What's Going On With SanDisk Shares?

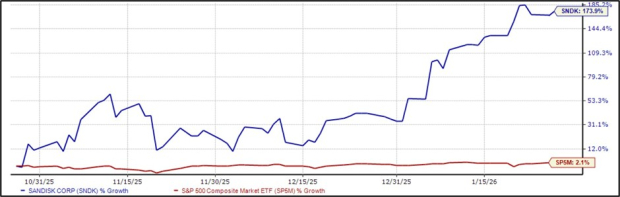

SanDisk SNDK shares have been melting higher over recent months as its role in the broader AI frenzy finally comes into focus. The stock is up more than 170% just over the last three months, by far reflecting one of the strongest moves we’ve seen over the period.

Image Source: Zacks Investment Research

AI is driving a huge surge in storage demand, which is where SanDisk comes in. NAND prices are rising rapidly, with AI data centers and cloud providers needing more high-speed storage.

Importantly, the stock is on the reporting docket this week, helping headline a jam-packed week of earnings overall.

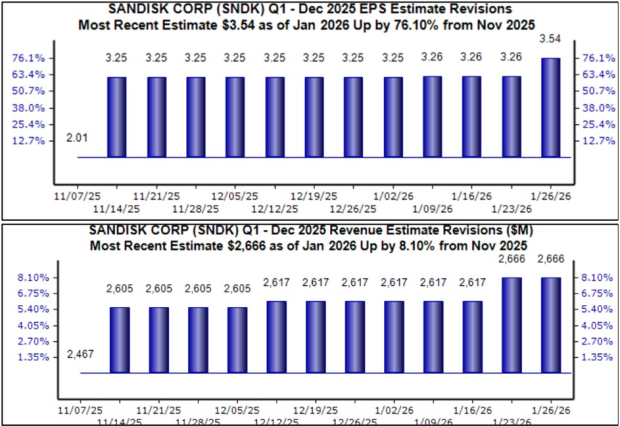

SanDisk Expectations Soar

SanDisk’s EPS outlook has shifted notably bullish over recent months, landing the stock into a current Zacks Rank #1 (Strong Buy). The outlook for the upcoming release has shifted notably bullish, with the current $3.54 Zacks Consensus EPS estimate up more than 70% since the beginning of last November.

Revenue expectations have followed a similar bullish path, as seen below.

Image Source: Zacks Investment Research

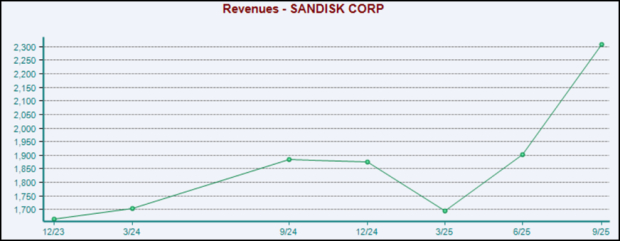

The company’s top-line acceleration is evident in the quarterly chart below, where sales of $2.3 billion climbed 22% year-over-year in its latest period. Its current fiscal year (ends in June) has also confirmed the favorable demand backdrop, with the current $11.2 billion estimate up nearly 20% over the last year.

Image Source: Zacks Investment Research

Still, investors should be aware of the steep volatility we’ll likely see following the upcoming release. A weak report/guidance would easily skew sentiment, though it’s worth noting that valuation multiples aren’t stretched to extreme levels by any means, even after the massive run. Shares currently trade at a 22.8X forward 12-month earnings multiple, well below the 2025 high of 42.1X.

Putting Everything Together

A highly favorable demand environment, driven by the AI frenzy, has positioned SanDisk SNDK in a notably strong position. The company could be at the beginning of a massive growth phase, with its storage solutions a key enabler for AI systems. Current consensus expectations for its current fiscal year allude to a 50% sales growth surge on 450% higher EPS, underpinning the favorable story.

The stock has jumped to a Zacks Rank #1 (Strong Buy) as a result, with its earnings this week set to be a big headliner. Expect some increased volatility post-earnings given the rapid rise, with investors undoubtedly expecting favorable guidance concerning the overall demand picture.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sandisk Corporation (SNDK): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com