Updated on March 23rd, 2020 by Bob Ciura

2020 is shaping up to be a tumultuous year for the major grocery stocks. While industry trends are changing, as more consumers gravitate toward online shopping and grocery delivery, grocery stores are among the market’s outperformers during the massive sell-off.

E-commerce giant Amazon.com (AMZN) made a huge entry into grocery with its $15 billion acquisition of Whole Foods, and is in the process of rolling out its cashier-less technology. Certain grocery stocks such as Costco Wholesale (COST), Walmart Inc. (WMT), and Target (TGT) have seen great success with their own e-commerce platforms, while others such as Kroger (KR) have fallen behind.

But many of these grocery stocks remain attractive for dividend growth investors, and have outperformed the S&P 500 Index to start the year. Wal-Mart and Target have dividend yields of 1.9% and 2.7%, respectively, and both stocks are members of the Dividend Aristocrats.

The Dividend Aristocrats are a group of 64 stocks in the S&P 500 Index, with 25+ years of consecutive dividend increases. You can see the entire list of 64 Dividend Aristocrats here.

The requirements to be a Dividend Aristocrat are:

- Be in the S&P 500

- Have 25+ consecutive years of dividend increases

- Meet certain minimum size & liquidity requirements

You can download an Excel spreadsheet of all 64 Dividend Aristocrats (with important financial metrics such as dividend yields and payout ratios) by clicking the link below:

Meanwhile, Costco and Kroger are members of the Dividend Achievers list, a group of stocks with 10+ years of consecutive dividend growth. You can see the entire list of all ~260 Dividend Achievers by clicking here.

These retailers are all making progress to better compete with Amazon, and reinvent themselves through investments in new technology to drive long-term growth. They stand to continue outperforming the S&P 500 in the event of a prolonged market downturn, as grocery stores are among the few retailers allowed to remain open in the coronavirus-related lockdown.

In the meantime, investors can collect their dividends, and see those dividends grow over time. This article will discuss the top 6 grocery stocks ranked in order of expected returns.

Table of Contents

We have ranked the top 6 grocery store stocks according to expected returns. The grocery store stocks are listed from lowest to highest five-year expected total returns. You can use the following links to instantly jump to any specific stock:

- Costco Wholesale (COST)

- Walmart (WMT)

- Kroger Co. (KR)

- Sprouts Farmers Market (SFM)

- Amazon.com, Inc. (AMZN)

- Target Corporation (TGT)

Best Grocery Stock #6: Costco Wholesale (COST)

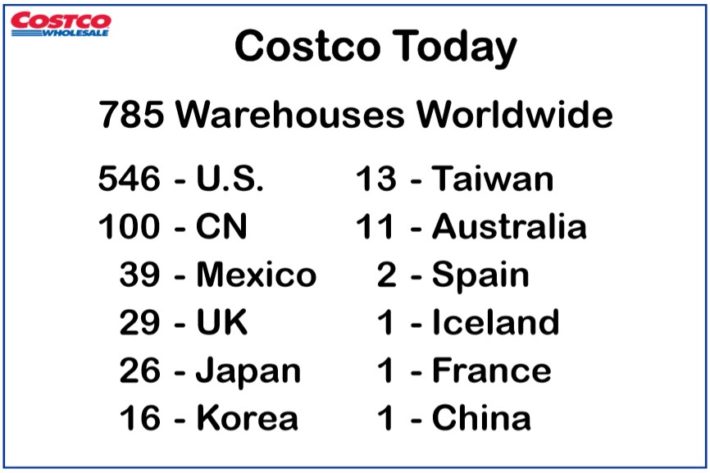

Costco’s humble beginning in a converted airplane hangar has given way to a powerhouse in an industry it helped create. Today, Costco is a diversified warehouse retailer that operates 785 warehouses that collectively generate in excess of $160 billion in annual sales. Warehouses are spread around the world.

Source: Investor Presentation

Costco reported fiscal second-quarter earnings on March 5th and results were better than expected on the top and bottom lines. Total revenue was up 10.5% to $38.3 billion for the quarter and 8.1% to $74.5 billion for the first half of the year. Comparable sales rose 7% in the US in the first half of the year, and 6.6% for the whole company. Excluding gasoline sales and foreign exchange, comparable sales rose 6.6% in the US and 6.5% company-wide.

Digital sales were 28% of revenue in the second quarter and 17.3% in the first half of the year. Net income for the quarter was $931 million, or $2.10 per share, up from $889 million, or $2.01 per share. For the first half of the year, net income was $1.77 billion, or $4.00 per share, up from $1.66 billion or $3.74 per share.

Costco has been an obvious winner in the coronavirus tragedy as consumers fight to keep their pantries and refrigerators stocked. As a result, we’ve bumped our earnings-per-share estimate for this year to $8.75.

Sales growth will continue to make up most of its predicted growth. Its model does not allow for expanding profit margins because its retail pricing is intended to be as low as possible for consumers. We are forecasting 7.5% earnings-per-share growth annually in the coming years as gross margin gains and SG&A spending continue to roughly offset each other.

The vast majority of Costco’s operating margin dollars come from its membership fees, which continue to grow at strong rates, but are a very small fraction of total revenue. This is 100% margin revenue and fuels higher comparable sales, as well as more members and more people in the stores buying. The company does not buy back stock in any sort of meaningful quantity so that is not a source of earnings growth. Steadily higher comparable sales should be enough to keep earnings growing at our forecast rate of 7.5% annually.

Costco stock trades for a 2020 P/E ratio of 32.1, which is a very high valuation, even for a growth stock like Costco. As a result, it trades above our fair value estimate of 24. Contraction of the P/E multiple could reduce annual returns by 5.7% per year over the next five years. The stock has a fairly low dividend yield of 0.9%, due largely to its impressive share price gains over the past several years. Therefore, total annual returns are estimated at 2.7% per year, due largely to the impact of overvaluation.

Best Grocery Stock #5: Walmart (WMT)

Walmart traces its roots back to 1945 when Sam Walton opened his first discount store. The company has since grown into the largest retailer in the world, serving 270 million customers each week. Revenue will likely be well in excess of $500 billion this year and the stock trades with a market capitalization above $300 billion.

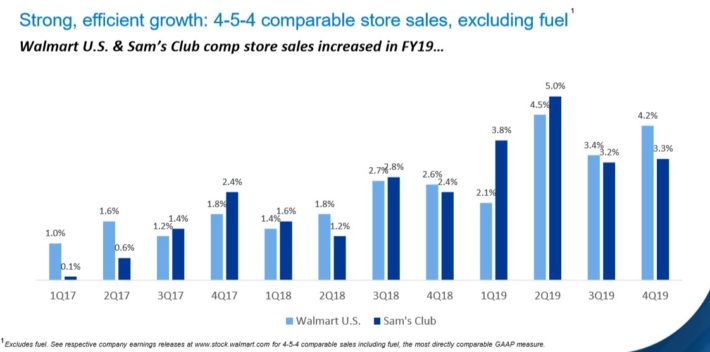

Walmart reported fourth-quarter and full-year results on February 18th, which were in line for revenue, but missed expectations on the bottom line. Total revenue was $524 billion for the year, up 1.9% from 2018. Excluding currency translation, revenue would have risen 2.7%. Comparable sales at Walmart US came to 2.8% in 2019, and on a two-year stacked basis, were up 6.4%. Walmart US ecommerce sales soared 37% in 2019, comprising nearly all of the company’s comparable sales gain.

Source: Investor Presentation

Sam’s Club continues to struggle as comparable sales were up just 0.7%, but reduced tobacco sales negatively impacted comparable sales by 310bps in 2019. International sales were up 2.8% in constant currency, with particular strength from Mexico, China, and India. Walmart generated $25.3 billion in operating cash flow in 2019 and returned $11.8 billion to shareholders through dividends and repurchases.

In total, earnings-per-share for 2019 came to $4.93, up fractionally from 2018. Walmart guided for much better earnings this year, and our initial estimate is for $5.10 for 2020.

Looking forward, we are forecasting 4.5% annual earnings growth for the next five years as Walmart continues to work through its margin issues. The company continues to buy back stock as well. We see low single-digit sales growth each year, with its e-commerce business being the primary driver of top line growth. That combination should be good enough to create mid-single-digit growth without the benefit of margin expansion.

Walmart’s competitive advantage is in its enormous size as it can buy and ship product at scales no other company can rival. This allows it to operate with low prices to consumers and as more than half of its revenue comes from groceries, its recession performance is excellent. The company managed to increase earnings steadily during and after the Great Recession. We view Walmart as arguably the safest retail stock to own in a recession.

However, Walmart appears to be overvalued, with a 2020 P/E ratio of 22.1, compared with our fair value estimate of 18. Contraction of the P/E ratio could reduce annual returns by 4.0% per year through 2025. EPS growth of 4.5% per year and the 1.9% dividend yield can offset this, but total returns are expected at just 2.4% per year through 2025.

Best Grocery Stock #4: Kroger Co. (KR)

Founded in 1883, Kroger is the largest supermarket chain in the U.S. The company has over 2,700 retail stores under a variety of brand names, 1,500 fuel centers, 2,200 pharmacies and 250 fine jewelry stores in 35 states. The company serves more than 60 million households every year.

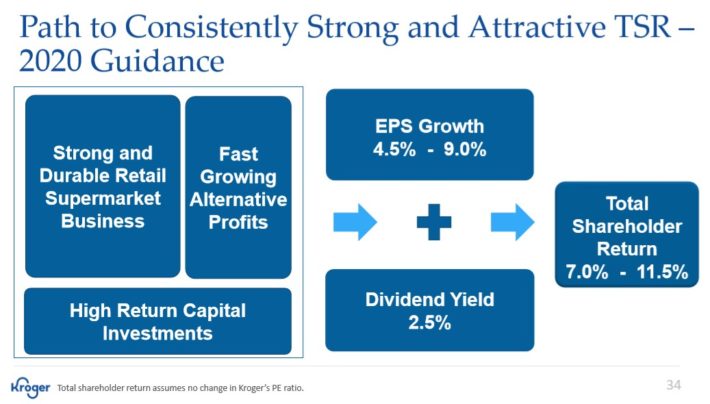

The competition in the retail sector has heated up with Amazon and Walmart expanding grocery delivery service. Kroger, which has successfully responded to the competition so far, initiated a strategic plan called “Restock Kroger,” which aims to increase its operating income by $400 million by 2020 by maximizing its efficiency and cost savings. The company expects this strategy to deliver strong returns for shareholders.

Source: Investor Presentation

On March 5th, 2020 Kroger reported fourth-quarter and full year results for the period ending February 1st, 2020. For the quarter Kroger reported $28.9 billion in sales, up from $28.3 billion in Q4 fiscal 2018. Total sales excluding fuel and dispositions were up 2.3% compared to the prior year period. Adjusted earnings-per-share equaled $0.57 compared to $0.48 previously.

For the year Kroger generated $122.3 billion in sales, up from $121.9 billion in 2018, with total sales excluding fuel and dispositions growing 2.3% year-over-year. Adjusted earnings-per-share totaled $2.19 – within prior guidance – compared to $2.11 in 2018. Kroger also updated its guidance for 2020. The company reiterated its expectation that sales would be up more than 2.25% with $2.30 to $2.40 in adjusted EPS.

Kroger does have some growth levers available. For instance, Kroger can continue to improve its margins via its “Restock Kroger” plan. Moreover, the company has reduced its share count significantly over the last decade. While we do not anticipate as robust repurchases moving forward, we do note that stock buybacks and margin improvement can allow slow top-line growth to turn into mid-single-digit improvement on the bottom line. Overall, we expect that the retailer can grow its earnings-per-share by 5.0% per year over the next five years.

Kroger stock trades for a 2020 P/E ratio of 13.3, slightly above our fair value estimate of 12. Contraction of the P/E multiple could reduce annual returns by 2.0% per year through 2025. This could be offset by expected EPS growth of 5%, plus the current dividend yield of 2.1%. Total returns are expected at 5.1% per year through 2025, making Kroger a hold but not a buy at this time.

Best Grocery Stock #3: Sprouts Farmers Market (SFM)

While big-box grocery stores struggle, niche players have found success, especially in areas that cater to a more health-conscious consumer. One example is Sprouts Farmers Market, a health-oriented grocery store that specializes in natural and organic foods. Sprouts had its initial public offering in 2013.

It offers a wide range of products, including fresh produce, bulk foods, supplements, meat and seafood, deli, baked goods, dairy, and more. Approximately 90% of its more than 20,000 products are either natural or organic. Sprouts operates more than 300 stores across the U.S., predominantly in the Southwest and Southeast.

Source: Investor Presentation

Sprouts credits its success to a multi-faceted management philosophy, which is to focus on healthy foods, while providing value to customers. These principles have resulted in excellent growth over the past several years. From fiscal 2014 through 2018, the company’s net sales increased at a 15% annual rate. Adjusted net income grew at an 8% annual rate from 2015 through 2018.

In February (2/20/2020) Sprouts Farmers Market reported fiscal 2019 fourth-quarter and full-year results. Net sales increased 8% for the fourth-quarter and full year, reaching $5.6 billion in 2019. Comparable store sales increased 1.1% for the year. Adjusted earnings-per-share declined 3% for the year due to higher costs, but the company remained highly profitable with adjusted EPS of $1.25.

Sprouts estimates net sales growth of 5.5% to 6.5% for 2020, due in large part to new store openings. The company expects to open 20 new stores this year. Comparable store sales are expected to be flat to up 1% for 2020. Future growth will be also be fueled by its private-label brands, which now represent nearly 14% of revenue and are growing at a ~25% annual rate. It is reasonable to expect ~8% annual EPS growth in the years ahead.

Sprouts expects diluted EPS of $1.20 for 2020. Based on this, the stock trades for a P/E ratio of 13.8; we view a 2020 P/E ratio of 15 as a reasonable estimate of fair value. Expansion of the P/E ratio could add 1.7% to the stock’s annual returns. The stock does not pay a dividend, but has a strong total return potential of 9.7% per year over the next five years.

Best Grocery Stock #2: Amazon.com, Inc. (AMZN)

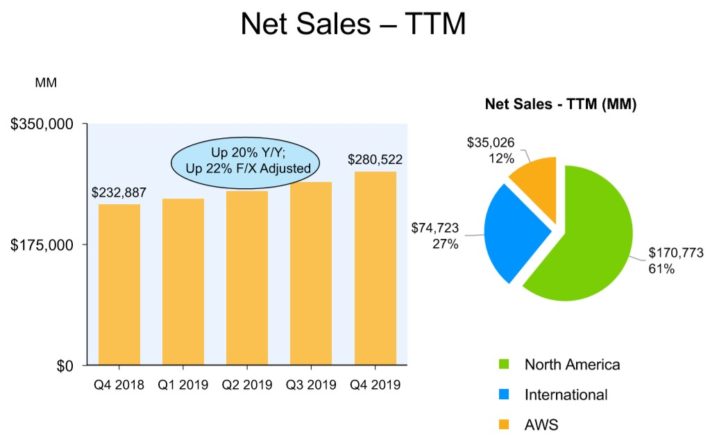

has become one the world’s largest online retailers. In 2019 the company generated $280.5 billion in revenue, with approximately 57% from product sales and 43% from services (from 61% and 39% in 2018). In addition, North America accounted for roughly 61% of sales, International markets make up 27% of sales and Amazon Web Services (AWS) equaled about 12% of sales last year.

On January 30th, 2020 Amazon released Q4 and full year 2019 results. For the quarter Amazon generated $87.4 billion in revenue, above prior guidance of $80 – $86.5 billion, representing a 20.8% improvement compared to Q4 2018. This result was driven by a 13.1% increase in product sales and a 33.3% increase in service sales.

For the year Amazon generated $280.5 billion in sales, representing a 20.5% year-over-year improvement compared to the $232.9 billion posted in 2018.

Source: Investor Presentation

Operating income increased from $12.42 billion to $14.54 billion. Net income increased from $10.07 billion ($20.14 per share) to $13.98 billion ($23.01 per share).

Amazon also provided guidance for the first quarter of 2020. The company expects Net Sales of between $69.0 billion and $73.0 billion, indicating 16% to 22% growth, along with Operating Income of $3.0 billion to $4.2 billion.

We expect 10% annual cash flow per share growth over the next five years. We prefer to analyze Amazon stock through the lens of cash flow instead of earnings-per-share, as the company’s EPS has historically proven volatile. Over the past decade shares of Amazon have traded hands with an average Price-to-Cash Flow ratio of about 40.

However, this was also during a time when this metric was growing by an average of 37% per year. Given the size of the business, the improvements already made and the lowered growth prospects moving forward, we have used 24 times Cash Flow as a starting baseline.

Amazon stock trades for a price-to-cash flow ratio of 23.7, based on expected CF-per-share of $80 for 2020. This means the stock is slightly undervalued. Amazon does not a pay a dividend, but due to underlying growth and a modest tailwind from valuation expansion, we expect annual returns of 10.3% per year through 2025.

Best Grocery Stock #1: Target (TGT)

Target was founded in 1902 and after a failed bid to expand into Canada, has operations solely in the U.S. market. Its business consists of about 1,850 big box stores, which offer general merchandise and food. Target generates approximately $81 billion in total revenue this year.

Target reported Q4 and full-year earnings on March 3rd and results beat expectations on the bottom line, but slightly missed revenue consensus. Comparable sales rose 1.5% in Q4, which was short of expectations of a 2.1% gain. Transactions rose 1.3% during the quarter and the average ticket moved fractionally higher, adding 0.2%.

Full-year sales were up 3.6% to $77 billion, reflecting a 3.4% comparable sales gain and a fractional gain from nonmature stores. The company continues to gain due to its digital initiatives, as that channel produced more than 80% of the company’s comparable sales gains in the fourth quarter.

Target’s earnings-per-share rose from $5.39 to $6.39 year-over-year as the company’s impressive growth continues. We expect $6.90 in earnings-per-share for this year as we see a modest revenue increase, share repurchases, and margin gains to combine to produce another solid year of earnings expansion.

After the market-wide selloff due to the coronavirus, Target shares are trading under our estimate of fair value. Shares trade at a price-to-earnings ratio of 15.4, which is still in excess of its 10-year average of 14.7, but below our estimate of fair value at 17 times earnings. We note this is the lowest yield the stock has traded with for several years, going back to the aftermath of the financial crisis. If the stock reverts to our estimate of fair value over the next five years, it will produce an annualized tailwind of about 2% to total returns.

Target is not immune to a recession, but it should fare better than many other retailers due to its status as a nationwide discount retailer. For example, in the Great Recession, its earnings-per-share fell 14% in 2008. Nevertheless, that performance was much better than that of most companies, which saw their earnings collapse during the Great Recession. Moreover, it took only one year for the earnings of Target to return to their pre-crisis level. Therefore, while Target is vulnerable to economic downturns, it is much more resilient than most stocks in such periods.

Target has a secure dividend payout with an expected 2020 payout ratio below 40%, and an attractive yield of 2.7%. The stock trades for a 2020 P/E ratio of 14.2, compared with our fair value estimate of 17. An expanding P/E ratio could add 3.7% to Target’s annual return. The combination of dividends and 6% expected EPS growth leads to total expected returns of 12.4% per year over the next five years. This makes Target our top-ranked grocery stock.

Final Thoughts

The grocery industry is changing like never before. Now that Amazon has acquired Whole Foods, it is likely the company will accelerate its push into the grocery industry even further, especially with new technologies such as cashier-less stores.

In addition, if Amazon is able to significantly lower Whole Foods’ notoriously high prices, it could represent a real threat to the entire grocery industry. Leveraging Whole Foods’ grocery presence and Amazon’s technological prowess could prove to be a formidable combination.

The top grocery stocks have decades of experience in the retail industry. They have proven the ability to navigate difficult waters before, and adapt to changing conditions when necessary. The grocery industry is evolving; the key players are differentiating themselves.

Broadly speaking, the grocery industry is attractive for investors right now, as the coronavirus lockdowns have resulted in the closures of many restaurants and retailers. Investors looking to buy stocks in this industry should focus on the grocery stocks with durable competitive advantages, and the financial strength to continue investing in growth.

In the final analysis, one thing is true. People will always be buying groceries. This makes the grocery stocks likely to outperform the S&P 500 Index in a prolonged market downturn, as they have done so far in 2020.

Target and Walmart have the longest histories of annual dividend increases, while Kroger and Costco have provided strong dividend growth. Amazon and Sprouts do not currently pay dividends, but in return could be higher-growth picks.