Updated on August 27th, 2021 by Bob Ciura

Fast food stocks are popular in the investing community, as they have an easy-to-understand business model and most investors are familiar with their products. In this article, we will focus on the 6 major fast food restaurant chains in the Sure Analysis Research Database, that pay dividends to shareholders.

In general, fast-food chains have generated long-term earnings-per-share growth due to a series of growth drivers including new store openings, same-store sales growth, margin expansion, and share repurchases. In addition, many fast food stocks reward shareholders with dividend payments, and regular dividend growth.

All 6 fast food stocks can be found on our list of 664 dividend-paying consumer cyclical stocks.

Fast food stocks do not have the highest dividend yields around, as most fast food companies prioritize share repurchases as a means of returning cash to shareholders. And, the rapid rise in share prices over the past year has further suppressed their dividend yields.

Still, these 6 fast food stocks pay dividends, and raise their regularly. They also have positive returns expected over the next five years, although we rank certain fast food stocks significantly ahead of others in terms of expected returns.

In this article, we will compare the expected 5-year returns of the top 6 fast food stocks.

Table of Contents

We have ranked our top 6 fast food stocks, according to annual expected returns over the next five years. Our expected return calculation incorporates expected annual earnings-per-share growth, changes in the valuation multiple, and dividend yields.

These stocks are ranked in order of expected returns, from lowest to highest. You can use the following links to instantly jump to any specific stock:

- McDonald’s Corporation (MCD)

- Domino’s Pizza (DPZ)

- Restaurant Brands International (QSR)

- Wendy’s Company (WEN)

- Yum! Brands (YUM)

- Jack in the Box (JACK)

- Final Thoughts

Fast Food Stock #6: McDonald’s Corporation (MCD)

McDonald’s is the largest publicly traded restaurant company in the world. It has raised its dividend for 44 consecutive years, which makes McDonald’s one of 65 Dividend Aristocrats.

You can download an Excel spreadsheet of all 65 Dividend Aristocrats (with metrics that matter) by clicking the link below:

McDonald’s is the world’s leading global foodservice company with more than 38,000 restaurants in more than 100 countries. Approximately 93% of restaurants worldwide are owned and operated by independent franchisees.

The company has three main business segments: the U.S. market, where the company has more than 14,000 stores, International Operated Markets, which includes developed markets France, the U.K, Canada and Australia, International Developed Licensee, which includes high-growth markets such as China, Italy and Russia.

McDonald’s recently reported second-quarter results in which global comparable sales increased 40.5% from the second quarter of 2020. Global comparable sales are up 7% on a two-year basis, meaning McDonald’s sales are well above their pre-pandemic levels.

McDonald’s has invested heavily in its Experience of the Future concept in recent years. This has involved remodeling of stores on a massive scale.

McDonald’s added DoorDash and GrubHub (GRUB) as delivery partners in late 2020 to go along with its existing relationship with Uber (UBER). Nearly 25,000 McDonald’s around the world, about two-thirds of worldwide restaurants, now offer delivery. This endeavor has paid off as delivery sales have quadrupled to $4 billion in just three years.

With a 2021 P/E of nearly 30, McDonald’s stock appears overvalued. Our fair value estimate for the stock is a P/E ratio of 20. This means that even with expected EPS growth of 6% and the 2.2% dividend yield, shares are expected to return less than 3% per year over the next five years.

McDonald’s is a solid holding for dividend growth investors, but now is not a great time to buy the stock due to its high valuation.

Fast Food Stock #5: Domino’s Pizza (DPZ)

Domino’s Pizza is the largest pizza company in the world based on global retail sales. The company operates more than 18,000 stores in more than 90 countries. It generates 49% of its sales in the U.S. while 98% of its stores worldwide are owned by independent franchisees.

Domino’s has proven to be one of the most resilient companies to the pandemic. Due to the closure of public places, the company faced a steep increase in its delivery orders. Domino’s has also benefited from its leading position in

digital orders. Its resilience to the pandemic is clearly reflected in its record earnings–per–share of $12.01 in 2020.

In late July, Domino’s reported (7/22/21) financial results for the second quarter of fiscal 2021. It grew its U.S. same store sales by 3.5% and its international same stores sales by 13.9%.

Adjusted earnings–per–share grew 4% over last year’s quarter, from $2.99 to $3.12. It was the 110th consecutive quarter of positive international same store sales growth and the 41st consecutive quarter of positive U.S. same store sales growth.

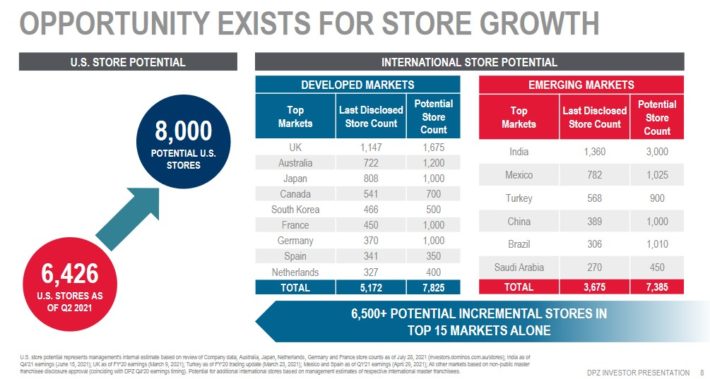

We believe the pizza chain has ample room to keep growing for years. Management is particularly aggressive about new restaurant openings.

Source: Investor Presentation

It is evident that there is still tremendous growth potential even without taking into account the growth potential in the other ~75 markets where the company is present. Overall, Domino’s aims to increase its store count to ~25,000 by 2025.

The company grows its earnings–per–share at a relentless pace thanks to three factors; many new stores, high same–store sales growth, and share repurchases.

Domino’s has provided a bright 3–year outlook, expecting 6%–10% annual global sales growth, mostly thanks to 6%–8% store count growth. Thanks to the impressive business momentum of the company, we now expect 12% annual earnings–per–share growth.

However, shares seem overpriced with a P/E ratio of nearly 37, compared with our fair value estimate of 26.6 which is the 10-year average P/E. This will somewhat offset EPS growth. Shares have a 0.7% dividend yield, leading to expected returns of 5.9% per year through 2026.

Fast Food Stock #4: Restaurant Brands International (QSR)

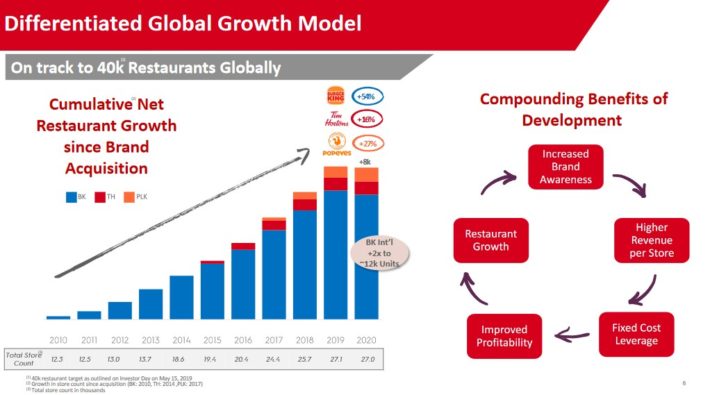

Restaurant Brands International is one of the world’s largest owner–operators of quick service restaurants (hence its stock ticker QSR). The company was founded in 2014 by the $12.5 billion merger between American fast food restaurant chain Burger King and Canadian coffee shop and restaurant Tim Horton’s.

Later, Restaurant Brands International expanded its franchise portfolio with the 2017 acquisition of American fast food chain Popeye’s Louisiana Kitchen. Restaurant Brands International has approximately 5,000 Tim Horton’s, 19,000 Burger King, and 3,500 Popeye’s Louisiana Kitchen restaurants.

On July 30th, the company posted better-than-expected results. Revenue of $1.44 billion increased 37% year-over-year, while adjusted earnings-per-share of $0.77 more than doubled from the same quarter last year. Global comparable sales rose 4% on a two-year basis from the same quarter in 2019, reflecting that the company has surpassed its pre-pandemic sales.

Restaurant Brands International has opened 378 net new restaurants in the first half of 2021. New restaurant openings are a major component of QSR’s growth plan.

Source: Investor Presentation

Expanding its digital capabilities is another growth catalyst. Restaurant Brands International is trying to maximize the potential of its stores via drive–thru, take–out and delivery options. It will install digital menu boards in more than 10,000 drive–thru points in the U.S. and Canada by mid–2022.

The company more than doubled its digital sales in North America in 2020. Digital sales in home markets increased 60% last quarter, year-over-year.

Shares appear somewhat overvalued, with a 2021 P/E ratio above 24 compared with our fair value estimate of 18. Annual EPS growth (10%) and dividends (3.3%) can offset the impact of overvaluation. With projected returns of 8.6%, QSR stock is a solid hold for income investors.

Fast Food Stock #3: Wendy’s Company (WEN)

Wendy’s is the third-largest hamburger quick-service restaurant chain in the world, with more than 6,700 restaurant locations globally. More than 90% of the company’s locations are in the United States.

On August 11th, Wendy’s reported second quarter 2021 results. The company’s global sales growth increased by 22.9% in the second quarter compared to growth of –6.2% in the same period last year. Global same–restaurant sales growth of 17.4% compared favorably to the 5.8% decline in 2020. Systemwide sales of $3.25 billion was 24% higher than $2.62 billion earned in 2Q2020.

Out of the 43 total new restaurant openings in the first quarter, the company had 28 net new restaurants. These results are favorable in comparison to last year’s gain of 1 net new restaurants in Q2 on 22 gross new restaurants. Ten of the net new restaurants in the quarter were opened in the U.S., while the other eight net new restaurants were international. The global reimaging of Wendy’s was reported to be 68% complete as of 2Q2021, in comparison to 61% one year ago.

Like its rivals, new restaurant openings are a major growth driver for Wendy’s.

Source: Investor Presentation

Adjusted revenues of $391 million for the quarter was up 20.6%, driven by higher sales at Company–operated restaurants and an increase in franchisee royalty revenue and fees. Revenues also rose due to higher franchise fees earned as a new technology fee was implemented in 2021. Adjusted earnings per share for the second quarter was more than double the prior year’s results, from $0.12 to 0.27.

Management upgraded their 2021 outlook for adjusted EPS from $0.73 to a new mid–point of $0.80. Additionally, the company expects system-wide sales growth of 11%-13%.

The company announced an 20% increase to the quarterly dividend to 12 cents, or $0.48 annually. They also repurchased 1.2 million shares in the second for $27 million, and increased their share repurchase authorization by $70 million which expires in February 2022.

Wendy’s continues to return lots of cash to shareholders. The company recently announced an 11% increase to the quarterly dividend to 10 cents, as they near their way back to their 2019 dividend level. Shares currently yield 2.1%.

Wendy’s stock trades for a 2021 price-to-earnings ratio just above 28. Our fair value estimate is a P/E ratio of 29.5, meaning we believe shares are slightly undervalued. The combination of P/E expansion, 7% annual EPS growth, and the current dividend yield of 2.1% result in total expected returns of 9.4% per year through 2025.

Wendy’s earns a buy recommendation for its strong projected returns.

Fast Food Stock #2: Yum! Brands

Yum! Brands is a fast-food company that operates KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill restaurants globally. At the end of 2020, the company had 25,000 KFC units worldwide, nearly 18,000 Pizza Huts, 7,400 Taco Bells, and close to 300 The Habit Burger Grills in operation in 150 countries and territories.

Yum Brands has pursued a strategy similar to McDonald’s in the last two years. It spun off its Chinese business two years ago and has refranchised its stores at an aggressive pace since then. Yum! Brands operates a franchise model that has helped it expand quickly, and with a capital-light business model, which also helps it achieve very strong profit margins.

Source: Investor Infographic

The strength of Yum!’s brands and their appeal to consumers constitute a significant competitive advantage, as does its massive footprint with over 50,000 restaurants.

Yum! Brands has returned to strong growth rates this year, thanks to the growth of its store count and its same-store sales. In the 2021 second quarter, worldwide system sales excluding foreign currency translation grew 26%, with 23% same-store sales and 2% unit growth. Adjusted EPS excluding was $1.16, an increase of 41% year-over-year.

Share repurchases will boost earnings-per-share growth. On May 10th, Yum! Brands approved a new $2 billion share repurchase through the end of 2022. This represents more than 5% of the company’s current market cap. Thanks to the strong business momentum, we expect the company to grow its earnings-per-share at a 12.0% average annual rate over the next five years.

We expect Yum! Brands to generate earnings-per-share of $4.50 for 2021. Based on this, the stock is presently trading at a price-to-earnings ratio (P/E) of 29.3. Our fair value estimate is a P/E of 24.2, which represents the 10-year average valuation multiple.

However, when combined with the 12.0% expected EPS growth rate and the 1.5% dividend yield, this implies the potential for 9.9% total annual returns over the next five years. This rate of return makes the stock a buy.

Fast Food Stock #1: Jack in the Box (JACK)

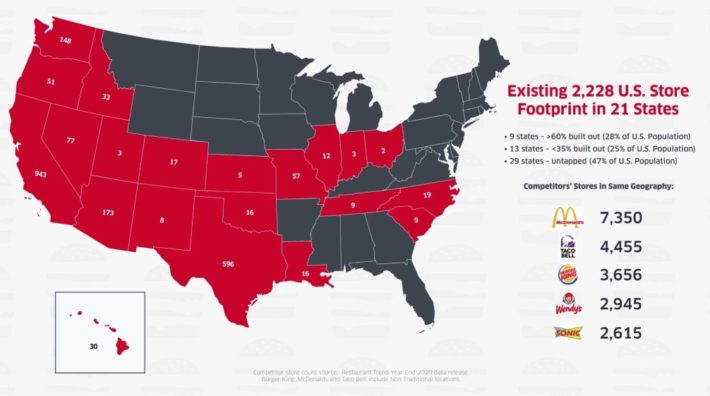

Jack in the Box is a fast-food chain that operates and franchises hamburger chains in the U.S., with more than 2,200 restaurants in 21 states and Guam. Jack in the Box previously owned the Qdoba brand, but sold it to Apollo Global Management in 2018 to focus on its core brand. Still, the company has a strong U.S. footprint.

Source: Investor Presentation

In early August, Jack in the Box reported (8/4/21) financial results for the third quarter of fiscal 2021 (ending 9/30/21). Revenues grew 10.6% over last year’s quarter, primarily thanks to 10.2% same–store sales growth. As a result, earnings–per–share grew 26%, from $1.42 to $1.79, and exceeded analysts’ consensus by $0.30.

The strong performance resulted from the popularity of the all–day menu, many menu innovations and stimulus checks.

Management raised the dividend 10% earlier this year. Shares yield 1.7%.

The performance of Jack in the Box is impressive and can be attributed, at least in part, to its affordable menu and the appointment of a new CEO, who has put the company back to its growth trajectory, after three years of stagnation.

Jack in the Box has repurchased its shares at an aggressive pace in the last five years. During this period, it has reduced its share count by 36%. Share repurchases will be a major component of future EPS growth. During the last decade, the company has grown its EPS at a 5.9% average annual rate.

We expect the company to grow EPS by 9.0% per year on average over the next five years. Jack in the Box is expected to earn $7.20 this year, giving the stock a price-to-earnings ratio of 14.8, which is lower than its 10-year average of 20. If the stock trades up to our target valuation of 18x earnings, shares would generate a ~4.6% annual return.

Expected EPS growth of 9% and the 1.7% dividend yield would further boost returns, leading to total expected returns of 15.3% per year over the next five years. Such a high rate of return makes JACK our top pick among restaurant stocks.

Final Thoughts

Fast food stocks are on the mend, after an extremely challenging environment last year caused by the coronavirus pandemic. Industry sales and profits have recovered significantly from last year, thanks to the gradual economic reopening. One of the biggest benefits of investing in fast food stocks is that they tend to be extremely resilient during recessions. Therefore, we expect continued growth in the years ahead.

However, not all fast food stocks are buys right now. Some, including McDonald’s, appear to be overvalued right now. While McDonald’s is a fantastic business, any stock can be overvalued at certain times. We recommend dividend growth investors favor Jack in the Box, Yum! Brands, and Wendy’s as the top three fast food stocks right now.