Updated on August 27th, 2021 by Bob Ciura

The U.S. wireless industry is a gold mine. Consumers love their smartphones and other mobile devices, and their mobile applications, web browsing, and text messaging requires data. Plus, as so many of us are extremely reluctant to go without our devices, wireless service providers hold pricing power and are resistant to economic downturns.

This means the major wireless service providers are highly profitable. The top two operators, Verizon Communications (VZ) and AT&T (T) rule the roost, while T-Mobile US (TMUS) is catching up quickly.

Verizon and AT&T are top picks for income investors, due to their high dividend yields. Both stocks can be found on our list of 137 dividend-paying telecommunications stocks.

This article will discuss the Big 3 wireless stocks in the U.S., based on the Sure Analysis Research Database, which ranks stocks based upon the combination of their dividend yield, earnings-per-share growth potential and valuation multiple change to compute total returns.

Table of Contents

We have ranked our top 3 wireless stocks based in the U.S., according to annual expected returns over the next five years. Our expected return calculation incorporates expected annual earnings-per-share growth, changes in the valuation multiple, and dividend yields.

These wireless stocks are ranked in order of expected returns, from lowest to highest. You can use the following links to instantly jump to any specific stock:

- Wireless Stock #3: T-Mobile US (TMUS)

- Wireless Stock #2: Verizon Communications (VZ)

- Wireless Stock #1: AT&T Inc. (T)

- Final Thoughts

Wireless Stock #3: T-Mobile US (TMUS)

T-Mobile US Inc. was formed through the combination of T-Mobile USA and MetroPCS in 2013. Its parent company is Germany-based telecommunications giant Deutsche Telekom (DTEGY).

On July 26th, 2019 T–Mobile and Sprint announced that they had received clearance from the Department of Justice for a merger to create the new T–Mobile. As a result, T-Mobile is one of the largest wireless stocks in the U.S.

Additionally, an agreement was made with DISH Network (DISH) to divest all of Sprint’s pre–paid businesses including Boost Mobile and Virgin Mobile, along with Sprint’s 800 MHz spectrum licenses for aggregate proceeds of $5 billion.

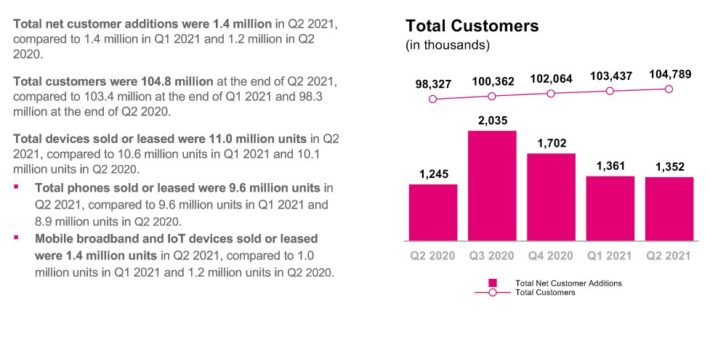

The company now boasts over 104 million customers.

Source: Investor Presentation

We expect 10% annual earnings growth for T-Mobile over the next five years, which may be a conservative estimate.

T–Mobile’s history is short and volatile but has generally grown very quickly since the merger with MetroPCS in 2013. The company has made significant network investments since then and has lured customers away from the established wireless giants – AT&T and Verizon – with attractive incentives. These investments have paid off, as T–Mobile successfully took market share from its larger competitors in the wireless space.

Going forward, T–Mobile’s continued growth could be fueled by the pending merger with Sprint, announced on April 29th, 2018, although this is still waiting completion. In addition, 5G deployment is a growth catalyst for T–Mobile. On December 2nd, 2019 T–Mobile announced America’s first nationwide 5G network.

T-Mobile shareholders have realized annual returns of 24.5% in the past five years. But after such a massive rally, the valuation is likely to come down as the company matures. Shares currently trade for a 2021 P/E of 56, based on average EPS estimates of $2.50 for 2021.

By 2026, we estimate fair value to be a price-to-earnings ratio of 18.0, which is a reasonable valuation due to the company’s earnings growth in the context of a saturated market for wireless stocks.

T-Mobile does not pay a dividend, which could make it unappealing for income investors. Therefore, total returns are expected to be very low, due to the extreme overvaluation of the stock and the lack of a dividend.

Wireless Stock #2: Verizon Communications (VZ)

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is one of the largest wireless stocks in the country. Wireless contributes three–quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

Verizon has now launched 5G Ultra–Wideband in several cities as it continues its rollout of 5G service. Customers in parts of Atlanta, Dallas, Detroit, Indianapolis, Omaha and Washington, D.C. were able to access the company’s 5G network. Verizon is the first of the major carriers to turn on 5G service.

Verizon reported second quarter earnings results on 7/21/2021. Revenue grew 11.2% to $33.8 billion, beating expectations by $1.1 billion. Adjusted earnings–per–share of $1.37 was a 16.1% increase from the prior year and $0.07 ahead of estimates.

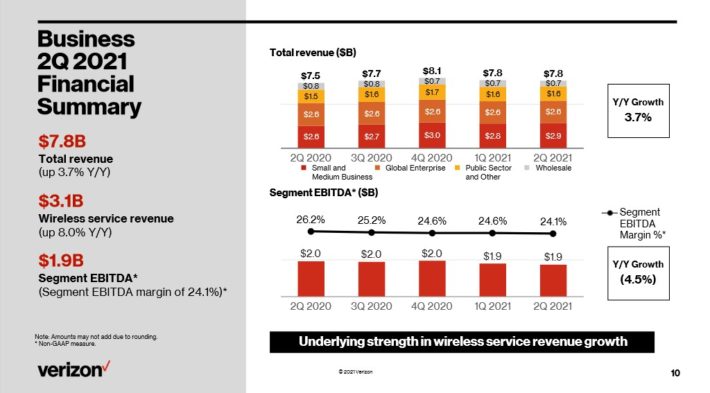

The company’s wireless segment led the way last quarter.

Source: Investor Presentation

Wireless retail postpaid net adds of 528K came in well above consensus estimates of 360K. Net phone additions totaled 275K. On a sequential basis, retail postpaid phone churn was lower by 5 basis points to 0.72. Wireless postpaid phone churn was 0.94%.

Revenue for the consumer segment was higher by 11.2% to $23.5 billion driven by higher 5G–phone adoption and 92K Fios net additions. The trailing year total Fios internet net additions is the highest since 2015. Business revenue grew 3.7% to $7.8 billion due to 178K retail postpaid net additions, including 78K net phone additions.

Verizon offered revised guidance for the year. The company expects adjusted earnings–per–share of $5.25 to $5.35, up from $5.00 to $5.15 previously. Wireless revenue is projected to grow 3.5% to 4%, up from at least 3% previously.

Using the midpoint of guidance ($5.30) shares trade for a 2021 P/E ratio of 10.3, below our fair value estimate of 13. Multiple expansion could boost annual returns by 4.8% per year. In addition, expected EPS growth of 4% and the 4.6% dividend yield, resulting in total expected returns of 13.4%.

Wireless Stock #1: AT&T Inc. (T)

AT&T is a giant among wireless stocks, as its core Communications segment provides mobile, broadband and video to 100 million U.S. consumers and 3 million businesses.

AT&T has increased its dividend for over 30 consecutive years, placing the stock on the exclusive Dividend Aristocrats list.

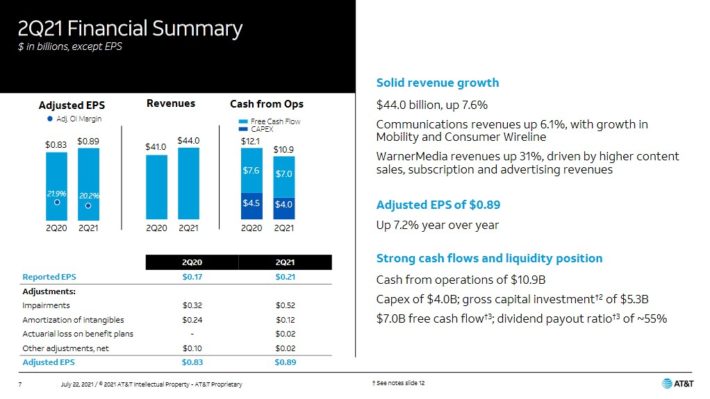

In the 2021 second quarter, AT&T generated $44.0 billion in revenue, up 7.6% from Q2 2020. Adjusted earnings-per-share (EPS) equaled $0.89 compared to $0.83 in the year ago quarter. AT&T ended the quarter with a net debt-to-EBITDA ratio of 3.15x.

Source: Investor Presentation

Reported net income equaled $7.5 billion or $1.04 per share. On an adjusted basis, earnings–per–share equaled $0.86 compared to $0.84 in the year-ago quarter. AT&T ended the quarter with a net debt–to–EBITDA ratio of 3.1x.

AT&T is undergoing massive changes as it seeks to unload its satellite TV and media assets. On February 25th, AT&T announced it will spin off multiple assets into a separate company called New DIRECTV that will own and operate the DirecTV satellite TV business, as well as AT&T TV and U-verse video. AT&T will own 70% of the company, and will sell 30% ownership to TPG for approximately nearly $8 billion, which will be used to pay down debt.

On May 17th, 2021 AT&T announced an agreement to combine WarnerMedia with Discovery, Inc. (DISCA) to create a new global entertainment company. AT&T will receive $43 billion in a combination of cash, securities and retention of debt. AT&T shareholders receive stock representing 71% of the new company, with Discovery shareholders owning 29%.

We believe these various deals with allow AT&T to simplify its operations, become more efficient, and return to its core focus on telecom services such as 5G rollout.

AT&T is optimistic about generating reasonable growth and the payout ratio had been falling, resulting in excess funds to divert toward paying down debt.

AT&T is a high dividend stock with a 7.7% yield.

With a P/E of 8.3, AT&T is undervalued against our fair value estimate of 11. The combination of an expanding P/E multiple, 3% expected EPS growth and the 7.7% dividend yield lead to total expected returns of 16.5% per year over the next five years.

Final Thoughts

Wireless stocks are prized for their high dividend yields and steady growth. They remain attractive for value and income investors today. However, not all wireless stocks are created equal. We believe AT&T and Verizon are far more appealing stocks for value and income investors, due to their modest valuations and high dividend yields. On the other hand, T-Mobile US seems to be significantly overvalued right now.