Published on July 8th, 2022 by Quinn Mohammed

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth over $360 billion, as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can follow Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all Warren Buffett stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download Buffett’s holdings now.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Buffett’s Berkshire Hathaway owned about 1.5 million shares of Royalty Pharma plc (RPRX) for a market value of $58.3 million. Royalty Pharma represents about 0.2% of Berkshire Hathaway’s investment portfolio. This marks it as one of the bottom positions in the portfolio.

This article will analyze the healthcare company in greater detail.

Business Overview

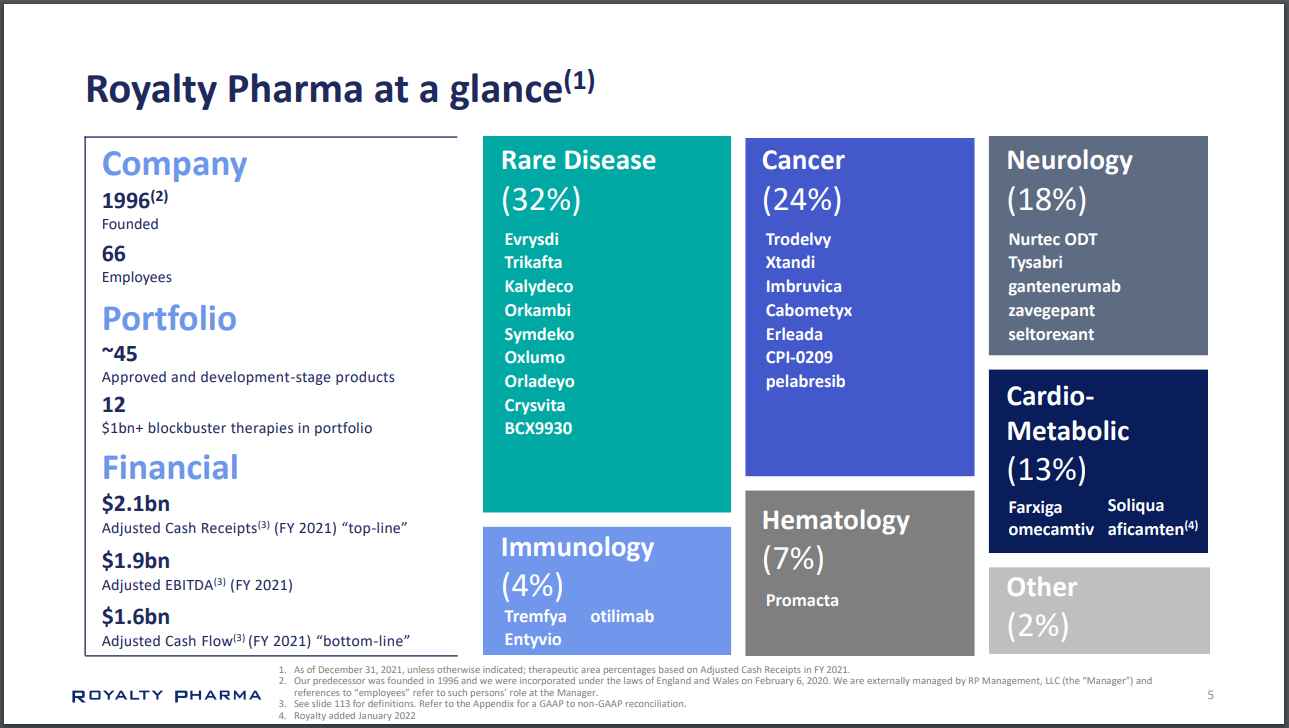

Royalty Pharma plc owns biopharmaceutical royalties and funds innovation in the biopharmaceutical industry in the U.S. The company’s portfolio holds royalties on roughly 35 marketed therapies and 10 development-stage product candidates, addressing areas such as rare disease, cancer, neurology, infectious disease, hematology, and diabetes.

Some of Royalty Pharma’s royalties entitle them to payments linked to the top-line sales of some leading therapies, such as AbbVie and Johnson & Johnson’s Imbruvica, Astellas and Pfizer’s Xtandi, Gildea’s Trodelvy, Merck’s Januvia and Novartis’ Promacta, plus many more.

Source: Investor Presentation

On May 5th, 2022, Royalty Pharma reported first quarter 2022 results. The company generated net cash from operating activities of $460 million, a 13% year-over-year decrease. Adjusted cash receipts rose 15% to $605 million. This increase was in large part due to double-digit increases in royalties from the cystic fibrosis franchise, Tysabri, and recent royalty acquisitions, partially offset by royalty expirations.

Royalty Pharma held cash, cash equivalents and marketable securities amounting to $2.3 billion as of March 31st, 2022. The company also held $7.3 billion in long-term debt.

Management provided a 2022 financial outlook, which estimates adjusted cash receipts to be between $2.23 billion and $2.3 billion.

We estimate that Royalty Pharma can generate $2.94 in earnings-per-share for the fiscal 2022 year.

Growth Prospects

Royalty Pharma has deployed billions of dollars in capital to acquire pharmaceutical royalties. The pace of this capital deployment has sped up in recent years. While Royalty Pharma deployed $1.49 billion during 2012 to 2016, they deployed $2.10 billion between 2017 to 2021. This has led to a doubling of adjusted cash receipts from 2012 to 2021.

The company will continue to focus on acquiring existing royalties for leading or late-stage development therapies with significant business potential. Additionally, Royalty Pharma will selectively acquire newly-created royalties on approved or late-stage development therapies. The company may also make equity investments or provide funding in exchange for long-term payment streams.

The company sees a significant opportunity where over $1 trillion of capital is required to fund innovation in biopharmaceuticals over the next decade, and Royalty Pharma plans to capitalize on this.

The company’s development-stage therapies are likely to all launch by the end of 2025, which should also boost the company’s top line.

We project that the company can continue to grow earnings per share by about 7.5% annually through 2027.

Competitive Advantages & Recession Performance

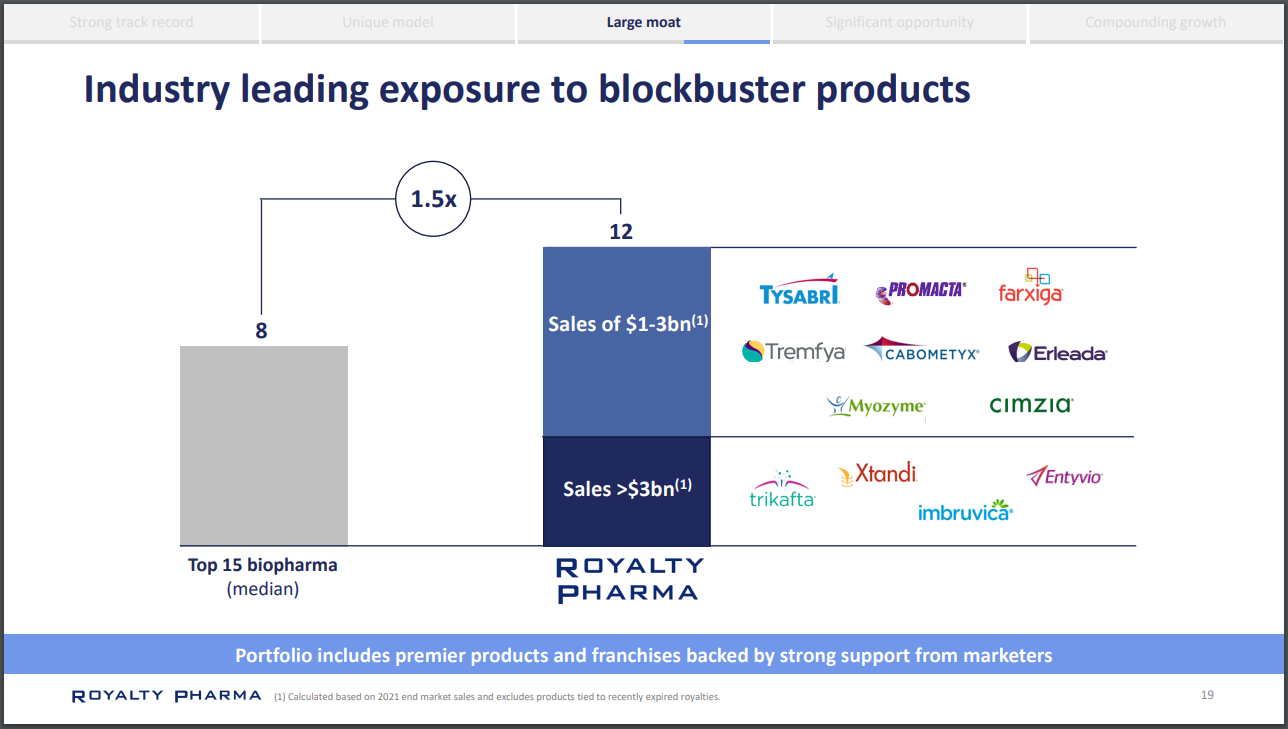

Royalty Pharma’s portfolio of pharmaceutical royalties is unmatched in the business. The company has acquired royalty interests in leading pharmaceutical drugs since 1996. Between 2012 and 2022 YTD, Royalty Pharma has maintained about a 60% overall share in the biopharma royalty market and is the major partner for large transactions.

Source: Investor Presentation

The company relies on their experienced team in Research & Investments. Over 60% of the team of 21 professionals have advanced degrees, and about 50% of them had scientific and/or medical degrees. The team has an average 14 years of experience in biopharma and/or investment.

The pharmaceuticals which are linked to Royalty Pharma’s royalties are necessary for the patients who utilize them. This adds to the company’s recession resilience, as people will need their pharmaceuticals through any time in the economic cycle.

Royalty Pharma has raised its dividend for two consecutive years so far. For a royalty company, Royalty Pharma sports a very low payout ratio of roughly 26% forecasted for 2022. We expect continued dividend growth of about 10% per annum.

Valuation & Expected Returns

Shares of Royalty Pharma have traded for an average price-to-earnings multiple of 14.3 since 2021. Shares are now trading in-line with this average, which indicates that shares could be near fair value at the current 14.7 times earnings.

Our fair value estimate for Royalty Pharma stock is 15.0 times earnings. If this proves correct, the stock will benefit from a 0.4% annualized gain in its returns through 2027.

Shares of Royalty Pharma currently yield 1.8%, which is in-line with its average yields of 1.7% as well. On a dividend yield basis, Royalty Pharma shares seem to be trading at roughly fair value.

Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 9.5% per year over the next five years. This makes Royalty Pharma a hold.

Final Thoughts

Royalty Pharma has built up its portfolio of pharmaceutical royalties since 1996 and holds royalties in blockbuster drugs.

The company has a stable source of profit, and year-to-date, shares have risen nearly 10%, in contrast to a falling broader market. Shares seem fairly valued at the current price, and we expect continued earnings and dividend growth.

Other Dividend Lists

Value investing is a valuable process to combine with dividend investing. The following lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats List is comprised of 65 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.