Updated on August 18th, 2021 by Bob Ciura

Dividend stocks can generally be separated into two groups. The first group is made up of high-dividend stocks. Think telecoms and utilities, which usually offer higher dividend yields of 4%+. Their high yields are attractive, but the trade-off is that they tend to have low dividend growth rates. Sometimes, their dividend increases barely beat inflation.

The second group is made up of stocks that have lower dividend yields, in the ~2% range, but have high dividend growth rates. These companies typically distribute a lower percentage of their earnings today, so that they can invest in the business to generate growth. On the other hand, they can raise their dividends 10% each year or more.

Investors on the hunt for high-quality dividend growth stocks should review our list of blue chip stocks, which have all raised their dividends for at least 10+ consecutive years.

You can download the complete list of all 260+ blue chip stocks (plus important financial metrics such as dividend yield, P/E ratios, and payout ratios) by clicking below:

Dividend growth stocks with lower yields may not appeal to retirees, who might want more income right now, but they are well-suited for young investors with longer time horizons.

Over time, a portfolio of these lower-yielding stocks can actually generate higher dividend income streams in the long run, due to their high dividend growth.

This article will discuss the top 10 dividend stocks for young investors.

Table of Contents

The 10 stocks in this article pay dividends to shareholders, and could generate double-digit dividend growth of 10% per year or more going forward.

You can instantly jump to any individual stock by using the links below:

- Long-Term Dividend Growth Stock #10: The Sherwin-Williams Company (SHW)

- Long-Term Dividend Growth Stock #9: Costco Wholesale (COST)

- Long-Term Dividend Growth Stock #8: Mastercard Incorporated (MA)

- Long-Term Dividend Growth Stock #7: Visa Inc. (V)

- Long-Term Dividend Growth Stock #6: Lowe’s Companies (LOW)

- Long-Term Dividend Growth Stock #5: The Home Depot (HD)

- Long-Term Dividend Growth Stock #4: Starbucks Corporation (SBUX)

- Long-Term Dividend Growth Stock #3: Nike Inc. (NKE)

- Long-Term Dividend Growth Stock #2: Microsoft Corporation (MSFT)

- Long-Term Dividend Growth Stock #1: Apple, Inc. (AAPL)

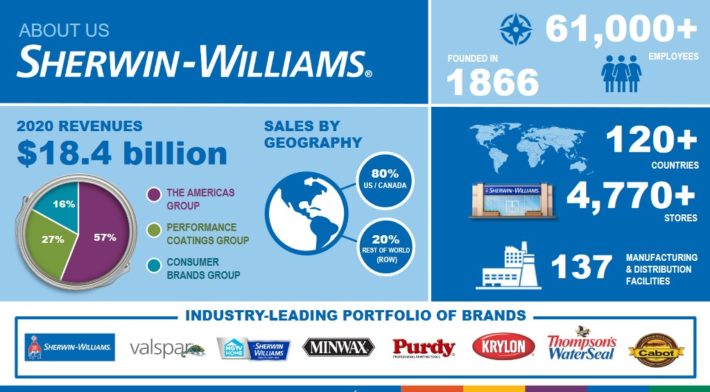

Long-Term Dividend Growth Stock #10: Sherwin-Williams (SHW)

Sherwin-Williams is North America’s largest manufacturer of paints and coatings. The company distributes its products through wholesalers as well as retail stores (including a chain of more than 4,900 company-operated stores and facilities) to 120 countries under the Sherwin-Williams name.

The company also manufactures Dutch Boy, Pratt & Lambert, Minwax, Thompson’s Waterseal, Krylon, Valspar (acquired in 2017), and other brands.

Source: Investor Presentation

Even with the coronavirus pandemic severely impacting the economy, 2020 was another year of growth for Sherwin-Williams. For the year, Sherwin-Williams generated $18.36 billion in 2020 sales, representing a 2.6% increase compared to 2019. Adjusted earnings-per-share equaled $24.58 for 2020, a 16.4% increase compared to 2019.

Growth has continued in 2021. Sherwin–Williams generated second-quarter revenue of $5.38 billion, a 16.9% increase compared to Q2 2020. This result was driven by a 22.6% increase in the Americas Group and a 41.3% increase in the Performance Coatings Group, which more than offset a decline in the Consumer Brands Group. Adjusted earnings–per–share equaled $2.65 compared to $2.37 in Q2 2020.

We believe that Sherwin-Williams is capable of delivering 8% annualized earnings growth over full economic cycles. Growth can come from several factors, including revenue expansion through higher sales at the company’s existing stores, as well as margin improvement, and share repurchases. The company has reduced its share count by roughly -20% throughout the last decade.

Further, acquisitions are a way for Sherwin-Williams to enhance its presence, with the recent Valspar transaction being a good example.

Sherwin-Williams is an excellent dividend growth stock. The company increased its dividend by 23% in February, and is a member of the exclusive Dividend Aristocrats list.

Long-Term Dividend Growth Stock #9: Costco Wholesale (COST)

Costco’s current dividend yield is just 0.7%, well below the ~1.3% average yield in the S&P 500 Index. However, Costco is a much more appealing dividend growth stock than the current yield indicates. It delivered a 13% dividend raise earlier this year. Since it initiated a dividend in 2004, it has increased the dividend by over 10% annually.

And, Costco pays a special dividend on occasion, including a $10 per-share special payout in November 2020 and a $7.00 per-share special dividend in 2017.

You may have heard about the death of retail, but Costco has proved otherwise. It has continued to grow, even in a very competitive retail environment.

Costco reported third quarter earnings on May 27th, 2021, with results coming in well ahead of expectations on both the top and bottom lines. Total sales were up 21.7% to $44.4 billion, which was up sharply from $36.5 billion in last year’s Q1.

For the 36–week period ending with Q3, sales were up 17.7% to $130.6 billion, which was up from $111 billion in the same 36–week period last year. Membership fees in Q3 were up from $815 million to $901 million.

Membership growth drives higher membership fees, which is a significant portion of Costco’s revenue base. For example, membership fees rose by 4% last quarter. Renewal rates continue to be strong, with 90.2% renewal last quarter in the U.S. and Canada.

And, Costco has invested in an e-commerce business of its own. Costco continues to invest in growth initiatives to keep up with the changing retail environment. Double-digit earnings growth should allow for high dividend growth rates, and occasional special dividends moving forward.

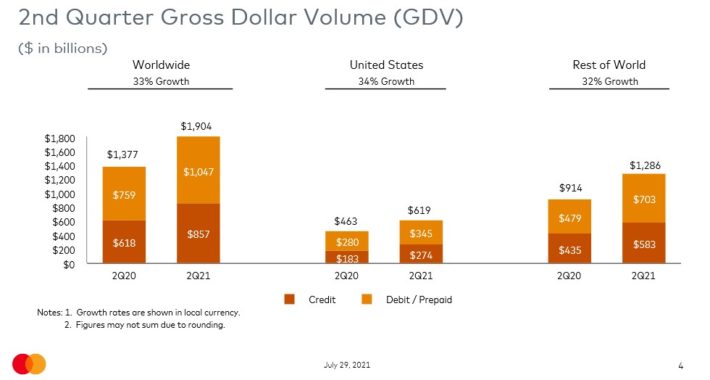

Long-Term Dividend Growth Stock #8: Mastercard Incorporated (MA)

Mastercard is a world leader in electronic payments. The company partners with 25,000 financial institutions around the world to provide an electronic payment network. Mastercard has nearly 3 billion credit and debit cards in use.

Revenue was up 36.4% to $4.5 billion, which was $130 million better than expected. Adjusted earnings–per–share of $1.95 compared favorably to adjusted earnings–per–share of $1.36 in the prior year and was $0.25 above estimates.

Gross dollar volumes improved 33% to $1.9 trillion.

Source: Investor Presentation

U.S. growth was 34% with the rest of the world increasing 32%. Cross border volumes were higher by 58% following declines of 17%, 29% and 34% over the past three quarters, respectively. Purchase volumes climbed 36%, switched transaction were higher by 41% and card in use was up 8% to 2.85 billion.

The adjusted operating margin contracted 70 basis points to 53%. The company repurchased 4.6 million shares at an average price of $370 in Q2. Mastercard has $6.4 billion, or 1.7% of its market capitalization, remaining on its share repurchase authorization.

As one of the largest companies in the electronic payment space, Mastercard is likely to benefit from increased use of debit and credit cards as a form of payment for goods and services.

Mastercard has increased its dividend by 20% per year in the past five years. With a 2021 expected payout ratio of ~22%, there is plenty of room for double-digit increases to continue.

Long-Term Dividend Growth Stock #7: Visa Inc. (V)

Visa has a very low dividend yield, of 0.7%. A dividend yield less than 1% might be an automatic disqualifier among income investors who focus on high yields. However, even a tiny dividend yield can grow to a high yield over time, especially given Visa’s high dividend growth potential.

Over the past five years, Visa has increased its quarterly dividend by approximately 20% per year, on average. At this rate, Visa’s dividends will double roughly every 3.5 years.

Such high dividend growth is made possible by Visa’s tremendous competitive advantages and strong brand. With that in mind, it is not surprising to see that Warren Buffett owns 10.5 million shares of Visa, which is one of Buffett’s highest-quality holdings.

You can see the complete list of Buffett’s top 20 stocks here.

Visa is a giant in the global payments industry. Visa-branded cards and payment products facilitate over $6 trillion in global payments volume every year. The company has multiple sources of revenue which can be seen below:

Source: Investor Presentation

The fundamental backdrop for Visa is very strong. In the most recent quarter, Visa reported revenue of $6.1 billion, adjusted net income of $3.3 billion and adjusted earnings–per–share of $1.49, resenting increases of 27%, 39% and 41% respectively.

These results were driven by a 34% gain in Payments Volume, a 47% gain in Cross–Border Volume and a 39% gain in Processed Transactions, as the company benefited from economies reopening around the world.

During the quarter Visa returned $2.9 billion to shareholders in the form of share repurchases and dividends, leaving $7.7 billion remaining on the share repurchase authorization.

Visa’s growth stems from the broader shift away from cash. Consumers are using mobile payments processing technology and cards, and are comfortable not carrying cash. There is good reason to go cashless, as physical currency can be lost or destroyed.

Visa’s most recent dividend increase of 6.7% was a bit muted than typical, due to the ongoing effects of the pandemic. However, the company has a 5-year dividend CAGR of 20%. With a very low payout ratio and high earnings growth potential, Visa could continue to increase its dividend by 20% every year, on average.

Long-Term Dividend Growth Stock #6: Lowe’s Companies (LOW)

Lowe’s Companies is the second-largest home improvement retailer in the US (after Home Depot). The company operates more than 2,200 home improvement and hardware stores in the U.S. and Canada.

Lowe’s reported strong second-quarter results. Net sales increased 1% to $27.6 billion. U.S. comparable sales declined 2.2% year-over-year, but over the past two years rose 32%. Diluted earnings-per-share rose 14% year-over-year.

Source: Infographic

Another key to Lowe’s success has been its booming e-commerce platform. This is a key differentiator between successful retailers like Lowe’s and the many retailers that are reporting losses or going out of business. Lowe’s is benefiting right alongside the e-commerce boom.

Lowe’s enjoys competitive advantages from scale and brand power as it operates in a duopoly with Home Depot. Neither of the two are expanding their store count significantly, and neither is interested in a price war. Both should remain highly profitable, as the home improvement market in the US is large enough for two companies to succeed.

In May, Lowe’s increased its dividend by 33%. The company has increased its dividend for over 50 years in a row, placing it on the exclusive list of Dividend Kings.

Long-Term Dividend Growth Stock #5: Starbucks Corporation (SBUX)

Starbucks began with a single store in Seattle’s Pike Place Market in 1971 and now has nearly 33,000 stores worldwide. The company operates under the namesake Starbucks brand, but also holds the Seattle’s Best Coffee, Teavana, Evolution Fresh, and Ethos Water brands in its portfolio. The company generates over $25 billion in annual revenue.

On July 27th, 2021, Starbucks announced Q3 fiscal year 2021 results for the period ending June 27th, 2021. (Starbucks fiscal year ends the Sunday closest to September 30th.) For the quarter, the company generated net revenue of $7.5 billion, representing a 78% increase compared to Q2 2020. Global comparable sales increased 73%, driven by a 75% increase in comparable transactions, partially offset by a –1% decline in the average ticket.

Adjusted earnings–per–share equaled $1.01 compared to a loss of –$0.46 in the prior year’s quarter, as Starbucks dealt with the pandemic. During the quarter Starbucks opened 352 net new stores, bringing the total up to 33,295 stores globally, of which 51% and 49% were company–operated and licensed, respectively.

Starbucks also updated its fiscal 2021 guidance, anticipating 18% to 21% global comparable sales growth (from 18% to 23%) and reiterated approximately 2,150 new store openings. In addition, the company now expects $29.1 billion to $29.3 billion in revenue (from $28.5 – $29.3 billion) and adjusted EPS of $3.20 to $3.25 (from $2.90 to $3.00).

Starbucks increased its dividend by 10% in September 2020, which was highly impressive given how challenging last year was due to the coronavirus pandemic. With a 2021 payout ratio expected at ~56% and expected EPS growth of 9% per year, Starbucks could continue to raise its dividend by at least 10% per year moving forward.

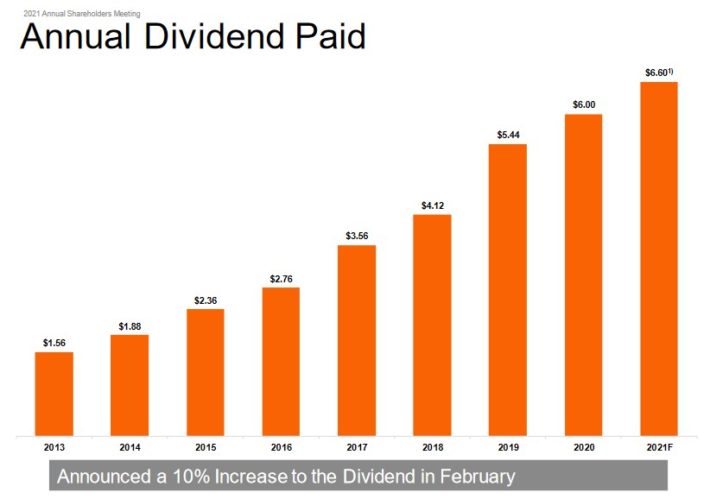

Long-Term Dividend Growth Stock #4: The Home Depot (HD)

Home Depot was founded in 1978 and since that time has grown into a juggernaut home improvement retailer with

almost 2,300 stores in the US, Canada and Mexico that generate around $132 billion in annual revenue.

Home Depot has generated excellent growth in the past decade, due to the strong housing market and consumers’ increasing desire to invest in home renovations and improvements.

The company has rewarded shareholders with excellent dividend growth as well:

Source: Investor Presentation

Over the eight-year period seen above, Home Depot increased its dividend by an average annual rate of approximately 20% per year. We expect 9% annual EPS growth over the next five years, making 10% annual dividend growth a reasonable estimate.

The unprecedented demand for home improvement projects continues to persist into 2021 and Home Depot continues to build on this momentum.

In the most recent quarter, Home Depot’s sales increased 8% as comparable sales rose 4.5% year-over-year. Diluted earnings-per-share rose 12.8%, as revenue growth was accompanied by share repurchases.

Home Depot has an expected payout ratio of 50% for 2021, making the dividend payout highly secure with room for lots of growth.

Long-Term Dividend Growth Stock #3: Nike Inc. (NKE)

Nike is a very strong business. Its brand strength allows it to command pricing power, and charge hefty prices for its shoes and athletic apparel. This leads to consistent growth, and high returns on capital.

Nike is the world’s largest athletic footwear, apparel and equipment maker. The namesake is one of the most valuable brands in the world. The company’s offerings focus on six categories: running, basketball, the Jordan brand, football (soccer), training, and sportswear. Nike also owns Converse and Hurley. The company had sales of $44.5 billion in fiscal year 2021.

On June 24th, 2021, Nike released Q4 and fiscal year 2021 results for the period ending May 31st, 2021. For the quarter revenue came in at $12.3 billion, representing a 95.5% increase compared to Q4 2020, as the company lapped poor results related to COVID–19 store closures. Nike posted a profit of $1.51 billion or $0.93 per share during the quarter, compared to a loss of –$790 million or –$0.51 per share in Q4 2020.

For the full year Nike generated revenue of $44.5 billion, a 19.1% increase compared to fiscal year 2020, reflecting growth across all geographies. Nike Direct sales equaled $16.4 billion, up 32%, driven by a 64% increase in Nike Brand Digital. Net income equaled $5.73 billion or $3.56 per share compared to $2.54 billion or $1.60 per share prior.

Nike expects strong growth to continue through fiscal 2025; the company’s outlook includes high single-digit to low double-digit revenue growth, along with mid-to-high teens EPS growth each year.

Such strong growth could easily allow for double-digit dividend growth. Nike raised its dividend by 12% in 2020, which was a very difficult year for the global economy.

Nike has a current dividend yield of just 0.7%, but it makes up for this with strong dividend growth. Nike has increased its dividend for 19 years in a row, making it a Dividend Achiever. In the past five years, Nike raised its dividend by approximately 11% per year.

Long-Term Dividend Growth Stock #2: Microsoft Corporation (MSFT)

Microsoft develops, manufactures and sells both software and hardware to businesses and consumers. Its offerings include operating systems, business software, software development tools, video games and gaming hardware, and cloud services.

The stock has a low yield below 1%, but it makes up for this with strong dividend growth. In September 2020 Microsoft raised its dividend by 10%, marking the 19th consecutive yearly increase.

On July 27th, 2021, Microsoft reported Q4 and fiscal year 2021 results for the period ending June 30th, 2021. For the quarter, the company generated revenue of $46.2 billion, representing a 21.3% increase compared to Q4 2020.

The Intelligent Cloud segment led the way with 30% revenue growth.

Source: Investor Presentation

The growth was across the board with Productivity and Business Processes, Intelligent Cloud and Personal Computing growing 25%, 30% and 9% respectively. Azure, Microsoft’s high–growth cloud platform, grew by 51% year–over–year. Net income equaled $16.5 billion or $2.17 per share compared to $11.2 billion or $1.46 per share in Q4 2020.

For the year Microsoft generated $168.1 billion in revenue, representing a 17.5% increase compared to 2020. Adjusted net income equaled $60.7 billion or $7.97 per share compared to $44.3 billion or $5.76 per share in 2020.

Microsoft’s cloud business is growing at a rapid pace thanks to Azure, which has been growing tremendously for a few years. Microsoft’s Office product range, which had been a low–growth cash cow for many years, is showing strong growth rates as well after Microsoft changed its business model towards the Office 365 software–as–a–service (SaaS) system.

Due to low variable costs, Microsoft should be able to maintain a solid earnings growth rate for the foreseeable future.

Microsoft’s strong balance sheet also supports its dividend growth. Its AAA–rated balance sheet makes it a low–risk business. As of the most recent quarterly report Microsoft held $130.3 billion in cash and securities, $184.4 billion in current assets and $333.8 billion in total assets against $88.7 billion in current liabilities and $191.8 billion in total liabilities.

Long-Term Dividend Growth Stock #1: Apple, Inc. (AAPL)

Claiming the top spot is Apple, the world’s most valuable brand. According to Forbes, Apple’s brand alone is worth over $240 billion.

Not only that, Apple is very highly profitable, with a high growth rate and an excellent balance sheet. The technology company designs, manufactures and sells products such as iPhones, iPads, Mac, Apple Watch and Apple TV. It also has a services business that sells music, apps, and subscriptions.

On July 27th, 2021, Apple reported Q3 fiscal year 2021 results for the period ending June 26th, 2021. (Apple’s fiscal year ends the last Saturday in September). For the quarter Apple generated revenue of $81.4 billion, representing a 36.4% increase compared to Q2 2020.

Product sales were up 37.4%, led by 49.8%, 16.3%, 11.9% and 36.0% respective gains in iPhones (49% of total sales), Mac, iPad and Wearables, Home & Accessories. Service sales increased 32.9% and made up 21% of all sales in the quarter. Net income equaled $21.7 billion compared to $11.3 billion in Q2 2020. Earnings–per–share doubled to $1.30, compared to $0.65 in the prior year’s quarter

Consumers line up to buy Apple products, and are willing to pay higher prices for them each year. This customer loyalty is the result of huge investments in research and development.

Going forward, investors can look forward to product releases on a regular basis such as new iPhone releases. This will be a major growth catalyst for Apple, since the iPhone is its most important product by far.

The stock has a current yield below 1%, as its share price has soared in the past several years. But with a payout ratio of just 15% expected for 2021, Apple should continue to be an excellent dividend growth stock.

Final Thoughts

Stock with low dividend yields may not be as attractive as those with high dividend yields of 5%+, but investors should not avoid them just because of their low yields. This is especially the case for stocks that raise their dividends by 10%-20% (or more) each year.

With such high dividend growth rates, the stocks on this list can eventually provide higher income than their high-yielding counterparts over time. With enough time, investors can actually earn higher yields from dividend growth stocks.

As a result, these 10 stocks should have appeal to young investors looking to build a dividend growth portfolio.