Proctor & Gamble Is Going To Set A New High

Proctor & Gamble’s (NYSE: PG) Q3 report echoes news from other Dividend Kings that have reported this week. The report is a shining example of why Dividend Kings, Dividend Aristocrats and Dividend growth stocks like Proctor Gamble, Clorox (NYSE: CLX) and Genuine Parts Company (NYSE: GPC) are great investments for long-term holders. Not only do they have the foresight to operate their businesses in a manner that sustains annual distribution growth, but they have the operating leverage to roll with the times.

Today that means cutting costs, improving efficiency and focusing on consumer satisfaction. What this means for PG investors is outperformance, improving margins, robust cash flow and increased guidance. This catalyzes higher share prices, putting this stock on track to set another all-time high soon.

Proctor Gamble Still Has Pricing Power

The latest retail sales figure suggests that America’s retailers are losing their grip on pricing power, but that is not true for consumer staples stocks or Proctor Gamble. The company reported $20.07 billion in revenue for the FQ3 period, which is up 3.5% and beat the analysts' consensus by 380 basis points. The gain was driven by strong sales in all segments, led by 9% growth in Healthcare and Fabric Home. All segments grew at least 6%, underpinned by a 10% system-wide increase in realized prices. A 3% decline in volume offset the increases in prices, Proctor Gamble is not immune to the conditions, but this was not enough to offset pricing and resulted in growth.

Proctor Gamble was able to widen the margin but not enough to completely offset rising costs and FX headwinds. The gross margin grew by 150 basis points and the operating margin by 40 to drive a 220 basis point increase in adjusted earnings. Adjusted earnings of $1.37 are up from last year's $1.34, beating the Marketbeat.com consensus by 380 basis points. The takeaway is that top-line strength carried through to the bottom line and led to increased guidance.

Proctor Gamble held its EPS guidance steady due to sustained economic pressures but raised the revenue and cash flow outlook. The company expected revenue growth near 1% compared to the prior -1% to 0% with cash returns rising. The company expects to buy back at least $7.4 billion in shares this year, up $1.4 billion at the low end of the range. The $1.4 billion increase is a 23% premium to the buyback minimum and 0.4% of the market cap. The new minimum is worth 2% this fiscal year, on top of the 2.5% dividend.

Proctor Gamble’s Dividend Is Worth Every Penny

Proctor Gamble isn’t the lowest value in the consumer staples sector, and it isn’t the best yield, but the 2.5% in payout is worth every penny of the 25X earnings you pay to get it. Proctor Gamble is among the bluest blue-chip dividend payers and is as reliable as they come. You may find a higher yield with names like Kraft Heinz (NASDAQ: KHC), but they come with higher risks. If the sell side can be used as an example, they think the stock is worth buying. The institutions own about 62%, which is a lot for such a widely-held name, and they are buying.

The analysts may also provide a catalyst for higher prices. They view it as a Moderate Buy with a price target that assumes fair value at the current level. The Q3 report may inspire upgrades and/or price target increases that would put the stock at an all-time high, if not higher.

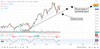

You want to view the monthly chart for this stock because the daily and weekly are showing a lot of noise. The monthly chart shows a clear uptrend and a market increase after confirming that trend. Assuming the market follows this trend, this stock should reach an all-time high in the next few months.

Source MarketBeat

Clorox Co. Stock

Our community is currently low on Clorox Co. with 3 Buy predictions and 10 Sell predictions.

A slightly negative potential of -5.02% at a current price of 131.6 € for Clorox Co. is the result of a target price of 125 €.