Published on March 22nd, 2022 by Bob Ciura

The Dividend Kings are the best-of-the-best in dividend longevity.

What is a Dividend King? A stock with 50 or more consecutive years of dividend increases.

The downloadable Dividend Kings Spreadsheet List below contains the following for each stock in the index among other important investing metrics:

- Payout ratio

- Dividend yield

- Price-to-earnings ratio

You can see the full downloadable spreadsheet of all 40 Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

We typically rank stocks based on their five-year expected annual returns, as stated in the Sure Analysis Research Database.

But for investors primarily interested in income, it is also useful to rank the Dividend Kings according to their dividend yields.

This article will rank the 20 highest-yielding Dividend Kings today.

Table of Contents

- High Yield Dividend King #20: SJW Group (SJW)

- High Yield Dividend King #19: Emerson Electric Co. (EMR)

- High Yield Dividend King #18: Cincinnati Financial Corp. (CINF)

- High Yield Dividend King #17: Sysco Corp. (SYY)

- High Yield Dividend King #16: Procter & Gamble Co. (PG)

- High Yield Dividend King #15: Johnson & Johnson (JNJ)

- High Yield Dividend King #14: Colgate-Palmolive Co. (CL)

- High-Yield Dividend King #13: National Fuel Gas Co. (NFG)

- High-Yield Dividend King #12: Genuine Parts Co. (GPC)

- High-Yield Dividend King #11: PepsiCo Inc. (PEP)

- High-Yield Dividend King #10: The Coca-Cola Company (KO)

- High-Yield Dividend King #9: Black Hills Corp. (BKH)

- High-Yield Dividend King #8: AbbVie Inc. (ABBV)

- High-Yield Dividend King #7: Federal Realty Investment Trust (FRT)

- High-Yield Dividend King #6: Northwest Natural Holding Co. (NWN)

- High-Yield Dividend King #5: Kimberly-Clark (KMB)

- High-Yield Dividend King #4: 3M Company (MMM)

- High-Yield Dividend King #3: Leggett & Platt (LEG)

- High-Yield Dividend King #2: Universal Corporation (UVV)

- High-Yield Dividend King #1: Altria Group (MO)

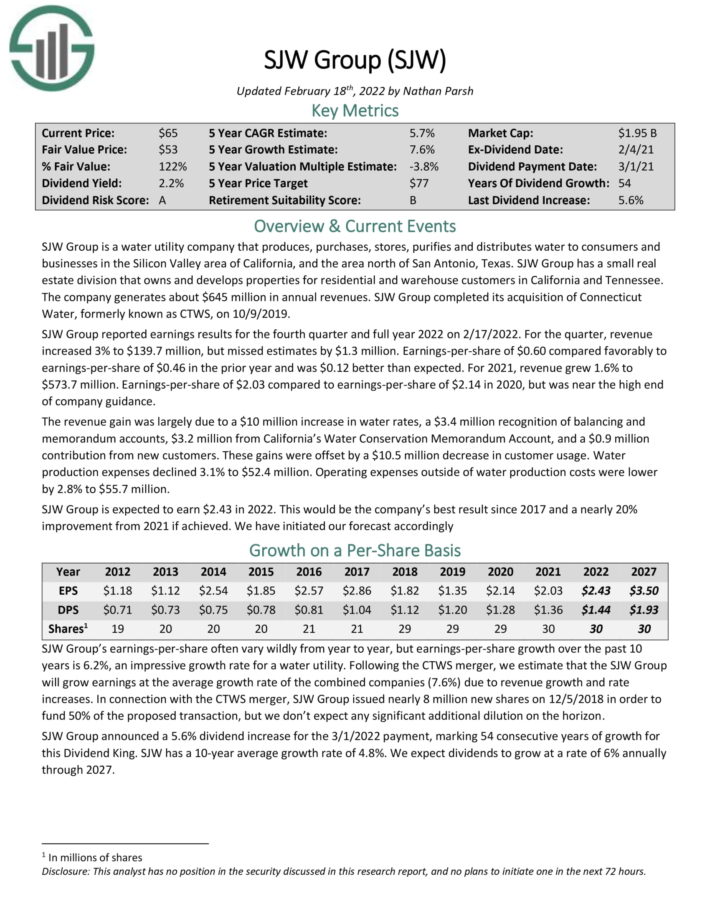

High Yield Dividend King #20: SJW Group (SJW)

- Dividend Yield: 2.1%

SJW Group is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, and the area north of San Antonio, Texas. SJW Group has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $645 million in annual revenues.

Source: Investor Presentation

SJW Group reported earnings results for the fourth quarter and full year 2022 on 2/17/2022. For the quarter, revenue increased 3% to $139.7 million, but missed estimates by $1.3 million. Earnings-per-share of $0.60 compared favorably to $0.46 in the prior year and was $0.12 better than expected. For 2021, revenue grew 1.6% to $573.7 million. EPS of $2.03 compared to $2.14 in 2020, but was near the high end of company guidance.

Click here to download our most recent Sure Analysis report on SJW Group (preview of page 1 of 3 shown below):

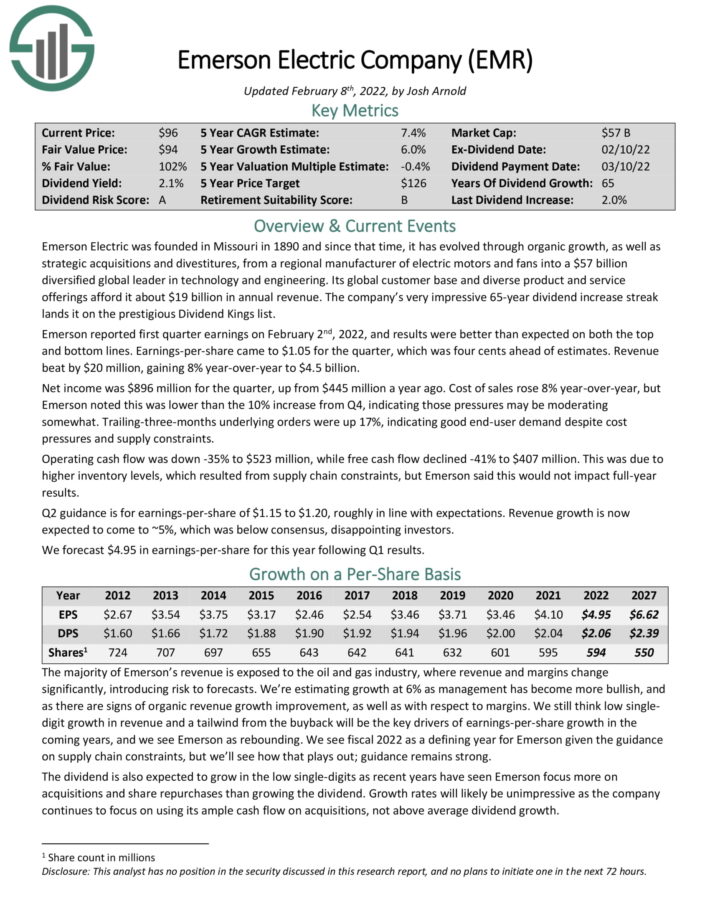

High Yield Dividend King #19: Emerson Electric Co. (EMR)

- Dividend Yield: 2.1%

Emerson Electric is an ideal candidate for a no-fee DRIP program, as the company has increased its dividend for over 60 years in a row. Emerson Electric was founded in Missouri in 1890. Today, it generates $18+ billion in annual revenue.

Emerson is organized into two major reporting segments called Automation Solutions and Commercial & Residential Solutions. Automation Solutions helps manufacturers minimize energy usage, waste, and other costs in their processes. The Commercial & Residential Solutions segment makes products that protect food quality and safety, as well as boost efficiency in the production process.

Emerson reported first quarter earnings on February 2nd, 2022, and results were better than expected on both the top and bottom lines. EPS came to $1.05 for the quarter, which was four cents ahead of estimates. Revenue beat by $20 million, gaining 8% year-over-year to $4.5 billion.

Click here to download our most recent Sure Analysis report on Emerson Electric (preview of page 1 of 3 shown below):

High Yield Dividend King #18: Cincinnati Financial Corp. (CINF)

- Dividend Yield: 2.2%

Cincinnati Financial is an insurance company founded in 1950. It offers business, home, auto insurance, and financial products, including life insurance, annuities, property, and casualty insurance.

As an insurance company, Cincinnati Financial makes money in two ways. It earns income from premiums on policies written and by investing its float, or the large sum of money consisting of the time value between the premium income and insurance claims.

On February 15, 2022, Cincinnati Financial reported results for the fourth quarter and full Fiscal Year (FY)2021. For the full year, total revenue was up 8% compared to FY2020. CINF generated a net income of $1,470 million, or $9.04 per share, compared with $1,049 million, or $6.47 per share, in the fourth quarter of 2020, after recognizing a $1.113 billion fourth–quarter 2021 after–tax increase in the fair value of equity securities still held.

For the year, net income is up 142%. On a non–GAAP operating income basis, the company made $320 million for the quarter, up $58 million or 22% compared to the fourth quarter of 2020.

For the fiscal year, non-GAAP operating income is up 95%, from $3.28 per share in FY2020 to $6.41 per share. The company book value increased 22 % since year–end to $81.72, which is a record high for the company. Also, on January 28, 2022, the company increased its dividend by 9.5% to $0.69 per share per quarter. This makes it its 62 years of dividend increases.

Click here to download our most recent Sure Analysis report on Cincinnati Financial (preview of page 1 of 3 shown below):

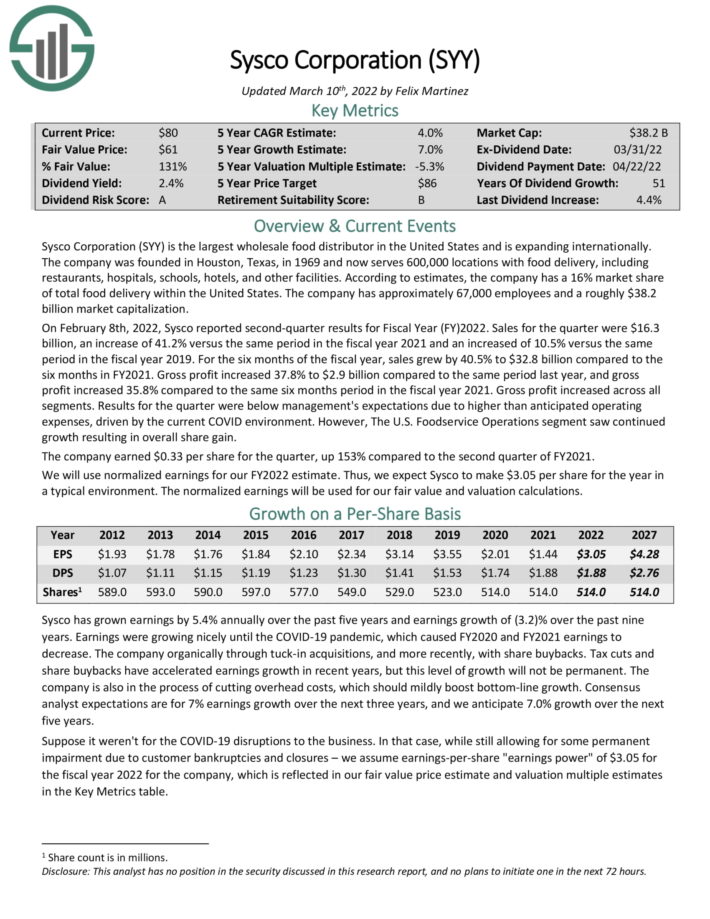

High Yield Dividend King #17: Sysco Corp. (SYY)

- Dividend Yield: 2.3%

Sysco Corporation is the largest wholesale food distributor in the United States and is expanding internationally. The company was founded in Houston, Texas, in 1969 and now serves 600,000 locations with food delivery, including restaurants, hospitals, schools, hotels, and other facilities.

Due to its leadership position in the food distribution industry, Sysco benefits from scale.

Source: Investor Presentation

On February 8th, 2022, Sysco reported second–quarter results for Fiscal Year (FY) 2022. Sales for the quarter were $16.3 billion, an increase of 41.2% versus the same period in the fiscal year 2021 and an increased of 10.5% versus the same period in the fiscal year 2019. For the six months of the fiscal year, sales grew by 40.5% to $32.8 billion compared to the six months in FY2021.

Click here to download our most recent Sure Analysis report on Sysco (preview of page 1 of 3 shown below):

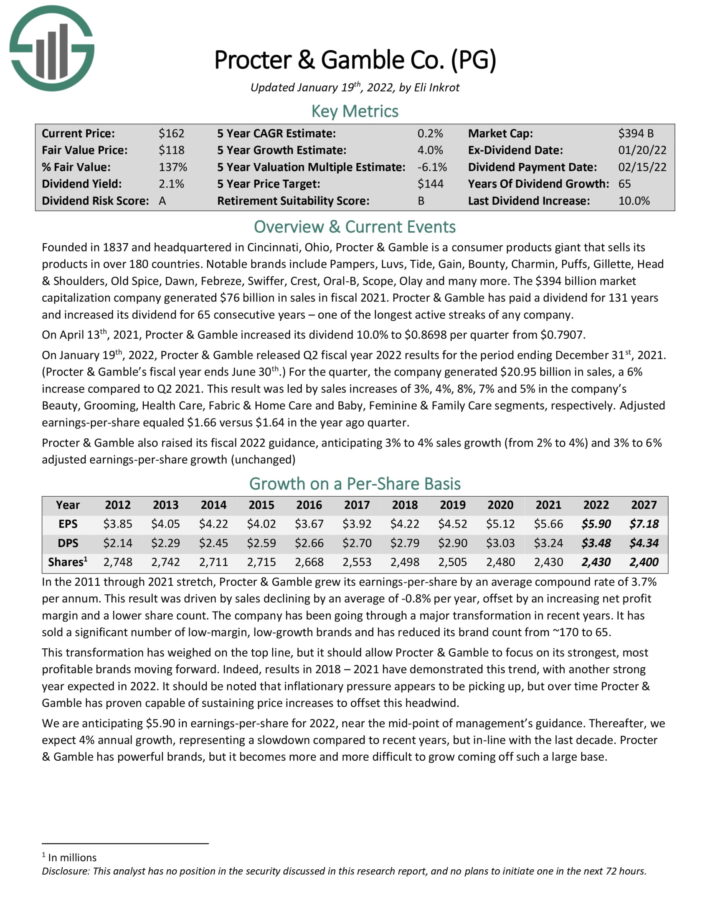

High Yield Dividend King #16: Procter & Gamble Co. (PG)

- Dividend Yield: 2.3%

Founded in 1837 and headquartered in Cincinnati, Ohio, Procter & Gamble is a consumer products giant that sells its products in over 180 countries. Notable brands include Pampers, Luvs, Tide, Gain, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Old Spice, Dawn, Febreze, Swiffer, Crest, Oral–B, Scope, Olay and many more. The company generated $76 billion in sales in fiscal 2021.

Procter & Gamble has paid a dividend for 131 years and increased its dividend for 65 consecutive years, which is one of the longest active streaks of any company. On April 13th, 2021, Procter & Gamble increased its dividend 10.0% to $0.8698 per quarter from $0.7907.

On January 19th, 2022, Procter & Gamble released Q2 fiscal year 2022 results for the period ending December 31st, 2021.

For the quarter, the company generated $20.95 billion in sales, a 6% increase compared to Q2 2021. This result was led by sales increases of 3%, 4%, 8%, 7% and 5% in the company’s Beauty, Grooming, Health Care, Fabric & Home Care and Baby, Feminine & Family Care segments, respectively. Adjusted EPS equaled $1.66 versus $1.64 in the year ago quarter.

Procter & Gamble also raised its fiscal 2022 guidance, anticipating 3% to 4% sales growth (from 2% to 4%) and 3% to 6% adjusted earnings–per–share growth.

Click here to download our most recent Sure Analysis report on PG (preview of page 1 of 3 shown below):

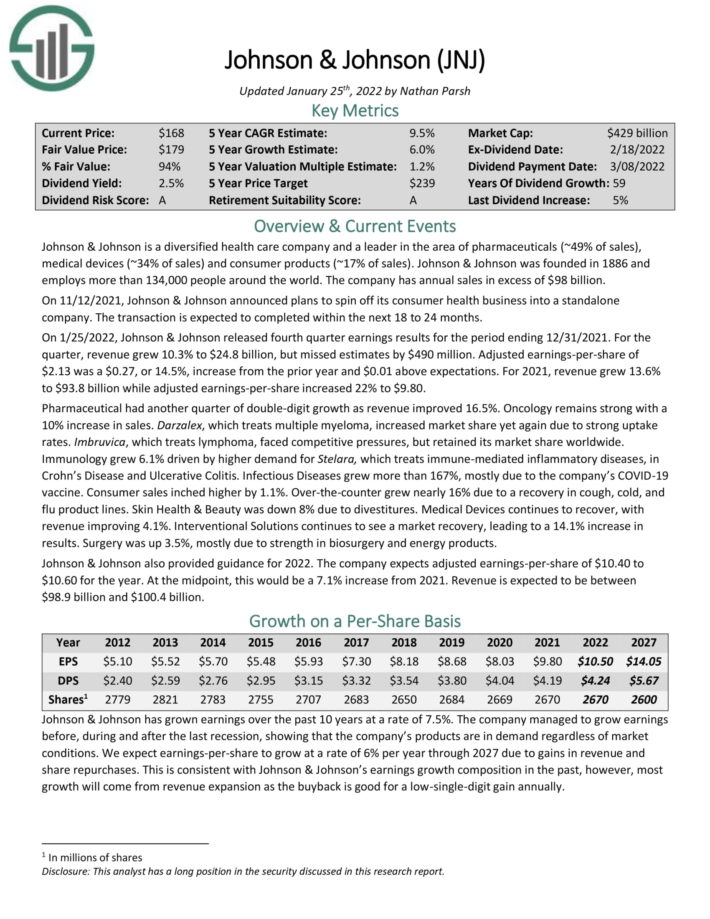

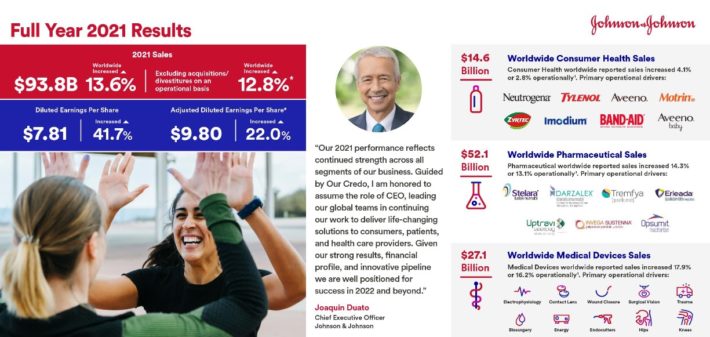

High Yield Dividend King #15: Johnson & Johnson (JNJ)

- Dividend Yield: 2.4%

Johnson & Johnson is a diversified health care company and a leader in the area of pharmaceuticals (~49% of sales), medical devices (~34% of sales) and consumer products (~17% of sales). The company has annual sales in excess of $93 billion.

Source: Investor Presentation

For 2021, revenue grew 13.6% to $93.8 billion while adjusted earnings–per–share increased 22% to $9.80. Pharmaceutical had another quarter of double–digit growth as revenue improved 16.5%. Oncology remained strong with a 10% increase in sales. Consumer sales inched higher by 1.1%. And Medical Devices continued to recover, with

revenue improving 4.1%.

Johnson & Johnson also provided guidance for 2022. The company expects adjusted EPS of $10.40 to $10.60 for the year. At the midpoint, this would be a 7.1% increase from 2021. Revenue is expected to be between $98.9 billion and $100.4 billion.

Click here to download our most recent Sure Analysis report on J&J (preview of page 1 of 3 shown below):

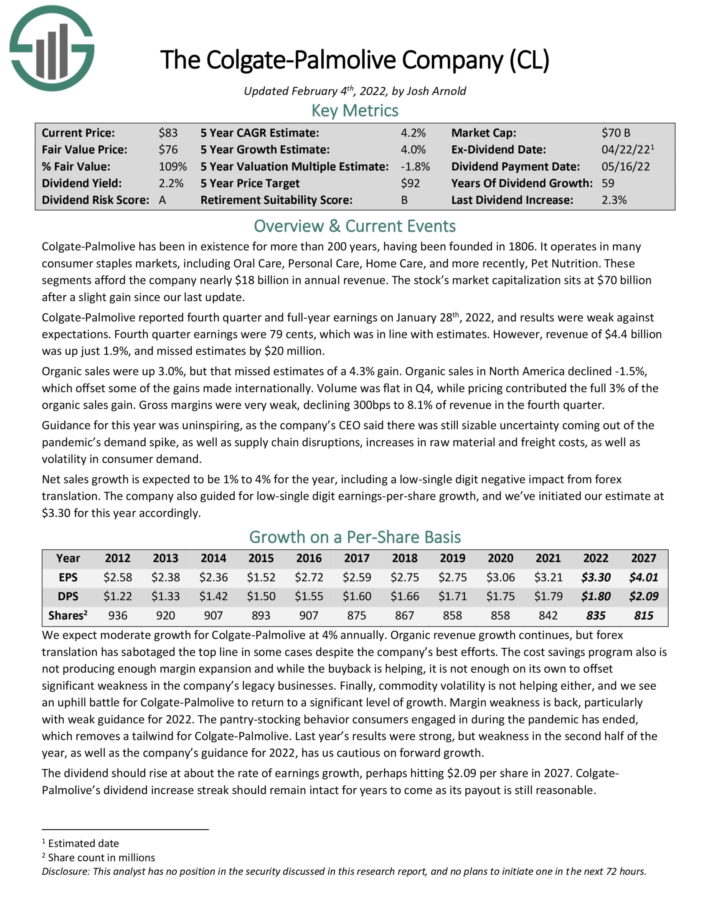

High Yield Dividend King #14: Colgate-Palmolive Co. (CL)

- Dividend Yield: 2.6%

Colgate-Palmolive has been in existence for more than 200 years, having been founded in 1806. It operates in many consumer staples markets, including Oral Care, Personal Care, Home Care, and more recently, Pet Nutrition. These segments afford the company nearly $18 billion in annual revenue.

Colgate-Palmolive reported fourth quarter and full–year earnings on January 28th, 2022, and results were weak against expectations. Fourth quarter earnings were 79 cents, which was in line with estimates. However, revenue of $4.4 billion was up just 1.9%, and missed estimates by $20 million.

Organic sales were up 3.0%, but that missed estimates of a 4.3% gain. Organic sales in North America declined 1.5%, which offset some of the gains made internationally. Volume was flat in Q4, while pricing contributed the full 3% of the organic sales gain. Gross margins were very weak, declining 300 basis points to 8.1% of revenue in the fourth quarter.

Click here to download our most recent Sure Analysis report on Colgate-Palmolive (preview of page 1 of 3 shown below):

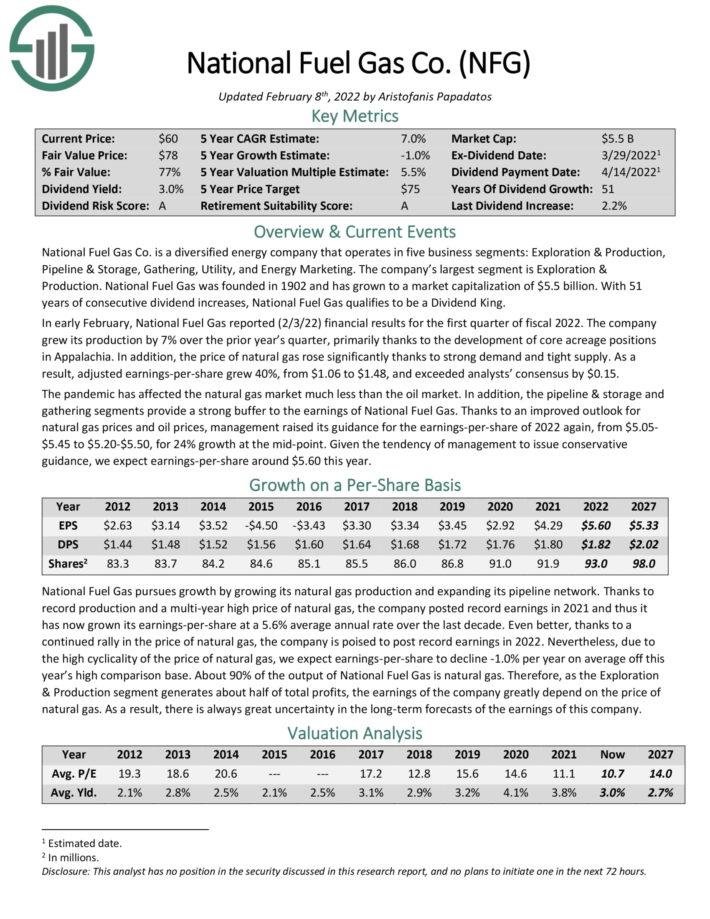

High Yield Dividend King #13: National Fuel Gas Co. (NFG)

- Dividend Yield: 2.7%

National Fuel Gas Co. is a diversified energy company that operates in five business segments: Exploration & Production, Pipeline & Storage, Gathering, Utility, and Energy Marketing. The company’s largest segment is Exploration & Production.

In early February, National Fuel Gas reported (2/3/22) financial results for the first quarter of fiscal 2022. The company grew its production by 7% over the prior year’s quarter, primarily thanks to the development of core acreage positions in Appalachia. In addition, the price of natural gas rose significantly thanks to strong demand and tight supply. As a result, adjusted EPS grew 40%, from $1.06 to $1.48.

Click here to download our most recent Sure Analysis report on NFG (preview of page 1 of 3 shown below):

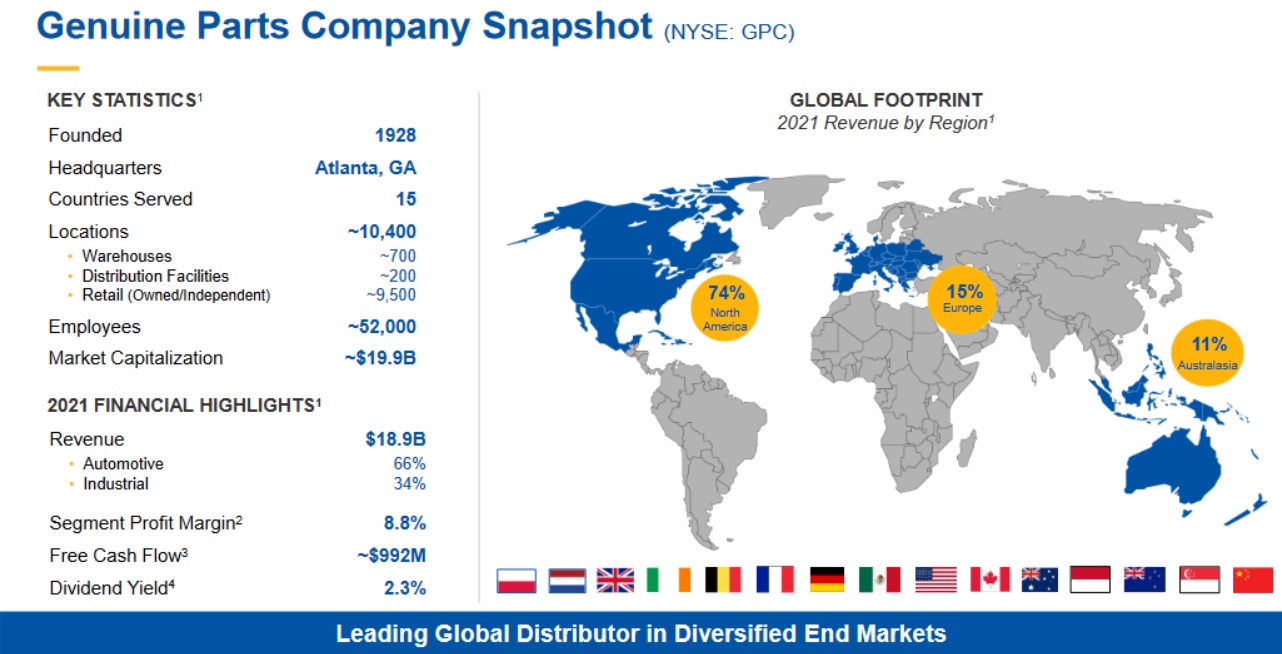

High Yield Dividend King #12: Genuine Parts Co. (GPC)

- Dividend Yield: 2.8%

Genuine Parts Company was founded in 1928 and since that time, it has grown into a sprawling conglomerate that sells automotive and industrial parts, electrical materials, and general business products.

Its global span reaches throughout North America, Australia, New Zealand, and Europe and is comprised of more than 9,000 retail locations.

Source: Investor Presentation

Genuine Parts is also a Dividend King, having raised its dividend for an incredible 66 consecutive years.

Genuine Parts reported fourth quarter and full–year earnings on February 17th, 2022. Total revenue was up 13% year–over–year to $4.8 billion, which was $140 million ahead of expectations. Sales gains in the fourth quarter were attributable to an 11.3% increase in comparable sales, as well as a 1.9% benefit from acquisitions.

Earnings in Q4 came to $1.79 per share, up sharply from $1.52 per share in the comparable period a year ago on an adjusted basis.

For the year, sales were $18.9 billion, a 14% increase from 2020. Net income on an adjusted basis was $997 million, or $6.97 per share, up 31% from $5.27 in 2020.

Click here to download our most recent Sure Analysis report on Genuine Parts (preview of page 1 of 3 shown below):

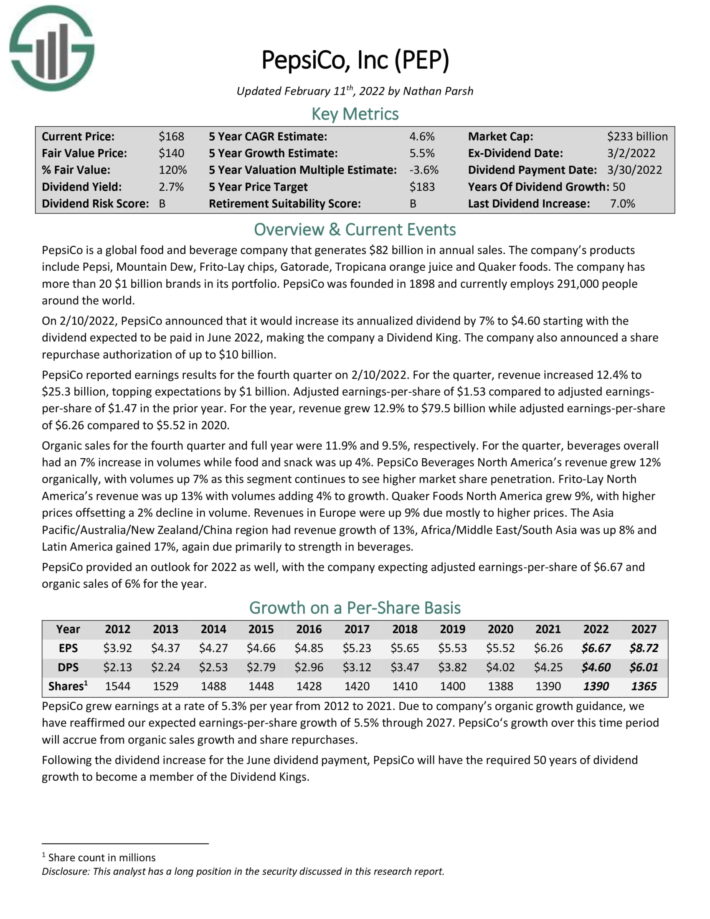

High Yield Dividend King #11: PepsiCo Inc. (PEP)

- Dividend Yield: 2.8%

PepsiCo is a global food and beverage company that generates $82 billion in annual sales. The company’s brands include Pepsi, Mountain Dew, Frito–Lay chips, Gatorade, Tropicana orange juice and Quaker foods. The company has more than 20 $1 billion brands in its portfolio.

On 2/10/2022, PepsiCo announced that it would increase its annualized dividend by 7% to $4.60 starting with the dividend expected to be paid in June 2022, making the company a Dividend King. The company also announced a share repurchase authorization of up to $10 billion.

PepsiCo reported earnings results for the fourth quarter on 2/10/2022. For the quarter, revenue increased 12.4% to $25.3 billion, topping expectations by $1 billion. Adjusted earnings–per–share of $1.53 compared to adjusted EPS of $1.47 in the prior year. For the year, revenue grew 12.9% to $79.5 billion while adjusted EPS of $6.26 compared to $5.52 in 2020.

Click here to download our most recent Sure Analysis report on PepsiCo (preview of page 1 of 3 shown below):

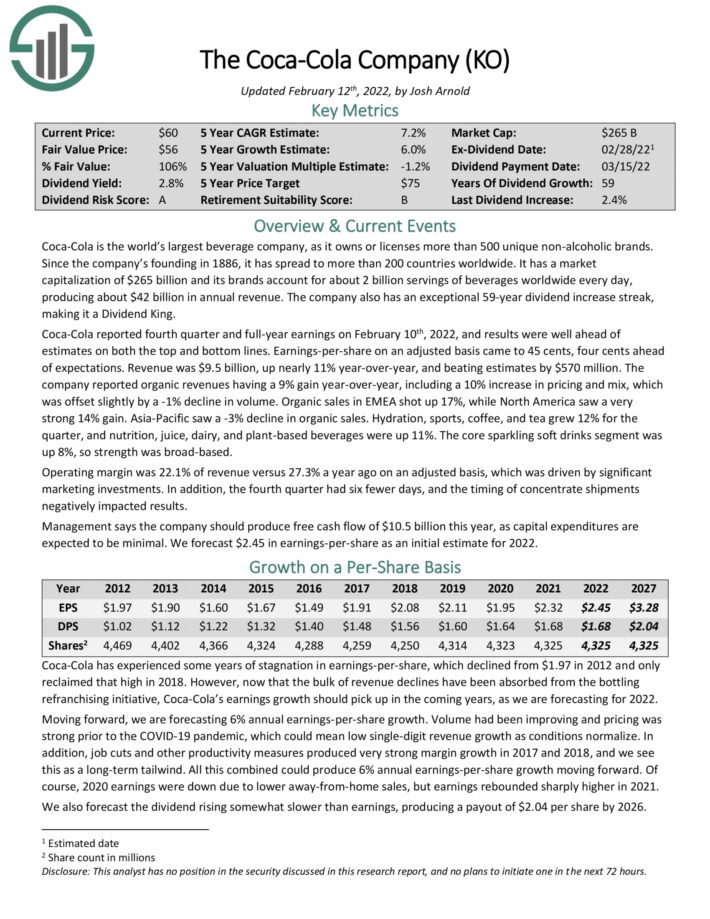

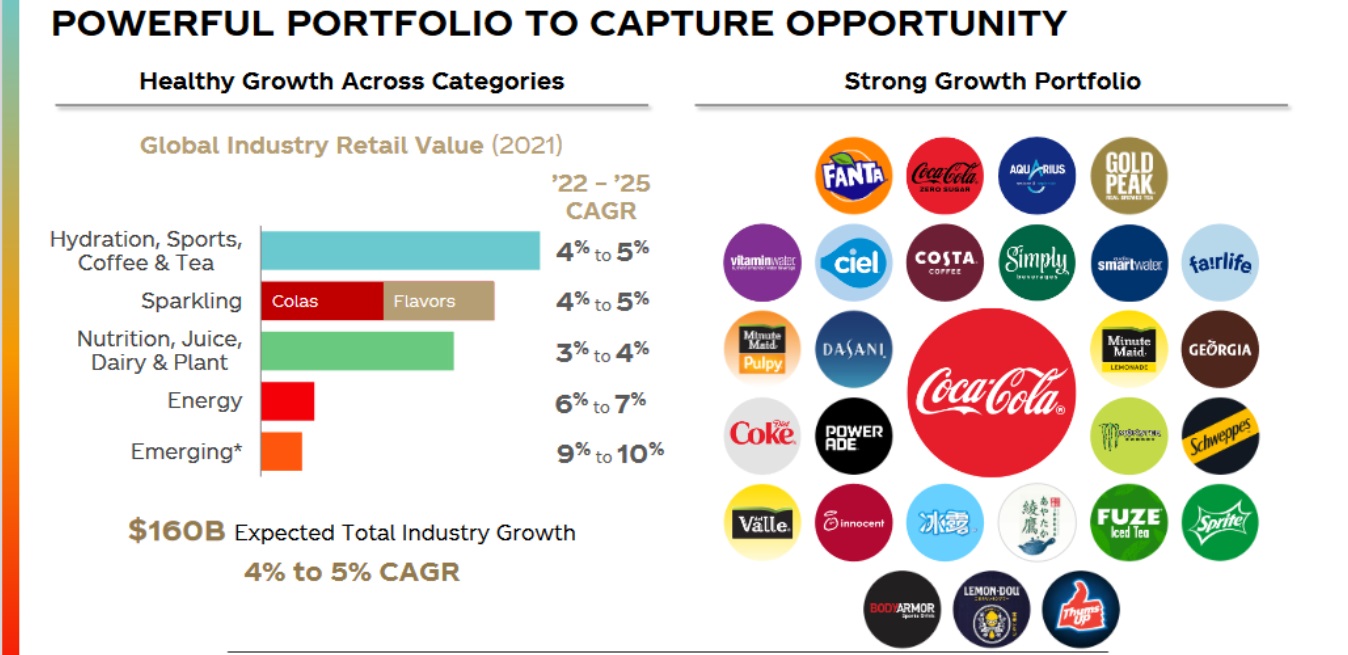

High Yield Dividend King #10: The Coca-Cola Company (KO)

- Dividend Yield: 2.9%

Coca-Cola is the world’s largest beverage company, as it owns or licenses more than 500 unique non–alcoholic brands. Since the company’s founding in 1886, it has spread to more than 200 countries worldwide.

Source: Investor Presentation

The company also has an exceptional 59-year dividend increase streak.

Coca-Cola reported fourth quarter and full-year earnings on February 10th, 2022, and results were well ahead of estimates on both the top and bottom lines.

Earnings-per-share on an adjusted basis came to 45 cents, four cents ahead of expectations. Revenue was $9.5 billion, up nearly 11% year-over-year, and beating estimates by $570 million.

Organic sales in EMEA shot up 17%, while North America saw a very strong 14% gain. Asia-Pacific saw a 3% decline in organic sales. Hydration, sports, coffee, and tea grew 12% for the quarter, and nutrition, juice, dairy, and plant-based beverages were up 11%. The core sparkling soft drinks segment was up 8%, so strength was broad based.

Click here to download our most recent Sure Analysis report on The Coca-Cola Company (preview of page 1 of 3 shown below):

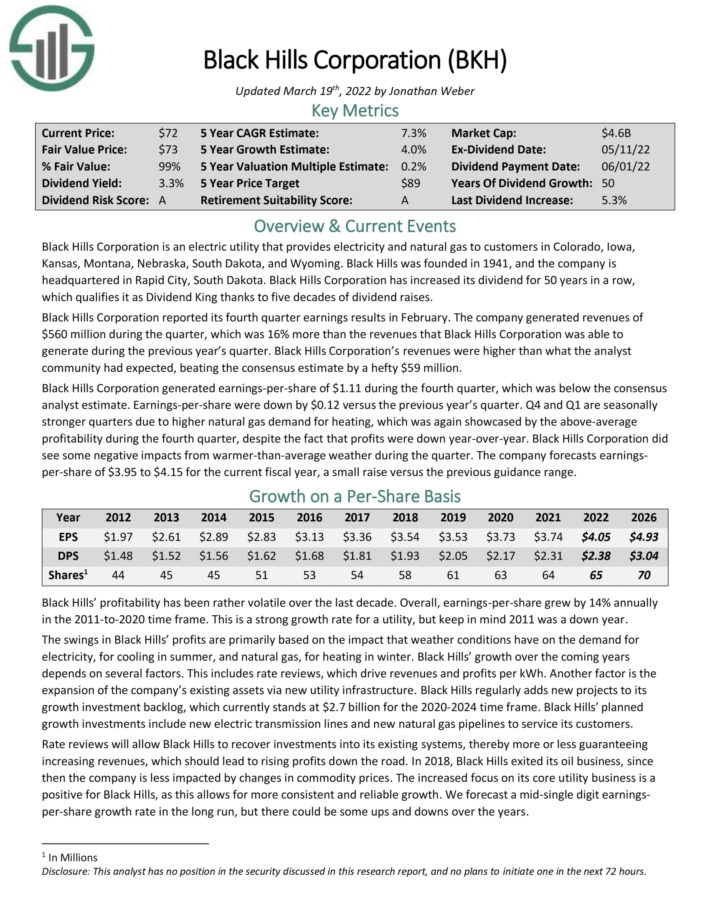

High Yield Dividend King #9: Black Hills Corporation (BKH)

- Dividend Yield: 3.3%

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming. Black Hills was founded in 1941, and the company is headquartered in Rapid City, South Dakota.

The company generated revenues of $560 million in the fourth quarter, which was 16% more than the revenues that Black Hills Corporation was able to generate during the previous year’s quarter. Black Hills Corporation’s revenues were higher than what the analyst community had expected, beating the consensus estimate by a hefty $59 million.

Black Hills Corporation generated EPS of $1.11 during the fourth quarter, which was below the consensus analyst estimate. EPS declined by $0.12 versus the previous year’s quarter. The company forecasts EPS of $3.95 to $4.15 for the current fiscal year, which should easily cover the dividend payout.

Click here to download our most recent Sure Analysis report on Black Hills (preview of page 1 of 3 shown below):

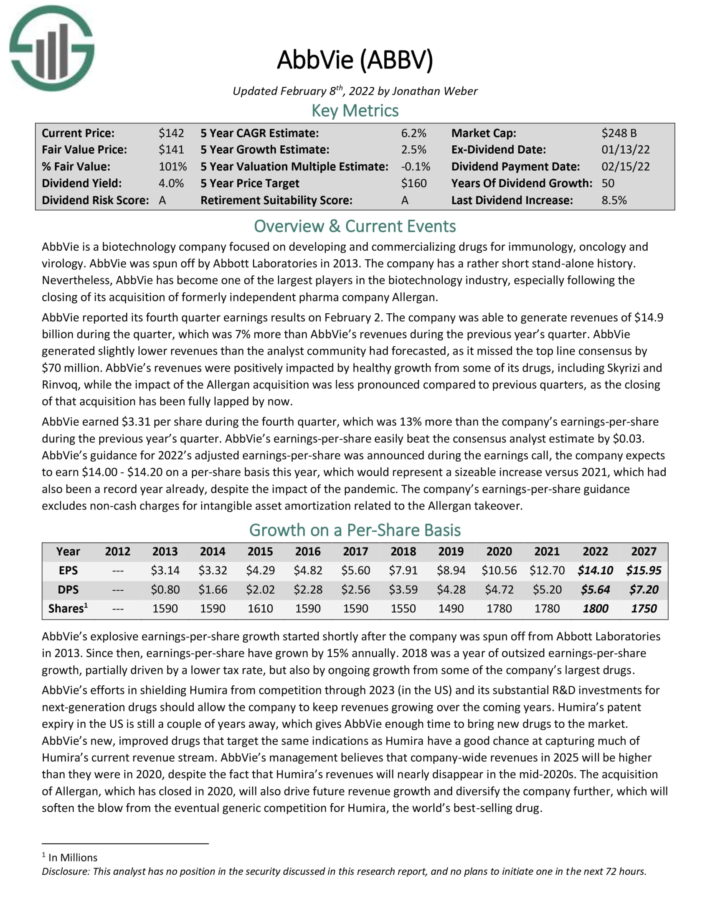

High Yield Dividend King #8: AbbVie Inc. (ABBV)

- Dividend Yield: 3.5%

AbbVie Inc. is a pharmaceutical company spun off by Abbott Laboratories (ABT) in 2013. Its most important product is Humira, which is now facing biosimilar competition in Europe, which has had a noticeable impact on the company. Humira will lose patent protection in the U.S. in 2023.

Even so, AbbVie remains a giant in the healthcare sector, with a large and diversified product portfolio.

AbbVie reported its fourth quarter earnings results on February 2. Revenues of $14.9 billion rose 7% from the previous year’s quarter. Revenues were positively impacted by healthy growth from some of its drugs, including Skyrizi and Rinvoq. AbbVie earned $3.31 per share during the fourth quarter, which was up 13% year-over-year.

Click here to download our most recent Sure Analysis report on AbbVie (preview of page 1 of 3 shown below):

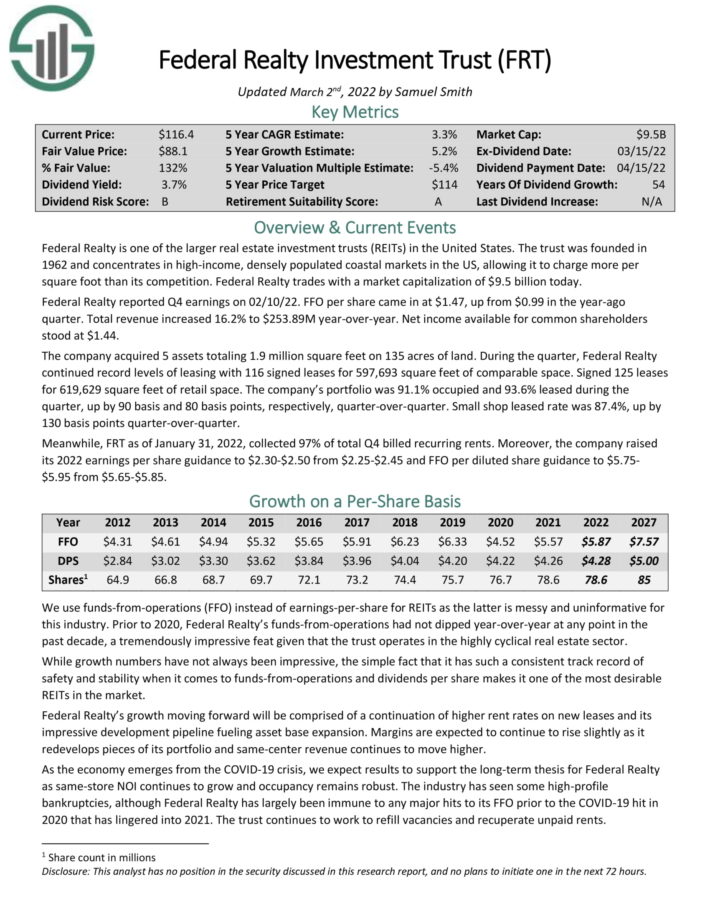

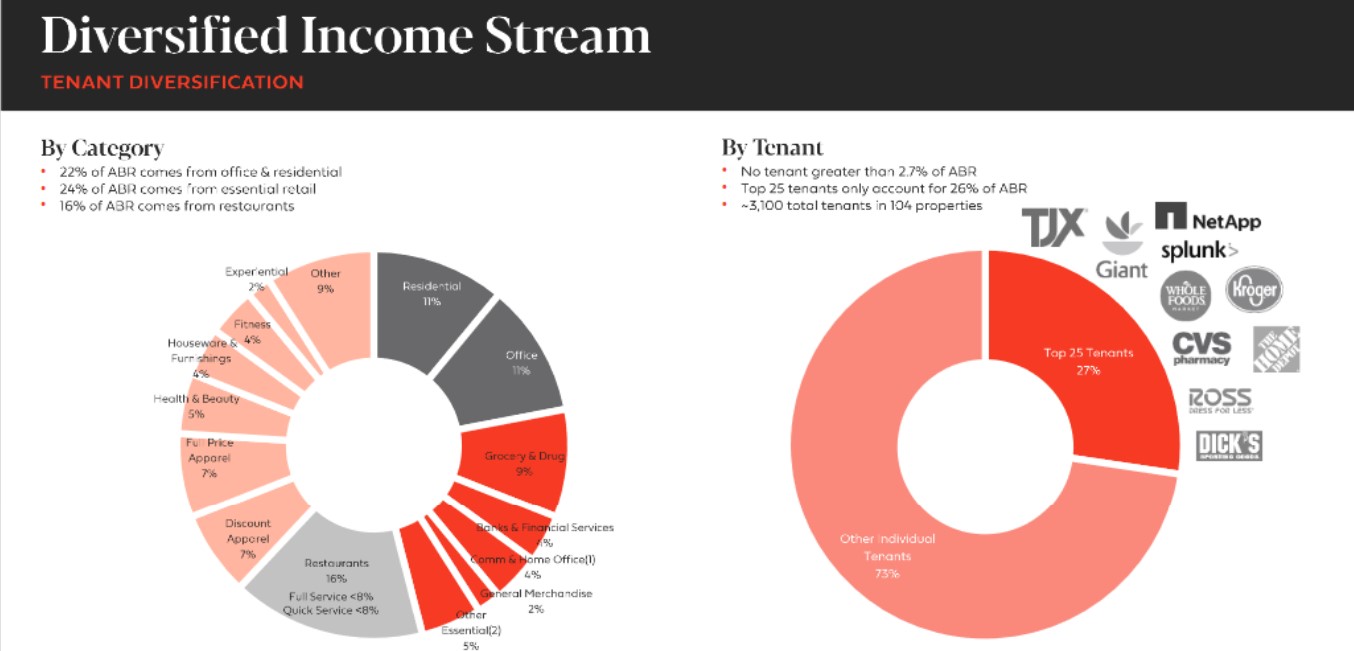

High Yield Dividend King #7: Federal Realty Investment Trust (FRT)

- Dividend Yield: 3.6%

Federal Realty was founded in 1962. As a Real Estate Investment Trust, Federal Realty’s business model is to own and rent out real estate properties. It uses a significant portion of its rental income, as well as external financing, to acquire new properties. This helps create a “snow-ball” effect of rising income over time.

Federal Realty primarily owns shopping centers. However, it also operates in redevelopment of multi-purpose properties including retail, apartments, and condominiums. The portfolio is highly diversified in terms of tenant base.

Source: Investor Presentation

Federal Realty reported Q4 earnings on 02/10/22. FFO per share came in at $1.47, up from $0.99 in the year-ago quarter. Total revenue increased 16.2% year–over–year. The company acquired 5 assets totaling 1.9 million square feet on 135 acres of land.

The company’s portfolio was 91.1% occupied and 93.6% leased during the quarter. Meanwhile, FRT as of January 31, 2022, collected 97% of total Q4 billed recurring rents.

Click here to download our most recent Sure Analysis report on Federal Realty (preview of page 1 of 3 shown below):

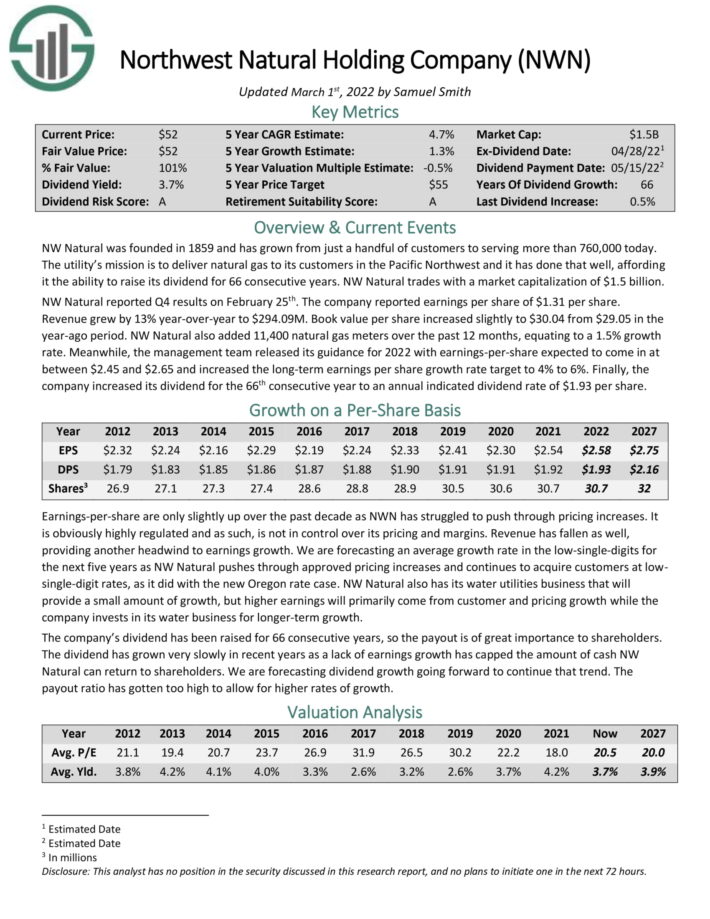

High Yield Dividend King #6: Northwest Natural Holding Co. (NWN)

- Dividend Yield: 3.7%

NW Natural was founded in 1859 and has grown from just a handful of customers to serving more than 760,000 today. The utility’s mission is to deliver natural gas to its customers in the Pacific Northwest and it has done that well, affording it the ability to raise its dividend for 66 consecutive years.

NW Natural reported Q4 results on February 25th. The company reported earnings per share of $1.31 per share. Revenue grew by 13% year-over-year to $294.09M. Book value per share increased slightly to $30.04 from $29.05 in the year-ago period. NW Natural also added 11,400 natural gas meters over the past 12 months, equating to a 1.5% growth rate.

Meanwhile, the management team released its guidance for 2022 with EPS expected to come in at between $2.45 and $2.65 and increased the long-term earnings per share growth rate target to 4% to 6%.

Click here to download our most recent Sure Analysis report on NWN (preview of page 1 of 3 shown below):

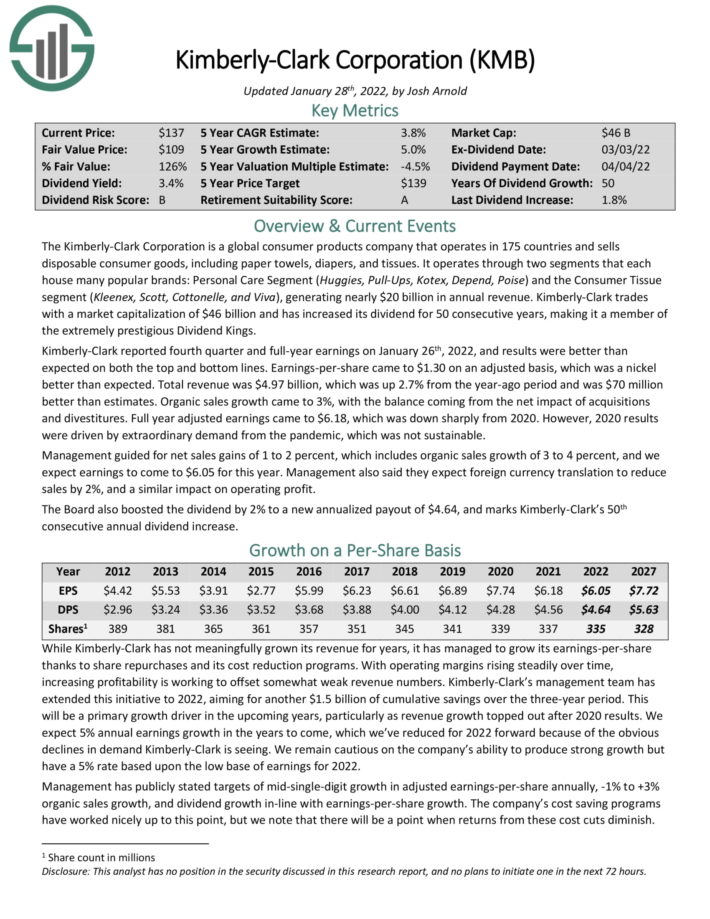

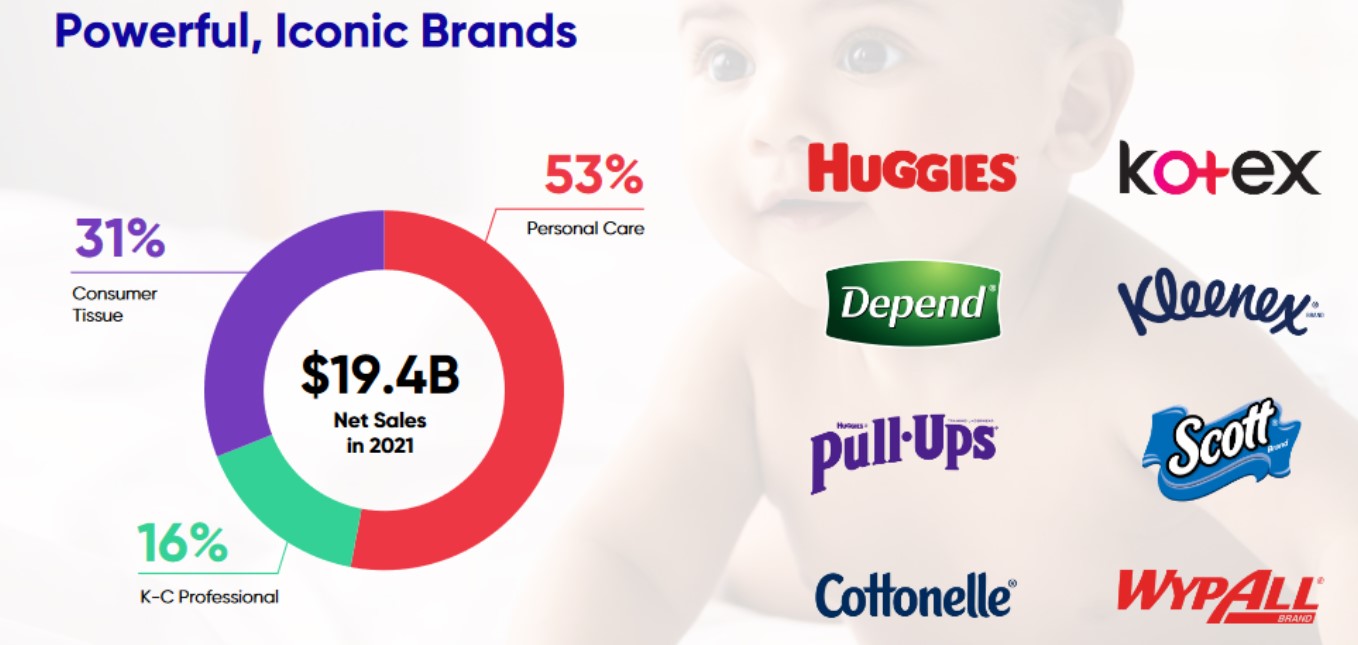

High Yield Dividend King #5: Kimberly-Clark (KMB)

- Dividend Yield: 3.8%

Kimberly-Clark is a global consumer products company that operates in 175 countries and sells disposable consumer goods, including paper towels, diapers, and tissues.

It operates through two segments that each house many popular brands: Personal Care Segment (Huggies, Pull-Ups, Kotex, Depend, Poise) and the Consumer Tissue segment (Kleenex, Scott, Cottonelle, and Viva), generating nearly $20 billion in annual revenue.

Source: Investor Presentation

Kimberly-Clark reported fourth quarter and full–year earnings on January 26th, 2022, and results were better than expected on both the top and bottom lines. EPS came to $1.30 on an adjusted basis, which was a nickel better than expected.

Total revenue was $4.97 billion, which was up 2.7% from the year–ago period and was $70 million better than estimates. Organic sales growth came to 3%, with the balance coming from the net impact of acquisitions and divestitures.

Full year adjusted earnings came to $6.18, which was down sharply from 2020. However, 2020 results were driven by extraordinary demand from the pandemic, which was not sustainable.

Click here to download our most recent Sure Analysis report on Kimberly-Clark (preview of page 1 of 3 shown below):

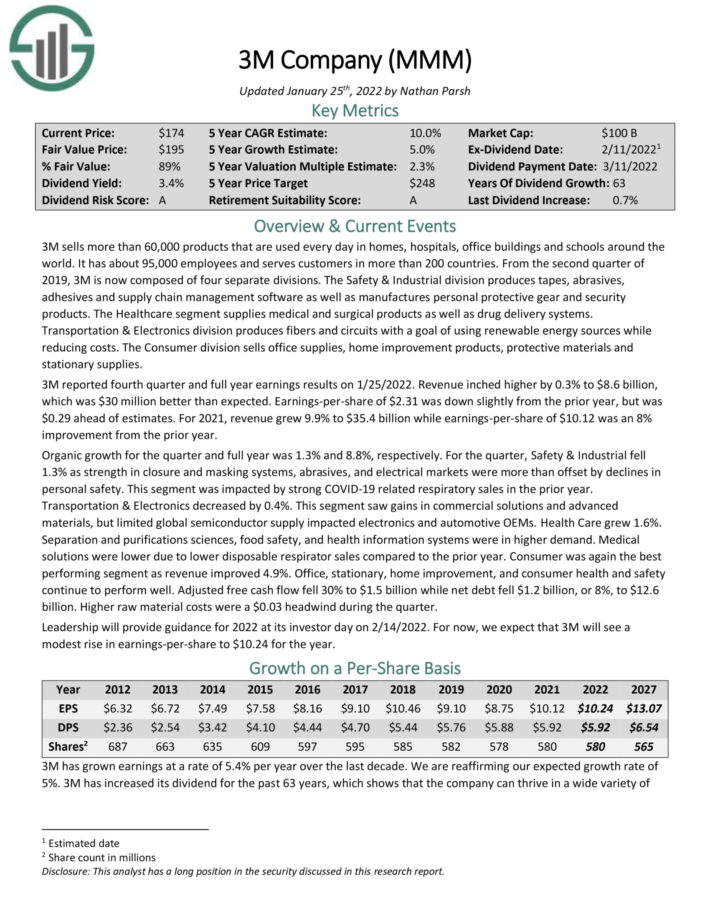

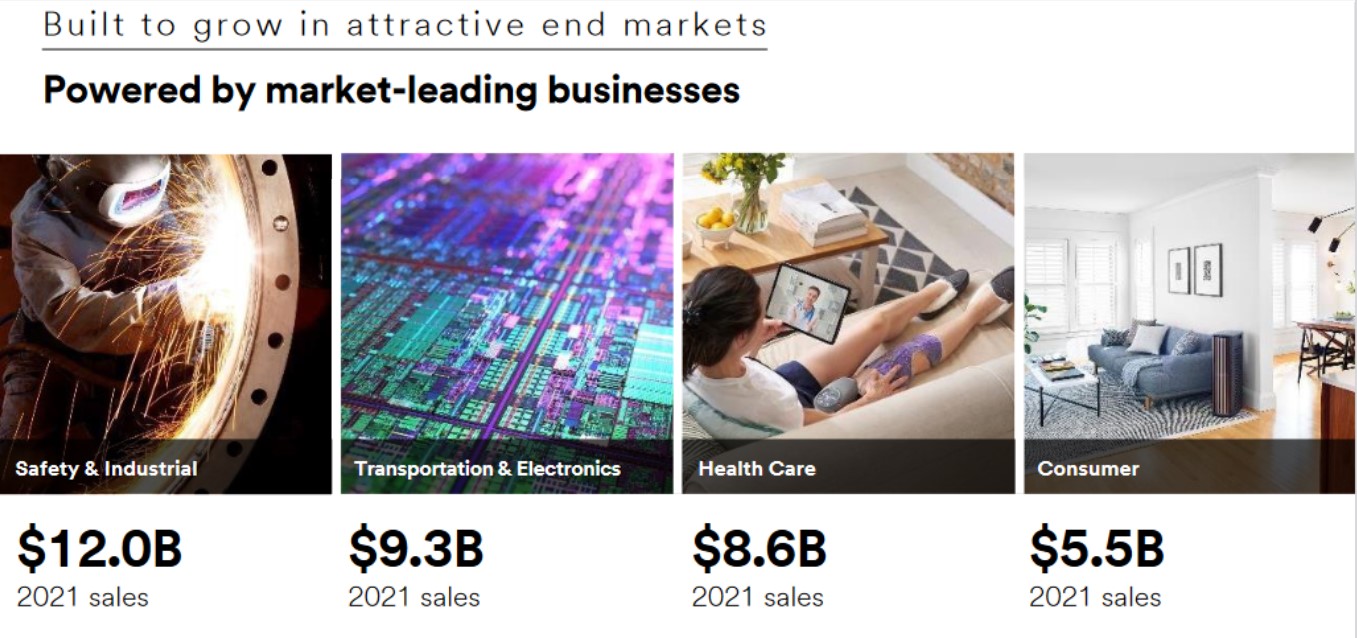

High Yield Dividend King #4: 3M Company (MMM)

- Dividend Yield: 4.0%

3M sells more than 60,000 products that are used every day in homes, hospitals, office buildings and schools around the world. It has about 95,000 employees and serves customers in more than 200 countries.

Source: Investor Presentation

3M is now composed of four separate divisions. The Safety & Industrial division produces tapes, abrasives, adhesives and supply chain management software as well as manufactures personal protective gear and security products.

The Healthcare segment supplies medical and surgical products as well as drug delivery systems. Transportation & Electronics division produces fibers and circuits with a goal of using renewable energy sources while reducing costs. The Consumer division sells office supplies, home improvement products, protective materials and stationary supplies.

3M reported fourth-quarter and full year earnings results on 1/25/2022. Revenue inched higher by 0.3% to $8.6 billion, which was $30 million better than expected. Earnings–per–share of $2.31 was down slightly from the prior year, but was $0.29 ahead of estimates.

For 2021, revenue grew 9.9% to $35.4 billion while earnings–per–share of $10.12 was an 8% improvement from the prior year.

Click here to download our most recent Sure Analysis report on 3M (preview of page 1 of 3 shown below):

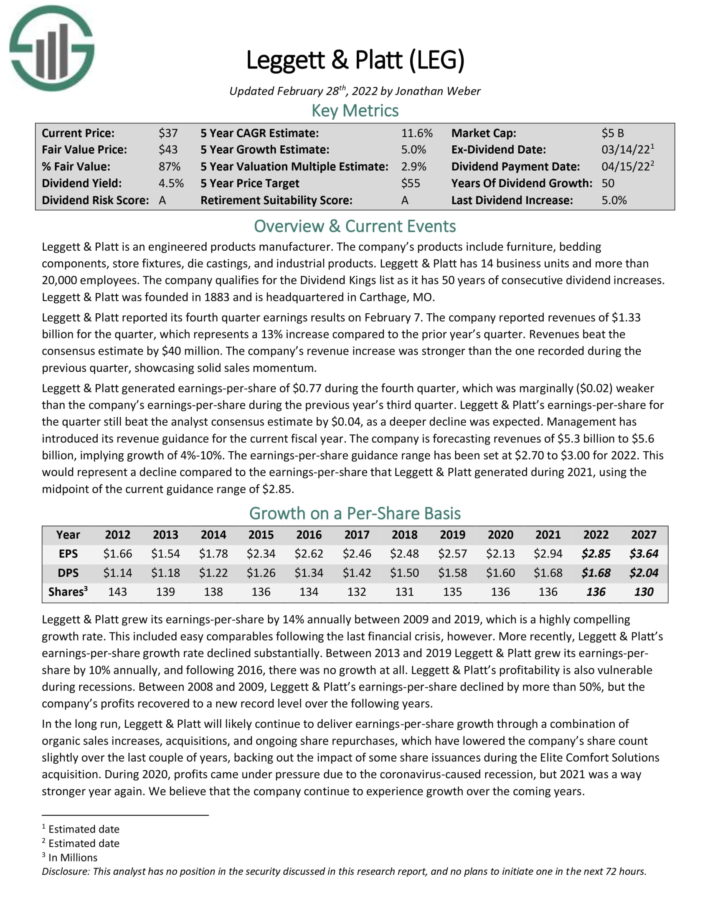

High Yield Dividend King #3: Leggett & Platt (LEG)

- Dividend Yield: 4.5%

Leggett & Platt is an engineered products manufacturer. The company’s products include furniture, bedding components, store fixtures, die castings, and industrial products. Leggett & Platt has 14 business units and more than 20,000 employees. The company qualifies for the Dividend Aristocrats Index as it has 50 years of consecutive dividend increases.

Leggett & Platt reported its fourth quarter earnings results on February 7th. The company reported revenues of $1.33 billion for the quarter, which represents a 13% increase compared to the prior year’s quarter. EPS of $0.77 during the fourth quarter was $0.02 lower than the previous year’s third quarter.

Management has introduced its revenue guidance for the current fiscal year. The company is forecasting revenues of $5.3 billion to $5.6 billion, implying growth of 4% to 10%. The EPS guidance range has been set at $2.70 to $3.00 for 2022.

Click here to download our most recent Sure Analysis report on Leggett & Platt (preview of page 1 of 3 shown below):

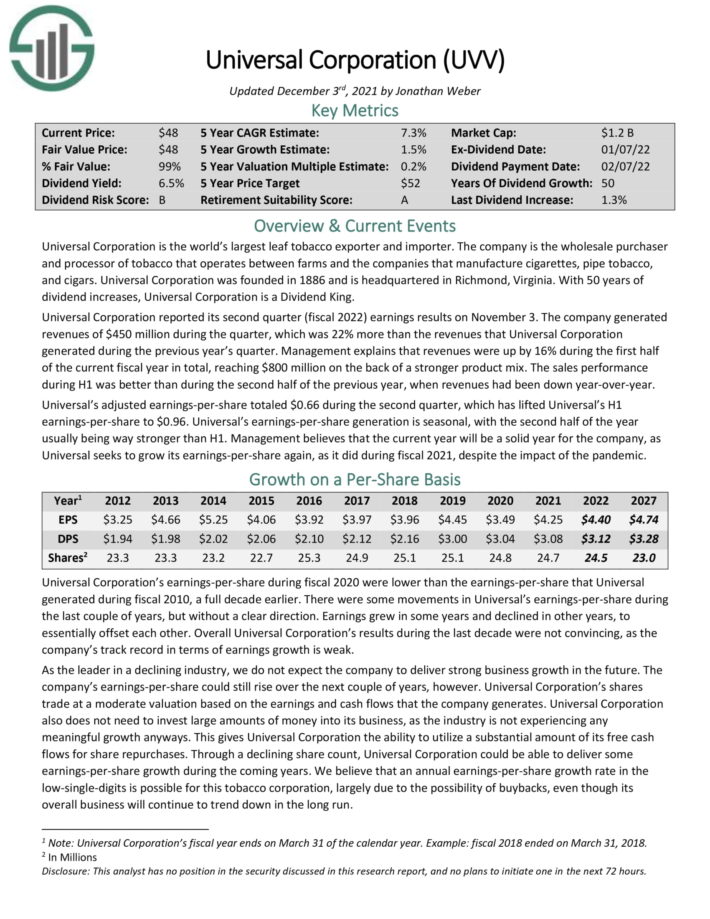

High Yield Dividend King #2: Universal Corporation (UVV)

- Dividend Yield: 5.6%

Universal Corporation is the world’s largest leaf tobacco exporter and importer. The company is the wholesale purchaser and processor of tobacco that operates between farms and the companies that manufacture cigarettes, pipe tobacco, and cigars. Universal Corporation was founded in 1886 and is headquartered in Richmond, Virginia.

The company generated revenues of $450 million during the fourth quarter, which was 22% more than the revenues that Universal Corporation generated during the previous year’s quarter. Management explains that revenues were up by 16% during the first half of the current fiscal year in total, reaching $800 million on the back of a stronger product mix.

The sales performance during H1 was better than during the second half of the previous year, when revenues had been down year-over-year. Universal’s adjusted EPS totaled $0.66 during the second quarter, which has lifted Universal’s H1 EPS to $0.96.

Click here to download our most recent Sure Analysis report on Universal (preview of page 1 of 3 shown below):

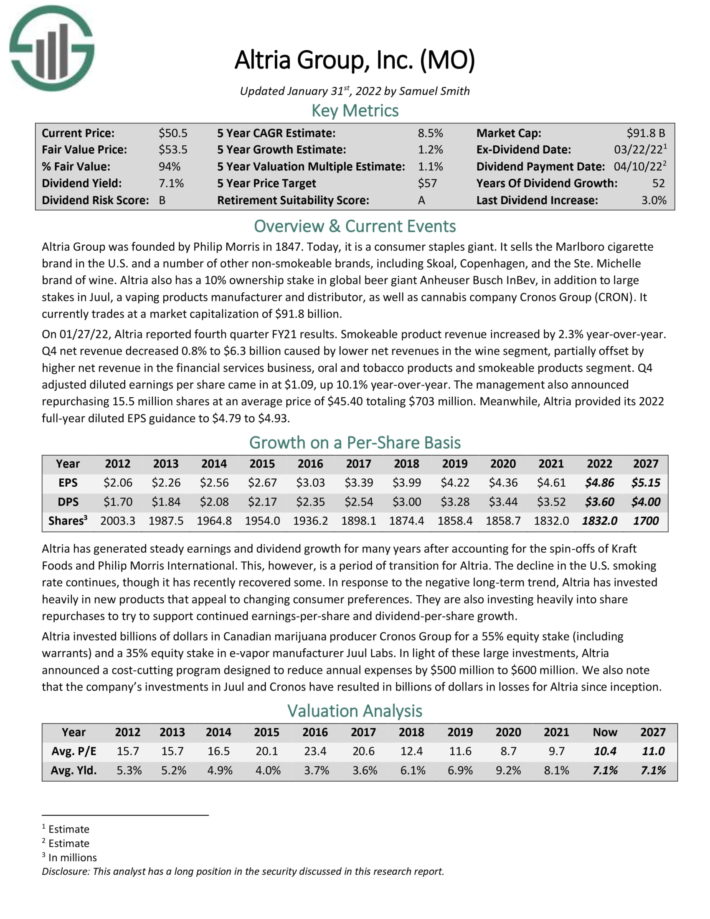

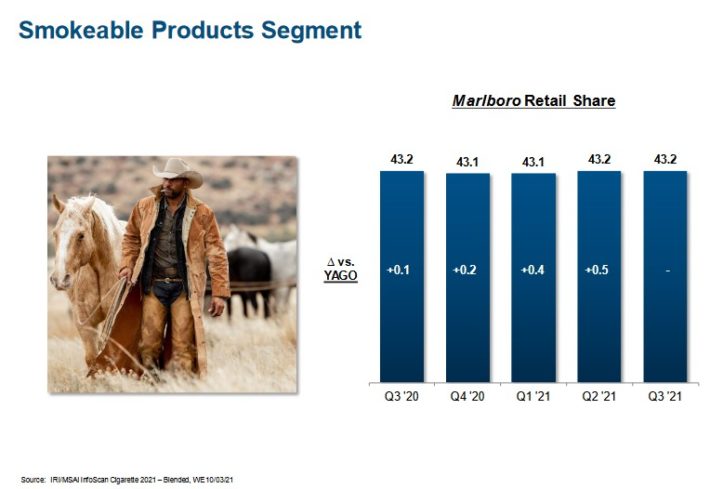

High Yield Dividend King #1: Altria Group (MO)

- Dividend Yield: 7.0%

Altria Group was founded by Philip Morris in 1847. Today, it is a consumer staples giant. It sells the Marlboro cigarette brand in the U.S. and a number of other non-smokeable brands, including Skoal and Copenhagen.

The flagship brand continues to be Marlboro, which commands over 40% retail market share in the U.S.

Source: Investor Presentation

Altria also has a 10% ownership stake in global beer giant Anheuser-Busch InBev, in addition to large stakes in Juul, a vaping products manufacturer and distributor, as well as cannabis company Cronos Group (CRON).

On 01/27/22, Altria reported fourth quarter FY21 results. Smokeable product revenue increased by 2.3% year-over-year. Net revenue decreased 0.8% to $6.3 billion caused by lower net revenues in the wine segment, partially offset by higher net revenue in the financial services business, oral and tobacco products and smokeable products segment. Q4 adjusted diluted earnings per share came in at $1.09, up 10.1% year-over-year.

Altria has increased its dividend for over 50 years.

Click here to download our most recent Sure Analysis report on Altria Group (preview of page 1 of 3 shown below):

Final Thoughts

High yield dividend stocks have obvious appeal to income investors. The S&P 500 Index yields just ~1.4% right now on average, making high yield stocks even more attractive by comparison.

Of course, investors should always do their research before buying individual stocks.

That said, the 20 stocks in this list have yields at least double the S&P 500 Index average, going all the way up to 7%. And, each of these stocks has increased their dividends for 50 consecutive years. They are all part of the exclusive Dividend Kings list.

As a result, income investors may find these 20 dividend stocks attractive.

Further Reading

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The Dividend Aristocrats List: a group of elite S&P 500 stocks with 25+ years of consecutive dividend increases.

- The Highest Yielding Dividend Aristocrats: the 20 Dividend Aristocrats with the highest dividend yields right now.

- The Dividend Champions List: a broader group of stocks with 25+ years of consecutive dividend increases, without the S&P 500 Index inclusion requirement.

- The Dividend Challengers List: stocks with 5-9 years of consecutive dividend increases.

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Blue Chip Stocks List: contains stocks on either the Dividend Achievers, Dividend Aristocrats, or Dividend Kings list.

- The Complete List of Monthly Dividend Stocks: stocks that pay dividends each month, for 12 payments over the year.

- The Highest Yielding Monthly Dividend Stocks: the 20 monthly dividend stocks with the highest dividend yields right now.