Updated on March 12th, 2020 by Josh Arnold

Oil prices have been decimated in the first quarter of 2020 as Saudi Arabia initiated a price war with global producers. As the market gets flooded with cheaper crude oil, companies that rely upon higher prices of the commodity to generate revenue and earnings have suffered.

This poses a problem for companies that engage in the production or transportation of oil, along with a variety of other industries that feel the impact.

Vermilion Energy (VET), along with many of its competitors, have much lower share prices than they have in recent years because of this. Indeed, Vermilion has seen its share price cut by two-thirds in the space of a couple of weeks as of this update. And, the recent plunge in oil prices forced the company to cut its dividend by 50%.

Vermilion Energy pays monthly dividends, as opposed to the more common quarterly schedule. There are currently just 58 monthly dividend stocks.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Even after the dividend cut, Vermilion still yields 28%, as its share price has plunged even faster than the rate of its dividend reduction. It therefore remains on our list of stocks with 5%+ dividend yields. You can see the full list of 5%+ dividend yields here.

However, Vermilion’s plunging share price is a clear indication that the market believes the dividend is still unsustainable. Indeed, it is reasonable to question the company’s financial viability at this point.

Vermilion Energy’s extremely high dividend yield and monthly dividend payments make it stand out to dividend investors. But investors should take extreme caution with Vermilion, as its business model has deteriorated significantly due to recent events.

Business Overview

Vermilion Energy is a Canadian oil and gas production company with a global operational footprint. Note that Vermilion trades in both Toronto and New York, and that we will use the US listing in this article. Thus, all financials are in US dollars, unless otherwise noted.

Founded in 1994, Vermilion Energy is headquartered in Calgary, Alberta, Canada and has a market capitalization of just ~$675 million after a brutal selloff that has taken away most of the prior value of the stock. Indeed, a year ago, Vermilion’s market capitalization was about six times higher than it is today.

More details about Vermilion Energy’s business model can be seen below.

Source: Investor presentation, page 2

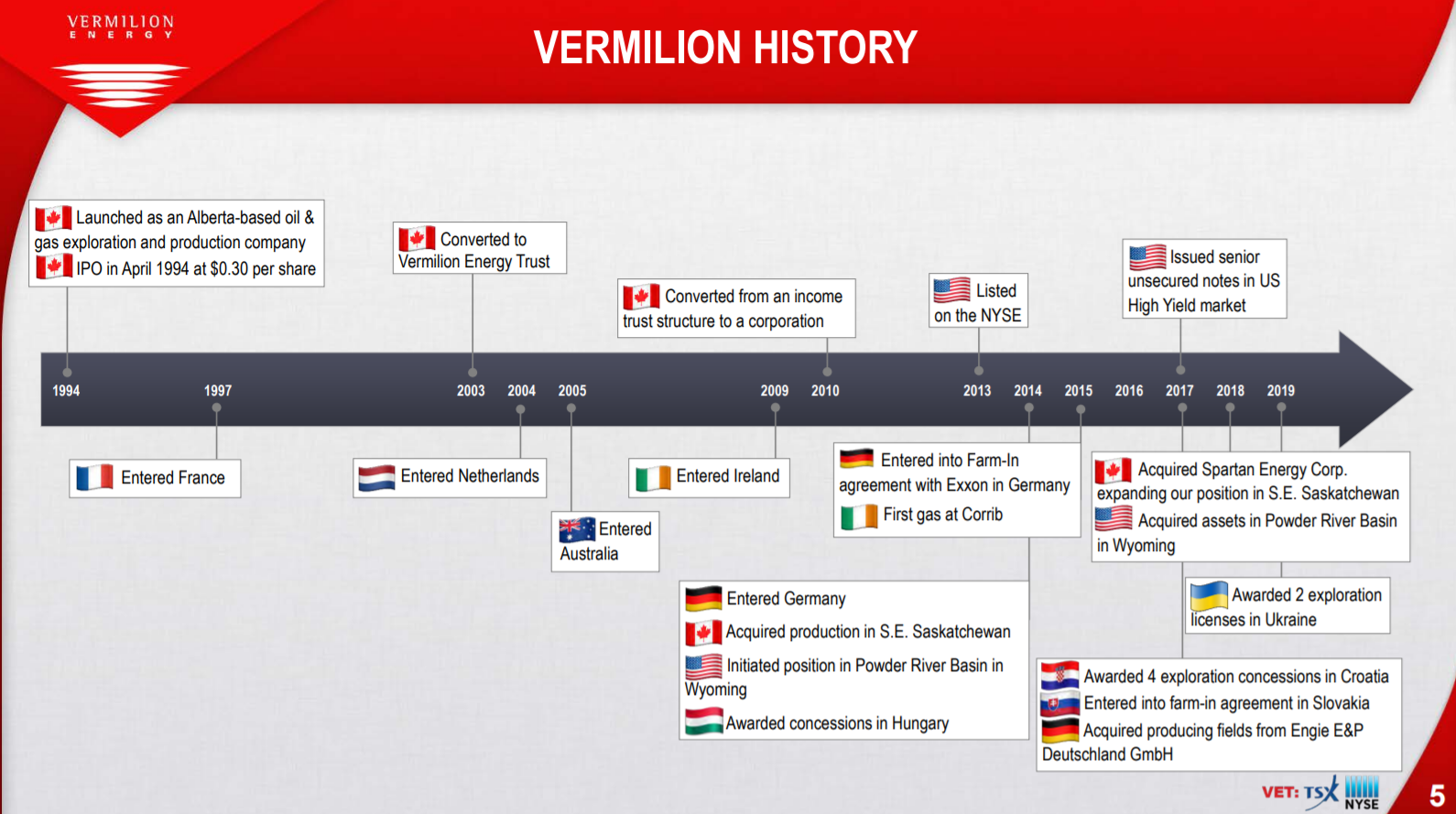

Since the company’s founding in 1994, Vermilion has experienced a truly exceptional rate of growth. It executed its initial public offering in April 1994 with an adjusted opening stock price of $0.30 per share. However, the recent selloff from the coronavirus impact has Vermilion trading at a stock price below $4, destroying the vast majority of prior returns that had accrued to shareholders from the IPO.

To its credit, the company has reinvented itself a few times since its corporate inception. In 2003, Vermilion Energy changed its corporate structure to that of a Canadian income trust, then converted back to a corporation in 2010. In 2013, Vermilion Energy was listed on the New York Stock Exchange, giving it exposure to a new group of United States-based investors.

Source: Investor presentation, page 5

The company’s growth since its founding is nothing short of remarkable. With that said, Vermilion Energy’s growth runway appears to have been significantly altered in recent weeks with the oil price war.

The company has driven growth through an attractive mix of organic expansion and mergers & acquisitions. Vermilion has a deep and diversified project backlog, allowing the company to pursue scale without sacrificing simplicity. It also isn’t afraid to make bold purchases, as it did with Spartan Energy in 2018, which was a transformative move for Vermilion given the size.

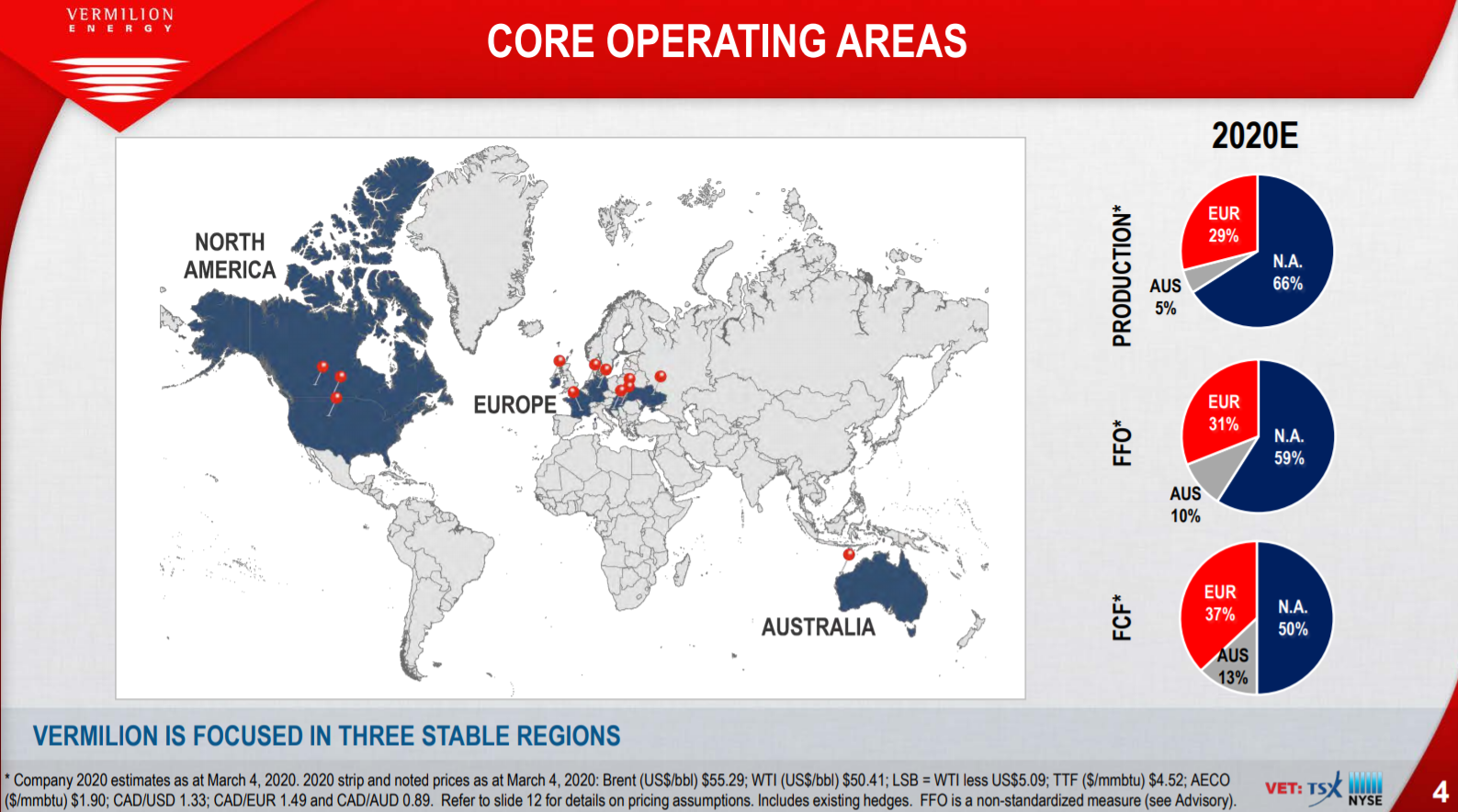

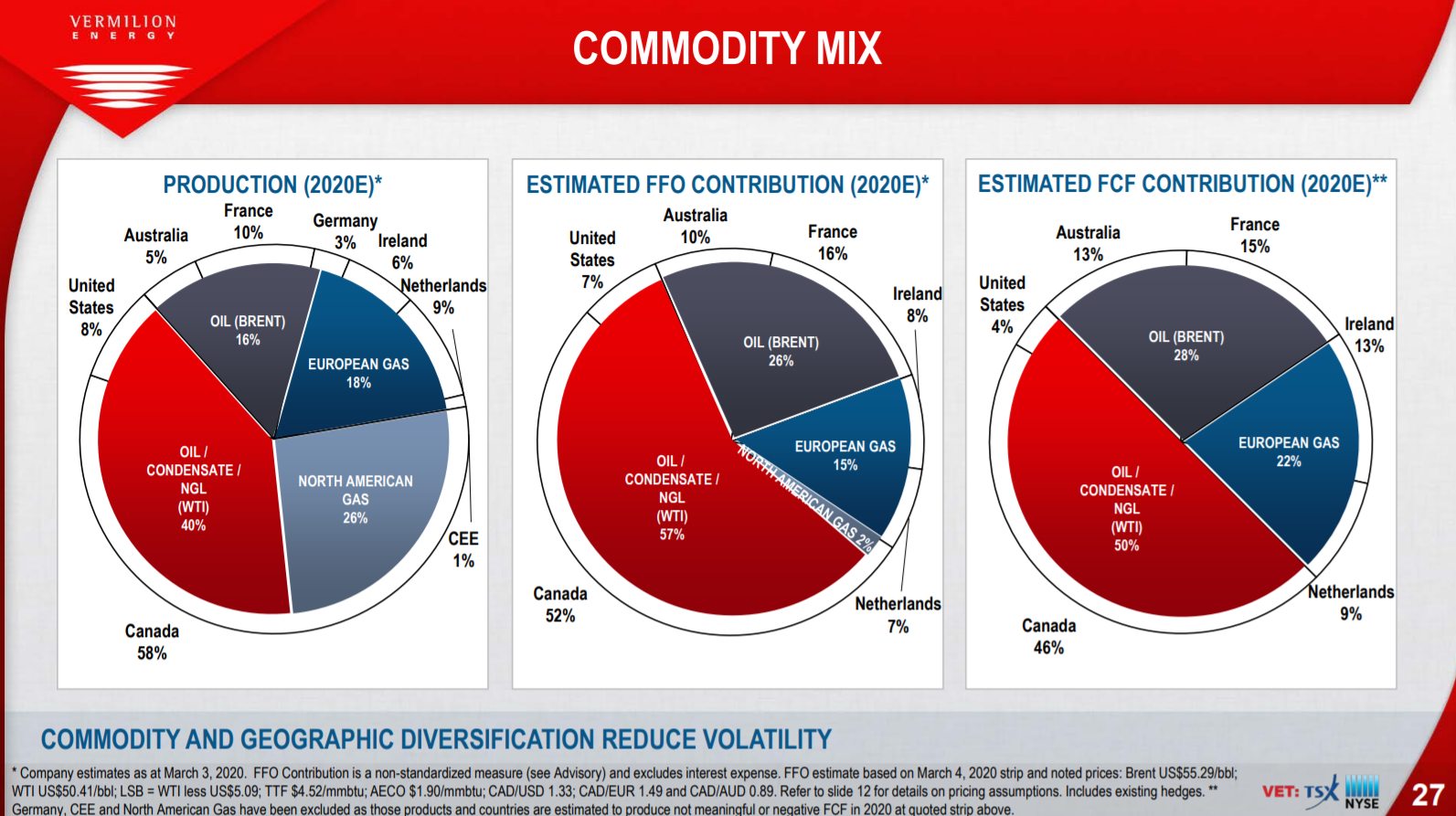

Vermilion Energy benefits from a considerable amount of geographic diversification. Along with its core operations in the United States, Vermilion Energy has a meaningful presence in Europe and Australia, giving it exposure to three core operating geographies.

Source: Investor presentation, page 4

In fact, Vermilion expects to get 34% of its total production this year from outside North America, about three-fifths of its funds-from-operations, or FFO, and half of its free cash flow. Those numbers are slightly down from last year as Vermilion is now seeing greater proportions of those metrics from Australia and Europe.

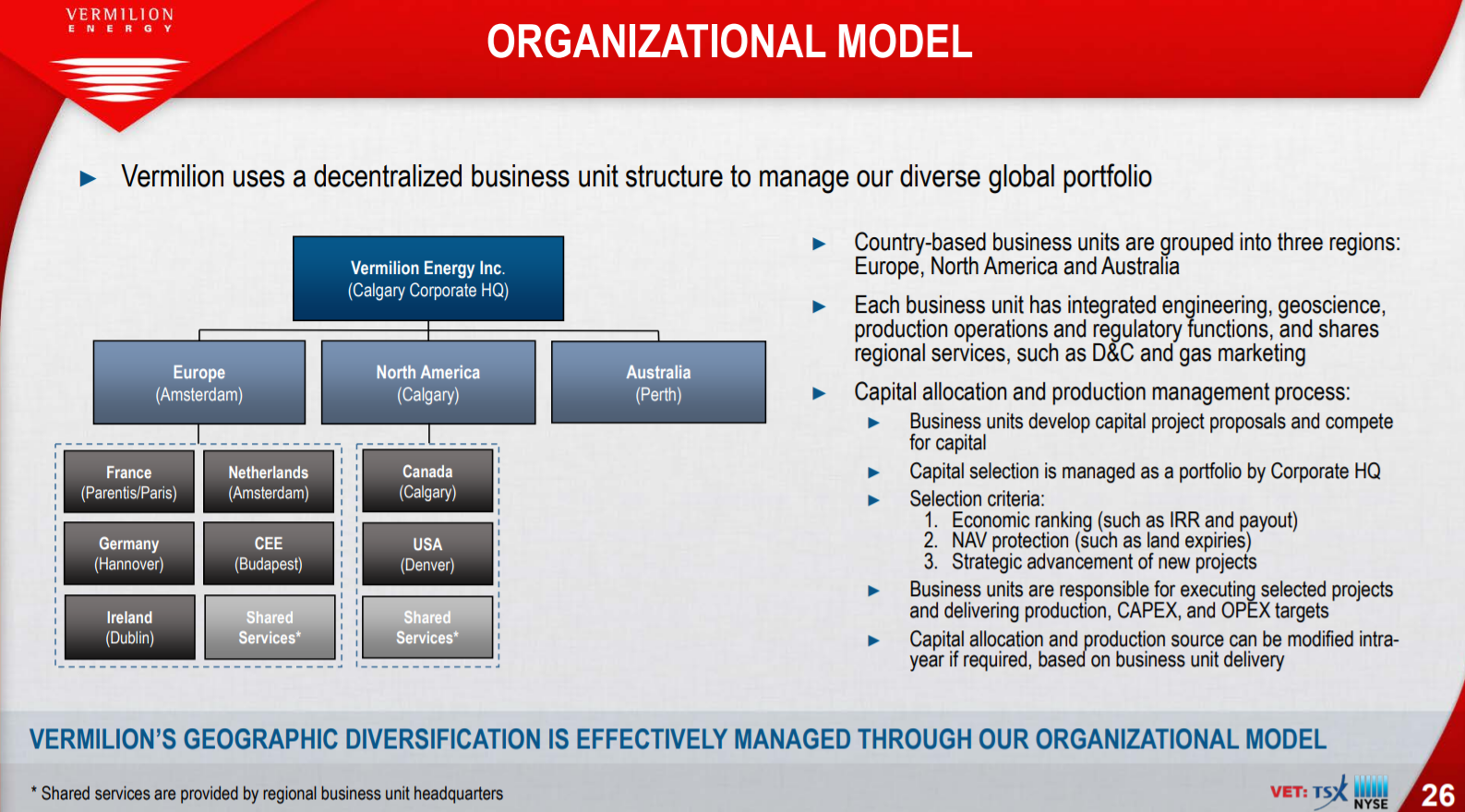

Vermilion’s diversification is focused on stable parts of the world. The publicly-traded parent company acts as a holding company for three operating subsidiaries in Vermilion’s main geographies: Europe, North America, and Australia.

At the headquarters level, staff focus on making capital allocation decisions while the operating business units are responsible for executing on their designated growth projects and delivering production, capex, and opex targets.

The company’s corporate structure can be seen in more detail below.

Source: Investor presentation, page 26

We’ll now take a look at Vermilion Energy’s growth prospects in detail.

Growth Prospects

Vermilion Energy’s total returns had been extremely strong since the company’s inception in 1994, up to the end of 2019. However, the recent, precipitous decline in the share price has erased much of those returns that took years to build.

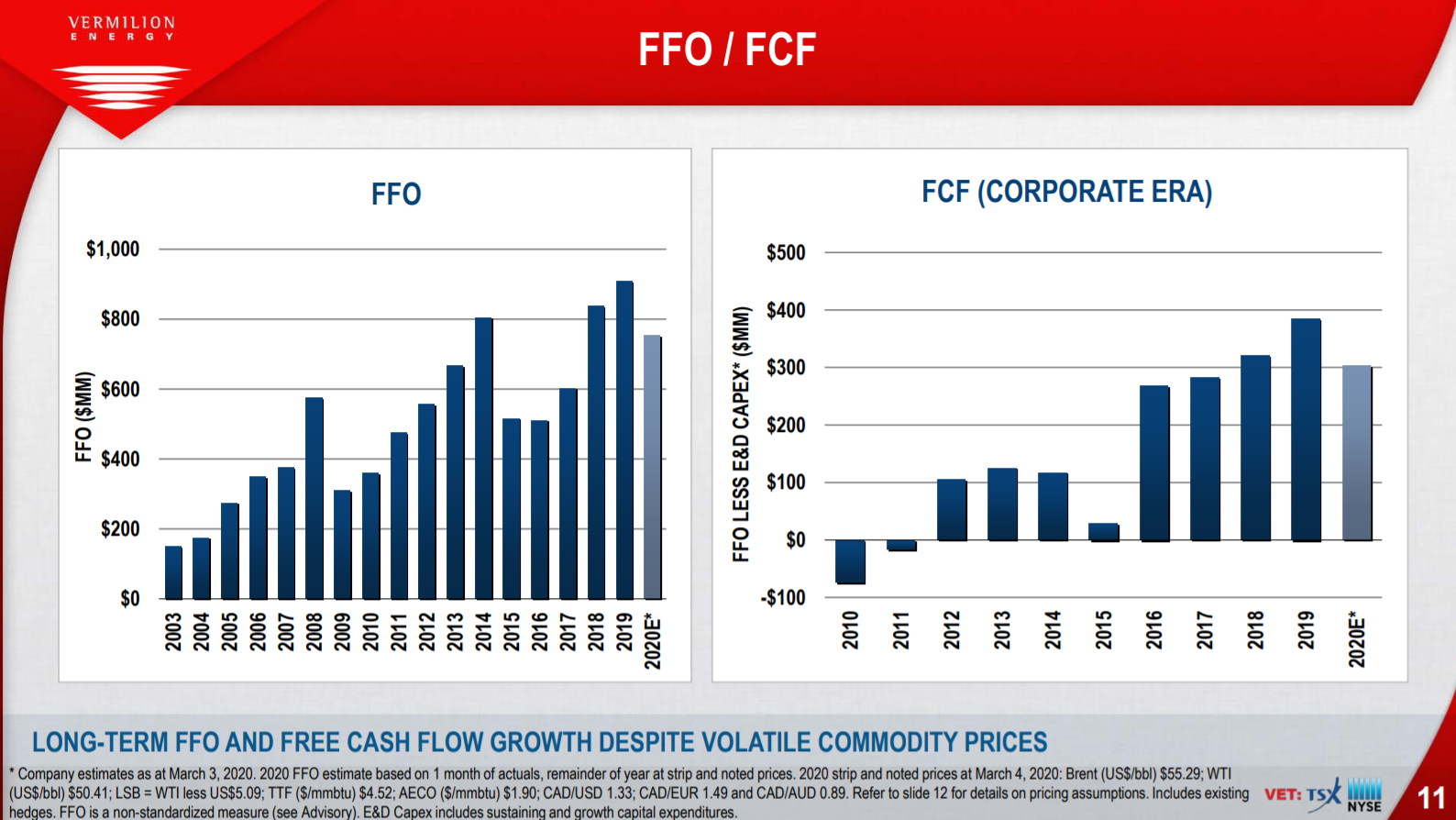

The company’s main yardstick by which it measures performance is fund flows from operations (FFO), a non-GAAP financial measure calculated by adding back non-cash charges like depreciation and amortization to net income.

After the collapse in oil prices in 2014, Vermilion, and just about any other company it competes with, suffered sizable earnings capacity declines. FFO fell from nearly $8 in 2014 to just over $4 in 2016, but has since recovered nicely. We expect to see a similar situation for 2020 as the landscape for oil companies has been materially altered by the recent actions of the Saudi Arabian government.

Vermilion Energy has achieved double-digit percentage FFO growth in many of the past years, as seen below:

Source: Investor presentation, page 11

Along with strong profit growth (as measured by fund flows from operations), Vermilion’s business generates a substantial amount of cash flow. Free cash flow was negative in 2010 and 2011, but has since been positive every year.

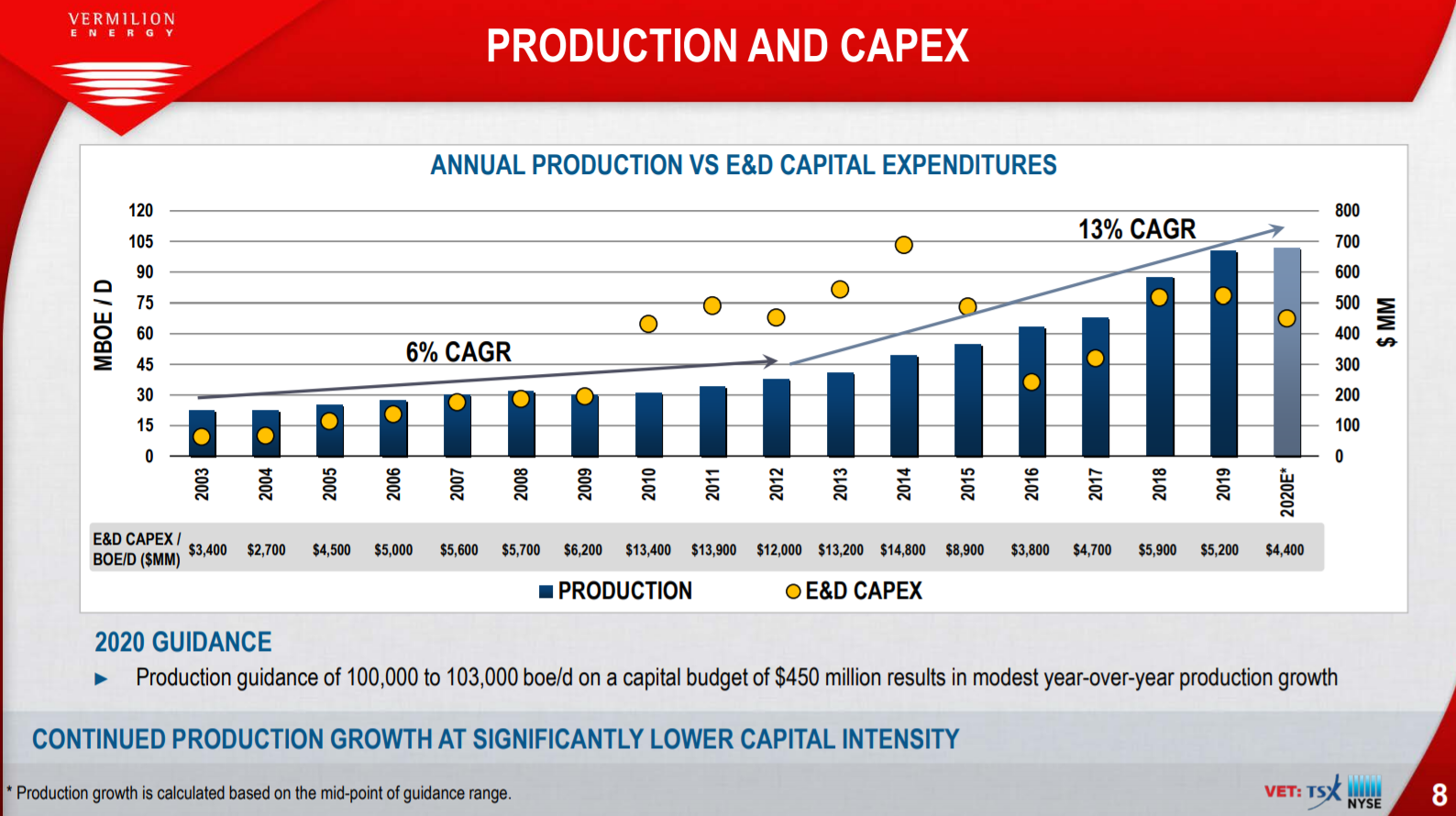

Guidance for 2020 was based upon estimates prior to the price war that was recently initiated, so we believe this guidance to be irrelevant at this point. We’re expecting significant reductions in FFO and free cash flow this year, akin to what we saw in 2015, the last time oil prices crashed the way they have thus far in 2020. Of course, much remains to be seen about the longer-term price of oil, but for now, Vermilion’s earnings capability has been materially altered.

Since 2016, Vermilion has seen FCF-per-share in excess of $2. With the dividend having been cut in half in early March in response to the oil price decline, the new payout of ~$1 per share (in U.S. dollars) annually should be easier for Vermilion to cover, even if FFO and FCF are temporarily impaired.

Source: Investor presentation, page 8

However, this depends on whether oil prices can recover in the near term, or whether the downturn in the commodity markets gets even worse. Looking ahead, Vermilion’s exposure to multiple geographies and the company’s strong cash flow generation will drive its growth. For now, we don’t think Vermilion’s model is impaired for the long-term, but we do recognize that 2020 is going to be very difficult for all oil producers, including Vermilion.

We think there is significant downside potential for 2020 based upon oil prices, but we note the price war is less than a week in, and depending upon what happens, Vermilion could be in much better – or worse – shape than it is today given the fluidity of the situation.

Competitive Advantages & Recession Performance

Like many energy companies, Vermilion Energy’s competitive advantage comes from its asset base. The company also benefits from its geographic diversification. This exposes Vermilion Energy to additional oil-rich regions while simultaneously isolating the company from any regional economic downturns or natural disasters.

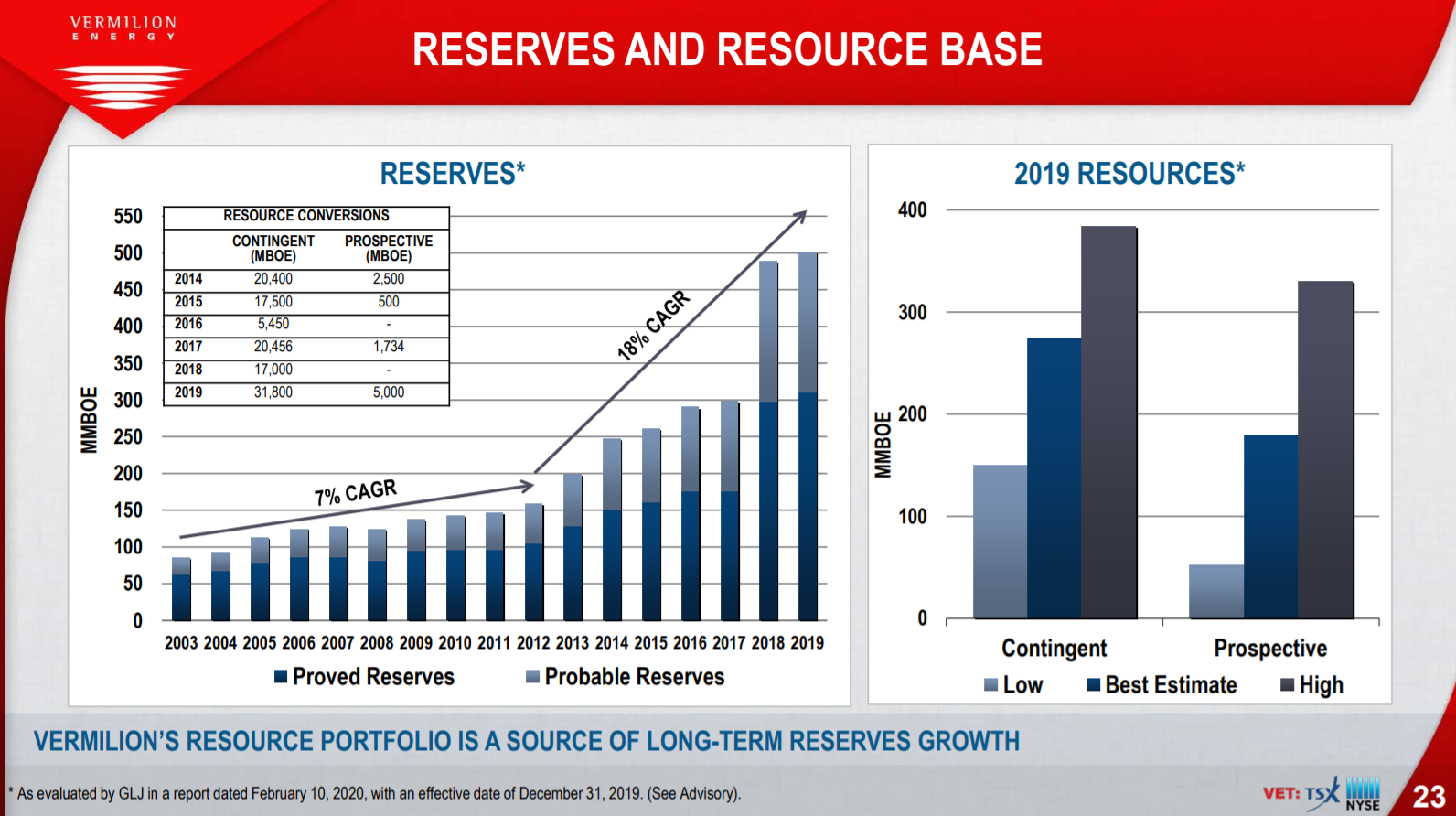

Source: Investor presentation, page 23

The company’s proven reserves have skyrocketed in recent years and we see this as a major advantage for the company’s long-term stability against its competitors. Investors can also appreciate the company’s diversification not only from a geographical perspective, but in its commodity mix as well.

Vermilion is extremely well diversified between oil products and gas. This is something that many pure-play oil or gas companies do not possess.

Source: Investor presentation, page 27

Of course, quality assets are of little consolation when oil and gas prices plunge. From a debt perspective, the company is reasonably leveraged today, and largely in line with its peers. Recessions generally come with lower commodity prices – oil included – so earnings would suffer further if the global economy slips into a deep recession. Vermilion’s ability to handle this external shock will be telling for its recession performance in the future.

Dividend Analysis

As previously mentioned, Vermilion cut its dividend in half in early March in response to the coronavirus and its economic impacts. That drove down the share price, along with the oil price war that is now occurring. Vermilion shares have been decimated as a result. The new monthly dividend rate of US$0.085 per share still equates to a current yield of 28%, showing just how far the company’s shares have fallen over the past few months.

We see Vermilion’s business model and dividend as sustainable through a transitory period of oil price weakness, but much depends upon how oil prices behave from here. Vermilion is obviously a very high-risk, high-reward stock at this point due to the dividend cut and massive share price decline.

We see the company’s growth in the low-single-digits under normal circumstances, but this year, earnings growth will be solidly into negative territory. While certain years will see much higher rates of growth, depending upon the price action of oil, there could certainly be years of negative growth as well, 2020 included.

The company has produced in excess of $2 per share in FFO annually in recent years, but won’t be anywhere close to that today. Still, with the share price at just over $4, Vermilion seems to be pricing in an astounding amount of bad news. While current FFO projections appear to cover the reduced dividend, there is a great deal of uncertainty due to the massive decline in commodity prices just over the past few weeks.

The market is clearly pricing in the possibility that Vermilion doesn’t survive this oil price war, so we hesitate to recommend buying the stock.

Final Thoughts

Vermilion Energy will undoubtedly struggle in 2020. The stock appears to be cheap, it has a diversified business model that has been proven over decades, and the stock yields 28%. The company also pays its dividends on a monthly basis, which makes it a very attractive investment for income-oriented investors.

However, there is so much uncertainty surrounding Vermilion, not the least of which is the recent dividend cut, that we recommend investors are cautious with Vermilion and wait for more clarity on its ability to survive the price war taking place in the oil industry.