Updated on September 9th, 2019 by Bob Ciura

The goal of most investors is to either:

- Maximize returns given a fixed level of risk

- Minimize risk given a particularly level of desired returns

Perhaps the best metric for analyzing both risk and return is the Sharpe Ratio. With that in mind, we’ve compiled a list of all stocks in the S&P 500 sorted by 5-Year Sharpe Ratio, which you can access below.

The list of S&P 500 stocks sorted by Sharpe Ratio available for download above has the following metrics for each of the constituents of the index:

- Sharpe Ratio

- 5-Year Annualized Total Returns

- Dividend yield

- Price-to-earnings ratio

- Market Capitalization

- 5-Year Beta

You can see a preview of the spreadsheet in the table below:

Ticker Name Price Dividend Yield Market Cap ($M) P/E Ratio Payout Ratio Beta Sharpe Ratio

MKTX

MarketAxess Holdings, Inc.

419.40

0.4

15,835

83.9

37.2

0.33

1.93

MSCI

MSCI, Inc.

241.27

1.0

20,435

35.8

34.4

1.32

1.86

CTAS

Cintas Corp.

266.19

0.8

27,281

32.2

24.8

1.07

1.81

CME

CME Group, Inc.

223.07

1.3

79,880

43.4

56.4

0.37

1.79

MA

Mastercard, Inc.

291.38

0.4

295,622

44.7

19.0

1.41

1.78

FISV

Fiserv, Inc.

108.62

0.0

42,684

44.8

0.0

1.00

1.77

V

Visa, Inc.

185.74

0.5

322,890

35.6

18.4

1.22

1.73

RSG

Republic Services, Inc.

88.88

1.7

28,508

27.4

46.2

0.47

1.71

WM

Waste Management, Inc.

119.33

1.6

50,623

28.9

47.3

0.53

1.68

CPRT

Copart, Inc.

81.38

0.0

18,645

34.3

0.0

1.05

1.60

MCD

McDonald's Corp.

220.03

2.0

167,100

28.6

58.4

0.39

1.59

GPN

Global Payments, Inc.

174.37

0.0

27,319

56.6

1.3

1.22

1.58

PGR

Progressive Corp.

77.39

3.4

45,245

14.0

47.3

0.96

1.57

NEE

NextEra Energy, Inc.

220.14

2.1

107,593

31.4

67.3

0.18

1.56

ADBE

Adobe, Inc.

284.94

0.0

138,320

52.5

0.0

1.62

1.53

ZTS

Zoetis, Inc.

128.43

0.5

61,332

44.9

21.6

0.98

1.51

TSS

Total System Services, Inc.

141.09

0.4

24,971

41.1

15.2

1.09

1.51

AWK

American Water Works Co., Inc.

125.70

1.5

22,708

39.1

59.4

0.25

1.49

SNPS

Synopsys, Inc.

145.51

0.0

21,868

34.6

0.0

1.30

1.47

INTU

Intuit, Inc.

287.80

0.7

74,849

48.0

31.4

1.35

1.47

MSFT

Microsoft Corp.

139.10

1.3

1,062,085

27.2

36.0

1.37

1.46

SYK

Stryker Corp.

221.40

0.9

82,605

23.3

21.4

0.93

1.45

TTWO

Take-Two Interactive Software, Inc.

130.76

0.0

14,799

48.1

0.0

1.24

1.43

BR

Broadridge Financial Solutions, Inc.

130.29

1.5

14,889

31.3

46.6

0.95

1.39

AMZN

Amazon.com, Inc.

1,833.51

0.0

906,956

74.3

0.0

1.71

1.39

UNH

UnitedHealth Group, Inc.

229.00

1.7

217,018

16.9

27.9

0.86

1.39

IDXX

IDEXX Laboratories, Inc.

288.47

0.0

24,834

61.3

0.0

1.26

1.38

VRSN

VeriSign, Inc.

207.57

0.0

24,570

39.6

0.0

1.11

1.38

CDNS

Cadence Design Systems, Inc.

70.00

0.0

19,610

45.0

0.0

1.31

1.38

ATO

Atmos Energy Corp.

109.09

1.9

12,894

25.7

48.6

0.27

1.37

FIS

Fidelity National Information Services, Inc.

137.67

1.0

84,452

59.1

57.5

0.91

1.37

BSX

Boston Scientific Corp.

43.45

0.0

60,524

43.0

0.0

1.16

1.36

JKHY

Jack Henry & Associates, Inc.

147.74

1.0

11,375

41.9

43.7

0.83

1.35

NOC

Northrop Grumman Corp.

367.77

1.3

62,225

17.9

23.9

0.80

1.35

ICE

Intercontinental Exchange, Inc.

94.89

1.1

53,177

26.7

28.9

0.61

1.35

TDG

TransDigm Group, Inc.

533.91

0.0

28,497

40.0

0.0

1.25

1.34

CINF

Cincinnati Financial Corp.

114.94

1.9

18,773

15.3

29.1

0.68

1.33

SPGI

S&P Global, Inc.

267.75

0.8

65,946

33.7

27.0

1.01

1.33

MSI

Motorola Solutions, Inc.

174.80

1.3

29,113

27.8

35.5

0.91

1.33

ACN

Accenture Plc

201.12

1.4

128,141

27.4

38.1

1.01

1.32

MKC

McCormick & Co., Inc.

164.98

1.3

21,864

31.8

42.0

0.42

1.31

TFX

Teleflex, Inc.

356.17

0.4

16,466

60.4

23.1

0.92

1.30

XEL

Xcel Energy, Inc.

64.80

2.4

33,372

26.4

64.1

0.21

1.29

NVDA

NVIDIA Corp.

178.65

0.4

108,797

39.6

14.0

2.13

1.29

CMS

CMS Energy Corp.

62.76

2.4

17,810

30.5

71.8

0.18

1.28

HD

The Home Depot, Inc.

231.13

2.1

253,122

22.9

47.4

0.92

1.28

DHR

Danaher Corp.

144.33

0.5

103,537

41.7

19.1

0.93

1.27

WEC

WEC Energy Group, Inc.

93.13

2.5

29,376

26.8

65.9

0.14

1.27

EQIX

Equinix, Inc.

554.09

1.7

46,997

91.3

156.2

0.57

1.25

LHX

L3Harris Technologies, Inc.

214.70

1.3

47,938

26.7

34.1

0.63

1.25

NDAQ

Nasdaq, Inc.

104.26

1.7

17,170

31.9

54.7

0.81

1.25

EW

Edwards Lifesciences Corp.

226.29

0.0

47,061

65.2

0.0

1.23

1.24

VRSK

Verisk Analytics, Inc.

164.58

0.3

26,909

45.2

13.7

0.84

1.24

ISRG

Intuitive Surgical, Inc.

505.26

0.0

58,232

47.9

0.0

1.48

1.23

AMT

American Tower Corp.

232.59

1.5

102,964

69.8

103.6

0.31

1.23

YUM

Yum! Brands, Inc.

119.21

1.3

36,273

27.8

36.4

0.56

1.20

INFO

IHS Markit Ltd.

67.91

0.0

27,238

60.3

0.0

0.98

1.20

LMT

Lockheed Martin Corp.

386.56

2.2

109,163

18.7

41.6

0.77

1.19

DRI

Darden Restaurants, Inc.

125.48

2.4

15,410

21.7

51.9

0.69

1.19

COST

Costco Wholesale Corp.

303.76

0.8

133,590

37.0

28.7

0.85

1.19

CHD

Church & Dwight Co., Inc.

75.90

1.2

18,754

30.9

36.3

0.41

1.18

AEE

Ameren Corp.

76.19

2.5

18,727

23.5

58.0

0.24

1.16

SBUX

Starbucks Corp.

95.74

1.5

114,600

33.5

50.3

0.73

1.16

ROP

Roper Technologies, Inc.

374.96

0.5

38,996

34.6

16.6

0.99

1.15

EXR

Extra Space Storage, Inc.

119.74

2.9

16,113

35.3

102.5

0.22

1.15

AON

Aon Plc

195.28

0.8

46,055

34.9

29.3

0.75

1.14

AJG

Arthur J. Gallagher & Co.

90.50

1.9

16,839

24.2

44.9

0.73

1.14

BDX

Becton, Dickinson & Co.

262.48

1.2

70,857

90.2

105.2

0.95

1.13

MMC

Marsh & McLennan Cos., Inc.

100.91

1.7

51,091

34.4

58.0

0.79

1.11

ROST

Ross Stores, Inc.

109.18

0.9

39,817

24.6

21.6

1.00

1.10

EL

The Estée Lauder Companies, Inc.

207.03

0.8

74,687

42.2

34.0

1.04

1.10

WCG

WellCare Health Plans, Inc.

269.00

0.0

13,533

25.6

0.0

0.85

1.10

TXN

Texas Instruments Incorporated

127.09

2.3

118,653

22.8

52.6

1.29

1.10

ROL

Rollins, Inc.

33.92

1.2

11,108

49.1

57.4

0.77

1.10

IQV

IQVIA Holdings, Inc.

154.07

0.0

30,335

123.6

0.0

1.12

1.07

NI

NiSource, Inc.

29.33

2.7

10,950

96.2

259.0

0.24

1.07

BA

The Boeing Co.

363.00

2.1

204,263

41.8

86.7

1.14

1.07

CCI

Crown Castle International Corp.

146.44

3.0

60,883

84.3

254.9

0.43

1.07

SYY

Sysco Corp.

75.71

2.0

38,852

23.3

47.1

0.48

1.06

TMO

Thermo Fisher Scientific, Inc.

295.05

0.2

118,160

33.4

8.2

1.10

1.06

ANSS

ANSYS, Inc.

217.59

0.0

18,299

41.6

0.0

1.39

1.06

LDOS

Leidos Holdings, Inc.

87.62

1.5

12,600

19.5

28.5

0.94

1.04

ES

Eversource Energy

82.35

2.5

26,648

30.4

76.7

0.18

1.04

ABMD

ABIOMED, Inc.

189.43

0.0

8,595

33.1

0.0

1.47

1.03

AEP

American Electric Power Co., Inc.

91.09

2.9

44,979

22.7

65.7

0.13

1.03

PLD

Prologis, Inc.

84.79

2.4

53,513

31.3

74.5

0.68

1.02

BLL

Ball Corp.

78.30

0.6

25,995

50.2

28.8

0.74

1.02

TMUS

T-Mobile US, Inc.

79.15

0.0

67,630

20.5

0.0

0.78

1.02

BAX

Baxter International, Inc.

89.78

0.9

45,837

29.6

26.1

0.83

1.02

LNT

Alliant Energy Corp.

52.26

2.6

12,412

24.2

63.8

0.21

1.02

RMD

ResMed, Inc.

140.30

1.1

20,157

49.7

52.4

0.84

1.02

ADP

Automatic Data Processing, Inc.

173.25

1.8

75,180

32.8

58.0

1.08

1.01

IEX

IDEX Corp.

168.85

1.1

12,806

29.9

33.0

1.03

1.01

PAYX

Paychex, Inc.

84.07

2.7

30,210

29.2

79.9

0.92

1.01

AVGO

Broadcom, Inc.

291.91

3.0

116,201

34.7

104.7

1.31

1.00

SHW

The Sherwin-Williams Co.

534.74

0.7

49,332

42.1

31.4

0.87

1.00

AVY

Avery Dennison Corp.

114.19

1.9

9,613

40.8

76.5

0.97

1.00

HON

Honeywell International, Inc.

171.16

1.9

123,150

17.9

33.5

0.94

0.99

DTE

DTE Energy Co.

128.88

0.0

23,623

21.2

0.0

0.17

0.99

ARE

Alexandria Real Estate Equities, Inc.

153.11

2.5

17,365

43.7

110.4

0.57

0.99

STZ

Constellation Brands, Inc.

204.75

1.5

39,224

15.7

22.8

0.81

0.98

PEG

Public Service Enterprise Group, Inc.

60.42

3.0

30,550

20.8

63.4

0.25

0.96

MCO

Moody's Corp.

220.54

0.9

41,726

33.8

28.8

1.18

0.96

DLR

Digital Realty Trust, Inc.

128.62

3.2

26,797

117.9

383.0

0.55

0.95

APD

Air Products & Chemicals, Inc.

225.59

2.0

49,709

29.1

58.2

0.79

0.95

CLX

The Clorox Co.

162.04

2.4

20,375

25.2

61.3

0.40

0.95

CBOE

Cboe Global Markets, Inc.

118.70

1.0

13,256

32.7

34.2

0.30

0.95

MAA

Mid-America Apartment Communities, Inc.

128.82

3.0

14,691

62.2

183.5

0.40

0.94

DG

Dollar General Corp.

161.54

0.8

41,526

25.8

19.5

0.81

0.94

DRE

Duke Realty Corp.

33.32

2.5

12,148

51.7

131.2

0.60

0.94

NKE

NIKE, Inc.

88.69

1.0

138,964

34.6

33.6

1.14

0.93

CHTR

Charter Communications, Inc.

425.72

0.0

94,287

71.1

0.0

0.92

0.93

PNW

Pinnacle West Capital Corp.

93.81

3.1

10,535

20.9

64.8

0.19

0.93

RTN

Raytheon Co.

190.46

1.9

53,049

17.5

33.3

0.79

0.92

ECL

Ecolab, Inc.

206.69

0.9

59,475

39.8

34.5

0.78

0.91

SBAC

SBA Communications Corp.

262.38

0.0

29,676

228.2

0.0

0.49

0.91

AFL

Aflac, Inc.

51.57

2.1

38,181

12.5

25.7

0.69

0.91

LRCX

Lam Research Corp.

227.92

1.9

32,941

15.9

30.6

1.50

0.89

ABT

Abbott Laboratories

86.04

1.4

152,067

52.5

75.6

1.02

0.88

ED

Consolidated Edison, Inc.

91.14

3.2

30,271

21.5

68.8

0.16

0.88

ORLY

O'Reilly Automotive, Inc.

399.73

0.0

30,584

23.6

0.0

0.62

0.87

CRM

salesforce.com, inc.

151.07

0.0

117,665

122.4

0.0

1.56

0.87

UDR

UDR, Inc.

48.93

2.7

23,329

85.3

231.7

0.41

0.87

WLTW

Willis Towers Watson Plc

197.75

1.3

25,508

30.4

38.4

0.71

0.86

MTD

Mettler-Toledo International, Inc.

684.98

0.0

16,856

31.2

0.0

1.12

0.85

FB

Facebook, Inc.

187.49

0.0

534,856

31.5

0.0

1.25

0.84

PEP

PepsiCo, Inc.

137.37

2.7

192,066

15.1

41.1

0.45

0.84

XYL

Xylem, Inc.

78.39

1.1

14,112

24.6

28.3

1.09

0.84

O

Realty Income Corp.

75.95

3.5

24,169

58.0

204.4

0.36

0.83

JPM

JPMorgan Chase & Co.

112.61

2.8

360,069

11.5

32.6

0.93

0.83

TJX

The TJX Cos., Inc.

56.14

1.5

68,079

22.3

33.8

0.89

0.83

IR

Ingersoll-Rand Plc

121.60

1.7

29,375

20.8

36.3

0.94

0.83

ADI

Analog Devices, Inc.

112.67

1.8

41,620

27.5

49.9

1.26

0.82

CSCO

Cisco Systems, Inc.

48.84

2.8

209,070

18.6

51.7

1.29

0.82

ALL

The Allstate Corp.

105.31

1.8

34,667

13.6

24.7

0.73

0.82

CB

Chubb Ltd.

161.03

1.8

73,389

19.6

35.8

0.61

0.82

ETR

Entergy Corp.

113.55

3.2

22,577

22.0

70.0

0.17

0.82

HSY

The Hershey Co.

158.98

1.8

33,318

26.7

48.4

0.25

0.81

MDT

Medtronic Plc

108.69

1.9

145,826

33.0

61.9

0.66

0.81

FTNT

Fortinet, Inc.

80.10

0.0

13,696

36.6

0.0

1.32

0.81

ESS

Essex Property Trust, Inc.

327.06

2.3

21,496

52.6

122.5

0.37

0.81

AMD

Advanced Micro Devices, Inc.

30.56

0.0

33,174

162.9

0.0

2.36

0.81

TRV

The Travelers Cos., Inc.

152.84

2.0

39,797

15.1

31.0

0.67

0.80

DHI

D.R. Horton, Inc.

50.13

1.1

18,539

11.9

13.6

0.78

0.79

PG

Procter & Gamble Co.

122.87

2.4

307,498

84.2

198.5

0.47

0.77

XLNX

Xilinx, Inc.

105.94

1.4

26,760

28.5

39.0

1.55

0.77

ANTM

Anthem, Inc.

249.38

1.2

63,795

15.8

19.6

0.86

0.77

TSN

Tyson Foods, Inc.

86.04

1.7

25,353

14.0

24.4

0.46

0.77

LLY

Eli Lilly & Co.

114.05

2.1

110,107

27.1

57.4

0.65

0.77

GOOG

Alphabet, Inc.

1,204.93

0.0

835,524

24.1

0.0

1.27

0.77

KLAC

KLA Corp.

150.98

2.0

24,044

20.0

39.7

1.48

0.77

KO

The Coca-Cola Co.

55.23

2.9

236,165

33.6

96.1

0.40

0.76

GL

Globe Life, Inc.

91.68

0.7

10,002

14.2

10.3

0.90

0.76

NFLX

Netflix, Inc.

290.17

0.0

127,046

109.9

0.0

1.73

0.76

SO

The Southern Co.

59.68

4.1

62,379

13.9

56.5

0.15

0.75

VMC

Vulcan Materials Co.

145.01

0.8

19,182

34.0

27.7

0.93

0.75

HAS

Hasbro, Inc.

112.40

2.3

14,184

45.7

106.4

0.97

0.75

AIZ

Assurant, Inc.

124.41

1.9

7,605

21.1

40.1

0.76

0.75

ITW

Illinois Tool Works, Inc.

152.49

2.6

49,327

20.4

53.4

1.10

0.74

LOW

Lowe's Cos., Inc.

114.71

1.7

88,533

35.8

62.1

1.08

0.74

GOOGL

Alphabet, Inc.

1,206.32

0.0

836,487

24.1

0.0

1.26

0.74

HIG

The Hartford Financial Services Group, Inc.

60.32

2.0

21,810

13.3

26.5

0.72

0.74

ALLE

Allegion Plc

98.95

1.0

9,239

21.4

20.7

0.92

0.73

AZO

AutoZone, Inc.

1,143.34

0.0

28,044

20.0

0.0

0.33

0.72

EA

Electronic Arts, Inc.

98.53

0.0

29,037

13.7

0.0

1.08

0.72

WAT

Waters Corp.

217.24

0.0

14,502

27.4

0.0

0.91

0.71

HOLX

Hologic, Inc.

49.71

0.0

13,287

-436.8

0.0

0.96

0.71

AAPL

Apple, Inc.

213.26

1.4

963,760

18.0

25.0

1.51

0.71

CMCSA

Comcast Corp.

46.35

1.7

210,660

17.5

30.1

0.89

0.71

CSX

CSX Corp.

67.52

1.4

53,892

16.2

22.0

1.06

0.70

HUM

Humana, Inc.

273.51

0.8

36,948

14.8

11.4

0.87

0.70

EQR

Equity Residential

86.85

2.6

32,208

50.2

128.0

0.37

0.70

RE

Everest Re Group Ltd.

249.00

2.2

10,144

19.6

43.2

0.56

0.69

AIV

Apartment Investment & Management Co.

51.80

3.0

7,712

22.7

69.0

0.46

0.69

DE

Deere & Co.

156.52

1.9

49,283

15.0

28.5

1.28

0.69

EXPD

Expeditors International of Washington, Inc.

73.25

1.3

12,505

19.9

25.8

1.04

0.69

HII

Huntington Ingalls Industries, Inc.

215.00

1.5

8,887

13.3

20.4

0.98

0.68

EXC

Exelon Corp.

48.12

2.9

46,752

20.5

60.3

0.24

0.68

ADSK

Autodesk, Inc.

150.35

0.0

33,015

582.8

0.0

1.66

0.67

PSA

Public Storage

257.50

3.1

44,958

30.7

95.4

0.12

0.67

MAS

Masco Corp.

41.75

1.1

12,084

17.0

19.6

1.06

0.67

FLT

FleetCor Technologies, Inc.

302.64

0.0

26,198

29.5

0.0

1.05

0.67

MXIM

Maxim Integrated Products, Inc.

56.92

3.2

15,440

18.9

61.0

1.35

0.67

APH

Amphenol Corp.

89.32

1.0

26,568

22.1

22.7

1.07

0.67

COO

The Cooper Cos., Inc.

302.84

0.0

15,012

33.5

0.7

0.87

0.67

DGX

Quest Diagnostics, Inc.

104.21

2.0

14,033

19.4

38.8

0.70

0.66

ULTA

Ulta Beauty, Inc.

233.10

0.0

13,717

19.6

0.0

0.96

0.66

FRC

First Republic Bank (San Francisco, California)

89.19

0.8

15,003

17.7

14.5

0.87

0.66

MDLZ

Mondelez International, Inc.

56.63

1.8

81,668

22.2

40.8

0.54

0.66

A

Agilent Technologies, Inc.

74.28

0.9

22,987

22.0

19.0

1.09

0.66

HRL

Hormel Foods Corp.

42.60

1.9

22,747

23.1

44.3

0.44

0.65

CNC

Centene Corp.

45.89

0.0

18,980

14.8

0.0

1.19

0.65

ALGN

Align Technology, Inc.

175.06

0.0

13,982

33.5

0.0

1.65

0.65

CE

Celanese Corp.

118.07

1.9

14,609

14.7

27.8

1.17

0.65

AME

AMETEK, Inc.

89.27

0.6

20,384

24.8

15.6

1.11

0.64

AVB

AvalonBay Communities, Inc.

215.75

2.8

30,130

32.6

90.5

0.42

0.63

AOS

A. O. Smith Corp.

47.81

1.8

6,614

19.1

33.5

0.92

0.63

FE

FirstEnergy Corp.

46.68

3.2

25,206

22.5

71.2

0.29

0.62

MRK

Merck & Co., Inc.

86.57

2.5

221,652

24.1

59.2

0.66

0.61

PHM

PulteGroup, Inc.

34.57

1.2

9,479

10.5

12.7

0.63

0.61

ATVI

Activision Blizzard, Inc.

54.58

0.6

41,864

24.8

15.4

1.28

0.61

PKI

PerkinElmer, Inc. (United States)

83.74

0.3

9,301

36.7

12.3

1.29

0.61

DUK

Duke Energy Corp.

93.76

4.0

68,313

20.7

81.9

0.15

0.61

MAR

Marriott International, Inc.

129.43

1.3

42,628

29.4

38.8

1.08

0.61

WMT

Walmart, Inc.

114.73

1.8

327,522

25.7

47.1

0.59

0.60

BBY

Best Buy Co., Inc.

66.35

2.9

17,718

11.8

33.8

1.20

0.60

LIN

Linde Plc

189.52

1.8

102,452

18.9

33.9

0.72

0.59

AMAT

Applied Materials, Inc.

50.10

1.6

46,280

16.5

27.0

1.54

0.59

KMB

Kimberly-Clark Corp.

138.05

2.9

47,516

26.4

77.8

0.41

0.59

EFX

Equifax, Inc.

146.76

1.1

17,740

-41.7

-44.3

0.79

0.58

TGT

Target Corp.

109.85

2.3

56,125

18.0

42.3

0.89

0.58

GD

General Dynamics Corp.

192.67

2.0

55,651

16.9

34.3

0.94

0.58

SRE

Sempra Energy

142.00

2.6

38,986

20.2

52.9

0.32

0.57

CTXS

Citrix Systems, Inc.

94.41

1.1

12,358

23.8

26.5

0.64

0.57

PNC

The PNC Financial Services Group, Inc.

131.72

0.0

58,649

11.8

0.0

0.85

0.56

ANET

Arista Networks, Inc.

235.70

0.0

18,064

24.5

0.0

1.64

0.55

GRMN

Garmin Ltd.

83.46

2.6

15,865

21.3

55.2

0.81

0.55

HLT

Hilton Worldwide Holdings, Inc.

93.74

0.6

26,889

34.1

21.8

1.04

0.55

BRK.B

Berkshire Hathaway, Inc.

204.73

0.0

501,856

17.4

0.0

0.92

0.55

DIS

The Walt Disney Co.

139.55

1.2

251,382

17.5

21.6

0.86

0.55

TROW

T. Rowe Price Group, Inc.

115.62

2.5

27,236

14.3

36.2

1.24

0.54

MNST

Monster Beverage Corp.

57.17

0.0

31,150

29.6

0.0

0.87

0.53

MCHP

Microchip Technology, Inc.

90.52

1.6

21,547

57.7

92.9

1.50

0.53

WELL

Welltower, Inc.

91.39

3.8

37,035

101.8

387.5

0.33

0.53

TEL

TE Connectivity Ltd.

94.85

1.9

31,863

10.1

18.9

1.02

0.53

IT

Gartner, Inc.

137.19

0.0

12,365

56.3

0.0

1.01

0.52

UNP

Union Pacific Corp.

164.60

2.0

115,965

19.5

39.7

1.08

0.52

HCA

HCA Healthcare, Inc.

126.10

1.2

42,997

11.9

14.1

0.95

0.52

ETFC

E*TRADE Financial Corp.

42.92

1.0

10,292

10.5

10.3

1.19

0.52

STI

SunTrust Banks, Inc.

62.90

3.2

27,923

11.0

34.9

0.87

0.52

DLTR

Dollar Tree, Inc.

109.62

0.0

25,938

-16.5

0.0

0.63

0.51

BF.B

Brown-Forman Corp.

62.30

1.1

29,750

36.3

38.2

0.79

0.51

AMGN

Amgen, Inc.

207.73

2.7

124,575

16.3

43.6

0.82

0.50

MLM

Martin Marietta Materials, Inc.

258.03

0.7

16,111

32.0

23.8

0.70

0.50

VTR

Ventas, Inc.

75.23

4.2

28,029

53.9

227.0

0.25

0.49

BAC

Bank of America Corp.

27.73

2.2

258,119

9.8

21.1

1.10

0.49

JNJ

Johnson & Johnson

128.21

2.8

338,367

21.0

59.7

0.58

0.49

WU

The Western Union Co.

22.85

3.4

9,685

8.2

28.1

0.66

0.49

EBAY

eBay, Inc.

40.37

0.7

33,860

15.6

10.8

1.02

0.48

NSC

Norfolk Southern Corp.

175.06

1.9

46,112

16.9

32.0

1.06

0.48

SWK

Stanley Black & Decker, Inc.

137.83

0.0

20,914

28.9

0.0

1.42

0.48

LH

Laboratory Corp. of America Holdings

172.93

0.0

16,895

20.3

0.0

0.82

0.48

PFE

Pfizer Inc.

36.50

3.9

201,883

16.4

63.7

0.74

0.47

VZ

Verizon Communications, Inc.

59.06

4.1

244,272

15.4

62.9

0.29

0.47

JEC

Jacobs Engineering Group, Inc.

92.32

0.7

12,509

-52.5

-37.5

1.09

0.46

INTC

Intel Corp.

50.92

2.4

225,575

11.7

28.2

1.21

0.45

CNP

CenterPoint Energy, Inc.

28.50

4.0

14,313

25.0

98.9

0.33

0.45

BKNG

Booking Holdings, Inc.

1,967.63

0.0

83,647

21.6

0.0

1.14

0.44

USB

U.S. Bancorp

53.41

2.8

84,165

12.5

34.8

0.74

0.43

RCL

Royal Caribbean Cruises Ltd.

108.41

2.6

22,718

12.3

31.7

1.26

0.43

VRTX

Vertex Pharmaceuticals, Inc.

181.33

0.0

46,608

20.9

0.0

1.18

0.43

CBRE

CBRE Group, Inc.

53.86

0.0

18,115

17.0

0.0

1.14

0.42

BBT

BB&T Corp.

48.72

3.3

37,327

11.9

39.6

0.77

0.41

PH

Parker-Hannifin Corp.

173.49

1.8

22,283

14.9

27.1

1.29

0.41

FLIR

FLIR Systems, Inc.

51.02

1.3

6,918

24.9

32.3

0.95

0.41

CI

Cigna Corp.

153.80

0.0

58,076

13.9

0.0

0.92

0.41

JBHT

J.B. Hunt Transport Services, Inc.

110.74

0.9

11,823

25.4

23.0

0.96

0.40

D

Dominion Energy, Inc.

76.37

4.6

62,769

51.3

235.2

0.16

0.40

VLO

Valero Energy Corp.

78.13

4.4

32,377

12.9

55.9

1.23

0.39

AXP

American Express Co.

120.19

1.3

99,718

14.9

19.3

1.04

0.39

PKG

Packaging Corporation of America

100.61

3.1

9,524

12.0

37.8

1.08

0.39

ROK

Rockwell Automation, Inc.

161.04

2.4

18,842

18.7

44.4

1.21

0.39

FMC

FMC Corp.

87.40

1.6

11,399

22.5

35.1

1.10

0.39

ORCL

Oracle Corp.

53.16

1.5

177,332

17.2

26.2

0.99

0.38

TSCO

Tractor Supply Co.

103.54

1.2

12,348

22.8

28.2

1.02

0.38

IPGP

IPG Photonics Corp.

133.51

0.0

7,102

23.4

0.0

1.71

0.37

RF

Regions Financial Corp.

14.85

3.8

14,816

10.3

38.7

1.06

0.37

VFC

VF Corp.

87.61

2.3

34,884

30.2

68.6

1.12

0.37

EXPE

Expedia Group, Inc.

131.71

1.0

18,749

31.7

30.8

0.89

0.37

VAR

Varian Medical Systems, Inc.

109.55

0.0

9,975

29.6

0.0

0.92

0.36

DAL

Delta Air Lines, Inc.

57.98

2.4

37,698

8.6

20.8

0.98

0.36

T

AT&T, Inc.

36.25

5.6

264,878

15.2

85.1

0.67

0.36

HBAN

Huntington Bancshares, Inc.

13.54

4.1

14,052

10.6

43.8

0.92

0.36

CHRW

C.H. Robinson Worldwide, Inc.

83.28

2.4

11,274

16.5

38.9

0.79

0.36

CL

Colgate-Palmolive Co.

74.70

2.3

64,093

28.4

64.2

0.55

0.36

REG

Regency Centers Corp.

66.92

3.4

11,236

39.1

133.1

0.49

0.35

BLK

BlackRock, Inc.

423.83

3.0

65,513

16.0

48.4

1.16

0.35

FAST

Fastenal Co.

31.56

2.6

18,097

23.6

62.1

1.13

0.35

UPS

United Parcel Service, Inc.

120.08

3.1

103,188

21.9

68.1

1.07

0.35

GLW

Corning, Inc.

28.33

2.7

22,121

15.9

42.6

1.30

0.34

LUV

Southwest Airlines Co.

52.14

1.3

28,026

12.1

15.3

0.91

0.34

RJF

Raymond James Financial, Inc.

80.56

1.6

11,185

11.2

18.3

1.18

0.34

APTV

Aptiv Plc

88.75

1.0

22,737

23.5

23.3

1.14

0.34

UTX

United Technologies Corp.

133.69

2.2

115,351

21.6

46.9

1.06

0.33

KMX

CarMax, Inc.

86.00

0.0

14,240

16.9

0.0

0.76

0.33

EIX

Edison International

70.98

3.4

25,417

-93.2

-320.8

0.51

0.33

FITB

Fifth Third Bancorp

26.76

3.2

19,444

9.0

28.9

0.90

0.33

SIVB

SVB Financial Group

201.28

0.0

10,373

9.2

0.0

1.55

0.33

NTRS

Northern Trust Corp.

89.82

2.6

19,301

13.5

34.6

1.08

0.33

UAL

United Airlines Holdings, Inc.

86.30

0.0

22,172

8.7

0.0

1.00

0.32

CTSH

Cognizant Technology Solutions Corp.

64.45

1.2

35,595

17.8

22.1

0.93

0.32

ETN

Eaton Corp. Plc

83.25

3.3

34,965

16.1

53.0

1.09

0.32

ZBH

Zimmer Biomet Holdings, Inc.

139.74

0.7

28,690

-79.4

-54.5

0.91

0.32

ZION

Zions Bancorporation NA

40.94

2.9

7,244

9.3

27.3

0.94

0.30

IRM

Iron Mountain, Inc.

33.05

7.3

9,488

32.4

237.5

0.57

0.30

DFS

Discover Financial Services

82.25

1.9

26,175

9.6

18.7

1.20

0.29

ABBV

AbbVie, Inc.

67.62

6.2

99,974

24.8

153.0

0.89

0.29

UHS

Universal Health Services, Inc.

148.26

0.3

13,119

16.9

4.5

0.77

0.29

AKAM

Akamai Technologies, Inc.

91.82

0.0

15,148

35.5

0.0

1.18

0.28

MMM

3M Co.

163.94

3.4

94,311

19.4

66.3

1.05

0.28

HSIC

Henry Schein, Inc.

61.56

0.0

9,126

19.4

0.0

0.72

0.28

KEY

KeyCorp

16.80

4.0

16,854

10.0

40.3

1.04

0.27

LEN

Lennar Corp.

52.00

0.3

16,751

8.9

2.7

0.74

0.27

GM

General Motors Co.

38.78

3.9

55,367

6.1

23.9

0.97

0.27

NEM

Newmont Goldcorp Corp.

38.66

1.4

31,697

-284.3

-411.8

-0.11

0.26

CCL

Carnival Corp.

45.72

4.4

24,087

10.7

46.9

1.02

0.26

SCHW

The Charles Schwab Corp.

39.90

1.5

52,156

14.9

22.4

1.16

0.26

SNA

Snap-On, Inc.

151.07

2.4

8,340

12.1

29.3

1.03

0.26

PCAR

PACCAR, Inc.

68.34

1.8

23,670

10.0

18.2

1.01

0.26

MTB

M&T Bank Corp.

146.44

2.7

19,577

10.5

28.6

0.77

0.26

FRT

Federal Realty Investment Trust

134.23

3.0

10,145

40.7

123.6

0.49

0.26

OMC

Omnicom Group, Inc.

77.54

3.2

16,866

13.0

41.8

0.73

0.25

SWKS

Skyworks Solutions, Inc.

79.87

1.9

13,713

15.1

28.8

1.47

0.25

ALK

Alaska Air Group, Inc.

63.09

2.1

7,777

15.4

32.7

0.97

0.25

ILMN

Illumina, Inc.

270.00

0.0

39,690

42.3

0.0

1.48

0.25

C

Citigroup, Inc.

65.97

2.7

149,030

9.1

25.0

1.23

0.25

NCLH

Norwegian Cruise Line Holdings Ltd.

52.12

0.0

11,236

11.7

0.0

1.16

0.25

MS

Morgan Stanley

42.18

2.8

69,713

9.1

25.8

1.21

0.24

PSX

Phillips 66

100.91

3.3

45,308

8.7

28.4

1.07

0.24

SYF

Synchrony Financial

32.88

2.6

21,813

6.8

17.4

0.97

0.23

BXP

Boston Properties, Inc.

130.17

2.9

20,120

38.1

111.1

0.63

0.23

MO

Altria Group, Inc.

43.85

7.3

81,916

13.0

95.0

0.52

0.23

CAT

Caterpillar, Inc.

122.70

2.8

69,029

11.3

31.7

1.40

0.22

PPL

PPL Corp.

29.79

5.5

21,515

12.1

66.7

0.26

0.22

IFF

International Flavors & Fragrances, Inc.

117.86

0.0

12,584

34.1

0.0

0.68

0.22

INCY

Incyte Corp.

79.24

0.0

17,041

55.4

0.0

1.12

0.22

CMA

Comerica, Inc.

61.61

4.1

9,202

7.8

32.2

0.95

0.21

LEG

Leggett & Platt, Inc.

38.98

4.0

5,124

18.0

71.2

1.05

0.21

L

Loews Corp.

49.28

0.5

14,901

20.2

10.2

0.89

0.21

AES

The AES Corp.

15.31

3.5

10,163

25.6

90.3

0.64

0.21

CAG

Conagra Brands, Inc.

28.66

3.0

13,946

18.8

55.9

0.63

0.21

HPQ

HP, Inc.

19.10

3.2

28,304

7.0

22.6

1.32

0.20

FBHS

Fortune Brands Home & Security, Inc.

51.57

1.6

7,213

17.8

29.0

1.25

0.20

CMI

Cummins, Inc.

154.90

2.9

24,441

9.4

27.7

1.07

0.20

PBCT

People's United Financial, Inc.

14.77

4.8

5,889

11.3

53.6

0.85

0.20

GIS

General Mills, Inc.

54.96

3.6

33,167

18.9

67.2

0.29

0.20

GPC

Genuine Parts Co.

94.33

3.1

13,779

17.4

54.8

0.63

0.20

IPG

Interpublic Group of Cos., Inc.

20.73

4.3

8,027

12.3

52.7

0.79

0.19

PPG

PPG Industries, Inc.

115.78

1.7

27,358

22.7

37.6

0.84

0.19

NTAP

NetApp, Inc.

51.98

3.2

12,366

13.1

42.2

1.52

0.18

MU

Micron Technology, Inc.

48.97

0.0

54,053

5.5

0.0

1.86

0.18

GS

The Goldman Sachs Group, Inc.

207.21

1.6

74,505

8.6

13.5

1.17

0.17

MPC

Marathon Petroleum Corp.

52.47

3.8

34,541

11.2

42.3

1.35

0.17

SYMC

Symantec Corp.

24.52

1.2

15,154

132.8

162.4

1.24

0.17

DOV

Dover Corp.

95.14

2.0

13,836

23.0

46.5

0.96

0.17

JCI

Johnson Controls International Plc

42.82

2.4

34,072

67.8

164.6

0.80

0.17

OKE

ONEOK, Inc.

71.83

4.7

29,663

23.6

111.9

0.94

0.17

BK

The Bank of New York Mellon Corp.

43.03

2.6

40,562

11.1

29.0

0.77

0.16

GWW

W.W. Grainger, Inc.

278.22

2.0

15,182

18.9

37.4

0.90

0.16

TXT

Textron, Inc.

46.48

0.2

10,696

9.3

1.6

1.25

0.15

KSU

Kansas City Southern

128.91

1.1

12,966

23.0

25.7

1.00

0.15

HCP

HCP, Inc.

35.58

4.2

17,473

17.3

71.8

0.31

0.15

COF

Capital One Financial Corp.

88.19

1.8

41,478

7.6

13.8

1.11

0.15

FANG

Diamondback Energy, Inc.

95.60

0.6

15,586

15.2

9.0

1.28

0.14

SJM

The J. M. Smucker Co.

105.21

3.3

11,998

22.3

72.8

0.20

0.14

MGM

MGM Resorts International

28.30

1.8

14,756

81.8

144.6

1.44

0.14

K

Kellogg Co.

64.22

3.5

21,875

25.5

88.9

0.37

0.14

ABC

AmerisourceBergen Corp.

86.32

1.8

17,982

19.1

35.0

0.80

0.14

PFG

Principal Financial Group, Inc.

54.50

3.9

15,194

10.2

40.1

1.15

0.13

AMP

Ameriprise Financial, Inc.

134.75

2.7

17,634

9.8

26.7

1.46

0.13

NRG

NRG Energy, Inc.

37.74

0.3

9,547

20.7

6.6

0.73

0.13

CPB

Campbell Soup Co.

44.98

3.1

13,545

52.5

163.3

0.29

0.13

CVX

Chevron Corp.

118.26

3.9

224,507

15.2

59.4

0.83

0.12

CMG

Chipotle Mexican Grill, Inc.

836.32

0.0

23,185

93.1

0.0

0.73

0.12

CERN

Cerner Corp.

67.36

0.3

21,447

37.0

9.9

0.90

0.12

QCOM

QUALCOMM, Inc.

78.84

3.1

95,842

27.7

87.0

1.02

0.12

RHI

Robert Half International, Inc.

53.41

2.2

6,278

13.9

30.7

1.34

0.11

SEE

Sealed Air Corp.

39.71

1.6

6,136

17.0

27.4

0.63

0.10

JNPR

Juniper Networks, Inc.

24.17

3.1

8,358

17.0

51.9

1.00

0.10

EMR

Emerson Electric Co.

62.25

3.1

38,290

17.5

55.0

1.15

0.10

XRAY

Dentsply Sirona, Inc.

50.69

0.7

11,363

105.1

72.6

0.71

0.10

MET

MetLife, Inc.

46.23

3.7

43,291

7.5

27.7

1.04

0.09

AIG

American International Group, Inc.

54.85

2.3

47,714

-548.5

-1,280.0

0.94

0.09

FDX

FedEx Corp.

161.87

1.6

42,226

81.1

130.3

1.30

0.09

STX

Seagate Technology Plc

54.33

4.6

14,616

7.6

35.1

1.32

0.07

WFC

Wells Fargo & Co.

47.15

3.7

207,748

9.7

36.1

0.82

0.07

HFC

HollyFrontier Corp.

48.64

2.7

8,005

9.0

24.4

1.36

0.07

PRU

Prudential Financial, Inc.

82.17

4.6

33,032

8.2

38.1

1.18

0.07

BMY

Bristol-Myers Squibb Co.

48.27

3.4

78,958

12.7

42.8

0.86

0.06

LNC

Lincoln National Corp.

55.20

2.6

11,050

7.7

20.0

1.34

0.06

SPG

Simon Property Group, Inc.

151.25

5.4

100,252

21.6

115.6

0.53

0.06

CF

CF Industries Holdings, Inc.

48.64

2.5

10,619

24.0

59.3

1.29

0.06

NKTR

Nektar Therapeutics

17.01

0.0

2,981

-7.0

0.0

1.47

0.06

PM

Philip Morris International, Inc.

72.97

6.2

113,529

14.5

90.7

0.50

0.06

FFIV

F5 Networks, Inc.

132.96

0.0

7,994

17.2

0.0

1.21

0.05

WHR

Whirlpool Corp.

143.88

3.2

9,140

10.1

32.5

1.15

0.05

AAP

Advance Auto Parts, Inc.

147.21

0.2

10,508

24.4

4.0

0.66

0.05

ALB

Albemarle Corp.

63.23

2.2

6,701

12.3

27.3

1.32

0.05

KIM

Kimco Realty Corp.

19.35

5.8

8,167

24.1

139.2

0.66

0.03

NUE

Nucor Corp.

50.16

3.1

15,206

7.1

22.3

1.12

0.03

CELG

Celgene Corp.

97.15

0.0

68,854

13.0

0.0

0.75

0.02

KR

The Kroger Co.

24.70

0.0

19,730

10.7

0.0

0.57

0.02

XRX

Xerox Holdings Corp.

29.85

3.4

6,605

13.2

44.1

1.24

0.00

CFG

Citizens Financial Group, Inc. (Rhode Island)

34.14

3.5

15,263

9.1

31.5

1.00

0.00

FTV

Fortive Corp.

68.47

0.4

22,973

8.8

3.6

1.02

0.00

HPE

Hewlett-Packard Enterprise Co.

14.57

3.1

19,022

-140.5

-433.9

1.33

0.00

KEYS

Keysight Technologies, Inc.

98.05

0.0

18,392

59.1

0.0

1.46

0.00

KHC

The Kraft Heinz Co.

27.28

7.5

33,281

-3.0

-22.5

0.48

0.00

LW

Lamb Weston Holdings, Inc.

71.22

1.1

10,374

22.3

24.5

0.31

0.00

PYPL

PayPal Holdings, Inc.

110.05

0.0

129,492

51.4

0.0

1.43

0.00

QRVO

Qorvo, Inc.

75.45

0.0

8,886

45.5

0.0

1.48

0.00

UA

Under Armour, Inc.

17.78

0.0

8,023

93.9

0.0

1.34

0.00

WRK

WestRock Co.

35.12

5.1

9,037

10.8

55.1

1.28

0.00

URI

United Rentals, Inc.

116.89

0.0

9,019

8.6

0.0

1.91

-0.01

KSS

Kohl's Corp.

48.56

5.3

7,867

10.6

56.1

1.06

-0.01

IP

International Paper Co.

39.43

5.0

15,489

9.9

49.7

1.13

-0.03

WY

Weyerhaeuser Co.

26.71

5.1

19,897

5,806.5

29,565.2

0.86

-0.03

TIF

Tiffany & Co.

88.22

2.5

10,656

19.1

48.3

1.12

-0.04

PNR

Pentair Plc

36.32

2.0

6,103

17.0

33.2

1.05

-0.04

TWTR

Twitter, Inc.

45.42

0.0

35,110

14.7

0.0

1.74

-0.05

PWR

Quanta Services, Inc.

34.22

0.4

4,866

15.5

5.4

1.14

-0.05

LKQ

LKQ Corp.

26.90

0.0

8,290

20.1

0.0

0.99

-0.05

HST

Host Hotels & Resorts, Inc.

16.66

4.8

12,160

11.2

54.0

0.86

-0.07

EMN

Eastman Chemical Co.

68.05

3.6

9,322

10.4

37.0

1.25

-0.07

VNO

Vornado Realty Trust

62.75

4.1

11,973

4.2

17.1

0.61

-0.07

WBA

Walgreens Boots Alliance, Inc.

52.56

3.3

47,469

10.3

34.4

0.96

-0.08

HRB

H&R Block, Inc.

24.14

4.2

4,883

11.4

47.9

0.63

-0.10

IBM

International Business Machines Corp.

140.57

4.5

124,527

14.5

65.1

1.02

-0.10

NWS

News Corp.

14.51

1.4

8,492

54.7

75.4

0.91

-0.11

ADM

Archer-Daniels-Midland Co.

38.71

3.5

21,560

16.5

58.5

0.75

-0.11

REGN

Regeneron Pharmaceuticals, Inc.

292.00

0.0

32,089

15.3

0.0

1.15

-0.12

WAB

Westinghouse Air Brake Technologies Corp.

68.27

0.7

13,087

37.7

26.5

1.04

-0.12

UNM

Unum Group

26.48

3.9

5,524

10.6

41.8

1.24

-0.13

CVS

CVS Health Corp.

62.23

3.2

80,930

17.4

56.0

0.84

-0.13

AAL

American Airlines Group, Inc.

27.79

1.4

12,374

8.3

12.0

1.49

-0.14

NWSA

News Corp.

14.11

1.4

8,258

53.2

75.4

0.93

-0.14

SLG

SL Green Realty Corp.

80.90

4.2

7,012

29.3

121.7

0.63

-0.14

LYB

LyondellBasell Industries NV

78.05

5.2

26,165

8.2

42.4

1.06

-0.15

WDC

Western Digital Corp.

62.24

3.2

18,423

-24.0

-77.2

1.68

-0.15

STT

State Street Corp.

51.84

3.6

19,314

9.3

33.7

1.01

-0.16

MHK

Mohawk Industries, Inc.

118.81

0.0

8,572

11.2

0.0

1.04

-0.17

TAP

Molson Coors Brewing Co.

53.42

3.1

11,554

12.9

39.6

0.62

-0.17

HES

Hess Corp.

64.04

1.6

19,498

-400.3

-625.0

1.60

-0.17

DD

DuPont de Nemours, Inc.

69.22

5.5

51,602

56.8

315.3

1.15

-0.18

COP

ConocoPhillips

53.63

2.2

59,536

8.6

19.2

1.11

-0.18

XOM

Exxon Mobil Corp.

70.93

4.7

300,112

17.1

80.2

0.86

-0.18

WYNN

Wynn Resorts Ltd.

111.44

2.9

11,992

14.4

42.0

1.77

-0.18

DVA

DaVita, Inc.

59.37

0.0

9,517

72.0

0.0

1.06

-0.18

JEF

Jefferies Financial Group, Inc.

19.11

2.2

5,733

50.1

111.4

1.22

-0.18

AGN

Allergan Plc

163.26

1.8

53,554

-6.4

-11.4

0.75

-0.19

BIIB

Biogen, Inc.

224.57

0.0

41,421

8.3

0.0

0.81

-0.19

COTY

Coty, Inc.

10.02

5.0

7,557

-2.0

-9.9

0.93

-0.19

EOG

EOG Resources, Inc.

76.44

1.2

44,362

12.4

15.3

1.24

-0.20

CBS

CBS Corp.

43.63

1.7

16,346

5.3

8.8

0.97

-0.21

TPR

Tapestry, Inc.

23.69

5.7

6,795

10.7

60.7

1.34

-0.22

MCK

McKesson Corp.

143.60

1.1

26,552

47.5

51.7

0.75

-0.23

PVH

PVH Corp.

85.39

0.2

6,396

9.5

1.7

1.32

-0.24

PXD

Pioneer Natural Resources Co.

128.87

0.4

21,539

24.2

9.0

1.37

-0.27

F

Ford Motor Co.

9.34

6.4

37,266

16.9

108.8

0.85

-0.27

DISCA

Discovery, Inc.

27.34

0.0

14,698

11.4

0.0

0.94

-0.28

UAA

Under Armour, Inc.

19.56

0.0

8,826

103.3

0.0

1.34

-0.28

ALXN

Alexion Pharmaceuticals, Inc.

103.84

0.0

23,283

17.4

0.0

1.44

-0.28

NWL

Newell Brands, Inc.

17.24

5.3

7,299

-1.1

-5.7

1.11

-0.29

KMI

Kinder Morgan, Inc.

20.41

4.2

46,204

20.4

85.2

0.83

-0.29

RL

Ralph Lauren Corp.

94.58

2.7

7,305

17.2

46.7

1.11

-0.29

ARNC

Arconic, Inc.

25.99

0.8

11,440

28.8

22.1

1.14

-0.29

WMB

The Williams Cos., Inc.

24.12

6.0

29,233

317.8

1,897.2

0.86

-0.30

DISCK

Discovery, Inc.

25.67

0.0

13,800

10.7

0.0

0.93

-0.31

HBI

Hanesbrands, Inc.

14.12

4.2

5,104

9.1

38.7

1.06

-0.31

FLS

Flowserve Corp.

44.02

1.7

5,774

27.9

48.1

1.51

-0.31

BWA

BorgWarner, Inc.

35.42

1.9

7,314

9.6

18.4

1.25

-0.31

CAH

Cardinal Health, Inc.

45.43

4.2

13,544

10.0

42.2

0.90

-0.31

FCX

Freeport-McMoRan, Inc.

9.42

2.1

13,667

21.2

45.0

1.47

-0.33

GILD

Gilead Sciences, Inc.

64.82

3.7

82,091

13.9

51.6

0.84

-0.33

JWN

Nordstrom, Inc.

31.07

4.8

4,813

10.2

48.5

0.96

-0.34

CXO

Concho Resources, Inc.

69.68

0.4

14,011

27.5

9.9

1.39

-0.34

HP

Helmerich & Payne, Inc.

38.43

7.4

4,205

-56.3

-415.8

1.20

-0.39

COG

Cabot Oil & Gas Corp.

17.55

1.7

7,342

8.9

14.7

0.58

-0.39

MRO

Marathon Oil Corp.

12.45

1.6

10,010

10.5

16.9

1.57

-0.39

HOG

Harley-Davidson, Inc.

32.55

4.6

5,101

11.9

54.7

1.18

-0.40

FTI

TechnipFMC Plc

25.18

2.1

11,242

-5.7

-11.7

1.28

-0.40

DISH

DISH Network Corp.

35.70

0.0

16,777

11.7

0.0

1.30

-0.40

GPS

Gap, Inc.

16.86

5.8

6,335

6.9

39.4

0.90

-0.41

TRIP

TripAdvisor, Inc.

37.88

0.0

5,276

38.5

0.0

1.41

-0.41

MYL

Mylan NV

20.52

0.0

10,585

342.0

0.0

1.39

-0.43

ADS

Alliance Data Systems Corp.

125.96

1.9

6,436

7.8

14.8

1.18

-0.43

DVN

Devon Energy Corp.

23.35

1.5

9,438

2.9

4.2

1.54

-0.43

BEN

Franklin Resources, Inc.

26.92

3.8

13,558

10.0

37.3

0.99

-0.43

OXY

Occidental Petroleum Corp.

45.46

6.9

40,663

9.0

61.6

0.97

-0.43

MOS

The Mosaic Co.

19.54

0.6

7,539

29.2

18.7

1.21

-0.43

MAC

Macerich Co.

30.20

9.9

4,580

39.4

389.7

0.68

-0.44

CPRI

Capri Holdings Ltd.

28.07

0.0

4,254

10.5

0.0

1.17

-0.45

CTL

CenturyLink, Inc.

11.80

13.4

12,871

-1.6

-21.3

0.93

-0.46

NLSN

Nielsen Holdings Plc

21.21

6.6

7,543

-10.9

-72.2

0.90

-0.51

BHGE

Baker Hughes, a GE Co.

23.53

3.1

24,432

67.2

205.7

1.02

-0.51

IVZ

Invesco Ltd.

15.98

7.6

7,714

11.0

83.1

1.09

-0.52

M

Macy's, Inc.

15.39

9.8

4,754

4.6

45.5

1.00

-0.54

LB

L Brands, Inc.

16.71

10.8

4,617

8.0

86.1

1.21

-0.54

VIAB

Viacom, Inc.

25.88

3.1

10,439

6.4

19.7

0.99

-0.55

NBL

Noble Energy, Inc.

22.71

2.0

10,861

-11.8

-23.4

1.47

-0.56

XEC

Cimarex Energy Co.

42.27

1.8

4,288

6.8

12.3

1.56

-0.56

GE

General Electric Co.

8.71

1.7

76,012

-3.6

-6.1

1.09

-0.57

AMG

Affiliated Managers Group, Inc.

78.63

1.6

3,981

-34.4

-54.2

1.21

-0.60

APA

Apache Corp.

22.35

4.5

8,402

-12.0

-53.5

1.36

-0.61

HAL

Halliburton Co.

19.09

3.8

16,721

12.6

47.4

1.24

-0.61

PRGO

Perrigo Co. Plc

49.92

1.6

6,791

77.5

121.1

1.26

-0.61

SLB

Schlumberger NV

34.20

5.8

47,298

22.6

132.5

1.07

-0.64

NOV

National Oilwell Varco, Inc.

22.17

0.9

8,555

-1.6

-1.4

1.24

-0.70

Ticker Name Price Dividend Yield Market Cap ($M) P/E Ratio Payout Ratio Beta Sharpe Ratio

Keep reading this article to learn more about using the Sharpe Ratio to analyze publicly-traded investments.

How To Use The Sharpe Ratios List To Find Compelling Investment Ideas

Having an Excel document with all the S&P 500 stocks sorted by their 5-year Sharpe Ratios can be extremely useful.

The resource becomes even more powerful when combined with a rudimentary knowledge of how to use the filter function of Microsoft Excel to find investment ideas.

With that in mind, this section will show you step-by-step how to implement a particular investing screen using the Sharpe Ratio stocks list. More specifically, we’ll show you how to screen for stocks with 5-year Sharpe Ratios above 1 and forward price-to-earnings ratios below 20.

Step 1: Download the Sharpe Ratio Stocks List by clicking here.

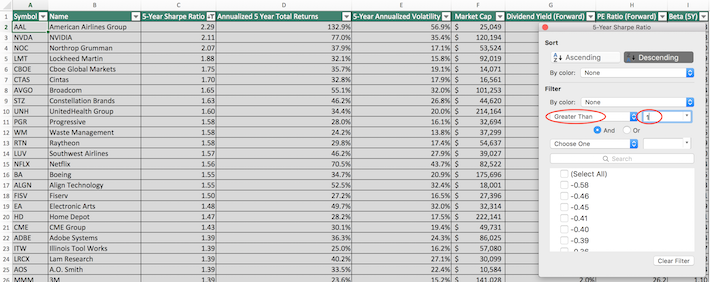

Step 2: Click the filter icon at the top of the Sharpe Ratio column, as shown below.

Step 3: Change the filter setting to “Greater Than” and input 1 into the field beside it, as shown below. This filters for S&P 500 stocks with Sharpe Ratios higher than 1.

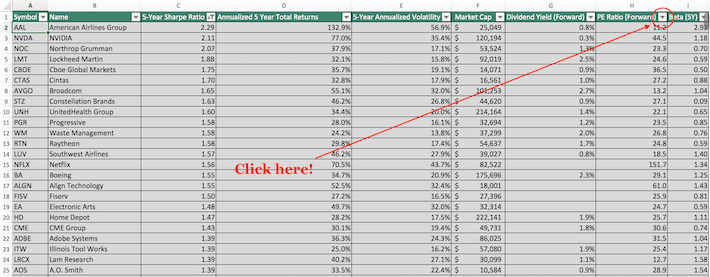

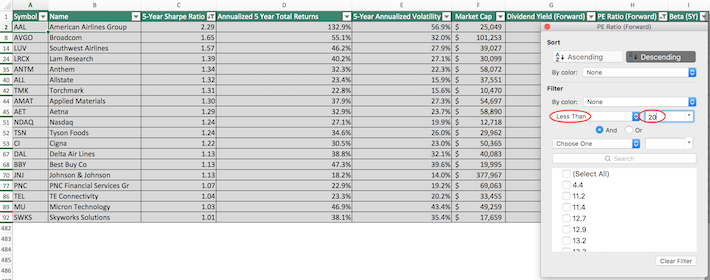

Step 4: Close out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button in the bottom right corner). Then, click the filter icon at the top of the price-to-earnings ratio column, as shown below.

Step 5: Change the filter setting to “Less Than” and input 20 into the field beside it, as shown below. This filters for S&P 500 stocks with forward price-to-earnings ratios less than 20.

The remaining stocks in this Excel document are S&P 500 stocks with trailing 5-year Sharpe ratios higher than 1 and forward price-to-earnings ratios less than 20.

You now have a solid fundamental understanding of how to use the Sharpe Ratios list to find investment ideas.

The remainder of this article will provide more information on how to analyze stocks using the Sharpe ratio.

What Is The Sharpe Ratio?

The Sharpe ratio is the financial industry’s favorite measure of risk-adjusted returns. It tells investors whether they are being appropriately rewarded for the risks they’re assuming in their investments.

The Sharpe ratio is calculated with the following formula:

There are three components to the Sharpe Ratio calculation:

- Investment return

- Risk free rate of return

- Investment standard deviation

Investment return and investment standard deviation are relatively straightforward and require no explanation.

The risk free rate of return can be different depending on your use case. For most investors, a suitable risk free rate of return is the current yield on 10-year U.S. government bonds.

For this article, we have used a risk free rate of 0, as interest rates have declined significantly in recent months.

The Sharpe ratio is rarely calculated by hand in practice. Instead, investors generally use a tool such as Microsoft Excel for the purpose of Sharpe ratio calculations.

How To Manually Calculate Sharpe Ratios Using Yahoo! Finance

At Sure Dividend, we use YCharts for much of our data analytics. YCharts requires a paid subscription that many of our readers do not have. Accordingly, we want to show you how to manually calculate Sharpe Ratio for publicly-traded stocks over a given time period.

More specifically, this tutorial will show you how to calculate a 3-year Sharpe ratio for Apple, Inc (AAPL).

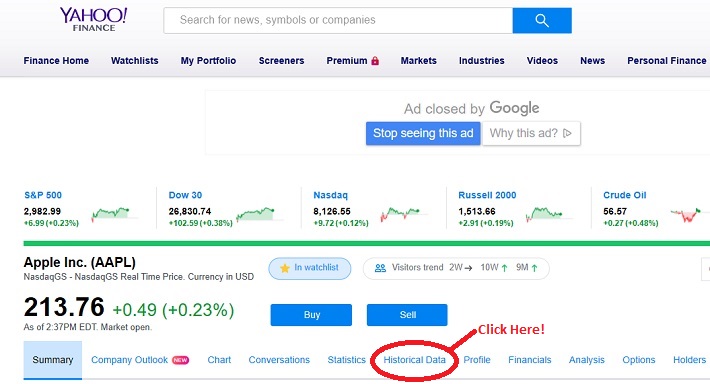

Step 1: Navigate to Yahoo! Finance. Type the ticker of your desired stock into the search bar at the top of the Yahoo! Finance bar. In our case, it’s Apple.

Step 2: Click on historical data, as shown below.

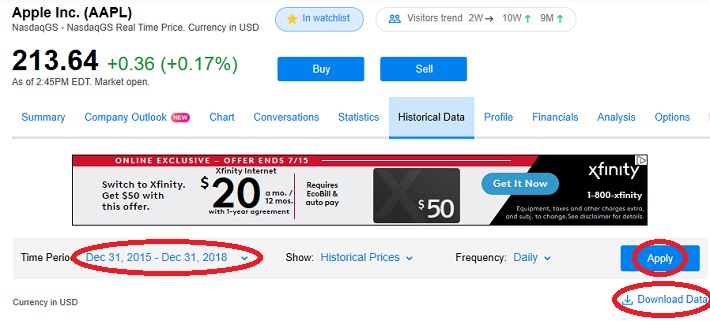

Step 3: Change the dates to the range of your choice, and then click “Apply.” After that, click “Download Data” (which is just below the Apply button).

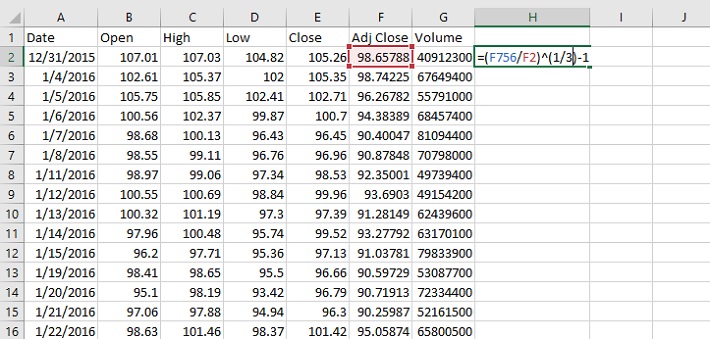

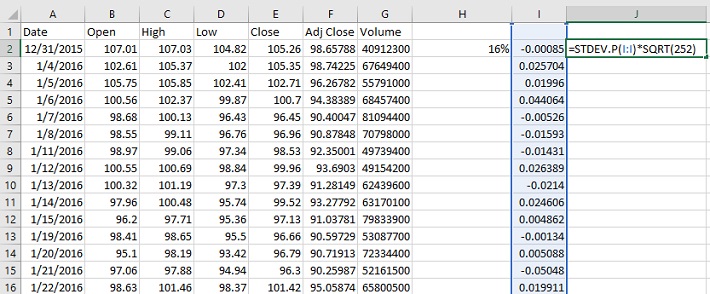

Step 4: The Excel document that will download as a result of your process so far will have six columns: Open, High, Low, Close, Adjusted Close (or “Adj Close” in the top row of the spreadsheet), and Volume. It’s Adjusted Close that we’re interested in, as this accounts for stock splits and dividend payments.

Using the adjusted close column, calculate the stock’s annualized returns during the time period under investigation. In the example shown below, this is done by dividing the current price by the oldest price and then raising this to the inverse power of the number of years during the sample. The equation is shown below.

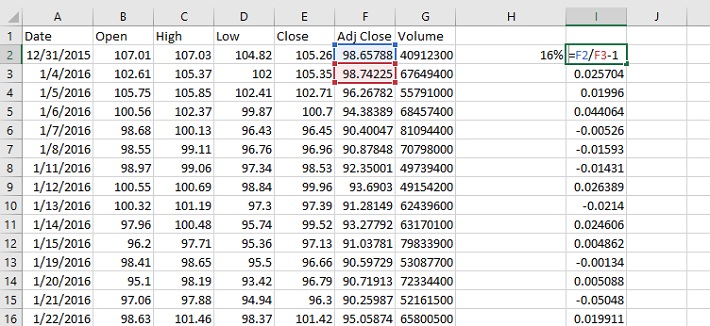

Step 5: Next, a time series of daily returns needs to be calculated. This is done in column I in the spreadsheet shown below.

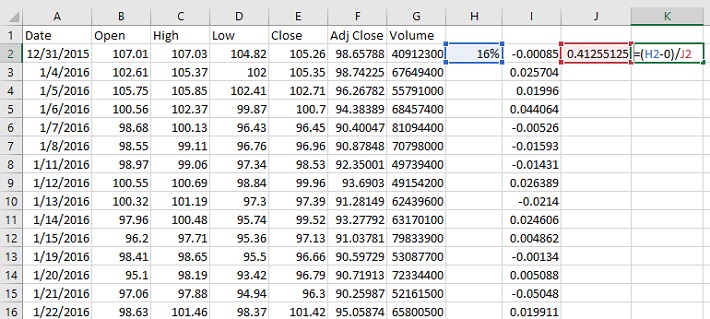

Step 6: Calculate the standard deviation of daily price returns using the STDEV.P() function, and then convert this number to an annualized figure by multiplying by the square root of 252. We use 252 instead of 365 (the number of days in a year) because there are approximately 252 trading days in an average calendar year. The formula to calculate the annualized standard deviation figure is shown below.

Step 7: Use the annualized return and annualized standard deviation data to calculate a Sharpe ratio. An example of how to do this is shown below, using 0% as the risk free rate of return.

The resulting number is the Sharpe ratio of the investment in question. In this case, Apple had a 3-year Sharpe ratio of 0.40 at the time of this writing.

Final Thoughts

Looking for stocks with strong historical Sharpe ratios is a useful way to find investment ideas.

With that said, this strategy is not the only way to find high-quality investments. To conclude this article, we’ll provide additional resources that you can use for your investment due diligence.

If you are looking for high-quality dividend growth stocks suitable for long-term investment, the following databases will be useful:

- The Dividend Aristocrats List: 25+ years of consecutive dividend increases.

- The Dividend Achievers List: 10+ years of consecutive dividend increases.

- The Dividend Kings: Widely considered to be the “best-of-the-best” when it comes to dividend growth streaks, the Dividend Kings are an exclusive group of dividend stocks with 50+ years of consecutive dividend increases.

You may also be looking for appealing stocks from a certain stock market sector to ensure appropriate diversification within your portfolio. If that is the case, you will find the following resources useful:

- The Complete List Of All Dividend-Paying Utility Stocks

- The Complete List Of All Dividend-Paying Healthcare Stocks

- The Complete List Of All Dividend-Paying Technology Stocks

- The Complete List Of All Dividend-Paying Telecommunications Stocks

- The Complete List Of All Dividend-Paying Materials Stocks

- The Complete List Of All Dividend-Paying Industrial Stocks

- The Complete List Of All Dividend-Paying Consumer Cyclical Stocks

- The Complete List Of All Dividend-Paying Consumer Staples Stocks

- The Complete List Of All Dividend-Paying Energy Stocks

- The Complete List Of All Dividend-Paying Financial Stocks

You may also wish to consider investments within the major market indices. The most well-known benchmarks for large- and small-cap U.S. stocks can be accessed below:

Other great places to look for investment opportunities are international markets. If that appeals to you, the following international stock market indices will be useful: