Published on June 27th, 2022 by Quinn Mohammed

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth over $360 billion, as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can follow Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all Warren Buffett stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download Buffett’s holdings now.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Buffett’s Berkshire Hathaway owned about 3.8 million shares of Charter Communications (CHTR) for a market value of $2.1 billion. Charter Communications represents about 0.6% of Berkshire Hathaway’s investment portfolio. This marks it as the 19th largest position in the portfolio, out of 49 stocks.

This article will analyze the telecom services company in greater detail.

Business Overview

Charter Communications is a broadband connectivity company and cable operator. The company serves over 32 million customers across 41 states under its Spectrum brand.

Charter provides communications services including Spectrum Internet, TV, Mobile and Voice to residential customers and businesses.

In May 2016, Charter acquired Time Warner Cable and Bright House Networks.

The company reported first quarter 2022 results on April 29th. First quarter revenue came to $13.2 billion, which was a 5.4% year-over-year increase. Residential revenue, mobile revenue and commercial revenue growth all came in at 3.7%, 40.2%, and 4.3%, respectively.

Net income of $1.2 billion in Q1 2022 increased 49% compared to Q1 2021, driven by higher adjusted EBITDA and non-recurring litigation settlement chargers recorded in Q1 2021.

Diluted earnings per share were $6.90 for the first quarter, a significant 68% year-over-year increase.

Charter also repurchased 6.0 million shares of common stock for roughly $3.6 billion.

We estimate that Charter Communications can generate $30.90 in earnings-per-share for the fiscal 2022 year.

Growth Prospects

Charter Communications’ primary goal is to drive connected customer and mobile broadband relationship growth. The company’s converged connectivity products should lead to further customer and revenue growth.

Additionally, the company recently created a joint venture with Comcast to provide a next generation streaming platform which will offer products that meet the fast-changing demand of consumers. This should enable Charter to better compete with streaming platform operators.

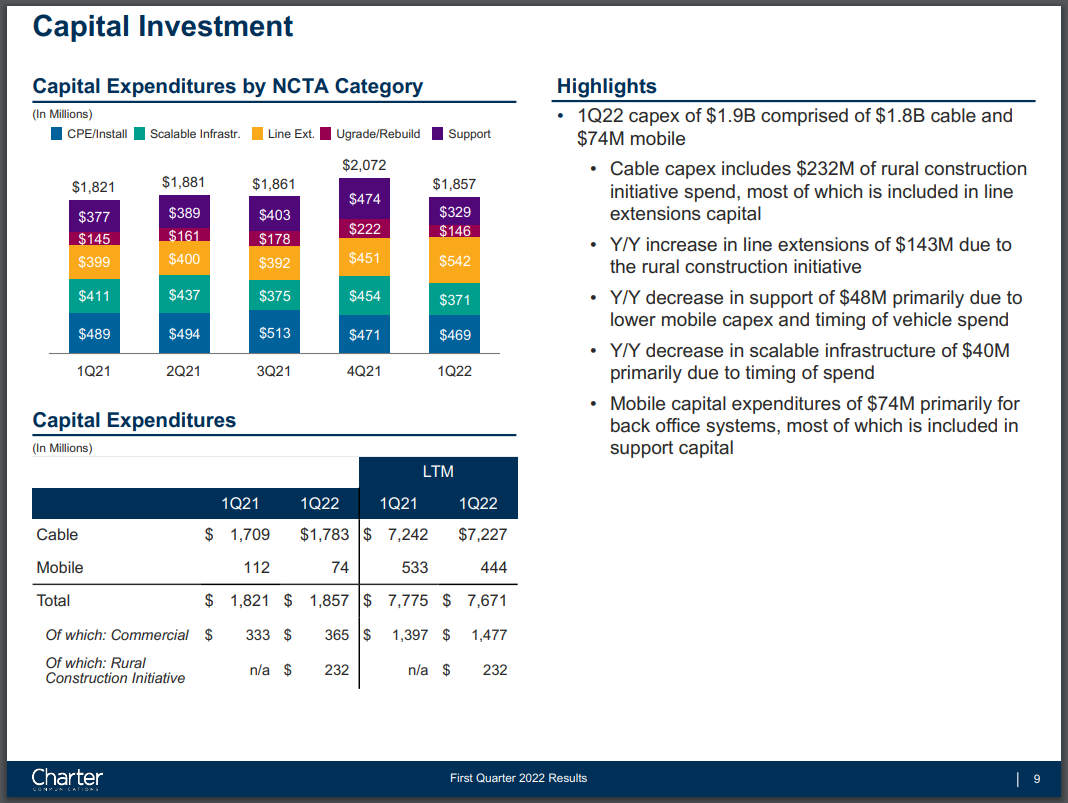

The company consistently invests in the business, with the bulk of it going into line extension, scalable infrastructure, and CPE/Install. In the first quarter of 2022, Charter spent 14.1% of total revenue on capex.

Source: Investor Presentation

Also, the company’s share repurchases could add to the company’s bottom line. In the trailing twelve months, Charter reduced their outstanding share count by 15.3%.

The share count hit a peak of 396 million shares in 2006 and has since come down to 174.5 million shares as of March 31st, 2022.

We expect Charter to produce 5.0% annual growth in the intermediate term.

Competitive Advantages & Recession Performance

Charter Communications’ competitive advantage lies in its major infrastructure set up which is difficult and expensive for new entrants to replicate. The company has a massive customer base and a significant geographical presence across the United States.

Charter is fairly vulnerable to recessions as it reorganized under Chapter 11 bankruptcy amid the Great Financial Crisis, which reduced its debt by $8 billion at the time. During the COVID-19 pandemic, however, results were strong, as more and more people began to spend time at and work from home. Additionally, the core broadband business is slowing, and the company must pivot successfully.

Charter has no dividend for which it may be unable to pay. As a result, the company can continue to spend a not insignificant portion of revenue on capital expenditures and growing the business.

Valuation & Expected Returns

Charter Communications shares have traded for an average price-to-earnings multiple of 35.9 since 2016. Shares are now trading at less than half of this average, which indicates that shares could be undervalued at the current 15.0 times earnings. As a result, we believe there is a potential for a valuation tailwind in the intermediate term.

Our fair value estimate for Charter Communications stock is 18.0 times earnings. If this proves correct, the stock will benefit from a 3.7% annualized gain in its returns through 2027.

Shares of Charter Communications currently do not pay a dividend, so investors must rely on earnings growth and valuation expansion for total returns.

Putting it all together, the combination of valuation changes and EPS growth produces total expected returns of 8.9% per year over the next five years. This makes Charter Communications a hold.

Final Thoughts

Given the significant share price losses so far in 2022, the company appears to be undervalued on a price-to-earnings basis and offers multiple expansion.

The company’s joint venture with Comcast should see some modernization in the company’s offerings, which in turn offers a growth avenue. However, with no dividend, Charter may be a pass for income investors.

Other Dividend Lists

Value investing is a valuable process to combine with dividend investing. The following lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats List is comprised of 65 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.