Updated on June 18th, 2020 by Josh Arnold

International REITs could be a valuable option for investors interested in diversifying their portfolios. There are many international Real Estate Investment Trusts based outside the U.S. with quality business models and high dividend yields.

One example is Granite Real Estate Investment Trust (GRP.U) (GRT-UN.TO), a REIT based in Canada. Not only does Granite have a proven business model, but it also pays a robust 4.3% dividend yield, which is about twice the level of the S&P 500.

Granite also pays its dividend monthly; a more attractive dividend schedule than REITs which pay dividends quarterly.

Granite is one of only 56 stocks that pays monthly dividends. You can access the full database of monthly dividend stocks (along with important financial metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

Granite is listed in both Toronto and New York, and for this article, we’ll be using the New York listing and US dollars.

This article will outline Granite’s business model, and discuss its merits as a dividend stock.

Business Overview

Granite owns and manages predominantly industrial real estate properties in North America and Europe. It converted to a REIT on January 3, 2013, and has transformed itself into a leaner, more efficient trust, with higher-quality assets.

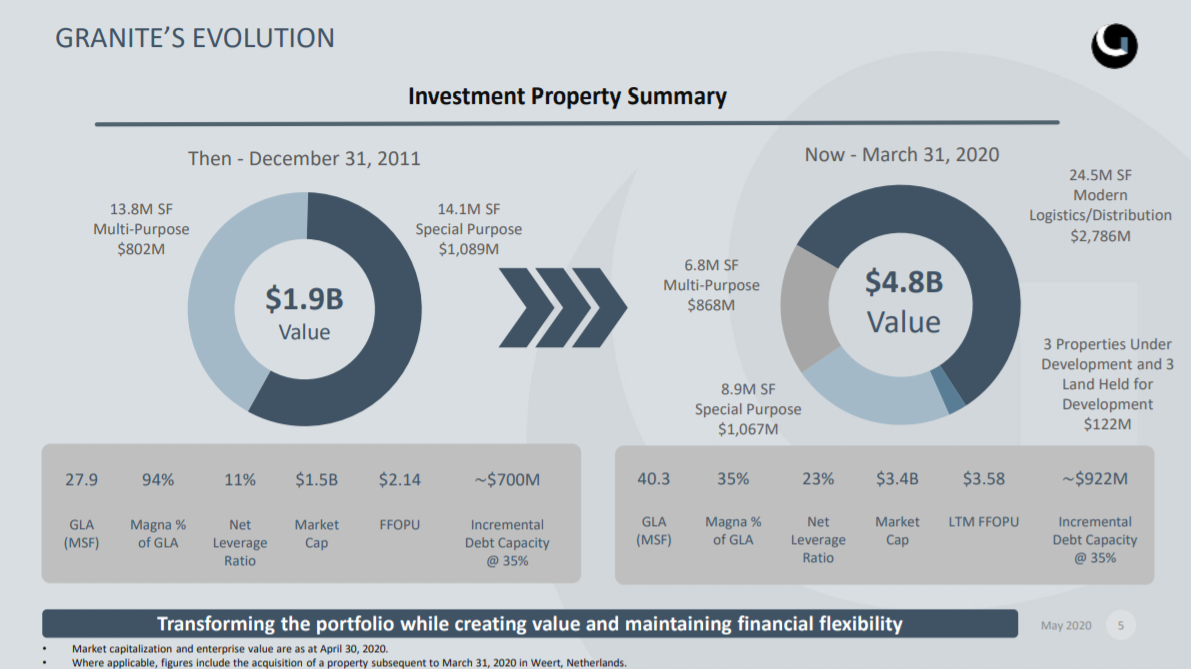

Source: Investor presentation, page 5

Over time, Granite has grown from a smaller, less valuable portfolio that was almost entirely dependent upon one tenant (Magna), to a diversified, much larger portfolio with significantly higher average property values. The trust has undergone a transformation in recent years to reach these goals, and it is clear that effort has paid off.

Magna is now 35% of the portfolio, and the portfolio as a whole is meaningfully more diversified between tenants and property types.

The trust’s income-producing portfolio consist of Multi-Purpose, Logistics and Distribution Warehouses, and Special-Purpose facilities. It owns a total of 40 million square feet spread across 93 properties in Europe, Canada, and the U.S. Combined, these properties have a carrying value of nearly $5 billion.

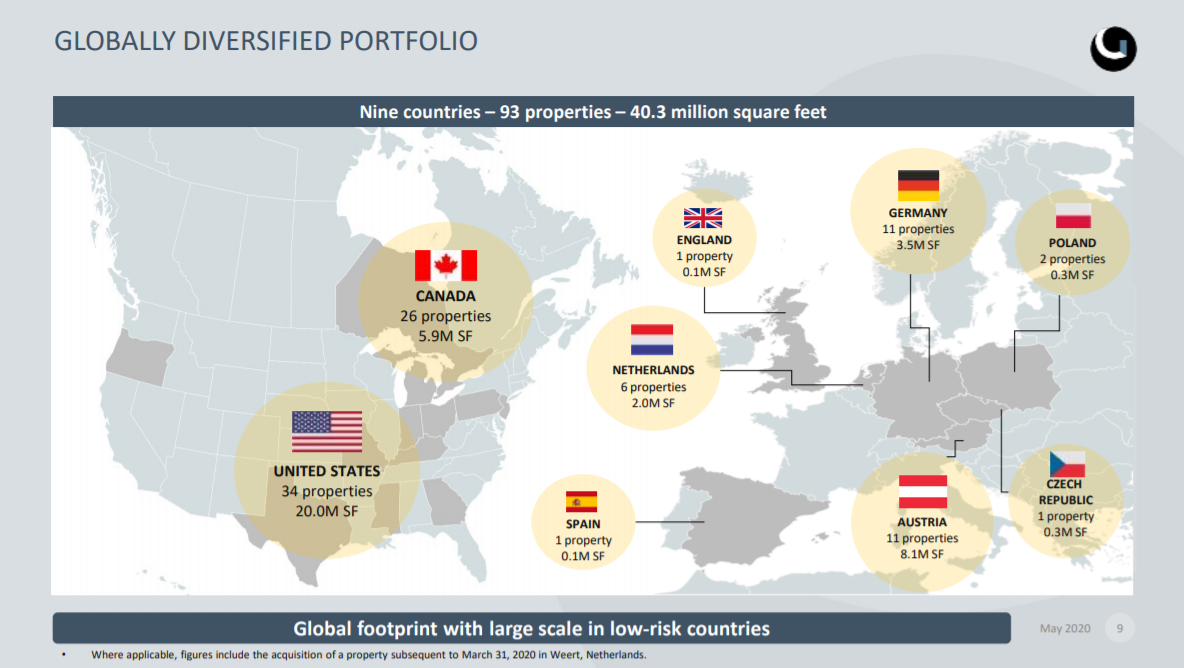

Source: Investor presentation, page 9

Granite is present only in countries with little or no geopolitical risk, and in properties and industries with strong long-term fundamentals. It is still very heavily concentrated in the US and Canada, with about two-thirds of its properties square footage located in North America.

Still, its international exposure provides a diversifying component to the trust’s results. Granite focuses on properties that support e-commerce development, and are located strategically to support such businesses in the best markets.

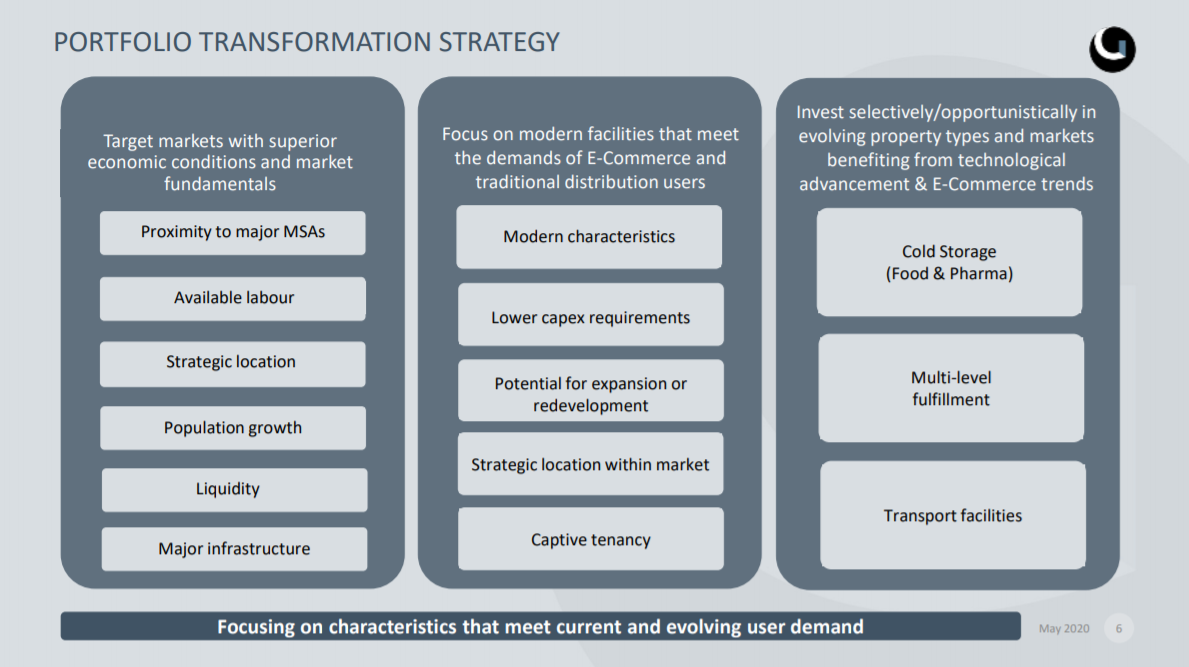

Source: Investor presentation, page 6

Granite seeks out areas that have proximity to major cities and have favorable demographics, including major infrastructure, and available labor pools. In addition, it buys properties that are already modern, meaning capital expenditure needs are low, with tenants that have high switching costs.

These characteristics mean that Granite is choosing only the most favorable properties to own with long-term tenants that have the best chance of thriving in various economic climates. Finally, it focuses on the enormous shift to e-commerce, with a particular focus on food and pharmaceuticals.

In short, Granite is betting that these characteristics will fuel its future growth, and results have certainly supported that notion.

Growth Prospects

Granite’s outlook is positive from a fundamental perspective, with the trust in the midst of a transformation. Granite is in the final stages of its years-long transformation in which it is optimizing its cost of capital, leverage on the balance sheet, and reaching what it considers a saturation point in critical target markets.

The trust went through a period of significant transition in recent years, switching out its CEO, board, and leadership team. Today, the trust is focused on transforming its portfolio through the sale of non-core assets, enhancing its presence in the U.S, and making purchases in select European markets.

Granite delivered on its prior stated goal of boosting the portfolio to more than 40 million square feet and carrying value of more than $4 billion, so we believe the highest levels of growth are likely behind the company. That said, future growth will be comprised mainly of rental increases, and selective acquisitions that are accretive to FFO. The boost for 2020 will be comprised almost entirely of acquisitions, which is part of the trust’s transformation plans.

Granite appears to have achieved its growth goals earlier than expected, and as a result we expect incremental investment to slow somewhat in the coming years. There is still a development pipeline in progress, with some properties in Europe and North America. However, Granite’s transformative moves have largely been completed.

Trends for e-commerce remain overwhelmingly positive and given the impact on physical retailers of COVID-19, it appears the trend towards e-commerce has only accelerated, which is a positive for Granite. It is therefore concentrating assets that fit its investment criteria to capitalize.

Granite’s growth outlook is favorable, given that it should continue to see higher rent prices, as well as a larger investment book through acquisitions and development.

Dividend Analysis

Granite currently pays a monthly dividend of $0.242 per share in Canadian dollars, which equates to ~$0.18 monthly in US dollars. The most recent dividend increase came in December of 2019, in the amount of 3.9%.

On an annualized basis, the current regular dividend payment is $2.904 per share in Canadian currency. In U.S. dollars, this works out to roughly $2.14 per share. This equates to a 4.3% yield.

It should be noted that if investors own the U.S. listing, the dividend will be subject to currency risk as it is translated from Canadian dollars to U.S. dollars. The dividend to U.S. investors will depend in part upon prevailing exchange rates, which currently stand at $1 CAD = $0.74 USD. Another important consideration for investing in international stocks is withholding taxes.

Note: As a Canadian stock, a 15% dividend tax will be imposed on US investors investing in the company outside of a retirement account. See our guide on Canadian taxes for US investors here.

Granite’s 4.3% dividend yield is supported with underlying cash flow. Based on adjusted FFO for 2020, Granite’s payout ratio is just 73%. That is much lower than in previous years as Granite is beginning to reap the benefits of its transformation strategy.

We believe Granite is going to grow FFO in the coming years and reduce the payout ratio, so in conjunction with the relatively low current payout ratio, we see the distribution as safe.

Final Thoughts

Investors can receive high levels of income and diversification benefits by considering REITs based outside the United States. Granite REIT is a good example of an international REIT with a high-quality business model, and an attractive dividend yield of 4.3%.

The trust has largely completed its transformation effort that diversified its portfolio, reduced risk, and enhanced its earnings growth prospects. We see this as supportive of future dividend increases, as the payout ratio has been reduced significantly. As a result, Granite remains an attractive option for investors looking for monthly dividends and a 4%+ dividend yield.