Published on August 27th, 2019 by Samuel Smith

There are two ways investors can gain exposure to gold. One way would be to invest in the commodity itself, which can be done either by purchasing physical gold or buying shares in an exchange-traded fund such as the SPDR Gold Trust (GLD), which tracks the price of gold.

The other way to invest in gold is to buy shares of gold mining companies. These are companies that explore for and produce gold. While these stocks are also reliant on the price of gold, their revenue and cash flow is dependent on other factors as well, such as production rates and quality of assets.

You can download our full list of gold mining stocks below:

Furthermore, you can view a preview of our gold stocks spreadsheet below:

| FCX | Freeport-McMoRan, Inc. | 8.77 | 2.3 | 12,825 | 19.7 | 44.6 | 1.47 |

| NEM | Newmont Goldcorp Corp. | 40.76 | 1.4 | 32,344 | -299.7 | -425.4 | -0.08 |

| ABX | Barrick Gold Corporation | 0.00 | 0.0 | 0 | 0.00 | ||

| AEM | Agnico Eagle Mines Ltd. | 63.89 | 0.8 | 14,729 | -47.8 | -36.2 | -0.31 |

| KL | Kirkland Lake Gold Ltd. | 49.91 | 0.3 | 10,021 | 27.8 | 7.1 | -0.36 |

| KGC | Kinross Gold Corp. | 5.19 | 0.0 | 6,249 | 1,620.3 | 0.0 | -0.35 |

| GFI | Gold Fields Ltd. | 6.22 | 0.0 | 57.4 | 0.0 | -0.54 | |

| AGI | Alamos Gold, Inc. | 7.36 | 0.4 | 2,749 | -120.8 | -51.1 | -0.50 |

| BTO | John Hancock Financial Opportunities Fund | 29.46 | 5.5 | 560 | -4.7 | -26.2 | 1.00 |

| BVN | Compañía de Minas Buenaventura SAA | 15.21 | 0.0 | -84.5 | 0.0 | -0.18 | |

| CG | The Carlyle Group LP | 22.22 | 5.8 | 7,439 | 8.7 | 50.2 | 1.18 |

| ASR | Grupo Aeroportuario del Sureste SA de CV | 139.71 | 0.0 | 15.1 | 0.0 | 0.66 | |

| CEY | VictoryShares Emerging Market High Dividend Volatility Wtd ETF | 21.98 | 0.0 | 0.71 | |||

| SBM | ProShares Short Basic Materials | 19.61 | 0.0 | -0.68 | |||

| SSRM | SSR Mining, Inc. | 17.20 | 0.0 | 1,974 | 104.1 | 0.0 | -0.37 |

| ELD | WisdomTree Emerging Markets Local Debt Fund | 34.25 | 0.0 | 0.21 | |||

| EDV | Vanguard Extended Duration Treasury Index Fund | 147.75 | 0.0 | -0.32 | |||

| RSG | Republic Services, Inc. | 88.81 | 1.7 | 28,306 | 27.3 | 46.5 | 0.48 |

| CDE | Coeur Mining, Inc. | 5.59 | 0.0 | 1,128 | -9.6 | 0.0 | 0.23 |

| NGD | New Gold, Inc. | 1.25 | 0.0 | 706 | -0.8 | 0.0 | -0.08 |

| MUX | McEwen Mining, Inc. | 2.10 | 0.5 | 724 | -12.4 | -6.2 | -0.27 |

| Ticker | Name | Price | Dividend Yield | Market Cap ($M) | P/E Ratio | Payout Ratio | Beta |

This article examines the investment prospects of 7 of the top gold mining stocks in detail, as ranked using expected total returns from the Sure Analysis Research Database as well as analysis of a few stocks outside of our current coverage universe.

We rank these 7 companies by our expected total annual return estimate over the next five years, which is a combination of future earnings-per-share growth, current dividend yield, and the impact of multiple expansion or contraction.

While not all 7 stocks are buys–many are holds or sells due to valuation concerns–these 7 companies provide investors to exposure to gold. If the price of gold rallies in the coming months or years, these 7 stocks stand to benefit the most.

Table of Contents

- Barrick Gold Corp (GOLD)

- Wheaton Precious Metals (WPM)

- Newmont Goldcorp (NEM)

- Newcrest Mining Limited (NCMGY)

- Yamana Gold (AUY)

- Kinross Gold (KCG)

- Freeport McMoRan (FCX)

Top Mining Stock #7: Barrick Gold Corp (GOLD)

- Estimated total annual return through 2024: -8.5%

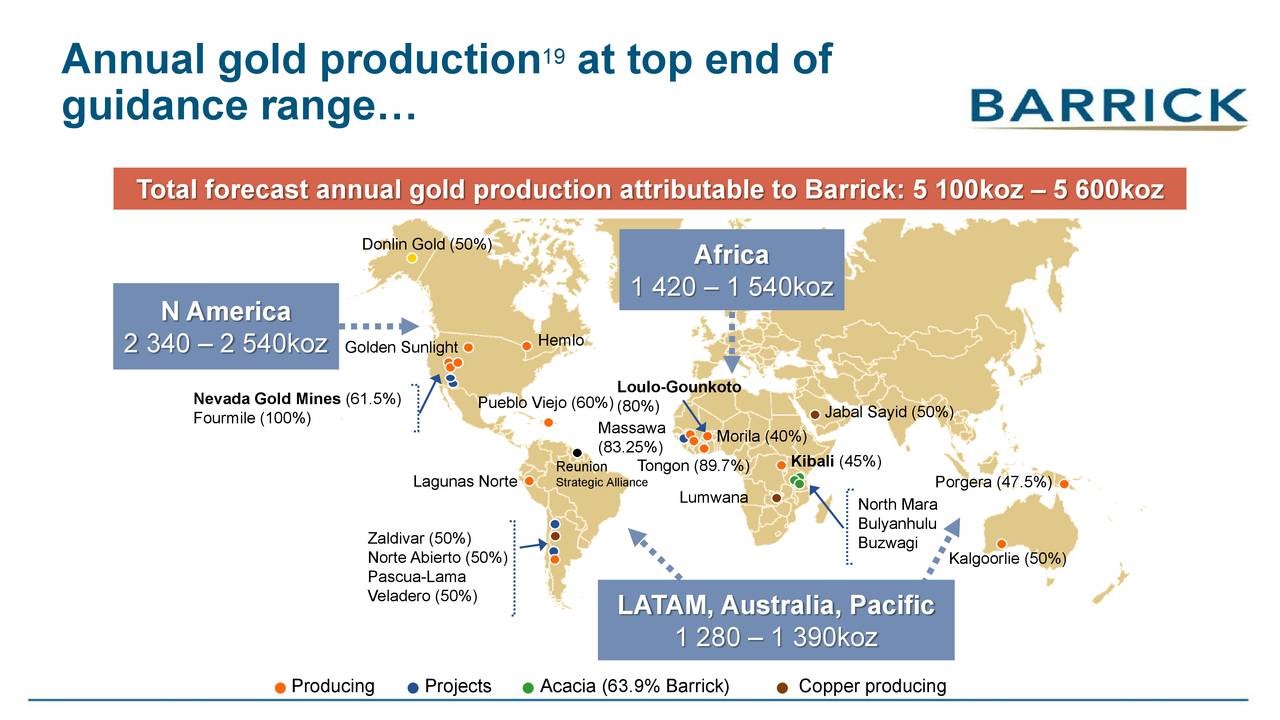

Barrick Gold is the largest gold mining company in the world with more than 62 million proven ounces of gold, over 10 billion pounds of proven copper reserves, and operations on four different continents. The company produces over $8 billion in annual revenue following its recent acquisition of Randgold.

The company recently reported its Q2 earnings and results were strong, leading to the company stating it would hit the high end of its production forecast for this year. Total revenue increased over 20% since Q2 of 2018 thanks to strong production and pricing during the quarter with 27% more ounces being mined this quarter than in the year ago period.

Copper production was up sizably in Q2 as well, rising 17% to 97 million pounds. Perhaps just as important, all-in sustaining costs did not rise dramatically at just 1.5% year-over-year to $869 per ounce. Meanwhile, the average realized gold price increased to $1,317 per ounce.

Source: Q2 Earnings Presentation

Looking ahead, in addition to benefiting from strong pricing, Barrick is guiding for annual attributable gold production of 5.1 million to 5.6 million ounces with all-in sustaining costs at reasonable $870 to $920 per ounce levels. Furthermore, the company also said volume should be towards the upper end while costs should be at the lower end, both of which bode well for a strong earnings number.

The company expects to focus on its core of six Tier 1 mines, using these to generate strong risk adjusted value for shareholders. It plans to accomplish this by performing careful due diligence on organic growth project opportunities, paying fair value for all new deals, identifying opportunities for synergies through detailed analysis, and then executing and delivering with excellence, sustainability, and safety.

While the company has not been this strong or financially secure in quite some time, the valuation looks quite rich assuming a stable gold price and growth prospects are not robust enough to compensate for it. As a result, if the gold price stagnates, we expect significant multiple contraction over time to offset earnings growth and dividend payments.

Top Mining Stock #6: Wheaton Precious Metals (WPM)

- Estimated total annual return through 2024: -6.3%

Wheaton Precious Metals is the world’s largest metal streaming company, meaning it does not own the mines but rather purchases the right to buy silver and gold at a low fixed cost. It has agreements with 20 mines, producing $860M in annual revenue. The company strives to deliver value to its shareholders by generating low risk, high quality, and diversified exposure and growth optionality to precious metals.

It also strives to generate value for its partners and neighbors by crystallizing value for precious metals yet to be produced, promoting responsible mining practices, and supporting the communities in which they live and operate.

Source: Q2 Earnings Presentation

The company recently reported second quarter revenue of $189 million on sales volume of 90,100 ounces of gold, 4.2 million ounces of silver, and 5,300 ounces of palladium. This is an 11% decline from the $212 million in revenue Wheaton produced in last year’s Q2 due to a 29% decline in sliver volume and a 10% decline in average realized silver price. Partially offsetting this was a 3% increase in gold volume, as well as a better average realized gold price.

Average costs in Q2 rose for gold and silver, which resulted in lower operating margins. Gold cost per ounce was $420, up from $407 a year ago. For silver, costs rose from $4.54 to $5.14. Cash operating margin came to $900 per ounce of gold, $9.79 per ounce of silver, and $1,134 for palladium. Adjusted net income came to a loss of $0.10 per share in Q2, up from a loss of $0.16 in the year-ago period.

While the dividend yield is 1.3% and the growth prospects are fairly attractive, the earnings multiple is high relative to historical norms. As a result, total returns will likely be underwhelming moving forward unless gold and silver prices continue to rise.

Top Mining Stock #5: Newmont Goldcorp Corporation (NEM)

- Estimated total annual return through 2024: -0.8%

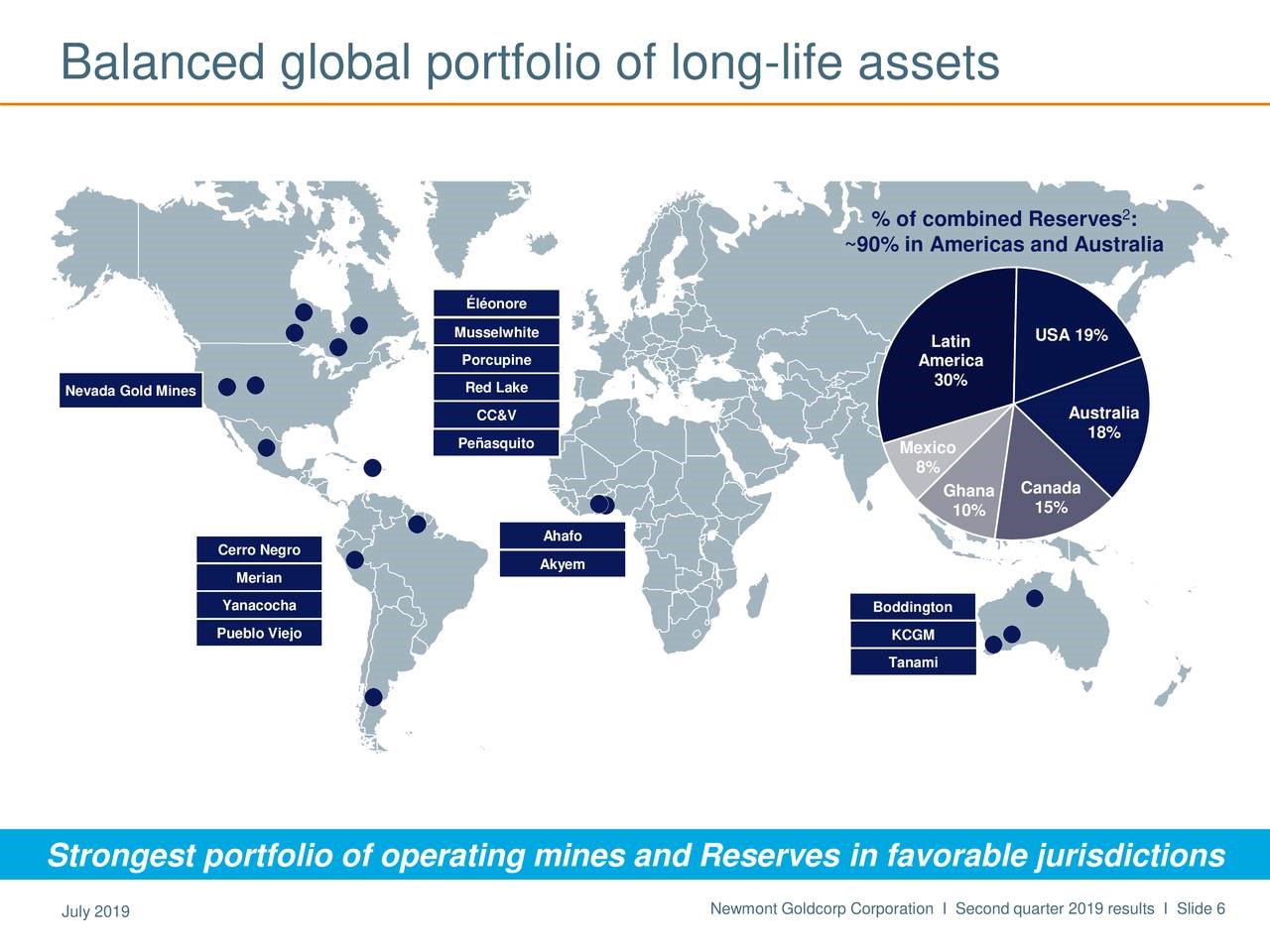

Newmont Goldcorp Corporation operates gold and copper mines on four different continents and brings in roughly $10 billion in annual revenue. Newmont completed its merger with Goldcorp in April of 2019, creating the world’s largest gold producer by market value, output, and reserves.

Source: Q2 Earnings Presentation

Some of the benefits that Newmont hopes to reap from the merger include developing superior operational execution, establishing a global portfolio of long-life assets, and achieving leading profitability and responsibility. Thus far, the company has made progress on these goals by delivering 1.59 million ounces at an all-in sustaining cost of $1,016.

It has done this by advancing profitable projects at Awonsu layback, making strong initial progress towards achieving their full run rate of profitability, and establishing the Nevada gold mines. Additionally, it is investing in long-term growth projects at places like Ahafo Mill and Quecher Main, and maintaining capital discipline and financial flexibility.

In North America, the company is mitigating near-term challenges. Penasquito recently safely resumed operations with full potential underway. Musselwhite established a secondary egress. Additionally, Eleonore is now ramping up Horizon 5 to achieve higher grades and Carlin Mill 6 has recently safely completed its maintenance operations.

In South America, Newmont is delivering productivity improvements. At Yanacocha, the company is producing sustained higher grades and the La Quinua leach pad is going through a leach pad draw down. Meanwhile, Merian overcame a negative seasonal weather impact with improved productivity and Cerro Negro remains on track to reach higher grades in the second half. Additionally, Quecher Main is expected to begin commercial production in Q4.

Australia has seen strong advances in profitable growth opportunities. Tanami is delivering solid production with improving costs thanks to the commissioning of a gas power station, Boddington’s stripping campaign is continuing with higher grades expected in Q4, and KCGM mining activity is increasing already in Q3 thanks to ongoing geotechnical remediation.

Finally, Africa is building momentum towards achieving a record year thanks to Akyem improving its mill performance and the Ahafo Mill Expansion expected to begin commercial production in Q4.

While the company has a strong investment grade balance sheet with $1.8 billion in cash on hand and net debt to adjusted EBITDA of just 1.5x, we see the stock as significantly overvalued right now. Therefore, expected mid-single digit earnings-per-share growth and the 1.5% dividend yield will be offset by a contracting valuation multiple, leading to low total returns over the next half decade, provided that gold prices remain stable.

Top Mining Stock #4: Newcrest Mining Limited (NCMGY)

- Estimated total annual return through 2024: 1.0%

Newcrest Mining Limited is engaged in exploration, mining & development of gold & gold-copper concentrate in the south pacific, with a portfolio of assets in Australia, Indonesia, Papua and New Guinea. The company’s vision is to be the miner of choice in its region as it executes on its five-pillared strategy of safety and sustainability, people, operating performance, technology and innovation, and profitable growth.

The company’s recent results highlight its ongoing commitment to safety as it has now gone three and a half years without a fatality and its Lihir Mine has gone five years since the last lost-time injury. Newcrest’s biggest competitive advantage is the fact that it has the lowest reported all-in sustaining costs per ounce for gold production.

Source:Q2 Earnings Presentation

This is in large part due to the fact that its assets possess a unique suite of technical capabilities that are well-suited to its unique geological characteristics. For example, at Lihir they employ an open pit structure. At Telfer they employ an open pit as well as a reef. At Gosowong, they employ a narrow vein. They also have higher grade assets with ore sorting and mass sensing technologies that improve efficiencies.

These capabilities enabled them to generate strong first half results which saw gold production grow by 6% year-over-year and copper production surge by 30%. At the same time, all-in sustaining cost declined by 13%, making free cash flow improve by 31%, and adjusted earnings-per-share increasing 104%. Meanwhile, the leverage ratio has declined to 0.6x on a net debt to EBITDA basis, giving them one of the best balance sheets in the gold mining industry.

This has enabled the company to aggressively grow its dividend, more than doubling it since 2016. Moving forward, the company targets a total dividend payment of at least 10%-30% of free cash flow with the dividend being no less than $0.15 per share on a full year basis.

While the company is certainly quite strong, the valuation looks quite rich and seems to be pricing in a further substantial increase in the gold price. As a result, assuming stable gold prices at current levels, forward total returns will likely be muted as valuation multiples contract.

Top Mining Stock #3: Yamana Gold Inc. (AUY)

- Estimated total annual return through 2024: 1.6%

Yamana Gold Inc. brings in annual revenue of ~$2 billion via gold, silver, and copper mining sites in Canada, Mexico and South America.

The company’s second quarter results were solid, as they produced 233,000 ounces of gold and 2,200,000 ounces of silver while keeping costs within their guidance range. This enabled Yamana to deliver free cash flow before dividend payments and debt reduction of $51.2 million. The company also increased guidance at Jacobina.

Source: Q2 Earnings Presentation

Meanwhile, the balance sheet and cost efficiencies also improved. Yamana repaid the outstanding balance of $385 million on its revolving credit facility and used $415 million to prepay its senior notes. As a result, it lowered its Net Debt to EBITDA ratio to 1.5x, with the goal of lowering it further to 1.0x by the end of 2021. General and administrative costs were lowered to align with the remaining portfolio of assets. The company continues to simplify its organizational structure and strengthen its balance sheet in order to improve its financial flexibility.

Management has been accomplishing this by selling off the Chapada Mine for over $1 billion, streamlining corporate overhead to save $15 million in annual G&A expenses, paying down debt, and lowering future capital expenditures. As a result it is now on track to increase free cash flow generation and is able to invest in new exploration projects which in turn is growing shareholder returns. The company doubled the dividend and made investments in high-return organic growth opportunities at sites like Jacobina, Canadian Malartic, Cerro Moro, and Agua Rica.

While the company has certainly improved its operational efficiency and safety, shares do not look particularly cheap on a historical basis. Separately, the dividend yield is less than 1%, and growth prospects are meager. As a result, total returns do not have a strong outlook assuming a stable gold price.

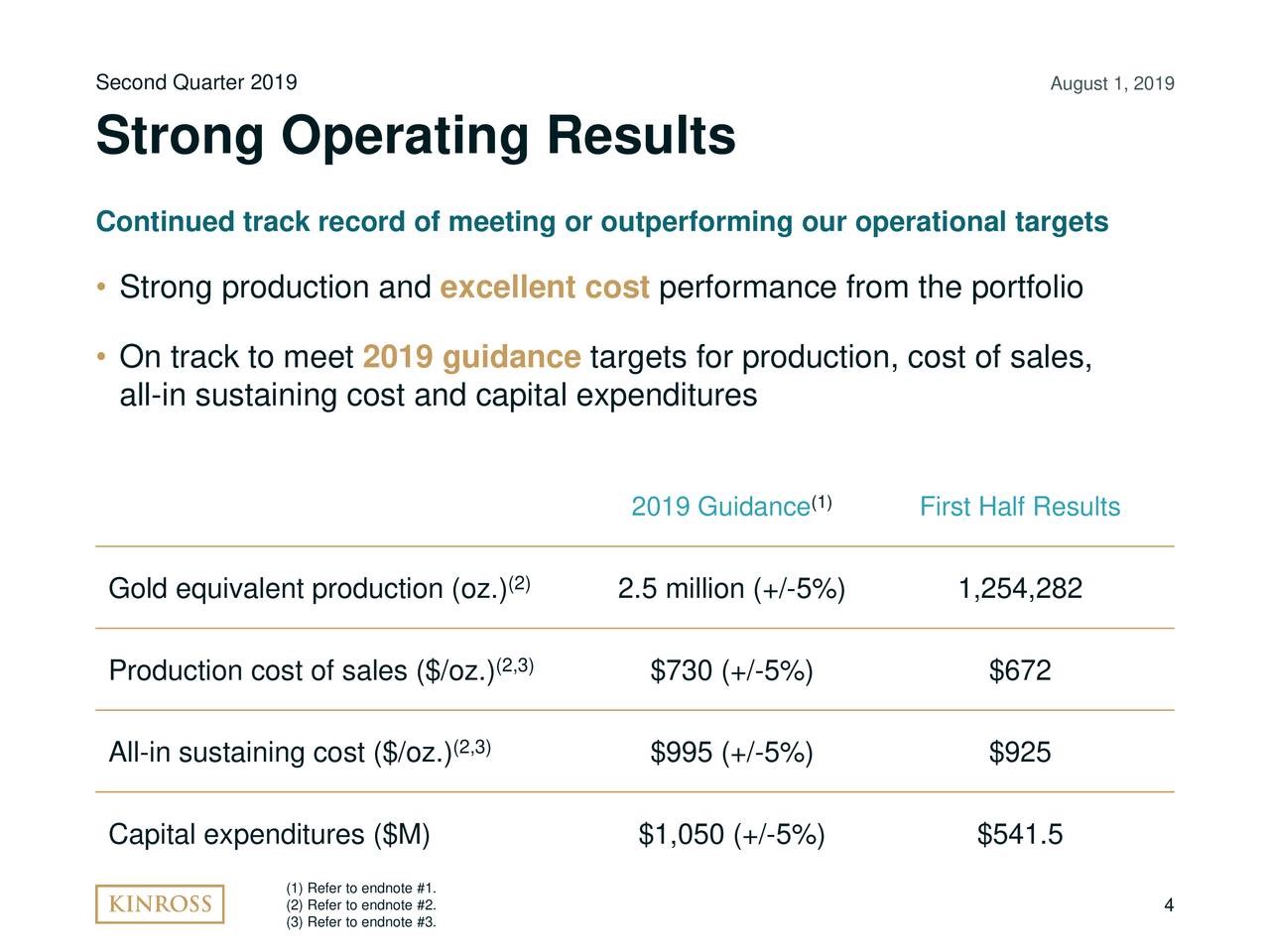

Top Mining Stock #2: Kinross Gold Corporation (KGC)

- Estimated total annual return through 2024: 3.0%

Kinross Gold Corporation engages in the acquisition, exploration, and development and reclamation of gold properties as well as silver production and sales across a broadly diversified portfolio of assets. These assets are spread across the United States, Russia, Brazil, Chile, Ghana, and Mauritania. As of year-end 2018, its proven and probable mineral reserves included approximately 25.5 million ounces of gold and 53.9 million ounces of silver.

At the beginning of August, Kinross reported strong second quarter results which revealed that the company remains on track to meet 2019 guidance for production, cost of sales, all-in sustaining cost, and capital expenditures. These strong results are largely a product of the company’s operational strength.

Source: Q2 Earnings Presentation

Moving forward, Kinross also has several lucrative expansion opportunities. These include Tasiast Phase Two, their “Americas Development Portfolio” (including Round Mountain Phase W, Bald Mountain Vantage Complex, Fort Knox Gilmore, and La Coipa Restart and Lobo-Marte), and the Russian Chulbatkan development property.

While the company’s long-term growth profile is attractive, especially with surging gold and silver prices, it also faces fairly substantial geo-political risk given its international profile. Additionally, the stock looks rather expensive after doubling in price since last November. As a result, total returns will likely be underwhelming moving forward.

Top Mining Stock #1: Freeport-McMoRan Inc. (FCX)

- Estimated total annual return through 2024: 8.0%

Freeport-McMoRan Inc. mines mineral properties from a widely diversified asset base in North America, South America, and Indonesia. The company primarily explores for copper, gold, molybdenum, silver, and other metals, as well as oil and gas.

As of December 31, 2018, the company’s estimated consolidated recoverable proven and probable mineral reserves totaled 119.6 billion pounds of copper, 30.8 million ounces of gold, and 3.78 billion pounds of molybdenum. It also has estimated proved developed oil and natural gas reserves of 7.2 million barrels of oil equivalents.

The company recently reported second quarter results. The highlights included strong performance and growing momentum in its innovation and advanced analytics program in the Americas. The company also saw healthy progress in its Lone Star project in Arizona, where Freeport is on track for first copper production by year end 2020 and opportunity for low capital intensive oxide expansion.

Additionally, the Grasberg Open Pit and Underground projects continue to make solid progress. On the whole, the company reaffirmed its annual sales outlook and continues to execute on a clearly defined strategy to drive shareholder value.

Source: Q2 Earnings Presentation

While the company appears to be firing on all cylinders, shares remain suppressed. This is in large part due to the negative past that continues to mar the company’s reputation as Freeport has a history of overpaying for acquisitions and piling on hefty levels of debt.

Furthermore, Freeport is heavily correlated with copper prices, which in turn are often impacted by the state of the global economy. With slowing seen across the globe and the threat of a recession looming on the horizon, this company is viewed by the market as riskier than pure gold miners at the moment.

That being said, the company is well positioned to succeed moving forward. It owns world class assets, copper fundamentals are increasingly robust, and growth is beginning to pick up. As a result, we see high single-digit to mid-teens total return potential in shares.

Final Thoughts

Of the 7 names on this list, we rate Freeport-McMoRan Inc. as a buy, assuming precious metals and copper prices stay steady. We would require the other names to pullback before recommending investors consider them for purchase.

However, for investors who are bullish on precious metals and/or copper prices, all of these miners – due to their considerable operational leverage to the price of their mined commodities – are attractive buys at current pricing.