Updated on March 5th, 2020 by Nathan Parsh

Real estate investment trusts – or REITs, for short – give investors a method to indirectly own high-quality real estate assets without the hassles and headaches associated with traditional real estate investment strategies.

They are also a great source of dividend income. Thanks to the steady cash flows delivered by rent or lease payments, REITs often have dividend yields well above the average stock in the S&P 500.

Global Net Lease (GNL) is one example of this. It has a 10.9% dividend yield, and it is a monthly dividend stock. This is very rare, as the vast majority of publicly-traded companies pay dividends on a quarterly basis.

We have compiled a full list of monthly dividend stocks. You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

With a dividend yield nearing 11%, Global Net Lease stands out even among the short list of high dividend stocks with 5%+ yields. You can see the full list of all stocks with 5%+ dividend yields here.

Global Net Lease’s very high dividend yield and monthly dividend payments make it an intriguing stock for income-oriented investors. This article will analyze the investment prospects of Global Net Lease in detail.

Business Overview

Global Net Lease is a triple net lease Real Estate Investment Trust that operates in many of the most important global economies, including the United States and various countries in Europe.

Triple net leases are those where the occupant is responsible for paying the three major secondary costs associated with buying real estate:

- Maintenance costs

- Insurance costs

- Property taxes

Triple net leases are also called net-net-net leases. Global Net Lease rents its international property portfolio to various corporations, often investment grade. The trust typically locks in its tenants under long-term contracts; Global Net Lease has a weighted average remaining lease term of 8.3 years as of the end of 2019.

Before becoming a publicly-traded investment vehicle, Global Net Lease was a privately-held REIT named American Realty Capital Global Trust.

One of the characteristics about GNL that stands out most to its investors is its global presence.

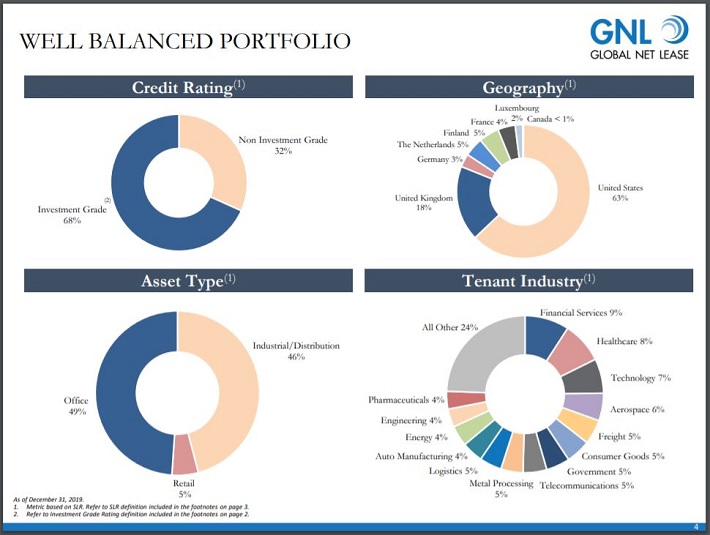

Source: 2019 Investor Presentation, slide 4

The company is highly diversified, with operations in the domestic United States as well as Europe. These markets were strategically targeted based on their high sovereign credit ratings, mature & growing economies, and low unemployment rates.

More specifically, Global Net Lease’s current portfolio includes investments in the following countries:

- United States

- United Kingdom

- Germany

- The Netherlands

- France

- Finland

- Luxembourg

- Canada

Global Net Lease is definitely a worldwide operation, but its United States portfolio still dwarfs its presence in Europe and Canada.

Presently, Global Net Lease has 278 properties worldwide, with 215 properties in the United States. The remaining 63 properties are found in Europe. Among tenants, 68.2% have a credit rating as investment grade.

Global Net Lease’s properties are fairly diversified as well, with no tenant industry accounting for more than 9% of all properties. Among asset types, 49% of properties are considered office, 46% are industrial or distribution and 5% are retail.

Growth Prospects

Since its inception in 2012 (as a private entity), Global Net Lease has grown by raising capital through the equity and debt markets and then deploying this new money into additional real estate assets.

Looking ahead, Global Net Lease’s growth will be largely driven by the execution of debt or equity issuances and the subsequent deployment into more properties, generating additional rental income.

Intuitively, this makes sense. As a real estate investment trust, Global Net Lease is required by law to pay out at least 90% of its net income as distributions to its shareholders. Thus, Global Net Lease turns to the public markets to raise more capital and drive fundamental growth.

Global net Lease needs to turn to capital markets to drive growth because adjusted-funds-from-operation, or AFFO, have been relatively stagnant over the past few years. AFFO has increased by less than 2% annually since 2015.

Investors likely won’t see a significant increase in AFFO due to the number of shares Global Net Lease issues to help fund acquisitions. Overall, we forecast no FFO-per-share growth over the next five years.

Competitive Advantages & Recession Performance

Global Net Lease’s competitive advantage comes from its considerable geographic diversification.

By having global operations, Global Net Lease is exposed to a much larger number of asset acquisition opportunities than its domestic-only counterparts.

The trust also benefits tremendously from its high-quality tenant base. Global Net Lease’s top ten tenants include well-known companies such as FedEx (FDX), the U.S. General Services Administration, ING, and Family Dollar. The trust isn’t too top-heavy either, as the top 10 tenants accounted for only 33% of total rents. This REIT also has a very long-dated lease maturity profile. Just 0.3% of leases are set to expire through 2022.

Global Net Lease was not a publicly-traded real estate investment trust during the last recession of 2007-2009, so investors cannot be sure exactly how the trust would react during an economic downturn. From a debt perspective, Global Net Lease’s positioning is reasonable for a REIT.

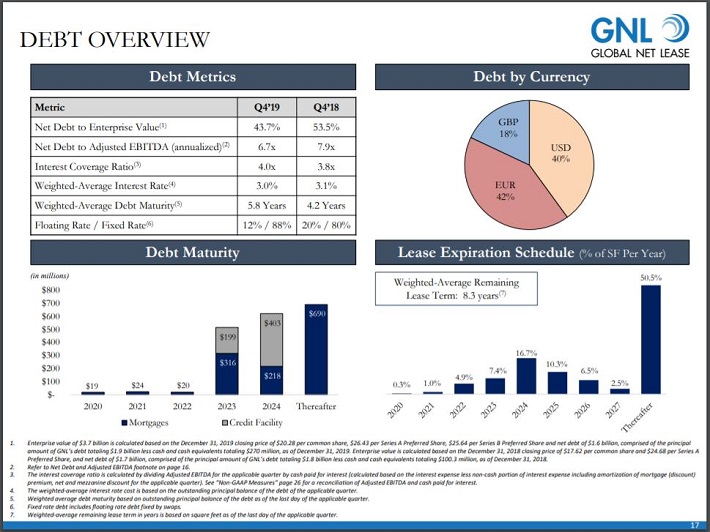

Source: 2019 Investor Presentation, slide 17

The trust’s net debt to adjusted EBITDA was 6.7x at the end of the fourth quarter of 2019, which compares favorably to net debt to adjusted EBITDA 7.9x at the end of the fourth quarter of 2018. This is still a fairly high level of debt overall, meaning investors should continue to monitor the company’s debt levels moving forward.

Further, the trust has an interest coverage ratio of 4.0x and a weighted average interest rate of 3.0%, both of which were improvements from the previous year. This gives the trust some margin for error in case of a recession or isolated operational difficulties.

The trust’s balance sheet also allows it fund purchases. For example, Global Net Lease completed $576 million of acquisitions in 2019 and has already purchased $273 million of properties in 2020.

Dividend Analysis

Investors likely own REITs because of the income they can produce. Given the size of its dividend yield and the lack of growth in funds-from-operations since its IPO, investors likely own the stock primarily for its nearly 11% yield. The trust has paid a dividend since 2015, but has maintained the same $2.13 payout since 2016. We don’t anticipate this changing, especially considering Global Net Lease’s habit of issuing shares to fund acquisitions.

For example, Global Net Lease issued more than 13 million shares in 2019 in order to make acquisitions. This led to adjusted-funds-from-operation of $1.85 in 2019, which was a 12% decrease from the previous year. This resulted in a payout ratio of 115%, the highest payout ratio that Global Net Lease has had, as the trust generally has had a payout ratio above 95% since inception.

For now, we anticipate that the trust’s dividend is likely safe. We cannot say with certainty how the trust would perform during a recession, because Global Net Lease has not experienced a downturn in the economy as a public company. A significant decrease in funds-from-operation could possibly lead to a steep dividend cut, as the payout ratio is already at a concerningly high level.

Final Thoughts

Global Net Lease offers a very high dividend yield and makes monthly dividend payments. This makes the trust attractive to investors looking for high levels of monthly income. Another plus for this business is that more than two-thirds of Global Net Lease’s tenants have an investment-grade credit rating.

That being said, Global Net Lease remains untested during an economic slowdown and the dividend often consumes all (or more) of adjusted-funds-from-operation. The elevated payout ratio for 2019 is quite concerning.

While we don’t have a sell rating on shares due to the high dividend yield, we find that Global Net Lease should only be purchased by investors with a very higher tolerance for risk.