Updated on June 19th, 2020 by Nathan Parsh

The energy industry is well-known for housing exceptional dividend stocks. However, when we think of dividend energy stocks, the heavyweights like Exxon Mobil (XOM) and Chevron (CVX) typically come to mind.

Smaller energy companies can be a surprisingly good source of dividend income as well. Inter Pipeline (IPPLF) (IPL.TO) is one example of this. Inter Pipeline has a high dividend yield of more than 6% even after a recent dividend cut.

And, Inter Pipeline still pays its dividend monthly, making it ideal for retirees or other investors who need to budget their dividend payments.

Although monthly dividend payments are superior for many investors, they are quite rare. There are currently just 56 monthly dividend stocks, which you can access (along with relevant metrics like dividend yields and payout ratios) by clicking on the link below:

Despite the recent dividend cut, Inter Pipeline’s high dividend yield and monthly dividend payments are two big reasons why the company may appeal to to dividend growth investors with a larger appetite for risk.

Business Overview

Inter Pipeline is an energy infrastructure corporation that is engaged in the transportation, storage, and processing of energy products in Western Canada and Europe.

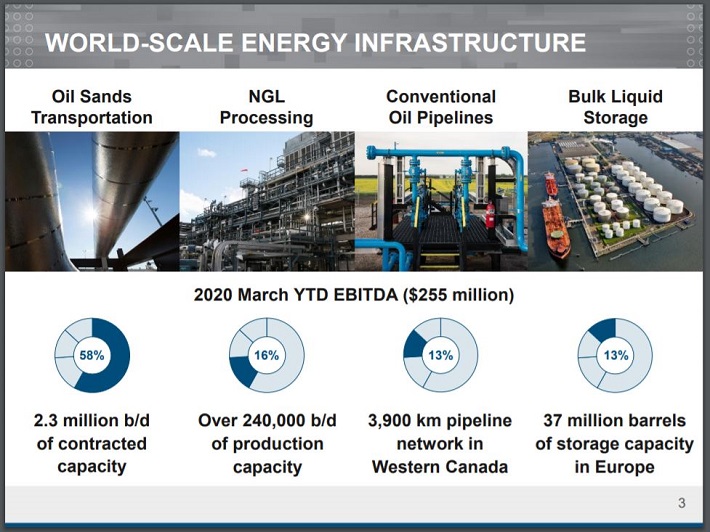

Inter Pipeline is headquartered in Calgary, Alberta, Canada and has a market capitalization of approximately $4 billion. The company is divided into four distinct segments for reporting purposes:

- Oil Sands Transportation (48% of EBITDA)

- NGL Processing (34% of EBITDA)

- Conventional Oil Pipelines (13% of EBITDA)

- Bulk Liquid Storage (5% of EBITDA)

More details about each of Inter Pipeline’s operating segments can be seen below.

Source: Inter Pipeline June 2020 Investor Presentation, slide 3

As mentioned, Inter Pipeline operates in two geographies: Western Canada and Europe. In Canada, Inter Pipeline owns assets in two provinces: Alberta and western Saskatchewan.

In Europe, Inter Pipeline’s operations can be found in Ireland, England, Netherlands, Germany, Denmark, and Sweden. The vast majority (95% of EBITDA) of Inter Pipeline’s business is in its home country of Canada, where much of the company’s growth will come from in future years.

Growth Prospects

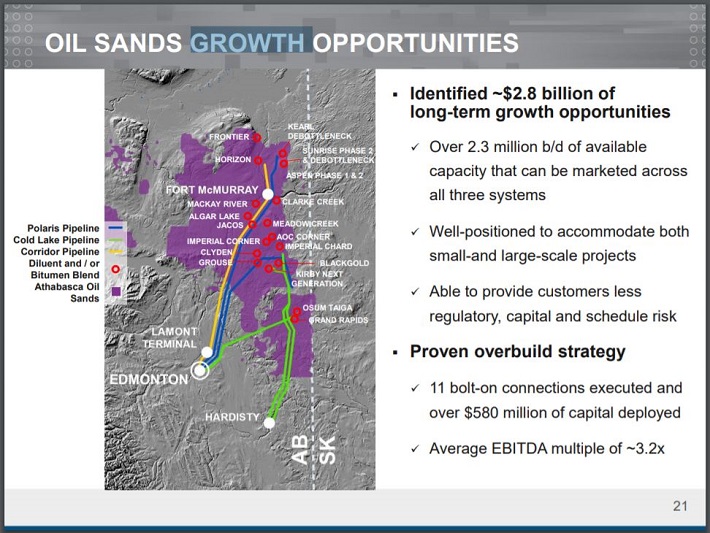

Inter Pipeline’s long-term strategy is to acquire and develop high-quality assets that generate stable and predictable cash flow, while delivering strong returns to shareholders. Inter Pipeline’s growth profile can be seen in the below image:

Source: Inter Pipeline June 2020 Investor Presentation, slide 21

However, Inter Pipeline has struggled recently as energy prices have fallen. Funds from operations (FFO) had climbed steadily between 2010 and 2018, but fell significantly last year. As such, the company has seen FFO increase just 2.2% annually over the last decade, but FFO declined 1.6% since 2015.

For context, FFO per share grew by 8.3% from 2009 through 2018 and 9.7% from 2014 through 2018. This shows how vulnerable Inter Pipeline is to the rise and fall of energy prices.

There is one area that could help Inter Pipeline see an improvement in its business. Inter Pipeline is currently developing Canada’s first integrated propane dehydrogenation (PDH) and polypropylene (PP) complex, which will add a fifth segment to the business.

Polypropylene is a high-value and easy to transport plastic used in manufacturing a wide range of finished products, including consumer packaging, automobile parts, medical equipment, currency and textiles.

The project is scheduled to begin producing polypropylene in late 2021; from there Inter Pipeline expects to earn approximately $450 to $500 million per year in long-term average annual EBITDA. EBITDA of $450 to $500 million would represent 43% to 48% of Inter Pipeline’s 2019 total EBITDA.

The Heartland Petrochemical Complex will have the capacity to consume ~22,000 b/d of propane to produce ~525 kilotonnes per annum (KTA) of PP. The Alberta-produced PP is expected to have one of the lowest cash costs in North America due to the oversupplied propane market in Western Canada.

The majority of PP production is expected to be sold into the US market, where it is expected to have the highest price in the world. Demand for PP is expected to grow 22% over the next five years, from ~74,000 KTA to over 90,000 KTA in 2023.

Inter Pipeline has invested ~$2.5 billion as of the first quarter of 2020, with an additional cost estimated to be $1.5 billion through 2022. Financing for the project comes from a variety of sources, including an existing committed credit facility of $2.5 billion, periodic issuance of new term debt, hybrid debt securities and undistributed cash flow from operations.

Competitive Advantages & Recession Performance

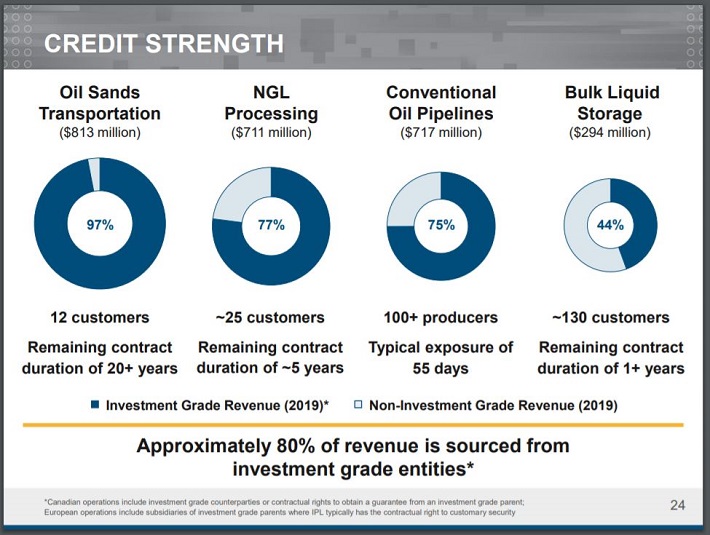

Inter Pipeline’s main competitive advantage comes from the strength of its business model. The company typically buys assets and sells their use to credit-worthy counter-party under long-term, inflation-adjusted, commodity-insulated contracts.

Most of Inter Pipeline’s contracts are with highly creditworthy counter-parties, with more than 80% of the company’s revenues being derived from investment-grade counter-parties.

Source: Inter Pipeline June 2020 Investor Presentation, slide 24

We would expect Inter Pipeline to perform decently well during a recession because of its low-risk business model, particularly relative to the broader energy sector.

Inter Pipeline’s FFO/share declined by about ~50% during the last recession, although much of this was a retracement after a significant run-up starting in 2007. The company recovered its previous level of profitability shortly thereafter.

Valuation & Expected Total Returns

Inter Pipeline’s future shareholder returns will be composed of valuation changes, dividend yield, and growth in FFO/share.

Inter Pipeline owns and operates long-lived energy assets like pipelines and storage tanks. Accordingly, this company incurs significant non-cash depreciation and amortization charges which impair our ability to analyze its valuation using the traditional price-to-earnings ratio.

One straightforward alternative is to compare the company’s current dividend yield to its long-term historical average dividend yield. Inter Pipeline currently pays a monthly dividend of $0.04 in Canadian currency, which works out to approximately $0.29 per share in U.S. dollars. This is a decline from the company’s previous year, where the monthly dividend was ~$0.10.

Note: As a Canadian stock, a 15% dividend tax will be imposed on US investors investing in the company outside of a retirement account. See our guide on Canadian taxes for US investors here.

Including dividends received prior to May, Inter Pipeline is now expected have a dividend payout of $0.79, or $0.56 for U.S. shareholders, for 2020. Shares currently yield 6.1%, slightly above its 10-year average yield of 5.9%. The company is likely trading at just about fair value (relative to historical norms) when comparing the current dividend to the historical average.

As with any high yield dividend stock, investors should take a moment to assess the safety of Inter Pipeline’s dividend before purchasing this security. Inter Pipeline’s dividend payments were more than covered by its FFO between 2010 and 2019.

By reducing its dividend, Inter Pipeline has vastly improved its payout ratio. The company is expected to produce FFO of $1.28 per share for 2020, which equates to a payout ratio of just 44% for the year. If achieved, this would be Inter Pipeline’s lowest payout ratio in more than a decade.

All said, Inter Pipeline’s dividend appears safe right now and for the foreseeable future following the dividend cut. The remainder of the company’s shareholder returns will be composed of FFO growth. We have lowered our expectations for growth to 3% due to the declines in energy prices.

Thus, Inter Pipeline’s total returns will be composed of:

- 6.1% dividend yield

- 3% FFO growth

We expect that Inter Pipeline will offer a total return just above 9% per year over full economic cycles. This is a satisfactory expected rate of return, albeit with an elevated level of risk which investors should note.

Final Thoughts

Inter Pipeline has a number of characteristics that help it stand out to dividend investors, including a 6.1% dividend yield and monthly dividend payments.

Further due diligence reveals that this company appears to have some growth prospects working in its favor, but faces headwinds from the decline in energy prices.

While we cannot say we are particularly fond of its shareholder dilution, it is a growth strategy that has worked well (so far) for the company. With the investments in the petrochemical complex, Inter Pipeline’s fifth business segment should add significantly to EBITDA.

That said, Inter Pipeline trades below our usual threshold to earn a buy recommendation from Sure Dividend. Add in a recent dividend cut and we feel that the company’s dividend could always be susceptible for another cut if FFO were to decline in a meaningful way.

Therefore, while higher risk investors may find the stock attractive, we rate shares as a hold for the majority of investors.