Updated on November 12th, 2019 by Bob Ciura

Lithium, also dubbed “white petroleum,” is one of the flashier metals that you will come across. While it is white or gray in typical form, when it is thrown into a fire it turns bright red. The lithium mineral was documented in the 1790’s, but it wasn’t until 1855 that the element was separated and identified.

Lithium (atomic symbol Li) has many unique characteristics. It’s light and soft – soft enough to be cut with a butter knife and light enough to float on water. Further, the metal has a relatively low melting point but a high boiling point. Its uses vary dramatically, from the manufacture of aircraft and batteries to mental health medicine.

In 1991 Sony popularized the lithium ion battery and now it has become a vital part of nearly every electronic device. Naturally the use of electronics has taken off with mobile phones leading the way in the last decade. However, electric vehicles are becoming the true drivers of demand, as an electric car requires 5,000 to 10,000 times as much lithium as a mobile phone.

This has caused interest in investing in the Lithium industry to surge. Because of this, we have created a list of Lithium stocks that can be downloaded using the link below:

This guide gives an overview of the Lithium Industry as well as detailed analysis on lithium stocks and lithium investing. You can also view a preview of the lithium stocks database with the table below:

| ALB | Albemarle Corp. | 67.73 | 2.12 | 7,181 | 12.54 | 26 | 1.44 |

| ALTAF | Altura Mining Ltd. | 0.04 | 0.00 | 99 | -4.30 | 0 | 0.85 |

| ARTX | Arotech Corp. | 2.98 | 0.00 | 79 | -124.69 | 0 | 0.51 |

| AVLIF | Advantage Lithium Corp. | 0.15 | 0.00 | 27 | -5.68 | 0 | 0.49 |

| BCLMF | Bacanora Lithium Plc | 0.46 | 0.00 | 61 | -5.60 | 0 | 0.66 |

| BYDDF | BYD Co., Ltd. | 4.88 | 4.69 | 40,512 | 32.27 | 151 | 0.86 |

| CAOHF | FDG Electric Vehicles Ltd. | 0.02 | 0.00 | 33 | -0.09 | 0 | -6.55 |

| ECSIF | eCobalt Solutions, Inc. | 0.21 | 0.00 | 34 | -1.78 | 0 | -0.26 |

| ENS | EnerSys | 69.22 | 1.01 | 2,927 | 16.49 | 16 | 1.28 |

| FJTSY | Fujitsu Ltd. | 17.29 | 0.00 | 17,522 | 2.30 | 0 | 0.39 |

| FMC | FMC Corp. | 99.01 | 1.62 | 12,833 | 24.45 | 39 | 1.17 |

| GALXF | Galaxy Resources Ltd. | 0.73 | 0.00 | 298 | -9.19 | 0 | 0.68 |

| GNENF | Ganfeng Lithium Co., Ltd. | 1.36 | 25.10 | 5,273 | 26.88 | 674 | -0.13 |

| GSCCF | ioneer Ltd. | 0.15 | 0.00 | 220 | -375.00 | 0 | -0.48 |

| GYUAF | GS Yuasa Corp. | 20.55 | 2.23 | 1,667 | 12.53 | 27 | 0.02 |

| JCI | Johnson Controls International Plc | 42.24 | 2.46 | 32,845 | 0.81 | ||

| KDDRF | Kidman Resources Ltd. | 1.28 | 0.00 | 511 | -60.66 | 0 | -0.19 |

| LAC | Lithium Americas Corp. | 2.98 | 0.00 | 261 | -9.39 | 0 | 1.22 |

| LMMFF | Lithium Australia NL | 0.02 | 0.00 | 10 | -1.15 | 0 | 0.35 |

| LTHM | Livent Corp. | 8.09 | 0.00 | 1,180 | 15.32 | 0 | 1.48 |

| MLNLF | Millennial Lithium Corp. | 0.78 | 0.00 | 70 | -17.64 | 0 | 0.01 |

| NMKEF | Nemaska Lithium, Inc. | 0.15 | 0.00 | 122 | -5.87 | 0 | 0.29 |

| NTTHF | Neo Lithium Corp. | 0.39 | 0.00 | 41 | -12.34 | 0 | 0.68 |

| OROCF | Orocobre Ltd. | 1.90 | 0.00 | 502 | 9.10 | 0 | 0.99 |

| PCRFY | Panasonic Corp. | 9.32 | 0.00 | 21,742 | 8.72 | 0 | 0.91 |

| PILBF | Pilbara Minerals Ltd. | 0.22 | 0.00 | 512 | -19.13 | 0 | 0.39 |

| PWRMF | Power Metals Corp. | 0.05 | 0.00 | 5 | -1.77 | 0 | 0.63 |

| RDRUY | Neometals Ltd. | 1.31 | 10.56 | 71 | 1.32 | 13 | 0.09 |

| SQM | Sociedad Quimica y Minera de Chile SA | 27.07 | 3.08 | 3,258 | 20.84 | 64 | 1.14 |

| STLHF | Standard Lithium Ltd. | 0.52 | 0.00 | 45 | -5.73 | 0 | 0.57 |

| TOSBF | Toshiba Corp. | 32.54 | 0.84 | 15,333 | -12.59 | -10 | 0.14 |

| TSLA | Tesla, Inc. | 345.09 | 0.00 | 62,200 | -72.49 | 0 | 1.32 |

| ULBI | Ultralife Corp. | 8.97 | 0.00 | 142 | 6.12 | 0 | 0.62 |

| Ticker | Name | Price | Dividend Yield | Market Cap ($M) | P/E Ratio | Payout Ratio | Beta |

Table of Contents

- Lithium Industry Overview

- Investing In Lithium

- Lithium Mining Stocks

- Lithium Battery Stocks

- The Best Lithium Stocks

- Final Thoughts

Lithium Industry Overview

In 2009 the lithium ion battery made up roughly 21% of all lithium consumption. In 2017, about 46% of lithium produced went to batteries – more than doubling its share (in a growing market) in less than a decade. Other important uses include ceramics and glass (27% of the market) and lubricating greases (7%).

Extracting Lithium

There are two main ways of extracting lithium: mining and brine water. Interestingly, about 87% of lithium is extracted via brine water from briny lakes known as salars. The highest concentrations of these lakes are found in Chile and Argentina.

Lithium is obtained via evaporation in the form of lithium carbonate, the raw material used in lithium ion batteries. This process also leaves behind magnesium, calcium, sodium and potassium.

While brine mining is a lengthy endeavor – normally taking 8 months to 3 years – it is still usually easier and cheaper than hard rock mining.

The remaining 13% of lithium is found in traditional mining operations. The concentration of lithium is greater in hard rock mines, but the cost to operate these mines and the environmental and geological impact is much greater. Still, a hard rock mine in operation can be competitive with an upstart brine mine.

While there are 145 minerals containing lithium, just five are used in lithium extraction. Moreover, of these five, spodumene makes up the lion’s share (~90%) of mineral-derived lithium. The mineral is heated, cooled and mixed with sulfuric acid to create lithium carbonate.

Finally, there is a very small amount of lithium that is being recycled from electronics. This method does not provide pure enough lithium to make new batteries, but it is suitable for other uses such as glass and ceramics.

Supply

Total lithium production in 2018 amounted to 85,000 MT (metric tons).

Here are the top lithium producing countries in 2018:

1. Australia = 51,000 MT (60% of worldwide production)

2. Chile = 16,000 MT (18.8%)

3. China = 8,000 MT (9.4%)

4. Argentina = 6,200 MT (7.3%)

5. Zimbabwe = 1,600 MT (1.9%)

As you can see the production of lithium is highly concentrated, with 97.4% of it being produced by just five countries. Indeed, Australia and Chile alone accounted for more than three-fourths of the production market last year. Keep in mind that this does not account for U.S. production, but this is currently limited to a single mine.

Total worldwide lithium reserves are estimated to be 16 million tons (188 times last year’s production). Here are the top lithium reserve countries:

1. Chile = 7,500,000 MT (46.9% of worldwide reserves)

2. China = 3,200,000 MT (20.0%)

3. Australia = 2,700,000 MT (16.9%)

4. Argentina = 2,000,000 MT (12.5%)

Here too the lithium reserves are quite concentrated in just a handful of countries. While some reserves exist in other countries throughout the world (60,000 MT in Portugal, 48,000 MT in Brazil, 35,000 MT in the U.S. and 23,000 MT in Zimbabwe for instance) these are not “long-term pools” of resources available to be extracted.

Long-term mining activity will continue to be driven by Chile, China, Australia and Argentina.

Demand

The demand for lithium currently has three main drivers: Continued mobile device adoption, energy storage for electric grids / renewable energy, and electric vehicles.

As noted above, short and intermediate-term demand for lithium will likely depend on the dynamics of the electric vehicle market. Mobil device adoption will continue to be a driver, but electric vehicles require thousands of times as much lithium and hence have a much larger influence.

Batteries for storage for renewable energy could be an important driver down the line, but that is viewed as more of a long-term demand driver.

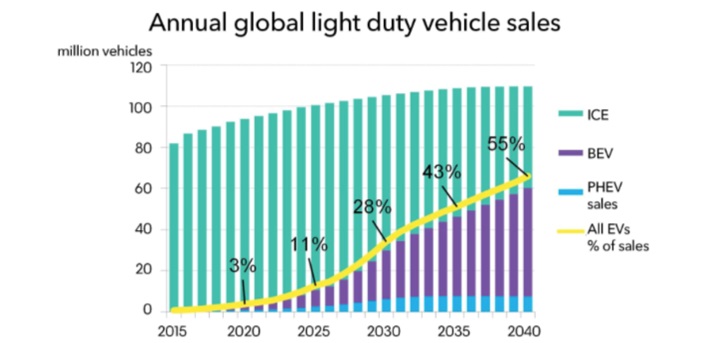

Bloomberg anticipates electric vehicle sales, which came in at 1.1 million in 2017, to rise to 11 million by 2025 and to 30 million by 2030, as electric battery costs become cheaper than internal combustion engines.

Moreover, the expectation is that China will lead the charge with electric vehicles making up 33% of the global fleet and 55% of all new car sales by 2040.

Source: Bloomberg New Energy Finance

Additionally, while demand forecasts vary widely, it is largely expected that electric vehicle production will test supply in the years and decades to come.

Indeed, some believe that electric vehicle adoption will be stymied by the availability (or lack thereof) of key components like lithium, as the recent ramp up in demand moves much faster than the ability to establish new mines, which often take years.

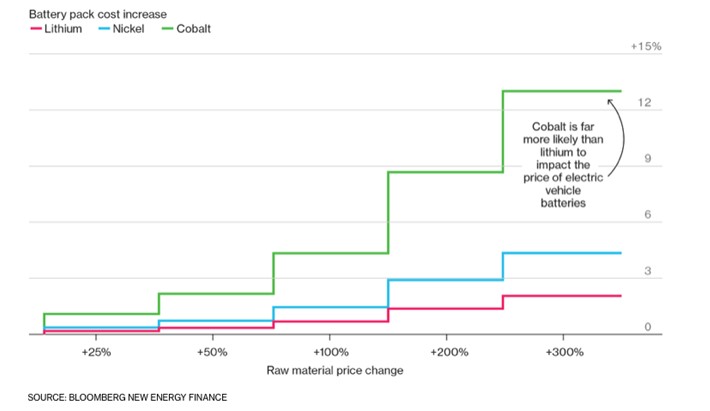

However, despite tremendous expectations, it should be noted that while lithium is an essential part to electric vehicles, it is not necessarily a fundamental cost driver. To give you an example, Tesla’s Model S’ entire battery pack weighs about 1,200 pounds, but the amount of lithium equivalent used is only about 15 pounds.

Source: Bloomberg New Energy Finance

More important cost drivers could include Nickel and Cobalt, making up 73% and 14% of a typical battery, as compared to 11% for lithium. Tesla’s Elon Musk calls lithium “the salt on the salad,” noting the relatively low expense of the material as compared to the overall cost of the vehicle.

While there are ample reserves of lithium available, the demand has picked up tremendously leading to supply-side constraints. As a result, pricing can be volatile.

Investing In Lithium

There is a way to directly and broadly invest in the lithium industry: The Global X Lithium & Battery Tech ETF (ticker: LIT).

The ETF “invests in the full lithium cycle, from mining and refining the metal, through battery production.” The fund’s objective is to “provide investment results that correspond to the price and yield performance, before fees and expenses, of the Solactive Global Lithium Index.”

The “before fees” portion is important, as management fees stand at 0.75% annually. Moreover, the current dividend yield is just 0.9%. The fund was started on July 22nd, 2010 and through October 31st, 2019 generated negative total annualized returns of -0.8%, compared with -0.3% for the index and double-digit annual returns for the S&P 500 index.

While the ETF’s performance has been uninspiring, interest has ballooned in the security. Assets under management increased from $68 million in June of 2016 to $478 million in November 2019, despite poor relative performance versus the S&P 500.

The fund holds just over 40 securities, but the top 10 positions make up nearly 75% of the ETF’s total assets:

1. Albemarle (18.7% of assets)

2. Quimica Y Minera Chil-Sp (13.9%)

3. Tesla (5.9%)

4. Varta AG (5.4%)

5. GS Yuasa (5.3%)

6. Livent (5.2%)

7. Panasonic (5.0%)

8. Samsumg (4.9%)

9. Enersys (4.8%)

10. LG Chem (4.8%)

We do not find this ETF attractive – the management fee and past record thus far have proven to be unimpressive – but it does offer an opportunity to discuss the major players in the industry.

Lithium Mining Stocks

For a long time the lithium mining industry was controlled by the “big three:” Albemarle (ALB), Sociedad Quimica Y Minera de Chile (SQM) and FMC (FMC).

Rockwood Holdings was also a large player, but Albemarle acquired it several years ago. These three businesses accounted for 85% of the world’s lithium market share.

However, more recently China has entered the market in a big way. For instance, Australia’s largest mine, the Greenbushes, is 51% controlled by China’s Tianqi Lithium and 49% owned by Albemarle.

Today the market share of the “big three” has dropped to 53%, while Chinese companies control about 40% of the world’s lithium market share.

Here are the five largest lithium-mining businesses:

1. FMC

2. SQM

3. Albemarle

4. Tianqi Lithium

5. Jiangxi Ganfeng Lithium

While the Chinese stocks cannot be invested in easily, the top three lithium-mining businesses do offer publicly traded shares:

Lithium Mining Stock: FMC Corporation (FMC)

FMC Corporation, based out of Philadelphia, PA operates as a diversified chemical company. In 2018 the company generated $4.7 billion in sales and earned $855 million in net profits.

Last year the company reported earnings-per-share of $6.29 and paid out $0.66 in dividends. That marked 15 straight quarters paying a $0.165 quarterly dividend.

However, starting this year the dividend was boosted to $0.40 per quarter. At the new rate, shares are trading with a trialing P/E ratio of 12.7, a dividend yield of 1.6%, and a payout ratio of 25%.

Earnings improved significantly in 2018, but in past years the underlying profit machine has been quite volatile. Earnings-per-share have come in as low as $2.08 and $2.47 in 2009 and 2015.

As of the most recent quarterly report FMC held $420 million in cash and equivalents and $9.8 billion in total assets against $2.5 billion in current liabilities and $7.1 billion in total liabilities.

FMC is more of a crop chemical producer, as lithium only accounted for about a fifth of its profits last year. Moreover, while the company held an 84.25% equity stake in Livent, the company’s former lithium segment, FMC completed a spin-off of the company on February 25th, 2019.

Indeed, the company’s future outlook excludes lithium from its forecasts and looking at the stand-alone, recently IPO’d, Livent Corporation (LYHM) will give a better picture of a pure, globally integrated lithium stock moving forward.

Lithium Mining Stock: Sociedad Quimica Y Minera de Chile (SQM)

Sociedad Quimica Y Minera de Chile ADR, more succinctly known as SQM, is a Chilean commodities producer with operations in lithium, potassium fertilizers, iodine and solar salts. Last year the company generated $2.3 billion in revenues and $440 million in net income.

On a per share basis, shares trade hands around $25; the company earned $1.67 in the last twelve months and paid out $2.03 in dividends. These numbers equate to a trailing earnings multiple of 15 times earnings, with an 8% dividend yield and a 122% payout ratio.

Keep in mind that the company’s dividend policy is to pay out all of its profits in dividends unless certain balance sheet requirements are not being met.

In addition to a dividend policy that allows for significant dividend fluctuations, we also caution that the security is subject to significant swings in earnings – ranging from $225 million in 2015 ($0.84 per share) up to $475 million in 2013 ($1.77 per share, two years prior).

Moreover, the share price has swung dramatically as well – falling 75% from 2011 to 2015 and jumping back 275% to 2017, only to fall 34% in 2019 year-to-date.

Still, the balance sheet looks strong. As of the 2019 second quarter, the company held $800 million in cash and equivalents and $4.7 billion in total assets against $990 million in current liabilities and $2.6 billion in total liabilities.

SQM’s most impressive assets are the low-cost lithium deposits in Chile’s Salar de Atacama, which has both the highest concentration of lithium globally and benefits from the high evaporation rates in the Chilean desert.

The company also has about half the market share in potassium nitrate and is the world’s largest producer of iodine. These three industries ought to benefit from the ongoing trends toward electric vehicles, increased crop production and healthcare spending.

The company has a long-term contract with Chile to extract 414,000 metric tons of lithium through 2030. Thereafter it is expected that this will be renewed, but this is somewhat unknown given Chile’s issues with former company Chairman Julio Ponce (which has since been resolved).

Lithium Mining Stock: Albemarle (ALB)

Albemarle Corporation has four operating units: Lithium & Advanced Materials, Bromine Specialties, Refining Solutions, and Other. The company operates in nearly 100 countries and is composed of four segments: Lithium & Advanced Materials (49% of sales), Bromine Specialties (21% of sales), Catalysts (21% of sales) and Other (9% of sales). Albemarle has a market capitalization of $6.3 billion, with annual sales of about $3.6 billion.

In 2018 the company generated $3.4 billion in revenue and earned $739 million. Shares are currently trading hands around $82 and in the last twelve months Albemarle has reported $6.34 in earnings-per-share and paid out $1.33 in dividends.

Albemarle stock trades for a price-to-earnings ratio of 11, with a 2.2% dividend yield.

Keep in mind that much like SQM, Albemarle’s profits are quite volatile. While the company has earned $6.34 in the last 12 months, this number has been as low as $1.94 and $1.69 in 2009 and 2014. Although we do note that the business has been profitable every year in the last decade.

As of the most recent quarter, Albemarle had $318 million in cash and equivalents and $8.1 billion in total assets compared to $1.4 billion in current liabilities and $4.1 billion in total liabilities. Despite volatile profits, Albemarle has a reasonable balance sheet that can continue to improve with a low dividend payout ratio.

Albemarle produces lithium from salt brine assets in Chile and two joint ventures in Australian mines. The company is also the second largest producer of bromine and a top producer of catalysts used in oil refining.

Albemarle has a long-term contract through 2043 with the Chilean government to be able to extract around 80,000 tons of lithium per year.

Lithium Battery Stocks

The producer side is fairly concentrated although recently China has been taking significant market share from the “Big 3.” On the application side, there are a wide variety of battery makers and the market share is still somewhat up for grabs.

Here’s a sampling of the top-10 lithium ion battery manufacturers in the world according to ELE Times:

1. Samsung SDI

2. Panasonic

3. Toshiba

4. LG Chem

5. Tesla

6. A123 Systems

7. eCobalt Solutions

8. BYD

9. Contemporary Amperex Technology

10. Johnson Controls

As far as investable equity positions for U.S. investors go, Samsung, Toshiba, LG Chem, A123 Systems, eCobalt Solutions, BYD and Contemporary Amperex Technology are headquartered outside of the U.S. / listed on a foreign exchange. Which gives you a fair idea of where the majority of batteries are being produced.

Notably, Warren Buffett’s Berkshire Hathaway owns about a seventh of Chinese based BYD. Additionally, note that Johnson Controls recently sold off its Power Solutions business (including batteries) for $11.4 billion in net proceeds to Brookfield Business Partners L.P.

That leaves just two companies from the above list: Panasonic and Tesla.

Lithium Battery Stock: Panasonic (PCRFY)

Interestingly, Panasonic supplies batteries for Tesla. However, this is only one portion of the Japanese business. Panasonic’s operating segments include Automotive & Industrial Systems (32%), Eco Solutions (18%), Connected Solutions (13%), Appliances (29%) and Other (8%). Panasonic has a market cap of $22 billion.

In the last year the company generated $74 billion in revenue and earned $1.9 billion in net profit. As a general theme, earnings have been volatile. Panasonic reported significantly negative earnings in 2008, 2009, 2011 and 2012. However, since 2013 earnings-per-share have increased by about 60%.

Panasonic is a diversified business, going well beyond the lithium battery market, with arms in electronic component mounting, appliances and home building products.

This has the benefit of safety (when one division does poorly, other divisions can often make up the shortfall) but it can also dilute the growth potential a “pure play” lithium battery maker might have. Still, Panasonic is well positioned in the industry. The stock also pays a dividend which yields around ~1.5% right now.

Lithium Battery Stock: Tesla (TSLA)

Tesla is a new business – founded in 2003 and publicly offered in 2010 – but it is a juggernaut in the industry. Here’s how the company describes itself:

“Tesla’s mission is to accelerate the world’s transition to sustainable energy. Since our founding in 2003, Tesla has broken new barriers in developing high-performance automobiles that are not only the world’s best and highest-selling pure electric vehicles— with long range and absolutely no tailpipe emissions —but also the safest, highest-rated cars on the road in the world. Beyond the flagship Model S sedan and the falcon-winged door Model X sports utility vehicle, we also offer a smaller, simpler and more affordable mid-sized sedan, Model 3, which we expect will truly propel electric vehicles into the mainstream.”

“In addition, with the opening of the Gigafactory and the acquisition of SolarCity, Tesla now offers a full suite of energy products that incorporates solar, storage, and grid services. As the world’s only fully integrated sustainable energy company, Tesla is at the vanguard of the world’s inevitable shift towards a sustainable energy platform.”

There is no doubt the company has a unique value proposition moving in a leading market for the future. However, the problem from a potential investment standpoint could be twofold: overall profitability and ongoing expectations.

From 2010 through 2018, Tesla racked up almost $6 billion in net losses. This has weighed heavily on both the balance sheet and the share count. The share count increased 80% in this nine-year stretch, jumping from 95 million in 2010 to 172 million last year.

Further, the company now holds nearly $10 billion in long-term debt. This puts a big burden on future endeavors. The good news is that the company just reported a net profit for the last two quarters. Earnings expectations are all over the map, but it remains that interest payments will make up a large portion of what the company might otherwise bring to the bottom line.

Over the first nine months of 2019, Tesla reported a net loss of $967 million.

Further, the company’s penchant to continue to expand requires significant cash that may not be easy (or pleasant) to continue to raise through share offerings or debt.

And, if we see an economic downturn in the years to come, this could dramatically test both the company’s customer base and its balance sheet at a time when neither are in a position to be tested.

Additionally, valuation is a key consideration. So far you could not think about the firm on a trailing earnings basis, but instead on expectations for the future. Eventually these expectations need to formulate into earnings.

The company enjoys a leading position in a growth industry, but you have to make difficult guesses about 1) how quickly the industry will grow, 2) what market share Tesla will take and 3) whether or not sustaining profits can ultimately be generated.

The Best Lithium Stocks

When you look across the publicly traded lithium market it’s hard to find a “pure play” lithium stock. Even among the lithium producers, each one has separate and important operations in other areas. Even an ETF focused specifically on lithium casts a wide net in a variety of industries.

On the mining side, you have the “Big 3” along with a group of Chinese companies working to take significant share. In general, the mining side looks somewhat interesting from an economic standpoint due to the inelastic demand of the raw material.

Because lithium is essential, but not a huge cost driver in battery production, battery makers are unlikely to significantly reduce their consumption even in the face of higher Lithium prices.

While miners cannot dictate higher prices by themselves, they are likely to benefit from higher prices if they come about from supply shortages / faster demand growth.

In our view, SQM and Albemarle look the most interesting on the mining side due to their premium position in Chile – a position offering the deepest reserves coupled with high concentrations and ideal environment.

While both businesses have seen significant upticks in profits as of late, the two securities offer separate value propositions. SQM is an ADR trading around 15 times earnings while paying out basically all of its profits in the form of a dividend.

Alternatively, Albemarle is trading around 11 times earnings while paying out only a fifth or so of its profits as cash dividends.

The balance sheets are comparable, but the capital allocation decision-making is dramatically different. In this way, it’s our view that Albemarle looks a bit more attractive. What it lacks in dividend yield, it could make up for in lesser economic times if the company can intelligently deploy the surplus between profits and dividends.

Moreover, with around half of its business in lithium, the company stands to benefit tremendously should the demand develop as anticipated in the decades to come.

On the battery side, it’s even more difficult to find a “pure play” lithium stock. There are plenty of companies in the market, but from an investment standpoint there is still a lot of uncertainty.

While there very well could be many “winners” in the industry over the long-term, current investors will likely have to deal with substantial earnings volatility and high expectations in the short to intermediate-term.

Final Thoughts

Lithium is here to stay. There’s a reason that it has gained popularity, especially in the last decade. It’s a versatile metal that has afforded tremendous improvements in how we work, communicate and get around.

Moreover, future demand appears robust as the move towards mobile devices, renewable energy and electric vehicles appears to be on the upswing (with the potential for a very long tail).

However, investors should recall this Ben Graham quote:

“Obvious prospects for physical growth in a business do not translate into obvious profits for investors.”

The takeaway is two-fold. Picking a growth industry in general may not be particularly difficult. For instance, it’s conceivable that just before (or even during) the ramp up of trains, automobiles, planes, and the Internet a potential investor could point to these areas as “growth industries.”

And indeed, they would have been correct. An investor pointing to the Internet, in say the mid-1990’s for example, would still be seeing that growth industry play out today.

Yet there are two problems. First, picking a growth industry may not be exceptionally difficult, but picking “winners” can test the best analyst. Out of the automobile or Internet just a handful of “winners” emerged, while hundreds or thousands were cast aside – once hyped, once with great expectations, but eventually for naught.

The second consideration is valuation. Even if you do happen to pick the “winners” you still have to be concerned about the price you pay. As a hypothetical, a security trading at say 40 times earnings that grows by 10% annually for a decade and later trades at say 20 times earnings would provide investors with returns of just 2.6% per annum.

The consideration is not just, “will a company grow?” but more importantly, “will it grow fast enough to justify the current valuation?” Expressed differently, will current investors capture their “fair share” of investment results?

Additionally, while lithium appears poised to be in strong demand for the foreseeable future, you should also take into consideration the possibility of new technologies coming along as well. Demand alone is exciting, but it could lead to unexpected results if it creates enough new entrants.

Overall we are upbeat on the metal and its prospects over the intermediate to long-term, with the above caveats in mind.

For investors interested in the lithium industry, Albemarle could be the best stock, as roughly half of its profits are derived from lithium, it has stakes in important reserve areas around the world, the dividend payout ratio is modest and shares are currently offering a reasonable value proposition, especially if growth continues moving forward.

Otherwise, we consider many of the other lithium stocks as too risky, as there are many unknowns coupled with tremendous expectations.