Updated August 26th, 2019 by Josh Arnold

Construction stocks can be defined very widely to include materials companies, home builders, retailers, and more.

You can download the full spreadsheet with all construction stocks below:

Furthermore, you can view a preview of our construction stocks spreadsheet below:

| FLR | Fluor Corp. | 17.99 | 4.8 | 2,427 | -5.2 | -25.1 | 1.59 |

| CAT | Caterpillar, Inc. | 117.99 | 2.9 | 66,205 | 10.9 | 31.8 | 1.39 |

| DE | Deere & Co. | 155.46 | 1.9 | 49,090 | 14.9 | 28.6 | 1.24 |

| GLDD | Great Lakes Dredge & Dock Corp. | 10.97 | 0.0 | 701 | 21.8 | 0.0 | 0.96 |

| DHI | D.R. Horton, Inc. | 49.89 | 1.2 | 18,287 | 11.8 | 13.7 | 0.80 |

| LEN | Lennar Corp. | 51.59 | 0.3 | 16,609 | 8.8 | 2.7 | 0.76 |

| NVR | NVR, Inc. | 3,681.11 | 0.0 | 13,192 | 16.1 | 0.0 | 0.60 |

| PHM | PulteGroup, Inc. | 33.04 | 1.3 | 9,019 | 10.0 | 12.8 | 0.64 |

| SHW | The Sherwin-Williams Co. | 526.30 | 0.8 | 48,679 | 41.5 | 31.3 | 0.88 |

| HD | The Home Depot, Inc. | 221.47 | 2.2 | 242,503 | 21.9 | 47.6 | 0.91 |

| LOW | Lowe's Cos., Inc. | 107.96 | 1.8 | 84,554 | 33.7 | 62.1 | 1.07 |

| TOL | Toll Brothers, Inc. | 35.77 | 1.2 | 5,072 | 7.5 | 9.4 | 0.70 |

| MAS | Masco Corp. | 40.68 | 1.2 | 11,844 | 16.6 | 19.5 | 1.02 |

| BLD | TopBuild Corp. | 92.51 | 0.0 | 3,178 | 18.6 | 0.0 | 0.83 |

| LII | Lennox International, Inc. | 257.46 | 1.0 | 10,122 | 28.1 | 29.0 | 0.85 |

| TMHC | Taylor Morrison Home Corp. | 23.61 | 0.0 | 2,468 | 11.0 | 0.0 | 0.67 |

| KBH | KB Home | 28.18 | 0.4 | 2,485 | 9.5 | 3.4 | 0.84 |

| MTH | Meritage Homes Corp. | 64.76 | 0.0 | 2,482 | 12.3 | 0.0 | 0.82 |

| FBHS | Fortune Brands Home & Security, Inc. | 51.84 | 1.6 | 7,285 | 17.9 | 28.9 | 1.21 |

| MHK | Mohawk Industries, Inc. | 115.64 | 0.0 | 8,368 | 10.9 | 0.0 | 1.01 |

| TPH | TRI Pointe Group, Inc. | 13.90 | 0.0 | 1,975 | 10.6 | 0.0 | 0.74 |

| OC | Owens Corning | 56.89 | 1.5 | 6,205 | 12.1 | 18.5 | 0.96 |

| MDC | M.D.C. Holdings, Inc. | 37.26 | 3.1 | 2,299 | 11.2 | 34.3 | 0.70 |

| CVCO | Cavco Industries, Inc. | 190.05 | 0.0 | 1,744 | 24.6 | 0.0 | 1.28 |

| WSO | Watsco, Inc. | 157.83 | 3.9 | 5,994 | 24.8 | 96.0 | 0.75 |

| LEG | Leggett & Platt, Inc. | 38.97 | 4.0 | 5,107 | 18.0 | 71.4 | 1.00 |

| TREX | Trex Co., Inc. | 85.88 | 0.0 | 5,005 | 41.3 | 0.0 | 1.33 |

| SKY | Skyline Champion Corp. | 30.37 | 0.0 | 1,730 | -39.5 | 0.0 | 1.68 |

| LGIH | LGI Homes, Inc. | 80.46 | 0.0 | 1,834 | 12.7 | 0.0 | 0.86 |

| IBP | Installed Building Products, Inc. | 58.65 | 0.0 | 1,774 | 29.7 | 0.0 | 1.20 |

| EXP | Eagle Materials, Inc. | 79.90 | 0.5 | 3,350 | 88.1 | 44.2 | 0.97 |

| MHO | M/I Homes, Inc. | 37.02 | 0.0 | 1,014 | 9.4 | 0.0 | 0.67 |

| LPX | Louisiana-Pacific Corp. | 22.55 | 2.3 | 2,807 | 16.9 | 39.4 | 0.68 |

| SSD | Simpson Manufacturing Co., Inc. | 63.85 | 1.4 | 2,869 | 23.7 | 32.8 | 0.89 |

| FND | Floor & Decor Holdings, Inc. | 49.24 | 0.0 | 4,841 | 40.6 | 0.0 | 1.37 |

| UFPI | Universal Forest Products, Inc. | 39.96 | 0.9 | 2,468 | 15.3 | 14.4 | 1.01 |

| CCS | Century Communities, Inc. | 28.83 | 0.0 | 883 | 11.6 | 0.0 | 1.03 |

| BLDR | Builders FirstSource, Inc. | 19.53 | 0.0 | 2,265 | 9.9 | 0.0 | 1.10 |

| BECN | Beacon Roofing Supply, Inc. | 31.11 | 0.0 | 2,115 | -97.2 | 0.0 | 0.69 |

| LENB | Lennar Corporation | 41.02 | 0.0 | 9,212 | 0.00 | ||

| WLH | William Lyon Homes, Inc. | 18.27 | 0.0 | 690 | 8.7 | 0.0 | 0.96 |

| DOOR | Masonite International Corp. | 50.30 | 0.0 | 1,253 | 20.3 | 0.0 | 0.71 |

| BZH | Beazer Homes USA, Inc. | 12.87 | 0.0 | 398 | -16.3 | 0.0 | 1.16 |

| JELD | JELD-WEN Holding, Inc. | 17.36 | 0.0 | 1,752 | 16.5 | 0.0 | 1.01 |

| AMWD | American Woodmark Corp. | 75.00 | 0.0 | 1,275 | 15.5 | 0.0 | 1.22 |

| PGTI | PGT Innovations, Inc. | 14.39 | 0.0 | 843 | 16.4 | 0.0 | 0.92 |

| NX | Quanex Building Products Corp. | 17.16 | 1.6 | 571 | -50.5 | -82.0 | 0.94 |

| ETH | Ethan Allen Interiors, Inc. | 18.15 | 4.2 | 476 | 18.8 | 79.8 | 0.63 |

| XTSLA | 0.00 | 0.0 | 0 | 0.00 | |||

| LL | Lumber Liquidators Holdings, Inc. | 9.05 | 0.0 | 256 | -4.4 | 0.0 | 1.09 |

| USD | ProShares Ultra Semiconductors | 43.29 | 0.0 | 2.81 | |||

| TTS | Tile Shop Holdings, Inc. | 2.75 | 7.6 | 133 | 53.3 | 406.8 | 0.72 |

| JCI | Johnson Controls International Plc | 42.03 | 2.4 | 34,135 | 66.5 | 161.2 | 0.80 |

| WSM | Williams-Sonoma, Inc. | 67.71 | 2.7 | 5,145 | 15.9 | 42.9 | 0.97 |

| WHR | Whirlpool Corp. | 139.80 | 3.3 | 8,903 | 9.8 | 32.4 | 1.13 |

| ALLE | Allegion Plc | 95.33 | 1.0 | 8,913 | 20.6 | 20.7 | 0.90 |

| IRBT | iRobot Corp. | 66.44 | 0.0 | 1,866 | 21.2 | 0.0 | 1.61 |

| AWI | Armstrong World Industries, Inc. | 94.98 | 0.6 | 4,639 | 23.7 | 13.1 | 0.96 |

| TPX | Tempur Sealy International, Inc. | 77.92 | 0.0 | 4,248 | 34.2 | 0.0 | 1.31 |

| HELE | Helen of Troy Ltd. | 152.48 | 0.0 | 3,824 | 22.2 | 0.0 | 0.67 |

| AAN | Aaron's, Inc. | 64.67 | 0.2 | 4,335 | 21.5 | 4.5 | 0.89 |

| NVR | NVR, Inc. | 3,681.11 | 0.0 | 13,192 | 16.1 | 0.0 | 0.60 |

| HD | The Home Depot, Inc. | 221.47 | 2.2 | 242,503 | 21.9 | 47.6 | 0.91 |

| TSCO | Tractor Supply Co. | 101.25 | 1.3 | 12,083 | 22.3 | 28.2 | 0.97 |

| MHO | M/I Homes, Inc. | 37.02 | 0.0 | 1,014 | 9.4 | 0.0 | 0.67 |

| MTH | Meritage Homes Corp. | 64.76 | 0.0 | 2,482 | 12.3 | 0.0 | 0.82 |

| BLD | TopBuild Corp. | 92.51 | 0.0 | 3,178 | 18.6 | 0.0 | 0.83 |

| MDC | M.D.C. Holdings, Inc. | 37.26 | 3.1 | 2,299 | 11.2 | 34.3 | 0.70 |

| TMHC | Taylor Morrison Home Corp. | 23.61 | 0.0 | 2,468 | 11.0 | 0.0 | 0.67 |

| IBP | Installed Building Products, Inc. | 58.65 | 0.0 | 1,774 | 29.7 | 0.0 | 1.20 |

| KBH | KB Home | 28.18 | 0.4 | 2,485 | 9.5 | 3.4 | 0.84 |

| PHM | PulteGroup, Inc. | 33.04 | 1.3 | 9,019 | 10.0 | 12.8 | 0.64 |

| JEC | Jacobs Engineering Group, Inc. | 87.26 | 0.8 | 11,656 | -49.6 | -38.1 | 1.10 |

| JCI | Johnson Controls International Plc | 42.03 | 2.4 | 34,135 | 66.5 | 161.2 | 0.80 |

| IR | Ingersoll-Rand Plc | 117.94 | 1.8 | 28,665 | 20.2 | 36.1 | 0.94 |

| LII | Lennox International, Inc. | 257.46 | 1.0 | 10,122 | 28.1 | 29.0 | 0.85 |

| MTZ | MasTec, Inc. | 61.90 | 0.0 | 4,726 | 15.0 | 0.0 | 1.29 |

| TTEK | Tetra Tech, Inc. | 81.00 | 0.6 | 4,442 | 25.4 | 15.9 | 1.04 |

| ROCK | Gibraltar Industries, Inc. | 41.93 | 0.0 | 1,355 | 22.9 | 0.0 | 0.68 |

| WMS | Advanced Drainage Systems, Inc. | 32.38 | 1.0 | 1,879 | -9.7 | -9.8 | 0.91 |

| AWI | Armstrong World Industries, Inc. | 94.98 | 0.6 | 4,639 | 23.7 | 13.1 | 0.96 |

| ACM | AECOM | 33.83 | 0.0 | 5,334 | 17.9 | 0.0 | 1.07 |

| CSL | Carlisle Cos., Inc. | 141.52 | 1.1 | 7,988 | 19.8 | 22.5 | 0.81 |

| EME | EMCOR Group, Inc. | 83.54 | 0.4 | 4,665 | 15.2 | 5.8 | 0.96 |

| PWR | Quanta Services, Inc. | 33.78 | 0.4 | 4,754 | 15.3 | 5.5 | 1.15 |

| OSK | Oshkosh Corp. | 69.87 | 1.5 | 4,736 | 8.5 | 12.9 | 1.44 |

| CMCO | Columbus McKinnon Corp. | 33.87 | 0.6 | 796 | 14.8 | 9.2 | 1.28 |

| MLM | Martin Marietta Materials, Inc. | 253.67 | 0.8 | 15,812 | 31.4 | 23.8 | 0.74 |

| LPX | Louisiana-Pacific Corp. | 22.55 | 2.3 | 2,807 | 16.9 | 39.4 | 0.68 |

| USCR | U.S. Concrete, Inc. | 44.39 | 0.0 | 752 | 46.9 | 0.0 | 1.30 |

| SWX | Southwest Gas Holdings, Inc. | 89.06 | 2.4 | 4,841 | 23.5 | 55.4 | 0.35 |

| Ticker | Name | Price | Dividend Yield | Market Cap ($M) | P/E Ratio | Payout Ratio | Beta |

In addition to the Excel spreadsheet above, this article covers our top 10 construction stocks today, as ranked using expected total returns from the Sure Analysis Research Database.

We believe the purest plays on construction relate to equipment and construction services companies and thus, these stocks offer the best way to take advantage of long-term fundamentals we find attractive.

Table of Contents

- Why We Like Construction Long-Term

- Sherwin-Williams (SHW)

- Deere & Company (DE)

- Johnson Controls (JCI)

- Williams-Sonoma (WSM)

- Home Depot (HD)

- Lowe’s Companies (LOW)

- Whirlpool (WHR)

- Leggett & Platt (LEG)

- Caterpillar (CAT)

- Fluor Corporation (FLR)

Before we get to our list of stocks, let’s take a look at why we find the construction sector attractive.

Why We Like Construction Long-Term

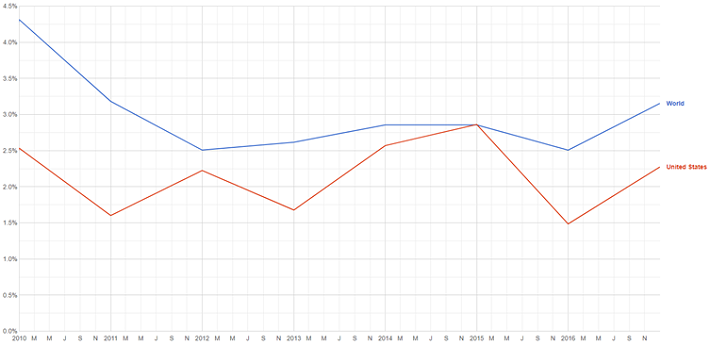

First, rising global gross domestic product, or GDP, means that construction activities and services will be in demand over the long-term. Data from the World Bank on global and US GDP is below from 2010 through 2018.

Source: World Bank via Google Public Data

While growth has slowed slightly from 2010’s levels, we have seen global and US GDP very steady in the 2% to 3% range annually. This constant increase in economic activity means office buildings, retail, housing and other core infrastructure items are being built across the developed world. In order for those things to happen, construction equipment and services are needed, and that is a key reason why we like the construction sector.

Complimentary to the growth of world GDP is the growth of the world’s population. Even in times of economic distress, the world’s population grows at fairly steady rates. Global and US population growth from the World Bank for the same time period as above can be seen below.

Source: World Bank via Google Public Data

The US has seen lower population growth than the rest of the world, but population is still moving higher over time. This is a steady, long-term driver for demand for things like residential and shopping space, as well as roads, utilities and other infrastructure items that support the daily lives of the world’s population.

Combined, population and GDP growth create a powerful and steady long-term tailwind for construction stocks. In addition, the many underdeveloped countries around the world offer emerging growth markets for construction companies to capitalize on down the road. These economies tend to offer higher rates of growth than developed countries, albeit with higher risks.

Further, in the US, specifically, existing infrastructure has a poor rating. The American Society of Civil Engineers updates its infrastructure report card on a regular cadence and the most recent update for the US was a D+. That implies many billions of dollars of infrastructure investments and upgrades are needed just in the US over the long-term to fix things like roads and bridges.

Higher infrastructure spending will power revenue streams for construction companies, as well as the best infrastructure stocks. This is in addition to any growth-related spending that may arise in the coming years.

Below, we’ll take a look at ten companies that we think are well-positioned to take advantage of these trends in construction spending in the coming years, ranked in ascending order of projected total returns.

Construction Stock #10: The Sherwin-Williams Company (SHW)

Sherwin-Williams was founded in 1866 and in the 150+ years since, it has grown into North America’s largest manufacturer of paints and coatings. It distributes products through nearly 5,000 company stores, as well as on a wholesale basis to 120 countries.

The company’s brands generate $18 billion of annual revenue and the stock trades with a market capitalization of $49 billion. Sherwin-Williams is a Dividend Aristocrat, having boosted its dividend for 40 consecutive years.

You can see a video detailing Sherwin-Williams’ dividend in further detail below:

Sherwin-Williams is a global leader in its core categories.

Source: Investor presentation, page 2

Sherwin-Williams has posted extraordinary growth rates in recent years, having compounded earnings-per-share at nearly 19% annually for the past decade. This has afforded shareholders outstanding total returns as shares have returned almost 800% in the past decade, nearly five times that of the broad market.

We estimate that Sherwin-Williams will be able to grow at 8% annually in the coming years, well off of its historical growth rate, but very strong nonetheless. The relatively recent corporate tax cuts have boosted net income margins for Sherwin-Williams, and has artificially moved the base of earnings higher. In addition, as any company grows larger, it becomes more challenging to grow on a percentage basis.

We see the company’s 8% growth as accruing from revenue expansion, margin improvements due to operating leverage, share repurchases, and economic growth that supports the need for paints and coatings.

Total returns will be tempered only by the stock’s lofty valuation, which is ~25 times earnings against our fair value estimate of 20 times earnings. This ~5% projected headwind is offset by 8% earnings-per-share growth, as well as the ~1% dividend yield for total returns in the neighborhood of 4%. This makes Sherwin-Williams the least attractive stock in this list by projected total returns.

Construction Stock #9: Deere & Company (DE)

Our next stock, Deere, is a manufacturer of heavy equipment used in agriculture, forestry, turf care and construction. The company also fairly recently solidified its dominant position in road construction and maintenance with its acquisition of Wirtgen. Deere produces about $34 billion in annual revenue and has a market capitalization of $49 billion.

Deere’s earnings-per-share, unsurprisingly, has been quite cyclical over time. For instance, Deere’s 2013 earnings-per-share peak wasn’t crested again until 2018. Deere’s average rate of annual growth of 7.1% seems a bit high to us, and we therefore forecast 6% annual growth moving forward.

We see Deere accruing this growth from acquisitions, particularly Deere’s growing Construction business. This exposes Deere to continuously strong construction markets in the US and China, for instance. We also see share repurchases as a continuous tailwind for earnings-per-share in the coming years, as it has been for many years.

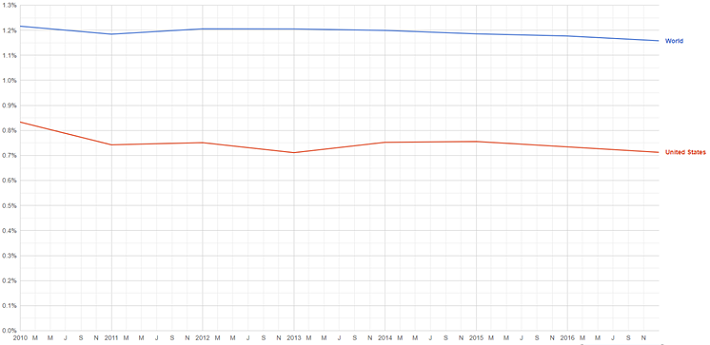

In addition, Deere has more recently pushed into becoming an end-to-end solution for road construction as a way to capitalize on the global need for infrastructure investment.

Source: Investor update, page 24

This slide shows how Deere’s Wirtgen acquisition has made it a true end-to-end provider of road construction equipment. Given the weak state of US infrastructure and similar situations around the world, we think Deere is well-positioned for long-term demand for all of its business segments, but this one in particular.

Deere was quite resistant to the last recession considering how cyclical the company’s revenue and earnings are, and it was able to continue to raise the dividend during the recession.

We see Deere as accruing 6% total annual returns, powered by 6% earnings growth. The yield of ~2% and a ~2% headwind from a lower valuation offset each other.

Construction Stock #8: Johnson Controls International PLC (JCI)

Johnson Controls traces its lineage to 1885 and in the 134 years since its founding, it has undergone significant transformations. Today, the company offers Building Solutions, including heating, ventilation, and security products. The company is headquartered in Ireland, and achieves about two-fifths of its total revenue from North America.

Earnings comparisons to historical years isn’t particularly useful for Johnson Controls given the significant number of mergers, divestitures and spin-offs that have occurred with this business in the past few years. However, we are bullish on the pure-play Building Solutions business that remains today. We also note that this increased concentration, while it should help focus efforts, may also increase the volatility of results as Johnson Controls ceded its prior diversification.

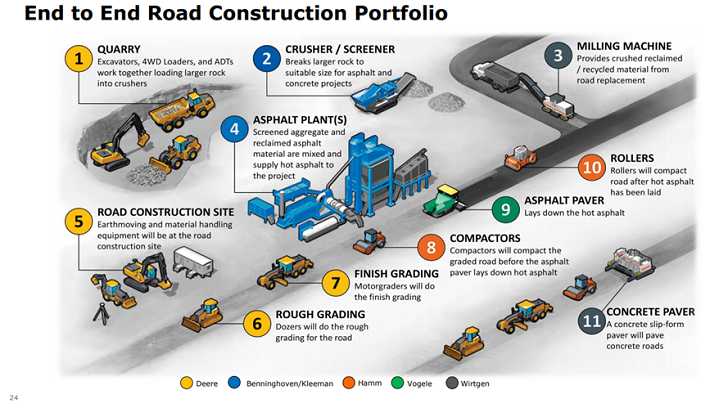

The recent sale of Power Solutions business has afforded Johnson Controls an enormous amount of cash it is putting work for the long-term good of the business.

Source: Investor presentation, page 15

This chart shows some of the deployment of the $11.6 billion of net proceeds it received during the transaction. Thus far, it has spent just over $4 billion on share repurchases, with another ~$4 billion yet to be spent. In addition, it has paid down $3.4 billion in long-term debt, reducing its gross debt from $12.4 billion in March of 2019 to a net position of just $3.6 billion at the end of June. Johnson Controls’ leverage has come down and its share count is much lower after the Power Solutions sale. We believe this will meaningfully boost future returns.

In total, we see 9% earnings-per-share growth annually in the coming years, combined with a ~2.5% dividend yield. However, the stock trades for 22 times earnings, which is well in excess of our fair value estimate of 17 times earnings. This headwind should be around 5% annually, for a net total annual return forecast of 6% to 7% through 2024.

Construction Stock #7: Williams-Sonoma (WSM)

Number seven on our list is Williams-Sonoma, a home furnishings and houseware brands retailer with a $5.5 billion market capitalization. The company owns very popular brands such as its flagship Williams-Sonoma, but also owns Mark & Graham, Rejuvenation, Pottery Barn, and West Elm.

Williams-Sonoma’s omni-channel strategy sees it operating traditional physical stores, as well as catalogs and e-commerce sites. The company was founded in 1956 and is headquartered in San Francisco.

Williams-Sonoma has posted strong growth over time. Since 2007, it has posted average earnings-per-share of 9% annually, which is very impressive for a retailer over this period. We note that 2018’s results were boosted significantly due to one-time tax reform benefits, but even so, the company’s growth rate has been outstanding for a specialty retailer.

We see 4% annual growth in the coming years as the company’s revenue should continue to grow, while margins remain roughly flat.

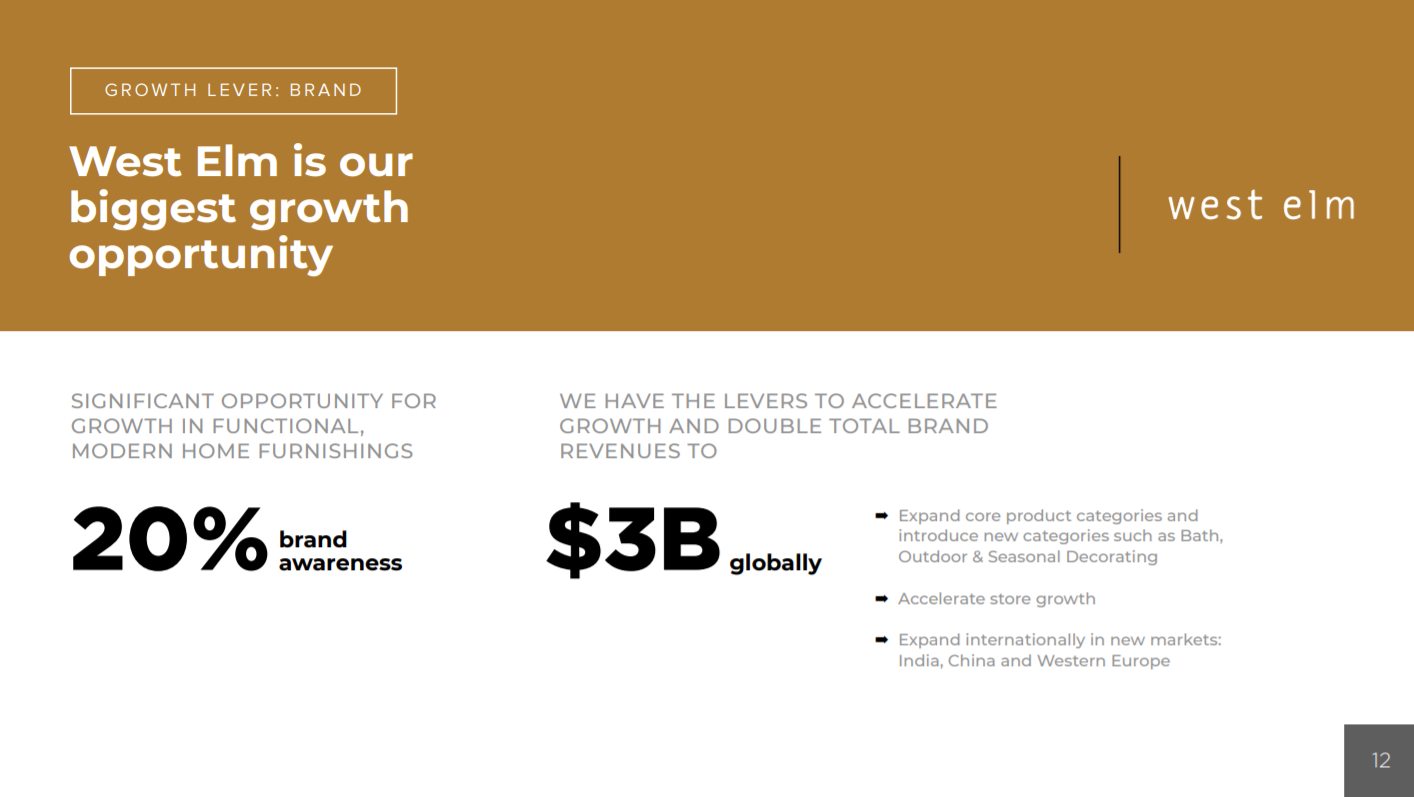

Source: Investor presentation, page 12

While Williams-Sonoma’s brands are all valuable for various reasons, its growth driver has been and will remain West Elm. This brand continues to post eye-popping revenue growth and is taking share from competitors. Williams-Sonoma continues to invest heavily in this brand, which we believe is undoubtedly the right strategy.

The company has a sizable authorization for share repurchases, continuing the work it has been doing for many years to reduce the float. However, the valuation has made these somewhat less attractive in recent months. Shares trade for $67 against our fair value estimate of $70 today, meaning the valuation will result in minimal impact to total returns.

In total, we see the ~3% dividend yield combining with 4% earnings-per-share growth and a very small tailwind from the valuation creating ~8% total annual returns in the coming years.

Construction Stock #6: Home Depot (HD)

The next company in our list of the best construction stocks is home improvement juggernaut Home Depot. The company has 2,300 stores in North America that produce more than $100 billion in annual revenue. Shares have been extremely profitable for investors in the past decade, and the company has grown into a $240 billion market capitalization.

Home Depot’s earnings growth has been nothing short of outstanding in the time since the Great Recession. The construction and housing growth that has taken place in the US and Canada in the past decade has been a very powerful tailwind for Home Depot, but it has done its part to take full advantage of it as well.

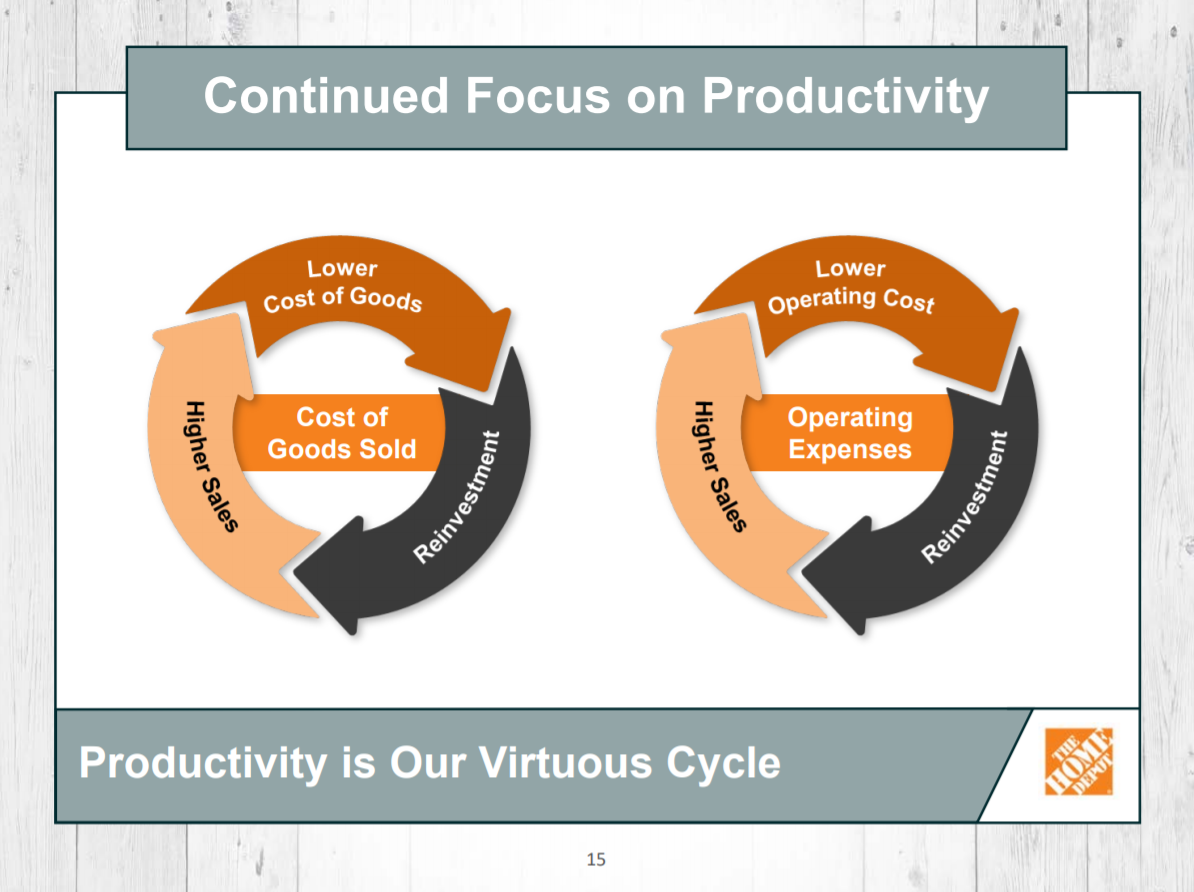

Source: Investor presentation, page 15

The reason the company’s earnings have grown so quickly, with 2019’s earnings-per-share roughly six times that of 2009’s earnings-per-share, is because its focus on profitable revenue growth is so strong. The above shows the company’s strategy when it comes to margin improvement, which it has achieved in large quantities in recent years. We expect future growth to accrue at 7.5% annually, consisting of comparable sales growth, which helps drive the above improvement in margins, as well as a small tailwind from share repurchases.

Shares trade for about 22 times this year’s earnings, which is in excess of our fair value estimate of 19 times earnings. That introduces a potential headwind of about 3% annually through 2024, which offsets the dividend yield. As a result, total returns in the coming years are expected to reach 8% to 9% each year.

Construction Stock #5: Lowe’s Corporation (LOW)

Up next at number five is Home Depot’s arch rival, Lowe’s Corporation. Lowe’s comes in a relatively distant second to Home Depot in terms of market share in the home improvement arena, but the two companies form a duopoly in the sector. Lowe’s was founded in 1946 and is still headquartered in Mooresville, North Carolina. It operates over 2,000 stores in North America, generating $70+ billion in annual revenue, and the stock trades for an $83 billion market capitalization.

Like Home Depot, Lowe’s has benefited immensely from macro factors in home price appreciation and construction. Indeed, during the decade ending 2018, Lowe’s posted 17% annual earnings-per-share growth. Lowe’s has benefited from growing comparable sales, which have driven margins higher as well. We forecast ~8% earnings-per-share growth annually in the coming years as the company continues to drive revenue and margin improvements, but also buys back a significant amount of its own stock.

Unlike Home Depot, which is focused on margin improvements, Lowe’s is looking to rekindle its comparable sales growth.

Source: Earnings infographic

Lowe’s is focusing on its various channels to boost future growth, including revamping its merchandising and inventory practices, as well as focusing on the lucrative Pro category.

The stock trades for 19 times this year’s earnings, which is slightly in excess of our fair value estimate of 18 times earnings. That will create a very small headwind to total returns, but the stock’s 2% dividend yield will more than offset it.

Lowe’s is a highly attractive stock for dividend growth. The company has increased its dividend for more than 50 years in a row, which places it on the exclusive list of Dividend Kings.

You can see a deep-dive into Lowe’s dividend safety by clicking on the following video:

Combined with robust earnings-per-share growth, we’re projecting ~9% total annual returns for Lowe’s in the coming years, even after accounting for the recent rally in the stock.

Construction Stock #4: Whirlpool Corporation (WHR)

Whirlpool Corporation was founded in 1955 and today, is the leading major home appliance company in the US. It owns top tier brands such as Whirlpool, KitchenAid, Maytag, and JennAir. Whirlpool is geographically diversified as just about half of its revenue comes from North America. It trades for an $8.5 billion market capitalization today and generates about $20 billion in annual revenue.

In the period of 2007 to 2018, Whirlpool posted annual earnings-per-share growth of 6%. Interestingly, total revenue moved only fractionally higher during that period as operating margins rose significantly, and as the share count declined due to repurchase activity.

We see growth largely in line with historical rates at 5.5% annually in the next five years with organic net sales, repurchases, and margin improvements combining for meaningful future EPS growth.

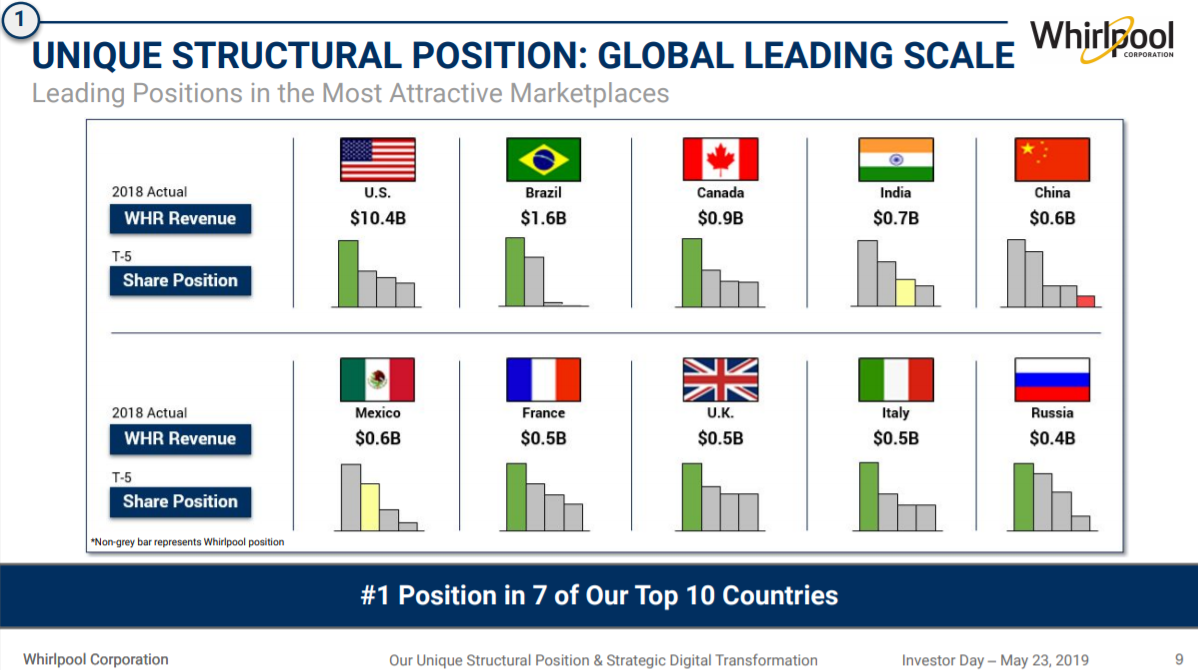

Source: Investor presentation, page 9

Whirlpool’s competitive position will be a primary driver of growth in the coming years. Whirlpool holds the #1 position in 7 of its top 10 markets, which affords brand recognition and pricing power. It is also a significant competitive advantage for Whirlpool against lesser competitors.

Shares trade for just 9 times this year’s earnings, which is well below our fair value estimate of 11 times earnings. We see a ~4% tailwind to total annual returns as a result of a rising valuation, combined with the ~3.5% dividend yield, as well as 5.5% earnings-per-share growth. In total, Whirlpool should produce robust total annual returns of 13% or so in the coming years.

Construction Stock #3: Leggett & Platt (LEG)

Coming in at number three on our list of the best construction stocks is Leggett & Platt. The company is an engineered products manufacturer that competes in various niches, including furniture, bedding, store fixtures, industrial products, and more. It has 14 business units in total, and produces $4.8 billion in annual revenue.

Leggett & Platt is a member of the Dividend Aristocrats index thanks to its 48-year dividend increase streak.

Leggett & Platt saw its earnings-per-share increase by 14% annually in the past decade ending 2018, which is outstanding growth. This growth included a low base thanks to depressed earnings during the Great Recession, but is impressive nonetheless. In contrast, there has been essentially no growth since 2016.

That said, we see 6% annual earnings-per-share expansion due to organic sales increases, acquisitions, and share repurchases. Leggett & Platt’s acquisition and divestiture activity should continue to support higher revenue, although we note revenue can be very volatile for the company.

Source: Investor presentation, page 8

However, Leggett & Platt is in the top tier of companies in the US in terms of total shareholder returns, which is the combination of dividends and buybacks. Leggett & Platt has managed to increase its dividend for 48 years while also paying down debt, funding capital expenditures for future growth, and repurchasing its own stock.

The below video further discusses Leggett & Platt’s dividend safety:

Shares trade for 14 times this year’s earnings, which is well under our estimate of fair value at 18 times earnings. This should create a mid-single digit tailwind for total returns, combining with a 4% dividend yield and 6% earnings-per-share growth for mid-teens total annual returns.

Construction Stock #2: Caterpillar (CAT)

Coming in at number two in our list is Caterpillar, a world leader in the manufacture and distribution of mining and construction equipment, diesel and natural gas engines, industrial gas turbines, and locomotives. The company has a $64 billion market capitalization and generates about $55 billion in annual revenue. It was founded in 1925 and is headquartered in Illinois.

Source: Investor presentation, page 5

The company’s diversification across industries, products, and customers is a huge competitive advantage and allows Caterpillar to smooth out some of the natural cyclicality that would otherwise exist in its results. It is certainly still cyclical, but the company has built itself over the years to take advantage of a variety of industries.

We see 5% annual earnings-per-share growth in the coming years as Caterpillar continues to accrue benefits from booming construction and mining markets in the US, China, and other places around the globe. In addition, it continues to cut costs, which boost margins. Finally, Caterpillar buys back a small amount of its own shares.

Caterpillar has an attractive yield of 3.6%. And we also believe Caterpillar’s dividend is safe.

Shares currently trade for just 9 times this year’s earnings after a recent selloff. That compares extremely favorably to our fair value estimate of 14 times earnings, implying a high single digit tailwind just from the valuation. Combined with earnings growth and the yield, we see Caterpillar producing high-teens total annual returns, and thus see the stock as very attractive.

Construction Stock #1: Fluor Corporation (FLR)

The top stock in our list, Fluor Corporation, produces about $18 billion in annual revenue and after an enormous recent selloff, the stock has a market capitalization of just over $2 billion.

Fluor’s attractiveness begins with its very diverse base of clients. Fluor serves just about every major industry that needs construction engineering services and thus, during downturns, it is perhaps more insulated than other, more specialized firms.

During the Great Recession, Fluor’s revenue dipped only slightly in 2009 and 2010 before rebounding strongly in 2011 in excess of pre-Recession highs. Earnings actually rose during 2009 before taking a hit in 2010, but just like revenue, earnings rebounded much higher in 2011.

The company’s dividend wasn’t raised during the Great Recession but it was maintained when so many others weren’t, which is another sign of the strength of the company’s model.

We see very attractive long-term prospective returns from Fluor as the stock has sold off meaningfully of late. Shares are at a 16-year low as of now, as concerns over the company’s customers delaying investment projects that would see significant revenue for Fluor have hit the stock.

However, for long-term investors, even if projects are delayed, they will almost certainly be completed eventually as they are critical infrastructure upgrades. Thus, we see near-term volatility as opportunity for new investors.

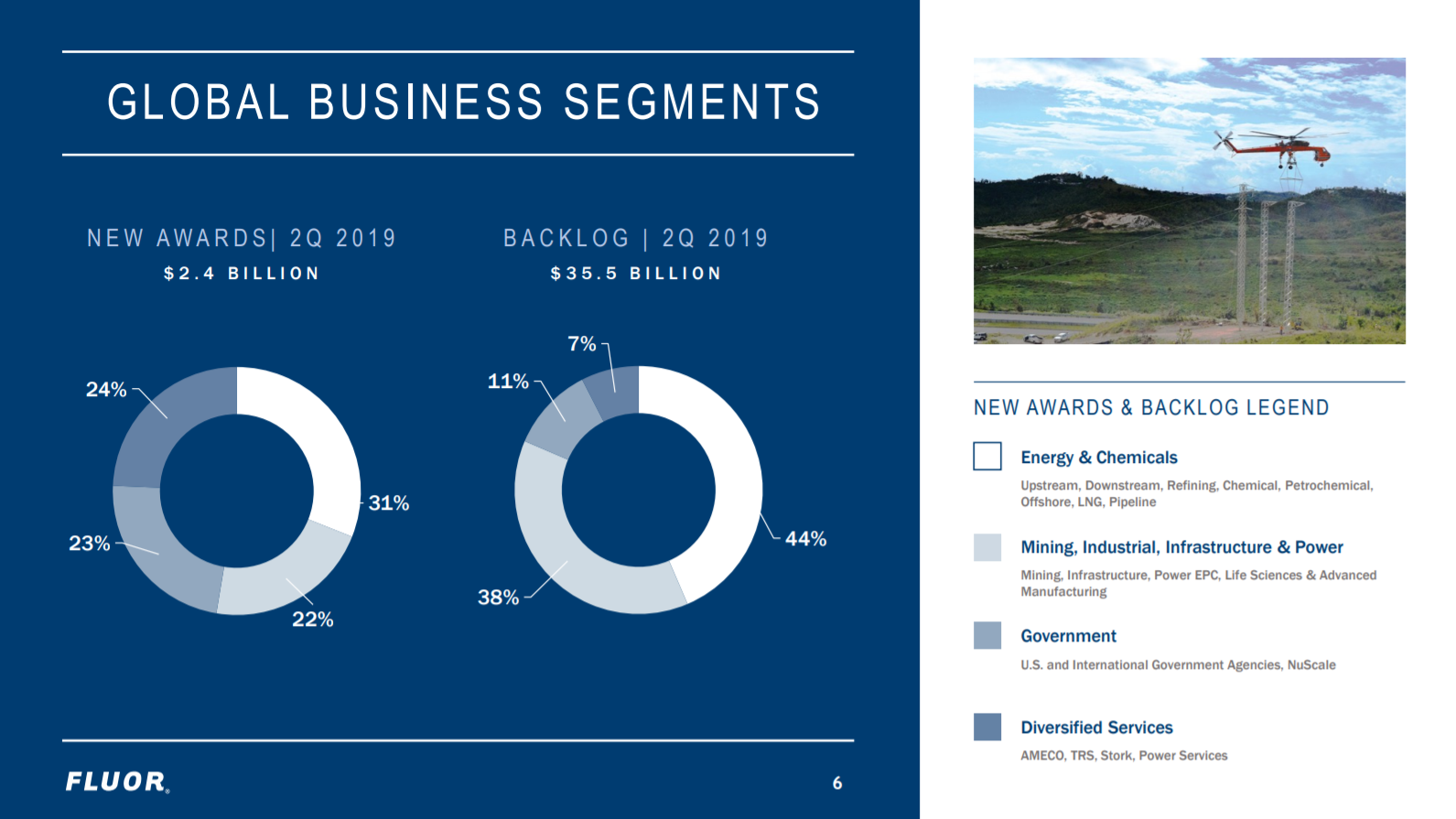

Source: Investor presentation, page 6

Indeed, this slide from a recent earnings presentation shows that Fluor’s customers are still booking with the company as they continue to express confidence in Fluor’s abilities. The backlog is now up to $35.5 billion, which is about two years’ worth of revenue.

Flour should achieve about 10% earnings growth annually, per management guidance. The stock is yielding nearly 5% after the selloff and we also see a sizable tailwind in the mid-single digits from a rising valuation. Fluor trades for ~10 times this year’s earnings, which compares favorably to our assessment of fair value at 14 times earnings.

Flour is a strong pick for long-term investors who don’t mind the short-term volatility in the stock. The combination of earnings growth, valuation reflation, and the high yield should produce total annual returns in excess of 20% in the years to come.

Final Thoughts

While construction stocks can be cyclical and sometimes volatile, they also offer investors access to long-term macroeconomic demand factors. The companies listed here represent different ways for investors to capitalize on construction in various capacities, are strategically aligned to long-term economic forces.

These companies should maintain profitability and dividend payments under all but the worst economic circumstances. Most offer decent returns, but some offer double-digit total return potential.

We rank Fluor, Caterpillar and Leggett & Platt as the strongest picks for investors looking to gain exposure to what should be a booming industry for decades to come (except during recessions, when investors must hold to take advantage of prosperous times). These are stocks one can buy and own for a very long time to come.