Updated on February 26th, 2020 by Bob Ciura

Shaw Communications (SJR) is a rare stock. It is based in Canada, and is the only telecom stock with a monthly dividend. The stock is listed in both New York and Toronto, and we’ll be using the latter throughout this article, unless otherwise noted.

While the U.S. telecoms like Verizon (VZ) and AT&T (T) pay quarterly dividends, Shaw’s monthly payouts allow investors to compound their dividend growth more quickly.

Indeed, Shaw is one of just 58 stocks that pay monthly dividends.

The other advantage for Shaw is it is outside the highly-competitive U.S. wireless market.

Shaw is growing subscribers and revenue, which fuels its 4%+ dividend yield. In addition, its impressive growth leaves the possibility for dividend increases moving forward.

This article will discuss Shaw’s business model and why the stock could be an attractive option for income investors.

Business Overview

Shaw Communications was founded in 1966 as the Capital Cable Television Company. It has since grown to become Western Canada’s leading content and network provider, catering to both consumers and businesses. The company produces about $4.1 billion USD in revenue annually and has a market capitalization of $9.7 billion. The stock is listed in both Canada and the U.S.

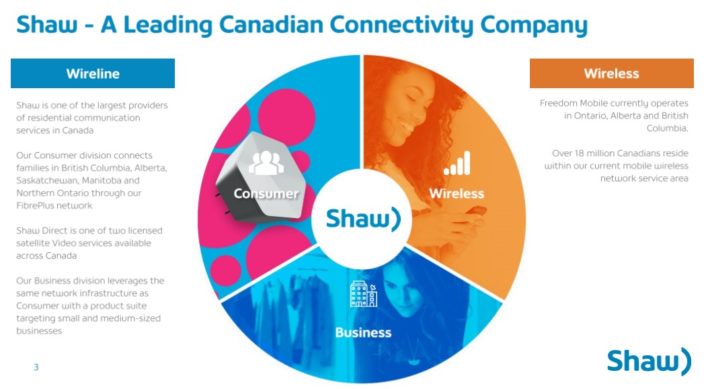

Shaw is a diversified telecommunications company. The company recently consolidated its four prior reporting segments into just two major segments, Wireless and Wireline. The Wireless segment includes service and related equipment, while the core Wireline segment includes consumer and business services.

Source: Investor Overview Presentation

In terms of service revenue, Shaw’s segment breakdown is as follows:

- Wireless (23% of revenue)

- Wireline (77% of revenue)

Shaw provides customers with a wide variety of services, including satellite video, fiber-coax network connectivity, and mobile phone services, among others. The company serves consumers and small to medium businesses in its service area, which mostly includes Canada. The bulk of the company’s revenue is from consumer services.

Shaw has struggled a bit in recent years to grow earnings as it has undergone a strategic transformation.

Source: Investor Overview Presentation

Shaw, in the past three years, has acquired Freedom Mobile, divested the Shaw Media and ViaWest businesses, and acquired wireless spectrum. These changes have left the company more focused on its long-term goals of sustainable growth.

Going forward, we believe there is still plenty of growth potential for the company.

Growth Prospects

The company’s Q1 earnings report was released on 1/13/20 and results were strong. Consolidated revenue increased by 2.1% to $1.06 billion USD. Adjusted EBITDA increased 8.1% year-over-year to $451 million USD.

The company added 67,000 customers to the Freedom Mobile segment. Wireless service revenue increased 18.1% as the customer base grows to over 1.7 million customers. First quarter average billing per unit (“ABPU”) grew by 4.5%. Postpaid churn increased for the quarter to 1.5%, primarily attributed to the intensity of competitive offers during the holiday shopping period.

Free cash flow increased 12.3% to $140 million USD, due to lower capital expenditures and cash taxes. Net income was down 12.4% from last year to $125 million USD for the first quarter of 2020. But this was almost entirely attributable to equity income recorded in Q1 2019 for the sale of the company’s investment in Corus Entertainment Inc.

Management is guiding for 2020 adjusted EBITDA to grow 11% to 12% (excluding IFRS 16, adjusted EBITDA would grow 4% to 5%), with capital expenditures of $0.84 billion USD and free cash flow of $537 million.

In addition, continued revenue growth and margin expansion should help drive earnings higher, marking another step forward in the company’s ongoing transformation.

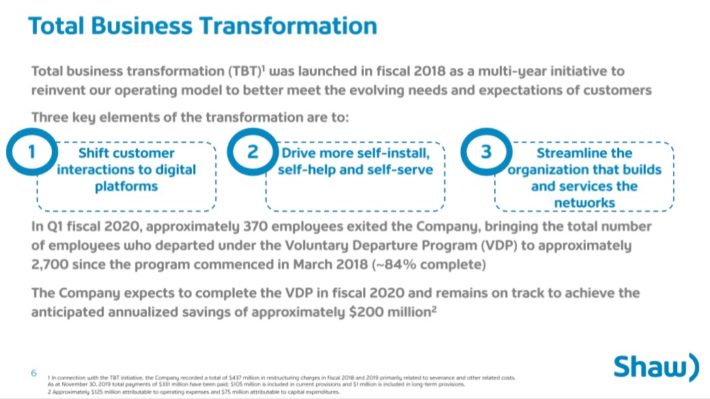

Source: Investor Overview Presentation

Shaw could continue to generate strong revenue and free cash flow growth through its Total Business Transformation strategy. Essentially, Shaw is looking to reinvent its operating model in order to not only better meet the needs of customers, but to reduce costs at the same time.

This will help drive customer engagement, which should hopefully lead to better retention rates, and significant cost savings. Savings from this program are expected to reach $200 million in fiscal 2020. This will help improve not only earnings, but free cash flow as well via lower capital expenditures.

In total, we see Shaw growing earnings at 6% annually for the foreseeable future through a mix of revenue growth and margin expansion. Fiscal 2020 is another important step forward towards the company’s growth plan, and we are optimistic on the company’s prospects.

Dividend Analysis

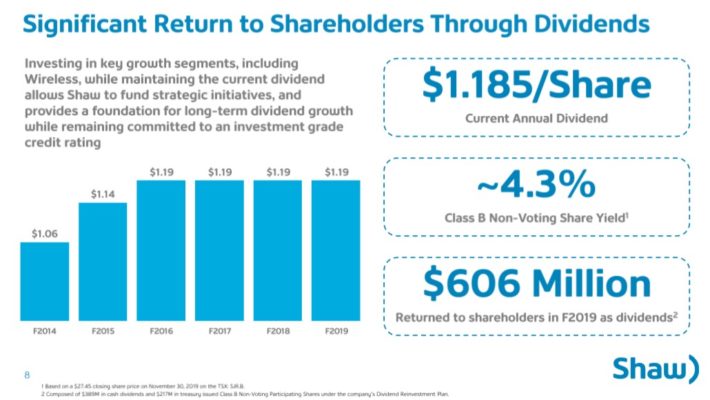

Shaw’s current monthly dividend rate is approximately $0.098542 per share in Canadian dollars, and it has paid the same monthly dividend rate since March 2015. On an annualized basis, this comes out to roughly $1.18 per share. Investors should consider that since Shaw is based outside the U.S., the dividend is exposed to currency risk as the dividend is declared in Canadian dollars.

As currencies fluctuate, the dividend rate is subject to change, once it is translated back into U.S. dollars. Based on prevailing exchange rates, Shaw’s dividend comes out to approximately $0.89 per share in U.S. dollars. At a recent price of ~$19 in the US, the dividend yield is 4.7%. Shaw’s yield is lower than AT&T’s 5.6% yield, but is higher than Verizon’s 4.3% yield. Shaw has the added advantage of monthly dividend payouts, which could be appealing for income investors desiring even more frequent payments.

Another important consideration for investing in foreign companies is withholding taxes. Dividends received in Canadian dollars are typically subject to a 25% withholding tax (15% for most U.S. investors). However, there is an exception for Canadian stocks – the withholding tax is waived for U.S. investors who hold the stock in a qualified retirement account, such as a 401(k) or IRA.

Shaw’s history of returning capital to shareholders is significant, even if it hasn’t raised the payout since 2016.

Source: Investor Overview Presentation, page 10

The dividend was raised briskly up until 2016, but Shaw’s major business transformation caused it to pause on payout increases. Indeed, this pause was necessary given the deterioration in the company’s ability to finance the dividend.

Fiscal 2019 free cash flow, for instance, was $545 million, while the dividend cost $384 million. When we view the dividend of $1.18 per share in the context of earnings-per-share, which came in at just $1.42 last year, we see a similar picture of sufficient coverage.

As a result, we view the dividend as sustainable, barring a major recession or business downturn. Shaw’s free cash flow guidance and earnings outlook have both improved significantly and we see the company growing its way out of the precariously financed dividend situation.

Certainly, investors would have liked dividend increases in the past few years, but Shaw simply couldn’t afford it. Now, we believe those days to be over and growth in the payout can resume at some point in the relatively near future.

Importantly, Shaw’s balance sheet is healthy. It has an investment grade credit rating from Standard & Poor’s and a net-debt-to-adjusted EBITDA ratio of 2.5x at the end of last quarter. Its leverage ratio is well within its target range of 2.5x-3.0x.

Final Thoughts

When investors think of telecoms, they likely think of AT&T and Verizon. These are both very strong dividend stocks, but there may also be strong telecom stocks outside the U.S. that are worth considering.

Shaw has a strong business model, growth potential thanks to revenue increases and margin expansion, and its 4.7% yield is now safer than it has been in recent years. Plus, Shaw gives investors the added bonus of dividend payments each month.

Overall, we see Shaw as attractive for investors that want a relatively high yield that is also paid monthly, although AT&T remains our top pick in the telecommunications sector.