Gold Resource has three ways it can increase profitability in any given year. First, it can produce more metal. Second, it can lower its cost of production. Third, it can realize higher selling prices for the metals it mines. Unfortunately, 2020 will likely prove that the first two are unrealistic, while higher selling prices will be a tailwind temporarily.

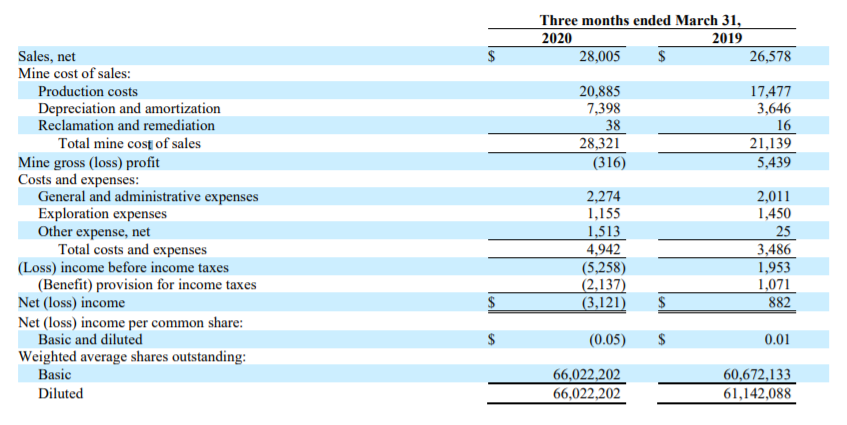

Indeed, first quarter results showed negative gross mine profit thanks to higher production costs.

Source: Q1 results

Production costs have risen for the past few years as the company has largely taken the easiest of the metals from its properties, and therefore, current and future volumes will likely continue to see higher costs. With negative gross profit in Q1, Q2 will certainly follow suit as the company’s operations in Mexico were shut down due to an order from the Mexican government. We may see a return to some sort of normal in Q3, as Oaxaca is back open and running, but Gold Resource has a tougher road ahead.

We see the company producing a loss this year, albeit slight, followed by a rebound in profitability next year. We note that much of this depends upon realized selling prices, and with gold near all-time highs, we are cautious on further gains in selling prices.

Higher volumes should help offset some of the rising production costs the company is seeing. But we still see a tough outlook in terms of profit growth.

Dividend Analysis

The dividend is of great importance to Gold Resource, and for shareholders as well. The current yield is about 1%, so it isn’t spectacular in that sense. However, the monthly payments help boost its attractiveness.

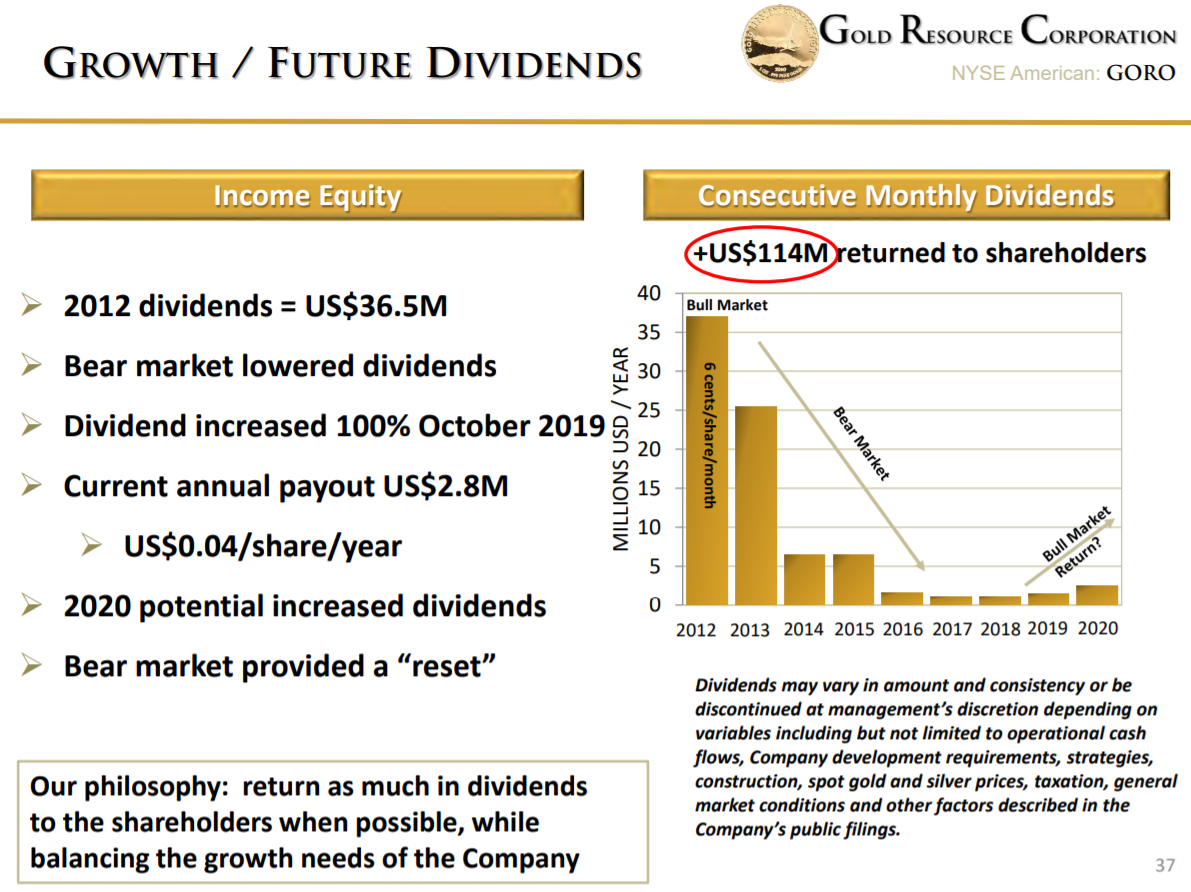

Source: Investor presentation, page 37

Gold Resource has cut its dividend on a few occasions. Metal pricing downturns have seen Gold Resource produce lower profits, and therefore, lower dividend payments to shareholders. Gold Resource paid more than $35 million in dividends in 2012, but in the past several years, that total has been below $5 million. This highlights the cyclicality of the company’s operations and why we are cautious on the company’s long-term prospects.

The current dividend of $0.0033 per share monthly equates to less than $3 million annually in cash expense for the company. We see this level as sustainable over the long-term, given the company’s earnings-per-share generation, as well as millions of dollars of operating cash flows.

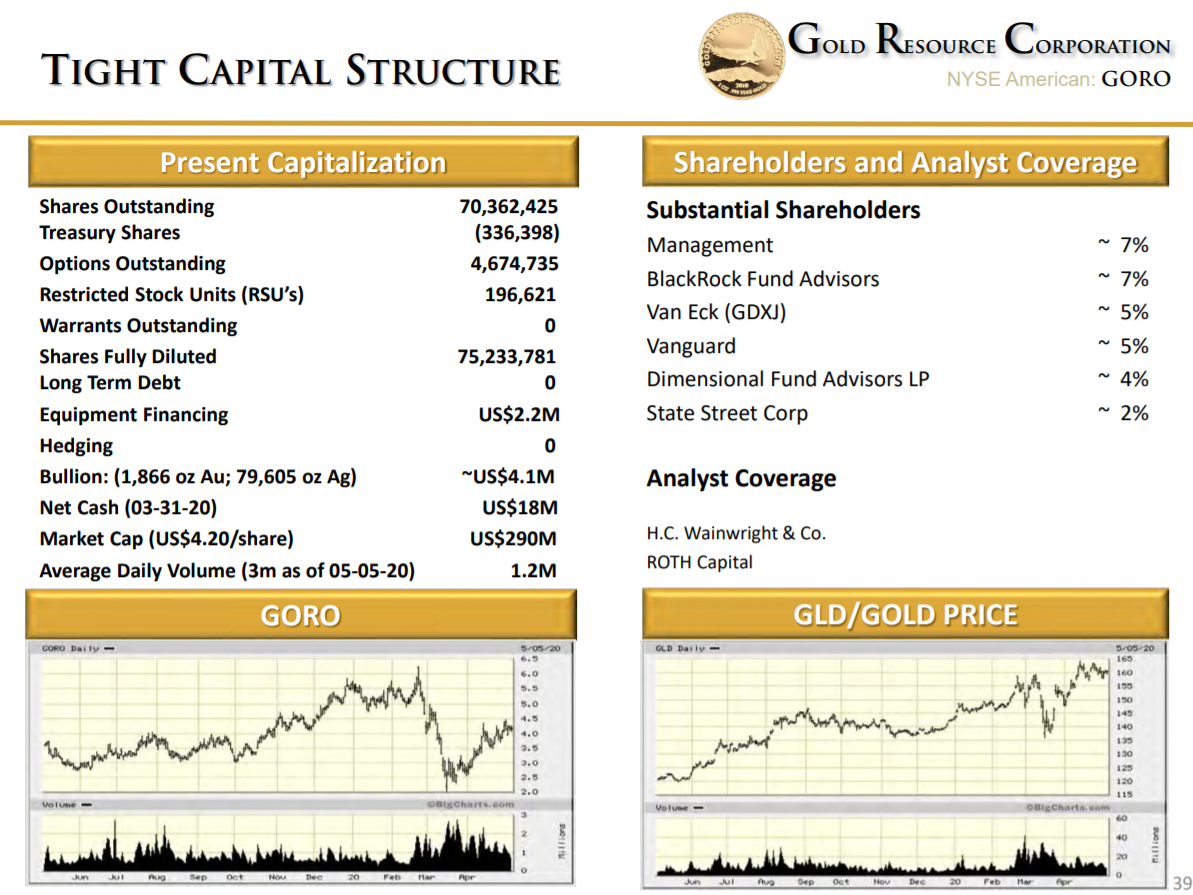

Source: Investor presentation, page 39

In addition, the company has a pristine balance sheet with zero long-term debt. With net cash of $18 million, it can afford to pay its dividend for years without producing any cash from operations. Thus, we see the current payout of $0.04 cents per share annually as safe and do not believe Gold Resources will cut its distribution any time soon.

Final Thoughts

Mining companies are generally beholden to prevailing prices for the metals they sell, and Gold Resources is no different in this respect. Where it is different is in the way it pays its dividends to shareholders monthly.

We see the dividend as attractive and sustainable at the current level. Gold Resources has plenty of cash on hand to continue to pay its dividend for a long time, and is producing more operating cash flows to help fund the dividend.

However, rising operating costs could impact profitability, and therefore earnings-per-share, in the coming years. Thus, we don’t see Gold Resources as a strong candidate for capital appreciation through rapid earnings growth. But with a 1% yield and a secure dividend, it is a decent choice for income investors.