Updated on February 26th, 2020 by Bob Ciura

The demographics of the United States are undergoing a seismic shift as the Baby Boomers age. The Baby Boomers are a very large generational group, meaning the aging U.S. population is expected to result in higher demand for healthcare.

Many investors have expressed concern about how this will effect the economy. While some areas of the economy may feel pressure from this trend, one sector is almost certain to grow as a result: healthcare spending, and healthcare Real Estate Investment Trusts.

LTC Properties (LTC) is poised to take advantage of this trend. As a premier owner-operator of healthcare properties, LTC is seeing the demand for its properties increase materially.

We believe LTC is an attractive investment for income investors. The stock has a high dividend yield of 4.6%, and pays these dividends monthly. There are currently fewer than 60 monthly dividend stocks, which you can access below:

While LTC Properties is poised to benefit from the aging population, that does not guarantee that the stock will be a strong performer moving forward; fundamental analysis is still required.

This article will analyze the investment prospects of LTC Properties in detail.

Business Overview

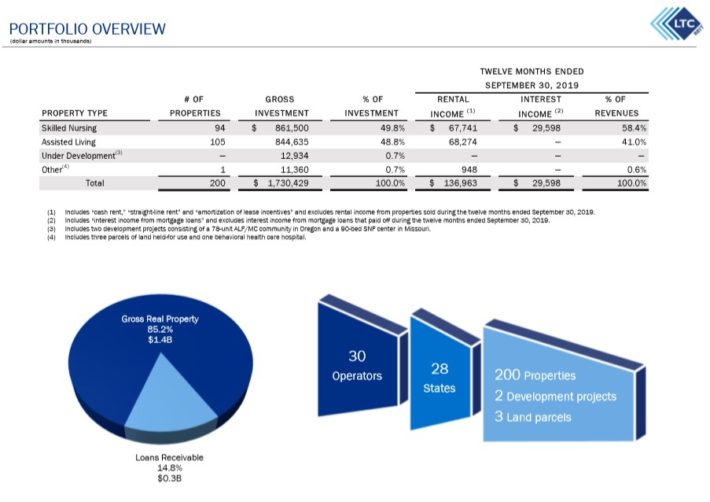

LTC Properties is a healthcare REIT that owns and operates skilled nursing facilities, assisted living facilities, and other healthcare properties. Its portfolio consists of approximately 50% senior housing and 50% skilled nursing properties. The REIT owns more than 200 investments in 28 states with 30 operating partners and has a market capitalization of $2 billion.

LTC is much smaller than other healthcare REITs like Omega Healthcare Investors (OHI), Healthpeak Properties (PEAK), or Welltower (WELL). But just like the other healthcare REITs, LTC benefits from a strong secular trend, namely the high growth of the population that is above 80 years old. This growth results from the aging of the baby boomers’ generation and the steady rise of life expectancy thanks to sustained progress in medical sciences.

More details about LTC Properties’ portfolio can be seen below.

Source: Investor Presentation

Further, the vast majority of LTC’s portfolio is in real properties, while about 15% of it is in loans receivable. LTC has actually slightly shrunk its total portfolio in recent years as it has acquired and divested properties at roughly equivalent rates.

Management has been careful not to overextend itself with new development, which has kept a lid on growth rates.LTC is currently facing a strong headwind, the bankruptcy of Senior Care Centers, which is the largest skilled nursing operator in Texas. Senior Care filed for Chapter 11 bankruptcy in December.

Until last year, it was generating nearly 10% of LTC’s annual revenue and was its fifth-largest customer. LTC is currently trying to assign those properties to another Texas operator under similar terms, but this issue could impact the company’s future growth potential.

LTC reported 1% FFO growth in 2019. On a per-share basis, FFO rose 0.7% to $3.08 for the year. Rental revenue increased 6% in 2019, but partnership income declined 17%. Fortunately, rental revenue constitutes the vast majority of the company’s revenue. As a result, total revenue increased 10% in 2019, to $190 million.

Growth Prospects

As mentioned, LTC Properties will benefit from the secular tailwind of the aging population in the United States. As the Baby Boomers age, the demand for skilled nursing and assisted living properties will increase materially. This benefits LTC Properties in two main ways.

First, more demand for its properties means that LTC can purchase more properties and expand its asset base. If this can be done conservatively – without diluting the REIT’s unitholders – this will boost the trust’s per-share funds from operations.

Recent years haven’t seen the portfolio grow, but that is an option for LTC, particularly given its conservative financing position.

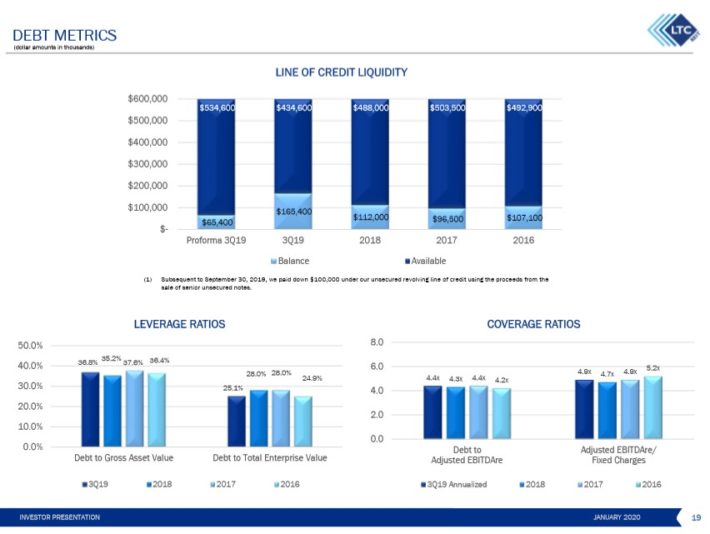

Source: Investor Presentation

The trust has $600 million available liquidity, but had used just over $65 million of it as of the 2019 third quarter. That not only means the trust has the financial capacity to expand as it pleases, but it also means its leverage and coverage ratios are outstanding. The trust has only 37% of its gross assets encumbered by debt. Furthermore, its interest coverage ratios are quite strong for a REIT as well, a sector that tends to operate on the higher end of the leverage spectrum.

Secondly, LTC Properties will have a tangential benefit since its tenants (healthcare operators) will be experiencing a higher demand for their services. Since their services are in high demand, this reduces the probability of default on their leases and also reduces the tenant vacancy of LTC Properties.

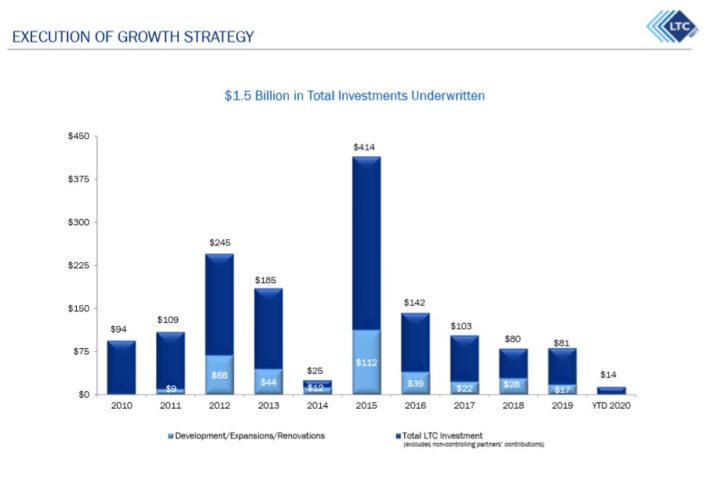

This REIT has been investing heavily to take advantage of this trend. Since 2010, LTC has put $1.5 billion to work in new real estate investments.

Source: Investor Presentation

For context, LTC currently has a market capitalization of $2 billion – so this $1.5 billion of capital deployed over the past eight years is significant relative to the size of the company.

LTC’s investment rate is lumpy by nature, with some years seeing an enormous amount of investment, but others seeing almost none. As the domestic population continues to age, LTC’s past investments should continue to pay dividends for years to come.

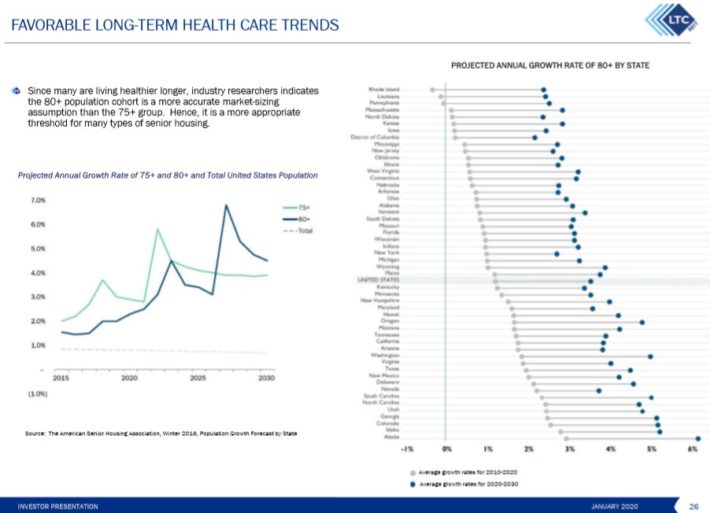

Source: Investor Presentation

This slide shows the immense amount of growth LTC’s target population will experience in the coming years.

The annual growth rate of the 75+ population will be roughly four times that of the general population, providing a strong, long-term tailwind for those that operate facilities to serve that segment of the population. Indeed, this is a well-publicized, but very valuable tailwind for LTC.

Thanks to the aforementioned favorable underlying fundamentals of the healthcare sector, LTC has grown its funds from operations at a 5.5% average annual rate in the last decade. Moreover, the REIT has most of its assets in the states with the highest projected increases in the 80+ population cohort over the next decade. On the other hand, growth has stalled in the last two years, partly due to the bankruptcy of Senior Care.

We also prefer to be somewhat cautious in our future estimates as a large number of leases, which generates 12% of total revenues, mature by the end of next year. We assume 3.0% growth in funds from operations per unit over the next five years.

Competitive Advantages & Recession Resiliency

LTC Properties has a cost-based competitive advantage from being a triple net REIT. This means that LTC’s tenants occupying the properties under triple net leases, implying that the tenants must absorb the three main costs associated with occupying real estate:

- Insurance expense

- Property tax expense

- Maintenance expense

By operating as a triple net REIT, LTC Properties has reduced its operator risk to essentially zero – which should be seen as a huge plus for LTC’s investors.

In addition, LTC Properties has a competitive advantage that comes from being both an owner and a developer of healthcare real estate. The company has a side business of real estate development that generates sizable profits. With that said, the development business is small in comparison to the ownership business.

The trust’s geographic diversification is outstanding, as its properties are spread across 29 states. This helps diversify the trust’s risk against shocks in local economies, and gives the trust a foothold in a wide variety of markets it can use for future expansion.

As a healthcare REIT, LTC Properties would be expected to perform well (compared to non-healthcare REITs) during an economic downturn. This is because healthcare is a necessity – consumers are highly unlike to cut spending on skilled nursing or assisted living when their disposable income becomes tight.

To this end, just over half of LTC’s revenue is paid by private payers, with the rest coming from a government source. This should help it hold up well during a recession from a receivables perspective and most of its revenue should be protected.

Valuation & Expected Total Returns

Total returns for the shareholders of LTC Properties will be composed of valuation changes, dividend yield, and growth in the company’s earnings power as measured by funds from operations (FFO) per unit. The trust’s FFO in 2019 was up slightly from the previous year, totaling $3.08 per share. Indeed, LTC has had a difficult time growing in recent years.

As a REIT, LTC Properties cannot be meaningfully analyzed using the price-to-earnings ratio. REITs are owners and operators of long-lived real estate assets and are continuously accounting for large depreciation and amortization charges. These accounting charges reduce GAAP earnings and artificially increase the price-to-earnings ratio. As a result, we analyze REITs through the lens of FFO.

The company has a trailing P/FFO ratio of 16.1. In the past 10 years, the stock traded for an average P/FFO ratio of 14.8; this represents our fair value estimate for LTC. As a result, corresponding contraction of the valuation multiple could reduce annual returns by 1.7% per year over the next five years.

Fortunately, this will be offset by FFO-per-share growth and dividends. We expect 3% annual FFO-per-share growth over the next five years, and the stock has a high current yield of 4.6%. Combined, we expect total annual returns of 5.9% through 2025.

The trust’s growth rate is likely to be fairly low in the coming years barring a shift in its investment strategy that expands its portfolio again. We believe investors can expect LTC Properties to boost its funds from operations per share at a low-single digit rate per year (on average) over full economic cycles.

Overall, we expect modest (albeit satisfactory) total returns for LTC over the next five years. Expected returns could be higher if investors wait for a lower share price before buying. Shares of LTC are currently trading just a few dollars from its 10-year high.

Final Thoughts

LTC has many of the characteristics of a solid dividend investment. The company has a strong 4.6% dividend yield (more than twice the average dividend yield of the S&P 500) and is very shareholder-friendly, paying these dividends monthly.

The trust will also benefit immensely from the secular trend of aging domestic populations. That said, FFO growth has been hard to come by in recent years, and the stock has enjoyed a meaningful rally over the past several years, which has elevated the valuation multiple.

With all this in mind, LTC Properties looks to be attractive for income investors looking for exposure to the healthcare REIT space, although the dividend will likely represent the vast majority of total returns.