Updated on July 16th, 2021 by Bob Ciura

As the saying goes, if something looks too good to be true, it usually is just that. This can often be applied to unusually high-yielding dividend stocks, many of which have to cut their dividends in a recession.

For example, Stellus Capital Investment Corp. (SCM) has a nearly 8% dividend yield, which is very attractive on the surface. The S&P 500 Index, on average, has a dividend yield of just 1.3%.

Not only that, but Stellus pays its dividend each month, rather than each quarter like most companies. This helps to make Stellus stand out, as we currently cover just ~51 monthly dividend stocks.

You can download the full list of monthly dividend stocks (along with important financial metrics such as dividend yields and payout ratios) by clicking on the link below:

However, while high dividend stocks are very appealing in a relatively low-rate environment, investors must make sure the dividend is sustainable.

Stellus has a very high payout ratio near 90%. As a BDC, Stellus is required to distribute essentially all of its income, so its payout ratio will always be high. However, it is in investors’ best interests to carefully monitor the company’s earnings performance for signs that a cut in the distribution may be coming.

This article will discuss Stellus’ fundamentals as they pertain to supporting its nearly 8% dividend yield.

Business Overview

Stellus is a Business Development Company, or BDC. It makes investments in small, predominantly private companies that are usually at an early stage in their growth cycles.

Stellus is a middle-market investment firm, and makes equity and debt investments in private middle-market companies. The company provides capital solutions to companies with $5 million to $50 million of EBITDA and does so with a variety of instruments, the majority of which are debt.

Stellus provides first lien, second lien, mezzanine, convertible debt, and equity investments to a diverse group of customers, generally at high yields, in the US and Canada.

Source: Investor Presentation

It also has a highly diversified investment portfolio, both geographically and in terms of industry concentration. Stellus will make a variety of debt investments including first lien, second lien, uni-tranche, and mezzanine financing.

The investments are placed in a variety of industries, including business services, industrial, healthcare, technology, energy, consumer products, and finance. Invested capital is used for a wide range of purposes, including acquisitions, growth investments, and more. Stellus is externally-managed, by Stellus Capital Management LLC, a registered investment advisor.

The company follows a disciplined investment strategy. It has closed less than 2% of deals reviewed. Its relative selectiveness allows the company to focus on the highest-quality investments.

It also means the company has far more investment opportunities than it needs, enhancing its ability to select only the best investments. Stellus generates particularly high yields from its first lien, second lien, and unsecured debt investments.

Next, we’ll take a look at the company’s growth prospects.

Growth Prospects

A strong catalyst for Stellus is its growing investment portfolio. Stellus has seen its investment portfolio rise at a rapid pace over the past five years, which has allowed the company to earn higher investment income.

However, this all came to a halt in 2020 as the coronavirus pandemic sent the U.S. economy into a deep recession, which negatively impacted many of Stellus’ investments.

The good news is that the company’s results seem to have stabilized. Stellus reported first-quarter earnings on May 6th, 2021, with results coming in mixed against expectations. Investment income was $14 million for the quarter, which was down from $15.3 million in the year–ago period, and was nearly entirely from interest income derived from portfolio investments.

Net investment income came to $5.1 million in Q1, down from $6.2 million in the year–ago period. On a per-share basis, NII-per-share declined 19% from the same quarter last year.

The increase in net assets from operations was $4.9 million, up from the –$43.9 million decline in the same period a year ago, which was due to massive disruption in financial markets from COVID–19. This equated to a gain of 25 cents per share in this year’s Q1.

Another potential catalyst for Stellus could be higher interest rates. As a primary debt investor, Stellus could benefit from higher yields on its future investments. Higher inflation in 2021 could set the stage for rate hikes in 2022.

In addition, the company’s portfolio is almost entirely floating rate. This is a positive in a rising rate environment, but this leverage works both ways.

Dividend Analysis

As far as dividend stocks go, Stellus is not a typical choice. It has a relatively short dividend history of less than 10 years, which means it has not yet developed a long track record of consistency.

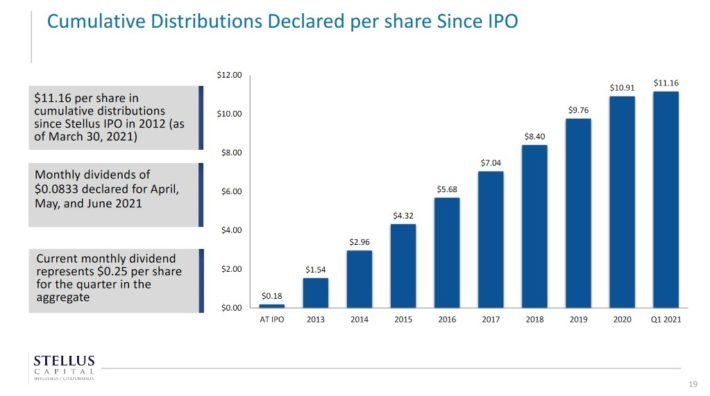

You can see an image of the company’s distribution history below:

Source: Investor Presentation

Stellus currently pays a monthly dividend of $0.0833 per share, which equates to an annualized payout of $1 per share. This is down from $0.1133 per share in 2020. The company cut its dividend last year due to the pandemic. On a positive note, Stellus paid a special dividend of $0.06 per share last year, but dividends still remain well below the peak level.

Net investment income is expected to come in at $1.15 per share for 2021. With the current annualized dividend of $1, Stellus is currently carrying a payout ratio of 87%. This means the current dividend payout is sustainable, but just barely. Keep in mind BDCs are required to distribute virtually all of their income, so Stellus’ payout ratio will always be high.

Even so, the company does not have much wiggle room. Even a modest decline in investment income could cause the payout ratio to rise above 100%, which signals a potentially unsustainable dividend.

It is very important that Stellus continue to increase its investment, as its recent results indicate. Stellus is a high-risk, high-reward dividend stock. If the company’s growth stays on track, investors will receive a ~8% return just from the dividend, plus any capital appreciation from a rising share price.

Even if the company does maintain its dividend, investors should not expect much in terms of dividend growth going forward. Net investment growth has been sluggish and given the high payout ratio, we don’t see any catalysts for a higher payout in the near future.

Final Thoughts

Stellus could be an attractive pick as it has a nearly-8% dividend yield and some measure of growth potential.

Plus, Stellus pays its dividend each month, which helps boost the compounding effect of reinvested dividends and enhances the attractiveness of the stock for those relying upon dividends for living expenses.

Of course, there is no guarantee the company’s growth plans will be successful and with a payout ratio nearing 100%, there is not much room for error. As a result, investors must accept the risk of a future dividend cut if financial results deteriorate. Only investors willing to take this risk should consider buying the stock.