Updated on October 31st, 2019 by Aristofanis Papadatos

Alibaba (BABA) has strongly rewarded its shareholders since its IPO, in 2014. Since then, the stock of the Chinese e-commerce giant has rallied 96% whereas the S&P 500 Index has advanced only 54%. It has generated these returns for shareholders purely with a rising share price, unlike many other technology stocks which provide returns through dividends.

We’ve compiled a list of all ~330 dividend-paying technology stocks complete with important investing metrics, which you can access below:

You can view a preview of our technology stocks spreadsheet below:

| AACAF | AAC Technologies Holdings, Inc. | 6.15 | 23.3 | 7,432.3 | 18.4 | 427.5 |

| AACAY | AAC Technologies Holdings, Inc. | 6.41 | 2.9 | 7,529.0 | 19.2 | 56.3 |

| AAPL | Apple, Inc. | 243.26 | 1.2 | 1,099,335.7 | 20.6 | 25.4 |

| ABT.TO | Absolute Software Corporation | 7.75 | 4.1 | 324.9 | 43.1 | 177.8 |

| ACKAY | Arçelik AS | 16.20 | 0.0 | 2,189.4 | 12.6 | 0.0 |

| ACN | Accenture Plc | 186.58 | 1.2 | 118,877.8 | 24.9 | 30.2 |

| ADI | Analog Devices, Inc. | 108.25 | 1.9 | 39,988.2 | 26.5 | 51.3 |

| ADTN | ADTRAN, Inc. | 9.58 | 2.8 | 458.2 | 117.1 | 330.1 |

| ADTTF | Advantest Corp. | 26.75 | 157.0 | 5,294.6 | 10.8 | 1,693.4 |

| AELTF | Adacel Technologies Ltd. | 0.30 | 0.0 | 25.2 | -12.1 | 0.0 |

| AEXAY | ATOS SE | 15.34 | 2.5 | 8,371.1 | 11.2 | 27.7 |

| ALMFF | Altium Ltd. | 22.04 | 1.1 | 2,886.5 | 54.3 | 59.9 |

| ALOT | AstroNova, Inc. | 15.70 | 1.8 | 110.7 | 17.1 | 30.6 |

| ALSWF | Absolute Software Corp. | 5.89 | 6.8 | 245.7 | 31.8 | 216.1 |

| ALTKY | Altran Technologies SA | 1.50 | 1.8 | 3,818.4 | 31.9 | 57.7 |

| AMADF | Amadeus IT Group SA | 74.70 | 1.6 | 32,193.0 | 27.2 | 42.8 |

| AMADY | Amadeus IT Group SA | 73.84 | 1.8 | 31,809.4 | 26.9 | 48.4 |

| AMAT | Applied Materials, Inc. | 55.21 | 1.9 | 51,000.5 | 18.2 | 33.9 |

| AMOT | Allied Motion Technologies, Inc. | 38.60 | 0.3 | 370.6 | 22.0 | 6.8 |

| AMSWA | American Software, Inc. | 16.31 | 3.4 | 511.6 | 77.2 | 260.2 |

| APELY | Alps Alpine Co., Ltd. | 40.56 | 0.0 | 4,180.4 | 25.5 | 0.0 |

| APH | Amphenol Corp. | 100.82 | 0.9 | 29,892.3 | 25.6 | 23.8 |

| ARLUF | Aristocrat Leisure Ltd. | 22.35 | 1.6 | 14,242.6 | 31.0 | 49.6 |

| ASMIY | ASM International NV | 102.96 | 1.0 | 4,760.5 | 17.8 | 18.6 |

| ASML | ASML Holding NV | 265.65 | 0.9 | 111,876.7 | 44.2 | 39.0 |

| ASMLF | ASML Holding NV | 262.15 | 1.2 | 110,402.7 | 43.6 | 52.4 |

| ASMVF | ASM Pacific Technology Ltd. | 14.05 | 19.2 | 5,708.3 | 45.0 | 865.7 |

| ASMVY | ASM Pacific Technology Ltd. | 42.26 | 2.4 | 5,723.2 | 45.2 | 110.4 |

| ASOZF | Asseco Poland SA | 12.68 | 24.2 | 1,052.4 | 11.8 | 285.8 |

| ASOZY | Asseco Poland SA | 11.65 | 6.9 | 967.0 | 10.8 | 75.2 |

| ASX | ASE Technology Holding Co., Ltd. | 5.10 | 3.2 | 10,669.6 | 20.3 | 64.5 |

| ATDRY | Auto Trader Group Plc | 1.78 | 1.2 | 6,578.3 | 25.9 | 30.5 |

| ATEYY | Advantest Corp. | 45.83 | 0.0 | 10,035.1 | 17.8 | 0.0 |

| ATVI | Activision Blizzard, Inc. | 55.87 | 0.7 | 42,853.7 | 25.3 | 16.8 |

| AUKUF | ams AG | 46.05 | 0.0 | 3,722.5 | 44.1 | 0.0 |

| AVEVF | AVEVA Group Plc | 54.30 | 0.8 | 8,750.3 | 200.9 | 159.1 |

| AVGO | Broadcom, Inc. | 290.24 | 3.7 | 115,129.8 | -72.4 | -264.3 |

| AVT | Avnet, Inc. | 39.60 | 2.0 | 3,998.1 | 31.7 | 64.9 |

| AVX | AVX Corp. | 15.40 | 3.7 | 2,604.0 | 11.2 | 41.9 |

| AYI | Acuity Brands, Inc. | 128.63 | 0.4 | 5,132.2 | 15.5 | 6.2 |

| BBOX | Black Box Corporation | 0.00 | 0.0 | 0.0 | ||

| BCNAF | Barco NV | 216.50 | 1.1 | 2,700.0 | 26.1 | 27.7 |

| BDC | Belden, Inc. | 51.13 | 0.4 | 2,324.0 | 12.6 | 4.9 |

| BELFA | Bel Fuse, Inc. | 13.09 | 1.8 | 161.2 | 9.2 | 16.8 |

| BELFB | Bel Fuse, Inc. | 15.18 | 1.8 | 187.0 | 9.3 | 17.1 |

| BKTI | BK Technologies Corp. | 3.61 | 1.7 | 45.9 | -20.5 | -34.0 |

| BLKB | Blackbaud, Inc. | 86.25 | 0.7 | 4,280.5 | 205.8 | 141.9 |

| BMI | Badger Meter, Inc. | 58.63 | 1.1 | 1,706.8 | 36.9 | 39.0 |

| BRKS | Brooks Automation, Inc. | 43.02 | 0.9 | 3,133.8 | 86.7 | 79.9 |

| BVILF | Breville Group Ltd. | 11.50 | 2.3 | 1,499.4 | 30.9 | 71.2 |

| BVILY | Breville Group Ltd. | 18.05 | 2.8 | 1,176.7 | 24.3 | 68.9 |

| BYDIF | BYD Electronic (International) Co., Ltd. | 1.66 | 13.4 | 3,740.3 | 15.7 | 209.7 |

| CA | CA, Inc. | 0.00 | 0.0 | 0.0 | ||

| CBLNY | Mersen SA | 6.42 | 3.3 | 661.6 | 9.4 | 31.4 |

| CCMP | Cabot Microelectronics Corp. | 151.69 | 1.1 | 4,453.3 | 38.2 | 41.4 |

| CCOEF | Capcom Co., Ltd. | 25.75 | 213.6 | 2,748.8 | 19.4 | 4,152.5 |

| CCUR | CCUR Holdings, Inc. | 3.60 | 0.0 | 32.1 | 44.3 | 0.0 |

| CDK | CDK Global, Inc. | 50.09 | 1.2 | 6,081.2 | 53.9 | 64.6 |

| CDW | CDW Corp. | 131.65 | 0.9 | 18,433.8 | 28.2 | 26.1 |

| CGEMY | Capgemini SE | 22.55 | 1.7 | 18,925.8 | 20.4 | 34.6 |

| CGNX | Cognex Corp. | 51.97 | 0.5 | 8,869.3 | 52.7 | 25.8 |

| CIOXF | Cielo SA | 8.77 | 9.4 | 23,797.9 | 36.8 | 344.5 |

| CIOXY | Cielo SA | 1.84 | 9.6 | 5,047.2 | 7.7 | 74.5 |

| CLRO | ClearOne, Inc. | 1.52 | 0.0 | 25.3 | -0.9 | 0.0 |

| CMG.TO | Computer Modelling Group Ltd. | 6.94 | 5.7 | 572.9 | 23.1 | 131.4 |

| CMI.V | C-Com Satellite Systems Inc. | 1.63 | 3.1 | 61.7 | 41.8 | 130.8 |

| CMPVF | CompuGroup Medical SE | 78.15 | 0.6 | 3,845.4 | 41.2 | 26.4 |

| CMSQF | Computershare Ltd. | 10.85 | 2.9 | 5,873.9 | 14.2 | 41.1 |

| CMTL | Comtech Telecommunications Corp. | 34.58 | 1.2 | 839.2 | 33.3 | 38.6 |

| CNSWF | Constellation Software, Inc. | 1,004.19 | 5.6 | 21,088.2 | 52.6 | 296.0 |

| COHU | Cohu, Inc. | 16.47 | 1.5 | 676.9 | -7.3 | -10.6 |

| CPSI | Computer Programs & Systems, Inc. | 23.41 | 1.7 | 336.1 | 17.9 | 30.6 |

| CRWRY | 0.00 | 0.0 | 0.0 | |||

| CSCO | Cisco Systems, Inc. | 47.56 | 2.9 | 201,836.6 | 18.1 | 52.5 |

| CSGS | CSG Systems International, Inc. | 52.22 | 1.7 | 1,723.7 | 22.3 | 37.4 |

| CSIOF | Casio Computer Co., Ltd. | 1.00 | 2,500.0 | 243.3 | 1.2 | 3,077.7 |

| CSPI | CSP, Inc. | 13.16 | 4.6 | 54.7 | -40.1 | -182.6 |

| CSSXF | China Singyes Solar Technologies Holdings Ltd. | 0.10 | 0.0 | 83.4 | -0.4 | 0.0 |

| CSU.TO | Constellation Software Inc. | 1,281.98 | 0.4 | 27,738.0 | 67.2 | 28.2 |

| CSVI | Computer Services, Inc. | 44.76 | 2.9 | 1,244.0 | 26.2 | 77.0 |

| CSXXY | carsales.com Ltd. | 20.88 | 3.0 | 2,559.3 | 42.2 | 127.6 |

| CSYJF | CSE Global Ltd. | 0.33 | 8.3 | 167.4 | 11.3 | 94.2 |

| CSYJY | CSE Global Ltd. | 3.37 | 5.9 | 171.2 | 11.5 | 68.4 |

| CTS | CTS Corp. | 27.63 | 0.6 | 900.8 | 20.8 | 12.0 |

| CY | Cypress Semiconductor Corp. | 23.29 | 1.9 | 8,601.3 | 29.4 | 55.5 |

| DAKT | Daktronics, Inc. | 7.15 | 3.4 | 321.4 | 206.1 | 691.6 |

| DASTF | Dassault Systèmes SA | 151.25 | 0.4 | 39,144.0 | 55.7 | 23.9 |

| DASTY | Dassault Systèmes SA | 151.49 | 0.5 | 39,431.3 | 57.5 | 27.6 |

| DBD | Diebold Nixdorf, Inc. | 6.92 | 0.0 | 531.1 | -1.5 | 0.0 |

| DCHIY | Digital China Holdings Ltd. | 2.68 | 1.5 | 895.6 | 570.2 | 840.4 |

| DNACF | DeNA Co., Ltd. | 16.87 | 237.1 | 2,453.0 | 27.2 | 6,458.9 |

| DOX | Amdocs Ltd. | 65.25 | 1.7 | 8,940.1 | 22.5 | 37.7 |

| DXC | DXC Technology Co. | 27.69 | 3.6 | 7,253.7 | 6.5 | 23.8 |

| EBIX | Ebix, Inc. | 43.40 | 0.7 | 1,323.2 | 14.5 | 10.0 |

| EGHSF | Enghouse Systems Ltd. | 28.04 | 2.1 | 1,534.2 | 30.8 | 65.9 |

| ELUXF | Electrolux AB | 24.00 | 35.4 | 6,897.5 | 18.2 | 643.7 |

| ELUXY | Electrolux AB | 52.67 | 3.4 | 7,493.9 | 17.5 | 59.4 |

| ENGH.TO | Enghouse Systems Limited | 37.93 | 1.2 | 2,076.0 | 31.6 | 36.7 |

| ENR | Energizer Holdings, Inc. | 43.35 | 2.8 | 2,986.9 | 373.7 | 1,034.5 |

| ENS | EnerSys | 67.90 | 1.0 | 2,884.5 | 17.7 | 18.2 |

| ERIC | Telefonaktiebolaget LM Ericsson | 8.75 | 1.2 | 26,725.1 | 1,944.4 | 2,392.3 |

| ERIXF | Telefonaktiebolaget LM Ericsson | 8.69 | 0.0 | 28,755.9 | -30.5 | 0.0 |

| ESE | ESCO Technologies, Inc. | 83.18 | 0.4 | 2,161.1 | 25.5 | 9.8 |

| ESP | Espey Manufacturing & Electronics Corp. | 22.50 | 4.4 | 54.0 | 22.9 | 101.6 |

| ET.TO | Evertz Technologies Limited | 17.99 | 4.0 | 1,378.0 | 18.7 | 75.7 |

| EUTLF | Eutelsat Communications SA | 19.69 | 12.9 | 4,576.9 | 11.8 | 152.2 |

| EVSBY | EVS Broadcast Equipment S.A. | 0.00 | 0.0 | 0.0 | ||

| EVTC | EVERTEC, Inc. | 31.88 | 0.8 | 2,321.9 | 23.8 | 18.5 |

| EVTZF | Evertz Technologies Ltd. | 12.03 | 13.5 | 924.3 | 16.5 | 222.6 |

| FDGRY | 0.00 | 0.0 | 0.0 | |||

| FDRVF | First Derivatives Plc | 28.90 | 0.9 | 771.3 | 43.2 | 40.3 |

| FELTF | Fuji Electric Co., Ltd. | 39.80 | 100.5 | 5,685.2 | 16.8 | 1,689.5 |

| FICO | Fair Isaac Corp. | 302.24 | 0.0 | 8,733.8 | 46.6 | 0.0 |

| FJTSF | Fujitsu Ltd. | 85.40 | 281.0 | 17,309.4 | 21.3 | 5,999.7 |

| FLIR | FLIR Systems, Inc. | 55.01 | 1.2 | 7,459.7 | 26.9 | 32.8 |

| FORTY | Formula Systems (1985) Ltd. | 67.50 | 1.3 | 1,032.4 | 27.6 | 35.2 |

| FSOYF | F-Secure Oyj | 3.18 | 0.0 | 501.8 | 138.9 | 0.0 |

| FTV | Fortive Corp. | 69.42 | 0.4 | 23,311.5 | 9.0 | 3.6 |

| FUWAF | Furukawa Electric Co., Ltd. | 27.60 | 5.6 | 1,963.0 | ||

| FUWAY | Furukawa Electric Co., Ltd. | 14.06 | 0.0 | 1,982.1 | 7.9 | 0.0 |

| GLW | Corning, Inc. | 30.39 | 3.2 | 23,730.5 | 21.2 | 68.2 |

| GREZF | GREE, Inc. | 4.10 | 243.9 | 943.9 | 43.8 | 10,672.4 |

| GRMN | Garmin Ltd. | 96.35 | 3.5 | 18,316.3 | 24.6 | 85.4 |

| GSB | GlobalSCAPE, Inc. | 9.78 | 5.4 | 169.8 | ||

| GTOFF | Gemalto Holding BV | 56.40 | 0.0 | 5,116.6 | 72.0 | 0.0 |

| GTOMY | Gemalto Holding BV | 28.11 | 0.0 | 5,100.2 | 71.8 | 0.0 |

| GYUAF | GS Yuasa Corp. | 20.55 | 413.6 | 1,667.3 | 13.9 | 5,735.5 |

| HIMX | Himax Technologies, Inc. | 2.36 | 0.0 | 411.4 | 214.1 | 0.0 |

| HNHPF | Hon Hai Precision Industry Co., Ltd. | 5.22 | 4.9 | 72,357.1 | 9.0 | 43.7 |

| HOCPF | HOYA Corp. | 84.50 | 53.3 | 31,858.1 | 27.7 | 1,474.6 |

| HPE | Hewlett-Packard Enterprise Co. | 16.31 | 3.5 | 21,294.3 | -157.3 | -549.7 |

| HPHTF | Hamamatsu Photonics KK | 39.45 | 101.4 | 6,106.8 | 32.7 | 3,317.3 |

| HPQ | HP, Inc. | 17.62 | 3.6 | 26,111.3 | 6.4 | 23.4 |

| HPS.A.TO | Hammond Power Solutions Inc. | 7.87 | 3.5 | 92.6 | -11.9 | -42.2 |

| HRELF | Haier Electronics Group Co., Ltd. | 2.85 | 13.3 | 7,973.9 | 13.8 | 184.6 |

| HRS | Harris Corp. | 189.13 | 1.4 | 22,341.2 | 24.9 | 34.6 |

| HTHIF | Hitachi Ltd. | 38.99 | 128.2 | 37,674.5 | 18.6 | 2,379.9 |

| HTHIY | Hitachi Ltd. | 76.73 | 0.0 | 7,414.1 | 3.4 | 0.0 |

| HURC | Hurco Cos., Inc. | 34.82 | 1.3 | 235.6 | 10.0 | 13.5 |

| HXGBF | Hexagon AB | 49.42 | 1.2 | 18,080.4 | 22.1 | 26.4 |

| HXGBY | Hexagon AB | 51.45 | 1.3 | 18,208.8 | 23.0 | 29.5 |

| IBIDF | IBIDEN Co., Ltd. | 19.70 | 279.2 | 2,752.8 | 83.3 | 23,265.7 |

| IBM | International Business Machines Corp. | 135.25 | 5.9 | 119,814.6 | 15.6 | 92.4 |

| IFNNF | Infineon Technologies AG | 19.79 | 1.4 | 24,781.6 | 23.2 | 31.5 |

| IFNNY | Infineon Technologies AG | 19.40 | 1.5 | 24,781.6 | 22.7 | 35.0 |

| IIJI | 0.00 | 0.0 | 0.0 | |||

| INFY | Infosys Ltd. | 9.57 | 3.4 | 40,029.8 | 18.8 | 64.4 |

| INTC | Intel Corp. | 56.60 | 2.8 | 246,210.0 | 13.1 | 36.1 |

| INTU | Intuit, Inc. | 260.29 | 0.7 | 67,694.7 | 43.4 | 32.4 |

| ISDR | Issuer Direct Corp. | 10.52 | 0.5 | 40.6 | 70.7 | 33.6 |

| ITRN | Ituran Location & Control Ltd. | 24.77 | 3.8 | 519.4 | 9.2 | 34.9 |

| ITTOF | ITOCHU Techno-Solutions Corp. | 23.20 | 349.1 | 5,359.9 | 23.2 | 8,108.1 |

| JBL | Jabil, Inc. | 37.51 | 1.1 | 5,726.1 | 20.5 | 21.9 |

| JCOM | j2 Global, Inc. | 95.26 | 1.4 | 4,659.8 | 31.6 | 44.3 |

| JCS | Communications Systems, Inc. | 4.60 | 1.7 | 42.9 | 62.6 | 108.8 |

| JEHLY | Johnson Electric Holdings Ltd. | 17.71 | 3.7 | 1,569.2 | 5.5 | 20.0 |

| JELCF | Johnson Electric Holdings Ltd. | 1.86 | 27.4 | 1,648.1 | 5.7 | 157.1 |

| JNPR | Juniper Networks, Inc. | 24.93 | 3.8 | 8,621.2 | 23.3 | 87.9 |

| KACPF | 0.00 | 0.0 | 0.0 | |||

| KDCXF | Kudelski SA | 9.47 | 0.0 | 518.3 | -46.4 | 0.0 |

| KLAC | KLA Corp. | 172.96 | 1.7 | 27,407.8 | 22.9 | 39.7 |

| KNAMF | Konami Holdings Corp. | 41.86 | 338.0 | 5,660.8 | 19.0 | 6,410.8 |

| KNMCY | Konami Holdings Corp. | 44.07 | 0.0 | 5,959.7 | 20.0 | 0.0 |

| KSFTF | Kingsoft Corp. Ltd. | 2.27 | 0.0 | 3,099.8 | -16.1 | 0.0 |

| KYCCF | KEYENCE Corp. | 646.00 | 48.7 | 74,698.7 | 40.1 | 1,953.9 |

| KYOCF | Kyocera Corp. | 62.00 | 129.0 | 22,428.7 | 26.7 | 3,443.4 |

| KYOCY | Kyocera Corp. | 65.50 | 0.0 | 23,495.9 | 28.2 | 0.0 |

| LARRF | Laird PLC | 0.00 | 0.0 | 0.0 | ||

| LDOS | Leidos Holdings, Inc. | 86.69 | 1.9 | 12,466.7 | 18.7 | 35.3 |

| LFUS | Littelfuse, Inc. | 174.27 | 1.3 | 4,285.0 | 26.0 | 33.6 |

| LNVGF | Lenovo Group Ltd. | 0.72 | 38.3 | 8,728.8 | 12.5 | 478.3 |

| LNVGY | Lenovo Group Ltd. | 13.90 | 5.0 | 8,614.6 | 12.2 | 60.3 |

| LOGI | Logitech International SA | 40.86 | 1.8 | 6,909.8 | 24.8 | 43.8 |

| LPL | LG Display Co., Ltd. | 5.84 | 0.0 | 4,186.4 | -10.7 | 0.0 |

| LRCX | Lam Research Corp. | 277.56 | 1.6 | 40,210.4 | 19.6 | 31.4 |

| LYTS | LSI Industries, Inc. | 5.06 | 4.0 | 132.7 | -8.1 | -31.9 |

| MANT | ManTech International Corp. | 84.58 | 1.5 | 2,821.8 | 38.5 | 57.8 |

| MAXR | Maxar Technologies, Inc. | 7.64 | 0.5 | 456.0 | -0.4 | -0.2 |

| MAXR.TO | Maxar Technologies Inc. | 10.08 | 0.5 | 596.0 | -0.5 | -0.3 |

| MCFUF | Micro Focus International Plc | 13.07 | 7.0 | 4,356.5 | -12.3 | -86.1 |

| MCHP | Microchip Technology, Inc. | 95.40 | 1.5 | 22,709.4 | 60.8 | 93.1 |

| MCRNF | Micro-Mechanics (Holdings) Ltd. | 1.00 | 16.0 | 139.0 | 16.2 | 259.7 |

| MDF.TO | Mediagrif Interactive Technologies Inc. | 6.96 | 5.8 | 104.1 | -3.8 | -22.1 |

| MEI | Methode Electronics, Inc. | 34.40 | 1.3 | 1,275.9 | 13.4 | 17.1 |

| MGIC | Magic Software Enterprises Ltd. | 9.44 | 3.2 | 461.5 | 23.3 | 75.6 |

| MIELF | Mitsubishi Electric Corp. | 13.88 | 288.2 | 29,774.1 | 14.9 | 4,296.5 |

| MIXIF | mixi, Inc. | 19.47 | 873.1 | 1,467.1 | 8.0 | 6,985.2 |

| MIXT | MiX Telematics Ltd. | 12.45 | 1.8 | 295.5 | 15.6 | 28.9 |

| MKSI | MKS Instruments, Inc. | 110.15 | 0.9 | 6,001.5 | 35.4 | 32.2 |

| MLAB | Mesa Laboratories, Inc. | 229.71 | 0.3 | 1,001.1 | 113.6 | 39.6 |

| MNBEF | Minebea Mitsumi, Inc. | 18.50 | 75.7 | 7,679.9 | 16.7 | 1,267.5 |

| MNBEY | Minebea Mitsumi, Inc. | 37.51 | 0.0 | 7,785.8 | 17.0 | 0.0 |

| MNDO | MIND C.T.I. Ltd. | 2.35 | 11.1 | 46.6 | 8.6 | 94.6 |

| MPWR | Monolithic Power Systems, Inc. | 151.68 | 1.0 | 6,588.2 | 62.5 | 61.9 |

| MRAAF | Murata Manufacturing Co. Ltd. | 53.66 | 436.1 | 34,330.0 | 17.8 | 7,754.8 |

| MRVL | Marvell Technology Group Ltd. | 24.31 | 1.0 | 16,274.8 | -38.1 | -37.5 |

| MSFT | Microsoft Corp. | 144.61 | 1.6 | 1,103,202.2 | 27.0 | 43.8 |

| MSI | Motorola Solutions, Inc. | 165.36 | 1.4 | 27,541.7 | 26.3 | 36.3 |

| MTHRF | M3, Inc. | 23.15 | 30.2 | 15,705.5 | 80.8 | 2,444.1 |

| MTSC | MTS Systems Corp. | 57.81 | 2.1 | 1,117.7 | 22.7 | 47.1 |

| MXIM | Maxim Integrated Products, Inc. | 58.87 | 4.0 | 15,959.4 | 20.9 | 82.9 |

| NATI | National Instruments Corp. | 41.88 | 2.3 | 5,523.3 | 34.5 | 80.8 |

| NEXOF | NEXON Co., Ltd. | 11.50 | 0.0 | 10,356.9 | 11.2 | 0.0 |

| NICE | NICE Ltd. (Israel) | 157.98 | 0.0 | 9,873.1 | 54.4 | 0.0 |

| NOK | Nokia Oyj | 3.65 | 3.1 | 20,452.0 | -34.3 | -105.4 |

| NOKBF | Nokia Oyj | 3.70 | 5.5 | 20,508.0 | -50.3 | -274.7 |

| NPEGF | Nippon Electric Glass Co., Ltd. | 25.72 | 622.1 | 2,485.0 | ||

| NPSNY | Naspers Ltd. | 28.26 | 0.3 | 61,831.7 | 4.4 | 1.5 |

| NTAP | NetApp, Inc. | 56.37 | 3.1 | 13,411.2 | 14.2 | 44.3 |

| NTDOF | Nintendo Co., Ltd. | 351.00 | 182.3 | 41,812.7 | 26.2 | 4,773.9 |

| NTDOY | Nintendo Co., Ltd. | 45.79 | 0.0 | 41,989.0 | 27.3 | 0.0 |

| NTES | NetEase, Inc. | 286.14 | 0.9 | 36,614.7 | 28.6 | 26.6 |

| NTP | Nam Tai Property, Inc. | 9.12 | 0.0 | 346.8 | -19.7 | 0.0 |

| NVDA | NVIDIA Corp. | 203.00 | 0.3 | 123,627.0 | 45.1 | 14.2 |

| NVEC | NVE Corp. | 62.94 | 6.4 | 305.0 | 22.2 | 141.4 |

| NXCLF | Lifull Co., Ltd. | 5.86 | 0.9 | 786.2 | 31.2 | 28.7 |

| OMRNY | OMRON Corp. | 58.28 | 0.0 | 12,155.3 | 27.8 | 0.0 |

| OPESY | 0.00 | 0.0 | 0.0 | |||

| ORCL | Oracle Corp. | 54.85 | 1.7 | 180,046.2 | 17.4 | 28.8 |

| OSAGF | OSRAM Licht AG | 43.84 | 2.5 | 4,231.4 | -17.3 | -43.9 |

| OTEX | Open Text Corp. | 40.27 | 3.8 | 10,897.7 | 37.9 | 143.2 |

| OTEX.TO | Open Text Corporation | 52.64 | 1.8 | 14,447.0 | 49.7 | 86.9 |

| OXINF | Oxford Instruments Plc | 16.20 | 0.9 | 927.0 | 24.7 | 22.0 |

| PCRFF | Panasonic Corp. | 8.28 | 362.3 | 19,314.4 | 7.7 | 2,806.6 |

| PCRFY | Panasonic Corp. | 8.53 | 0.0 | 19,757.6 | 8.0 | 0.0 |

| PCTI | PCTEL, Inc. | 7.37 | 0.7 | 136.3 | -12.5 | -9.3 |

| PEGA | Pegasystems, Inc. | 75.77 | 0.2 | 5,991.9 | -114.4 | -18.1 |

| PKE | Park Aerospace Corp. | 17.61 | 26.4 | 361.3 | 35.9 | 948.2 |

| PLPC | Preformed Line Products Co. | 56.90 | 1.4 | 286.2 | 11.9 | 16.7 |

| PLT | Plantronics, Inc. | 39.93 | 1.5 | 1,560.1 | -8.0 | -12.2 |

| PMCUF | Pro Medicus Ltd. | 18.94 | 0.3 | 2,000.6 | 143.4 | 42.6 |

| POWI | Power Integrations, Inc. | 91.89 | 0.9 | 2,703.6 | 46.4 | 43.4 |

| PRYMF | Prysmian SpA | 22.30 | 1.9 | 5,867.3 | 21.1 | 40.7 |

| PRYMY | Prysmian SpA | 11.57 | 4.2 | 6,088.3 | 21.9 | 91.7 |

| PTFRY | PT Tower Bersama Infrastructure Tbk | 22.39 | 2.2 | 1,950.7 | 41.8 | 91.2 |

| PTG.TO | Pivot Technology Solutions, Inc. | 1.46 | 11.0 | 57.6 | -13.3 | -146.4 |

| PXGYF | PAX Global Technology Ltd. | 0.37 | 21.6 | 407.1 | 5.4 | 117.1 |

| QADA | QAD, Inc. | 46.44 | 0.6 | 944.9 | -60.7 | -37.7 |

| QADB | QAD, Inc. | 36.00 | 0.7 | 732.5 | -58.9 | -39.3 |

| QCOM | QUALCOMM, Inc. | 81.44 | 3.8 | 99,003.4 | 28.6 | 108.8 |

| QTRH | Quarterhill, Inc. | 1.28 | 3.9 | 152.1 | -4.5 | -17.7 |

| QTRH.TO | Quarterhill Inc. | 1.70 | 2.9 | 200.8 | -6.0 | -17.5 |

| RELL | Richardson Electronics Ltd. | 5.75 | 5.2 | 75.5 | -9.7 | -50.7 |

| RFIL | RF Industries Ltd. | 5.97 | 1.3 | 56.1 | 17.4 | 23.4 |

| RHDGF | Retail Holdings NV | 2.35 | 383.0 | 12.1 | -0.6 | -211.6 |

| RNSHF | Renishaw Plc | 49.00 | 1.2 | 3,566.6 | 29.9 | 36.6 |

| RPGRF | REA Group Ltd. | 45.00 | 1.9 | 5,927.2 | 79.9 | 149.7 |

| RSTAY | RIB Software SE | 51.45 | 0.8 | 1,256.7 | 58.9 | 45.9 |

| RTMVF | Rightmove Plc | 6.59 | 1.0 | 5,791.8 | 26.9 | 27.8 |

| RTMVY | Rightmove Plc | 15.49 | 1.1 | 6,834.8 | 31.7 | 34.7 |

| SABR | Sabre Corp. | 23.32 | 2.5 | 6,031.8 | 26.5 | 67.3 |

| SAIC | Science Applications International Corp. | 82.86 | 1.7 | 4,885.4 | 29.2 | 50.3 |

| SAP | SAP SE | 132.63 | 1.3 | 159,023.3 | 41.5 | 52.2 |

| SAPGF | SAP SE | 132.77 | 1.1 | 158,474.3 | 41.5 | 46.9 |

| SCND | Scientific Industries, Inc. | 9.00 | 0.6 | 13.4 | 20.8 | 11.6 |

| SEKEF | Seiko Epson Corp. | 13.94 | 667.1 | 4,860.1 | 11.8 | 7,900.8 |

| SEPJF | Spectris Plc | 30.90 | 2.0 | 3,582.4 | 57.9 | 117.0 |

| SEPJY | Spectris Plc | 16.32 | 2.4 | 3,784.1 | 61.2 | 146.1 |

| SGAMF | Sega Sammy Holdings, Inc. | 14.08 | 426.1 | 3,305.1 | 88.8 | 37,831.0 |

| SGPYY | The Sage Group Plc | 37.94 | 2.3 | 10,248.0 | 25.0 | 57.5 |

| SILC | Silicom Ltd. | 32.74 | 0.0 | 256.0 | 12.7 | 0.0 |

| SIMO | Silicon Motion Technology Corp. | 42.29 | 6.0 | 1,584.3 | 19.1 | 114.8 |

| SKLTF | SEEK Ltd. | 12.57 | 2.6 | 4,408.7 | 34.2 | 89.5 |

| SKSJF | Shinko Shoji Co., Ltd. | 7.83 | 906.8 | 293.6 | 26.0 | 23,595.9 |

| SLP | Simulations Plus, Inc. | 34.78 | 0.9 | 609.7 | 77.3 | 66.7 |

| SMTGF | SMA Solar Technology AG | 32.80 | 0.0 | 1,138.2 | -5.0 | 0.0 |

| SMTOF | Sumitomo Electric Industries Ltd. | 12.96 | 555.6 | 10,107.4 | 10.9 | 6,065.7 |

| SNE | Sony Corp. | 60.76 | 0.3 | 76,156.4 | 10.2 | 3.1 |

| SNEJF | Sony Corp. | 61.80 | 64.7 | 77,066.7 | 10.4 | 671.1 |

| SNPTF | Sunny Optical Technology (Group) Co., Ltd. | 15.89 | 4.4 | 16,397.9 | 43.3 | 191.7 |

| SPHHF | Sophos Group Plc | 7.45 | 0.6 | 3,639.8 | 131.9 | 74.0 |

| SQNXF | Square Enix Holdings Co., Ltd. | 47.00 | 169.0 | 5,642.1 | 37.0 | 6,251.8 |

| SRMC | Sierra Monitor Corp. | 3.24 | 0.6 | 33.2 | 206.4 | 127.4 |

| SSNC | SS&C Technologies Holdings, Inc. | 51.92 | 0.7 | 13,213.3 | 40.7 | 29.7 |

| STM | STMicroelectronics NV | 22.55 | 1.6 | 20,550.1 | 18.0 | 28.2 |

| STMEF | STMicroelectronics NV | 23.15 | 1.6 | 20,684.1 | 19.6 | 30.5 |

| STWRY | Software AG | 8.15 | 2.4 | 2,438.4 | 13.1 | 31.3 |

| STX | Seagate Technology Plc | 57.85 | 4.4 | 15,280.8 | 8.0 | 35.1 |

| SUMCF | SUMCO Corp. | 16.69 | 341.5 | 4,894.8 | 10.2 | 3,481.8 |

| SVT | Servotronics, Inc. | 10.30 | 1.6 | 25.6 | 7.3 | 11.4 |

| SWDHY | Skyworth Group Ltd. | 8.14 | 2.8 | 24,916.0 | ||

| SWKS | Skyworks Solutions, Inc. | 90.97 | 1.7 | 15,619.8 | 17.2 | 29.9 |

| SYMC | Symantec Corp. | 22.99 | 1.3 | 14,208.6 | 124.5 | 162.4 |

| SYZ.V | Sylogist Ltd. | 10.00 | 4.0 | 236.9 | 18.9 | 75.5 |

| TACT | TransAct Technologies, Inc. | 12.22 | 2.9 | 91.3 | 20.3 | 59.8 |

| TAIT | Taitron Components, Inc. | 2.59 | 4.6 | 14.9 | 10.8 | 49.9 |

| TCEHY | Tencent Holdings Ltd. | 40.56 | 0.3 | 382,906.3 | 29.4 | 9.3 |

| TCS.TO | Tecsys Inc. | 15.25 | 1.4 | 196.4 | -190.6 | -274.5 |

| TCTZF | Tencent Holdings Ltd. | 40.31 | 2.5 | 382,337.2 | 29.2 | 72.4 |

| TCYSF | TECSYS, Inc. | 11.72 | 1.9 | 153.3 | -202.4 | -380.0 |

| TEL | TE Connectivity Ltd. | 90.15 | 2.0 | 30,284.5 | 9.6 | 19.2 |

| TER | Teradyne, Inc. | 61.57 | 0.6 | 10,667.5 | 22.0 | 12.6 |

| TESS | TESSCO Technologies, Inc. | 16.08 | 5.0 | 137.0 | 71.1 | 353.8 |

| TMICF | Trend Micro, Inc. | 46.50 | 350.5 | 6,462.2 | 25.2 | 8,847.2 |

| TOELF | Tokyo Electron Ltd. | 203.87 | 415.5 | 32,835.2 | 16.5 | 6,873.9 |

| TRUHF | Truly International Holdings Ltd. | 0.13 | 0.0 | 427.6 | 15.9 | 0.0 |

| TRUHY | Truly International Holdings Ltd. | 2.68 | 0.0 | 440.8 | 16.3 | 0.0 |

| TSM | Taiwan Semiconductor Manufacturing Co., Ltd. | 51.52 | 3.9 | 269,209.4 | 26.0 | 100.5 |

| TSYHF | TravelSky Technology Ltd. | 2.12 | 14.4 | 6,203.6 | 17.6 | 254.4 |

| TSYHY | TravelSky Technology Ltd. | 22.37 | 1.8 | 2,064.7 | 18.6 | 32.8 |

| TTCNF | Telit Communications Plc | 2.10 | 0.0 | 277.3 | 12.9 | 0.0 |

| TTDKF | TDK Corp. | 102.50 | 280.2 | 11,719.0 | 17.6 | 4,943.6 |

| TXN | Texas Instruments Incorporated | 117.79 | 2.7 | 110,154.6 | 21.5 | 58.5 |

| TYPE | Monotype Imaging Holdings, Inc. | 19.84 | 1.8 | 833.3 | 31.9 | 56.0 |

| UMC | United Microelectronics Corp. | 2.28 | 4.1 | 5,416.6 | 56.4 | 229.2 |

| VCM.TO | Vecima Networks Inc. | 9.45 | 2.3 | 211.4 | -59.1 | -137.6 |

| VNWTF | Vecima Networks, Inc. | 7.29 | 3.0 | 163.1 | -62.9 | -189.8 |

| VSH | Vishay Intertechnology, Inc. | 20.07 | 1.8 | 2,932.2 | 11.5 | 20.4 |

| VTKLF | VTech Holdings Ltd. | 8.40 | 62.3 | 2,111.8 | 12.3 | 768.3 |

| VTKLY | VTech Holdings Ltd. | 8.85 | 7.6 | 2,224.9 | 13.0 | 98.2 |

| WCAGY | Wirecard AG | 63.83 | 0.2 | 15,767.0 | 32.1 | 5.7 |

| WCRS | Western Capital Resources, Inc. | 4.00 | 5.4 | 34.7 | 189.6 | 1,024.7 |

| WDC | Western Digital Corp. | 62.16 | 3.2 | 18,476.6 | -24.0 | -77.2 |

| WIRE | Encore Wire Corp. (Delaware) | 55.85 | 0.1 | 1,167.6 | 16.1 | 2.3 |

| WIT | Wipro Ltd. | 3.96 | 0.4 | 23,136.8 | 16.8 | 6.1 |

| WNXDF | Diebold Nixdorf AG | 68.10 | 0.0 | 2,030.5 | 45.6 | 0.0 |

| WNXDY | Diebold Nixdorf AG | 13.03 | 0.0 | 1,942.5 | 43.6 | 0.0 |

| WRCDF | Wirecard AG | 128.13 | 0.2 | 15,419.8 | 32.2 | 5.2 |

| WSO | Watsco, Inc. | 174.74 | 3.6 | 6,706.8 | ||

| WSO.B | Watsco, Inc. | 178.89 | 3.6 | 6,808.5 | ||

| WSTG | Wayside Technology Group, Inc. | 14.35 | 4.7 | 64.7 | 10.1 | 48.1 |

| XLNX | Xilinx, Inc. | 91.26 | 2.0 | 22,948.9 | 24.2 | 48.6 |

| XPER | Xperi Corp. | 20.54 | 3.9 | 1,016.9 | 32.6 | 126.4 |

| XPPLF | XP Power Ltd. | 34.35 | 3.1 | 656.1 | 19.6 | 61.1 |

| XRX | Xerox Holdings Corp. | 34.12 | 1.5 | 7,550.2 | 11.7 | 17.2 |

| YAHOF | Z Holdings Corp. | 3.01 | 588.7 | 14,334.9 | 23.6 | 13,919.9 |

| YASKF | YASKAWA Electric Corp. | 33.09 | 235.7 | 8,663.9 | 40.5 | 9,553.0 |

| Ticker | Name | Price | Dividend Yield | Market Cap ($M) | P/E Ratio | Payout Ratio |

Alibaba does not currently pay a dividend to shareholders. However, in contrast to other high-growth tech stocks that do not pay dividends and might never, such as Netflix (NFLX), Uber (UBER), and Lyft (LYFT), Alibaba is highly profitable and generates positive free cash flow.

As a result, the company has the capacity to initiate and sustain a dividend for the next several years. Therefore, the big question for income investors is whether the company will ever decide to pay a dividend.

Business Overview

Alibaba is a gigantic e-commerce company, which provides online and mobile commerce businesses in China and in many other international markets.

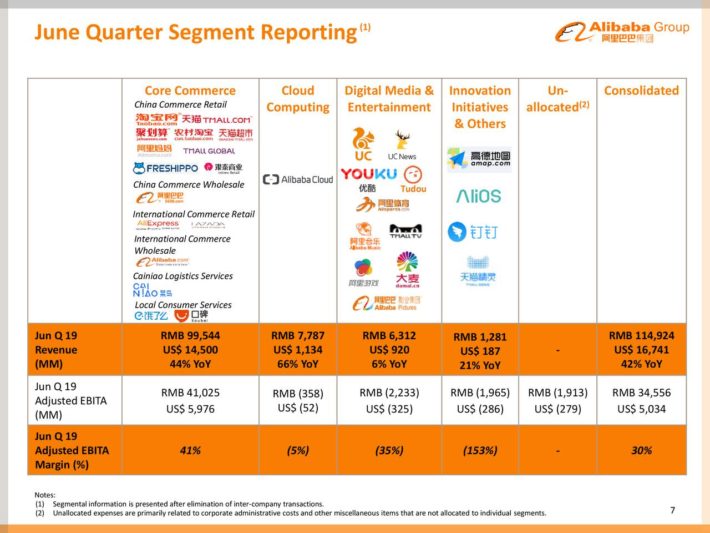

It operates in four segments: Core commerce, cloud computing, digital media and innovation initiatives. While the company expects meaningful growth from all its segments, its core commerce business is by far its most important, as it generates essentially all the earnings of the company.

The primary concern for Alibaba is that it will be severely affected by the ongoing trade war between the U.S. and China as well as the deceleration of these two economies. In fact, many investors wonder how Alibaba has maintained its strong growth momentum amid the prolonged trade war between the two largest economies in the world.

There are four major reasons behind Alibaba’s sustained business momentum amid the prevailing macro challenges. First of all, the company benefits from the strong growth of the Chinese economy. China has grown its gross domestic product by more than 6% per year every single year in the last decade.

Source: Trading Economics

As it is impossible for any country to continue growing at a high single-digit rate indefinitely, the Chinese economy has decelerated in recent years. Nevertheless, it is still growing at a much faster pace than the developed nations, including the U.S. economy.

Moreover, the middle class of China in large cities has exceeded 300 million people and thus it has become almost equal to the entire U.S. population. These consumers seek to upgrade the quality of products they purchase and thus they pursue a great variety of foreign brands. Alibaba, which connects all these people to well-known foreign brands, greatly benefits from this behavior of consumers.

It is also important to note that China’s middle class is expected to double in size within the next 10 years, with most of the growth driven by the less developed cities. Apart from the major metropolitan areas of China, such as Shanghai, Beijing and Shenzhen, China has more than 150 cities with a population of more than 1 million people.

All these cities have more than 500 million people in aggregate and a consumption economy of $2.3 trillion. The economies of these cities grow much faster than the economies of the major metropolitan areas. As a result, consumption from this category of Chinese cities is expected to approximately triple in a decade, from $2.3 trillion this year to about $7.0 trillion in 2029–for a 12% average annual growth rate. This secular trend will provide a strong tailwind to Alibaba, which relies to a great extent on domestic consumption.

Moreover, Alibaba greatly benefits from the fast pace of digitization of the Chinese economy. During the last decade, digitization has been driven primarily by smartphones, which have made it possible for consumers to remain connected to the internet for most of the day. Digitization of the Chinese economy will accelerate even further in the upcoming years thanks to the advent of 5G technology and the fast propagation of IoT (Internet of Things) devices. Alibaba is ideally positioned to benefit from the increasing penetration of Internet in the lives of consumers.

Investors can realize the impact of digitization on Alibaba from the recent reports of the National Bureau of Statistics of China. In July and August, total retail sales in China grew 7.5% over last year’s periods but the online retail sales grew 11% and 17%, respectively, in these two months. It is thus evident that online sales in China have much greater momentum and growth potential than traditional retail sales.

Alibaba stock has incurred a 14% correction off the all-time high it posted in the summer, primarily due to the ongoing trade conflict between the U.S. and China but also due to the somewhat rich valuation of the stock. While the eventual effect of the trade tensions on the Chinese economy is unknown, it is reasonable to assume that Chinese exports will be negatively affected. Consequently, the growth of the Chinese economy may incur a headwind from the outcome of the trade conflicts in the upcoming years.

That said, it is important to note that the Chinese economy will continue growing at a high rate despite its shift from an export economy to a consumption economy. In the last five years, China lost 14 million manufacturing jobs but gained 70 million jobs in services. Overall, Alibaba has exciting growth prospects ahead thanks to the sustained economic growth of China and the secular growth of digitization.

The growth potential of Alibaba was evident in its latest earnings report. In its fiscal first quarter, the online retailer grew its revenue 42% over last year’s quarter, mostly thanks to the strong performance of its core commerce business, which posted 44% revenue growth.

Source: Investor Presentation

This division grew the number of customers from 721 million at the end of the previous quarter, to 755 million.

The cloud business posted 66% revenue growth, thanks to an increase in the number of customers and also average revenue per user.

During the quarter, Alibaba grew private cloud revenue by 250% over last year’s quarter, and management expects this segment to continue growing at a high rate for years. Nevertheless, this segment is still too small to have a meaningful effect in the results of the company.

Source: Investor Presentation

More than 70% of the increase in active consumers came from less developed cities in China. While this trend may fuel some concerns that the company is approaching its limits in its growth trajectory, the high growth rate confirms that the company has ample room to keep growing for several years.

Thanks to its strong business performance, Alibaba grew its adjusted earnings per share by 55%, from $1.01 in last year’s quarter to $1.57. Since its IPO in 2014, the company has almost quadrupled its earnings per share, from $1.61 in 2014 to $5.58 in fiscal 2019. It is also remarkable that Alibaba has exceeded the analysts’ earnings-per-share estimates by a wide margin for four consecutive quarters.

Moreover, Alibaba expects to grow its annual active consumers from 721 million at the end of fiscal 2019 to more than 1.0 billion by the end of fiscal 2024. Furthermore, the online retail giant is expected to grow its earnings per share by 23% in the running fiscal year, and by another 26% in its next fiscal year. As Alibaba does not show any signs of business fatigue, it is likely that the company will continue growing at a fast pace for several more years.

Free Cash Flows

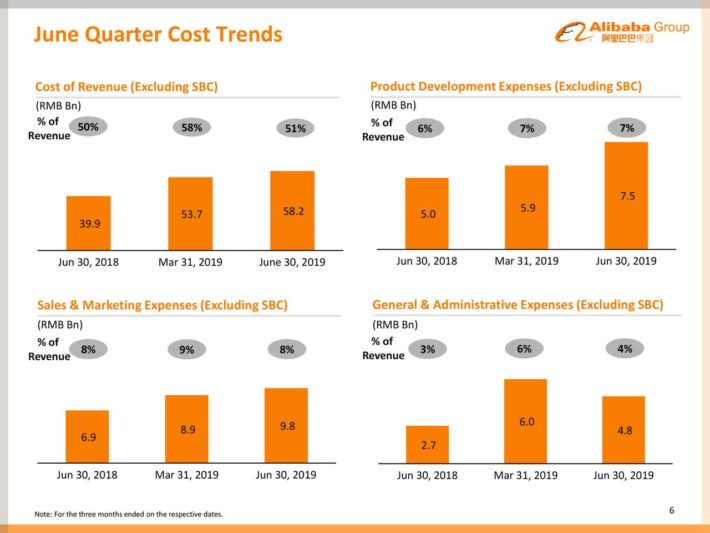

As Alibaba is trying to grow its customer base at a relentless pace, it is investing heavily in its business. More precisely, it spends significant amounts on product development, marketing and general & administrative expenses.

Source: Investor Presentation

All these expenses consume a significant portion of the operating cash flows of the company, and therefore somewhat limit its free cash flow. However, Alibaba has enjoyed positive free cash flows in each of the last seven years. Even better, the online retail giant has strengthened its free cash flows at an impressive pace, from $2.0 billion in 2013 to $14.7 billion in the last 12 months.

In the most recent quarter, the free cash flows of Alibaba remained essentially flat, at $3.8 billion, but they were negatively affected by some non-recurring factors. Going forward, Alibaba is likely to continue growing its free cash flows at a high rate.

This performance greatly differentiates Alibaba from other high-growth tech stocks, such as Netflix, Uber and Lyft. These companies have been growing their revenues at tremendous rates but are still far from achieving positive free cash flows. This is an important difference, as it renders the other stocks much riskier than Alibaba. The higher risk of the other stocks is clearly reflected in the yields of their bonds, which are much higher than the yields of Alibaba’s bonds.

Will Alibaba Ever Pay A Dividend?

Thanks to its positive free cash flows, Alibaba has the financial capacity to initiate a dividend. In addition, the company has a remarkably strong balance sheet. Its net debt is only $18.5 billion, which is only about 1.4 times the annual earnings of the company. Moreover, interest expense consumes only ~8% of the operating income. Therefore, it would not be unreasonable for Alibaba to initiate a dividend in the future.

It is also remarkable that the company repurchased 10.9 million shares in fiscal 2019 and its management confirmed its commitment to continue repurchasing shares to enhance shareholder value. However, it is important to note that the share count increased 0.5% in fiscal 2019.

In other words, Alibaba repurchased shares only to offset the dilutive effect of the shares awarded to its management. Even if this were not the case, the number of shares repurchased was only 0.4% of the total share count. Therefore, investors should not expect meaningful share repurchases from Alibaba.

Moreover, while Alibaba seems to have the financial strength to initiate a dividend, it is not likely to do so for the foreseeable future. The company has initiated the process for a secondary listing, in Hong Kong. Alibaba is expected to raise approximately $15 billion in this secondary listing and use the proceeds to fund its growth initiatives, such as cloud computing and Hema supermarkets.

The process of the secondary listing has been delayed due to the rising political unrest in Hong Kong but Alibaba is expected to launch the offering whenever the prevailing conditions somewhat improve, probably before the end of the year.

Despite the delay in the secondary listing, it is evident that Alibaba is in the process of raising new funds in order to invest in its business instead of returning cash to its shareholders. This should not be viewed as a negative move, as Alibaba has exciting growth prospects. When a company is in a highly profitable business and grows at a fast clip, it is much more rational from an economic point of view to invest cash in the business than to return cash to the shareholders.

The strategy of Alibaba conveys a positive signal, as it implies that there are promising growth prospects ahead. In fact, whenever Alibaba initiates a dividend, its stock will probably come under pressure, as investors will fear that the high-growth era of the company is coming to an end.

Final Thoughts

Alibaba greatly benefits from the sustained growth of the Chinese economy and the secular growth of digitization. The e-commerce giant has been growing its revenues, earnings, and free cash flows at an impressive rate for many years.

Moreover, in contrast to other popular high-growth stocks, Alibaba is already strongly profitable with positive free cash flow. In addition, it has a strong balance sheet, which collectively means that the company could initiate a dividend without facing any financial stress.

However, Alibaba is still in its high-growth phase, with ample room to continue growing at a high rate for several more years. As a result, it makes much more sense to continue invest in its business than to return cash to its shareholders right now.

This is clearly reflected in its strategy, which is executing a secondary listing in Hong Kong in an effort to raise approximately $15 billion and use the proceeds to fund its growth initiatives. For all these reasons, investors should not expect a dividend from the online retail giant for the next several years at least.