Updated on July 8th, 2020 by Nate Parsh

Sabine Royalty Trust (SBR) has a high dividend yield of more than 9% based on annualized distributions over the past 7 months. This places Sabine on the high dividend stocks list. You can see all 200+ 5%+ yielding stocks here.

Sabine also pays dividends on a monthly schedule, which means investors receive their dividends more frequently than the traditional quarterly schedule.

There are 50+ monthly dividend stocks. You can see our complete list of monthly dividend stocks, with important financial metrics like dividend yields, price-to-earnings ratios, and payout ratios, by clicking on the link below:

Royalty trusts have unique characteristics and risk factors, which investors should consider before investing. But they could be appealing for income investors due to their high yields. And, investors looking for exposure to the oil and gas industry may find them attractive.

This article will discuss Sabine’s business model, and why investors anticipating higher oil and gas prices may want to give this royalty trust a closer look.

Business Overview

Sabine Royalty Trust was established on December 31, 1982. Its business model is based on income received from its royalty and mineral interests in various oil and gas properties. Sabine is a small-cap stock, with a market capitalization of ~$423 million.

Its oil and gas producing properties are located in Florida, Louisiana, Mississippi, New Mexico, Oklahoma, and Texas. The trust has had a long and successful history. When the trust was formed in 1982, reserves were estimated at 9 million barrels of oil and 62 billion cubic feet of gas.

At inception, the lifespan of the trust was pegged at 9-10 years. The trust was expected to be fully depleted by 1993. 38 years later, Sabine Royalty Trust is still kicking. In that time, the trust has produced nearly 22 million barrels of oil, and 275 billion cubic feet of gas.

Sabine has paid out more than $1.3 billion in distributions to unitholders over the course of the past 38 years. The most recent forecasts are for remaining reserves of 7.1 million barrels of oil, and 35.4 billion cubic feet of gas. If these projections are accurate, the trust would have a remaining lifespan of roughly 8-10 years.

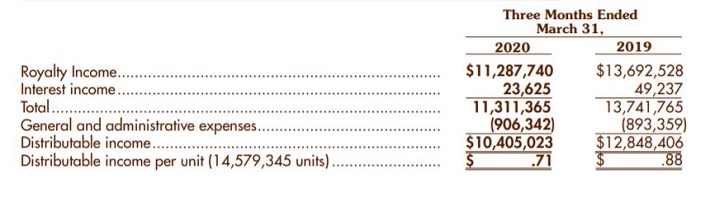

The trust does not have a specified end date, but it would terminate if revenue from the royalty properties falls below $2 million per year, in any consecutive two-year period. Through the first quarter of 2020, Sabine reported declines in royalty income, distributable income, and distributable-income-per-share.

Source: 2020 Q1 report

In the first quarter of 2020, Sabine saw royalty income decrease by almost 18% and distributable income decline 19% from the first quarter of the previous year.

Looking back, the spike in oil and gas prices took Sabine’s distributable-income-per-unit to $4.03 in 2014, which allowed the trust to distribute $4.10 per unit that year.

In the following years, the trust saw an increase in royalty income and distributions. Higher oil prices were the primary driver of growth for the trust. This trend stopped in 2019 when distributions fell below the prior year’s total. Lower gas prices were the primary cause of lower distributions.

Unfortunately, the negative trends have continued in 2020. The coronavirus has dealt the global economy a severe blow, and by extension commodity prices have declined. This has caused distributions to decline again this year.

Growth Prospects

The biggest growth catalyst for Sabine is rising oil and gas prices. Supportive commodity prices are critical for the trust’s ability to generate higher royalty income, which yield higher distribution payouts. Average price per barrel rose 16% to $56.85 at the end of the first quarter. Oil production declined by 16% to 153,638 barrels in the first quarter.

On the other hand, the price of gas fell 34.3% to $1.97 during this time. This decline in price has been offset slightly by a 5.9% increase in gas production. The $2.4 million decline in royalty income for the first three months of 2020 was due to lower prices for natural gas ($2 million), lower production of oil ($1.4 million) and the absence of tax refunds from Oklahoma and New Mexico ($0.8 million).

These declines were partially offset by the increase in the price of oil ($1.4 million), higher production for natural gas ($0.2 million) and lower taxes ($0.2 million). The results from the first quarter show how much royalty trusts like Sabine benefit from higher commodity prices. That said, they also suffer mightily when commodity prices decline, as occurred during 2014 to 2016 and again in 2020 due to the coronavirus crisis.

Dividend Analysis

Sabine Royalty Trust pays a monthly distribution. The record date each month is usually the 15th day.

Distributions are paid no later than 10 business days after the monthly record date.

Sabine’s dividend fluctuates depending on the direction of oil and gas prices. When times are good, the trust has distributed $3-$4 per unit annually.

However, distributions began to dry up last year as falling commodity prices took their toll. Sabine’s distribution history over the past ten years is as follows:

- 2010 distributions of $3.70449 per unit

- 2011 distributions of $3.96617 per unit

- 2012 distributions of $3.70090 per unit

- 2013 distributions of $3.91645 per unit

- 2014 distributions of $4.09779 per unit

- 2015 distributions of $3.10520 per unit

- 2016 distributions of $1.93403 per unit

- 2017 distributions of $2.22923 per unit

- 2018 distributions of $3.34906 per unit

- 2019 distributions of $3.01979 per unit

Sabine distributed approximately $3.02 per unit to investors in 2019. Based on its recent unit price of $30, this represents a trailing twelve month yield of 10.1%.

However, Sabine cut its dividend by 41.2% to $0.15171 for the May 29th distribution. Sabine then raised its dividend by 2.6% for June distribution before more than doubling it for the upcoming July distribution. Based on distributions for the first seven months of the year, unit holders should receive approximately $2.83 per unit in 2020. This equates to a dividend yield of 9.4%.

If oil prices were ever to get back to $100 per barrel, there could be considerable dividend growth potential. The same goes for an increase in the price of natural gas. Of course, this is a big ‘if’. Rising oil and gas production, particularly by shale drillers in the U.S., coupled with sluggish global demand growth, could keep a lid on oil and gas prices for the foreseeable future.

The opposite scenario could also be true—if oil prices collapsed back to their 2016 low, Sabine’s dividends could continue to fall.

Final Thoughts

Royalty trusts like Sabine are essentially a bet on commodity prices. From an operational standpoint, the fundamentals of the trust look strong. Sabine has high-quality oil and gas properties that have kept the trust going for almost four decades, which was much longer than originally expected.

If oil and gas prices increase, the assets of the trust could potentially be undervalued. And, distributions could grow from 2019 levels, if commodity prices cooperate. That said, investors should carefully review the risks and unique considerations that go along with investing in volatile royalty trusts.