The Santa-Trump Rally Keeps Giving, But with Less Enthusiasm

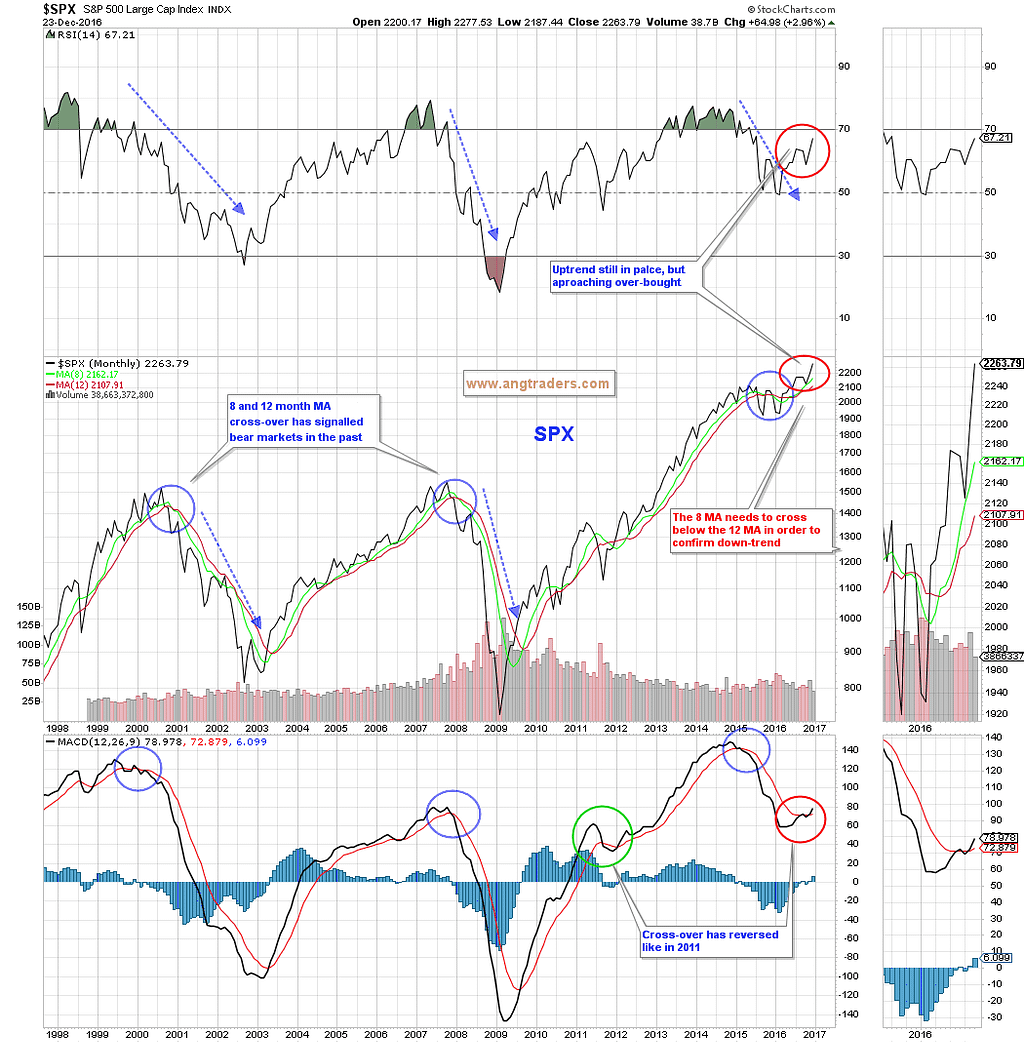

We’ll start with the long-term chart (below). The long-term moving averages continue to push higher, although the RSI is approaching over-bought territory.

{This section is for paid subscribers only}

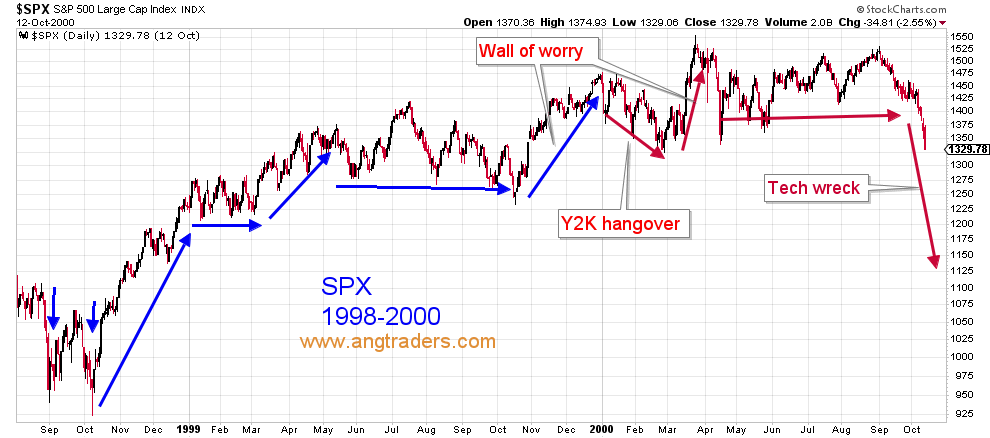

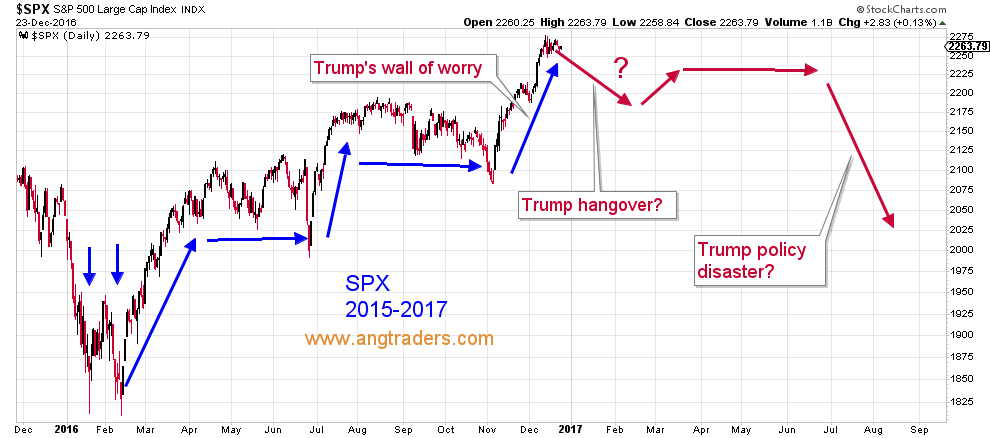

A couple of weeks ago, we wrote about the similarities between 1998–2000 and today, and that pattern is still viable (charts below). A Trump induced hangover would not be a surprise in the new year.

{This section is for paid subscribers only}

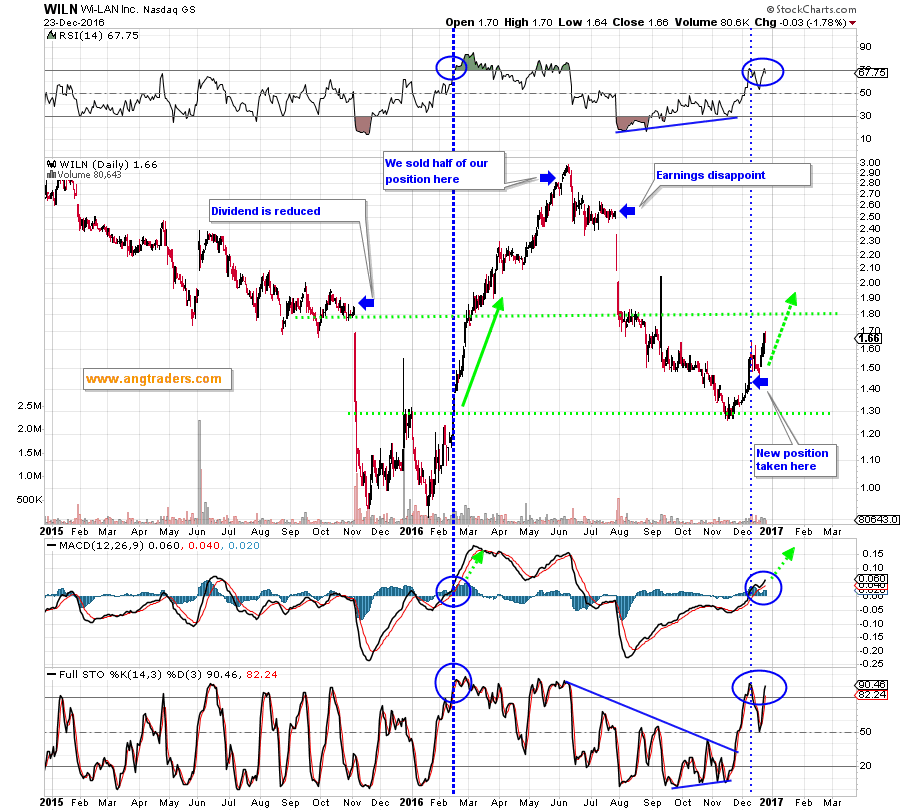

Our new position in WILN is performing well (chart below). We are working on a public article on the patent industry in general and WILN in particular. We think this company will benefit from a more patent friendly environment that the Trump administration is assumed will be providing.

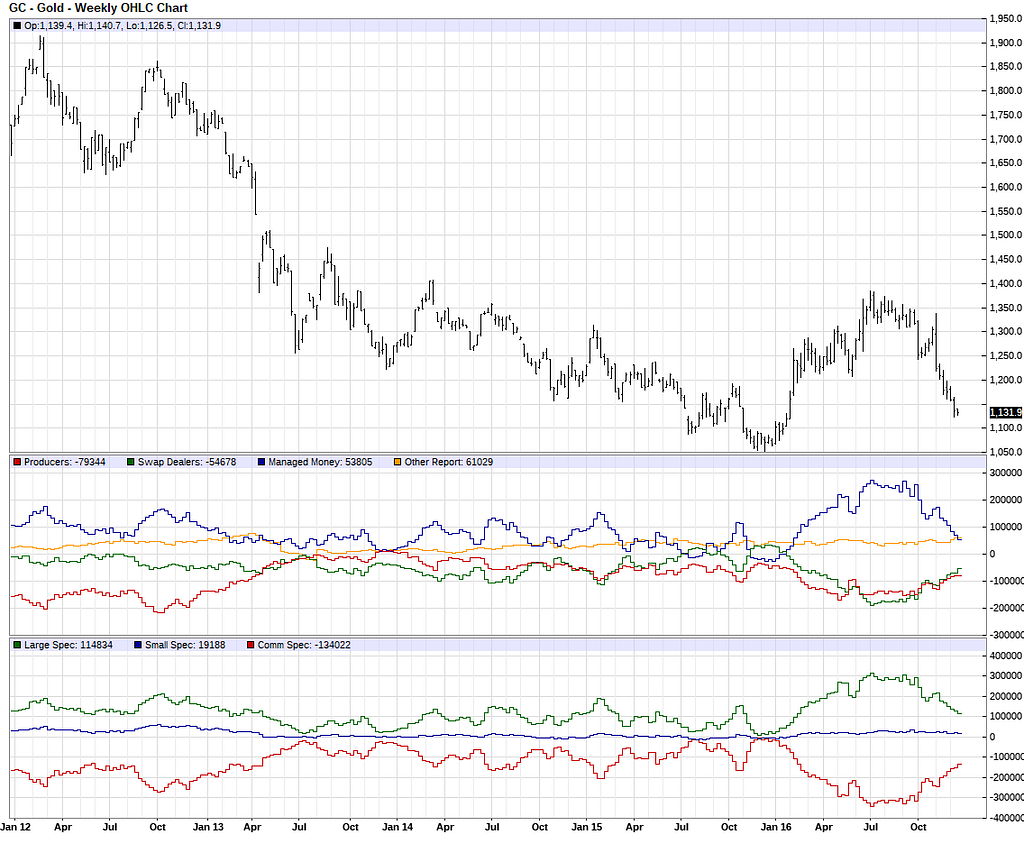

Gold

We finished another week during which gold failed to bounce, although it did stop its relentless slide (chart below). If it does attempt a bounce from here, the $1140 level may act as resistance in a similar fashion as the $1180 level did.

{This section is for paid subscribers only}

The commitments of futures traders (chart below) shows that the large speculators continued to slightly reduce their long positions from 70% bullish to 68%, and the commercial traders slightly reduced their short positions from 74% bearish to72%. These levels, however, are still above the levels that are normally reached when gold bottoms-out. This is further evidence that gold has yet to reach a minimum.

{This section is for paid subscribers only}

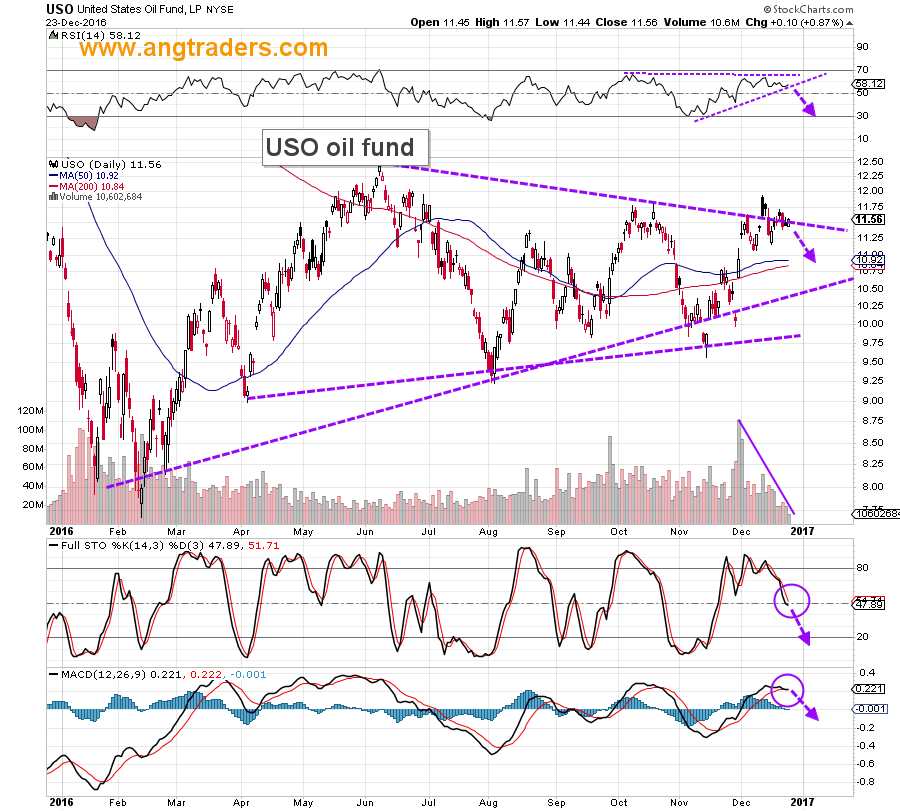

Oil

This week we shorted oil via put options in USO. This allows us to limit any losses, should oil continue to rise in price (outright shorting has potentially limitless losses). We see oil as technically weak (chart below), and fundamentally it is unlikely that OPEC will be able to reduce production as much as it hopes. In addition, the American fracking industry is sitting on the bench eager to hedge the oil price if it moves much higher than it already is.

{This section is for paid subscribers only}

We wish our subscribers a happy, healthy holiday season. Please continue to monitor email for Trade Alerts.

Regards,

ANG Traders

Join us at www.angtraders.com and replicate our trades.

Source: Nicholas Gomez