Put-To-Call Ratios, And A Once-In-A-Generation Bubble

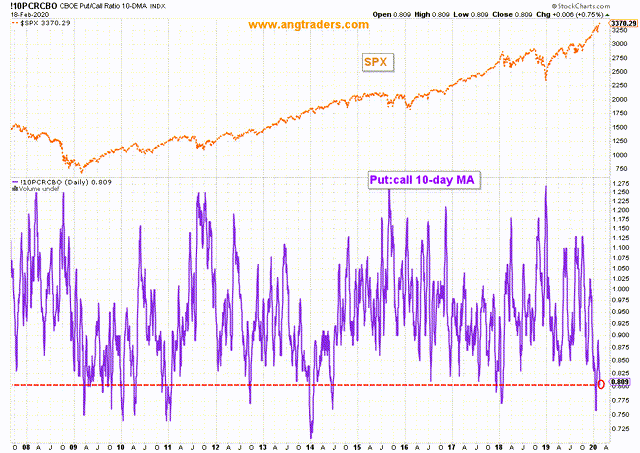

The put:call ratio can be used to measure the amount of hedging and the amount of speculation; higher ratios imply increased hedging, and lower ratios imply increased speculation. At the moment, the ratio is near the low end of a decade-long range and implies bullish speculation which often correlates with over-extended markets (chart below).

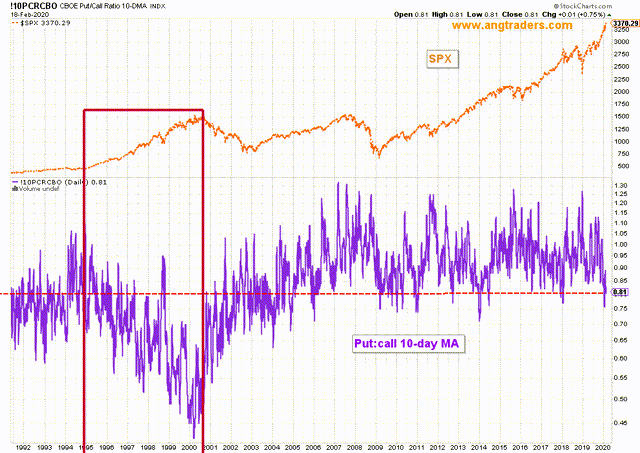

But this is a relative measure, not an absolute. When we look past the latest decade, we can see that since the GFC there has been historically-low speculation (higher ratios), despite a decade-long bull market (chart below).

We see this as a reflection of the psychological damage that the GFC imparted on investors; a form of investing PTSD. Even though the market has climbed 350% in the 11-years since the GFC, the investing-herd is still in no mood to speculate in the stock market like they used to in the latter part of the 20th-Century.

We have pointed out several times in our Weekly Summaries, that the market is in a very similar position to 1995 based on the Fed funds rate profile and the net yield of the SPX, and now we can add the put:call ratio as another similarity. In 1995, the ratio was at similar levels as today (chart above), but decreased significantly over the next five years as the market rallied 200%. We think that can happen again as the pent-up speculative potential is unleashed by fiscal support and disruptive green environmental technologies.

Some analysts are saying that won’t happen because the market has already gone up 350%, but we point out that in the decade leading up to 1995 the market also rallied 350%, and Greenspan made his infamous “irrational exuberance” remark in 1996, as stocks went on to rally a further 200% over 5-years.

We are on the verge of another once-in-a-generation technological bubble, and the fact that few (or none) of the market participants see it coming, only increases our confidence.

ANG Traders

Join us at www.angtraders.com and profit from our 40-years of market experience.

Source Nicholas Gomez