Updated on November 15th, 2019 by Bob Ciura

Coal is the most burdensome type of energy fuel for the environment. As a result, numerous countries make coordinated efforts to phase out coal in favor of natural gas and renewable energy sources, such as solar and wind power.

While U.S. consumption of coal has steadily decreased since peaking in 2008, coal production has actually grown in the last two years thanks to the impressive growth in U.S. coal exports. Demand continues to rise in emerging markets such as China and India.

In 2018, U.S. coal exports reached 116 million short tons, the highest level in five years and almost twice the level of 2016. The increased exports have resulted from high international prices, which have made it economical for the domestic producers to export coal.

This has allowed several coal companies to return to profitability, and in some cases, pay dividends to shareholders. Dividend-paying coal stocks are included on our list of 427 dividend stocks in the materials sector.

You can access all 427 dividend-paying materials stocks with a downloadable spreadsheet below:

While many investors have concluded that coal stocks will soon become irrelevant, this is far from true. In this article, we will analyze the four best coal stocks today.

Table Of Contents

You can use the following table of contents to instantly jump to a specific stock:

- Warrior Met Coal (HCC)

- Alliance Resource Partners (ARLP)

- BHP Group (BHP)

- Natural Resource Partners (NRP)

Rankings are compiled based upon a qualitative assessment of strength of business model, future growth potential, balance sheet health, and sustainability of shareholder dividends. The four stocks are listed in no particular order. These four stocks collectively represent our top picks in the coal industry over the next several years.

Coal Stock #4: Warrior Met Coal (HCC)

Warrior Met Coal is a low-cost producer of metallurgical coal. It has underground mining operations in Alabama. The company produces high-quality hard coking coal, which is the reason behind the ticker of the stock. Warrior sells all its coal production to steel producers in Europe, South America and Asia. Warrior is a small-cap with a market capitalization of $930 million.

Warrior exhibited remarkably strong performance in 2018 and exceeded its own guidance. It achieved record production of 7.7 million short tons and record sales of 7.6 million short tons, higher than its guidance of 7.1-7.5 million short tons for both metrics.

The company thus grew its production by 15% and its revenues by 17% over prior year. It also reported free cash flow of $458 million or $8.70 per share, a great achievement for a company that engages in a capital-intensive business.

It is impressive that Warrior returned $400 million to its shareholders last year, which is 25% of its market capitalization. The greatest part of those returns was the special dividend of $6.53, which the company distributed a year ago.

Warrior followed this up with another special dividend of $4.41 per share in the second quarter of 2019. It is reasonable to expect additional special dividends in the upcoming years. Warrior has an exceptionally strong balance sheet. Plus, the company buys back stock with a recently-authorized $70 million repurchase program.

It has net debt of $157 million, compared with $601 million of annual adjusted EBITDA. It has a leverage ratio of just 0.26x, meaning its debt is essentially negligible.

Moreover, Warrior has exciting growth prospects. Blue Creek, one of the few remaining untapped reserves of premium metallurgical coal, has the potential to provide Warrior with meaningful growth for several years.

Source: Investor Presentation

Management believes that Blue Creek can produce up to 3.0 million short tons per year. Such a production rate would increase the current output by nearly 40%. It appears that this project will be a major growth driver for the company in the upcoming years. Management expects to spend $550-$600 million over the next several years on this project.

The company has continued to perform well to start 2019. In the most recent quarter, sales and production volumes rose 19% year-over-year.

To conclude, Warrior has exciting growth prospects and a strong balance sheet. Both of these characteristics are very important in this highly cyclical business.

Moreover, the company distributes exceptionally high special dividends thanks to its extremely shareholder friendly management.

As the stock is trading at a trailing price-to-earnings ratio of only 6.8, it is likely to highly reward its shareholders from its current price.

The cheap valuation of coal stocks is a result of their high cyclicality but Warrior seems capable of withstanding downturns thanks to its high-value asset portfolio and its healthy balance sheet.

Coal Stock #3: Alliance Resource Partners (ARLP)

Alliance Resource Partners is a master limited partnership (MLP) that generates income primarily from coal production. It produces coal from eight mining complexes in various U.S. states and operates a coal loading terminal in Indiana. It also receives royalty income from its stakes in some oil and gas producing regions in the U.S., in an effort to reduce its exposure to coal prices.

However, this royalty income comprises a very small amount of its total EBITDA and hence Alliance Resource Partners should be viewed as an essentially pure-play coal producer.

As a commodity producer, Alliance Resource Partners is extremely sensitive to the prevailing price of coal. This is clearly reflected in the behavior of its stock, which has been on a roller coaster in the last five years.

Between 2014 and 2016, the price of coal plunged and caused the earnings per share of the company to slump more than 50%. That slump took its toll on the stock price, which plunged 80%, from $50 in 2014 to $10 in early 2016.

However, the strong international demand for coal has greatly increased the amount of U.S. exports in the last three years and thus it has provided a strong boost to the price of coal.

As a result, Alliance Resource Partners has enjoyed a strong recovery in the last three years, with its stock price almost doubling off its bottom three years ago.

In 2018, the company posted strong performance. Thanks to strong export volumes, it reported record sales volumes and grew its revenues by 11.5%, assisted also by higher coal prices. The company also grew its earnings 21%.

However, operating conditions have become more challenging to start 2019. In the third quarter, revenue declined 6.6% from the same quarter last year, due to lower sales volumes and weaker pricing. Adjusted EBITDA declined 10%, while the company absorbed a $15.2 million non-cash asset impairment charge.

Still, Alliance Resource Partners expects adjusted EBITDA of $598 million-$618 million for the full year. And, it continues to pay a compelling dividend, currently at $0.54 per quarter. Alliance Resource Partners is offering an exceptional 18.0% distribution yield. It has raised its dividend several times over the past two years.

While such abnormal yields usually indicate the risk of an imminent cut, analysts currently expect the company to earn $2.18 per share for 2019, which would sufficiently cover the annualized distribution of $2.16.

On the other hand, investors should always remember that commodity producers are very sensitive to the underlying commodity prices. In the downturn of its business, Alliance Resource Partners cut its distribution by 35% in 2016, from $0.675 to $0.4375.

Nevertheless, the company has raised its distribution in most quarters since then and thus it has partly restored its dividend, to $0.54 per quarter.

Overall, Alliance Resource Partners is likely to continue offering an exceptional distribution yield for the foreseeable future and the stock will still offer an attractive yield even in the event of a major downturn.

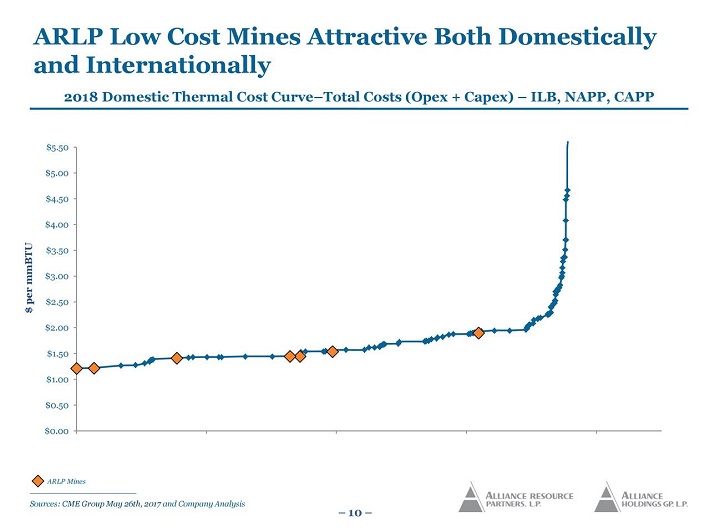

It is also important to note that Alliance Resource Partners has a significant competitive advantage, namely the low production cost of its mines.

Source: Investor Presentation

This competitive advantage is of paramount importance, given the high cyclicality of the business. Whenever a downturn shows up and coal prices slump, Alliance Resource Partners should remain profitable while some of its peers will incur losses due to their high cost base.

Finally, investors should focus on the most important feature of the company, its solid balance sheet. Given the high cyclicality of this business, a strong balance sheet is of paramount importance.

A strong balance sheet helps the company navigate successfully during downturns, without causing permanent losses (via dilution) to its shareholders. A healthy balance sheet is also a testament to the quality of management, which is very important in the cyclical sectors.

Coal Stock #2: BHP Group (BHP)

BHP Group, formerly known as BHP Billiton, is an exploration and production giant headquartered in Australia. BHP is in the metals and mining industry, with a market capitalization of $119 billion. Approximately 39% of annual EBITDA is derived from Iron Ore production, 28% from Copper, 19% from Coal, and 14% from Petroleum. One ADR is equal to two common shares.

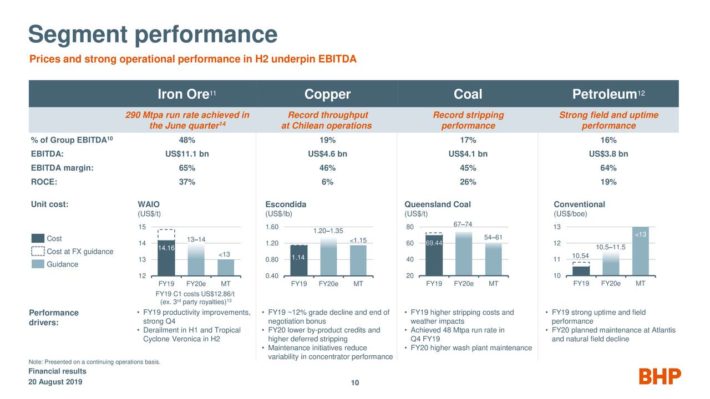

In mid-August, BHP reported (8/20/19) financial results for the fourth quarter of its fiscal 2019 (BHP’s fiscal year ends June 30th). The company grew its operating earnings-per-share 33%, from $2.49 to $3.32, primarily thanks to higher commodity prices, particularly the iron ore prices. In addition, BHP completed its U.S. onshore asset sale for $10.4 billion. Thanks to this asset sale and its strong results, BHP declared a record dividend of $2.66 per ADR.

Source: Investor Presentation

Management emphasized that it has grown production 10% and has reduced unit production costs more than 20% in the last 5 years. BHP has greatly benefited from the reduced supply in the iron ore market due to the collapse of a dam in Brazil in January, which led the country’s authorities to close 56 dams. Due to that disaster, the price of iron ore increased significantly this year.

However, Brazil is now in the process of restoring its production while the ongoing trade war is exerting pressure on commodity prices due to fears over deceleration of the global economy. Consequently, the price of iron ore has fallen off its peak, with BHP’s management expecting further downside over the next three years

Just like all commodity producers, BHG Group is very sensitive to the gyrations of commodity prices. Consequently, its performance record has been highly volatile. In the Great Recession, its earnings per share plunged 62%. Even worse, in the recent commodities downturn, the company incurred huge losses in 2016 and thus it was forced to slash its dividend by 76% in that year.

That said, since the bottom of the commodity cycle in early 2016, BHP Group has enjoyed a strong recovery and hence its stock price more than doubled. Moreover, the company enjoys a strong tailwind this year, namely the reduced supply in the iron ore market due to the collapse of a dam in Brazil, which led the country’s mining regulator to close 56 tailing dams.

With that said, BHP Group remains a highly cyclical stock, which is highly vulnerable to downturns in the prices of commodities. Moreover, investors should be aware that the supply shortage in the iron ore market will be eliminated at some point in the future, when the iron ore mines in Brazil return to production mode. Therefore, the strong rally of the stock this year is more likely a profit-taking opportunity than an investing opportunity.

BHP Group is prudently managed in order to navigate successfully through the boom and bust cycles of commodities. However, it is impossible to avoid the high cyclicality of business performance and the dramatic swings of the stock price.

As a result, while the stock may maintain its positive momentum thanks to the supply shortage in the iron ore market, the stock will have significant downside whenever this market reverts to a healthy equilibrium.

Coal Stock #1: Natural Resource Partners (NRP)

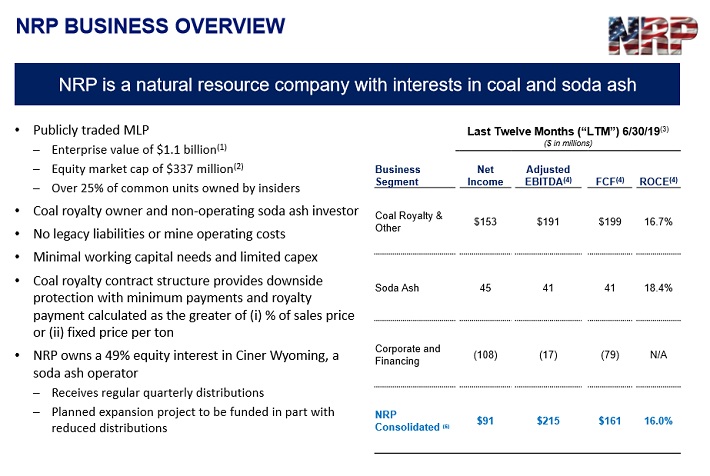

Natural Resource Partners is a master limited partnership headquartered in Texas. The company has a portfolio of properties related to coal, industrial minerals and other natural resources and has a market capitalization of only $275 million.

It receives royalties from coal producers and thus it does not incur the costs and risks related to the coal mining business. In addition, it receives about 60% of its coal royalties from metallurgical coal, which does not face the threats from environmental policies. Natural Resource Partners also has an interest in a soda ash company.

Source: Investor Presentation

At the end of last year, Natural Resource Partners sold its construction aggregates segment, VantaCore Partners, for $205 million. That transaction was a game changer for the stock, as the value of the transaction was approximately 40% of the current market capitalization of the stock.

The company used the proceeds to reduce its debt load and thus it reduced its leverage. Its debt-to-adjusted EBITDA ratio has decreased substantially over the past several years. For example, in 2016 the company had a leverage ratio of 5.3x, which is dangerous territory. But it has steadily reduced this to 2.6x, a much more manageable level of debt. In the most recent quarter, distributable cash flow increased 72% year-over-year.

Moreover, Natural Resource Partners has proved remarkably vulnerable to downturns. In 2015, when the price of coal plunged, the company posted a loss of $572 million. That loss offset all the earnings that the company had accumulated in the preceding four years. In addition, the stock plunged 95% in less than two years. Even worse, despite its rally off its bottom, the stock is still well below its 5-year high.

Natural Resource Partners is an example of the excessive risk of cyclical stocks. A rough year can erase the profits of several years and can cause devastating losses to the shareholders, who may not be able to retrieve their losses for more than a decade.

Natural Resource Partners has an 8% dividend yield, and is less risky than a traditional coal miner due to its unique business model. However, as with all the other coal stocks mentioned in this article, investors should view this stock as a high-risk, high-reward bet on coal’s future.

Final Thoughts

Coal stocks are highly cyclical and hence they should be avoided in principle by income-oriented investors. With that said, Warrior Met Coal has a cheap valuation, promising growth prospects and offers extremely generous dividends to its shareholders.

Alliance Resource Partners also has a cheap valuation and an exceptional double-digit distribution yield, with its distribution seeming safe for the foreseeable future.

Overall, while risk-averse and income oriented investors should avoid coal stocks in general, they may consider purchasing the above two stocks thanks to the remarkably attractive features they have right now.