We see U.S. Global Investors as struggling to grow in the coming years. We expect low earnings for the foreseeable future as headwinds to profitability persist.

This isn’t a new phenomenon, however, as the company has struggled for years with profitability.

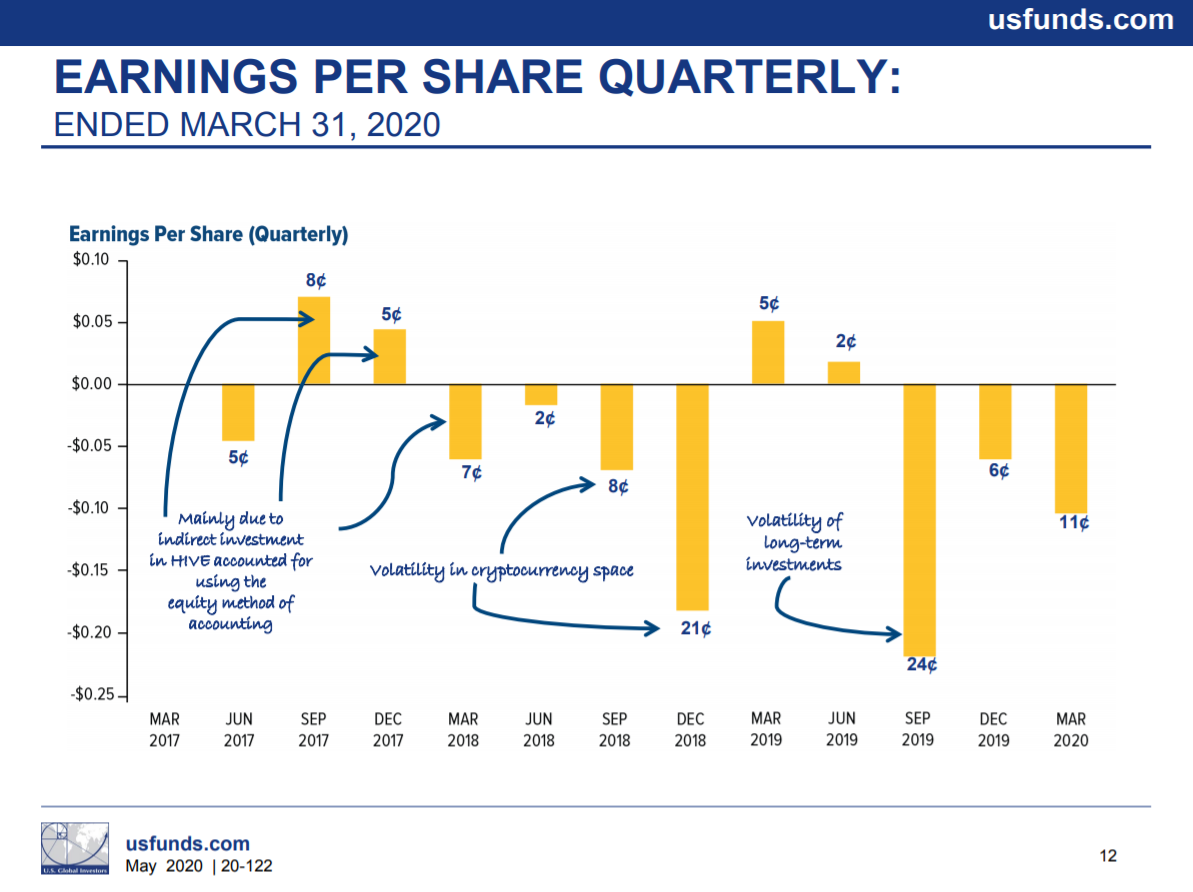

Source: Investor presentation, page 12

This look at quarterly earnings-per-share highlights the inherent volatility in the company’s results since 2017. The company’s third quarter results showed higher revenue thanks to higher AUM, but these gains were more than offset by the cost to support higher AUM. In addition, the company has investments of its own that produce fairly sizable gains and losses in any particular quarter, including its investment in HIVE Blockchain Technologies (HVBTF).

U.S. Global Investors bought its stake in HIVE for a total of $2.4 million as a way to gain exposure to crypto-currencies. HIVE is a crypto-currency miner, meaning it has supercomputers that mine Bitcoin, Ethereum, and others.

U.S. Global Investors’ position in HIVE was only worth $1.3 million at the end of March as shares of HIVE fell markedly during that period. The stock has since nearly doubled as financial markets and crypto-currencies have rebounded, so we expect the company’s position in HIVE to be worth somewhere around $2.5 million as of the end of the fiscal year. This will help bolster results, but investors should keep in mind that a huge investment in a penny stock that mines crypto-currencies is far from a safe long-term strategy.

While certain quarters – like fiscal Q4 that ended in June – will show large investment gains for U.S. Global Investors, we see the long-term business model as challenged. We therefore do not believe the growth prospects of this company are particularly enticing.

Dividend Analysis

U.S. Global Investors has paid its dividend on a monthly basis for more than 11 consecutive years, which is a decent track record. At the current payout of $0.03 per share annually, the stock yields 1.3%. On a yield basis, U.S. Global Investors is far from attractive.

The problem is that with an extremely murky outlook for earnings growth, we believe dividend growth will also be very difficult to come by. On the plus side, the current payout costs the company only about $450,000 per year. And with a clean balance sheet, we believe it can continue to pay the dividend for some time, if it were to choose to fund it with cash on hand rather than earnings.

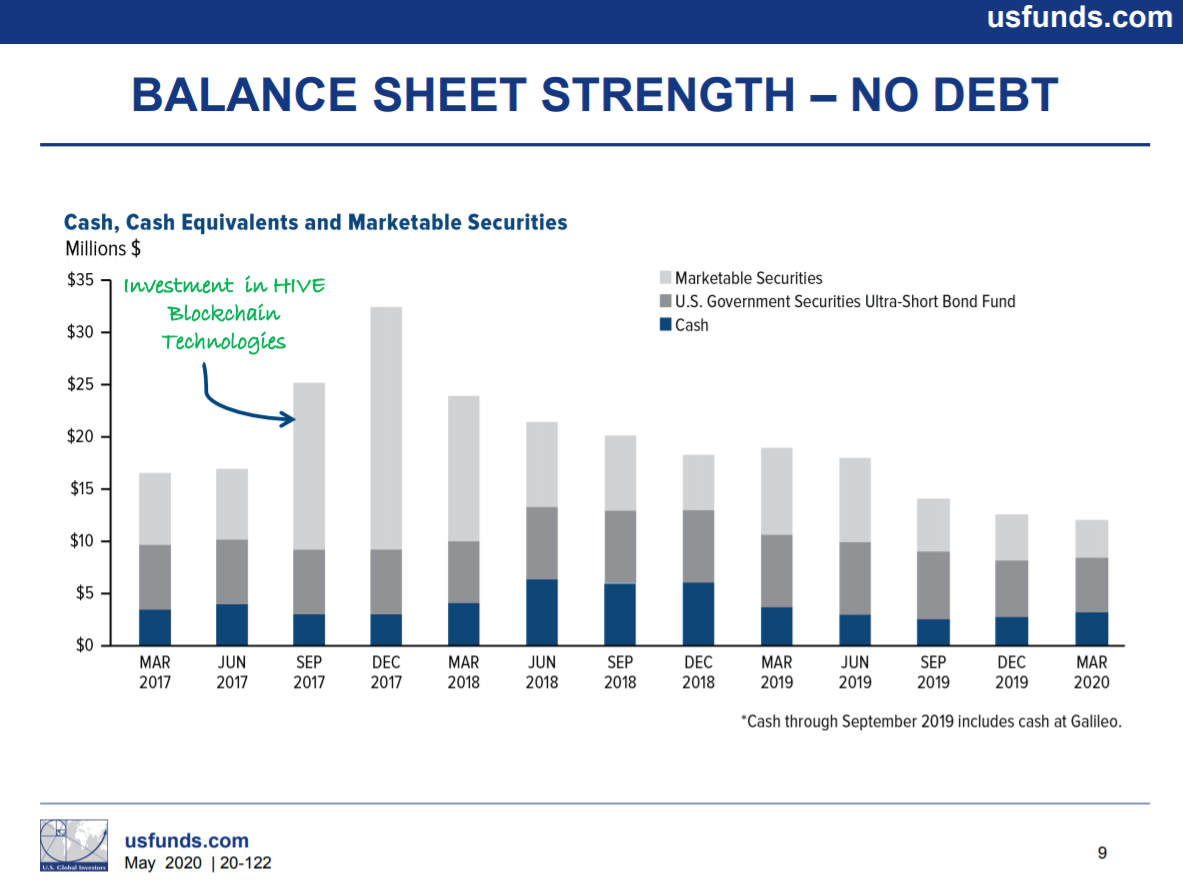

Source: Investor presentation, page 9

The company’s cash and equivalents balance has declined over time as well, but it had nearly $15 million in total at the end of March. With HIVE’s rebound, that number should be somewhat higher for the end of the fiscal year. U.S. Global Investors has enough cash and short-term bonds on the balance sheet that it could theoretically pay the dividend for years without earnings. Thus, we believe the payout is safe at this point.

Final Thoughts

U.S. Global Investors has a tough road ahead of it. The company has to compete with other asset managers that are many times its size in an industry where scale means pricing power. This company has no scale or pricing power, and is seeing rising operating costs.

Given this, and the fact that the dividend yield is so low, we think investors should avoid this stock. There are many better choices in terms of payout growth, current yield, and dividend growth.