Updated on August 29th, 2019 by Bob Ciura

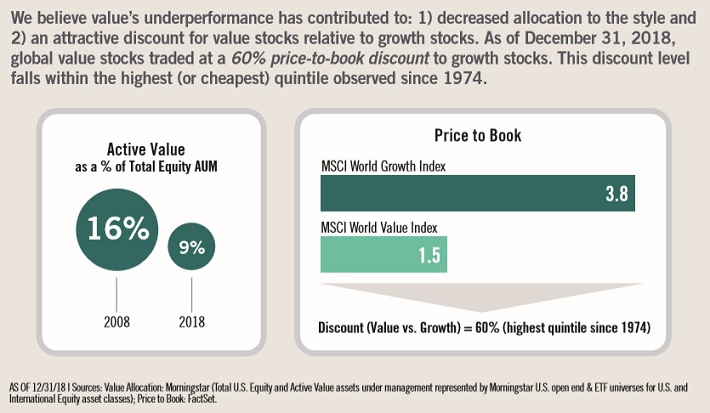

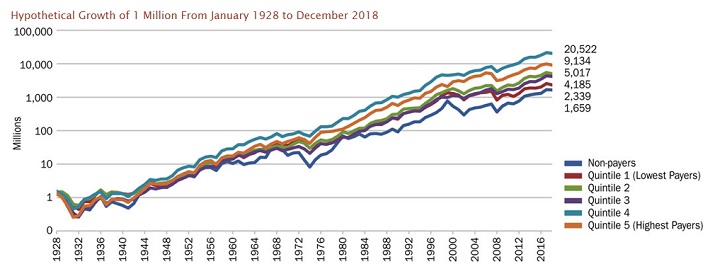

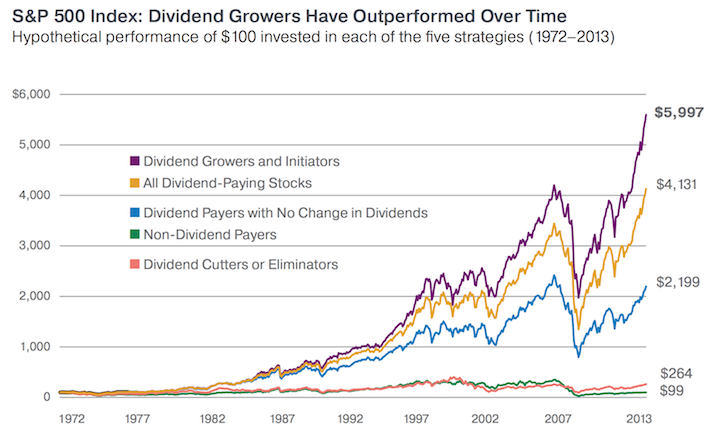

We firmly believe that investors looking to generate superior returns over the long-term, without taking excessive risks, should focus on high-quality dividend growth stocks.

Investors can successfully implement a dividend growth investing strategy by finding dividend stocks that are also trading at attractive valuations.

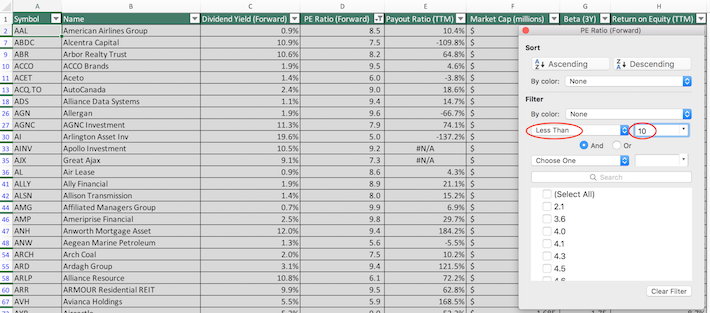

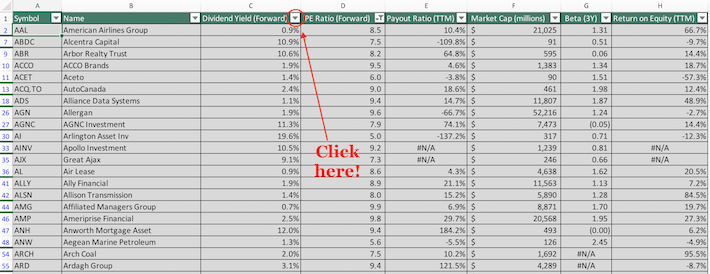

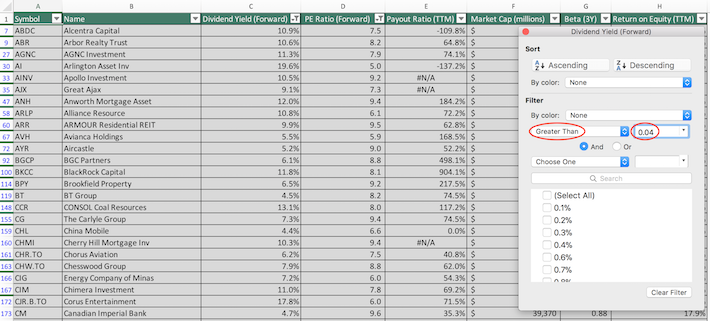

In this article, we present a method for investors to quickly and effectively screen for cheap dividend stocks with a downloadable list.

You can download a list of cheap dividend stocks (defined as dividend-paying stocks with price-to-earnings ratios below 15) using the link below.

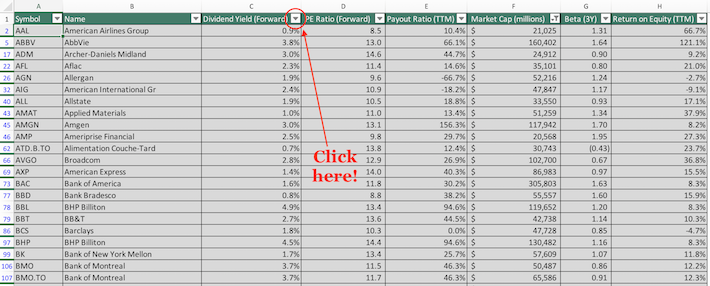

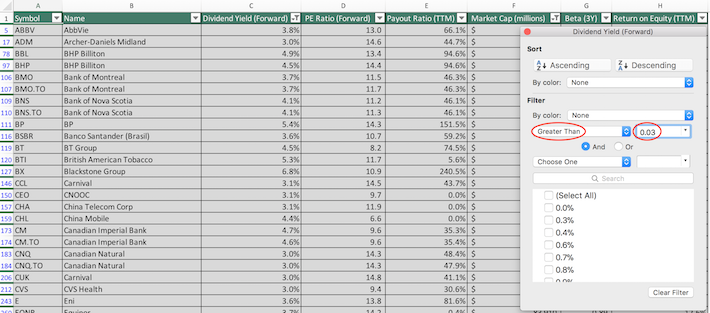

The database of cheap dividend stocks available for download above contains the following information for every stock in the spreadsheet:

- Dividend yield

- Price-to-earnings ratio

- Payout ratio

- Market capitalization

- Beta

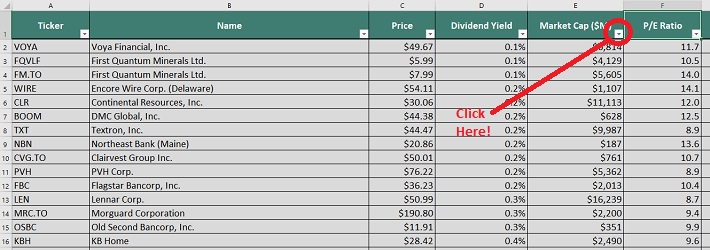

Furthermore, you can see a preview of our cheap dividend stocks in the table below:

Ticker Name Price Dividend Yield Market Cap ($M) P/E Ratio Payout Ratio Beta

VOYA

Voya Financial, Inc.

49.67

0.1

6,814

11.7

1.0

1.20

FQVLF

First Quantum Minerals Ltd.

5.99

0.1

4,129

10.5

1.3

1.47

FM.TO

First Quantum Minerals Ltd.

7.99

0.1

5,605

14.0

1.8

2.78

WIRE

Encore Wire Corp. (Delaware)

54.11

0.2

1,106

14.1

2.1

1.01

CLR

Continental Resources, Inc.

30.06

0.2

11,112

12.0

2.0

1.69

BOOM

DMC Global, Inc.

44.38

0.2

627

12.5

2.3

1.05

TXT

Textron, Inc.

44.47

0.2

9,987

8.9

1.6

1.22

NBN

Northeast Bank (Maine)

20.86

0.2

187

13.6

2.6

0.31

CVG.TO

Clairvest Group Inc.

50.01

0.2

760

10.7

2.1

0.88

PVH

PVH Corp.

76.22

0.2

5,361

8.9

1.9

1.27

FBC

Flagstar Bancorp, Inc.

36.23

0.2

2,013

10.4

2.3

0.71

LEN

Lennar Corp.

50.99

0.3

16,239

8.7

2.8

0.75

MRC.TO

Morguard Corporation

190.80

0.3

2,200

9.4

2.9

0.41

OSBC

Old Second Bancorp, Inc.

11.91

0.3

350

9.9

3.4

0.75

KBH

KB Home

28.42

0.4

2,489

9.6

3.4

0.83

FCNCA

First Citizens BancShares, Inc. (North Carolina)

445.12

0.4

4,832

11.8

4.2

0.77

PWR

Quanta Services, Inc.

33.74

0.4

4,688

15.2

5.5

1.12

EME

EMCOR Group, Inc.

85.13

0.4

4,635

15.5

6.0

0.98

LEN.B

Lennar Corp.

40.42

0.4

12,853

6.9

2.8

0.72

FTV

Fortive Corp.

70.50

0.4

23,366

9.0

3.6

1.03

OBNK

Origin Bancorp, Inc.

31.95

0.4

749

14.5

5.9

0.65

FCNCB

First Citizens BancShares, Inc. (North Carolina)

380.00

0.4

4,221

10.1

4.1

0.49

RKUNF

Rakuten, Inc.

8.62

0.5

11,671

7.3

3.4

0.51

AYI

Acuity Brands, Inc.

125.42

0.4

4,827

14.6

6.3

1.17

SBT

Sterling Bancorp, Inc. (Michigan)

9.44

0.4

476

8.1

3.5

0.92

MTX

Minerals Technologies, Inc.

47.95

0.4

1,625

11.2

4.8

1.37

SFTBF

SoftBank Group Corp.

44.37

0.4

91,875

4.8

2.1

0.93

BDC

Belden, Inc.

45.92

0.5

1,737

11.4

5.2

1.47

GBL

GAMCO Investors, Inc.

18.25

0.5

489

5.1

2.3

0.77

ONEXF

ONEX Corp.

58.01

0.5

5,808

1.6

0.7

0.36

ONEX.TO

Onex Corporation

76.79

0.5

7,876

2.1

1.1

0.49

AYALY

Ayala Corp.

17.67

0.5

11.2

5.6

0.00

CTO

Consolidated-Tomoka Land Co.

64.10

0.5

316

11.5

6.3

0.57

EGBN

Eagle Bancorp, Inc. (Maryland)

40.33

0.6

1,375

9.2

5.1

0.76

SNEJF

Sony Corp.

55.68

0.6

69,405

9.3

5.3

0.56

XAU.TO

Goldmoney Inc.

2.19

0.6

162

7.9

4.7

1.94

LEVL

Level One Bancorp, Inc.

23.41

0.6

181

12.8

7.6

0.24

CNBKA

Century Bancorp, Inc. (Massachusetts)

81.42

0.6

452

9.7

5.7

0.44

FANG

Diamondback Energy, Inc.

99.42

0.6

15,754

15.8

9.2

1.29

SPR

Spirit AeroSystems Holdings, Inc.

80.28

0.6

8,135

12.4

7.5

0.99

TWC.TO

TWC Enterprises Limited

12.90

0.6

352

1.6

1.0

-0.22

JLL

Jones Lang LaSalle, Inc.

134.86

0.6

6,776

13.2

8.4

1.13

CASH

Meta Financial Group, Inc.

31.34

0.6

1,173

14.2

9.2

0.72

CMCO

Columbus McKinnon Corp.

32.10

0.7

737

14.1

9.5

1.27

CJPRF

Central Japan Railway Co.

194.95

0.7

38,233

9.5

6.4

-0.01

NGHC

National General Holdings Corp.

23.37

0.7

2,649

11.3

7.7

0.90

QCRH

QCR Holdings, Inc.

35.53

0.7

553

11.5

7.8

0.85

RNR

RenaissanceRe Holdings Ltd.

180.10

0.7

8,029

13.3

9.8

0.48

NCI

Navigant Consulting, Inc.

27.84

0.7

1,070

-4,971.4

-3,574.0

0.74

RICK

RCI Hospitality Holdings, Inc.

17.12

0.7

164

12.1

8.5

1.17

WEBK

Wellesley Bancorp, Inc.

31.22

0.7

79

12.8

9.2

0.13

SURDF

Sumitomo Realty & Development Co., Ltd.

37.45

0.7

17,749

14.2

10.3

0.01

FFWM

First Foundation, Inc.

14.03

0.7

614

11.9

8.6

0.80

DDS

Dillard's, Inc.

58.44

0.7

1,492

12.0

8.3

0.70

PGC

Peapack-Gladstone Financial Corp.

28.37

0.7

539

12.3

8.9

0.72

SLM

SLM Corp.

8.47

0.7

3,527

6.8

4.9

0.97

MVBF

MVB Financial Corp.

18.62

0.7

215

8.8

6.4

0.51

KNX

Knight-Swift Transportation Holdings, Inc.

33.58

0.7

5,582

13.8

10.1

1.46

ALCO

Alico, Inc.

30.79

0.8

231

10.5

8.1

0.47

GL

Globe Life, Inc.

88.51

0.8

9,500

13.7

10.5

0.89

BBU.UN.TO

Brookfield Business Partners L.P.

42.48

0.8

3,538

40.8

31.5

0.97

HUM

Humana, Inc.

279.96

0.8

37,295

15.2

11.6

0.88

BBU

Brookfield Business Partners LP

32.85

0.8

2,109

13.9

10.9

0.86

ESXB

Community Bankers Trust Corp.

7.85

0.8

173

12.1

9.3

0.68

TECK.A.TO

Teck Resources Limited

22.21

0.8

12,364

5.0

3.9

0.90

TECK.B.TO

Teck Resources Limited

22.07

0.8

12,542

4.9

3.9

1.01

GHC

Graham Holdings Co.

689.80

0.8

3,645

11.4

9.1

0.54

ZEUS

Olympic Steel, Inc.

10.70

0.8

112

8.5

6.6

1.17

AYYLF

Ayala Corp.

18.15

0.8

11,386

11.5

9.1

-0.06

CYSM

Community Bancorp of Santa Maria

12.48

0.8

30

9.9

7.9

0.07

SKYW

Sky West, Inc.

56.92

0.8

2,810

9.0

7.2

1.22

HIFS

Hingham Institution for Savings

181.10

0.8

385

12.1

10.0

0.49

FBK

FB Financial Corp.

35.79

0.9

1,088

14.4

12.3

0.81

PALDF

North American Palladium Ltd.

11.37

0.9

669

5.3

4.5

0.67

NOBH

Nobility Homes, Inc.

23.00

0.9

88

14.5

12.6

0.12

EBIX

Ebix, Inc.

35.31

0.9

1,052

11.8

10.3

1.36

ISTR

Investar Holding Corp.

22.88

0.9

227

13.9

12.3

0.69

KEM

KEMET Corp.

17.05

0.9

981

4.7

4.2

2.08

VTYB

The Victory Bancorp, Inc.

9.80

0.9

19

8.3

7.6

0.08

TECK

Teck Resources Ltd.

16.73

0.9

9,268

4.9

4.5

1.17

AGCO

AGCO Corp.

68.29

0.9

5,124

14.0

12.7

1.06

LAD

Lithia Motors, Inc.

132.46

0.9

3,039

11.5

10.3

0.58

QBCRF

Quebecor, Inc.

22.27

0.9

5,699

13.6

12.8

0.22

CARO

Carolina Financial Corp.

34.31

0.9

740

12.7

11.9

0.81

DIT

AMCON Distributing Co.

75.66

0.9

47

10.4

9.4

0.46

HCC

Warrior Met Coal, Inc.

20.86

1.0

1,044

1.6

1.6

1.04

FBP

First BanCorp (Puerto Rico)

9.56

1.0

2,034

9.4

9.1

0.93

ALBY

Community Capital Bancshares, Inc.

10.70

0.9

13

8.8

8.2

0.11

UFPI

Universal Forest Products, Inc.

39.11

1.0

2,376

14.9

14.7

1.03

JOUT

Johnson Outdoors, Inc.

56.74

1.0

565

13.2

13.1

0.79

FIX

Comfort Systems USA, Inc.

38.00

1.0

1,363

13.1

13.1

0.93

NXPI

NXP Semiconductors NV

102.06

1.0

28,597

15.3

15.3

1.62

OI

Owens-Illinois, Inc.

10.00

1.0

1,548

6.2

6.2

1.26

PRI

Primerica, Inc.

119.28

1.0

4,872

14.8

15.0

1.30

SXI

Standex International Corp.

67.39

1.1

859

17.9

20.6

1.08

SFDL

Security Federal Corp.

34.50

1.0

101

13.4

13.9

0.00

PCB

PCB Bancorp

16.34

1.0

260

9.7

10.1

0.69

CMGGF

Commercial International Bank (Egypt) SAE

3.89

1.0

5,673

12.0

12.6

0.20

SF

Stifel Financial Corp.

53.25

1.0

3,607

9.3

9.6

1.26

VSEC

VSE Corp.

32.41

1.0

355

9.9

10.1

1.06

ETFC

E*TRADE Financial Corp.

41.64

1.0

9,654

10.2

10.6

1.18

FSFG

First Savings Financial Group, Inc.

58.56

1.1

137

9.4

9.9

0.46

KELYB

Kelly Services, Inc.

27.92

1.1

1,091

9.6

10.3

0.08

WSFS

WSFS Financial Corp.

41.52

1.1

2,176

13.1

14.3

0.77

KAI

Kadant, Inc.

82.10

1.1

914

14.2

15.7

0.93

CBTX

CBTX, Inc. (Texas)

27.26

1.1

679

13.1

14.4

0.81

PLAY

Dave & Buster's Entertainment, Inc.

42.39

1.1

1,503

13.7

15.0

0.91

ARCB

ArcBest Corp.

29.67

1.1

737

8.9

9.9

1.37

ITIC

Investors Title Co.

142.20

1.1

265

11.7

13.4

0.47

VB.TO

VersaBank

6.82

1.1

144

8.3

9.5

0.40

OPBK

OP Bancorp

9.44

1.1

145

9.7

10.5

0.97

BBSI

Barrett Business Services, Inc.

88.59

1.1

660

13.8

15.6

1.15

PANL

Pangaea Logistics Solutions Ltd.

3.17

1.1

140

8.8

9.7

0.03

FRBA

First Bank (Hamilton, New Jersey)

10.65

1.2

193

11.9

13.7

0.42

SIFY

Sify Technologies Ltd.

1.24

1.1

13.9

15.8

0.91

CNBKB

Century Bancorp, Inc. (Massachusetts)

41.25

1.2

229

9.9

11.5

0.00

ABCB

Ameris Bancorp

35.36

1.2

1,654

10.2

11.8

1.17

AMAL

Amalgamated Bank

16.27

1.1

505

13.0

14.7

0.62

DHI

D.R. Horton, Inc.

49.10

1.2

18,121

11.6

13.7

0.80

WERN

Werner Enterprises, Inc.

32.11

1.2

2,165

12.5

14.4

0.96

KELYA

Kelly Services, Inc.

24.40

1.2

960

8.4

10.2

0.79

FSBW

FS Bancorp, Inc.

48.59

1.2

217

7.8

9.3

0.42

SAH

Sonic Automotive, Inc.

27.34

1.2

1,177

11.1

13.0

1.03

LNR.TO

Linamar Corporation

39.16

1.2

2,677

5.0

6.1

1.19

INBK

First Internet Bancorp

19.50

1.2

198

9.2

11.1

1.02

PNFP

Pinnacle Financial Partners, Inc.

51.85

1.2

3,935

10.4

12.6

0.96

TOL

Toll Brothers, Inc.

36.00

1.2

5,137

7.6

9.3

0.72

IBTN

InsCorp, Inc. (Tennessee)

15.80

1.3

45

10.8

13.6

0.11

DLMV

Delmarva Bancshares, Inc.

7.90

1.3

31

13.1

16.6

-0.02

IHT

InnSuites Hospitality Trust

1.62

1.2

15

-1.3

-1.6

0.40

LIMAF

Linamar Corp.

29.44

1.2

1,921

4.9

6.0

0.57

PHM

PulteGroup, Inc.

33.55

1.3

9,164

10.1

12.7

0.64

FETM

Fentura Financial, Inc.

20.65

1.3

74

7.9

10.0

-0.02

TRCB

Two River Bancorp

19.12

1.3

162

14.0

17.5

0.33

AL

Air Lease Corp.

41.20

1.2

4,465

8.1

10.0

1.31

FBNC

First Bancorp (North Carolina)

35.51

1.3

1,040

11.4

14.4

0.84

HCA

HCA Healthcare, Inc.

120.64

1.3

40,594

11.4

14.3

0.94

SCVL

Shoe Carnival, Inc.

31.60

1.2

380

12.1

15.0

1.09

ENS

EnerSys

56.51

1.3

2,358

14.7

18.5

1.24

LUV

Southwest Airlines Co.

52.18

1.3

27,499

12.1

15.6

0.90

SNDR

Schneider National, Inc.

19.08

1.3

3,281

14.9

19.3

1.22

UBNC

Union Bank (North Carolina)

14.76

1.3

51

12.8

16.9

0.06

EOG

EOG Resources, Inc.

75.35

1.3

42,093

12.2

15.9

1.24

AXP

American Express Co.

120.77

1.3

98,805

14.9

19.6

1.03

PRIM

Primoris Services Corp.

18.85

1.3

941

11.4

14.8

0.92

HTH

Hilltop Holdings, Inc.

23.33

1.3

2,111

13.6

18.0

0.76

MHGU

Meritage Hospitality Group, Inc.

16.90

1.4

106

7.8

10.7

0.00

DBCP

Delmar Bancorp

7.45

1.3

74

11.3

15.2

0.08

PBR

Petróleo Brasileiro SA

13.37

1.3

10.7

14.2

1.00

WGO

Winnebago Industries, Inc.

32.41

1.3

1,010

9.3

12.2

1.03

RUSHB

Rush Enterprises, Inc.

35.87

1.3

1,303

8.1

10.9

0.76

SGTZY

Surgutneftegas PJSC

3.85

1.4

1.2

1.7

0.38

OFG

OFG Bancorp

20.86

1.3

1,051

11.8

15.5

0.94

EQB.TO

Equitable Group Inc.

96.86

1.4

1,625

9.0

12.3

1.62

FXNC

First National Corp. (Virginia)

20.50

1.4

101

10.9

14.9

0.21

SBBX

SB One Bancorp

22.55

1.4

208

11.3

15.4

0.65

BFC

Bank First Corp.

55.37

1.4

393

14.9

20.5

-3.82

NC

NACCO Industries, Inc.

49.83

1.4

348

8.0

11.0

0.62

RUSHA

Rush Enterprises, Inc.

35.62

1.4

1,263

8.1

11.1

0.75

LPLA

LPL Financial Holdings, Inc.

73.94

1.4

5,931

11.9

16.5

1.24

GPI

Group 1 Automotive, Inc.

75.83

1.4

1,390

9.4

13.0

0.86

EFSC

Enterprise Financial Services Corp.

39.49

1.4

1,043

11.8

16.4

0.78

HURC

Hurco Cos., Inc.

31.54

1.4

213

8.0

11.4

0.93

OMF

OneMain Holdings, Inc.

36.12

1.4

4,819

7.4

10.5

1.28

CBAF

CITBA Financial Corp.

29.63

1.4

54

12.1

17.3

0.00

ALSN

Allison Transmission Holdings, Inc.

44.10

1.4

5,176

8.4

11.8

0.98

ICBK

County Bancorp, Inc. (Manitowoc, Wisconsin)

17.06

1.4

115

8.6

12.0

0.37

JRSH

Jerash Holdings (US), Inc.

7.18

1.4

81

16.0

22.3

0.55

HTLF

Heartland Financial USA, Inc.

43.64

1.4

1,569

10.7

15.0

0.94

WTFC

Wintrust Financial Corp.

62.64

1.4

3,480

10.6

15.2

0.96

GIVSY

Grupo de Inversiones Suramericana SA

20.70

1.4

12.3

17.9

0.10

WWW

Wolverine World Wide, Inc.

25.63

1.4

2,153

13.6

19.3

0.89

MPCIY

Metro Pacific Investments Corp.

17.87

1.5

11.2

16.2

-0.02

PHX

Panhandle Oil & Gas, Inc.

11.75

1.4

186

12.4

17.4

0.87

UNTY

Unity Bancorp, Inc.

19.71

1.5

214

9.3

13.7

0.57

ERF.TO

Enerplus Corporation

8.59

1.5

2,062

4.7

7.1

2.00

B

Barnes Group, Inc.

44.49

1.5

2,215

15.3

22.4

1.20

ERF

Enerplus Corp.

6.71

1.4

1,492

4.8

6.8

1.35

QBR.A.TO

Quebecor Inc.

29.70

1.5

7,627

11.8

18.0

0.53

SVT

Servotronics, Inc.

10.20

1.6

25

7.3

11.4

0.51

PZN

Pzena Investment Management, Inc.

8.32

1.5

569

11.2

16.5

0.88

EBSB

Meridian Bancorp, Inc.

17.71

1.5

936

15.2

22.4

0.60

QBR.B.TO

Quebecor Inc.

29.95

1.5

7,707

11.9

17.9

0.50

GCBC

Greene County Bancorp, Inc.

26.49

1.5

226

12.9

19.5

0.29

STL

Sterling Bancorp (Montebello, New York)

19.03

1.5

3,833

9.7

14.6

1.08

SVBI

Severn Bancorp, Inc.

7.90

1.5

100

10.5

16.0

0.51

TCFC

The Community Financial Corp. (Maryland)

31.17

1.5

174

11.4

17.4

0.49

PPBI

Pacific Premier Bancorp, Inc.

29.39

1.5

1,744

12.6

19.1

1.13

AFG

American Financial Group, Inc.

100.36

1.6

8,976

12.6

19.5

0.72

CIX

CompX International, Inc.

15.87

1.5

194

12.7

19.6

0.43

DBIN

Dacotah Banks, Inc.

34.00

1.6

379

13.7

21.4

-0.07

MEI

Methode Electronics, Inc.

31.77

1.5

1,052

13.0

20.1

1.29

ECA

Encana Corp.

4.44

1.6

5,816

3.8

6.0

1.36

OVLY

Oak Valley Bancorp

16.57

1.6

135

11.0

17.6

0.66

OSK

Oshkosh Corp.

69.20

1.5

4,650

8.4

13.0

1.43

SFBC

Sound Financial Bancorp, Inc.

35.27

1.6

90

13.1

20.9

0.07

CBAN

Colony Bankcorp, Inc.

15.77

1.6

151

12.7

20.0

0.01

OC

Owens Corning

57.53

1.6

6,105

12.3

19.0

0.98

SMBC

Southern Missouri Bancorp, Inc.

33.79

1.6

310

10.7

16.7

0.62

DVN

Devon Energy Corp.

22.47

1.6

8,860

2.8

4.3

1.52

AGO

Assured Guaranty Ltd.

42.61

1.6

4,180

10.0

16.1

0.81

CF.TO

Canaccord Genuity Group Inc.

4.90

1.6

538

9.3

15.1

0.64

RGA

Reinsurance Group of America, Inc.

151.85

1.6

9,431

12.2

19.5

0.83

PPBN

Pinnacle Bankshares Corp. (Virginia)

30.50

1.6

46

10.2

16.6

-0.09

IBTX

Independent Bank Group, Inc.

49.00

1.6

2,071

11.5

18.5

1.03

HII

Huntington Ingalls Industries, Inc.

206.87

1.6

8,424

12.8

20.7

0.97

MNBEF

Minebea Mitsumi, Inc.

14.50

1.7

6,019

13.1

22.9

-0.05

CCORF

Canaccord Genuity Group, Inc.

3.70

1.6

401

7.1

11.5

0.83

AAL

American Airlines Group, Inc.

26.41

1.6

11,278

7.9

12.5

1.48

OPY

Oppenheimer Holdings, Inc.

27.89

1.6

352

9.9

15.9

0.91

GS

The Goldman Sachs Group, Inc.

203.84

1.6

72,063

8.5

13.7

1.16

CBS.A

CBS Corp.

45.61

1.6

16,638

5.5

9.0

0.84

NATH

Nathan's Famous, Inc.

67.18

1.6

283

12.8

20.9

0.59

RBC

Regal Beloit Corp.

70.67

1.7

2,895

11.7

19.3

1.05

ORXGF

Orca Exploration Group, Inc.

4.99

1.7

174

11.8

19.5

-0.12

SCHW

The Charles Schwab Corp.

37.80

1.6

48,012

14.1

23.0

1.15

FCCY

1st Constitution Bancorp

17.32

1.7

146

10.5

17.6

0.23

CNOB

ConnectOne Bancorp, Inc.

20.87

1.6

716

10.1

16.4

0.95

CCBG

Capital City Bank Group, Inc.

24.31

1.6

407

14.6

24.0

0.84

PLPC

Preformed Line Products Co.

51.31

1.7

242

10.7

17.8

1.15

HLC.TO

Holloway Lodging Corporation

8.29

1.7

128

6.6

11.1

-0.07

OLBK

Old Line Bancshares, Inc.

26.67

1.7

447

12.7

21.2

0.62

FUNC

First United Corp.

21.32

1.7

151

13.9

23.4

0.60

MBIN

Merchants Bancorp (Indiana)

16.38

1.7

449

8.6

14.2

0.76

BOTJ

Bank of the James Financial Group, Inc.

14.50

1.7

63

11.6

19.1

0.21

WEN

The Wendy's Co.

22.09

1.7

4,997

11.0

18.8

0.54

PUB

People's Utah Bancorp

26.86

1.7

496

11.8

20.2

0.77

BOCH

Bank of Commerce Holdings

10.12

1.7

181

11.5

19.7

0.60

RCKY

Rocky Brands, Inc.

29.54

1.7

216

14.2

24.3

0.75

MRO

Marathon Oil Corp.

12.29

1.7

9,600

10.4

17.4

1.56

YFGSF

Yamaguchi Financial Group, Inc.

11.44

1.7

2,902

13.4

23.2

RJF

Raymond James Financial, Inc.

78.28

1.7

10,585

10.8

18.8

1.17

COG

Cabot Oil & Gas Corp.

17.35

1.7

7,024

8.8

15.2

0.57

IMKTA

Ingles Markets, Inc.

38.46

1.7

551

9.6

16.3

0.68

CBS

CBS Corp.

42.52

1.7

15,638

5.2

8.9

0.95

HFBL

Home Federal Bancorp, Inc. of Louisiana

31.92

1.8

58

11.9

20.9

0.04

ECA.TO

Encana Corporation

5.74

1.7

7,991

5.6

9.6

2.74

CBSH

Commerce Bancshares, Inc. (Missouri)

56.58

1.7

6,086

15.1

26.3

0.77

WLK

Westlake Chemical Corp.

58.22

1.8

7,321

12.1

21.3

1.27

NXST

Nexstar Media Group, Inc.

94.87

1.8

4,315

11.5

20.3

1.23

HLF.TO

High Liner Foods Incorporated

11.04

1.8

374

19.4

35.1

-0.58

THG

The Hanover Insurance Group, Inc.

132.24

1.8

5,172

18.0

32.2

0.47

CRS

Carpenter Technology Corp.

47.80

1.7

2,203

13.7

23.6

1.62

SZKMF

Suzuki Motor Corp.

39.97

1.7

18,439

15.3

25.5

0.03

SCRPF

Sembcorp Industries Ltd.

1.61

1.8

2,877

10.9

19.7

-0.06

SNX

SYNNEX Corp.

84.15

1.8

4,128

10.4

18.6

1.46

SBGI

Sinclair Broadcast Group, Inc.

44.21

1.8

4,098

12.9

22.5

1.00

HFBK

Harford Bank

29.00

1.8

35

12.0

21.1

0.14

CWVLF

Crown Point Energy, Inc.

0.37

2.0

26

2.5

5.0

0.44

TTDKF

TDK Corp.

78.14

1.8

9,868

13.4

24.9

0.31

CLDB

Cortland Bancorp, Inc. (Ohio)

23.24

1.9

101

13.6

25.7

0.26

PLBC

Plumas Bancorp

21.63

1.9

111

7.5

14.1

0.33

IIP.UN.TO

InterRent Real Estate Investment Trust

15.80

1.8

1,913

9.5

17.5

-0.24

FMCB

Farmers & Merchants Bancorp (California)

762.01

1.8

599

11.4

21.0

0.07

CNHI

CNH Industrial NV

9.83

1.8

12,670

11.6

21.2

1.30

KTWIF

Kurita Water Industries Ltd.

26.25

1.9

2,947

13.8

25.7

-0.06

EHMEF

goeasy Ltd.

40.35

1.9

581

12.5

23.2

0.26

HWBK

Hawthorn Bancshares, Inc.

22.50

1.9

136

10.2

18.8

0.43

PKKW

Parkway Acquisition Corp.

11.95

1.8

73

11.4

21.0

0.18

CGO.TO

Cogeco Inc.

93.58

1.8

1,509

11.3

20.8

1.02

ALL

The Allstate Corp.

102.08

1.9

33,712

13.2

24.7

0.74

CSFL

CenterState Bank Corp.

22.80

1.9

2,899

12.3

23.0

1.01

MRE.TO

Martinrea International Inc.

9.91

1.8

894

5.3

9.7

1.82

MRETF

Martinrea International, Inc.

7.44

1.8

615

5.3

9.7

0.70

SFBS

ServisFirst Bancshares, Inc.

30.65

1.9

1,593

11.6

21.8

0.97

PKOH

Park-Ohio Holdings Corp.

26.62

1.9

332

6.8

12.8

1.11

COF

Capital One Financial Corp.

86.38

1.9

39,785

7.4

14.0

1.11

MI.UN.TO

Minto Apartment Real Estate Investment Trust

22.92

1.9

566

5.0

9.7

0.00

X

United States Steel Corp.

11.03

1.9

1,826

1.9

3.6

1.63

CTRN

Citi Trends, Inc.

17.28

1.9

201

12.0

23.0

0.81

ITTOF

ITOCHU Techno-Solutions Corp.

23.20

1.9

5,359

23.2

45.2

0.00

BWFG

Bankwell Financial Group, Inc.

25.93

1.9

203

10.8

20.9

0.50

CGEAF

Cogeco Communications, Inc.

78.91

2.0

3,905

16.4

32.3

-0.03

PNGAY

Ping An Insurance (Group) Co. of China Ltd.

22.93

2.0

9.7

19.0

0.90

PCAR

PACCAR, Inc.

65.11

1.9

22,129

9.6

18.6

0.99

PEBK

Peoples Bancorp of North Carolina, Inc.

28.00

1.9

166

11.6

22.5

0.79

ADS

Alliance Data Systems Corp.

123.68

2.0

6,246

7.6

15.0

1.17

CINF

Cincinnati Financial Corp.

112.07

2.0

18,146

14.9

29.3

0.69

LBRT

Liberty Oilfield Services, Inc.

10.65

1.9

1,238

7.8

15.0

1.48

DE

Deere & Co.

156.94

1.9

48,411

15.1

29.3

1.27

EIG

Employers Holdings, Inc.

42.53

2.0

1,357

8.4

16.5

0.69

TEL

TE Connectivity Ltd.

91.97

2.0

29,958

9.8

19.5

1.00

SBNY

Signature Bank (New York, New York)

115.61

2.0

6,244

10.4

20.5

0.68

CVCY

Central Valley Community Bancorp

19.63

2.0

260

12.0

23.5

0.47

TGNA

TEGNA, Inc.

14.31

2.0

3,054

7.5

14.9

1.09

PH

Parker-Hannifin Corp.

163.76

2.0

20,458

14.1

27.9

1.26

MRAAF

Murata Manufacturing Co. Ltd.

40.00

2.1

25,590

13.3

27.9

0.48

ASHTF

Ashtead Group Plc

25.99

2.0

11,957

12.0

24.2

0.64

FBTT

First Bankers Trustshares, Inc.

31.20

2.0

96

11.4

23.0

0.01

XEC

Cimarex Energy Co.

42.04

1.8

4,220

6.8

12.4

1.54

CCA.TO

Cogeco Communications Inc.

104.97

2.0

5,179

13.3

26.6

0.80

ASRV

AmeriServ Financial, Inc.

4.20

2.0

73

9.4

19.0

0.09

CR

Crane Co.

75.13

2.0

4,443

12.5

24.9

1.12

WD

Walker & Dunlop, Inc.

55.80

2.0

1,685

10.0

20.1

1.06

HA

Hawaiian Holdings, Inc.

24.74

2.0

1,134

5.6

11.1

1.27

EML

The Eastern Co.

22.35

2.0

137

11.4

22.8

0.96

HIG

The Hartford Financial Services Group, Inc.

58.28

2.1

21,119

12.9

26.4

0.72

SSB

South State Corp.

74.11

2.0

2,503

14.6

29.7

0.92

RICOF

Ricoh Co., Ltd.

10.08

2.1

7,306

14.6

30.0

0.03

DFS

Discover Financial Services

80.04

2.0

25,128

9.4

19.0

1.19

NBHC

National Bank Holdings Corp.

32.97

2.0

1,018

13.7

28.0

0.85

SWKS

Skyworks Solutions, Inc.

75.31

2.1

12,597

14.3

29.6

1.45

CE

Celanese Corp.

111.59

2.0

13,554

13.9

28.4

1.15

ALLY

Ally Financial, Inc.

31.37

2.1

12,020

7.9

16.4

1.13

CLF

Cleveland-Cliffs, Inc.

7.97

2.1

2,084

2.0

4.1

1.63

CSHX

Cashmere Valley Bank

59.50

2.1

245

11.1

23.2

0.21

WTBDY

Whitbread Plc

13.12

2.1

21.2

44.7

0.29

RBB

RBB Bancorp

18.74

2.1

369

9.2

19.1

0.86

SBFG

SB Financial Group, Inc.

16.19

2.1

105

10.6

22.2

0.14

CWBC

Community West Bancshares

9.66

2.1

81

11.9

25.3

0.09

TCBK

TriCo Bancshares

35.37

2.1

1,067

12.6

26.6

0.78

KKR

KKR & Co., Inc.

26.29

2.1

21,637

9.6

20.4

1.44

TRV

The Travelers Cos., Inc.

146.78

2.1

38,112

14.5

31.1

0.67

GFED

Guaranty Federal Bancshares, Inc.

23.94

2.1

106

9.8

20.8

0.10

TRI.TO

Thomson Reuters Corporation

89.72

2.1

45,650

13.5

28.7

0.37

GABC

German American Bancorp, Inc.

30.68

2.1

808

13.9

29.4

0.84

CPKF

Chesapeake Financial Shares, Inc. (Maryland)

26.55

2.1

107

9.6

20.7

0.21

TRCO

Tribune Media Co.

46.52

2.2

4,111

11.2

24.2

0.22

OSGCF

OSG Corp. (6136)

19.90

2.2

1,950

13.8

29.8

0.00

AWTRF

Air Water Inc.

16.72

2.2

3,275

13.0

28.1

0.01

AFL

Aflac, Inc.

49.74

2.2

36,367

12.1

26.1

0.69

WVFC

WVS Financial Corp.

16.68

2.2

32

10.6

22.9

-0.02

BPOP

Popular, Inc.

52.26

2.2

4,940

8.9

19.1

0.84

KUBTF

Kubota Corp.

13.83

2.3

16,982

12.8

29.0

0.02

LLY

Eli Lilly & Co.

111.85

2.2

107,134

26.6

57.9

0.65

CRI

Carter's, Inc.

92.18

2.1

4,035

15.0

31.7

0.96

BWA

BorgWarner, Inc.

32.66

2.1

6,571

8.8

18.8

1.22

EBCOF

Ebara Corp.

24.65

2.2

2,363

14.6

31.9

-0.14

ULH

Universal Logistics Holdings, Inc.

20.73

2.1

580

9.6

19.7

1.25

HSII

Heidrick & Struggles International, Inc.

26.59

2.1

505

9.4

19.8

1.09

QNTQY

QinetiQ Group plc

13.35

2.2

12.6

27.8

0.03

DNG.TO

Dynacor Gold Mines Inc.

2.00

2.2

77

20.2

43.4

-0.68

VRTS

Virtus Investment Partners, Inc.

104.92

2.2

708

10.7

23.0

1.21

LRCX

Lam Research Corp.

209.21

2.2

29,380

14.6

31.5

1.50

LBC

Luther Burbank Corp.

10.60

2.2

591

12.9

28.1

0.64

CPHC

Canterbury Park Holding Corp.

12.45

2.2

57

11.2

25.3

0.23

WAFD

Washington Federal, Inc.

35.28

2.2

2,753

13.7

30.1

0.79

TRI

Thomson Reuters Corp.

68.50

2.2

33,788

70.6

156.3

0.54

SWPIF

Sawai Pharmaceutical Co., Ltd.

54.86

2.2

2,401

13.0

28.9

-0.02

RS

Reliance Steel & Aluminum Co.

97.51

2.2

6,360

11.0

24.1

0.95

ARCH

Arch Coal, Inc.

75.20

2.3

1,204

3.9

9.1

0.89

RHI

Robert Half International, Inc.

53.54

2.2

6,248

13.9

31.0

1.34

KFRC

Kforce, Inc.

32.81

2.2

792

15.2

33.4

0.88

EBTC

Enterprise Bancorp, Inc.

28.61

2.2

326

10.8

23.9

0.86

TKGSF

Tokyo Gas Co., Ltd.

24.20

2.2

10,506

14.6

32.7

0.04

HTHIF

Hitachi Ltd.

34.25

2.2

33,094

15.2

34.1

0.21

RVSB

Riverview Bancorp, Inc.

7.11

2.3

161

9.4

21.3

0.78

ACU

Acme United Corp.

20.85

2.3

69

14.4

32.6

0.53

HBCP

Home Bancorp, Inc.

35.85

2.2

337

10.6

23.7

0.49

LTXB

LegacyTexas Financial Group, Inc.

40.25

2.2

1,922

12.2

27.2

1.00

BAC

Bank of America Corp.

27.27

2.2

249,927

9.6

21.5

1.09

SMMF

Summit Financial Group, Inc. (West Virginia)

24.86

2.3

310

10.4

23.3

0.78

FFH.TO

Fairfax Financial Holdings Limited

589.95

2.3

16,498

19.7

44.8

0.91

FABK

First Advantage Bancorp

24.52

2.3

89

13.2

30.1

0.09

DNTUF

Dentsu, Inc.

35.43

2.3

9,987

14.5

33.3

-0.16

EBMT

Eagle Bancorp Montana, Inc.

16.28

2.3

104

13.0

29.5

0.26

FMBH

First Mid Bancshares, Inc.

31.90

2.3

532

12.2

27.5

0.74

TSBK

Timberland Bancorp, Inc. (Washington)

24.92

2.2

207

9.1

20.5

0.66

ALK

Alaska Air Group, Inc.

59.78

2.3

7,240

14.6

33.2

0.96

GSY.TO

goeasy Ltd.

52.96

2.4

776

12.0

28.6

1.88

BANF

BancFirst Corp. (Oklahoma)

53.31

2.3

1,714

13.2

30.3

0.84

MBCN

Middlefield Banc Corp.

47.81

2.3

155

11.9

27.9

0.55

GSBC

Great Southern Bancorp, Inc. (Missouri)

56.22

2.3

789

10.5

24.3

0.81

FBSS

Fauquier Bankshares, Inc.

20.60

2.3

77

12.8

29.8

0.11

SOI

Solaris Oilfield Infrastructure, Inc.

13.84

2.2

648

7.6

16.8

1.47

SONA

Southern National Bancorp of Virginia, Inc.

14.63

2.4

348

11.0

26.0

0.61

MLR

Miller Industries, Inc. (Tennessee)

31.29

2.3

353

9.2

21.3

0.72

BLMN

Bloomin' Brands, Inc.

16.80

2.3

1,433

14.1

32.5

0.70

COP

ConocoPhillips

52.65

2.3

57,671

8.4

19.5

1.12

JEF

Jefferies Financial Group, Inc.

18.71

2.3

5,457

49.1

114.6

1.21

CWCO

Consolidated Water Co. Ltd.

14.55

2.3

218

18.1

42.3

0.33

MOV

Movado Group, Inc.

20.19

2.8

489

8.2

22.7

0.75

ALB

Albemarle Corp.

60.53

2.4

6,287

11.8

27.8

1.31

FCCO

First Community Corp. (South Carolina)

17.95

2.3

133

12.5

29.1

0.50

PKE

Park Aerospace Corp.

17.13

2.4

346

33.2

78.5

0.48

VSBN

VSB Bancorp, Inc.

20.12

2.4

36

11.6

27.8

0.10

SYX

Systemax, Inc.

20.03

2.3

737

20.1

46.9

1.17

RBCAA

Republic Bancorp, Inc. (Kentucky)

42.97

2.4

890

11.7

27.8

0.88

QNTO

Quaint Oak Bancorp, Inc.

12.55

2.4

25

10.8

25.8

0.14

PIAIF

Ping An Insurance (Group) Co. of China Ltd.

11.40

2.4

207,938

9.7

22.9

0.54

PFBC

Preferred Bank (California)

49.89

2.3

753

10.1

23.6

0.92

WNC

Wabash National Corp.

13.72

2.4

726

12.3

29.0

1.04

VSH

Vishay Intertechnology, Inc.

15.75

2.4

2,149

7.6

17.8

1.51

SGB

Southwest Georgia Financial Corp.

19.91

2.4

50

10.5

25.3

0.16

AIT

Applied Industrial Technologies, Inc.

52.98

2.4

1,995

14.2

33.9

1.13

PSO

Pearson Plc

10.16

2.4

13.6

33.0

0.51

IOCJY

Iochpe-Maxion SA

1.80

2.4

9.2

22.3

0.03

UNTN

United Tennessee Bankshares, Inc.

22.10

2.4

18

10.9

26.5

-0.02

SHBI

Shore Bancshares, Inc.

15.36

2.4

196

8.0

19.2

0.68

FFNW

First Financial Northwest, Inc.

13.37

2.5

138

13.4

33.0

0.47

SRCE

1st Source Corp.

44.45

2.4

1,112

13.3

31.7

0.91

DXC

DXC Technology Co.

32.81

2.5

8,335

7.7

19.0

1.41

ITOCY

ITOCHU Corp.

39.14

2.5

8.3

20.5

0.47

NUVR

Nuvera Communications, Inc.

19.85

2.5

103

10.5

25.9

0.11

AMLLF

AEON Mall Co., Ltd.

13.88

2.5

3,157

10.4

25.8

0.00

TILE

Interface, Inc.

10.87

2.5

618

12.6

31.0

1.10

QNTQF

QinetiQ Group plc

3.44

2.5

1,942

13.0

32.6

-0.02

HBB

Hamilton Beach Brands Holding Co.

13.78

2.5

128

9.3

23.1

0.86

JCI

Johnson Controls International Plc

42.66

2.4

33,849

67.5

165.0

0.80

IBKC

IBERIABANK Corp.

69.13

2.4

3,584

9.0

21.9

0.92

CRHCF

CRH Plc

31.89

2.5

25,407

15.7

40.0

0.28

UCBI

United Community Banks, Inc.

26.35

2.5

2,056

12.0

29.5

0.86

KTHN

Katahdin Bankshares Corp.

17.65

2.5

60

7.9

19.7

-0.04

DAL

Delta Air Lines, Inc.

57.85

2.5

36,853

8.6

21.2

0.98

UVE

Universal Insurance Holdings, Inc.

24.28

2.7

822

7.8

20.6

0.66

HLKHF

HELLA GmbH & Co. KGaA

47.20

2.5

5,244

7.3

18.2

0.32

GATX

GATX Corp.

73.72

2.5

2,597

13.2

32.6

1.19

IMO

Imperial Oil Ltd.

24.66

2.5

18,543

8.2

20.2

0.73

EPWDF

Electric Power Development Co., Ltd.

27.00

2.5

4,942

13.7

34.3

0.00

TFIFF

TFI International, Inc.

28.61

2.5

2,378

10.3

25.3

0.42

MALJF

Magellan Aerospace Corp.

11.55

2.5

672

9.9

24.8

0.22

INDB

Independent Bank Corp. (Massachusetts)

67.55

2.5

2,286

15.3

37.7

0.90

FMNB

Farmers National Banc Corp.

13.89

2.5

377

11.4

28.5

0.79

SNA

Snap-On, Inc.

148.72

2.5

8,075

11.9

29.8

1.03

CDPYF

Canadian Apartment Properties Real Estate Investment Trust

40.13

2.5

6,413

6.4

16.2

0.21

NPEXF

Nippon Express Co., Ltd.

55.20

2.5

5,221

12.8

32.3

0.00

RUTH

Ruth's Hospitality Group, Inc.

19.90

2.4

590

14.0

34.3

0.62

BXS

BancorpSouth Bank

27.51

2.5

2,751

12.5

31.5

0.92

CMCT

CIM Commercial Trust Corp.

19.70

2.5

866

2.6

6.7

0.44

FNCB

FNCB Bancorp, Inc.

7.49

2.5

154

9.4

23.3

0.59

PB

Prosperity Bancshares, Inc.

64.73

2.5

4,366

13.7

34.4

0.84

CSBB

CSB Bancorp, Inc. (Ohio)

40.00

2.6

109

10.9

27.8

0.05

TFII.TO

TFI International Inc.

37.90

2.5

3,209

10.6

26.9

1.54

EWBC

East West Bancorp, Inc.

40.31

2.5

5,664

8.9

22.0

1.17

MRLN

Marlin Business Services Corp.

22.17

2.5

270

11.6

29.4

0.63

ALPMF

Astellas Pharma, Inc.

13.44

2.6

25,349

12.7

32.3

0.08

MAL.TO

Magellan Aerospace Corporation

15.46

2.6

912

10.0

25.5

0.41

TOWN

TowneBank

26.49

2.5

1,879

13.6

34.4

0.90

CHMG

Chemung Financial Corp.

41.74

2.5

200

9.2

23.0

0.67

IPXHF

INPEX Corp.

8.44

2.6

12,324

12.5

32.3

0.05

TMP

Tompkins Financial Corp.

78.73

2.5

1,174

15.0

38.2

0.71

THFF

First Financial Corp. (Indiana)

40.84

2.5

557

11.2

28.6

0.80

FBIZ

First Business Financial Services, Inc.

22.48

2.6

194

9.0

23.3

0.58

CIB

Bancolombia SA

49.52

2.6

11.3

29.3

0.93

MFSF

MutualFirst Financial, Inc.

30.23

2.6

257

12.0

30.9

0.75

WTBCF

Whitbread Plc

50.15

2.6

6,679

20.2

52.7

0.00

LKFN

Lakeland Financial Corp. (Indiana)

42.28

2.6

1,068

12.6

32.6

0.79

ESSA

ESSA Bancorp, Inc.

15.16

2.6

172

13.7

35.2

0.32

GBT.TO

BMTC Group Inc.

10.42

2.6

359

9.7

25.4

1.24

CCNE

CNB Financial Corp. (Pennsylvania)

26.60

2.6

399

10.8

28.1

0.84

AMTD

TD Ameritrade Holding Corp.

43.88

2.6

23,367

11.6

30.3

1.02

SZKBF

The Shizuoka Bank, Ltd.

7.60

2.6

4,361

12.2

31.8

0.21

FFMR

First Farmers Financial Corp.

44.00

2.5

314

11.3

28.2

0.29

CAR.UN.TO

Canadian Apartment Properties Real Estate Investment Trust

53.21

2.6

8,530

6.5

16.9

0.55

HBNC

Horizon Bancorp, Inc. (Indiana)

16.46

2.6

728

12.4

32.1

0.75

STLC.TO

Stelco Holdings Inc.

10.83

3.7

970

3.4

12.7

0.00

FRME

First Merchants Corp. (Indiana)

35.88

2.6

1,754

10.9

28.3

0.94

FMBI

First Midwest Bancorp, Inc. (Illinois)

19.26

2.6

2,077

10.9

28.4

0.98

RNST

Renasant Corp.

32.65

2.6

1,869

11.1

29.1

1.02

SGC

Superior Group of Cos., Inc.

14.59

2.7

222

13.7

37.7

0.76

ACCO

ACCO Brands Corp.

9.36

2.6

907

9.1

23.5

0.81

HDI.TO

Hardwoods Distribution Inc.

11.40

2.7

246

8.7

23.1

1.64

MAN

ManpowerGroup, Inc.

81.47

2.6

4,820

10.2

26.5

1.15

SFNC

Simmons First National Corp.

24.05

2.6

2,279

10.5

27.5

0.95

THYCF

Taiheiyo Cement Corp.

27.06

2.7

3,311

8.7

23.1

0.02

CIT

CIT Group, Inc.

42.72

2.6

3,955

9.6

25.2

1.13

IBOC

International Bancshares Corp.

35.48

2.6

2,284

11.1

29.2

1.00

SYF

Synchrony Financial

32.25

2.6

21,210

6.7

17.6

0.96

HFWA

Heritage Financial Corp. (Washington)

26.19

2.6

954

15.0

39.3

0.92

INTC

Intel Corp.

46.99

2.7

202,849

10.8

28.9

1.19

CATC

Cambridge Bancorp

74.00

2.7

358

13.9

37.9

0.33

PKBK

Parke Bancorp, Inc.

21.73

2.7

235

8.4

22.2

0.50

UBOH

United Bancshares, Inc. (Ohio)

18.71

2.7

61

7.4

19.7

0.29

LEA

Lear Corp.

108.44

2.7

6,499

7.8

21.2

0.96

MATW

Matthews International Corp.

29.83

2.7

927

15.1

40.5

0.89

EQH

AXA Equitable Holdings, Inc.

20.54

2.7

9,857

10.7

28.7

1.21

BOKF

BOK Financial Corp.

76.15

2.7

5,297

11.3

30.3

0.94

NTRS

Northern Trust Corp.

87.37

2.7

18,291

13.2

35.5

1.07

TROW

T. Rowe Price Group, Inc.

109.88

2.7

25,386

13.6

36.9

1.23

BBY

Best Buy Co., Inc.

62.77

2.7

18,425

11.2

30.0

1.24

BMBLF

Brambles Ltd.

7.60

2.7

12,074

23.2

63.2

0.24

BK

The Bank of New York Mellon Corp.

41.98

2.7

38,696

10.9

29.6

0.76

EVR

Evercore, Inc.

78.79

2.7

3,068

8.8

23.8

1.35

MPB

Mid Penn Bancorp, Inc.

23.62

2.7

200

13.0

34.6

0.67

OVBC

Ohio Valley Banc Corp.

31.71

2.7

149

15.2

40.9

1.15

NWIN

NorthWest Indiana Bancorp

44.00

2.8

151

13.6

37.4

0.08

TYHOF

Toyota Tsusho Corp.

32.85

2.7

11,558

9.1

24.9

0.00

RCL

Royal Caribbean Cruises Ltd.

104.62

2.7

21,622

11.8

32.1

1.26

MNAT

Marquette National Corp.

31.82

2.8

142

12.7

35.2

0.06

BKU

BankUnited, Inc.

31.75

2.7

2,953

11.1

30.0

0.80

WOR

Worthington Industries, Inc.

34.67

2.7

1,918

12.9

34.9

1.32

TYIDF

Toyota Industries Corp.

50.66

2.8

15,729

11.4

31.5

0.05

MCBC

Macatawa Bank Corp.

10.02

2.8

333

11.5

31.9

0.75

PEP

PepsiCo, Inc.

135.99

2.8

189,018

15.0

41.4

0.46

IMO.TO

Imperial Oil Limited

32.40

2.8

25,004

8.2

22.7

1.38

CVLY

Codorus Valley Bancorp, Inc.

22.16

2.8

208

11.5

32.1

0.53

MTB

M&T Bank Corp.

148.08

2.8

19,430

10.6

29.1

0.76

KNL

Knoll, Inc.

23.09

2.7

1,135

13.3

36.2

0.91

FCBC

First Community Bancshares, Inc. (Virginia)

32.48

2.7

500

13.5

37.2

0.68

TYTMF

Tokyo Tatemono Co., Ltd.

12.23

2.8

2,556

10.3

28.7

0.02

JFROF

J. FRONT RETAILING Co., Ltd.

11.30

2.8

2,957

12.4

34.8

0.06

TSCDY

Tesco Plc

8.02

2.7

15.0

41.2

0.36

LNC

Lincoln National Corp.

52.90

2.8

10,345

7.4

20.5

1.32

FDEF

First Defiance Financial Corp.

26.40

2.8

512

11.3

31.3

0.84

TRBAB

Tribune Media Co.

35.61

2.8

3,148

8.6

24.2

0.00

MOFG

MidWestOne Financial Group, Inc.

29.56

2.7

468

11.8

32.6

0.94

STBI

Sturgis Bancorp, Inc.

21.00

2.8

51

9.2

25.9

0.20

BSRR

Sierra Bancorp

24.64

2.8

376

11.5

31.9

0.80

ACNB

ACNB Corp.

33.40

2.8

236

9.9

28.0

0.69

ALRS

Alerus Financial Corp.

19.70

2.8

272

9.6

26.9

0.05

BDORY

Banco do Brasil SA

10.54

2.8

8.5

24.1

0.63

KTYB

Kentucky Bancshares, Inc.

23.12

2.8

138

11.2

31.7

0.12

TRMK

Trustmark Corp.

33.00

2.8

2,098

14.7

41.4

0.83

CFX.TO

Canfor Pulp Products Inc.

8.79

2.8

581

7.3

20.8

1.62

SYBT

Stock Yards Bancorp, Inc.

36.72

2.8

818

13.7

38.4

0.73

TCN.TO

Tricon Capital Group Inc.

9.93

2.9

1,917

13.2

37.9

0.72

DCOM

Dime Community Bancshares, Inc.

19.88

2.8

706

14.8

42.2

0.71

BELFB

Bel Fuse, Inc.

10.85

2.9

117

6.6

19.4

1.46

HOMB

Home Bancshares, Inc. (Arkansas)

17.67

2.8

2,912

10.3

28.9

0.95

KMT

Kennametal, Inc.

29.56

2.8

2,361

10.1

28.1

1.57

NHOLF

Sompo Holdings, Inc.

40.75

2.9

15,089

13.9

40.1

-0.01

MGA

Magna International, Inc.

50.05

2.8

15,274

6.4

18.2

1.02

CDCTF

GOLDCREST Co., Ltd.

18.81

2.9

663

7.8

22.4

1.26

PFIN

P&F Industries, Inc.

7.02

2.8

22

3.7

10.4

0.01

FAF

First American Financial Corp.

58.91

2.9

6,521

12.3

35.6

0.78

CBKM

Consumers Bancorp, Inc.

17.95

2.9

49

8.8

25.5

0.19

USB

U.S. Bancorp

52.43

2.9

81,281

12.3

35.3

0.73

CZFS

Citizens Financial Services, Inc.

58.11

3.0

204

11.2

33.6

0.07

ANAT

American National Insurance Co.

113.83

2.9

3,040

7.4

21.5

0.71

CDNAF

Canadian Tire Corp. Ltd.

101.47

2.9

6,256

12.5

36.3

0.16

WSBF

Waterstone Financial, Inc.

16.64

2.9

452

14.6

42.5

0.34

EVBN

Evans Bancorp, Inc.

34.05

2.9

168

9.5

27.4

0.64

C

Citigroup, Inc.

63.98

2.9

140,874

8.9

25.6

1.22

LYBC

Lyons Bancorp, Inc.

41.00

2.9

122

12.5

36.6

-0.06

AMP

Ameriprise Financial, Inc.

128.61

2.9

16,469

9.4

27.3

1.45

UCFC

United Community Financial Corp.

9.73

2.9

462

12.5

36.6

0.68

TKR

The Timken Co.

39.53

2.9

2,951

9.6

27.6

1.29

RMR

The RMR Group, Inc.

46.94

2.9

1,410

10.2

29.5

1.38

STAR

iStar, Inc.

12.74

2.9

790

3.8

11.1

0.52

CAC

Camden National Corp. (Maine)

41.87

2.9

635

11.8

34.3

0.82

YORUF

The Yokohama Rubber Co., Ltd.

18.79

3.0

3,014

9.7

28.9

0.16

SAL

Salisbury Bancorp, Inc.

37.52

3.0

105

10.5

31.3

0.22

MPC.TO

Madison Pacific Properties Inc.

3.55

3.0

184

6.2

18.3

0.20

TSCDF

Tesco Plc

2.65

2.8

25,952

14.9

42.3

0.04

SOHVF

Sumitomo Heavy Industries, Ltd.

34.00

3.0

4,165

10.6

31.5

0.00

BMTC

Bryn Mawr Bank Corp.

34.42

3.0

681

11.5

34.1

0.79

TGOPY

3i Group Plc

6.84

2.8

8.1

23.0

0.65

EAF

GrafTech International Ltd.

11.90

2.9

3,396

4.2

12.3

1.92

BNE.TO

Bonterra Energy Corp.

4.25

3.0

142

7.3

21.8

1.09

NBTB

NBT Bancorp, Inc.

34.87

3.0

1,514

12.9

38.4

0.76

GTMEY

Globe Telecom, Inc.

35.22

3.0

12.3

37.1

0.01

WTSHF

Westshore Terminals Investment Corp.

16.08

3.0

1,072

11.1

33.5

0.21

MS

Morgan Stanley

41.40

3.0

66,738

8.9

26.5

1.20

BTU

Peabody Energy Corp.

17.91

3.0

1,803

4.2

12.5

1.02

CNA

CNA Financial Corp.

46.81

3.0

12,595

14.6

44.0

0.71

VIA

Viacom, Inc.

27.57

3.0

10,831

6.8

20.3

0.87

MIELF

Mitsubishi Electric Corp.

11.96

3.0

25,655

12.8

38.8

0.18

JPM

JPMorgan Chase & Co.

109.49

3.0

341,491

11.1

33.4

0.92

DWAHF

Daiwa House Industry Co., Ltd.

34.00

3.0

22,570

10.0

30.4

0.00

WTE.TO

Westshore Terminals Investment Corporation

21.19

3.0

1,423

11.2

34.0

0.94

AEGXF

Aecon Group, Inc.

13.75

3.0

835

13.6

40.2

0.26

CAT

Caterpillar, Inc.

117.40

3.0

64,618

10.8

32.4

1.38

LCII

LCI Industries, Inc.

84.33

3.0

2,040

15.6

46.7

1.28

ZION

Zions Bancorporation NA

41.01

3.0

7,082

9.3

28.0

0.92

ASGLF

AGC, Inc. (Japan)

35.40

3.0

7,842

11.9

36.1

0.02

ENBP

ENB Financial Corp. (Pennsylvania)

19.20

3.1

218

10.4

32.3

0.04

APYRF

Allied Properties Real Estate Investment Trust

39.10

3.1

4,546

9.2

28.0

-0.11

BANR

Banner Corp.

53.87

3.0

1,826

12.4

37.0

0.90

JW.B

John Wiley & Sons, Inc.

43.16

3.1

2,437

14.7

44.8

0.52

BRKL

Brookline Bancorp, Inc.

14.09

3.0

1,106

13.0

39.5

0.81

HFC

HollyFrontier Corp.

44.25

3.0

7,132

8.2

24.9

1.35

JW.A

John Wiley & Sons, Inc.

44.54

3.0

2,457

15.1

45.9

0.88

PFIS

Peoples Financial Services Corp.

44.30

3.0

327

12.3

37.2

0.48

ALC.TO

Algoma Central Corporation

13.22

3.0

507

11.5

34.8

0.78

BELFA

Bel Fuse, Inc.

9.20

3.0

113

6.4

19.6

0.90

TKOMF

Tokio Marine Holdings, Inc.

52.72

3.1

37,201

14.6

45.0

-0.08

CTC.A.TO

Canadian Tire Corporation, Limited

134.84

3.1

8,670

12.1

37.1

0.74

MDC

M.D.C. Holdings, Inc.

37.34

3.1

2,296

11.3

34.4

0.71

TOYOF

Toyota Motor Corp.

63.89

3.1

180,446

10.6

33.1

0.32

MG.TO

Magna International Inc.

65.12

3.0

20,885

8.4

25.0

1.66

PFB.TO

PFB Corporation

10.12

3.6

68

9.6

34.3

0.30

BOH

Bank of Hawaii Corp.

82.08

3.1

3,297

14.9

45.7

0.67

AP.UN.TO

Allied Properties Real Estate Investment Trust

52.06

3.1

6,044

9.4

28.9

0.34

WYNN

Wynn Resorts Ltd.

105.77

3.1

11,334

13.7

42.2

1.77

WEGRY

The Weir Group Plc

8.52

3.1

143.2

443.0

1.09

NWFL

Norwood Financial Corp.

30.75

3.1

190

14.0

43.4

0.73

AIV

Apartment Investment & Management Co.

50.91

3.1

7,530

22.3

69.4

0.47

SC

Santander Consumer USA Holdings, Inc.

26.18

3.1

8,916

9.7

30.2

0.98

CFFI

C&F Financial Corp.

47.71

3.1

162

8.9

27.6

0.78

FCF

First Commonwealth Financial Corp. (Pennsylvania)

12.39

3.1

1,200

11.8

36.7

1.02

SKUYF

Sansei Technologies, Inc.

10.04

3.1

185

9.0

28.2

-0.05

CPF

Central Pacific Financial Corp.

27.67

3.1

787

13.2

41.2

0.72

MAWHY

Man Wah Holdings Ltd.

8.55

3.2

9.4

29.7

0.00

CKSNF

Vesuvius Plc

8.20

3.2

2,205

13.6

43.1

0.00

STBA

S&T Bancorp, Inc.

34.49

3.1

1,173

11.2

34.8

0.75

ONB

Old National Bancorp

16.99

3.1

2,874

13.0

40.6

0.95

BRTHF

Brother Industries, Ltd.

17.10

3.2

4,442

9.8

31.2

-0.06

CFY.V

CF Energy Corp.

0.65

3.2

44

5.5

17.3

-0.88

BHLB

Berkshire Hills Bancorp, Inc.

29.50

3.1

1,315

14.6

45.4

0.86

HWC

Hancock Whitney Corp.

35.27

3.1

2,950

8.8

27.7

1.01

MHVYF

Mitsubishi Heavy Industries, Ltd.

36.22

3.2

12,163

13.1

42.4

0.09

CVBF

CVB Financial Corp.

20.56

3.2

2,840

15.0

47.4

0.82

TVK.TO

TerraVest Industries Inc.

12.50

3.2

212

9.5

30.2

0.52

FIBK

First Interstate BancSystem, Inc. (Montana)

38.46

3.1

2,453

14.5

45.4

0.78

CMI

Cummins, Inc.

149.03

3.1

22,973

9.1

28.4

1.05

FLIC

The First of Long Island Corp.

21.85

3.2

528

13.2

42.0

0.77

SNV

Synovus Financial Corp.

35.72

3.2

5,357

10.4

33.1

1.06

AGESY

ageas SA/NV

53.40

3.2

11.0

35.3

0.51

HI

Hillenbrand, Inc.

27.14

3.1

1,678

12.1

37.8

1.04

CMC

Commercial Metals Co.

15.71

3.1

1,803

11.3

35.5

1.45

OCFC

OceanFirst Financial Corp.

21.36

3.2

1,066

11.4

36.3

0.72

UVSP

Univest Financial Corp.

25.45

3.2

733

11.3

36.2

0.82

AGM

Federal Agricultural Mortgage Corp.

82.40

3.2

868

9.1

28.8

0.94

MTGRY

Mount Gibson Iron Ltd.

7.42

3.2

8.8

28.2

0.13

LBAI

Lakeland Bancorp, Inc.

15.01

3.2

746

11.3

36.0

0.78

NRIM

Northrim BanCorp, Inc.

35.77

3.2

238

13.1

41.9

0.78

VABK

Virginia National Bankshares Corp.

36.00

3.2

96

13.4

43.0

0.10

WBS

Webster Financial Corp.

44.10

3.2

3,981

10.4

33.6

1.05

PKG

Packaging Corporation of America

99.70

3.2

9,324

11.9

38.2

1.08

KMP.UN.TO

Killam Apartment Real Estate Investment Trust

20.45

3.2

1,866

10.3

33.3

0.43

ISUZF

Isuzu Motors Ltd.

10.30

3.2

7,596

8.2

26.7

0.17

TBNK

Territorial Bancorp, Inc.

27.34

3.2

264

12.0

38.7

0.38

EFSI

Eagle Financial Services, Inc.

29.80

3.3

102

11.9

38.8

0.26

SPB

Spectrum Brands Holdings, Inc.

54.50

3.2

2,568

-5.4

-17.4

0.97

FULT

Fulton Financial Corp.

15.85

3.2

2,590

11.4

36.5

0.89

WAYN

Wayne Savings Bancshares, Inc.

20.51

3.3

57

9.0

29.4

0.24

JEHLY

Johnson Electric Holdings Ltd.

17.60

3.3

5.4

17.7

-0.16

TAP

Molson Coors Brewing Co.

51.28

3.2

11,063

12.4

39.7

0.63

AROW

Arrow Financial Corp.

32.07

3.2

465

13.0

41.8

0.69

VIAB

Viacom, Inc.

25.28

3.2

10,016

6.2

20.1

0.98

GGB

Gerdau SA

2.97

3.2

9.8

31.7

1.11

TDBOF

Toyota Boshoku Corp.

15.36

3.3

2,852

14.4

47.3

0.00

OBYCF

Obayashi Corp.

8.77

3.3

6,293

5.9

19.5

0.01

ACLLF

ATCO Ltd.

35.92

3.3

4,119

10.5

34.4

0.04

STLD

Steel Dynamics, Inc.

27.24

3.2

5,830

5.8

18.8

1.12

CHBH

Croghan Bancshares, Inc.

54.00

3.3

123

10.7

35.4

0.09

OMC

Omnicom Group, Inc.

76.10

3.3

16,444

12.7

42.1

0.73

IAG.TO

iA Financial Corporation Inc.

54.69

3.3

6,036

9.2

30.5

1.53

BKRIY

Bank of Ireland Group Plc

3.80

3.3

5.6

18.6

0.27

JCYGY

Jardine Cycle & Carriage Ltd.

49.55

3.3

14.5

48.2

0.04

TPX.B.TO

Molson Coors Canada Inc.

69.57

3.4

15,974

-42.2

-142.1

0.80

EDUC

Educational Development Corp.

5.94

3.4

50

7.8

26.4

0.48

DACHF

Daicel Corp.

8.65

3.3

2,812

10.7

35.6

0.14

TPX.A.TO

Molson Coors Canada Inc.

72.25

3.3

15,752

-43.8

-142.3

-0.19

SAFT

Safety Insurance Group, Inc.

97.07

3.3

1,478

14.3

47.7

0.67

STI

SunTrust Banks, Inc.

61.43

3.3

26,986

10.7

35.3

0.86

MBWM

Mercantile Bank Corp.

31.66

3.3

495

11.6

38.7

0.82

HOFT

Hooker Furniture Corp.

17.77

3.3

206

6.0

20.0

1.03

BKSC

Bank of South Carolina Corp.

18.47

3.4

102

14.3

48.0

-0.07

FHN

First Horizon National Corp. (Tennessee)

15.79

3.4

4,843

8.8

29.6

0.78

CFR

Cullen/Frost Bankers, Inc.

82.52

3.3

5,125

11.5

38.3

0.91

NUE

Nucor Corp.

48.66

3.3

14,339

6.9

22.9

1.10

ENRFF

Enerflex Ltd.

9.06

3.4

812

8.4

28.7

0.28

LARK

Landmark Bancorp, Inc. (Kansas)

23.00

3.4

100

9.8

33.3

0.20

AEO

American Eagle Outfitters, Inc.

17.06

3.3

2,914

11.4

37.1

1.14

FITB

Fifth Third Bancorp

26.30

3.3

18,725

8.8

29.4

0.88

MAWHF

Man Wah Holdings Ltd.

0.45

3.4

1,720

9.9

33.7

0.32

BMY

Bristol-Myers Squibb Co.

47.88

3.3

79,596

12.6

42.1

0.88

DK

Delek US Holdings, Inc.

31.91

3.4

2,351

4.9

16.7

1.74

IBCP

Independent Bank Corp. (Michigan)

19.62

3.4

438

11.1

37.5

0.80

INGR

Ingredion, Inc.

76.08

3.3

4,984

13.2

44.1

0.57

DAN

Dana, Inc.

12.48

3.3

1,767

8.0

26.1

1.58

MFNC

Mackinac Financial Corp.

14.00

3.4

150

11.3

38.8

0.14

NMEHF

Nomura Real Estate Holdings, Inc.

19.80

3.4

3,639

9.8

33.6

0.02

ACO.X.TO

ACO-X.TO - ATCO Ltd.

47.54

3.4

5,446

10.5

35.8

0.52

ACO.Y.TO

ATCO Ltd.

47.40

3.4

5,450

10.5

35.8

0.52

TRMLF

Tourmaline Oil Corp.

9.67

3.3

2,630

7.1

23.4

0.36

MPC.C.TO

Madison Pacific Properties Inc.

3.10

3.4

184

5.4

18.3

-0.28

BUSE

First Busey Corp.

24.68

3.4

1,348

12.5

42.0

0.76

FISI

Financial Institutions, Inc.

29.13

3.4

457

11.7

40.2

0.72

FII

Federated Investors, Inc.

31.77

3.4

3,182

13.4

46.2

0.51

CBWBF

Canadian Western Bank

23.58

3.3

2,056

10.8

36.0

0.41

EV

Eaton Vance Corp.

42.51

3.4

4,692

11.9

40.4

1.22

ORI

Old Republic International Corp.

23.27

3.4

6,964

9.3

32.1

0.84

WHR

Whirlpool Corp.

138.20

3.4

8,723

9.7

32.7

1.14

LFGP

Ledyard Financial Group, Inc.

20.75

3.5

67

12.3

42.6

0.01

MRG.UN.TO

Morguard North American Residential Real Estate Investment Trust

19.49

3.5

650

5.5

19.1

0.29

AHODF

Royal Ahold Delhaize NV

23.01

3.5

26,005

12.7

44.0

0.13

FRAF

Franklin Financial Services Corp. (Pennsylvania)

31.70

3.5

137

9.3

32.4

0.22

BDGE

Bridge Bancorp, Inc.

27.02

3.5

527

12.2

42.4

0.84

AHKSF

Asahi Kasei Corp.

8.80

3.5

12,209

10.1

35.1

0.14

PGR

Progressive Corp.

75.29

3.5

43,766

13.6

47.5

0.96

NTR

Nutrien Ltd.

49.94

3.5

28,208

147.9

510.4

0.99

CWB.TO

Canadian Western Bank

31.19

3.5

2,752

10.8

38.2

1.75

EFX.TO

Enerflex Ltd.

12.02

3.5

1,086

8.4

29.4

0.93

PSX

Phillips 66

97.66

3.4

43,180

8.4

28.8

1.08

SASR

Sandy Spring Bancorp, Inc.

33.67

3.4

1,178

10.6

36.5

0.79

OZK

Bank OZK

25.85

3.4

3,236

8.1

27.7

1.10

HPQ

HP, Inc.

18.24

3.5

26,796

6.7

23.2

1.31

INDOY

Indorama Ventures Public Co. Ltd.

12.26

3.5

9.5

33.2

0.16

BOS.TO

AirBoss of America Corp.

7.53

3.7

178

19.8

73.7

0.21

FGBI

First Guaranty Bancshares, Inc.

18.30

3.5

161

13.0

45.6

0.72

SCHN

Schnitzer Steel Industries, Inc.

22.66

3.4

594

6.0

20.1

1.22

AVX

AVX Corp.

13.59

3.5

2,223

8.5

29.7

1.18

TLKGY

Telkom SA SOC Ltd.

21.86

3.5

13.4

46.9

0.23

PCRFF

Panasonic Corp.

7.75

3.5

18,075

7.3

25.3

0.46

NPPXF

Nippon Telegraph & Telephone Corp.

47.40

3.4

89,134

12.0

41.2

0.33

BOTRF

China Everbright Water Ltd.

0.24

3.5

670

6.9

24.4

0.39

ASB

Associated Banc-Corp

19.30

3.5

3,066

9.6

33.7

0.85

CBT

Cabot Corp.

39.60

3.4

2,252

10.9

37.5

1.36

FFG

FBL Financial Group, Inc.

54.44

3.5

2,650

13.0

45.6

0.66

NRE

NorthStar Realty Europe Corp.

16.92

3.5

851

4.7

16.5

0.52

CPPTF

Circle Property Plc

2.33

3.5

65

3.3

11.8

-0.01

BBT

BB&T Corp.

47.48

3.5

35,703

11.6

40.3

0.75

PDL.TO

North American Palladium Ltd.

15.03

3.5

862

5.3

18.4

2.05

WSBC

WesBanco, Inc.

34.53

3.5

1,868

11.5

40.3

0.79

WBA

Walgreens Boots Alliance, Inc.

50.54

3.5

45,111

9.9

34.8

0.96

ATLO

Ames National Corp.

27.33

3.5

249

14.5

50.4