This Stock Is Down 86%, But 1 Number Suggests a Reversal Might be Near

Interest rates soared throughout 2022 and 2023, leaving businesses feeling uncertain. They couldn't be sure about the impact on consumer spending, so many of them braced for lower revenue by slashing costs -- especially on line items like marketing. That hurt companies reliant on advertising to generate revenue, including Meta Platforms, Google parent Alphabet, and (NYSE: SNAP).

Meta and Google have used their scale to great effect and are growing nicely once again after a challenging 18 months between 2022 and the first half of 2023. But advertisers haven't flocked back to Snap's SnapChat platform quite as quickly, and the company generated no year-over-year revenue growth in 2023.

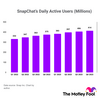

But one metric makes me confident that Snap's recovery is inevitable. SnapChat had a record-high 414 million daily active users in the recent fourth quarter, marking a 10% year-over-year increase. Per the below chart, SnapChat's user base grew in every single quarter throughout this tough period.

Source Fool.com

Snap Inc Stock

Our community is currently high on Snap Inc with 11 Buy predictions and 5 Sell predictions.

However, we have a potential of -1.2% for Snap Inc as the target price of 14 € is below the current price of 14.17 €.