Published on June 28th, 2022 by Felix Martinez

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth more than $360 billion as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can ‘cheat’ from Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Free Excel Download: Get a free Excel Spreadsheet of all Warren Buffett stocks, complete with metrics that matter – including P/E ratio and dividend yield. Click here to download Buffett’s holdings now.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31, 2022, Buffett’s Berkshire Hathaway owned just over 151.6 million shares of American Express Company (AXP) for a market value exceeding $22.16 billion. American Express Company currently constitutes a little over 7.3% of Berkshire Hathaway’s investment portfolio.

This article will analyze this consumer finance company in greater detail.

Business Overview

American Express is a globally integrated payments company that operates in the following business units: US Card Services, International Consumer and Network Services, Global Commercial Services, and Global Merchant Services. American Express was founded in 1850 and is headquartered in New York, NY.

The company currently has a market capitalization of $110.1 billion. AXP has been growing its dividend for nine consecutive years from 2012 to 2020. However, it has paid the same dividend for two and a half years. Thus losing its nine-year streak, it recently increased its dividend by 20% in March 2022 and now has a low dividend yield of 1.42%.

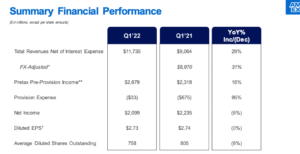

On April 22, 2022, the company reported first-quarter results for Fiscal Year (FY)2022. Revenue beats estimates by $70 million to $11.73 billion. This represents a year-over-year increase of 29.5%. Reported Q1 GAAP EPS of $2.73 per share also beats estimates by $0.28.

The company reported a net income of $2.1 billion, or $2.73 per share, compared to a net income of $2.2 billion, or $2.74 per share, a year ago. This represents a decrease of 4,5% and 0.4%, respectively.

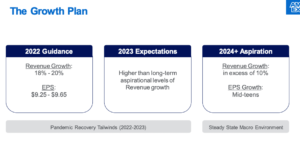

Overall, the company management was happy with the quarter results and is reaffirming the company’s full-year guidance of 18 -20% revenue growth and earnings per share between $9.25 and $9.65 per share.

Source: Investor Presentation

Growth Prospects

The company operates as a closed-loop network for payments. This means that American Express issues the credit card to the consumer, operates the payment network, and establishes a direct relationship with the merchant. A closed-loop network allows American Express to capture the total economic profit from a single credit card payment.

So as long as the company can sign up new customers, this will help with growth for the top and bottom lines.

Source: Investor Presentation

The company expects to grow revenue by 18-20% in 2022 compared to 2021. They also expect earnings to be between $9.25 and $9.65. The mid-point would be $9.45 per share. This would represent a decrease of 5.7%. This is ok, as the company grew earnings from 2020 to 2021 by 166%.

Source: Investor Presentation

Competitive Advantages & Recession Performance

Its strong brand and global reach serve as competitive advantages. The company generates most of its revenue from discount revenue and card fees, with noninterest income making up roughly 80% of its revenue. In contrast, other credit card issuers typically depend on net interest income. Not being as reliant on interest income benefits American Express to build a solid competitive position in credit cards for high-income individuals and businesses. Both groups are less likely to carry large outstanding balances on their cards.

The company did not perform well during the Great Recession of 2008-2009, and it did not perform well during the COVID-19 pandemic. For example, during the Great Recession, the company’s earnings dropped 24% in 2008 and 40% in 2009. However, the company did not cut the dividend. Instead, the company froze the dividend but continued to pay it out.

Durning COVID-19, earnings drop 53% from 2019 to the end of 2020. Again, fortunately, the company was able to continue to pay its dividend. However, they also froze their dividend for 2020 and 2021. The company recently announced a dividend increase of 20% in March 2022.

Valuation & Expected Returns

The company is trading hands currently with a PE ratio of 14.5X earnings. Over the past ten years, the company has averaged a PE of 15.4X earnings. Thus, the stock looks to be slightly undervalued at today’s price.

The current dividend yield is also higher than the company’s five-year average of 1.35%. Thus, another indicator is that the stock is slightly undervalued.

We expect earnings will grow 7% annually for the next five years. Thus, with a slight valuation tailwind, and a solid earnings growth of 7%, we see that the company can generate 10-13% in total return for the next five years annually.

Final Thoughts

Credit card company American Express is a quality name that combines consistent earnings and dividend growth with a recession performance that was much better than many of its peers. Its strong brand and global reach serve as competitive advantages. We believe that American Express will produce solid earnings-per-share growth during the coming years as the economy and the company recover from the coronavirus aftereffect. Thus, we rate the stock a buy at the current price.

Other Dividend Lists

Value investing is a valuable process to combine with dividend investing. The following lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats List is comprised of 65 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 38 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.