Updated on August 19th, 2021 by Bob Ciura

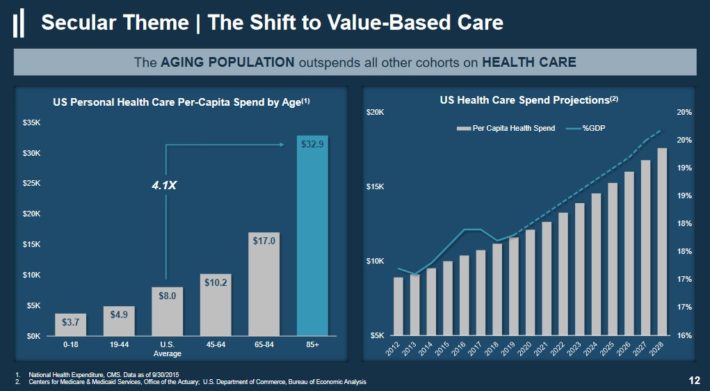

Health care is an industry that is likely to grow at a high rate over the next few decades. There are a number of driving factors behind this industry growth, with the biggest catalyst being the aging U.S. population.

The older population is getting bigger, and is expected to spend far more on healthcare than younger generations. Overall, this should lead to sustained growth in healthcare spending over the next few decades.

One way investors can position themselves to capitalize on this trend is through Real Estate Investment Trusts, also known as REITs.

With that in mind, you can view over 160+ REITs in our database by clicking on the link below:

Click here to download my free REIT Excel Spreadsheet List now, which includes all of our 166 publicly-traded REITs along with important metrics such as dividend yields and payout ratios.

Savvy investors will be thinking about ways to profit from this trend.

One method would be to purchase healthcare stocks. These could be manufacturers of medical devices like Abbott Laboratories (ABT); or a healthcare conglomerate like Johnson & Johnson (JNJ).

To be sure, both are excellent companies and premier dividend growth stocks. But for income investors seeking higher yields, there is a better way….

Purchasing healthcare REITs will give beneficial exposure to this demographic shift without as much regulatory uncertainty and with higher potential for current income.

Table of Contents

You can instantly jump to any specific section of the article by utilizing the links below:

- Real Estate Investment Trusts Overview

- Why Healthcare REITs?

- Healthcare REIT #1: Welltower (WELL)

- Healthcare REIT #2: Ventas (VTR)

- Healthcare REIT #3: Healthpeak Properties (PEAK)

- Healthcare REIT #4: Omega Healthcare Investors (OHI)

- Valuation Comparison

- Final Thoughts

Real Estate Investment Trusts Overview

Real Estate Investment Trusts, or REITs for short, have become increasingly popular with income investors in the past several years. For dividend investors, REITs have a number of attractive characteristics. The most notable is their dividend requirements.

REITs are legally required to pay 90% (or more) of their earnings as distributions to unitholders. While this makes it more difficult for REITs to realize rapid business growth, it generally drives high yields that benefit investors looking for current income.

Therefore, it is common for REITs to have high dividend yields of 5% or more. And, many high-quality REITs also offer regular dividend growth.

For example, there are three REITs on the exclusive Dividend Aristocrats list: Essex Property Trust (ESS), Realty Income (O), and Federal Realty Investment Trust (FRT). The Dividend Aristocrats list includes just 65 companies within the S&P 500 Index that have each raised their dividends for at least 25 consecutive years.

In fact, Federal Realty is a member of the Dividend Kings, as the company has increased its dividend for over 50 years in a row.

In addition to their high yields and dividend growth, REITs have become popular over the past several years because they provide the opportunity to gain exposure to real estate, without having to own property. Investing in physical real estate is a time-intensive, costly pursuit that involves low liquidity.

On the other hand, purchasing a REIT is as easy as pressing a button.

Why Healthcare REITs?

There are many different industries within REITs. For example, there are retail REITs, office REITs, data center REITs, residential and commercial housing REITs, mortgage REITs, and more.

Healthcare REITs are especially attractive for income investors, as the industry will benefit from a major trend. The United States is an aging population.

According to healthcare REIT giant Welltower (WELL), the 80+ age group in the U.S. is expected to grow at a 3.6% compound annual rate through the end of the decade. Growth rates over 3% in this age bracket are also expected in the U.K. and Canada.

Source: Investor Presentation

Plus, older demographics spend significantly more money on healthcare than their younger counterparts. On a per-capita basis, the 85+ year demographic spends more than four times the U.S. average on personal health care.

There are currently four large health care REITs whose size differentiates them from the rest of the industry. These REITs are:

- Welltower, Inc. (HCN): $35 billion market capitalization

- Ventas, Inc. (VTR): $21 billion market capitalization

- Healthpeak Properties (PEAK): $19 billion market capitalization

- Omega Healthcare Investors (OHI): $7.8 billion market capitalization

This article will discuss the investment prospects of each company in detail.

Healthcare REIT #1: Welltower (WELL)

Seasoned investors will recognize Welltower by its previous name. The company went by the name of Health Care REIT until the name change in September of 2015.

The trust was founded in 1970 and is currently one of the largest REITs (healthcare or otherwise) in the United States.

You can see an image of Welltower’s portfolio below:

Source: Investor Presentation

In the 2021 second quarter, Welltower reported normalized FFO-per-share of $0.79, while the Seniors Housing Operating portfolio occupancy increased 190 basis points.

Welltower completed $1.5 billion of gross investments during the second quarter.

As Welltower was repositioning its portfolio, it got hit by COVID–19 impacts that led to a 30% dividend cut. The new

payout ratio of about ~80% (in terms of FFO) should better protect its dividend going forward. Welltower reported having no material senior unsecured note maturities until 2024.

Healthcare REIT #2: Ventas (VTR)

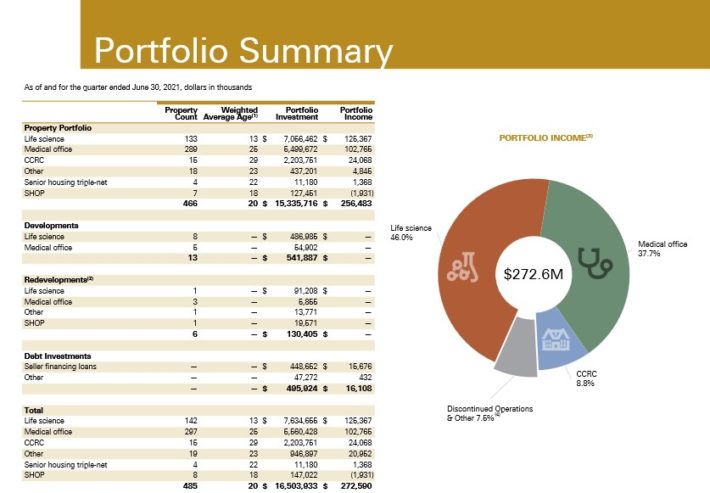

Ventas is one of the largest healthcare REITs in the U.S., with approximately 1,200 properties in the U.S., Canada and the United Kingdom.

Due to its size and industry presence, Ventas benefits from the favorable trends. As the baby boomer generation ages and the average life expectancy is on the rise, the senior population of the U.S. is expected to grow significantly in the upcoming years. The 75+ age group is expected to grow by 6% per year until 2030.

In addition, this age group has immense spending power, as its average net worth exceeds $640K. Thanks to these trends, healthcare spending is expected to grow by 5.8% per year until 2024.

On the other hand, Ventas is currently going through some challenges. The company sold a large portion of its skilled nursing facilities in 2017, as these facilities had been harmed by changes in medical billing procedure. As a result, these facilities now comprise just 1% of Ventas’ total assets. In addition, the REIT is experiencing intense competition in several major markets (Atlanta, Dallas and Chicago).

Consequently, it has failed to grow its funds from operations (FFO) for six consecutive years. Given its fundamental challenges and its high debt load, the dividend was recently cut by -43%.

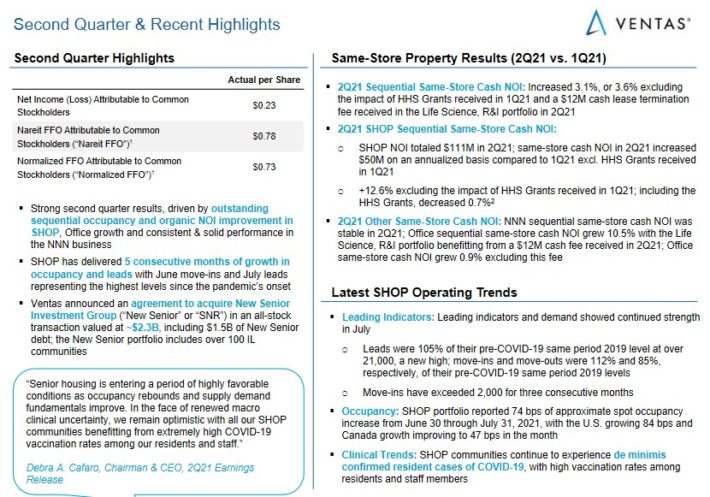

Fortunately, Ventas’ performance improved in the second quarter.

Source: Investor Presentation

Normalized FFO-per-share fell 5% in the most recent quarter, compared with the same quarter last year. However, same-store cash NOI increased 3% from the previous quarter, showing accelerating momentum throughout the year.

The company is not out of the woods. After the 2021 second quarter, Ventas reported a Net Debt to Adjusted Pro Forma EBITDA ratio of 7.0x. This is a high level of debt that the company will likely try to reduce in the coming years.

Healthcare REIT #3: Healthpeak Properties (PEAK)

Healthpeak Properties was formerly known as HCP. On October 30th, 2019, HCP changed its name to Healthpeak Properties and its ticker from HCP to PEAK in order to reflect the culmination of its efforts to reform its portfolio. Healthpeak Properties is the largest healthcare REIT in the U.S., with over 620 properties. It was the first healthcare REIT that was included in the S&P 500.

The 34–year old REIT invests in life science facilities, senior houses, and medical offices, with 97% of its portfolio based on private–pay sources.

Source: Investor Presentation

In the 2021 second quarter, adjusted FFO came to $0.40 per share, with total same-store portfolio cash NOI growth of 1.2%. Future growth is likely to come from rental increases as well as property acquisitions. The company spent $425 million on acquisitions last quarter.

The performance of Healthpeak Properties has been poor in the last five years and the REIT cut its dividend by –19% this year. As this is the second dividend cut of the REIT in the last decade, it is evident that the REIT is vulnerable to

downturns. Even after the dividend cut, the payout ratio remains elevated while the REIT has a heavy schedule of debt maturities in the upcoming years.

Healthcare REIT #4: Omega Healthcare Investors (OHI)

Omega Healthcare Investors is one of the premier skilled nursing focused healthcare REITs. It also generates about 20% of its annual revenue from senior housing developments. The company’s three main selling points are its financial, portfolio, and management strength. Specifically, Omega is the leader in Skilled Nursing Facilities.

Source: Investor Presentation

OHI recently reported second-quarter results which showed resilience in the face of the coronavirus pandemic. Adjusted FFO-per-share of $0.85 increased 4.9% year-over-year. Omega collected over 99% of contractual rent and mortgage payments in the quarter.

The portfolio benefits from a favorable near-term supply and demand outlook. It also has no material upcoming lease expirations or lease renewal risk and enjoys strong geographic and operator diversification (71 operators across 40 states plus the United Kingdom). Omega also has an investment-grade credit rating of BBB-.

Acquisitions will help accelerate the company’s growth. For example, Omega invested over $600 million in acquisitions in the first half of 2021.

Valuation Comparison

REITs are unique in that they are exposed to many non-cash charges (like depreciation and amortization) that effect the company’s earnings from an accounting perspective. As a result, traditional valuation techniques such as the price-to-earnings ratio are not effective for assessing REITs.

For a more detailed discussion of how to value REITs, click here.

One of the easiest alternatives is to compare a REIT’s current dividend yield to its historical dividend yield. If the current dividend yield is higher than average, the REIT is undervalued; similarly, if the dividend yield is lower than average, the REIT is undervalued.

With those rules in mind, let’s consider the dividend yield of each of these four REITs compared to historical averages.

- Welltower: Current Dividend Yield of 2.9%; 10-Year Average of 4.9%

- Ventas: Current Dividend Yield of 3.3%; 10-Year Average of 4.6%

- Healthpeak Properties: Current Dividend Yield of 3.4%; 10-Year Average of 5.2%

- Omega Healthcare Investors: Current Dividend Yield of 8.2%; 10-Year Average of 7.1%

Knowing this data, it is easy to compute the premium or discount associated with the current stock price of these REITs. This is under the assumption that their 10-year average dividend yield occurs when the company’s stock price is near fair value.

Of course there are other factors at play as well. For example, Welltower, Ventas, and Healthpeak Properties have all cut their dividends since the beginning of 2020.

From the dividend yields, it appears Welltower, Ventas, and Healthpeak Properties are trading at a premium, while Omega Healthcare is trading at a discount. Therefore, Omega Healthcare is the most attractively valued right now.

Another way to analyze REIT valuations is the P/FFO ratio. Welltower, Ventas, Healthpeak Properties and Omega are trading for 2021 P/FFO ratios of 26.1, 18.7, 22.1, and 9.9, respectively. It also appears that Omega is the most attractive healthcare REIT on a P/FFO basis as well.

Final Thoughts

Healthcare REITs are in a very favorable position right now. Our aging population and the medical costs that come with it are going to create plenty of new business for these companies in the years to come.

Each of the four companies discussed in this article will benefit from this trend, but one stands out in particular.

Omega Healthcare Investors has an impressive dividend history. It has the highest dividend yield of the four, and was the only one not to cut its dividend during the coronavirus pandemic. Investors looking to gain exposure to favorable macro trends in the healthcare industry should consider adding this REIT to their portfolio.