Updated on April 9th, 2021 by Nikolaos Sismanis

Owl Creek Asset Management was founded in 2001 by Jeffrey Altman, who still owns substantially all of the firm, and is responsible for its day-to-day operations and investment choices. The firm is run primarily out of its office in New York City, and a satellite office in Miami.

The fund managed a total of $3.4 billion at the end of 2020 and had just 17 clients on its books as of that time. Owl Creek is a Registered Investment Adviser with the SEC.

Investors following the company’s 13F filings over the last 3 years (from mid-February 2018 through mid-February 2021) would have generated annual total returns of 4.92%. This compares to the S&P 500’s annualized returns of 12.50% over the same time period.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

Keep reading to learn more about Owl Creek Asset Management.

Table Of Contents

- Introduction & 13F Spreadsheet Download

- Owl Creek’s Investing Strategy

- Owl Creek’s Top 10 Holdings

- Final Thoughts

Owl Creek’s Investing Strategy

Owl Creek’s overarching investment objective is to seek above-average returns through an opportunistic, event-driven value strategy. The firm uses event-driven investing, such as a merger, fundamental or value-driven investing in equities, both long and short, as well as long and short credit investments.

Owl Creek counts high net worth individuals, banks and thrifts, investment companies, pension plans, profit-sharing plans, trusts, estates, charitable organizations, corporations, and private investment funds among its clients.

New investors are generally required to make minimum initial investments of at least $5 million, and incremental investments by existing clients generally have to exceed $100,000. Investors in Owl Creek are accredited investors as defined by the SEC.

The firm analyzes each potential investment using a bottom-up analysis, the results of which it uses to determine whether to buy or sell short a variety of financial instruments to achieve its objectives. These instruments can include common stocks, preferred stocks, convertible securities, depository receipts, public and private debt issues, rights, warrants, put and call options, swaps, forward contracts, credit default swaps, and other derivatives.

Owl Creek’s Top 10 Equity Holdings

As of its February-2021 13F filing, Owl Creek had significantly shrunk its public-equity portfolio, which now counts just 23 individual stocks, compared to 48 in the previous quarter. Total assets were near $3.4 billion at the end of the quarter, while public equities accounted for just under 40% of that, around $1.3 billion.

During the period covering Owl Creek’s latest 13F filing, the fund initiated and ditched the following entries:

New Buys (weighting at least 1% of total holdings):

- Citigroup, Inc. (C)

- Morgan Stanley (MS)

- CVS Health Corp (CVS)

- Alphabet Inc. Class C (GOOG)

- Executive Network Partnering Corp. (ENPC)

- Cohn Robbins Holdings Corp. (CRHC)

- FIserv Inc. (FISV)

Noteworthy Sells:

The fund sold off 25 individual equity stakes during the quarter. The most noteworthy were:

- Advantage Solutions Inc. (ADV)

- Marathon Petroleum Corp (MPC)

- Hims & Hers Health Inc. Class A (HIMS)

- Facebook Inc (FB)

- Mesa Air Group Inc (MESA)

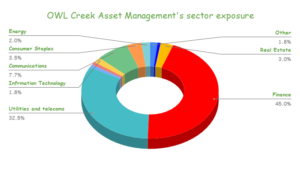

Due to Owl creek concentrating its portfolio compared to its previous filing, diversification has declined, with finance and utilities & telecoms accounting for 77.5% of its total weight.

Source: 13F filings, Author

The fund’s 10 largest public-equity holdings are the following:

Source: 13F filings, Author

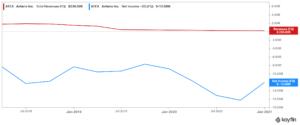

Anterix (ATEX):

The firm’s largest equity position, by a wide margin, is in small-cap telecommunications company Anterix. The position is worth around $212 million, or 16.4% of the firm’s total equity portfolio. Owl Creek’s position also accounts for 30% of Anterix’s total market capitalization, which indicates that the fund has an enormous amount of conviction in this company’s future. Keep in mind that the company has still to commercialize its product, with its revenues still in the low single-digit $millions range. The company is losing money continuously as well.

The position in Anterix is a relatively new one, making its first appearance in the firm’s 13F filing in February of 2020. Owl Creek held its position steady quarter-over-quarter.

PG&E Corp. (PCG):

PG&E Corp. was on the brink of bankruptcy last year, as the California fires had put further pressure on its operations and liabilities. Convinced of a potential turnaround towards financial sustainability, Owl Creek increased had increased its stake in Q3, while the position was held steady as of the most recent filing. The stock now accounts for around 13.6% of its equity holdings. The stock is currently trading at only 11.4 times its forward net income, so if Owl Creek’s hopes for PG&E to manage its liabilities effectively take place, the fund could be looking at significant gains ahead.

Morgan Stanley (MS):

The banking giant Morgan Stanley has been performing amazing as of lately, outperforming its peers by a significant margin. The company has been growing its revenues and net income with no disturbances caused by the ongoing pandemic. Management has been taking advantage of the stock’s valuation, which has remained in the low teens, to repurchase bulks of stock on the cheap, delivering substantial shareholder value. Yet, shares continue trading quite cheaply, at just 13.5 times the company’s forward net income.

Owl Creek’s position in Morgan Stanley is entirely new, initiated during the period of its latest 13F filing.

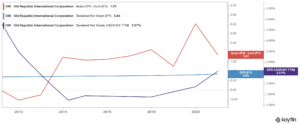

Old Republic International Corporation (ORI):

Old Republic is Owl Creek’s fourth-largest holding, accounting for around 9.7% of its portfolio. The Chicago-based insurer numbers 29 years of consecutive annual dividend increases, by prudently managing its finances for decades. This dividend history qualifies Old Republic as a Dividend Champion.

Dividend growth has been quite slow, featuring a 5-year CAGR of 2.57%. However, this prudent management has allowed the company to retain its payouts even under the great financial crisis. The payout ratio currently stands at a healthy 43%, while the stock yields a hefty 4%.

Owl Creek increased its position by 606% during the period covering its latest 13F filing.

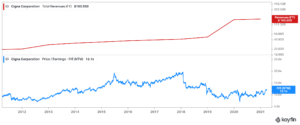

Cigna Corporation (CI):

Currently, comprising just over 8% of its total holdings, Cigna Corporation is one of the fund’s biggest value plays. The stock trades at around 12 times its underlying earnings, which is a steep discount compared to its historical average multiples. The company recently initiated a dividend to reward shareholders amid record profitability, amid net income hitting new all-time highs of $8.46 billion at the end of the year. At its current annual rate of $4.00 per share, the stock yields around 1.6%.

Similar to Morgan Stanley, as shown earlier, the financial sector has lagged as a whole over the past year compared to the overall market. Following an eventual rebound to its attractively valued equities, Owl Creek’s stake in Cigna could appreciate significantly amid a potential valuation expansion. The fund’s exposure was increased by 31% quarter-over-quarter.

T –Mobile (TMUS):

Since its merger with Sprint, the company has grown into a $154 billion telecommunication giant. The company should now be able to leverage its increased network and client base to compete against AT&T, as well as Verizon actively. Revenues hit a new all-time high of $68.4 billion in FY2020. Net income has been relatively stagnant lately, though it should grow as soon as the merger’s economies of scale kick in.

Owl Creek held its position steady during the quarter.

Citigroup Inc. (C):

Owl Creek seems to be pushing further into the undervalued stocks of the financial sector, initiating a brand new position in the banking behemoth Citigroup. While the company’s financials lagged during 2020 due to the COVId-19 outbreak, Citigroup remains a cash cow, that is also quite attractively priced as well.

The stock trades at just over 10 times the company’s forward net income, which management has been taking advantage of to buying back a ton of shares over the past few years. Since 2014, the company has repurchased around 1/3 of its share outstanding. Dividends have also been on the menu, with the stock currently yielding 2.8% as well.

Overall, Citigroup is a very investor-friendly company when it comes to returning massive amounts of capital back to shareholders.

Alibaba Group Holdings (BABA):

Owl Creek’s position in Alibaba has been relatively new, quickly climbing the ranks to occupying around 6.5% of its total holdings. The company recently reported its Q4 results, smashing estimates by delivering revenues of $33.88 billion, a 37.0% growth year-over-year.

While Alibaba remains a highly profitable company, displaying net income margins that often surpass the 30%+ levels, its shares have been recently lagging due to the ongoing concerns surrounding Chinese equities.

The recent incident of Jack Ma’s prolonged and mysterious disappearance is an unacceptable event for one of the largest publicly-traded companies in the world, while the Chinese government’s involvement in steering the company’s direction has also been raising questions amongst investors. The stock is currently trading at around 20.5 times its forward net income, to reflect these risks.

For these reasons, investors should not expect an Alibaba dividend in the near future.

The fund increased its position in Alibaba by 71% quarter-over-quarter.

CVS Health Corp. (CVS):

CVS’s shares have had a tough ride over the past 5 years, having considerable outrun their financials in the past. However, the company remains a cash-cow. Its essential business model was hardly affected during the pandemic, with CVS posting record profits of $7.18 billion during the quarter. The dividend was held constant during the year to preserve liquidity, which was a prudent move by management.

At a forward P/E ratio of just over 10, and a well-covered dividend, we can see why the stock accounts for Creek’s 4.3% of Owl Creek’s portfolio. This is an entirely new holding for Owl Creek.

At a forward P/E ratio of just over 10, and a well-covered dividend, we can see why the stock accounts for Creek’s 4.3% of Owl Creek’s portfolio. This is an entirely new holding for Owl Creek.

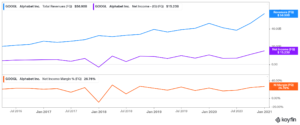

Alphabet (GOOGL)(GOOG):

Alphabet is Owl Creek’s tenth-largest holding, occupying around 4% of its portfolio. Alphabet’s financials lagged momentarily during COVID-19’s initial outbreak. Despite that, both revenues and net income hit new all-time highs of $56.9 billion and $15.26 billion respectively in FY2020, amid a strong acceleration towards the end of the year. The company enjoys margins north of 20% consistently. Alphabet has been growing its top and bottom line consistently, yet only trades at around 30 times its next year’s net income.

Owl Creek’s position in Alphabet is entirely new, initiated during the period covered in its latest 13F filing.

Final Thoughts

Owl Creek Asset Management seeks to produce returns over time using a variety of highly complex strategies, including using derivatives and credit investments, in addition to traditional equity investments. The firm’s performance may have lagged over the past few years, though sometimes clients like those Owl Creek manages usually seek risk-adjusted, inflation-beating returns. Hence, Owl Creek may be succeeding in that regard.

The firm has a huge bet on Anterix, a company with very little revenue and negative earnings, as well as the quite risky utility PG&E. These positions aren’t traditional value stocks.

For investors seeking exposure to companies with high risk, high reward situations, Owl Creek’s 13F shows a select few stocks the firm believes will outperform over time as evidenced by the high concentration of its portfolio.

Additional Resources:

Athanor Capital’s 534 Stock Portfolio: Top 10 Holdings Analyzed

Viking Global’s 75 Stock Portfolio: Top 10 Holdings Analyzed

Lone Pine Capital’s 37 Stock Portfolio: Top 10 Holdings Analyzed

Slate Path Capital’s 20 Stock Portfolio: Top 10 Holdings Analyzed