Still Fearful, But the Market Should Pullback Before Continuing its Climb Higher

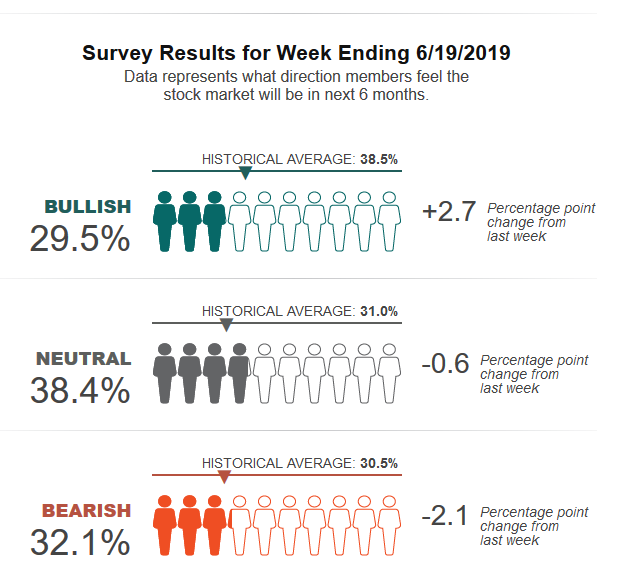

The AAII survey had only a minor increase of +2.7% in bullish sentiment (chart below).

The bull-minus-bear differential continues negative which almost never leads to market tops (chart below).

The bull sentiment continues to follow a normal rally pattern (chart below).

70.5% of independent investors can’t imagine that the market will be higher in 6-months time, which implies that it likely will be.

The National Association of Active Investment Managers (NAAIM) exposure index 50-week MA leads market down-turns and lags market up-turns. The pattern is similar to the trading in 2009, 2012, and early 2016. Despite the drop in exposure, the 50-day MA continues to carve out a rounded bottom (chart below).

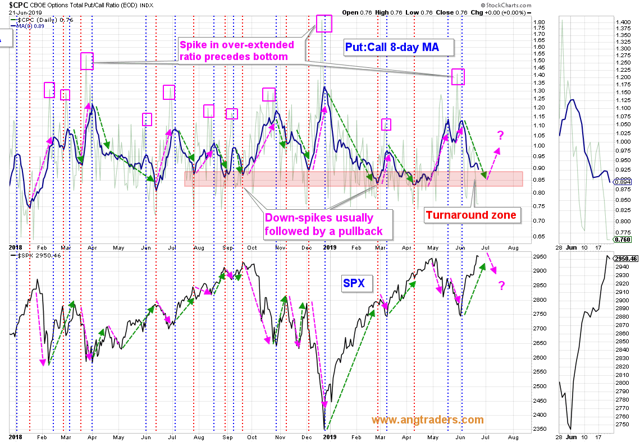

The 8-day MA of the total put:call ratio is descending into a zone (~0.85) which has triggered increased hedging, a turnaround in the ratio’s average, and a pullback in the SPX. We could see some more gains next week, but a pullback is likely (chart below).

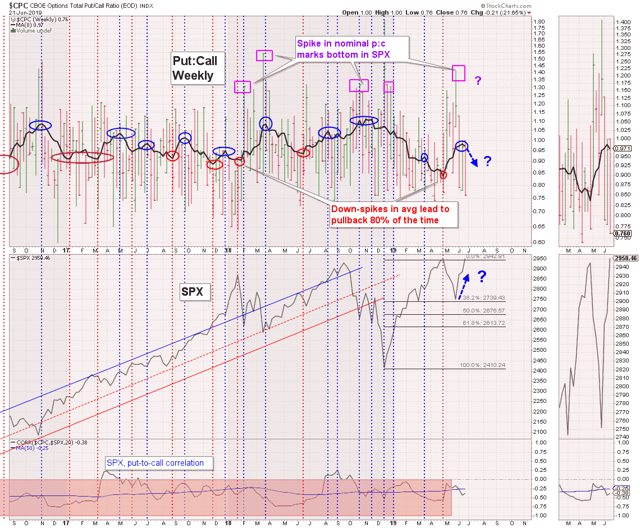

The 8-week MA of the total put:call ratio has started to turn and confirm the up-spike in the daily. This implies that any pullback in the SPX is likely to be shallow and short-lived (chart below).

The price/earnings ratio of the S&P 500, in ratio to the volatility index (PE:VIX), has a strong direct-correlation to the S&P 500; 85% of up-spikes in the ratio correspond with local market tops, while nearly 100% of down-spikes correspond with market lows.

The PE:VIX ratio has been rising along with the SPX (as expected), but it is possible that the ratio will be turned-back by the upward-sloping trend line and that the SPX will pullback slightly. This scenario fits with the put:call analysis above (chart below)

In summary: The sentiment indicators continue to show that there is still substantial fear in the market despite the big indexes printing all-time highs. There is an elevated risk of a minor pullback later this week, but the primary bull trend is not at risk. We will use any pullback as a “buy-the-dip” opportunity.

Join us at www.angtraders.com and replicate our trades and profits.

Quelle Nicholas Gomez