Published on June 27th, 2022 by Quinn Mohammed

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth over $360 billion, as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can follow Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all Warren Buffett stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download Buffett’s holdings now.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Buffett’s Berkshire Hathaway owned about 5.2 million shares of Citigroup Inc. (C) for a market value of $2.9 billion. Citigroup Inc. represents about 0.8% of Berkshire Hathaway’s investment portfolio. This ranks it the 15th largest position in the portfolio, out of 49 stocks.

This article will analyze the financial services company in greater detail.

Business Overview

Citigroup was founded in 1812, and in the past 200+ years, has grown into a global behemoth in credit cards, commercial banking, trading, and a variety of other financial activities.

The corporation does business in more than 160 countries and jurisdictions, has roughly 200 million customer accounts, and produces about $71 billion in annual revenue.

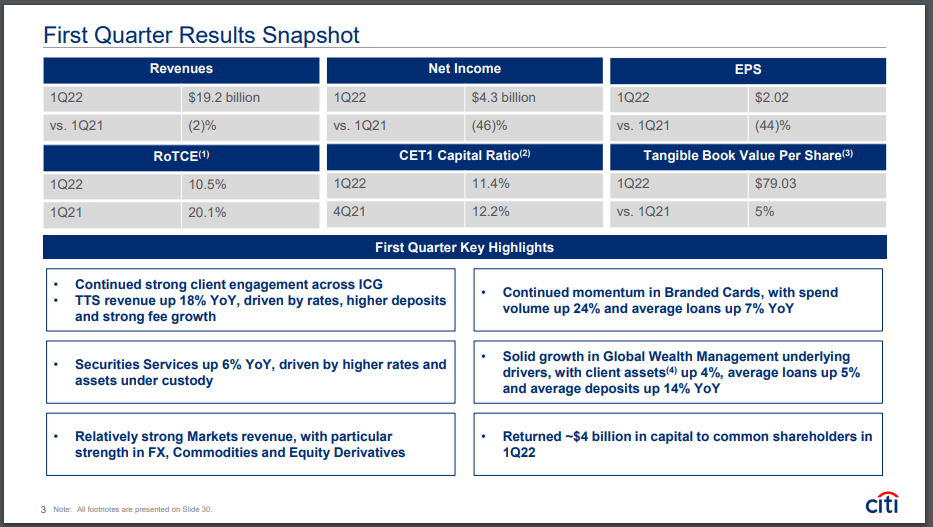

Citi reported first quarter earnings on April 14th, 2022, and results came in above expectations. Adjusted revenue was $19.2 billion in the quarter, which was down about 2% year-over-year.

Source: Investor Presentation

The company generated earnings-per-share of $2.02, down from strong earnings of $3.62 per share in the prior year. Earnings benefited from a 6% decline in Citi’s common shares outstanding.

Cost of credit came to $755 million in Q1, which was up dramatically from a benefit of $2.1 billion a year ago. Operating expenses were $13.2 billion, up 15% year-over-year. Excluding divestitures, expenses would have risen 10% year-over-year as the bank continues to invest in items like IT infrastructure.

We have a $6 earnings-per-share forecast for the fiscal year 2022, which would be a more normalized value compared to the record the company posted in 2021.

This year’s forecast is lower than 2021 levels since billions of dollars in profit reported in the prior year was the result of credit loss reserve releases, which won’t be repeatable in 2022.

Growth Prospects

We believe Citi will continue to generate higher revenue as its institutional and consumer businesses collect cheap deposits and lend them prudently, resulting in reasonable loss rates and favorable margins.

As a result of less than favorable spreads on loans, Citi appears to be pulling back on lending for the time being. The resulting higher deposit costs without commensurate lending revenue weigh on top line and margin growth.

Citi is not as reliant on traditional lending as most other banks, so the yield curve is not as crucial, while the cost of deposits is important for its massive credit card business.

Additionally, the company’s buybacks could amount to a mid-single-digit reduction in the share count annually, as we saw with the 6% reduction in the trailing twelve months, further boosting bottom line results.

We estimate Citi can grow earnings-per-share at about 5% annually in the intermediate term.

Competitive Advantages & Recession Performance

Citigroup’s competitive advantage is in its global reach and its major position in the profitable credit card business. Citi has distinguished itself from the other money center banks in this way and it continues to benefit the bank meaningfully.

The corporation is very vulnerable to recessions as it nearly went out of business during the Great Financial Crisis in 2008 & 2009. The 2020 COVID-19 pandemic downturn also wasn’t kind to Citi. We note that the bank is in much better shape than it was heading into the financial crisis though, from both a balance sheet and business mix perspective.

Citi has raised its dividend for six consecutive years leading into 2020. Earnings were nearly slashed in half in 2020 compared to the previous year, and Citi kept its dividend at the $2.04 level, where it has remained since.

Despite this pause, we expect dividend raises in the years to come. Citi’s payout ratio now is only 34% of estimated earnings for this year.

Valuation & Expected Returns

Shares of Citigroup have traded for a 5- and 10-year average price-to-earnings multiple of 9.8 and 11.1, respectively. Shares are now trading below both of these averages, which indicates that shares could be undervalued at the current 7.7 times earnings. As a result, we believe there is a potential for a valuation tailwind in the intermediate term.

Our fair value estimate for Citigroup stock is 9.5 times earnings. If this proves correct, the stock will benefit from a 4.2% annualized gain in its returns through 2027.

Shares of Citigroup currently yield 4.2%, which is far above the 5- and 10-year average yields of 2.6% and 1.5%. Due to the 33% year-to-date loss in the stock price, the company now has a higher-than-average dividend yield. On a dividend yield basis, Citigroup shares seem to be trading at a discount.

Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 12.9% per year over the next five years. This makes Citigroup a buy.

Final Thoughts

Given the sharp decline in Citi’s share price so far in 2022, the company boasts a higher-than-average dividend yield of 4.4%, which would add to returns meaningfully. Additionally, shares seem to be undervalued on a price-to-earnings basis and offers fair mid-single digit earnings growth from here on out.

Citigroup shares appear to offer good value at these prices, but the company so far has paused its dividend growth streak. So, dividend growth investors may be cautious on this name.

Other Dividend Lists

Value investing is a valuable process to combine with dividend investing. The following lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats List is comprised of 65 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.