Updated on August 22nd, 2019 by Josh Arnold

As a business owner, selling products that have high profit margins along with strong brand awareness and an exceptionally loyal customer base is strongly desirable.

The cigarette industry fits this model, despite declines over time in the number of customers that use its products. Tobacco stocks are particularly attractive to income-oriented investors thanks to their generous dividends and defensive characteristics during recession.

You can download a spreadsheet with all our tobacco stocks using the link below:

Furthermore, you can view a preview of our tobacco stocks spreadsheet below:

| MO | Altria Group, Inc. | 46.335 | 6.9 | 86,399 | 13.7 | 95.1 | 0.5 |

| BTI | British American Tobacco plc | 36.6 | 7.0 | 10.5 | 73.4 | 0.5 | |

| IMBBY | Imperial Brands Plc | 25.59 | 9.7 | 11.9 | 115.7 | 0.4 | |

| VGR | Vector Group Ltd. | 12.385 | 13.0 | 1,717 | 22.1 | 285.9 | 0.7 |

| UVV | Universal Corp. | 52.045 | 5.8 | 1,301 | 14.1 | 81.3 | 0.4 |

| PM | Philip Morris International, Inc. | 83.275 | 5.5 | 129,212 | 16.6 | 91.0 | 0.5 |

| PYX | Pyxus International, Inc. | 15.23 | 0.0 | 138 | -1.1 | 0.0 | 1.6 |

| TPB | Turning Point Brands, Inc. | 38.78 | 0.5 | 746 | 23.2 | 10.7 | 0.9 |

| XXII | 22nd Century Group, Inc. | 1.95 | 0.0 | 233 | -19.1 | 0.0 | 1.4 |

| JAPAF | Japan Tobacco Inc. | 20.85 | 6.5 | 36,982 | 10.4 | 68.2 | 0.1 |

| SDI | Standard Diversified, Inc. | 14.826 | 0.0 | 250 | -59.2 | 0.0 | 0.8 |

| Ticker | Name | Price | Dividend Yield | Market Cap ($M) | P/E Ratio | Payout Ratio | Beta |

Table of Contents

In this article, we will analyze the prospects of 6 of the largest tobacco stocks:

- Universal Corp. (UVV)

- Philip Morris (PM)

- British American Tobacco (BTI)

- Vector Group (VGR)

- Altria Group (MO)

- Imperial Brands PLC (IMBBY)

But first, we’ll take a look at the tobacco industry’s primary concern, which is declining tobacco usage.

Industry Overview: Declining Smoking Rates

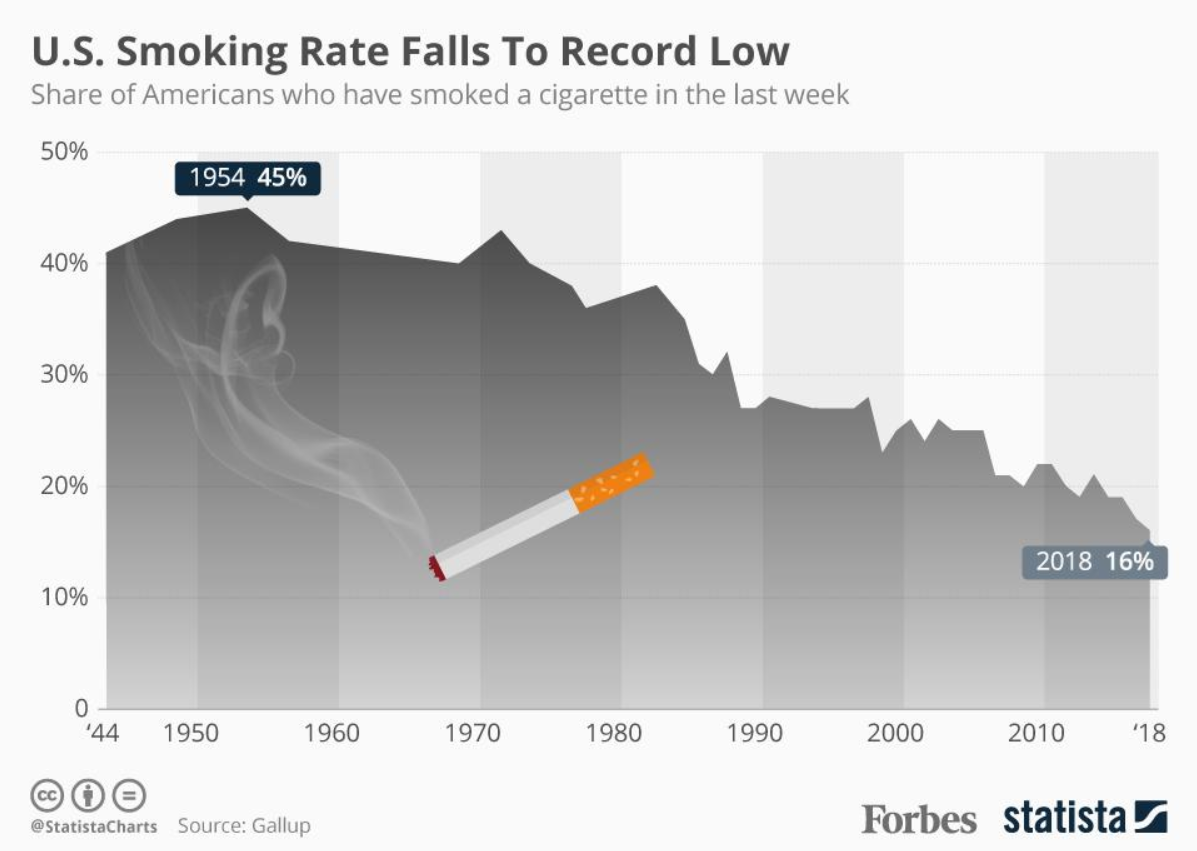

The percent of the U.S. population that smokes is in a continuous decline.

Source: Forbes

As shown in the above chart, the percent of the U.S. smoking adult population has steadily declined from 45% in 1954 to just 16% recently.

An increasing number of U.S. states have significantly raised the tax on cigarettes in order to reduce their budget deficits. Given the deteriorating budgets of many states and the appeal of tax increases on cigarettes, the situation will likely only get worse for tobacco producers.

To make matters worse, most of the world’s smoking population rate looks much the same as the above chart. It has become abundantly clear that consumers around the world are eschewing tobacco products for health concerns.

These negative trends have kept many investors away from tobacco stocks. However, tobacco stocks can still generate solid total returns. The key behind an investment in tobacco stocks is the inelastic demand for cigarettes relative to their price due to the addictive nature of these products.

Tobacco companies have been able to raise their prices to help offset declining smoking rates. As a result, they have exceptional growth records. In addition, population growth partly offsets the effect of the declining percent of smokers.

Tobacco Stock #6: Universal Corporation (UVV)

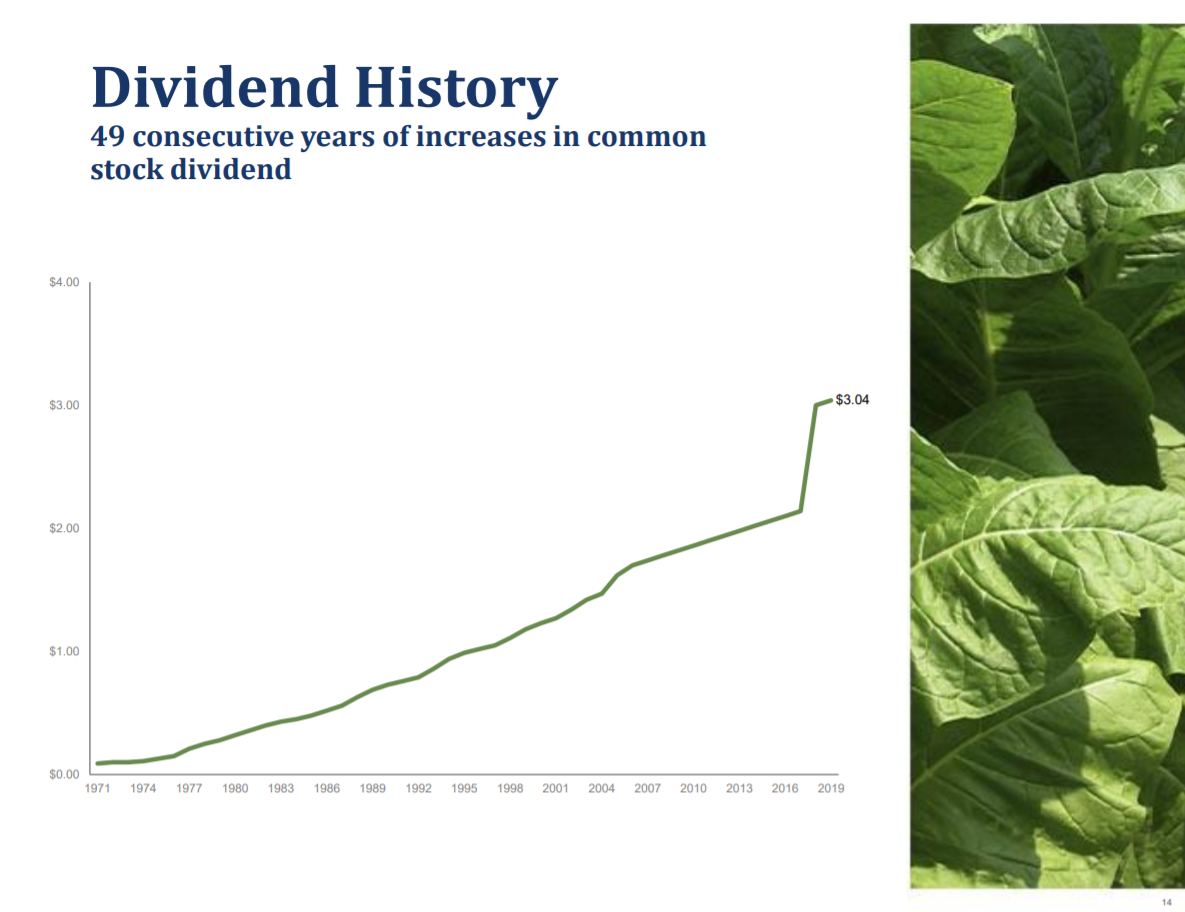

Universal Corporation is the world’s largest leaf tobacco exporter and importer. The company is the wholesale purchaser and processor of tobacco that operates as an intermediary between tobacco farms and the companies that manufacture cigarettes, pipe tobacco, and cigars. Universal Corporation was founded in 1886 and has a market capitalization of $1.3 billion. Universal Corporation has raised its dividend for 49 consecutive years, and is therefore a Dividend Champion.

Source: Investor Presentation

Universal Corporation has exhibited a volatile performance record and has failed to grow its earnings over the last decade. While most investors tend to focus on the near-term growth prospects of a stock and ignore past performance, a consistent growth record is extremely important in investing decisions. As Universal Corporation is the leader in a declining industry, it is prudent to keep growth expectations at a minimum in order to avoid negative surprises in the future.

The stock is currently offering a 5.9% dividend yield, which is about three times the broad market’s average yield, and is in line with the rest of the tobacco stocks in this list. In addition, the stock is now trading at a price-to-earnings ratio of 11.2 after a relatively poor performance thus far in 2019. The stock is now trading near its 10-year average price-to-earnings ratio of 11.4. Given this, the outlook for total returns has improved from recent quarters when the stock was much more expensive.

Overall, Universal Corporation has a much worse performance record than some of the other tobacco stocks mentioned in this article. In addition, the stock, after a recent weak period of performance, is only just trading at fair value. This means that expected total returns in the area of 8% annually make it the least attractive stock in this list.

Tobacco Stock #5: Philip Morris International (PM)

Philip Morris International was spun off from Altria in 2008, and is charged with the production and distribution of Altria’s products outside of the United States. This distribution includes the exceedingly valuable Marlboro brand.

When Philip Morris was spun off from Altria, the former was considered the high-growth entity while the latter was considered the slow-growth company. In the first four years, the spin-off turned out according to expectations. Philip Morris grew its earnings-per-share by 56% whereas Altria grew its earnings-per-share by only 24% in that period.

However, the story has changed since then. Philip Morris has failed to grow its earnings in the last six years. The company has been hurt by a strong dollar, which has negatively affected the conversion of international sales into dollars. Indeed, even our estimate of $5.14 in earnings-per-share for this year is below 2013 earnings of $5.26. It is worth noting that earnings-per-share are moving in the right direction after some significant declines in earlier years, but Philip Morris has a growth problem.

Additionally, in the first years after the spin-off, the company performed extremely aggressive share repurchases even though it was distributing almost all its earnings as dividends. That was a double-edged sword. On the one hand, the share count decreased by 18% in that period and thus provided a significant boost to earnings-per-share and the stock price.

On the other hand, the company’s debt ballooned. The weak balance sheet forced the company to eliminate share repurchases in the last five years. The bottom line was also hurt by higher interest expense. Overall, Philip Morris has failed to grow its earnings in the last five years and thus its stock price has dramatically underperformed the market over this period, as it is down 3% whereas the S&P has rallied 44%, excluding dividends.

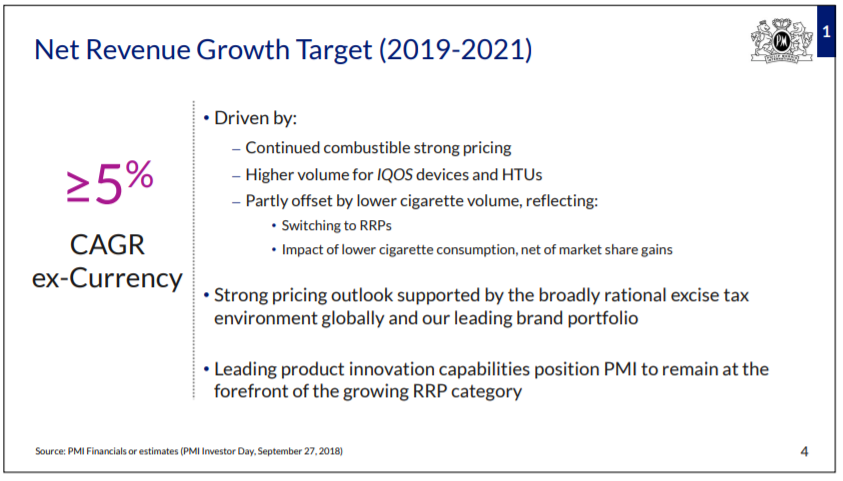

A potential game changer for the company is the expansion of IQOS in new markets. Philip Morris has increased its capital expenses in the last two years in order to develop and manufacture this new product. IQOS has met great success in some markets, such as Japan and Korea, and have helped the company grow its sales meaningfully in recent quarters, even though the volumes of traditional cigarettes have declined. They have also led management to provide rosy guidance for the medium term.

Source: Investor presentation, page 4

Management sees currency-neutral revenue growth in excess of 5% annually, and 8% earnings-per-share growth over the same time frame. Interestingly, Philip Morris has a stated corporate goal of switching all of is users from tobacco products to some sort of smoke-free alternative over time. There aren’t many businesses around the world that are deliberately trying to force its customers off of their core product and into something else.

Philip Morris currently offers an attractive 5.5% dividend yield. The stock is trading at a price-to-earnings ratio of 16.2, which is essentially in line with our fair value estimate of 16.5.

Looking for more Philip Morris dividend safety analysis? See the video below:

On the other hand, thanks to the promising prospects of IQOS, the stock is likely to offer high-single digit returns in the upcoming years, with its shareholders receiving a generous 5.5% dividend while waiting for the growth expectations to materialize.

Tobacco Stock #4: British American Tobacco (BTI)

British American Tobacco is one of the largest tobacco companies in the world, with a market capitalization of $83 billion. British American Tobacco owns the following tobacco brands, among others: Kool, Benson & Hedges, Dunhill, Kent, and Lucky Strike.

Source: Investor presentation, page 7

In July of 2017, the company acquired the remaining 48% stake in Reynolds American Tobacco that it did not already own. Although the company is incorporated in the United Kingdom and headquartered in London, American investors can purchase its stock through American Depository Receipts that trade on the New York Stock Exchange under the ticker BTI. The United Kingdom does not impose a dividend withholding tax on United States investors.

British American Tobacco has grown its earnings-per-share at a ~5% average annual rate over the last decade. However, most of this growth came in the early part of the decade. Indeed, from 2013 to 2018, earnings-per-share growth averaged just 1% annually. We see slightly better growth than that for 2019, but British American Tobacco continues to face growth struggles, much the same as other companies on this list.

Even worse, the company is currently facing an extremely strong headwind, as the FDA just confirmed that it will restrict the sales of flavored e-cigarettes to minors and pursue a national ban on menthol cigarettes and flavored cigars. British American Tobacco generates more than a third of its revenue of its profits from the U.S. market. Therefore, it is easy to understand the impact of the recent announcement of the FDA on the company.

Of course the new regulation will probably take years to come into effect but, whenever it does, it will have a severe impact on the results of British American Tobacco. Combined with constantly-declining cigarette usage rates among consumers, this is another risk and headwind for holders of British American Tobacco.

Due to declining usage rates and regulatory headwinds, British American Tobacco shares continue to languish, trading near decade lows today. Investors, it seems, aren’t convinced the company can grow its way out of the problems it is facing.

On the plus side, given the payout ratio of 65%, the dividend seems to be fairly safe even in an adverse scenario. The current yield is enormous at 7.4%, and we expect the payout to continue to grow in the coming years.

Shares trade for just 8.8 times this year’s earnings, which is meaningfully lower than our fair value estimate of 10 times earnings. This should introduce a low single digit tailwind to total returns.

Overall, we feel that the market has overreacted in the case of British American Tobacco due to the uncertainty facing the company from declining usage rates and regulatory headwinds. However, those who can ignore paper losses and maintain a long-term horizon are likely to enjoy mid-teens annual returns from the current stock price thanks to the 7.4% dividend yield and the expansion of the price-to-earnings ratio from its current depressed level.

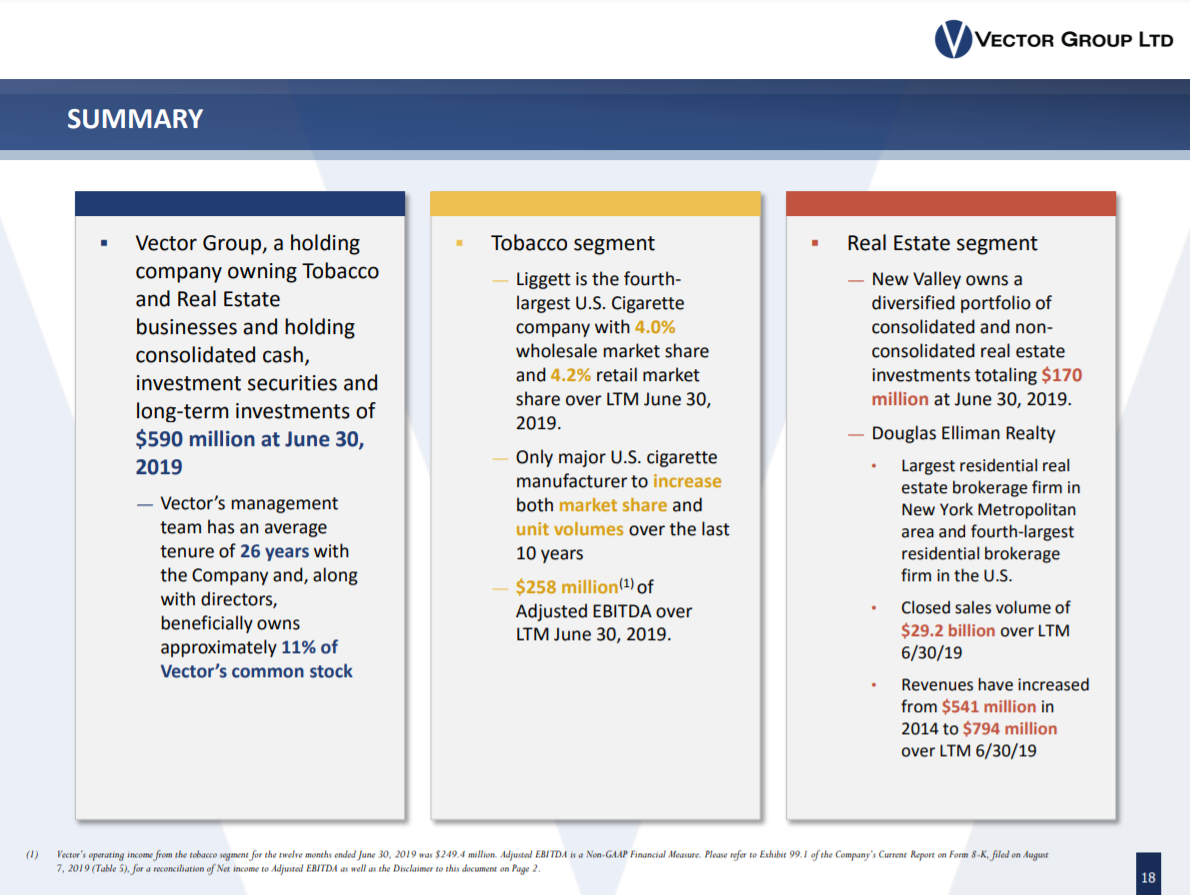

Tobacco Stock #3: Vector Group

Vector Group is an unusual combination of a real estate investment firm and a tobacco company. The latter was founded in 1873 and continues to operate today as the Liggett Group, while the real estate business came later. Vector has a market capitalization of $1.7 billion and is poised to produce nearly $2 billion in total revenue this year.

Source: Investor presentation, page 18

Like Universal Corporation, Vector Group has exhibited a volatile performance record and has failed to grow its earnings-per-share meaningfully over the last decade. While its earnings have remained essentially flat in the last eight years, the company has increased its share count by about 30% over this period. Therefore, it is prudent to keep growth expectations at a minimum for this company.

Moreover, Vector Group has a weak balance sheet. Its long-term debt of $1.2 billion is about 6 times its annual earnings, although the company has been working on deleveraging of late. Still, the company is significantly exposed to any unforeseen financial headwind, and means that further share issuances are likely to finance corporate needs, as well as to pay down debt. Its high leverage also helps explain its volatile performance record.

The only appealing feature of Vector Group is its extraordinary 14%+ dividend yield. Such a yield may be sufficient to entice many income-oriented investors. However, investors should note that the dividend payout ratio currently stands in excess of 400%, which is certainly unsustainable in the long run.

While the company has managed to maintain a payout ratio above 100% for the last decade, investors should not base their investing thesis on the ability of the company to maintain such irregular payout ratios for years. Given the company’s poor track record of growth and weak balance sheet, the enormous yield is the only attractive trait of this stock. However, its yield is more than sufficient to produce double digit annual returns in the coming years if one believes the payout will be maintained. We believe a cut to the dividend will be necessary in the relatively near term. However, Vector’s payout has defied gravity for many years, so we are maintaining an open mind.

Tobacco Stock #2: Altria (MO)

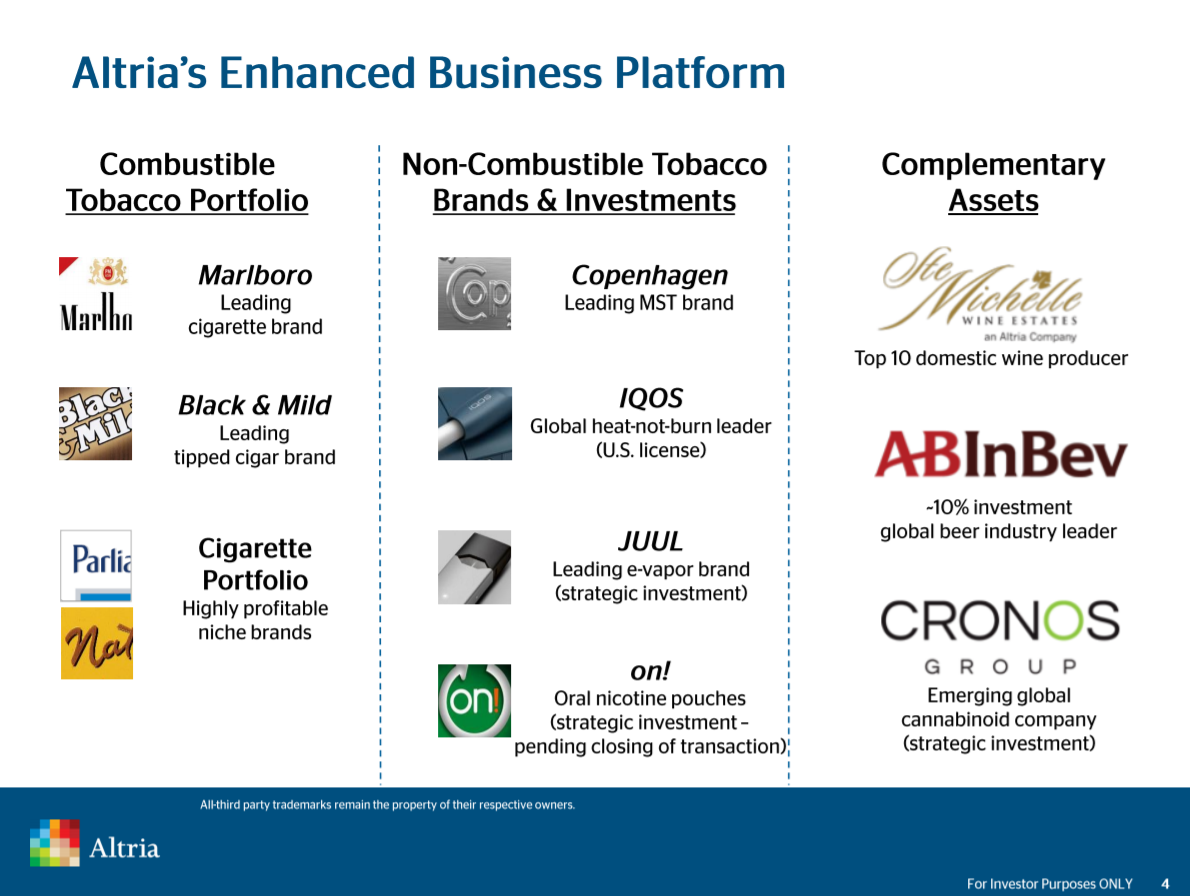

Altria is the market leader in American cigarette sales. Before 2003, the company was known as Philip Morris, but was renamed as Altria after restructuring (including the aforementioned spin-off of Philip Morris International in 2008).

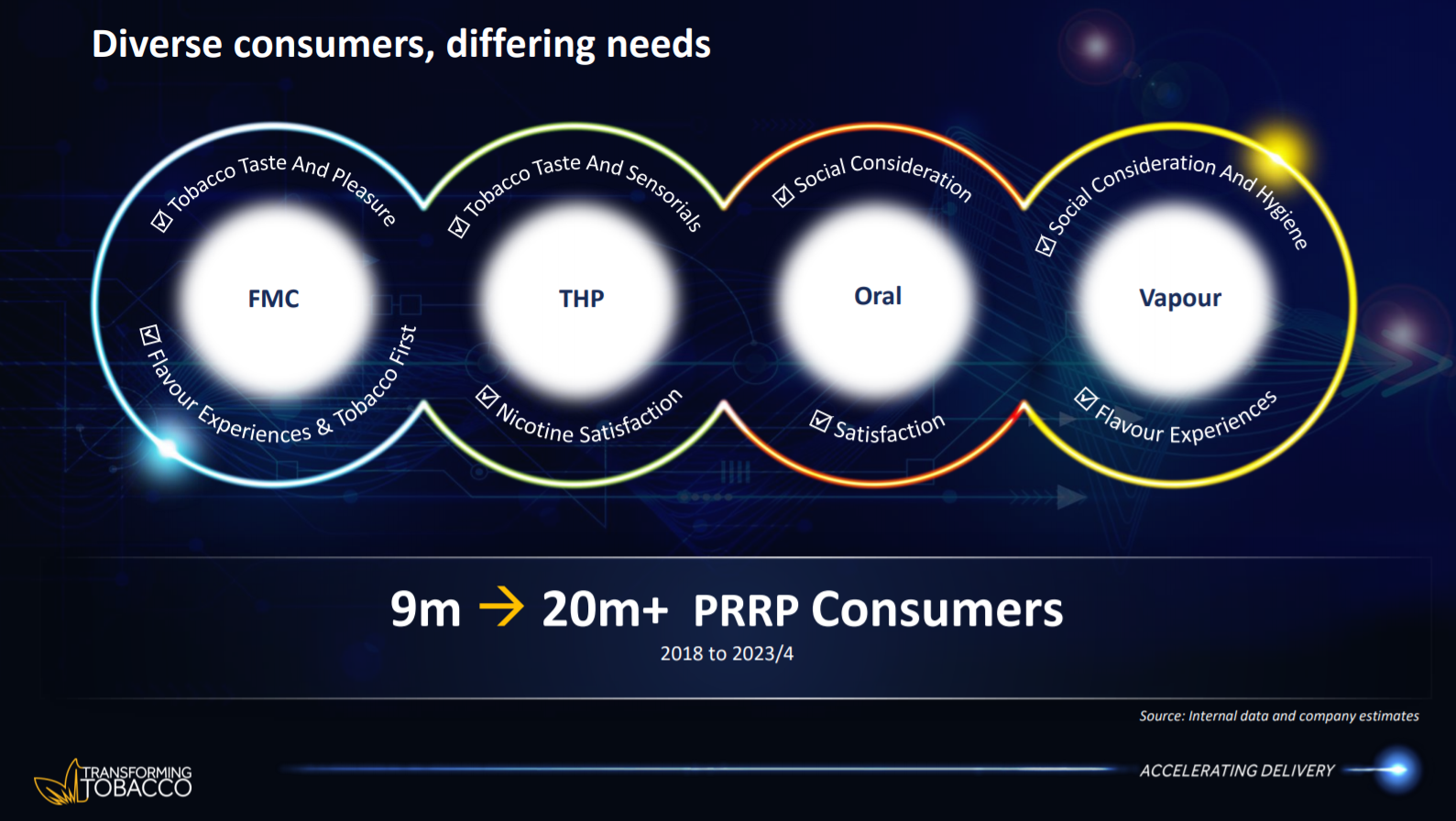

The company owns many well-known brands, including Marlboro, Skoal and Copenhagen. Altria still derives the overwhelming majority of its revenue and profits from smokeable tobacco, but the company also recognized years ago that smoking rate declines wouldn’t cease.

To that end, it has been very busy remaking itself for the industry challenges it knew it would face. As seen below, Altria has positioned itself with its IQOS product, as well as recent acquisitions of JUUL and on! to diversify away from its dominant position in cigarettes.

Source: Investor presentation, page 4

Altria is the market leader in the US cigarette industry. Market shares for large cigarette brands are relatively stable due to advertising restrictions; Marlboro remains the #1 brand in cigarettes today. This entrenched position in cigarettes has created tens of billions of dollars in profits over the years for Altria’s shareholders.

Altria has an exceptional growth record. It has grown its earnings-per-share in 9 out of the 10 last years. Over the last decade, it has grown its earnings-per-share at a 9.1% average annual rate. In addition, it has raised its dividend 52 times in the last 49 years. This is an impressive record, particularly given the aforementioned decline in the percent of the U.S. smoking population. This extraordinary performance is a testament to the strength of the business model of Altria and the reliability of its cash flows.

Altria has largely been able to offset smoking declines with meaningful price hikes. Even better, as its volume sales have decreased, its production cost has decreased as well. However, guidance for 2019 is for a mid-single digit decline in industry usage rates, meaning that Altria, even with the mighty Marlboro brand, has an uphill climb in front of it.

Even so, Altria enjoys extremely strong free cash flows. In fact, its capital expenses are almost negligible, as they have been less than 6% of its operating cash flows in every year in the last decade. As a result, almost all of the company’s operating cash flows end up as free cash flow. Thus, almost all earnings are available for shareholder distributions.

This is the exact type of business model that Warren Buffett looks for; companies that need minimum capital expenses and thus enjoy strong free cash flows. Thanks to this strength, Altria pursues a dividend payout ratio around 80% and its management has confirmed that it will continue to distribute about 80% of the earnings in dividends.

Very few companies can grow their earnings-per-share at a 9.1% average annual rate while distributing almost all their earnings to their shareholders. This makes Altria an extremely rare stock.

However, since the stock peaked in mid-2017, Altria shares have fallen 40% while the broad market has risen 20%. That performance gap is smaller when dividends are included, but the fact remains that holders of Altria have faced a difficult road for the past two years.

Due to this, Altria is now trading at a price-to-earnings ratio of 11.0, which is lower than its 10-year average in the mid-teens. We assess fair value at 15 times earnings, so we see the stock as cheaply valued right now. As we expect the stock to revert to its average valuation level over the next five years, the stock is likely to enjoy a 6% to 7% annualized boost thanks to the expansion of its price-to-earnings ratio.

Finally, thanks to its recent selloff, Altria is currently offering a nearly decade-high dividend yield of 6.9%. Overall, the stock is likely to offer average annual returns of about 17% over the next five years thanks to expected 4% annual earnings-per-share growth, its 6.9% dividend and a ~6%% annualized expansion of its price-to-earnings ratio. Thus, investors can initiate a position in this tobacco stalwart at a very attractive entry point.

Tobacco Stock #1: Imperial Brands PLC (IMBBY)

The final stock on our list is Imperial Brands, a British tobacco product conglomerate that was founded in 1901. Today, the company is a market leader in a variety of locations around the globe and has a $24 billion market capitalization.

Source: Investor presentation, page 4

Imperial has shown very impressive earnings growth in recent years. In the past decade, it has compounded earnings at a rate of nearly 14% annually. Since 2012, its annual growth rate has been nearly 20%. This kind of growth is difficult to come by in any industry, but particularly in one where stocks act more like utilities than growth companies. Imperial, however, has been the latter over the long-term.

Looking forward, management sees revenue growth of 1% to 4% annually, while earnings-per-share are expected to rise at 4% to 8% per year. We’re taking a slightly more cautious approach given the company’s exposure to a declining cigarette market globally, estimating 3% annual growth in the coming years.

Like many of the other companies on this list, Imperial is highly leveraged. It has around $15 billion of net debt on its balance sheet, which certainly isn’t unsustainable, but interest expense and debt servicing is a constant concern. Again, this is fairly normal for tobacco companies, but investors should keep Imperial’s leverage in mind over time, particularly if earnings were to level off or even decline.

Imperial’s dividend yield is quite robust as its trailing four quarterly dividend payments of $2.45 give it an annualized yield of 9.6%. That sort of yield is almost unheard of as it is five times the broad market yield. Even so, Imperial’s payout ratio is just two-thirds of earnings, so we find the dividend to be sustainable at current levels. The stock is trading for a relatively low multiple of earnings, and Imperial, like many of the other companies on this list, converts an enormous amount of revenue into free cash flow.

Our estimate for this year is $3.66 in earnings-per-share, and shares trade for just 7 times that number. That’s the lowest valuation Imperial has seen in the past decade by a fairly wide margin, and well below our assessed value of 11 times earnings. Should the stock reflate back to 11 times earnings, we see a high-single digit tailwind to total returns. Coupled with modest growth and the huge dividend yield, Imperial should return in excess of 20% annually in the coming years.

Final Thoughts

The tobacco stocks as a group have had a very difficult time in the past couple of years. Regulatory and consumer taste challenges continue to plague the group, but valuations are very cheap, dividend yields are high, and the companies themselves are at various stages when it comes to diversifying away from tobacco.

Imperial offers the best total projected annual returns, but several of these companies offer new shareholders bright prospects, particularly when it comes to yield.

We see Vector, Altria, and Imperial as offering the best total returns, and all offer sizable dividend yields. We’d caution that Vector’s yield is the least safe among the group, given its enormous payout ratio, but overall, there is a lot for income investors to like when it comes to the tobacco stocks.