Updated on November 11th, 2019 by Bob Ciura

Income investors might be reluctant to even consider buying shares of a company that does not pay a dividend. Of the 505 stocks in the S&P 500 Index, nearly 90 do not currently pay dividends to shareholders.

You can see the entire list of S&P 500 stocks here.

On the other hand, capital allocation decisions are not written in stone. Companies that do not currently pay a dividend could initiate a dividend at some point in the future, if the underlying fundamentals support a payout to shareholders and management is willing to do so.

We believe that even though tech giant Facebook Inc. (FB) does not offer a dividend today, it could begin a dividend in time.

Business Overview

Facebook is a social media giant, with a market capitalization of $540 billion. Facebook is the unquestioned leader in social media. At the end of the most recent quarter, Facebook had 1.62 billion active daily users and 2.45 billion active monthly users.

Its family of offerings also includes Instagram, WhatsApp, and Messenger. Facebook estimates that more than 2.8 billion people use at least one of their services.

Facebook began as many startups do, with rising revenue but a lack of profitability. However, all that changed when the company effectively monetized its massive user base. Facebook and its various properties represent massive advertising platforms.

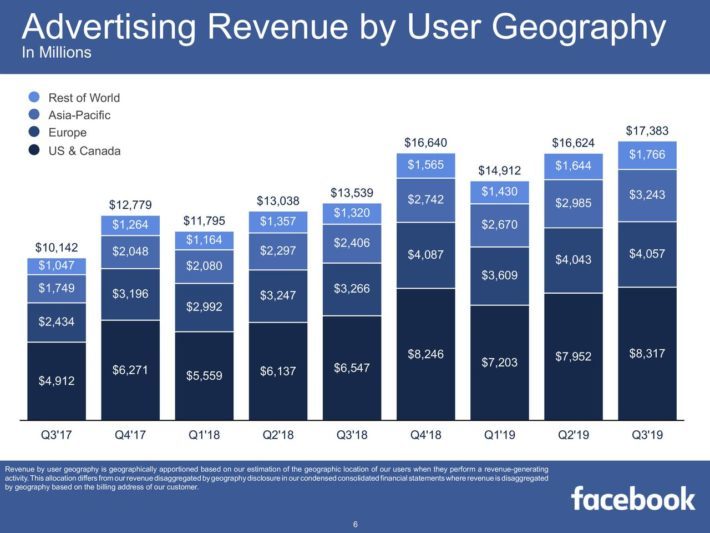

And, given the amount of time users spend on the site, Facebook is simply a gold mine for advertising potential. Mobile advertising revenue represents approximately 94% of total advertising revenue.

Source: Earnings Presentation

The result is that Facebook is now enormously profitable. Last year was an incredible one for the company. Revenue increased 38% in 2018, to over $55 billion. Diluted earnings-per-share increased 40%, to $7.57. Total costs and expenses increased 51% in 2018, outpacing revenue growth for the year. While this caused operating margin to contract by five full percentage points, Facebook made up for this with a huge drop in its effective tax rate from 23% to 13% last year.

Facebook’s strong growth has continued in 2019. On October 30th, 2019 Facebook released excellent third-quarter results. For the quarter, total revenue came in at $17.6 billion, a 29% year-over-year increase compared to the $13.7 billion posted in the same quarter last year. Net income totaled $6.09 billion ($2.12 per share), compared to $5.14 billion ($1.76 per share), representing increases of 19% and 20% respectively, aided by a lower share count.

For the first nine months of 2019, Facebook generated $49.6 billion in revenue, up 27% from the same nine-month period in 2018. Net income of $11.1 billion fell 27%, however, due to a $5 billion FTC charge. Cash, equivalents and marketable securities totaled $52.3 billion at the end of the quarter (up from $48.6 billion in Q1).

Growth Prospects

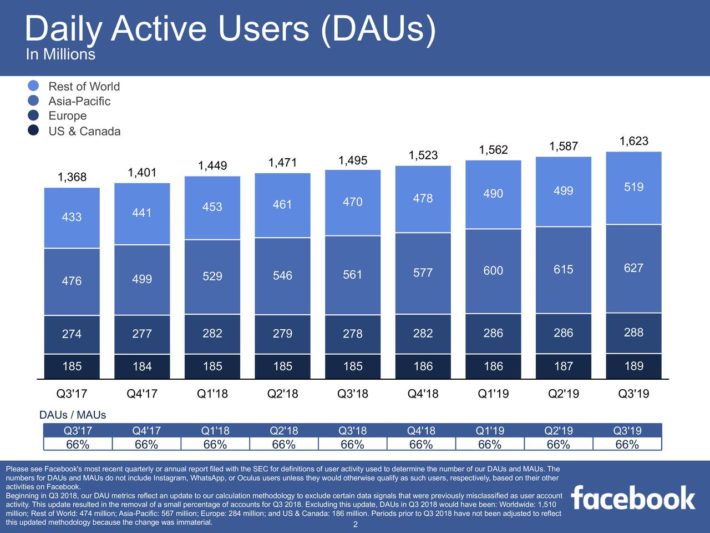

Facebook’s growth potential remains highly attractive. While the company is nearing saturation in the U.S.—daily active users increased just 1% in the U.S. last quarter–overall the Facebook community continues to grow.

Source: Earnings Presentation

Daily active users were 1.62 billion on average at the end of the first quarter, an increase of 8.6% year-over-year.

At the same time, billions of people around the world still do not use Facebook or one of its other platforms, leaving a massive global growth opportunity for the company in the years ahead.

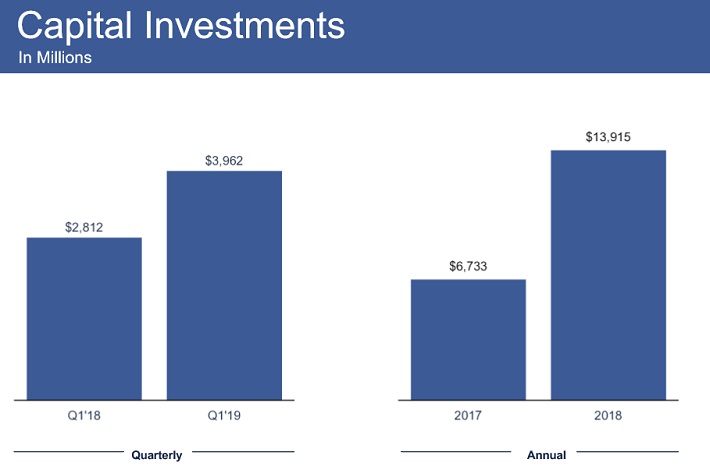

To be sure, Facebook will have to dedicate a huge amount of financial resources to obtain this growth. Indeed, capital investments more than doubled in 2018, to nearly $14 billion.

Source: Earnings Presentation

Facebook’s growth potential is amplified by the company’s massive competitive advantages. Specifically, it has come to dominate social media. Consumers simply love social media and appear to be unwilling to do without it (evidenced by the number of daily active users who use Facebook every day and every month).

It is very difficult for another social media brand to enter the space and successfully take users away from Facebook, or its other valuable properties such as Instagram.

In addition, Facebook is investing in a number of new avenues for future growth, in tech devices such as Oculus. Virtual reality and artificial intelligence are exciting areas of potential growth for the tech industry, and Facebook is poised to be at the forefront of these new technologies.

Why Facebook Could Pay A Dividend

There are good reasons for a company to announce a dividend. In addition to improving investor sentiment by rewarding loyal shareholders with dividend income, initiating a dividend payout opens up a new and large group of institutional investors who manage income-oriented funds. Income investors previously would not have invested in a non-dividend paying stock such as Facebook.

Facebook’s size and financial position certainly appear similar to many other stocks that do pay dividends. With a market capitalization above $500 billion, Facebook is a mega-cap stock.

Of the 26 mega-cap stocks (defined as companies with market capitalizations above $200 billion) just three do not pay dividends: Facebook, Alphabet (GOOG), and Amazon (AMZN).

Plus, Facebook’s fundamentals seem to support a dividend payment, as the company is highly profitable. Based on 2019 estimates, Facebook is expected to generate earnings-per-share of $8.50 for 2019. The company could theoretically announce a significant dividend, while still leaving plenty of cash flow for reinvestment into growth initiatives.

For example, if Facebook maintained a target payout ratio of 25% of annual EPS, the company could declare an annual dividend payout of ~$2.13 per share. This would represent a dividend yield of ~1.1% based on the current share price.

While this would still not quality Facebook as a high-yield stock, investors should not expect high yields from the technology sector.

Instead, Facebook could grow its dividend at a high rate each year, particularly with a starting payout ratio of just 25% and the company’s future EPS growth potential.

And, the argument for a dividend payout is augmented by the fact that cash continues to pile up on Facebook’s balance sheet. Cash, equivalents and marketable securities exceeded $52 billion at the end of the third quarter. At the same time, Facebook had total liabilities of $30 billion.

Facebook has a current ratio (which compares short-term assets to short-term liabilities) above 4x, which is very high. Furthermore, Facebook generated free cash flow of $15.8 billion over the first nine months of 2019, up 31% from the same nine-month period last year. Free cash flow can be used for a number of purposes, including but not limited to paying a dividend.

By virtually any measure, Facebook has massive financial resources and ample liquidity, certainly enough to distribute a portion of its cash flow to shareholders without jeopardizing its current financial position or future growth.

Final Thoughts

The typical reason a company chooses not to pay dividend to shareholders is that it simply does not have the financial strength to do so. Small companies in a high-growth stage, or cyclical companies with inconsistent profitability, need to preserve as much cash flow as possible.

However, Facebook has reached maturity and is clearly no longer in its start-up phase. It is a massive company and a cash flow machine. It has a fortress balance sheet with a huge amount of cash. Fundamentally, there is little reason for Facebook to not pay a dividend. It has plenty of cash for growth investment, and then some.

The tech industry was once a desert for dividend investors, but this has changed rapidly over the past decades. Tech giants such as Apple (AAPL) and Cisco (CSCO) have initiated dividend programs in the past 10 years, while others such as Microsoft (MSFT) and Texas Instruments (TXN) offer attractive yields and annual dividend increases.

Dividends have become much more commonplace in the technology sector in recent years. Facebook does not yet pay a dividend, but investors should not be surprised to see a dividend payout announced in the coming years.