Published on April 7th, 2022 by Aristofanis Papadatos

Monthly dividend stocks distribute their dividends on a monthly basis, with a smoother income stream to their shareholders. In addition, many of these companies are shareholder-friendly, i.e., they do their best to maximize their distributions to their shareholders.

As a result, many of these stocks are great candidates for the portfolios of income investors.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yields and payout ratios) by clicking on the link below:

In this article, we will analyze the prospects of a high-quality monthly dividend stock, namely Phillips Edison & Company (PECO).

Business Overview

Phillips Edison & Company is an experienced owner and operator that is exclusively focused on grocery-anchored neighborhood shopping centers. It is a Real Estate Investment Trust (REIT) that operates a portfolio of 289 properties, including 268 wholly-owned properties.

Phillips Edison has a 30-year history but it began trading publicly only in the summer of 2021. Its management owns 7% of the company and hence its interests are aligned with those of the shareholders.

Shopping centers are going through a secular decline due to the shift of consumers from brick-and-mortar shopping to online purchases. This shift has accelerated in the last two years due to the coronavirus crisis.

However, Phillips Edison is well protected from this trend. It generates 72% of its rental income from retailers that provide necessity-based goods and services and has minimal exposure to distressed retailers. To be sure, the trust generated less than 1% of its rental income from bankrupt retailers in 2020, which was marked by unprecedented lockdowns.

Moreover, there are nearly 23,000 average total trips per week to each of the shopping centers of Phillips Edison. The strong foot traffic is a testament to the strength of the business model of the REIT while it also enables the trust to increase its rents on a regular basis.

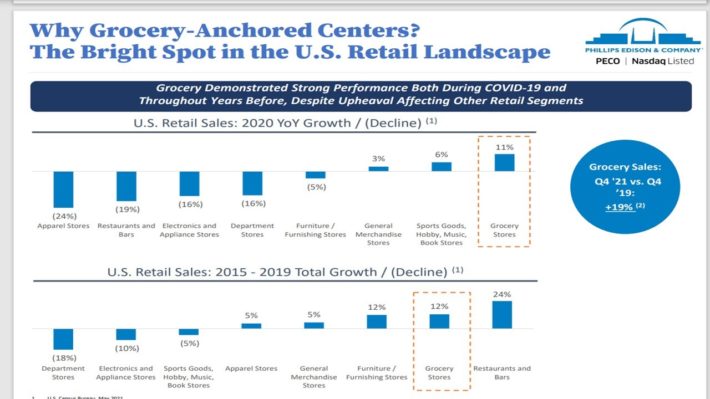

As shown in the chart below, grocery stores proved much more resilient to the pandemic than all the other categories of retail stores.

Source: Investor Presentation

While almost all the categories of retail stores incurred a significant decrease in their sales in 2020, grocery stores grew their sales 11% in that year. The superior growth trajectory of grocery stores was evident even before the pandemic, in 2015-2019.

Phillips Edison currently enjoys positive business momentum. In the fourth quarter of 2021, the trust grew its same-center net operating income by 15.2% over the prior year’s quarter and by 3.9% over the pre-pandemic quarter of 2019. It also grew its funds from operations (FFO) by 7%, though its FFO per unit dipped 5% due to the issuance of new units. The strong performance resulted from material rent hikes; new and renewal rent spreads were 18.3% and 7.8%, respectively.

On the other hand, management provided lackluster guidance for 2022. It expects core FFO per unit of $2.16-$2.24, thus essentially implying flat performance vs. last year, when the trust posted core FFO per unit of $2.19. Nevertheless, given the strong recovery from the pandemic in 2021, it is somewhat reasonable to expect the business momentum to take a temporary breather.

Growth Prospects

As Phillips Edison became public only last year, it has a very short performance record and hence it is somewhat challenging to forecast its future growth with any degree of precision. On the other hand, the REIT has several growth drivers in place.

Source: Investor Presentation

Phillips Edison pursues growth by raising its rents on a regular basis. Rent hikes are included in its leases while the trust raises its rents at a faster pace when it leases a property to a new tenant. It also pursues growth by redeveloping its properties when the returns are attractive.

Notably, Phillips Edison performed 280 acquisitions of properties for a total amount of $4.7 billion during 2012-2018. As this amount exceeds the current market capitalization of $4.5 billion of the stock, it is evident that the REIT has been investing heavily in its future growth. Moreover, management has identified more than 5,800 shopping centers across the country that meet its acquisition criteria.

As Phillips Edison currently has only 289 properties, it obviously has immense growth potential, though it will have to issue plenty of new units to fund its acquisitions. It is also worth noting that Phillips Edison has been ranked as the largest acquirer of neighborhood centers among its peers during 2018-2020.

Overall, Phillips Edison has several growth drivers in place and ample room for future growth but it is prudent to keep somewhat conservative expectations due to the short performance record of the trust.

Competitive Advantages & Recession Performance

The competitive advantage of Phillips Edison lies in its focus on retailers that provide necessity-based goods and services. This focus renders the REIT more resilient to the secular decline of shopping centers than other retail-focused REITs. It also renders the REIT more resilient to recessions than most of its peers.

On the other hand, Phillips Edison performed its IPO less than a year ago and hence it has not been tested during a recession. Therefore, its defensive business model has yet to be tested.

Dividend Analysis

Phillips Edison pays its dividends on a monthly basis and currently offers a 3.1% dividend yield. In addition, the trust has a payout ratio of 50% and an investment grade balance sheet, with a BBB- credit rating from S&P and a Baa3 rating from Moody’s. Moreover, it has well-laddered debt maturities and no material debt maturities for the next two years. Furthermore, 98.7% of its total debt has a fixed rate, which is paramount in the current environment of rising interest rates. Overall, the dividend of Phillips Edison should be considered safe for the foreseeable future.

As a side note, while Phillips Edison has an investment grade balance sheet, its leverage ratio (Net Debt to EBITDA) currently stands at 5.6. This is above the upper limit of our comfort zone (5.0) and reveals the eagerness of management to invest in the aggressive expansion of the trust. Nevertheless, we believe that a lower leverage ratio is necessary in order to render the REIT more resilient to unexpected downturns.

Moreover, the 3.1% dividend yield of Phillips Edison is somewhat lower than the median dividend yield of the REIT sector (3.5%). However, the 50% payout ratio of the stock is lower than the median payout ratio of the REIT sector (60%). This means that Phillips Edison prefers to retain a greater portion of its earnings in order to invest more aggressively in its expansion. Overall, the dividend proposition of Phillips Edison is in line with the average stock of the REIT sector.

Final Thoughts

Monthly dividend stocks are attractive because they enhance the positive effect of compounding. On the other hand, some of these stocks are highly speculative, with high payout ratios and vulnerability to recessions. Therefore, investors should perform their due diligence carefully before investing in this group of stocks.

Phillips Edison seems much better than a typical monthly dividend stock, as it has a healthy payout ratio and a fairly resilient business model. Nevertheless, due to the uncertainty that results from its short history and its somewhat leveraged balance sheet, we recommend waiting for an approximate 10% correction of the stock before purchasing it.