This is a guest contribution by Matthew Ramey of MoneyByRamey

2020 was certainly interesting and 2021 seems to be off to an even crazier start. With seemingly no end in sight to the Covid pandemic, a new administration in the White House, and Reddit investors beating up hedge funds, what are investors to do with the predictable volatility heading our way?

In my opinion, continue buying into solid companies at attractive valuations.

About MoneyByRamey.com and My Dividend Portfolio

The goal at MoneyByRamey is to teach Financial Freedom to the Universe – one of the best ways I know how to do that is to achieve passive income. My personal favorite source: dividend income.

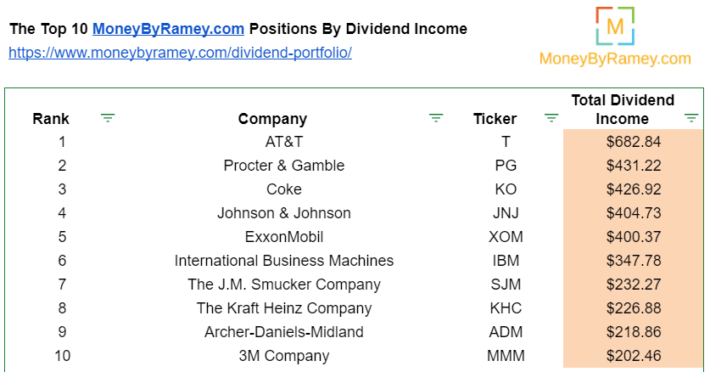

I currently earn $7300+ year in annual dividend income (ADI) on 57 various stock positions. You can find the full listing of positions here. I have also included the portfolio values by top 10 value rank and top 10 Annual Dividend Income ranks below.

The Portfolio Top 10 Value Rank

The Portfolio Top 10 ADI Rank

Dividend Stocks Watchlist

First off, how do I find these awesome stocks to include in my portfolio? While I have used many different sources over the years, I have worked to consolidate and build out my own tools. One of the very best tools that I currently use – and offer as a downloadable file – is the MoneyByRamey.com Dividend Stocks Watchlist.

For the purpose of this article, I have used a variation of the dividend stock watch list to identify what I see as my top 5 dividend stocks for 2021.

The MoneyByRamey Top 5 Dividend Stocks for 2021

Below I have listed out my current top 5 dividend stocks for 2021. I will explain a few key metrics on why I find these stocks appealing and provide an indicator as to my overall buying strategy.

Before we dive in, here are key definitions for the article below:

- Ramey Rating – This is a valuation rating that I have set up for my own personal use. You can find out more about this rating in our dividend stocks watchlist – each score is out of a possible 55 points

- Portfolio Rank (ADI) – This is the particular stock’s ranking in my dividend portfolio according to yearly annual dividend income

- Portfolio Rank (Value) – This is the particular stock’s ranking in my dividend portfolio according to the current overall value

- Dividend Calculator – This is a tool available on MoneyByRamey.com to quickly preview a stock’s potential for dividend income at various investment amounts – the assumption below is $5k of capital invested at current market price

#1 – Johnson & Johnson ($JNJ)

- Ramey Rating: 16

- Portfolio Rank (ADI): 4

- Portfolio Rank (Value): 2

Why I Like this Stock

$JNJ has been an amazing stock for my portfolio. I bought in a large position during late 2019 / early 2020 when the stock was adversely being affected by potential opioid legislation and it has been a solid performer ever since.

Being one of the companies that are leading the charge on the Covid-19 vaccination, I can see the potential for this stock to continue rising in 2021 and beyond.

$JNJ continues to have a solid balance sheet, sporting a debt/equity ratio of only .59x. It also has an Aaa debt rating at Moody’s, which is on par with the US government. Historically it was only one of two companies with a debt rating higher than that of the US government, which is quite the bragging rights.

With a payout ratio of 66.90%, dividend investors can rest assured that the chance of a dividend cut is lower and that the 58 years of consecutive dividend growth will be a trend that holds into the future.

Will I Buy This Stock?

Currently, $JNJ is a bit overvalued according to my stock screening criteria. I typically look to deploy capital into companies with a 3% or greater dividend yield and a Ramey Rating of +28.

However, larger considerations are at play as well, such as a diminishing value of the USD and higher levels of inflation. I am currently looking to deploy a cash position into stocks as a way to defend against current inflationary pressures and potential oncoming negative interest rates.

$JNJ certainly fits the bill – I have deployed capital into the company in 2021 and will look to do so, especially if the stock entry point becomes more attractive.

#2 – The Coca-Cola Company ($KO)

- Ramey Rating: 21

- Portfolio Rank (ADI): 3

- Portfolio Rank (Value): 4

Why I like this Stock

Investing in $KO is the definition of consistency; no real highs, no real lows, but steady performance. At the beginning of my dividend investing journey, I was hesitant to invest in this company due to the general movements towards organic, healthier eating. Millennials are drinking less pop in favor of more coffee, carbonated water, and specialty beers.

Being that is the case, I am still very bullish on Coca-Cola. Not only is it routinely in the Top 10 recognized brands the world over, but it is also working to continue diversifying itself into coffee, sparkling water, and even alcoholic product lines. Rumors of a dip into the canned cannabis market are also floating around as well.

To me, Coke soda products will always be consumed by the world at large. Demand may fluctuate, but I do like the enterprising spirit of the company to continue looking for ways to enter new markets and create new products. It also helps to know that I am investing alongside notably the greatest investor of all-time, Warren Buffett.

Will I Buy This Stock?

I am looking to actively purchase shares in $KO. This is mainly driven by it being more attractively valued amongst the dividend stocks that I am looking at. In February 2021, I added to my growing position in $KO, and will be looking to add in more shares if the price drops and I move more out of cash.

#3 – General Dynamics ($GD)

- Ramey Rating: 33

- Portfolio Rank (ADI): 13

- Portfolio Rank (Value): 11

Why I like this Stock

$GD came up on my radar screen in late 2020. It had a very high Ramey Rating and I became intrigued at the prospect. In reviewing the stock, I saw a company with a high dividend yield, a low payout ratio, and an overall lower risk profile.

In thinking through the political ramifications of the US elections, I believe that the US is set to return to a more interventionist-hawkish war view in the coming years, so defense stocks like $GD, $LHX, and $LMT are set to fair well.

I do own $GD and $LHX, but for the time being, $GD seems primed to gain in valuation while sustaining its solid dividend.

Will I Buy This Stock?

I have been adding to my $GD position in the past few months, mainly due to its solid valuation relative to price and its solid dividend. I may look to further add to this position if it dips as I am bullish on defense stocks.

#4 – Microsoft ($MSFT)

- Ramey Rating: 17

- Portfolio Rank (ADI): 39

- Portfolio Rank (Value): 12

Why I like this Stock

What is not to like about $MSFT? It has a repeatable business model in its subscription-based tools like Excel, Word, etc. and it has the entire business world locked into these programs and its windows operating system. Microsoft also ranks 2nd in the world in cloud-based providers, an industry that is primed to grow in 2021 and beyond.

Boasting a debt/equity ratio of .55x, a current ratio of 2.5x, and a payout ratio of just 31%, you can be rest assured that your dividend is in safe hands. Like $JNJ, this is one of two US companies with debt ratings on par with the US government. It doesn’t get more secure than that.

I am also hopeful that Microsoft will continue increasing its dividend over the coming years and perhaps even look to engage in a similar stock split that we saw in $AAPL and $TSLA. There is also the opportunity for the company to increase its dividend, perhaps significantly.

Will I Buy This Stock?

Right now Microsoft is trading a premium, so if I were to deploy capital at these levels, there is risk that I am buying in towards the top. Though I’m actively looking for ‘safer’ places to put my cash in 2021 that will actually earn me some ROI, so I might look to buy into a stabler stock like $MSFT.

At the present moment, I do not plan on buying $MSFT but may if I see some interesting dips.

#5 – Realty Income Corp ($O)

- Ramey Rating: 26

- Portfolio Rank (ADI): 27

- Portfolio Rank (Value): 40

Why I like this Stock

Of all the stocks on my top 5 dividend stocks list, $O is the riskiest in terms of deploying capital, mainly because of the pandemic and its effects on commercial real estate.

“Buy when others are fearful…” is one of the top commandments in the world of investing. I believe that the world is very fearful when it comes to commercial real estate and for good reason – the pandemic has exposed fragile the idea that one needs to be in an office setting to be successful at a job. The fact is remote working is here to stay and robust office space is at risk.

The market’s fear of the remote working is a main reason why Realty Income saw a drastic drop in share price at the start of the pandemic and why one can currently buy shares with a 4%+ dividend yield. To me, this is a potential buy signal and I’ll be digging into this stock in 2021 and beyond.

A quick note: according to the company’s top 10 tenants list, 5.5% of its overall portfolio is made up of AMC & Regal Cinemas. Regardless of $AMC’s recent price spike in recent months, there remains much risk in this sector and it is challenging for a company to have exposure at this time. This will be something to look at when completing due diligence and you should too.

Will I Buy This Stock?

Realty Income is on the potential buying opportunity list. I would like to see the stock price suppressed a bit more, but I do like having real estate in the portfolio, so I would like to have an opportunity to buy more $O or perhaps look into other REITs in the near term.

Disclosure: I am/we are long $JNJ $MSFT $KO $GD $O

All the information above is not a recommendation for or against any investment vehicle or money management strategy. It should not be construed as advice and each individual that invests needs to take up any decision with the utmost care and diligence. Please seek the advice of a competent business professional before making any financial decision.

Author Bio

Matthew Ramey is the owner and operator of MoneyByRamey.com. He teaches money management, investing (especially in dividend-paying stocks), and how to achieve Financial Freedom through developing more active and passive income. He is the author of two books; Simple Budgeting and Simple Investing, which can be purchased on Amazon.