Published on July 3rd, 2022 by Felix Martinez

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth more than $360 billion as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can ‘cheat’ from Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all Warren Buffett stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download Buffett’s holdings now.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31, 2022, Buffett’s Berkshire Hathaway owned just over 325.6 million shares of The Kraft Heinz Company (KHC) for a total market value exceeding $12.58 billion. The Kraft Heinz Company currently constitutes over 4.2% of Berkshire Hathaway’s investment portfolio.

In this article, we’ll thoroughly examine The Kraft Heinz Company’s prospects as an investment today.

Business Overview

Kraft-Heinz is a processed food and beverages company with a large product portfolio that includes food products such as condiments, sauces, cheese & dairy, frozen & chilled meals, and infant diet & nutrition. The company was created in 2015 in a merger between Kraft Food Group and H. J. Heinz Company, orchestrated by Warren Buffett’s Berkshire Hathaway and 3G Capital. Kraft-Heinz is headquartered in Chicago, IL.

The company leverages its scale and agility to grow across a portfolio of six consumer-driven product platforms. The company’s well-known brands are Heinz ketchup, Mayo, Lunchable, Oscar Mayer, Jell-o, and Kool-Aid. The company has a total net sales of $26 billion for Fiscal Year (FY)2021, with a market capitalization of $46.7 billion.

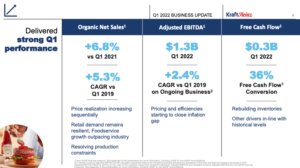

On April 27, 2022, the company reported first-quarter results for FY2021. For the first quarter, total sales were down 5.5% compared to the first quarter of 2021. Total sales were $6,045 million compared to 1Q2021 of $6,394 million. The United States region saw a significant decrease of 8.5% in sales, whereas the international region saw sales increases of 3.6%, and the Canada segment also saw sales decrease 5.5% year-over-year. However, year-over-year organic net sales growth was 6.8% for the quarter versus the first quarter of 2021.

Net income for the quarter was up substantially. The company reported a profit of $781 million compared to a profit of $568 million in 1Q2021, mainly due to lower non-cash impairment losses in the current year period, lower interest expense primarily due to debt extinguishment costs in the prior-year period, and favorable changes in other expense/(income).

Thus, diluted Earning Per Share (EPS) was increased to $0.60 compared to $0.46 per share same quarter the prior year. However, Adjusted EPS was down for the quarter by 16.7%, from $0.72 per share in 1Q2021 to a reported $0.60 per share, primarily driven by lower Adjusted EBITDA, including a negative $0.08 impact from divestitures, and higher taxes on adjusted earnings that more than offset lower interest expense versus the prior-year period

Source: Investor Presentation

Growth Prospects

Growth drivers for the company will come from devasting on low-performing brands and acquiring brands that complement existing brands. Emerging markets are also a source of growth for the company. Organic net sales grew by 17% for 2021 compared to 2019. Also, focusing on brand expansion like plant-based items and Heinz brand extension should help the company with future growth.

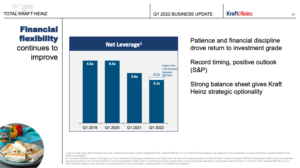

Source: Investor Presentation

Also, growth from the company’s international segment will help continue the development of the company. As you can see, organic net sales in the emerging market increased 31% compared to 1Q2022. It has grown 18% compared to 1Q2019, pre-COVID-19 pandemic levels.

Source: Investor Presentation

Competitive Advantages & Recession Performance

The competitive advantage for the company is its brand awareness. The company has brands that most people, if not all, in America have heard of. Thus, we think maintaining or increasing brand spending will be important in sustaining brand awareness and assuring a competitive advantage. The spending on advertising is essential for the company since most customers are now looking for healthier options.

Since the company was not around during the Great Recession of 2008-2009, we will look at how the company performed during the COVID-19 pandemic.

KHC’s earnings-per-share before and after the COVID-19 pendmic:

- 2018 earnings-per-share of $3.53

- 2019 earnings-per-share of $2.85 (19% decrease)

- 2020 earnings-per-share of $2.88 (1% increase)

- 2021 earnings-per-share of $2.93 (2% increase)

Earnings declined before the COVID-19 pandemic, as the company earnings dropped by 19% in 2019. But the company did recover modestly by 1% in 2020 and 2% in 2021.

Source: Investor Presentation

Valuation & Expected Returns

Earnings are expected to be $2.69 per share for this year. This is lower by 8% than what the company earned in 2021, which was $2.93 per share. At the current price of $38.64, this gives us a PE ratio of 13.8x earnings.

The current PE ratio is higher than the company’s five-year average of 12.2x earnings. Thus, this lets us know that the company looks to be slightly overvalued at the current price.

Thus, we expect a total return over the next five years to be between 5-7%. This will mostly come from the company’s high dividend yield of 4.1%.

Final Thoughts

The Kraft Heinz Company is a company that is trying to change things around. The company owns some of the well-known brands in the USA. Because of international growth, the company should be able to generate some earnings growth in the long run, but Kraft-Heinz will never turn into a high-growth company. Overall, the company dividend is safe and well suited for investors looking for a safe, high-yield company. However, we do view the company as a hold at the current price.

Other Dividend Lists

Value investing is a valuable process to combine with dividend investing. The following lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats List is comprised of 65 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 38 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.