Updated on March 17th, 2021 by Nikolaos Sismanis

Valley Forge Capital Management is one of the largest equity hedge fund managers in the mid-Atlantic region with more than $1 billion in assets under management, out of Wayne Pennsylvania. The fund runs a long-biased equity strategy and employs a rigorous, bottom-up fundamental approach to find the highest quality businesses. According to its latest 13F filing, the fund’s public-equity portfolio consisted of 10 securities, currently valued at around $1.05 billion.

Investors following the company’s 13F filings over the last 3 years (from mid-February 2018 through mid-February 2021) would have generated annualized total returns of 23.6%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 12.50% over the same time period.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

You can download an Excel spreadsheet (with important financial metrics that matter) of Valley Forge’s current 13F equity holdings below:

Keep reading this article to learn more about Valley Forge.

Table Of Contents

Valley Forge’s Investment Philosophy

Valley Forge’s founder Dev Kantesaria believes that superior investment returns are achieved through patience and avoiding acting emotionally during volatile market swings. This way, Valley Forge can take advantage of opportunities when the rest of the market may be behaving irrationally or fearfully.

The fund’s philosophy is quite unique, focusing on a few, multi-year conviction ideas. Valley Forge looks to purchase industry-leading companies whose business models can flourish under various economic conditions. By implementing this approach, the fund faces no need to time the market around macroeconomic factors, or make short-term predictions.

The fund’s investing rule is simple: to buy “compounding machines” that are likely to appreciate in value over the long term, and avoid “cigar butt” stocks, which look cheap but often end up being value traps. Particularly, Valley Forge is looking to invest in public equities that benefit significantly from organic growth.

The fund’s portfolio is constructed with a few high-conviction ideas, which management believes is the only way to significantly outperform the general indices over the long term. Since the fund usually holds around 10 positions and adds only one to three positions per year, new holdings must meet its rigorous criteria of business quality, financial metrics, and operational standards.

Current Portfolio Holdings

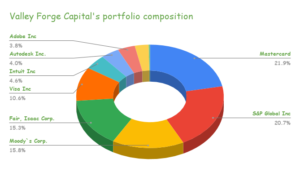

The fund’s investment philosophy is well-mirrored in its concentrated portfolio, consisting of only 10 market-leading holdings with wide moats in their respective industries.

Source: Company filings, author

S&P Global (SPGI) & Moody’s Corp. (MCO)

Both S&P Global and Moody’s Corp are market leaders in providing ratings, benchmarks, analytics, and data to the capital and commodity markets worldwide. The two companies possess a wide moat and are widely trusted for the proprietary data, organically growing as the economy expands. VFCM is so confident when it comes to the two companies’ market dominance and resilience that the two stocks account for 36.5% of the fund’s total portfolio. The fund increased both positions slightly, by around 1% each, during Q4.

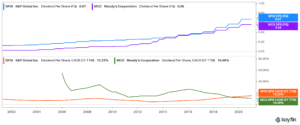

The two companies do not only fit Valley Forge’s organic growth requirements, but they also feature excellent dividend growth histories. S&P Global is a Dividend Aristocrat, boasting 48 years of consecutive annual dividend increases. Moody’s has also been growing its dividend annually for the past 12 years, and never cutting it since its first one paid in 2000. Amid rapid earnings growth, both companies have been able to grow their dividends rapidly as well, while still retaining payout ratios below 30%. Their 5-year DPS CAGRs are currently 15.22% and 10.49%, respectively.

Visa & Mastercard: (V),(MA):

Another duo that fits Valley Forge’s investment criterion is Visa and Mastercard. The two companies enjoy an unparalleled business model, with a non-approachable barrier to entry. Having strong relationships with every major bank in the world, the two companies operate virtually in a duopoly, dominating the payments processing industry. Further, operating as a toll-booth to every transaction, they are set to organically grow as the global economies go cashless, checking all of VFCM’s boxes. Both stocks account for around 32.4% of the total holdings, having shown promising recovery signs amid COVID-19’s adverse effects on card swipes.

While they have underperformed the overall tech sector as of recently due to their lagged performance, the two companies remain excellent investments for the long-term, with a massive margin of safety and AAA management teams. Capital returns continue to remain attractive as well. Both companies have been growing their dividends at double-digit rates, while retiring considerable amounts of their stock each quarter, further boosting their EPS growth.

Valley Forge increased both its Visa and Mastercard position by 11% and 52%, respectively during Q4.

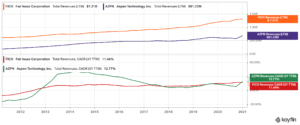

Fair Isaac & Aspen Technology (FICO),(AZPN):

Another pair to complement VFCM’s fintech and capital markets-oriented portfolio is Fair Isaac & Aspen Technology, occupying around 20% of its holdings. The two companies provide asset optimization and data management software solutions that enable businesses to automate and enhance their decision-making processes.

It’s important to notice how Valley Forge’s portfolio is structured to benefit from their respective favorable market trends, by holding pairs of market leaders whose business models have proven to be impenetrable over the past decade. Management’s patience and confidence in its long-term thesis are quite remarkable. Over the past two years, the portfolio’s only modification was to swap Facebook with Autodesk, besides adding to its existing positions.

Intuit (INTU):

Intuit is around 4.6% of its total holdings. The company is the market leader in providing services for consumers, small businesses, self-employed, and accounting professionals worldwide. The creator of Turbo-Tax has been taking the industry by storm through serial acquisitions. Intuit has bought more than 35 companies over the past few years, with its most recent big deal to purchase Credit Karma for $7 billion, striving to expand its global moat further.

The company just recently ended its financial year strongly once again, achieving quarterly revenues of $1.58 billion. While lower due to calendar mismatching, revenue actually grew year-over-year. Management also announced its FY2021 guidance for revenues of $8.20-8.40 billion, a 4%-7% growth rate year-over-year. Due to its consistent growth, strong guidance, and recession-proof services, the company’s forward P/E of around 43.5 should be well-justified.

Adobe (ADBE) & Autodesk (ADSK):

Collectively taking up just under 8% of its holdings, both Adobe and Autodesk are the most trusted and widely used software suites in the digital arts and engineering spaces, respectively. Adobe has effectively monopolized the sector through its Creative Cloud, which is used from amateur creators to Hollywood blockbuster video and photo editors.

On the other hand, Autodesk holds the dominant position in designing and visualizing the infrastructure that surrounds us. Valley Forge has ensured its exposure in the future software designer leaders of both the digital and real world.

Valley forge increased its Adobe position by 12% during the quarter, while holding its Autodesk stake stable.

Amazon (AMZN):

Amazon is less than 1% of Valley Forge’s total holdings. The e-commerce and digital infrastructure giant is another example of the fund’s philosophy put in action. The company has been proven to be an unstoppable juggernaut, whose latest earnings report surprised investors by delivering a record $7.22 billion in quarterly profits.

Based on Valley Forge’s past investing behavior, we believe that management will continue adding to its current, rather tiny position.

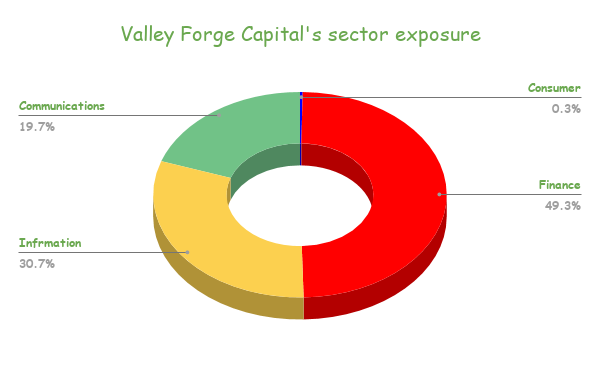

While the company’s portfolio has been truly outperforming the overall market, it is extremely concentrated and lacks sector diversification.

Investors should not plainly copy Valley Forge’s holdings, as the fund likely holds various other financial derivatives to protect itself against its diversification risks.

Source: Company filings, Author

Final Thoughts

Valley Forge holds a highly concentrated portfolio of stocks that complement each other. Its conviction, industry-leading holdings greatly illustrate the fund’s investment philosophy. Despite its non-diversified and arguably controversial asset allocation, Valley Forge has greatly outperformed the market by a wide margin. Over the past few years, the fund’s returns are more than double those of the S&P500, proving management’s winning stock-picking skills.