Published on April 6th, 2020 by Bob Ciura

The rise in inflation, the ongoing war between Russia and Ukraine, and the Federal Reserve’s plan to raise interest rates, are all potential headwinds for the economy. As a result, it is possible that the U.S. economy could enter a recession in 2022.

With this in mind, risk-averse investors might want to consider positioning their portfolios in anticipation of a potential recession. One way to do this would be to buy high-quality dividend growth stocks. We believe blue-chip stocks that have market-beating dividend yields, and the ability to raise their dividends each year, can outperform in a recession.

You can download the complete list of all 350+ blue-chip stocks (plus important financial metrics such as dividend yield, P/E ratios, and payout ratios) by clicking below:

In addition to the Excel spreadsheet above, this article covers our top 20 recession-proof blue-chip stock buys today as ranked using expected total returns from the Sure Analysis Research Database.

The following list represents 20 recession-proof dividend stocks, ranked in order of expected annual returns over the next five years.

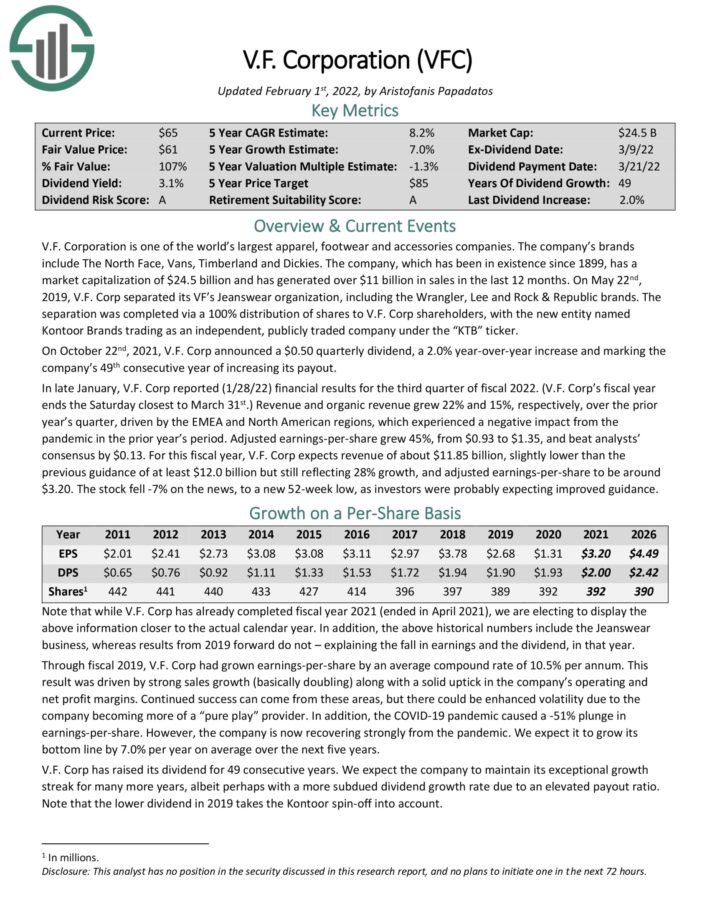

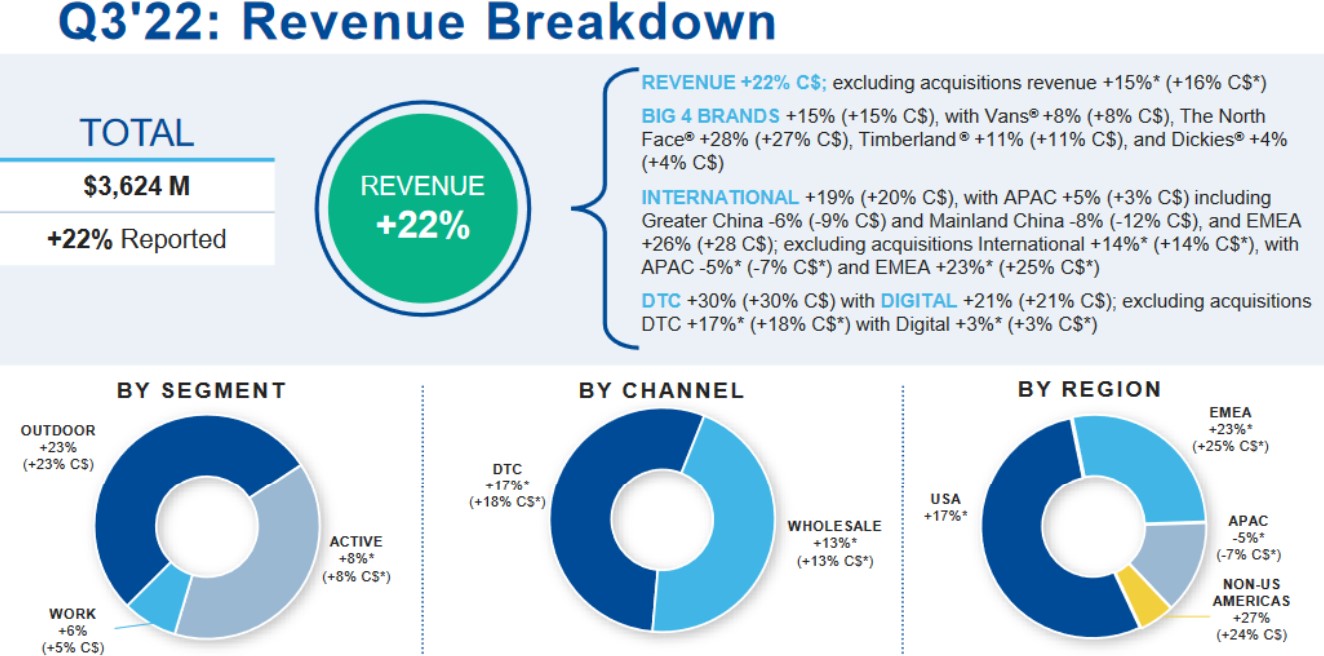

Recession-Proof Income Stock #20: V.F. Corp (VFC)

- 5-year expected annual returns: 11.3%

V.F. Corporation is one of the world’s largest apparel, footwear and accessories companies. The company’s brands include The North Face, Vans, Timberland and Dickies. The company, which has been in existence since 1899, generated over $11 billion in sales in the last 12 months.

Source: Investor Presentation

V.F. Corp has a competitive advantage in the way of a stable of well-known, premium brands that offer pricing power. During the last recession the company posted earnings-per-share of $1.39, $1.29 and $1.61 in the 2008 through 2010 stretch, indicating the resiliency of the business. Also, of note is the company’s storied dividend record. The company has increased its dividend for 49 years in a row, qualifying it as a Dividend Aristocrat.

Total returns are estimated at 11.3%, due to the 3.6% dividend yield, 7% annual EPS growth, and a small boost from a rising P/E ratio.

Click here to download our most recent Sure Analysis report on V.F. Corp. (preview of page 1 of 3 shown below):

Recession-Proof Income Stock #19: Qualcomm Inc. (QCOM)

- 5-year expected annual returns: 12.0%

Qualcomm, as it is known today, develops and sells integrated circuits for use in voice and data communications. The chip maker receives royalty payments for its patents used in devices that are on 3G and 4G networks.

Qualcomm reported earnings results for the first quarter of fiscal year 2022 on 2/2/2022 (the company’s fiscal year ends 9/30/2022). Revenue grew 29.9% to $10.7 billion, beating estimates by $270 million. Adjusted earnings-per-share of $3.23 compared favorably to adjusted earnings-per-share of $2.17 in the previous year.

Qualcomm recently increased its dividend by 10%, and the stock now yields 2%. The company has increased its dividend for 20 consecutive years. We expect total returns of 12% per year, driven by the 2% dividend yield, 7% expected EPS growth, and a 3% annual boost from an expanding valuation.

Click here to download our most recent Sure Analysis report on Qualcomm (preview of page 1 of 3 shown below):

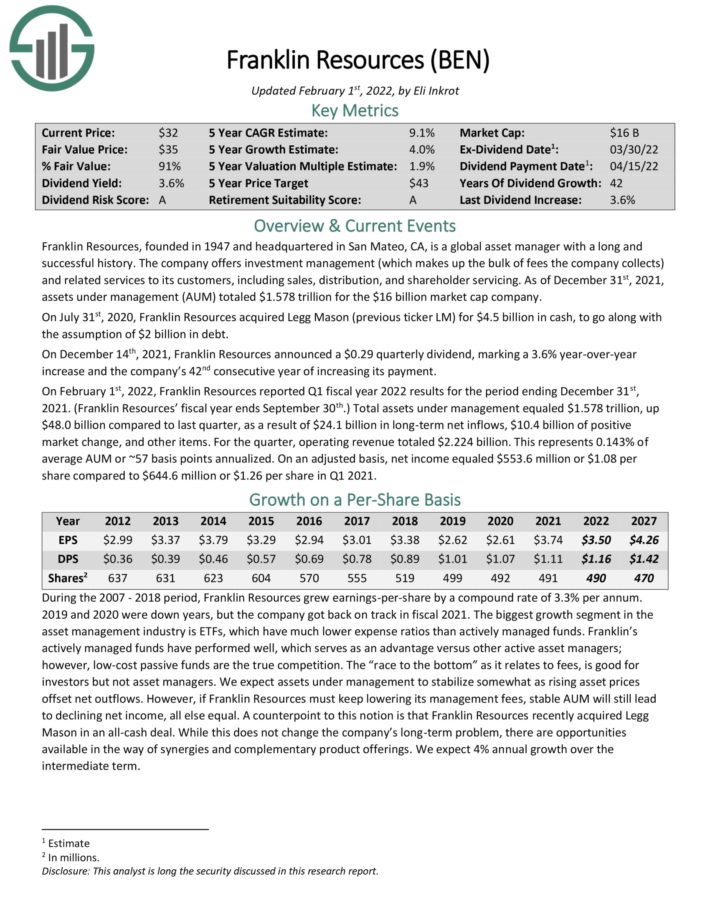

Recession-Proof Income Stock #18: Franklin Resources (BEN)

- 5-year expected annual returns: 12.0%

Franklin Resources is a global asset manager with a long and successful history. The company offers investment management (which makes up the bulk of fees the company collects) and related services to its customers, including sales, distribution, and shareholder servicing.

On December 14th, 2021, Franklin Resources announced a $0.29 quarterly dividend, marking a 3.6% year-over-year increase and the company’s 42nd consecutive year of increasing its payment.

In the most recent quarter, total assets under management equaled $1.578 trillion, up $48.0 billion compared to last quarter, as a result of $24.1 billion in long-term net inflows, $10.4 billion of positive market change, and other items.

We expect annual returns of 12% per year, consisting of the 4.2% dividend yield, 4% expected EPS growth, and a 3.8% boost from a rising P/E multiple.

Click here to download our most recent Sure Analysis report on Franklin Resources (preview of page 1 of 3 shown below):

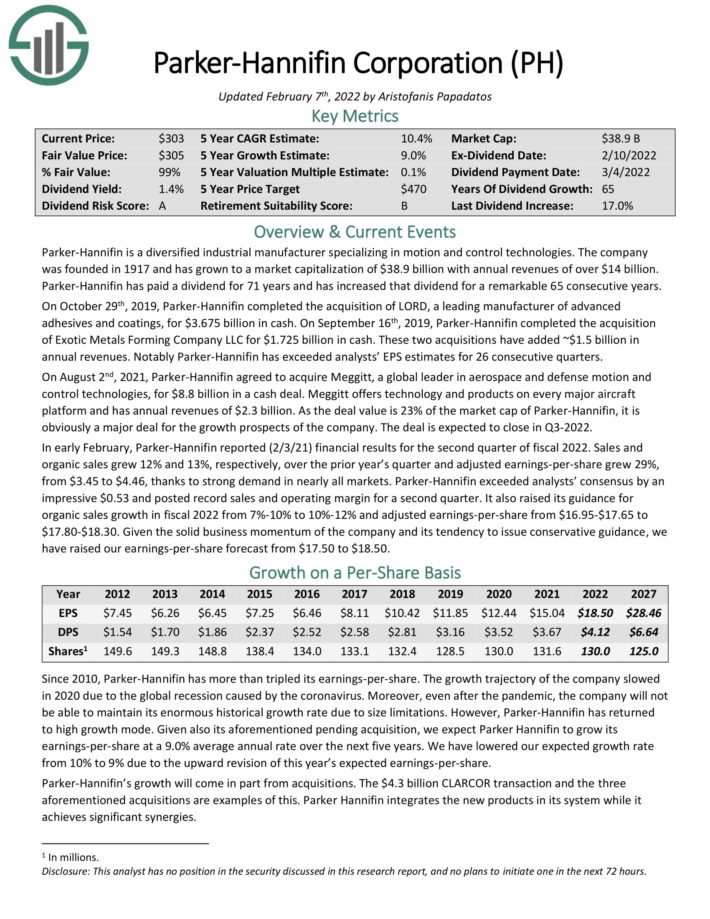

Recession-Proof Income Stock #17: Parker-Hannifin (PH)

- 5-year expected annual returns: 12.0%

Parker-Hannifin is a diversified industrial manufacturer specializing in motion and control technologies. The company was founded in 1917 and has annual revenues of over $14 billion. Parker-Hannifin has paid a dividend for 71 years and has increased that dividend for a remarkable 65 consecutive years.

Notably Parker-Hannifin has exceeded analysts’ EPS estimates for 26 consecutive quarters. In the most recent quarter, net sales and organic sales grew 12% and 13%, respectively, over the prior year’s quarter and adjusted earnings-per-share grew 29%, thanks to strong demand in nearly all markets. It also raised its guidance for organic sales growth in fiscal 2022 from 7%-10% to 10%-12% and adjusted earnings-per-share from $16.95-$17.65 to $17.80-$18.30.

We expect total returns of 12% per year, driven by 9% EPS growth, the 1.5% dividend yield, and a 1.5% annual boost from a rising P/E ratio.

Click here to download our most recent Sure Analysis report on Parker-Hannifin (preview of page 1 of 3 shown below):

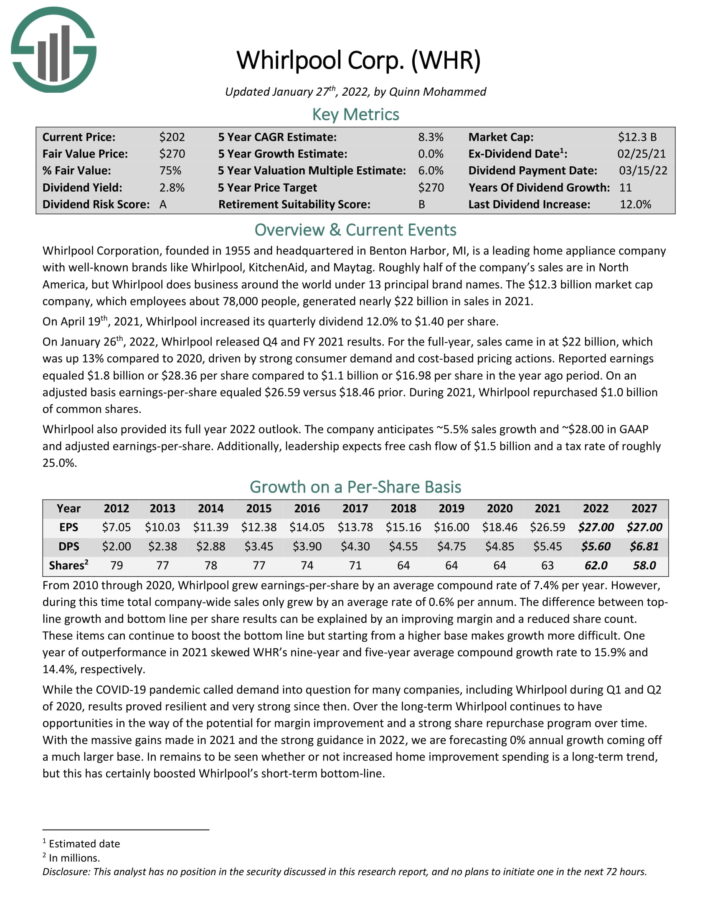

Recession-Proof Income Stock #16: Whirlpool Corporation (WHR)

- 5-year expected annual returns: 12.1%

Whirlpool is a leading home appliance company with well-known brands like Whirlpool, KitchenAid, and Maytag. Whirlpool generated nearly $22 billion in sales in 2021.

On January 26th, 2022, Whirlpool released Q4 and FY 2021 results. For the full-year, sales came in at $22 billion, which was up 13% compared to 2020, driven by strong consumer demand and cost-based pricing actions. Adjusted earnings-per-share rose 44% in 2021.

In April, Whirlpool increased its quarterly dividend 12.0% to $1.40 per share. Shares currently yield 4.1%.

We expect annual returns just above 12%, due to the high dividend yield, and a sizable 8% annual boost from a rising P/E ratio.

Click here to download our most recent Sure Analysis report on Whirlpool (preview of page 1 of 3 shown below):

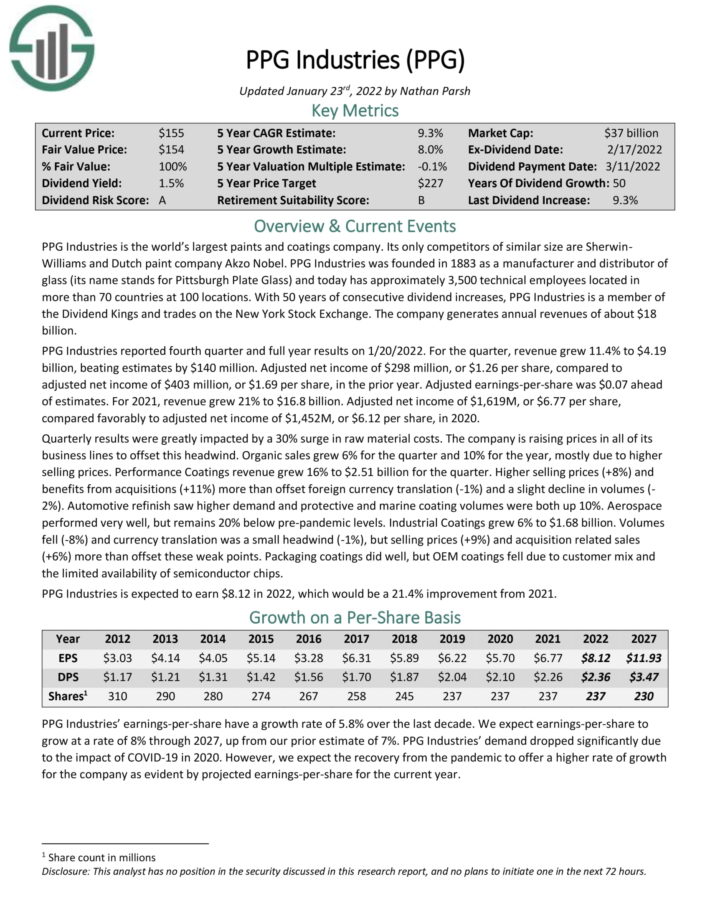

Recession-Proof Income Stock #15: PPG Industries (PPG)

- 5-year expected annual returns: 12.5%

PPG Industries is the world’s largest paints and coatings company. It was founded in 1883 as a manufacturer and distributor of glass. With 50 years of consecutive dividend increases, PPG Industries is a member of the Dividend Kings. The company generates annual revenues of about $18 billion.

In the 2021 fourth quarter, revenue grew 11.4% to $4.19 billion. Adjusted net income $1.26 per share, compared to $1.69 per share, in the prior year. For 2021, revenue grew 21% to $16.8 billion. Adjusted net income $6.77 per share, compared favorably to $6.12 per share in 2020.

We expect 12.5% annual returns, consisting of the 1.8% dividend yield, 8% EPS growth, and a 2.7% annual boost from a rising P/E ratio.

Click here to download our most recent Sure Analysis report on PPG (preview of page 1 of 3 shown below):

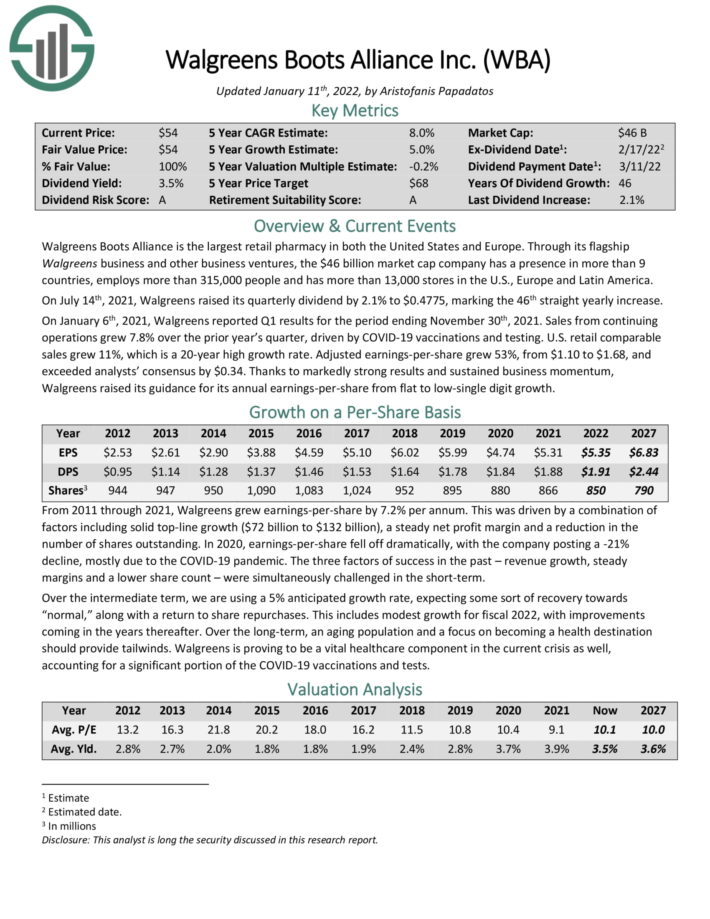

Recession-Proof Income Stock #14: Walgreens Boots Alliance (WBA)

- 5-year expected annual returns: 12.6%

Walgreens Boots Alliance is the largest retail pharmacy in both the United States and Europe. Through its flagship Walgreens business and other business ventures, the company employs more than 325,000 people and has more than 13,000 stores.

In the most recent quarter, sales from continuing operations grew 7.8% over the prior year’s quarter, driven by COVID-19 vaccinations and testing. U.S. retail comparable sales grew 11%, which is a 20 year high growth rate. Adjusted EPS grew 53%, from $1.10 to $1.68, and exceeded analysts’ consensus by $0.34.

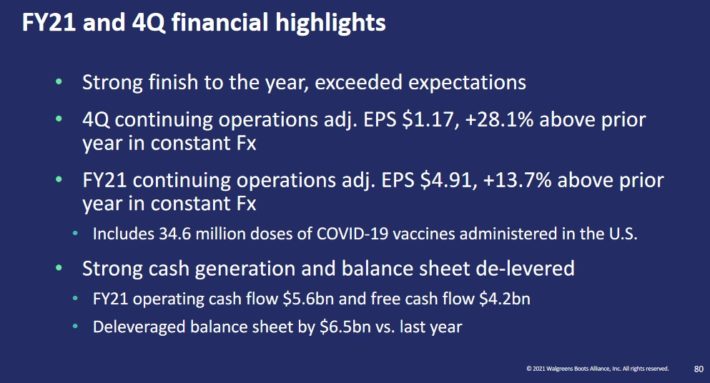

An overview of Walgreens’ most recent quarterly performance can be seen in the image below:

Source: Investor Presentation

Walgreens stock currently yields 4.4%, while we expect 5% annual EPS growth. With the addition of P/E expansion, total returns are estimated at 12.6% per year.

Click here to download our most recent Sure Analysis report on Walgreens (preview of page 1 of 3 shown below):

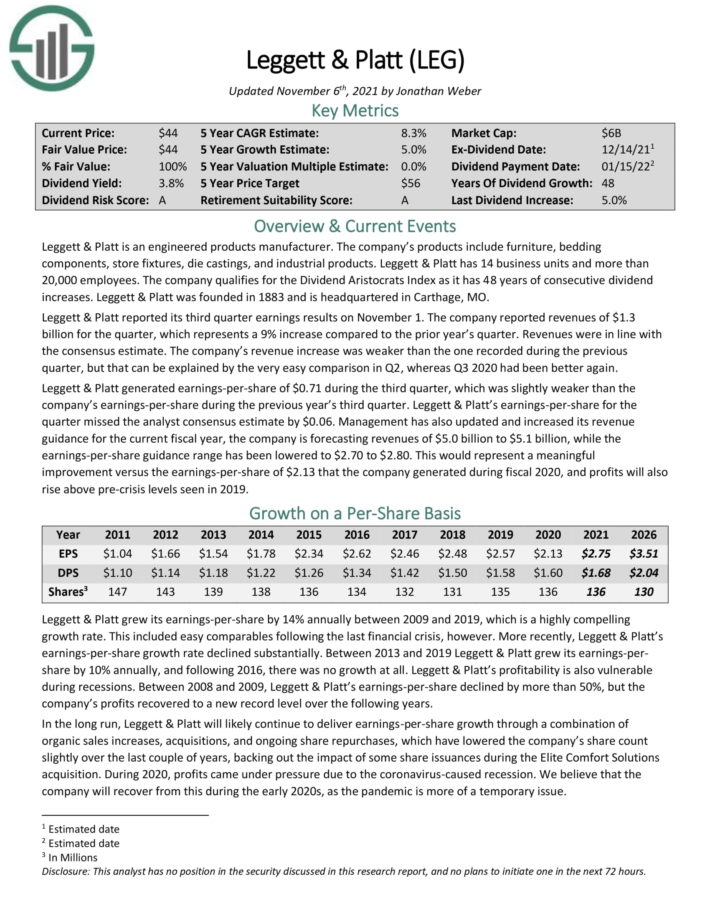

Recession-Proof Income Stock #13: Leggett & Platt (LEG)

- 5-year expected annual returns: 12.6%

Leggett & Platt is an engineered products manufacturer. The company’s products include furniture, bedding components, store fixtures, die castings, and industrial products.

The company reported revenues of $1.33 billion for the quarter, which represents a 13% increase compared to the prior year’s quarter.

The company is forecasting revenues of $5.3 billion to $5.6 billion for 2022, implying growth of 4% to 10%. The EPS guidance range has been set at $2.70 to $3.00 for 2022.

With a P/E of 15, Leggett & Platt stock is undervalued against our fair value estimate of 16. The combination of a rising valuation multiple, 5% expected EPS growth, and the 4.7% dividend yield leads to total expected returns of 12.6% per year over the next five years.

Click here to download our most recent Sure Analysis report on Leggett & Platt (preview of page 1 of 3 shown below):

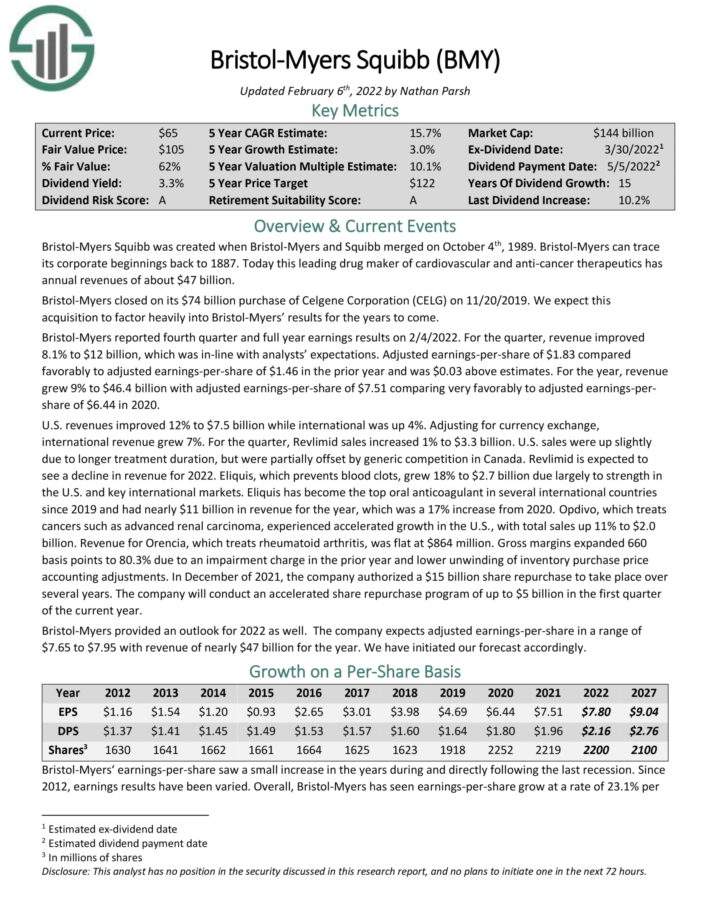

Recession-Proof Income Stock #12: Bristol-Myers Squibb (BMY)

- 5-year expected annual returns: 12.7%

Bristol-Myers Squibb is a leading drug maker of cardiovascular and anti-cancer therapeutics. The company transformed itself due to the $74 billion acquisition of Celgene, a peer pharmaceutical giant which derived almost two-thirds of its revenue from Revlimid, which treats multiple myeloma and other cancers.

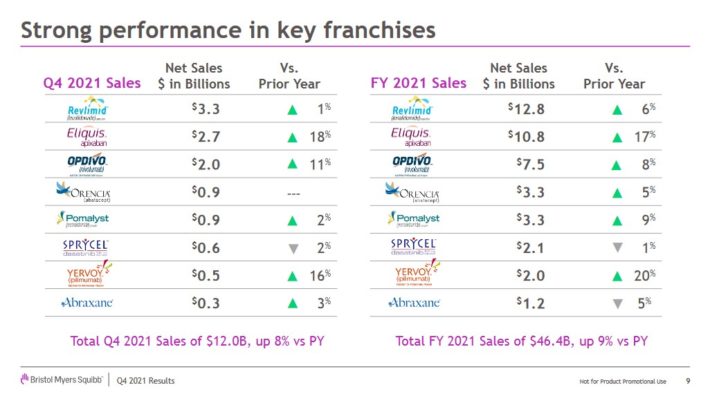

The company generated solid growth in the fourth quarter, and in 2021:

Source: Investor Presentation

For the 2021 fourth quarter, revenue increased 8% while adjusted EPS increased 25%. For the year, revenue grew 9% to $46.4 billion with adjusted earnings-per-share up 17%.

Shares of BMY trade for a forward P/E ratio below 10. Our fair value P/E estimate is 13-14, which is more in-line with the pharmaceutical peer group. Lastly, BMY has a 2.9% dividend yield, leading to total expected returns of 12.7% per year over the next five years.

Click here to download our most recent Sure Analysis report on Bristol-Myers Squibb (preview of page 1 of 3 shown below):

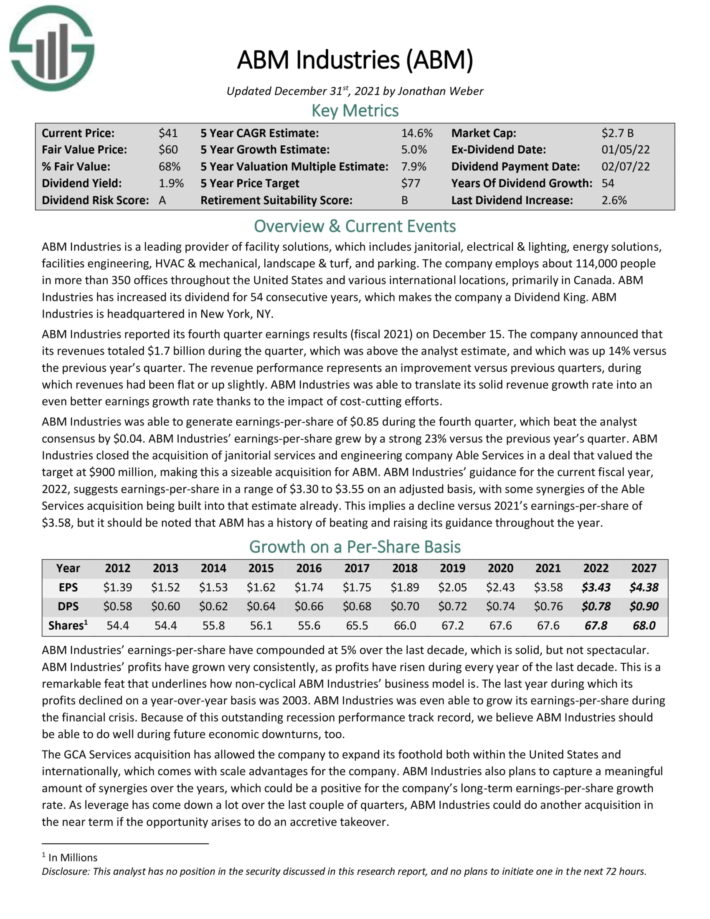

Recession-Proof Income Stock #11: ABM Industries (ABM)

- 5-year expected annual returns: 12.8%

ABM Industries is a leading provider of facility solutions, which includes janitorial, electrical & lighting, energy solutions, facilities engineering, HVAC & mechanical, landscape & turf, and parking. The company has increased its dividend for 54 consecutive years, which makes it a Dividend King.

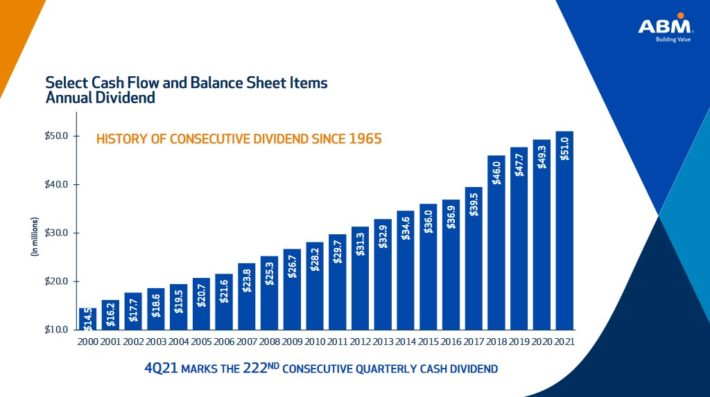

The company has an impressive dividend history:

Source: Investor Presentation

In the most recent quarter, revenues totaled $1.9 billion up 30% versus the previous year’s quarter. Earnings actually declined 7% compared to the previous year’s quarter to $0.94, but this result beat the analyst consensus by $0.16.

ABM’s dividend payout ratio is expected at 22% for 2022. Due to the low dividend payout ratio and its very stable, recession-resilient business model, ABM Industries’ dividend looks very safe.

Click here to download our most recent Sure Analysis report on ABM (preview of page 1 of 3 shown below):

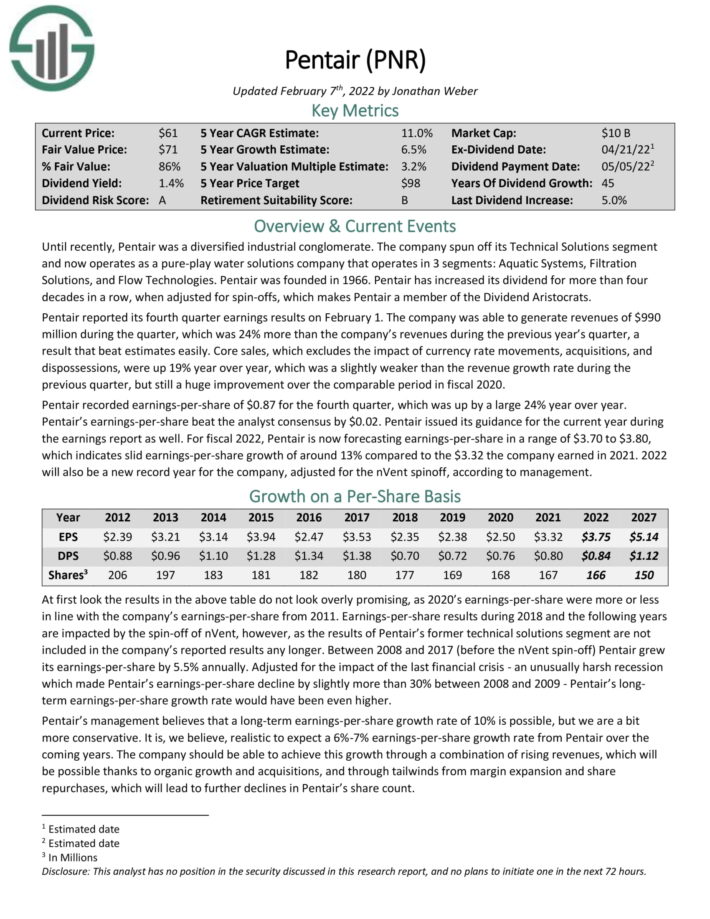

Recession-Proof Income Stock #10: Pentair plc (PNR)

- 5-year expected annual returns: 13.3%

Pentair is a pure-play water solutions company that operates in 3 segments: Aquatic Systems, Filtration Solutions, and Flow Technologies. Pentair was founded in 1966. Pentair has increased its dividend for more than 40 years, which makes it a member of the Dividend Aristocrats.

In the most recent quarter, revenues of $990 million during the quarter rose 24% year-over-year. Pentair recorded earnings-per-share of $0.87 for the fourth quarter, which was up by 24% year over year.

Pentair issued its guidance for the current year, now forecasting earnings-per-share in a range of $3.70 to $3.80. At the midpoint, this would represent 13% growth compared to the $3.32 the company earned in 2021.

Click here to download our most recent Sure Analysis report on Pentair (preview of page 1 of 3 shown below):

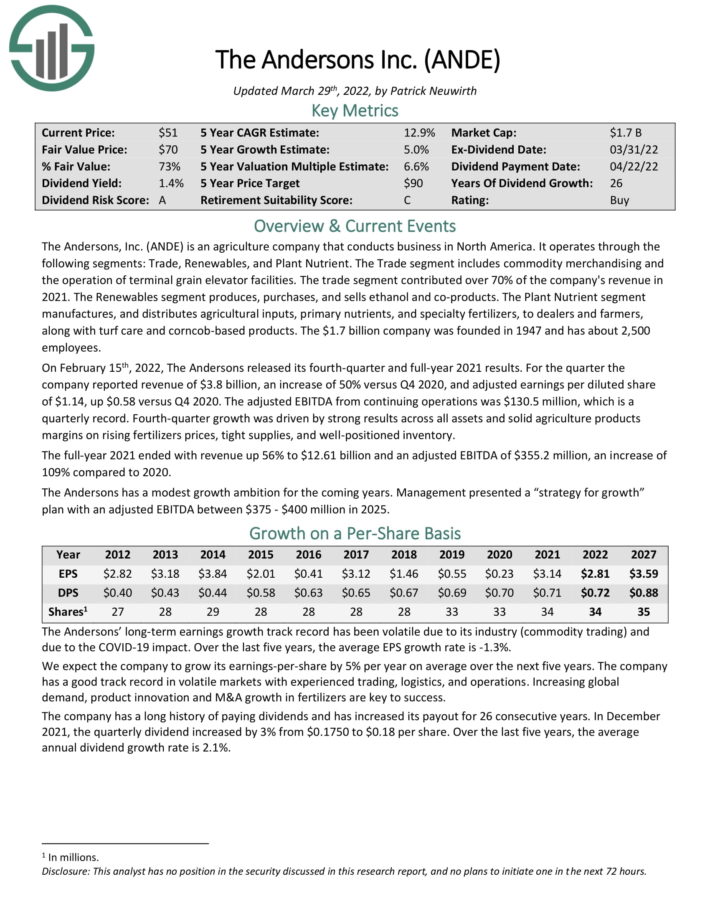

Recession-Proof Income Stock #9: The Andersons, Inc. (ANDE)

- 5-year expected annual returns: 13.3%

The Andersons, Inc. is an agriculture company that conducts business in North America. It operates through the following segments: Trade, Renewables, and Plant Nutrient. The Trade segment includes commodity merchandising and the operation of terminal grain elevator facilities. The trade segment contributed over 70% of the company’s revenue in 2021.

In the most recent quarter, revenue of $3.8 billion increased 50% versus Q4 2020, and adjusted earnings per diluted share of $1.14, up $0.58 versus Q4 2020. Growth was driven by strong results across all assets and solid agriculture products margins on rising fertilizers prices and tight supply.

The company has a long history of paying dividends and has increased its payout for 26 consecutive years. Shares currently yield 1.5%. Total returns are estimated at 13.3% per year.

Click here to download our most recent Sure Analysis report on ANDE (preview of page 1 of 3 shown below):

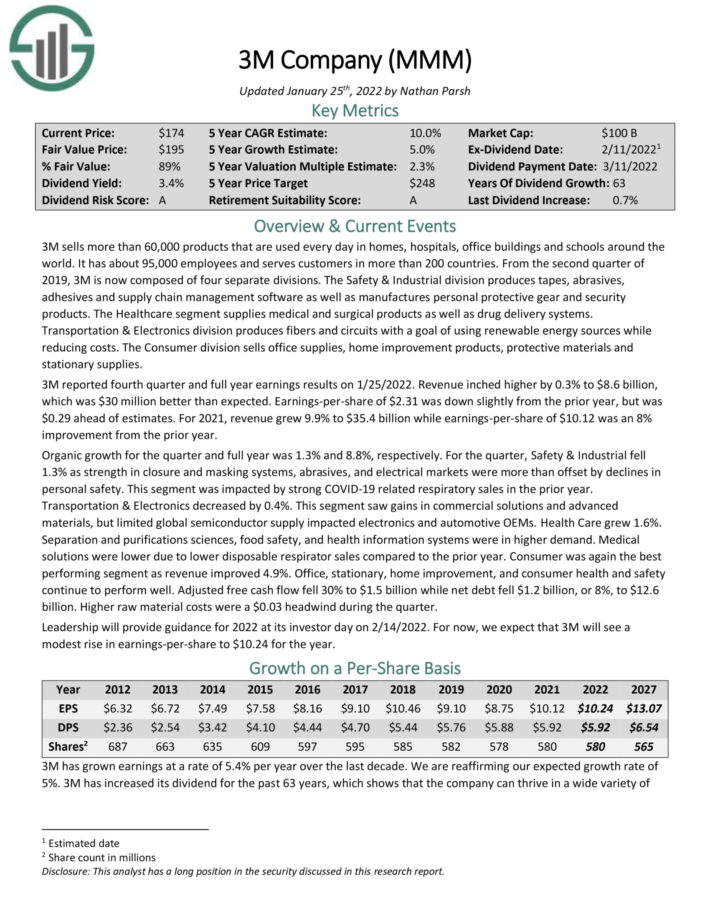

Recession-Proof Income Stock #8: 3M Co. (MMM)

- 5-year expected annual returns: 13.4%

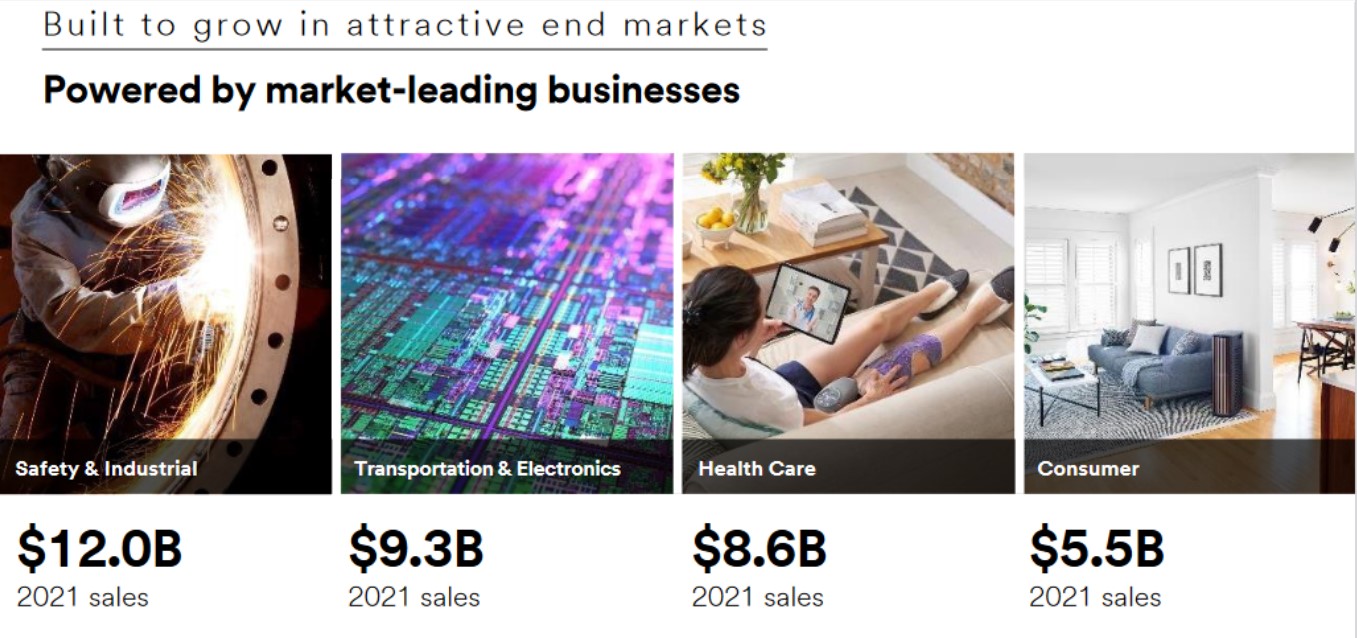

3M is an industrial conglomerate that sells more than 60,000 products. The company has four separate divisions: Safety & Industrial, Healthcare, Transportation & Electronics, and Consumer products.

Source: Investor Presentation

In the 2021 fourth quarter, revenue increased 0.3% to $8.6 billion, which was $30 million better than expected. Earnings-per-share of $2.31 was down slightly from the prior year but was $0.29 ahead of estimates.

For 2021, revenue grew 9.9% to $35.4 billion while earnings-per-share of $10.12 was an 8% improvement from the prior year.

3M has increased its dividend for over 60 years in a row, and the stock yields 4%. Total returns are expected to reach 13.5% per year over the next five years.

Click here to download our most recent Sure Analysis report on 3M (preview of page 1 of 3 shown below):

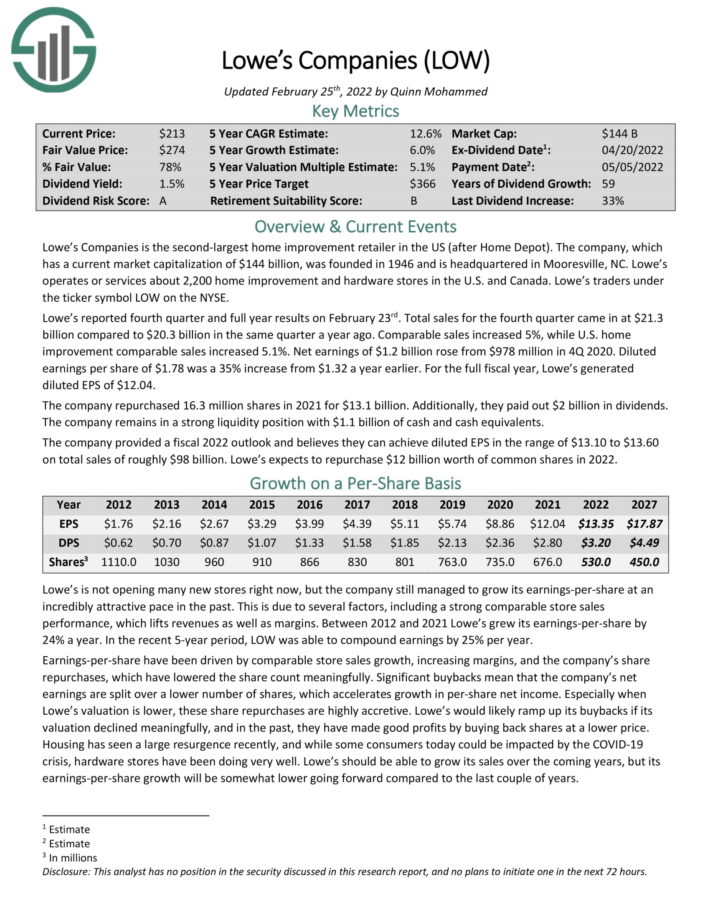

Recession-Proof Income Stock #7: Lowe’s Companies (LOW)

- 5-year expected annual returns: 13.8%

Lowe’s Companies is the second-largest home improvement retailer in the US (after Home Depot). Lowe’s operates or services more than 2,200 home improvement and hardware stores in the U.S. and Canada.

In the 2021 fourth quarter, Lowe’s comparable sales increased 5%, while U.S. home improvement comparable sales increased 5.1%. Diluted earnings per share of $1.78 was a 35% increase from $1.32 a year earlier.

The company provided a fiscal 2022 outlook and expects diluted EPS in the range of $13.10 to $13.60 on total sales of roughly $98 billion.

Lowe’s is a Dividend King, with over 50 consecutive years of dividend increases. Shares currently yield 1.6%. The combination of multiple expansion, 6% expected EPS growth and dividends lead to total expected returns of 13.8% per year.

Click here to download our most recent Sure Analysis report on Lowe’s (preview of page 1 of 3 shown below):

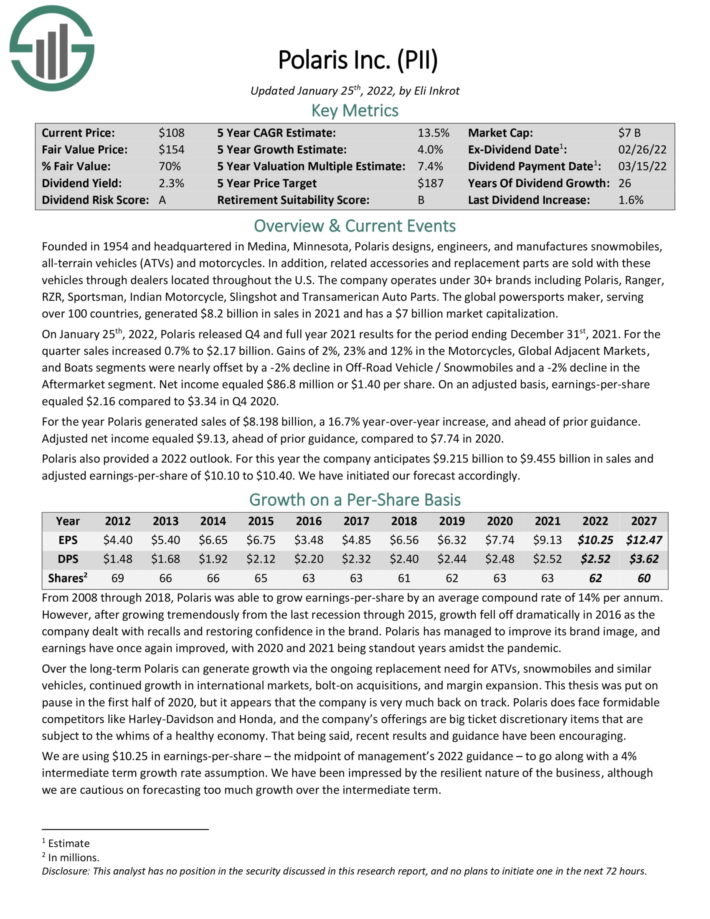

Recession-Proof Income Stock #6: Polaris Inc. (PII)

- 5-year expected annual returns: 13.8%

Polaris designs, engineers, and manufactures snowmobiles, all-terrain vehicles (ATVs) and motorcycles. In addition, related accessories and replacement parts are sold with these vehicles through dealers located throughout the U.S. The company operates under 30+ brands.

For the 2021 fourth quarter, sales increased 0.7% to $2.17 billion. On an adjusted basis, earnings-per-share equaled $2.16 compared to $3.34 in Q4 2020. For the year Polaris generated sales of $8.2 billion, a 16.7% year-over-year increase, and ahead of prior guidance.

Polaris also provided a 2022 outlook. For this year the company anticipates $9.215 billion to $9.455 billion in sales and adjusted earnings-per-share of $10.10 to $10.40.

Total returns are expected to reach nearly 14% per year, driven by 4% EPS growth, the 2.4% dividend yield, and a sizable boost from a rising P/E multiple.

Click here to download our most recent Sure Analysis report on Polaris (preview of page 1 of 3 shown below):

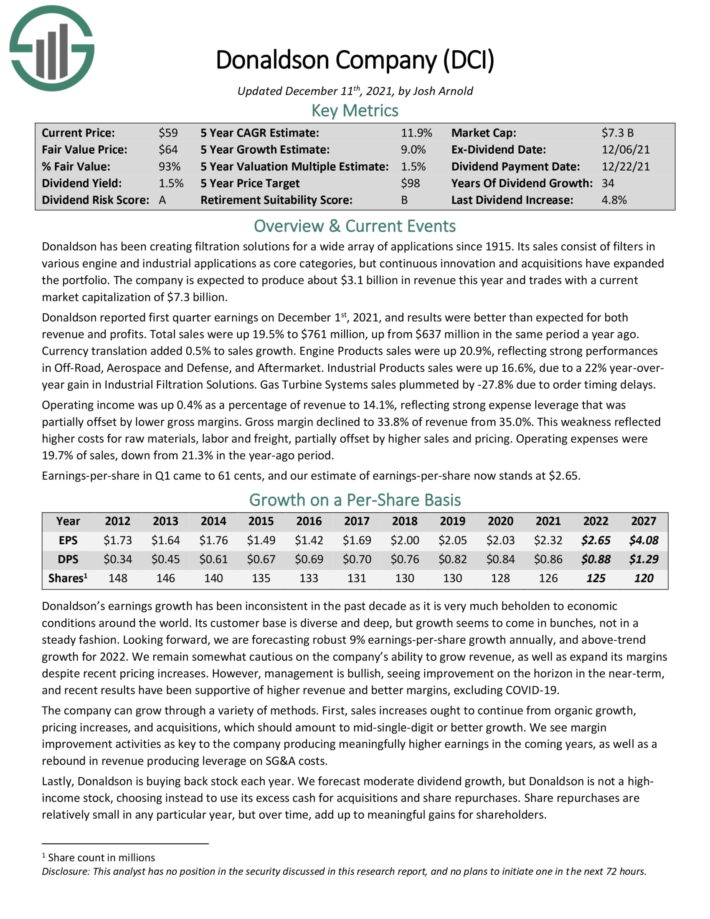

Recession-Proof Income Stock #5: Donaldson Company (DCI)

- 5-year expected annual returns: 13.8%

Donaldson has been creating filtration solutions for a wide array of applications since 1915. Its sales consist of filters in various engine and industrial applications as core categories, but continuous innovation and acquisitions have expanded the portfolio.

In the most recent quarter, revenue increased 18% to $803 million, and was $32 million ahead of analyst estimates.

Donaldson’s payout ratio remains well below 40% of earnings. As mentioned, Donaldson prefers to use most of its excess cash for acquisitions and a small amount of share repurchases, but it does raise the dividend regularly.

Donaldson’s recession performance is solidified by the competitive advantage of more than 100 years of experience in its field, as well as a strong history of innovation and a sizable installed customer base.

We expect annual returns of 13.8% per year, driven by 8% expected EPS growth, the 1.8% dividend yield, and a 4% boost from a rising P/E ratio.

Click here to download our most recent Sure Analysis report on DCI (preview of page 1 of 3 shown below):

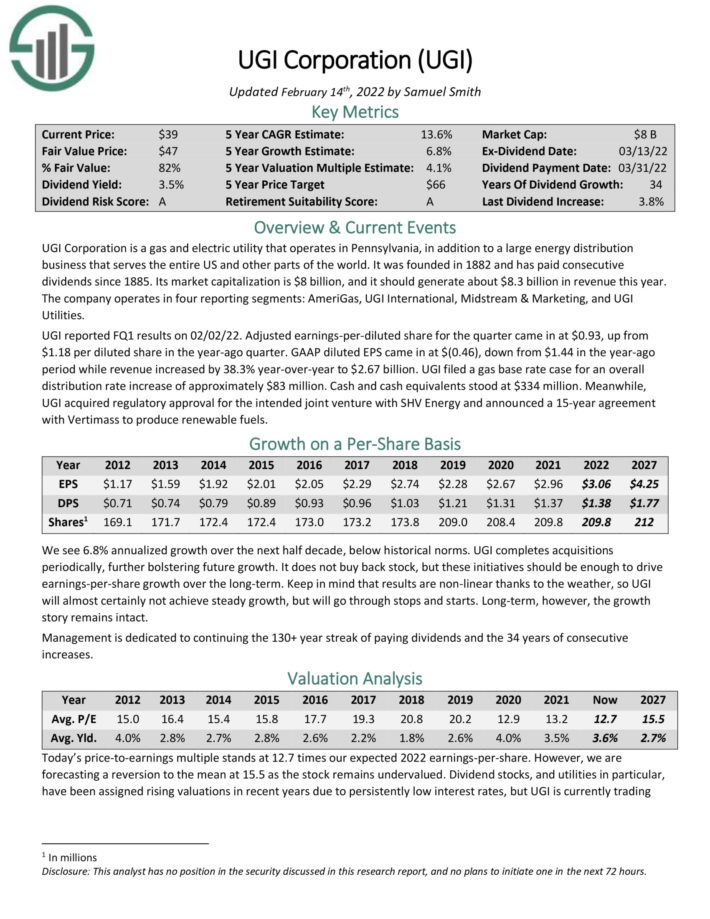

Recession-Proof Income Stock #4: UGI Corp. (UGI)

- 5-year expected annual returns: 14.9%

UGI Corporation is a gas and electric utility that operates in Pennsylvania, in addition to a large energy distribution business that serves the entire US and other parts of the world. It was founded in 1882 and has paid consecutive dividends since 1885.

UGI’s main competitive advantage is in its highly diversified business model. It has electric and gas utilities, propane distribution that covers a wide geographic area and diverse customer base. UGI’s strong performance during the Great Recession illustrates this.

The payout ratio is quite reasonable today given the company weathered the COVID-19 recession well. We expect a sub-50% payout ratio for the foreseeable future, indicating excellent dividend safety.

We expect 14.9% annual returns over the next five years, due to 6.8% EPS growth, the 3.8% dividend yield, and a ~4.3% annual boost from a rising P/E multiple.

Click here to download our most recent Sure Analysis report on UGI (preview of page 1 of 3 shown below):

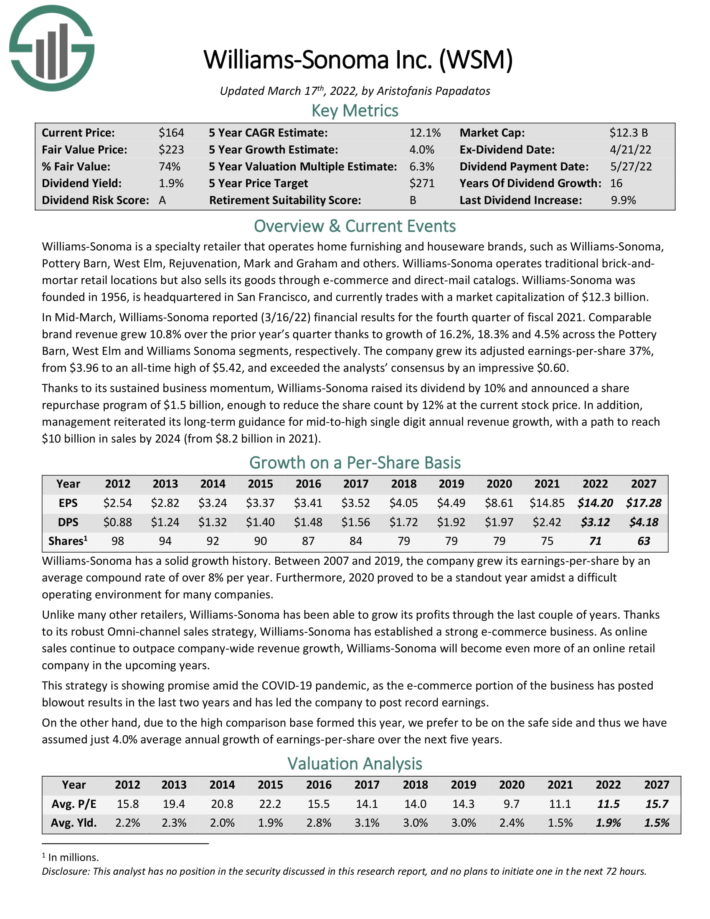

Recession-Proof Income Stock #3: Williams-Sonoma (WSM)

- 5-year expected annual returns: 15.4%

Williams-Sonoma is a specialty retailer that operates home furnishing and houseware brands, such as Williams-Sonoma, Pottery Barn, West Elm, Rejuvenation, Mark and Graham and others.

Source: Investor Presentation

In the 2021 fourth quarter, comparable brand revenue grew 10.8% over the prior year’s quarter thanks to growth of 16.2%, 18.3% and 4.5% across the Pottery Barn, West Elm and Williams Sonoma segments, respectively. The company grew its adjusted earnings-per-share 37%, from $3.96 to an all-time high of $5.42, and exceeded the analysts’ consensus by an impressive $0.60.

Thanks to its sustained business momentum, Williams-Sonoma raised its dividend by 10%. We expect annual returns of 15.4% per year, driven by expected EPS growth of 4% per year, the 2.1% dividend yield, and a ~9.3% annual boost from an expanding P/E multiple.

Click here to download our most recent Sure Analysis report on Williams-Sonoma (preview of page 1 of 3 shown below):

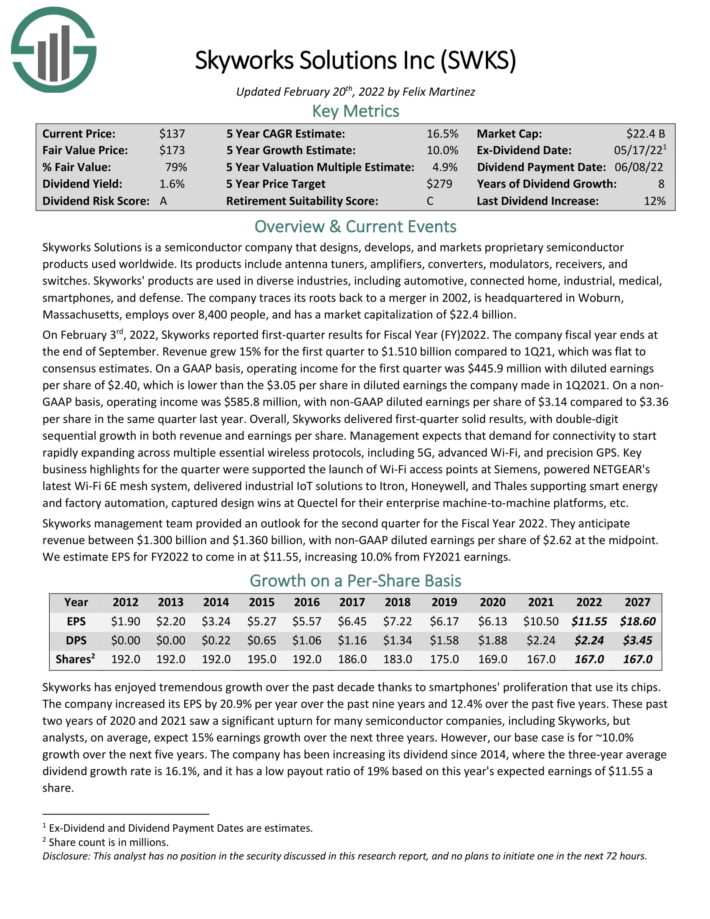

Recession-Proof Income Stock #2: Skyworks Solutions (SWKS)

- 5-year expected annual returns: 17.3%

Skyworks Solutions is a semiconductor company that designs, develops, and markets proprietary semiconductor products used worldwide. Its products include antenna tuners, amplifiers, converters, modulators, receivers, and switches.

In the most recent quarter, revenue grew 15% year-over-year. Adjusted diluted earnings per share of $3.14 compared to $3.36 per share in the same quarter last year. Overall, Skyworks delivered first-quarter solid results, with double-digit sequential growth in both revenue and earnings per share.

Skyworks has a strong balance sheet with over $1 billion in cash and cash equivalents and no debt. This gives the company tremendous flexibility and resiliency to offset some of its concentrated customer base risks and move forward with its growth plans. The dividend is very well covered by earnings, and we consider it very safe. The company remained profitable during the previous recession.

Click here to download our most recent Sure Analysis report on SWKS (preview of page 1 of 3 shown below):

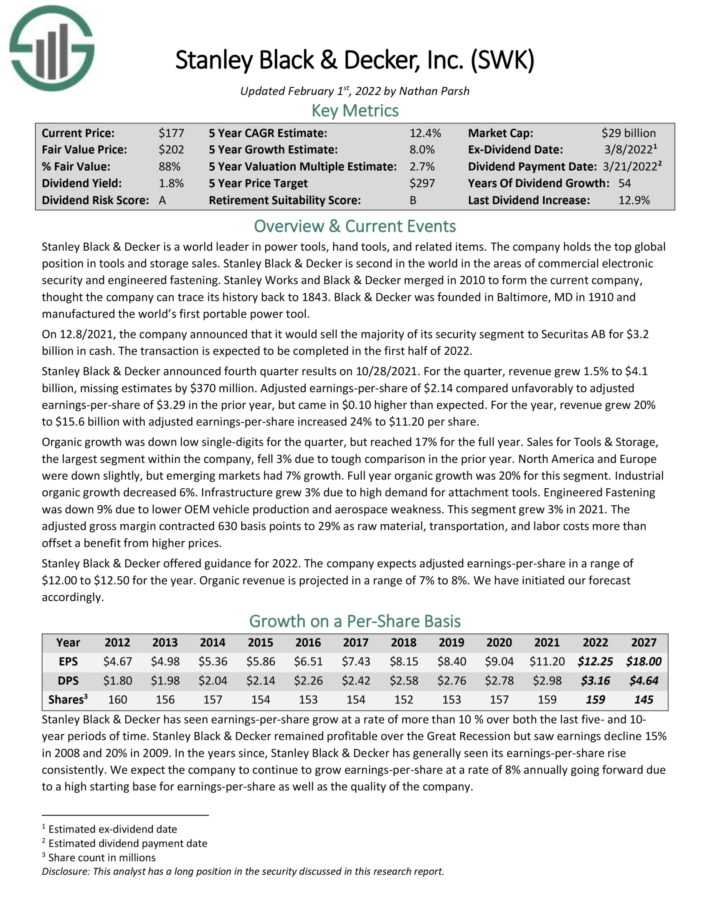

Recession-Proof Income Stock #1: Stanley Black & Decker (SWK)

- 5-year expected annual returns: 17.6%

Stanley Black & Decker is a world leader in power tools, hand tools, and related items. The company holds the top global position in tools and storage sales.

Stanley Black & Decker announced fourth quarter results on 10/28/2021. You can see an overview of the company’s 2021 fourth-quarter performance in the image below:

Source: Investor Presentation

For the quarter, revenue grew 1.5% to $4.1 billion, missing estimates by $370 million. Adjusted earnings-per-share of $2.14 compared unfavorably to adjusted earnings-per-share of $3.29 in the prior year, but came in $0.10 higher than expected.

The company’s low payout ratio (26% projected for 2022) does make it likely that dividends will continue rising even through a serious economic downturn. Stanley Black & Decker’s key competitive advantage is that its products are well-known and respected by customers.

The stock has a 2.2% dividend yield, and we expect 8% annual EPS growth. With a ~7.4% boost from an expanding P/E multiple, total returns are expected to reach 17.6% per year.

Click here to download our most recent Sure Analysis report on SWK (preview of page 1 of 3 shown below):

Additional Reading

The Blue Chips list is not the only way to quickly screen for stocks that regularly pay rising dividends:

- The High Yield Dividend Aristocrats List is comprised of the Dividend Aristocrats with the highest current yields.

- The Dividend Kings List: stocks with 50+ consecutive years of dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Dividend Achievers List: 10+ years of dividend increases.