Updated on May 26th, 2020 by Nate Parsh

Horizon Technology Finance (HRZN) has a current dividend yield of more than 11%. That makes it one of 200 stocks with at least a 5% dividend yield. You can see the entire list of 5%+ yielding stocks here.

Horizon’s eye-popping dividend yield makes it extremely attractive at first glance. The S&P 500 Index, on average, offers just a ~2% dividend yield.

Not only does it have a very high dividend yield, but it also makes its payments each month. Horizon is one of only 57 monthly dividend stocks.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Horizon’s yield is very near the top of the list of monthly dividend stocks, a group that includes many other high-yield securities like REITs and other BDCs.

This article will discuss Horizon’s business model and whether it is an appealing stock for income investors.

Business Overview

Horizon is a Business Development Company, or BDC. These are companies that make investments in privately-held companies.

Horizon makes its returns via investments in companies through directly originated senior secured loans and, to a smaller extent, capital appreciation potential through warrants.

It provides debt financing to early-stage companies across three industry groups:

- Life Science

- Technology

- Healthcare Information & Services

Life science companies primarily include biotechnology, medical devices, and specialty pharmaceuticals.

Technology investments are typically made in cloud computing, wireless communications, cyber security, data analytics and storage, internet, software, and more. Healthcare information includes diagnostics, medical records, and patient management software providers.

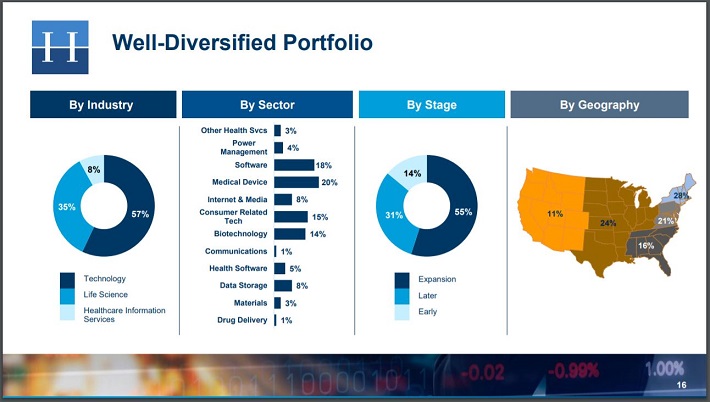

A breakdown of Horizon’s portfolio by industry and geography is as follows:

Source: Investor Presentation, slide 16.

The portfolio is heavily weighted in the technology group, but even within that group, industries are highly diversified.

In addition, the company has a favorable mix of stable and growing companies, respectively, in its portfolio, to provide a mix of growth and safety in its lending.

Horizon views prospective investments through a long-term lens. It invests in companies that have growth potential, strong management teams, superior technology, and/or valuable intellectual property.

As of the end of March, Horizon had a net asset value of $11.48 per share. The share price currently trades at a slight discount to net asset value.

Horizon has a sound investment philosophy. It also has a high-quality loan portfolio, that should provide the company with growth going forward.

Growth Prospects

In the first quarter of 2019, Horizon reported net investment income of $4.3 million, or $0.26 per share. This was a 7% decrease from the previous year.

Horizon’s dollar-weighted annualized yield on average debt investments for the year was 13.2%, down from 14.4%

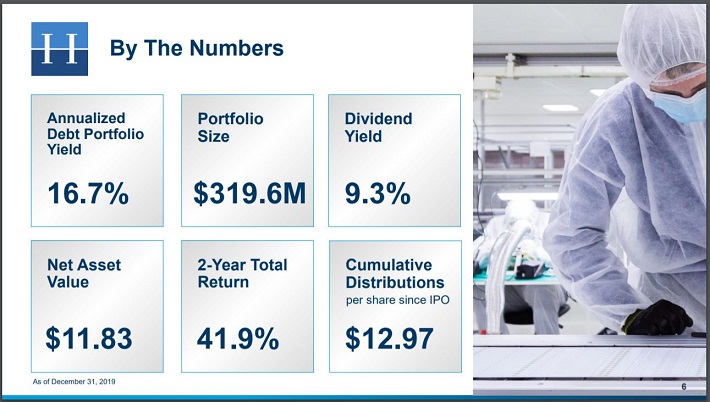

Additional details about Horizon’s portfolio can be seen below.

Source: Investor Presentation, slide 6.

The company’s portfolio size is nearly $320 million dollars compared to its market capitalization of just over half that amount.

It also has a very strong history of returning capital to shareholders, as it is required to do under laws governing BDCs. Shareholders have received nearly $13 in distributions since the IPO, which is above the current share price.

And with a yield of 11.5% today, capital returns look to be a sizable source of total returns in the coming years.

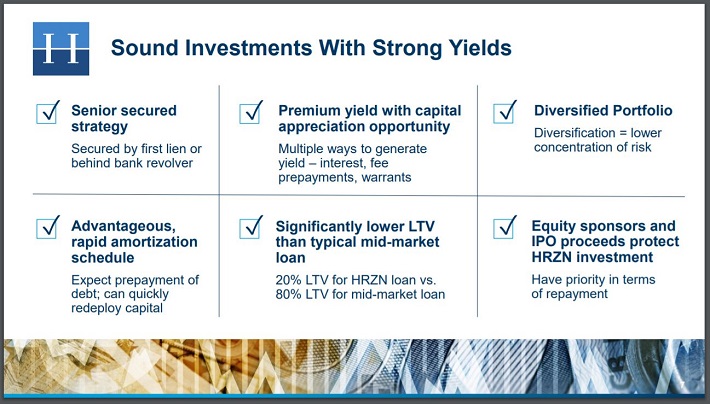

Source: Investor Presentation, slide 7.

Loan growth appears to be the main growth catalyst for the future, and the company’s investment philosophy – pictured above – should help it continue to drive profitable growth.

The company’s loan is lower risk than a typically middle market loan and its loans are senior secured loans that have repayment priority.

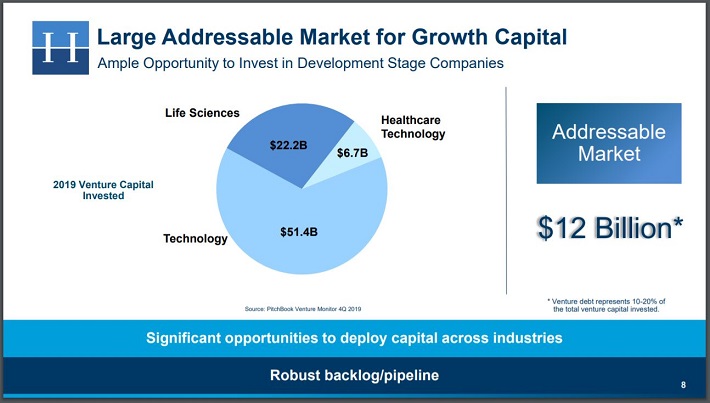

In addition, Horizon has ~$52 million in available liquidity, so it has plenty of capital at the ready for future growth opportunities. Horizon also has a growing and enormous addressable market.

Source: Investor Presentation, slide 8.

Horizon sees a $12 billion addressable market against its current portfolio of $320 million. This should provide a wealth of opportunities for Horizon, and it can therefore select the best opportunities in the coming years.

Dividend Analysis

Horizon cut its dividend from 11.5 cents monthly to 10 cents monthly, or $1.20 per share annually, late in 2016. It continues to declare a monthly dividend of 10 cents for 2020.

The annualized dividend payout of $1.20 represents a yield of 11.5%, based on Horizon’s current price. This demonstrates why BDCs are a popular investment for income investors, and particularly one that has a yield as high as Horizon.

However, sky-high dividend payouts can be reduced if the issuing company encounters financial difficulty. That said, Horizon still offers a double-digit yield, which could be very appealing for income investors.

Net investment income for 2019 was $1.52, which equates to a payout ratio of 79%. This is an improvement from 2018, where NII was $1.20, the same as the dividend, and 2017, where the payout ratio was 112%. Horizon didn’t cut its dividend in either year, so the current payout ratio makes the dividend appear secure.

If investment income declines in the future, the dividend would be in danger of a reduction. On the other hand, if the U.S. economy avoids a recession, and Horizon continues to see success from its investing strategies, the dividend could be maintained.

In an optimal scenario, Horizon could continue to pay its distribution of $1.20 annually for the foreseeable future.

However, any BDC has increased risk of cutting its distribution given that it is required to distribute essentially all of its income. Should Horizon’s financial results deteriorate, a dividend cut is certainly possible, as occurred in 2016.

Final Thoughts

Double-digit dividend yields are often a sign of elevated risk. In this case, there is considerable risk that Horizon’s dividend could be reduced in the future if its investment income deteriorates, which could occur in a deep recession.

However, the outlook for Horizon is generally positive. It invests in technology and healthcare, two stable industries with growth potential. The company’s underwriting principles offer high yields and generally safe lending condition, which support net investment income and therefore, the dividend.

Horizon could be an attractive stock for income investors thanks to its 10% dividend yield, with the acknowledgement that the dividend could be at risk in a business downturn.