Published on June 29th, 2022 by Quinn Mohammed

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth over $360 billion, as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can follow Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all Warren Buffett stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download Buffett’s holdings now.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Buffett’s Berkshire Hathaway owned almost 4.0 million shares of Mastercard Inc. (MA) for a market value of $1.4 billion. Mastercard represents about 0.4% of Berkshire Hathaway’s investment portfolio. This marks it as the 24th largest position in the portfolio, out of 49 stocks.

This article will analyze the credit services company in greater detail.

Business Overview

MasterCard is a world leader in electronic payments. The company partners with 25,000 financial institutions around the world to provide an electronic payment network. MasterCard has nearly 3 billion credit and debit cards in use.

MasterCard released first quarter results for the period ending March 31st, 2022, on April 28th. Revenue grew 24% to $5.2 billion, which was $300 million higher than expectations. Adjusted earnings-per-share of $2.76 compared favorably to $1.74 in the prior year.

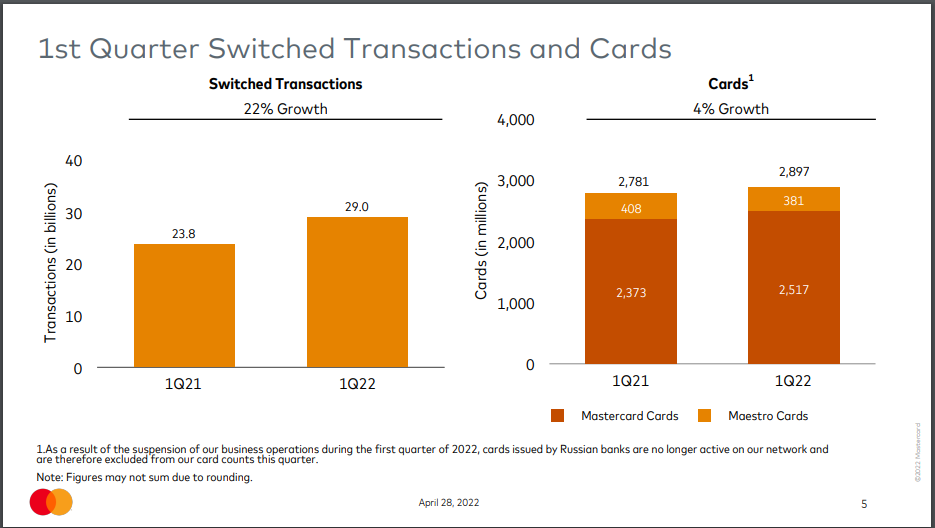

Gross dollar volumes grew 17% worldwide year-over-year to $1.9 trillion. Cross border volumes soared 53% and switched transactions improved 22%. Cards in use grew 4% to just under 3 billion.

Source: Investor Presentation

Expenses rose 11% as a result of acquisitions, personnel expenses, advertising, and data processing costs. Still, the adjusted operating margin expanded 460 basis points to 57.5%.

The company repurchased 6.8 million shares at an average price of $353 during the quarter. And so far in Q2, MasterCard has repurchased another 1.7 million shares at an average price of $352. The company still has $8.9 billion remaining on its share repurchase authorization.

We estimate that MasterCard can generate $10.15 in earnings-per-share for the fiscal 2022 year.

Growth Prospects

MasterCard has grown earnings-per-share at a rate of almost 17% per year over the last decade.

Future growth will come from a combination of an increase in revenue, increased consumer sentiment and spending, and share buybacks.

Consumers are attached to their credit cards, especially those who frequently shop online, which is an ever-growing trend. This is happening not only in the U.S., but many other industrialized countries. Additionally, some research firms estimate only a little more than 20% of point-of-sale purchases are made with cash in the U.S.

This ongoing transformation from using cash to purchase goods to now using credit and debit cards across the world will provide a continued growth opportunity for MasterCard to capitalize on.

Additionally, direct payments from governments to consumer will further increase consumer spending, of which MasterCard can likely directly benefit from. Recently, California announced they will be sending out inflation relief checks of up to $1,050.

We project that the company can continue to grow earnings by 15% annually through 2027.

Competitive Advantages & Recession Performance

MasterCard’s entrenched position in the electronic payment space is one of its key competitive advantages. It is one of the top companies in the electronic payment space and is likely to benefit from increased use of debit and credit cards as a form of payment for goods and services.

During the last recession, MasterCard was still able to grow earnings. While consumers will likely cut back on spending during recessions, items like gas, groceries and clothes are necessities. Even with a drop in spending, consumers will likely continue to use debit and credit cards for their purchases.

MasterCard has raised its dividend for eleven consecutive years so far. The company’s leadership position in its industry affords it the ability to constantly increase its dividend at an extremely strong growth rate, and still maintain a very reasonable payout ratio of roughly 20%. We expect continued dividend growth from MasterCard of about 15% per annum, in-line with earnings growth.

Valuation & Expected Returns

Shares of MasterCard have traded for a 5- and 10-year average price-to-earnings multiple of 34.9 and 29.7, respectively. Shares are now trading in between both of these averages, which indicates that shares could be near fair value at the current 32.6 times earnings. However, we prefer to remain conservative, and peg fair value at the lower range.

Our fair value estimate for MasterCard stock is 27.0 times earnings. If this proves correct, the stock will correct by a -3.7% annualized loss in its returns through 2027.

Shares of MasterCard currently yield just 0.6%, which is identical to its 5- and 10-year average yields of 0.6% as well. On a dividend yield basis, MasterCard shares seem to be trading at roughly fair value.

Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 11.4% per year over the next five years. This makes MasterCard a buy.

Final Thoughts

MasterCard is a leader in electronic payment services and has had an incredible run-up in its share price in the last five and ten years. For a growth stock, it has held up fairly well in the year-to-date period where it has shed -13.5% of its share price.

While the company has a miniscule yield of 0.6%, it’s competitive advantage enables it to grow the dividend at an impressive annual rate. Given it’s incredible growth outlook, MasterCard appears to be an attractive stock, though it is trading above our fair value estimate.

Other Dividend Lists

Value investing is a valuable process to combine with dividend investing. The following lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats List is comprised of 65 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.