Updated on May 21st, 2020 by Josh Arnold

Business Development Companies – or BDCs, for short – allow investors to generate income with the potential for robust total returns, while minimizing the amount of tax that is paid at the corporate level.

Despite these advantages, business development companies are generally avoided by investors. This may be due to the tax implications of their distributions for their shareholders. But even with the added headache come tax time, BDCs can still be worthwhile for income investors.

Prospect Capital Corporation (PSEC) is one of the more attractive business development companies in the market today.

Prospect actually pays monthly dividends, giving its shareholders a steady and predictable passive income stream which is highly appealing for income investors.

There are currently just 57 monthly dividend stocks. You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Prospect Capital has a tremendously high dividend yield of 15%, which is about eight times that of the average S&P 500 stock. You can see the full list of stocks with 5%+ dividend yields here.

Prospect’s high dividend yield and monthly dividend payments are two of the reasons why the company merits further research.

This article will discuss the investment prospects of Prospect Capital Corporation in detail.

Business Overview

Prospect Capital Corporation is a Business Development Company that was founded in 2004. Prospect Capital is one of the largest business development companies and currently has approximately $6 billion of assets under management.

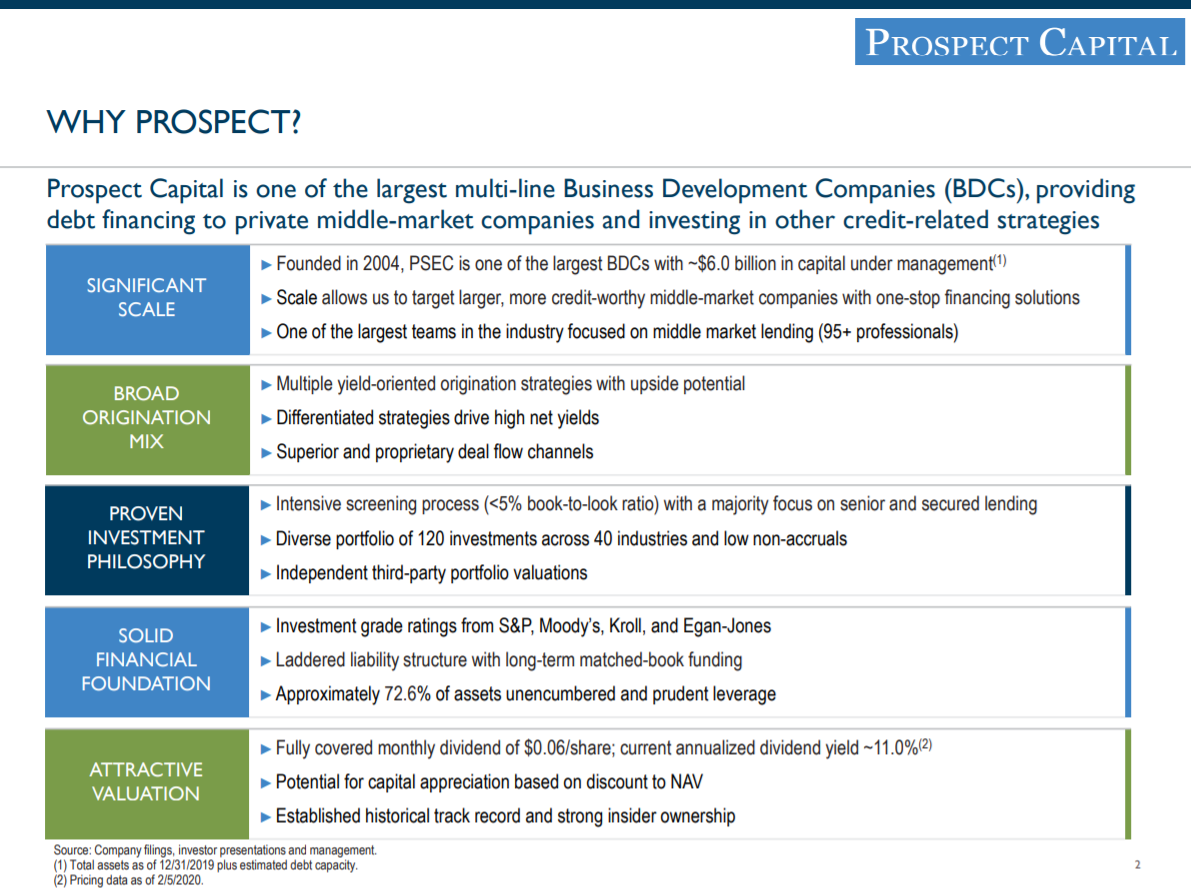

Details about Prospect Capital’s business model can be seen below.

Source: Investor Presentation, slide 2

Prospect Capital is a leading provider of private equity and private debt financing for middle market companies, broadly defined as a company with between 100 and 2,000 employees.

Operating in the middle market is beneficial for Prospect Capital because of the lack of competition from larger, more established lenders. In addition, with a market capitalization of $1.8 billion and total assets near $6 billion, Prospect Capital is one of the larger players in this market.

Middle-market companies are generally too small to be the customers of commercial banks, but too large to be served by the small business representatives of retail banks. The ‘sweet spot’ between these two services is where Prospect Capital does business.

This lack of competition in this sector has allowed Prospect Capital to finance some truly attractive deals.

The company’s current portfolio yield is 10.1%, which is down from 12%+ in recent years. Lower rates across the globe have driven down yields in a variety of asset classes, so this is to be expected. On just those assets that are interest-bearing, the company’s average yield is 12.4%.

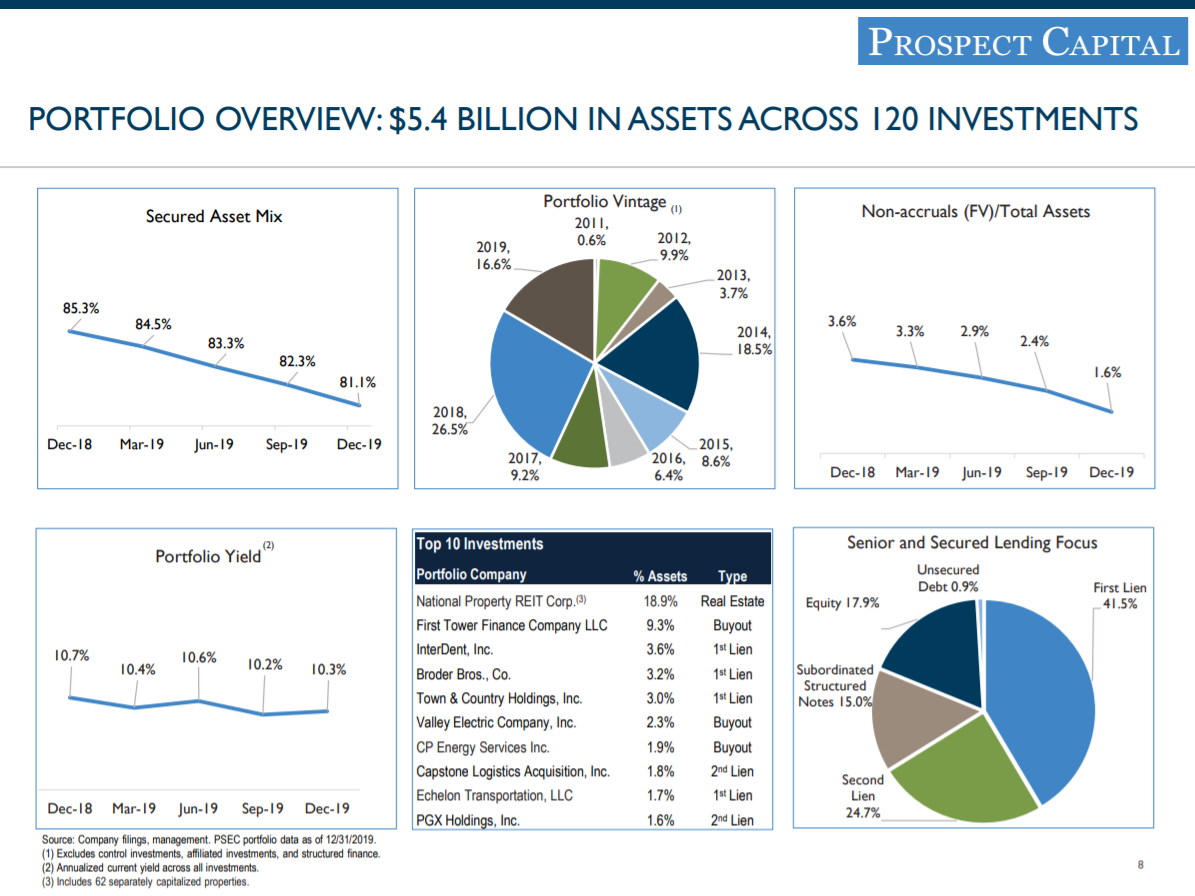

More details about Prospect Capital’s current portfolio holdings can be seen below:

Source: Investor Presentation, slide 8

Investors should note that Prospect Capital is highly exposed to volatile interest rates. This is because the company’s liabilities are nearly all at fixed rates, while its investments are nearly all floating-rate instruments. That means interest expense is largely fixed, while interest income rises and falls commensurately with prevailing interest rates.

As interest rates rise, the revenues from Prospects floating-rate interest-bearing assets will increase. At the same time, Prospect’s interest expense will remain essentially constant since most of its debt is fixed rate. Of course, the opposite is true, as falling rates generally mean declining interest income.

This makes Prospect Capital a great portfolio hedge against interest-sensitive securities like REITs and utilities, but it underperforms in periods like today where rates are very low.

The company has already begun to address this as essentially all of its debt was fixed rate in recent years, so it is slowly progressing towards a portfolio that isn’t quite as sensitive to rates.

Prospect Capital’s flexible origination mix is also a meaningful positive from an investor’s perspective, given that the wide variety of instruments it uses to produce income helps it find the best opportunities.

Source: Investor Presentation, slide 5

The company has nine different ways to make investments with target companies including different types of debt and equity. They all have different risk levels and rates of return, and the largest single source is private equity sponsor finance at 22% of the portfolio. At this time last year, that exposure was 28%, so Prospect has diversified further in the past year or so.

Prospect Capital’s willingness to seek out the best instruments – and having the scale to do so – is a major advantage over other middle market BDCs. The company’s investment strategy is central to its long-term growth.

Growth Prospects

Prospect Capital’s growth prospects stem largely from the company’s ability to:

- Raise new capital via debt or equity offerings

- Invest this new capital in deal originations with an internal rate of return higher than the cost of capital raised in Step 1

The most important part of this process is Prospect’s ability to source new deals that offer appropriate risk-adjusted returns.

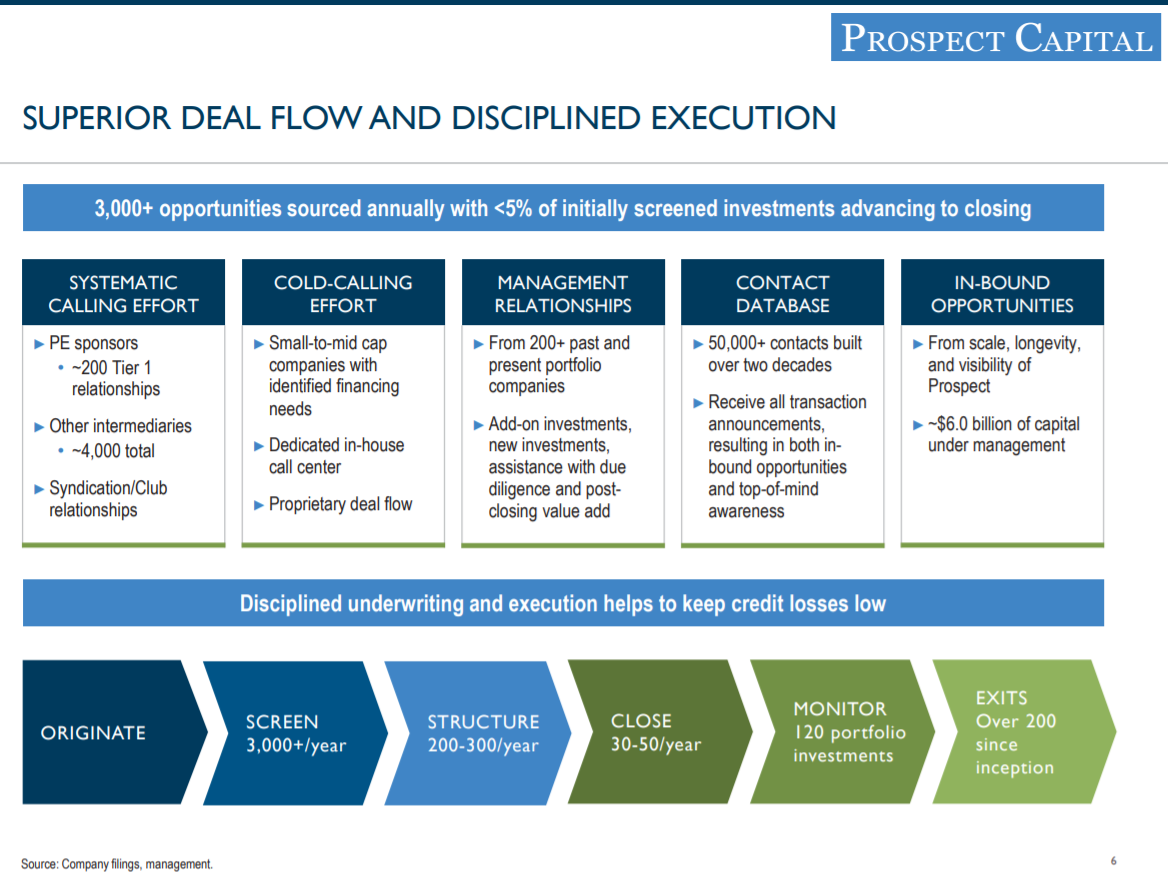

Fortunately for the company (and its investors), there is no shortage of new deals for Prospect’s consideration. The company has thousands of deal opportunities each year, which allows them to be very selective in their investment decision-making. Less than 5% of initially screened investments receive a final investment from Prospect Capital.

More details about the company’s deal flow process can be seen below:

Source: Investor Presentation, slide 6

The company focuses on disciplined underwriting so as not to take undue risk when making new deals. In addition, it is willing to pass when that is the prudent course of action, as well as exit when the time is right.

Prospect has an enormous list of contacts that will provide it no shortage of potential deals in the years to come, and is therefore in an enviable position amongst its competitors.

The company’s robust deal origination will be the driver of its future growth.

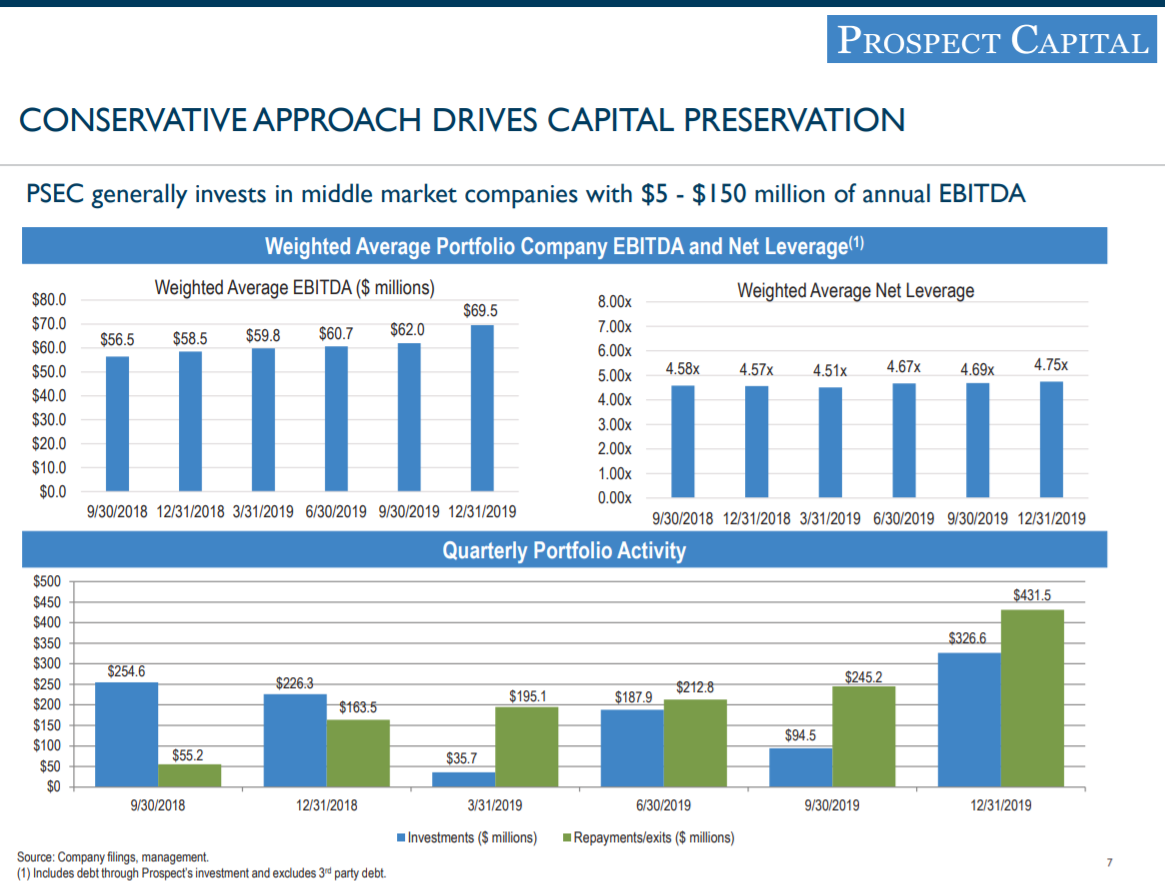

Source: Investor Presentation, slide 7

This slide offers a quick look at the activity the company has undertaken in the past several quarters, and we can see that exits have outpaced investments, particularly since the beginning of 2019.

The company’s investment mix is constantly changing as management follows the underwriting standards discussed above. And, because of the recent shrinking of the portfolio – albeit slightly – Prospect Capital’s cash position has increased.

In the most recent quarter, Prospect reported $136 million of net originations, so it seems the company has begun deploying some of its excess cash. That marks the first quarter since the end of 2018 when originations outpaced repayments.

Dividend Analysis

Prospect Capital’s dividend is the obvious reason why investors would choose to own the stock, so it is critical that the dividend is as safe as possible.

As a BDC, Prospect Capital has no choice but to distribute essentially all of its taxable income to shareholders. Because of this, its payout ratio will always be very high.

For the quarter ended March 31st, Prospect Capital produced $0.19 per share in net investment income, which compares favorably to its distributions of $0.18 per share.

In other words, the dividend is actually covered by net investment income at this point, meaning the payout should be relatively safe, barring a sizable impact from the current economic downturn.

The company has now paid more than 140 consecutive monthly distributions to shareholders, although we’ll caveat that with the cut in the distribution that occurred in September of 2017, with the payout falling from 8.3 cents monthly to the current 6 cents.

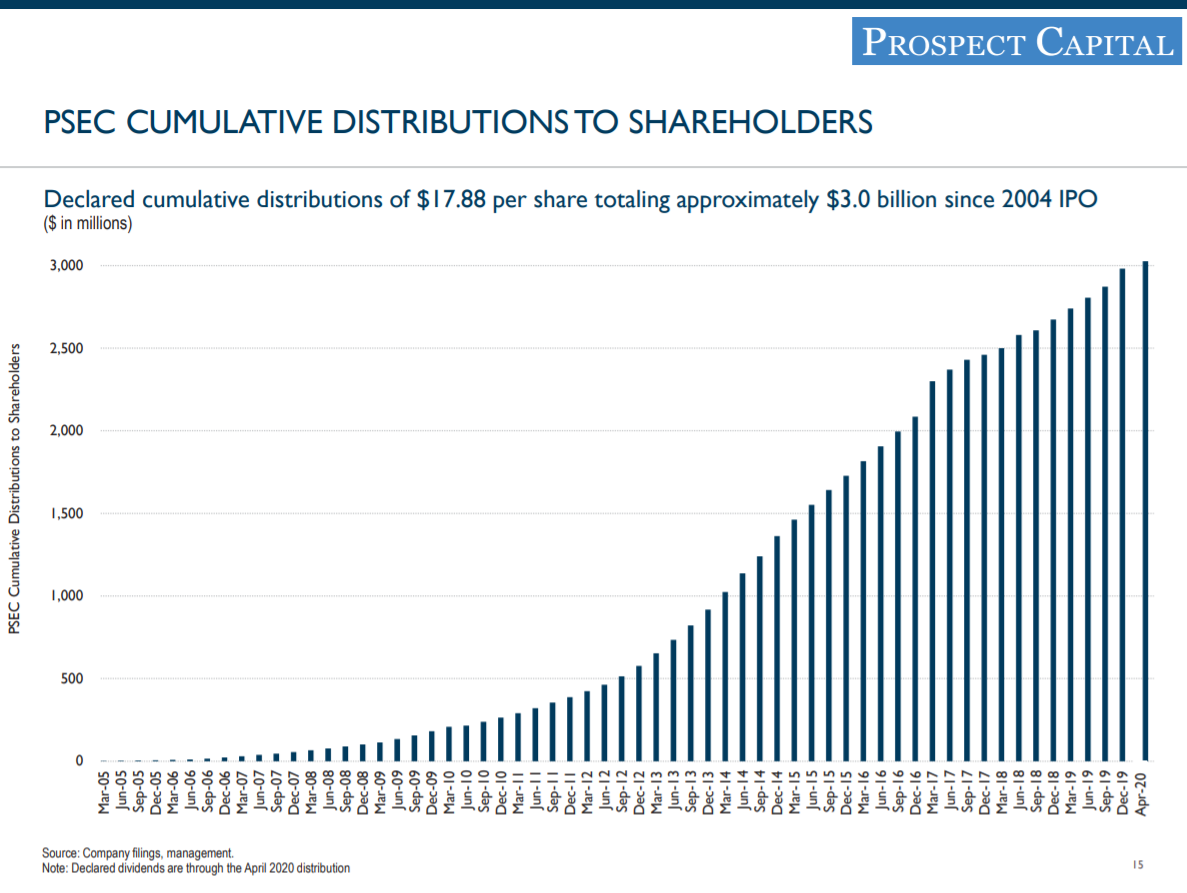

Source: Investor Presentation, slide 15

Even so, Prospect Capital has declared total distributions of $17.88 per share since its IPO, which is nearly four times the current share price of $4.50.

Clearly, the draw for Prospect Capital is in its ability to generate cash to return to shareholders and over time, it has done that well.

The dividend appears safe for now, but investors should continuously monitor the company’s net investment income for any signs of trouble that could potentially lead to further cuts down the road.

Final Thoughts

Prospect Capital’s enormous 16% dividend yield and its monthly distributions are two of the main reasons why an investor might take an interest in this stock.

Taking a closer look reveals that this BDC has a high-caliber leadership team and has positioned itself to thrive in most environments, although historically low interest rates are certainly a negative, at least for the short-term. Net asset value is $7.98 per share so the valuation is reasonable at the current share price, and the stock’s high dividend yield makes it a suitable investment for retirees and other investors seeking to generate current income, assuming one can tolerate the inherent risk.

The dividend appears sustainable for the time being, meaning Prospect is worth a look for those investors seeking high levels of current income that can stomach the risk of owning a BDC. We see the share price as pricing in significant weakness that has yet to accrue, and therefore think the stock is attractively valued.