Updated on December 28th, 2021 by Bob Ciura

The book publishing industry is undergoing rapid changes. The business model that remained relatively unchanged for decades is rapidly moving towards new technologies such as e-books, while traditional books lose market share. The distribution channels through which the publishers sell books are shifting as well.

Traditional book stores are increasingly closing down, whereas sales of books via e-commerce platforms are growing.

Amazon (AMZN), which started out as an online book store and expanded into many other product categories since, is the largest online book seller.

Amazon is not only selling books, it has also moved into publishing books itself, which puts some pressure on traditional publishers.

Despite these factors the publishing industry still has some positives: sales of print books were up 11% in the first nine months of 2021, and were up 90 million units over 2019.

In this article we will look at the three biggest publicly traded book publishing stocks: Scholastic (SCHL), John-Wiley & Sons (JW.A), and Pearson plc (PSO), which is the parent company of Random House.

All three of these companies pay dividends to shareholders, and are included in our list of all consumer cyclical stocks.

The three stocks are ranked by estimated total returns over the coming five years. More data on each company is available through the Sure Analysis Research Database.

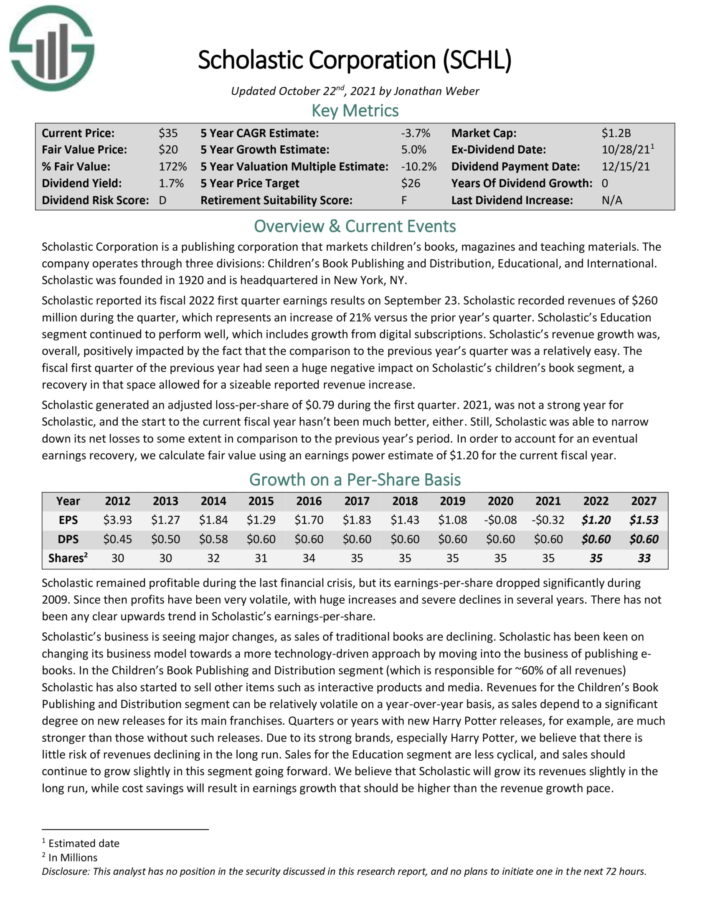

Book Publishing Stock #3: Scholastic (SCHL)

- 5-year expected annual returns: -6.9%

Scholastic Corporation is a publishing corporation that markets children’s books, magazines and teaching materials. The company operates through three divisions: Children’s Book Publishing and Distribution, Educational, and International.

Scholastic reported its fiscal 2022 first quarter earnings results on September 23. Scholastic recorded revenues of $260 million during the quarter, which represents an increase of 21% versus the prior year’s quarter. Scholastic’s Education segment continued to perform well, which includes growth from digital subscriptions.

Scholastic’s revenue growth was, overall, positively impacted by the fact that the comparison to the previous year’s quarter was a relatively easy. The fiscal first quarter of the previous year had seen a huge negative impact on Scholastic’s children’s book segment, a recovery in that space allowed for a sizeable reported revenue increase.

Scholastic generated an adjusted loss–per–share of $0.79 during the first quarter. 2021, was not a strong year for Scholastic, and the start to the current fiscal year hasn’t been much better, either.

Click here to download our most recent Sure Analysis report on Scholastic (preview of page 1 of 3 shown below):

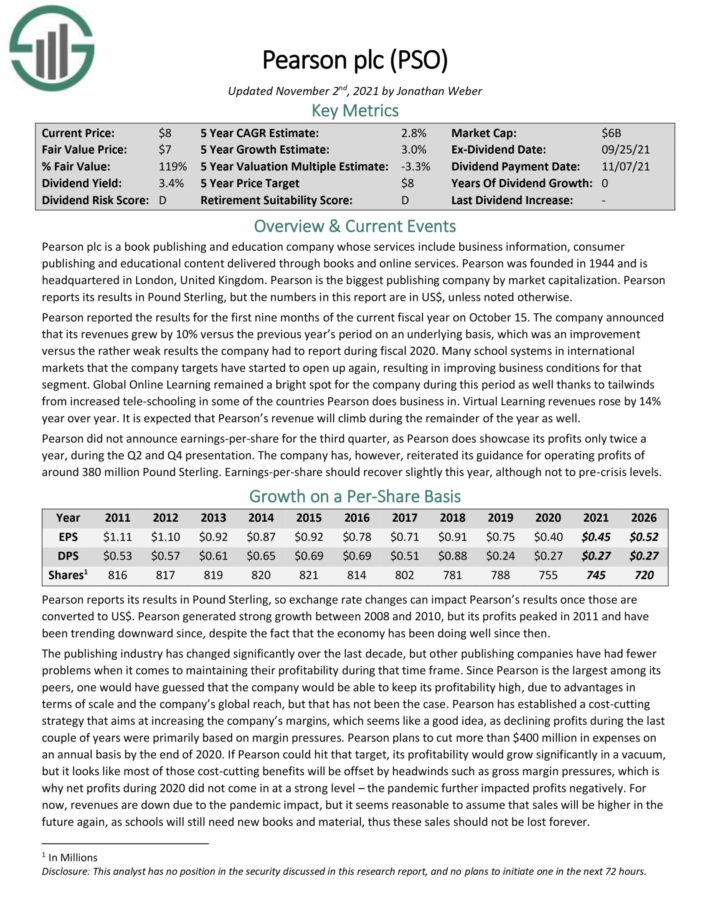

Book Publishing Stock #2: Pearson plc (PSO)

- 5-year expected annual returns: 2.7%

Pearson plc is the biggest book publishing company in the world, with annual sales of ~$6 billion and a market capitalization of $8.5 billion. Pearson is headquartered in the U.K., and the company was founded in 1944.

Pearson is active in consumer publishing, education content and business information markets.

Pearson reported the results for the first nine months of the current fiscal year on October 15. The company announced that its revenues grew by 10% versus the previous year’s period on an underlying basis, which was an improvement versus the rather weak results the company had to report during fiscal 2020.

Source: Investor Presentation

Many school systems in international markets that the company targets have started to open up again, resulting in improving business conditions for that segment. Global Online Learning remained a bright spot for the company during this period as well thanks to tailwinds from increased tele–schooling in some of the countries Pearson does business in.

Virtual Learning revenues rose by 14% year over year. It is expected that Pearson’s revenue will climb during the remainder of the year as well.

Click here to download our most recent Sure Analysis report on Pearson (preview of page 1 of 3 shown below):

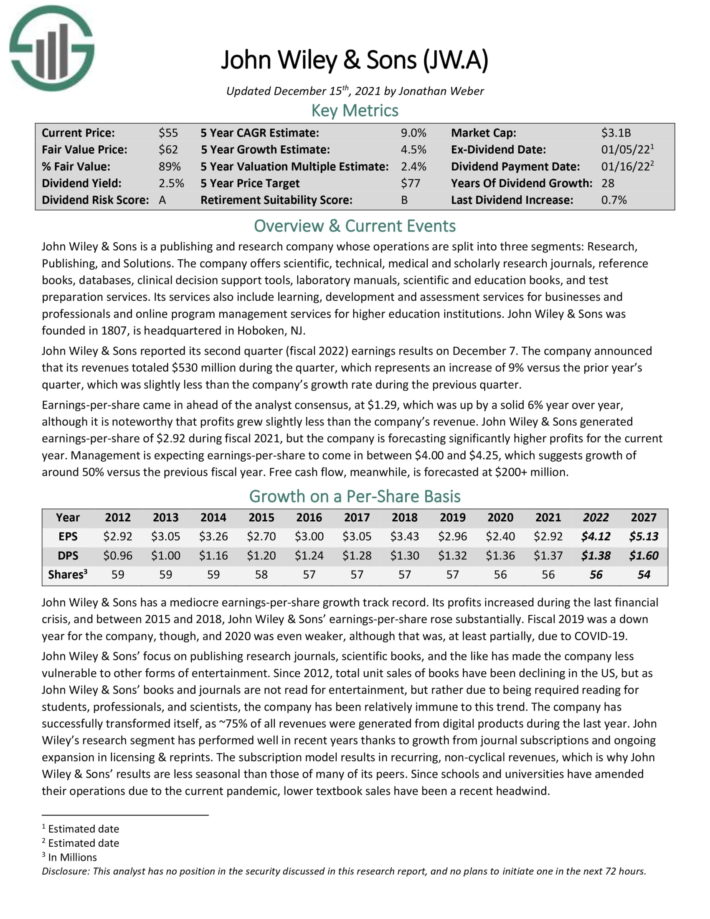

Book Publishing Stock #1: John Wiley & Sons (JW.A)

- 5-year expected annual returns: 8.7%

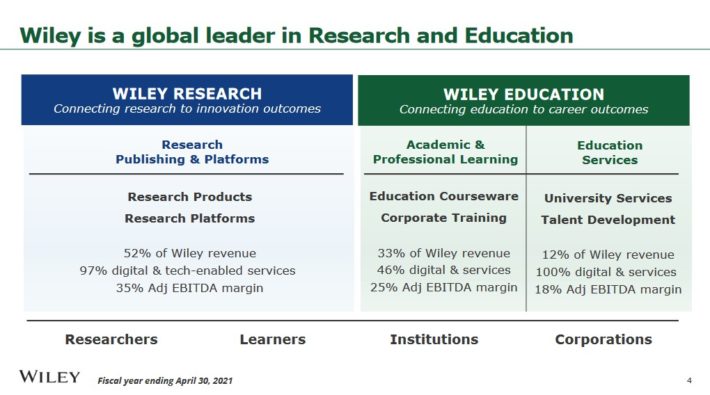

John Wiley & Sons is a publishing company with a strong focus on the professional & scientific community, its products include research journals (scientific, technical, medical & scholarly), reference books, manuals, databases, scientific and education books, test preparation services, and more.

The company also offers services such as development and assessment services for businesses and services for higher education institutions. John Wiley & Sons was founded in 1807.

Source: Investor Presentation

John Wiley & Sons reported its second quarter (fiscal 2022) earnings results on December 7. The company announced that its revenues totaled $530 million during the quarter, which represents an increase of 9% versus the prior year’s quarter, which was slightly less than the company’s growth rate during the previous quarter.

Earnings–per–share came in ahead of the analyst consensus, at $1.29, which was up by a solid 6% year over year.

John Wiley & Sons’ dividend payout ratio was never especially high. Most of the time, it remained below 50%. John Wiley & Sons has raised its dividend continually throughout the last decade. We believe that the dividend is relatively safe, especially as John Wiley’s dividend was not in danger during the Great Recession, either.

Based on its successful ongoing transformation of its business model towards digital products, and due to John Wiley & Sons’ strong position in the non–cyclical scientific and professional markets, there is little risk to its business model.

Click here to download our most recent Sure Analysis report on John Wiley & Sons (preview of page 1 of 3 shown below):

Final Thoughts

Book publishing stocks have experienced a number of challenges in recent years. Not only did the industry suffer from the coronavirus pandemic, but it was already dealing with the rise of e-readers and online education. Book publishing stocks have had to adapt to these challenges, with varying levels of success thus far.

Because the industry remains in a challenged state heading in to 2022, investors should be selective when it comes to book publishing stocks. Not all book publishers will succeed going forward.

Due to the company’s earnings growth outlook, solid dividend yield, and reasonable valuation, we view John Wiley & Sons as the top book publishing stock today.

We view Pearson as a hold, while Scholastic is a sell due to its negative expected returns.