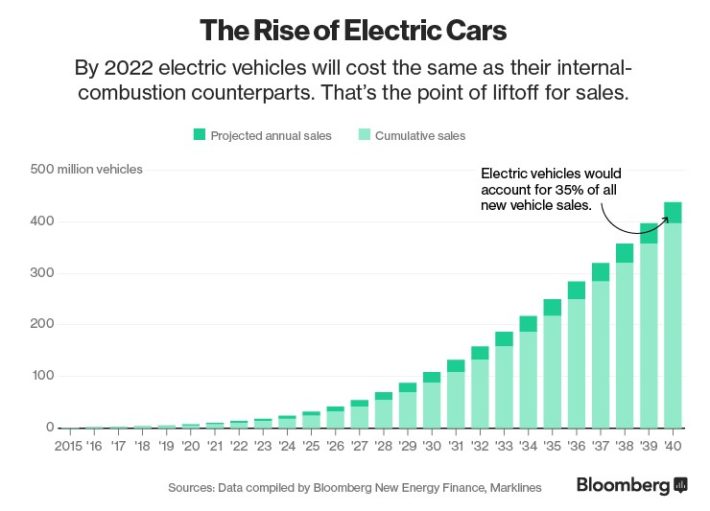

Source: Bloomberg New Energy Finance

As the above chart shows, the electric vehicle industry is only in the very early stages of its growth trajectory. It is likely to continue growing at a fast pace for decades and the sales of electric cars are likely to comprise 35% of all the new vehicles sales in 20 years from now.

NIO is doing its best to enhance its production capacity in order to meet the growing demand for its vehicles. The company expects to boost its production capacity from 5,000 units in September to about 7,500 units by January-2021.

NIO is on track to more than double its revenue this year, from $1.1 billion in 2019 to $2.4 billion this year. Even better, the company has ample room to keep growing its revenue at a breathtaking pace for many more years. Analysts agree on this view, as they expect NIO to triple its revenue over the next two years, from $2.4 billion to $7.2 billion in 2022.

Competitive Advantages

NIO has a gross margin of 13%, which is much lower than the gross margin of the largest player in the industry, Tesla (TSLA), which has a gross margin of 24%. Tesla’s significantly higher margin can be attributed to the economies of scale that result from its much higher sales as well as regulatory credits. Therefore, NIO does not seem to have a meaningful competitive advantage over Tesla.

Moreover, investors should keep in mind that the automotive industry is characterized by intense competition. Auto manufacturers have to spend hefty amounts on capital expenses year after year in order to come up with new models to remain relevant. Otherwise, they risk losing market share to competitors who launch new models.

Overall, the electric vehicle industry is much more appealing than the conventional auto industry thanks to its high growth. But investors should remember that the auto industry, whether electric or conventional, is characterized by cut-throat competition, with narrow profit margins.

Will NIO Ever Pay A Dividend?

In order to pay a dividend, companies need to generate positive free cash flows. In other words, their business should generate cash flows that exceed their capital expenses. Some popular stocks cannot pay dividends to their shareholders due to their negative free cash flows. For instance, Uber (UBER), Lyft (LYFT) and Netflix (NFLX) have not managed to generate positive free cash flows yet in order to pay dividends to shareholders.

NIO spends a significant portion of its revenues on R&D expenses in order to continuously improve the technology of its models and thus become more competitive compared to its peers. In the most recent quarter, NIO spent 13% of its revenue on R&D expenses.

NIO also spends a meaningful portion of its revenues on selling, general and administrative expenses. In the most recent quarter, NIO spent 16% of its revenue on these expenses. As a result, the company has not managed to make a profit yet while its free cash flows are negative. It is thus evident that there are no funds available for the initiation of a dividend.

Analysts expect ΝΙΟ to switch from a loss per share of -$0.56 this year to a marginal profit per share of $0.05 in 2022 and $0.20 in 2023. However, investors should not expect a dividend from NIO even when it becomes profitable, at least as long as the company remains in high-growth mode. The company is growing its business at such a high rate that it makes much more sense to invest in the business instead of initiating a dividend.

As NIO has several years of double-digit revenue growth ahead, it is not likely to initiate a dividend anytime soon. Instead, its management is likely to remain focused on enhancing the capacity in order to meet the fast-rising demand for its vehicles. Moreover, as there is heating competition from the other auto manufacturers, NIO will continue reinvesting in its business in order to improve its vehicles and remain competitive. Therefore, its shareholders should not expect a dividend anytime soon.

High-growth companies do not offer a dividend for another reason as well. Their stocks usually enjoy such a rich valuation that a dividend is meaningless for the shareholders. To provide a perspective, NIO is currently trading at 240 times its expected earnings in 2023. Therefore, even if the company distributes 50% of its future earnings in the form of dividends, it will offer just a 0.2% dividend yield. Such a yield will be negligible for its shareholders and as a result, there is little incentive for the company to initiate a dividend.

Final Thoughts

To sum it up, NIO is in the very early stages of its growth trajectory, with promising growth prospects ahead thanks to the impressive momentum in the sales of electric vehicles. As a result, the company will continue investing heavily in its business in order to expand its capacity, improve the technology in its vehicles, and remain as competitive as possible in its markets. As a result, NIO is not likely to initiate a dividend for the next several years.