Time to Buy Quantum Stocks? (QBTS, IONQ, RGTI)

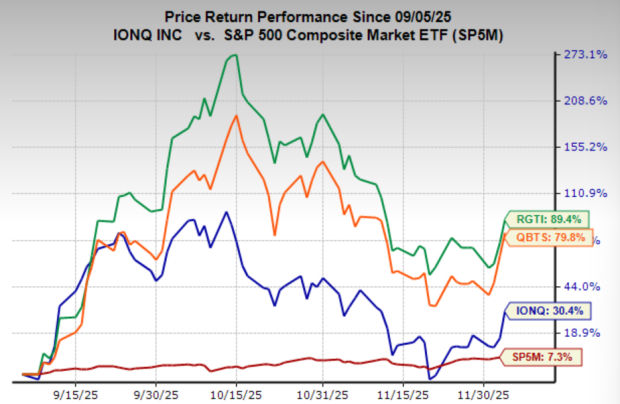

After a sharp six-week correction, quantum stocks are finally showing signs of life. The technical setups across IonQ (IONQ), Rigetti Computing (RGTI), and D-Wave Quantum (QBTS) have tightened into bullish coils and all three have broken higher this week on good volume, which can often an early signal of renewed momentum.

The selloff began last month as fears of a broader collapse in AI stocks triggered widespread risk-off behavior. The most speculative corners of the market were hit hardest, and quantum names were no exception. Several of these stocks dropped by as much as 65% from their October highs, a dramatic reset after what had already been a spectacular run this year. In hindsight, the pullback served as a necessary shakeout of late to enter traders.

With the broader market stabilizing and speculative appetite returning, the momentum in quantum computing appears to be turning. Let’s take a closer look at the technical picture in IonQ, Rigetti, and D-Wave, and whether this rebound has room to run.

Image Source: Zacks Investment Research

IonQ Stock Breaks Higher

Among the quantum names highlighted here, and arguably across the entire sector, IonQ remains the clear leader, supported by the largest market capitalization, the strongest commercial traction, and the most meaningful annual revenue. After spending nearly three weeks consolidating near its recent lows, the stock finally unleashed a decisive breakout, surging almost 12% in today’s session alone.

As long as IonQ holds above its breakout zone, the technical picture remains constructive, and a successful retest of that level would only strengthen the setup.

For investors looking to initiate or add to a position, the breakout area now serves as a logical risk management anchor. Pullbacks into that region may offer favorable entry points, especially if supported by continued strength in the quantum theme more broadly.

Image Source: TradingView

D-Wave Quantum Stock Rallies

D-Wave is delivering one of the strongest rebounds in the group, now posting its second consecutive day of sharp gains. After collapsing more than 60% during the recent selloff, the stock formed a tight base at the lows and has since exploded higher.

The near-term trend has clearly shifted and as long as D-Wave holds above yesterday’s breakout levels, the stock has room to extend this move. Traders can look for shallow pullbacks or inside-day consolidations as potential continuation signals.

Image Source: TradingView

Rigetti Computing Shares on the Run

Rigetti’s chart mirrors the broader sector: a deep pullback, a multi-week coil, and now a clean move back above resistance. Today’s breakout confirms that buyers are returning.

Rigetti remains a high-beta name and tends to move sharply in both directions, but the reclaim of key levels is a constructive sign. If the stock can remain above its breakout point, momentum could carry it higher alongside the rest of the quantum computing group.

Entry-minded investors may want to watch for controlled pullbacks into prior resistance, which now acts as support.

Image Source: TradingView

Should Investors Buy Shares in QBTS, IONQ and RGTI?

Quantum stocks remain highly speculative, but the technical picture across the group has improved meaningfully. All three names have reclaimed key levels, broken out of multi-week consolidations, and attracted renewed buying interest.

While volatility is still elevated, the recent shakeout has reset sentiment and created cleaner setups. For investors comfortable with higher-risk opportunities, this rebound could mark the beginning of another leg higher in the quantum computing theme. As always, position sizing and disciplined risk management remain essential.

Zacks' Research Chief Picks Stock Most Likely to "At Least Double"

Our experts have revealed their Top 5 recommendations with money-doubling potential – and Director of Research Sheraz Mian believes one is superior to the others. Of course, all our picks aren’t winners but this one could far surpass earlier recommendations like Hims & Hers Health, which shot up +209%.

See Our Top Stock to Double (Plus 4 Runners Up) >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

IonQ, Inc. (IONQ): Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI): Free Stock Analysis Report

D-Wave Quantum Inc. (QBTS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Source Zacks-com