Lyft, Inc. (LYFT) made its widely-expected initial public offering, or IPO, in March-2019 at a price of $72. Since then, the stock has plunged 47% and has disappointed its investors due to its dramatic under-performance compared to the broad market.

Approximately half of the decline of the stock price has occurred due to the coronavirus crisis but the stock underperformed the market even before the pandemic, primarily due to the exceptionally high growth expectations that prevailed during the IPO process.

However, the company is only in the very early phases of a multi-year growth trajectory and is growing its revenues at a high rate. And it still has promising growth prospects up ahead. Nevertheless, it is natural for income-oriented investors to wonder whether Lyft will ever pay a dividend.

Lyft does not currently pay a dividend, which is fairly common among growth stocks, particularly those in the technology sector. Income investors are much more likely to consider high-quality dividend growth stocks such as the Dividend Aristocrats, a group of 65 stocks in the S&P 500 with 25+ years of dividend increases.

You can download an Excel spreadsheet of all 65 (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

Investors interested in buying shares of Lyft may also be interested to know whether the company will pay a dividend anytime soon. While there is always a chance a company could initiate a dividend down the road, Lyft still has a long way to go on its journey before a dividend is a real possibility.

Business Overview

Lyft operates a marketplace for on-demand ride-sharing in the U.S. and Canada. The company was founded in 2012. Today, it has over 20 million riders and 2 million drivers.

Lyft benefits from a strong secular trend, which supports its business model. The world is at the very early stages of shifting away from car ownership towards transportation-as-a-service. About 35% of Lyft users do not own a car. The company also estimates that about 300,000 people have got rid of their cars because of Lyft.

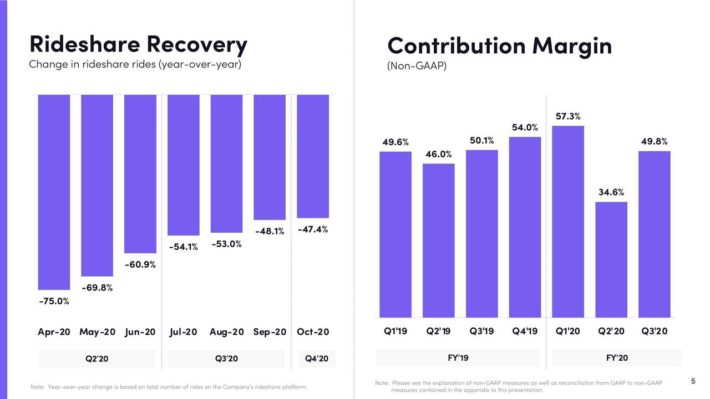

However, Lyft is currently facing a severe downturn due to the coronavirus crisis. In early November, Lyft reported financial results for the third quarter of the year. The company grew its revenues by 47% sequentially, primarily thanks to 44% growth in the number of active riders.

Source: Investor Presentation

The improved performance vs. the previous quarter resulted from the reopening of the economy and the gradual return of people towards their normal daily habits.

The positive trend in the recovery is evident if one looks at the revenue of the company on a monthly basis. At the peak of the lockdowns, in April, revenue plunged 75% over last year’s quarter but it then recovered to -70% in May, -61% in June, -54% in July and -47% in October.

Source: Investor Presentation

Unfortunately, revenue is still 48% lower than it was in the prior year’s quarter. It is thus evident that Lyft still has a long way to go to recover from the pandemic, which has forced people to stay at home more than ever.

It is also remarkable that Lyft has greatly underperformed its major competitor, Uber, during the pandemic. The revenue of Uber has recovered to just 10% lower than last year’s level whereas the revenue of Lyft is still approximately half of last year’s level.

The key reason behind this striking difference is the focus of Uber on the delivery service, which has greatly benefited from the pandemic. People now spend much more time at home and thus they order food much more often than they did before the pandemic.

Uber has taken advantage of this trend to a great extent whereas Lyft has pronouncedly lagged its competitor in this respect. This helps explain the recovery of the stock price of Uber to its pre-COVID level whereas the stock of Lyft is still 30% lower than its pre-COVID level.

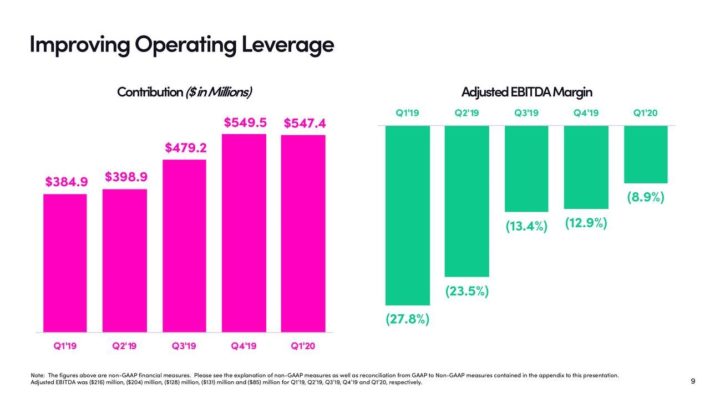

Moreover, Lyft seems to be far from making a profit anytime soon. It has posted material losses in every single quarter in recent years. In fact, it has incurred significant EBITDA losses and operating losses in every single quarter.

Source: Investor Presentation

In other words, Lyft has been a loss-making company even if its depreciation, interest expense and taxes are excluded from the picture. Management has stated that it expects to achieve positive adjusted EBITDA for the first time in the fourth quarter of 2021.

However, there is high uncertainty in this forecast due to the ongoing second wave of the pandemic and its impact on Lyft. In addition, it could be a red flag when management focuses on EBITDA instead of earnings. Some investors avoid stocks whose management focuses on EBITDA instead of earnings, as such a stance usually reveals that the business model is far from becoming profitable.

On the bright side, the consumer transportation market is a $1.2 trillion market, with over $1.0 trillion spent on car ownership. Given the strong momentum of Lyft in terms of its number of riders and drivers, it is evident that the company has high revenue growth potential.

On the other hand, no one can predict when the company will manage to make a meaningful net profit. Lyft management has not provided any guidance in this respect.

Lyft spent 26% of its revenues on R&D expenses in the third quarter. It thus improved this metric from the 39% spent in the adverse second quarter but still the company spends a great portion of its revenues on R&D expenses, which are required for the expansion of the company. Moreover, the company spent 14% of its revenues on sales and marketing expenses.

It is thus evident that Lyft needs to spend a large amount to grow its business. As long as R&D and marketing expenses remain elevated, cash flow will suffer, and hence it will likely prevent Lyft from paying a dividend for the foreseeable future. We expect the company to keep posting negative free cash flows in the upcoming years.

Even if Lyft achieves positive free cash flows in a few years, it will almost certainly prefer to reinvest its excess cash, given that its business will remain in high-growth mode for several more years. When a company expands its revenue base at such a fast rate, a dividend is typically the last thing that management has in mind.

Will Lyft Ever Pay A Dividend?

Until Lyft becomes profitable, investors should not expect a dividend from the company. Even when the company becomes profitable, investors should not expect a dividend right away. As Lyft is still a high-growth company, its stock will be trading at excessive price-to-earnings ratios when it does become profitable.

Consequently, even if the company considers distributing a portion of its earnings in dividends, those dividends will be negligible for the shareholders. For instance, if Lyft trades at a price-to-earnings ratio of 50 and decides to distribute 25% of its earnings in the form of dividends, it will offer a ~0.5% dividend yield to its shareholders. Such a yield will be negligible for the shareholders of a high-growth stock.

Moreover, a dividend is a long-term commitment. Once a company initiates a dividend, its shareholders expect to receive a regular dividend each quarter. In fact, they expect to receive a growing dividend year after year. Therefore, a company needs to achieve reliable earnings for many years before it initiates a dividend. As Lyft is very far from posting consistent profits for years, investors should realize that the company is very far from initiating a dividend.

As dividends are paramount for income-oriented investors, most investors in this category will likely avoid the stock. However, the rest of investors should not dismiss the stock solely for the absence of a dividend. When a business has tremendous growth potential, management should focus exclusively on investing in the business in the best possible way and not be distracted with a meaningless dividend.

There are many examples of companies that have rewarded their shareholders with exceptional returns even though they have never paid a dividend. Just to name a few, Amazon (AMZN), Alphabet (GOOG) and Netflix (NFLX) have offered life-changing returns without paying a dividend to their shareholders.

Of course, Lyft still has a long way to go to produce impressive returns, as the company is not likely to achieve positive free cash flows anytime soon. This separates Lyft from other free cash flow positive tech giants such as Amazon and Alphabet, neither of which pay a dividend.

Final Thoughts

Lyft is growing its revenue at a tremendous pace and has exciting growth potential ahead. The pandemic has temporarily disrupted the growth trajectory of Lyft this year but the pandemic is likely to subside at some point next year. As a result, Lyft will return to growth mode next year.

However, the company has a long way to go to achieve a meaningful profit, let alone consistent profits for years. Even if it achieves earnings for some years, it will probably need to continue investing hefty amounts in its business in order to keep growing.

Moreover, its stock will probably be trading at a high price-to-earnings ratio and thus it may not be able to offer a meaningful dividend yield to its shareholders. As a result, Lyft is not likely to offer a dividend for the next several years at least.

On the bright side, the stock of Lyft is approximately half of the IPO price due to the pandemic and the company has ample room for future growth. Therefore, the investors who are confident that the pandemic will subside next year have good chances of being highly rewarded if they purchase Lyft around its current suppressed price.