Updated on March 13th, 2020 by Nate Parsh

Business development companies, or BDCs, are an attractive investment vehicle for those focused on generating income. They generally distribute most of their earnings to shareholders and as a result, typically have very high yields.

Gladstone Capital Corporation (GLAD) is a BDC with a current dividend yield above 10%. It is one of more than 200 stocks with a 5%+ dividend yield. You can see the full list of established 5%+ yielding stocks here.

And, including Gladstone Capital, there are less than 70 stocks that pay dividends each month, versus the more traditional quarterly or semi-annual payment schedules.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Gladstone Capital’s dividend yield towers above the rest of the market. The S&P 500 Index, on average, has a dividend yield of just over 2%, which is less than one-fifth of Gladstone Capital.

But a high yield is not enough if the underlying business is weak or the dividend is at risk of being cut. This article will discuss whether or not Gladstone Capital is a good investment option for income investors.

Business Overview

Gladstone Capital operates as a Business Development Company and invests in debt and equity securities, generating income primarily from its debt investments. It has a current market capitalization of $258 million.

As of December 31st, 2019, GLAD had total investments of $429 million at fair value. The company invests in middle market companies primarily through debt investments.

Gladstone Capital chooses targets in stable industries with sustainable margins and cash flows and favorable growth characteristics. The company focuses on non-cyclical and non-financial companies in order to avoid peaks and valleys in its target companies’ earnings. These are companies with leadership positions in their respective industries, growth potential, and annual EBITDA between $3 million-$15 million.

In order for Gladstone Capital to keep paying its hefty dividends to shareholders, which is its primary stated goal, it is critical that its investment portfolio continues to generate interest and dividend income and capital gains in excess of its operating and financial expenses.

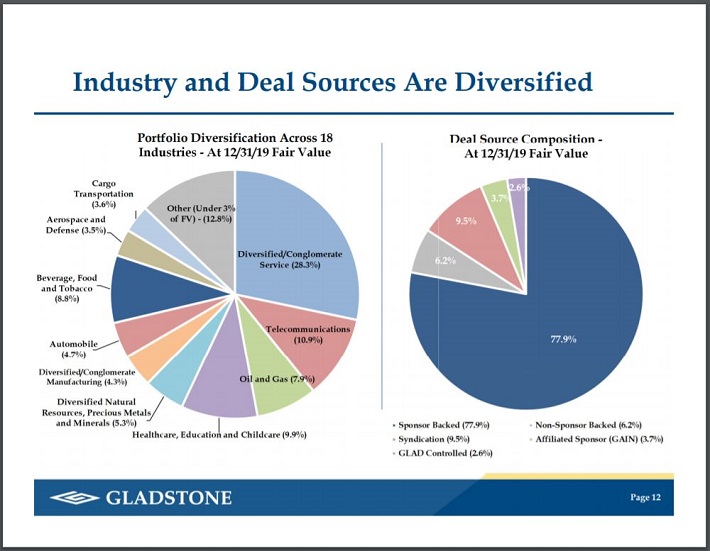

It has a diversified portfolio, both in terms of deal sourcing, and industry groups.

Source: Investor Presentation, slide 12

Loans made to these businesses are usually between $7 million-$30 million, with generally short terms of a few years. Equity investments include preferred or common stock. Gladstone Capital seeks to maintain a 90%-10% split between debt investments and equity investments.

Thanks to the company’s investment strategy, the company has considerable growth opportunities to look forward to.

Growth Prospects

Gladstone Capital is generating strong growth rates, thanks to its investment strategy. One of the most compelling growth catalysts for Gladstone Capital is rising interest rates. The company stands to benefit from higher interest rates because the vast majority of its debt portfolio is in variable-rate securities.

Approximately 90% of its debt portfolio is tied to floating rate investments. This means rising interest rates have the potential to significantly boost Gladstone Capital’s investment income.

According to the company, Gladstone Capital’s net interest income will increase by $776 million each year, if interest rates (as measured by LIBOR) rise 100 basis points. On a net interest income basis, the gain would be near $500 million. Of course, falling interest rates have the opposite effect, although the impact is mitigated from hedging activities.

Importantly, Gladstone Capital’s portfolio is protected against interest rate declines. A move down of more than 200 bps would result in only a small decline in net interest income. In other words, Gladstone Capital has all of the upside potential with essentially no downside in terms of the direction of interest rates. This is important considering recent rate cuts.

Gladstone Capital reported first fiscal quarter financial results in early February. Net investment income of $6.4 million was up fractionally from the same quarter last year. Investment income declined 4.4% year-over-year, but this was than offset by an 9.6% decrease in operating expenses and fees.

Net asset value declined 1.7% year-over-year, to $8.08 per share. Portfolio investment activity continues to accelerate, which should help grow net asset value over the long-term.

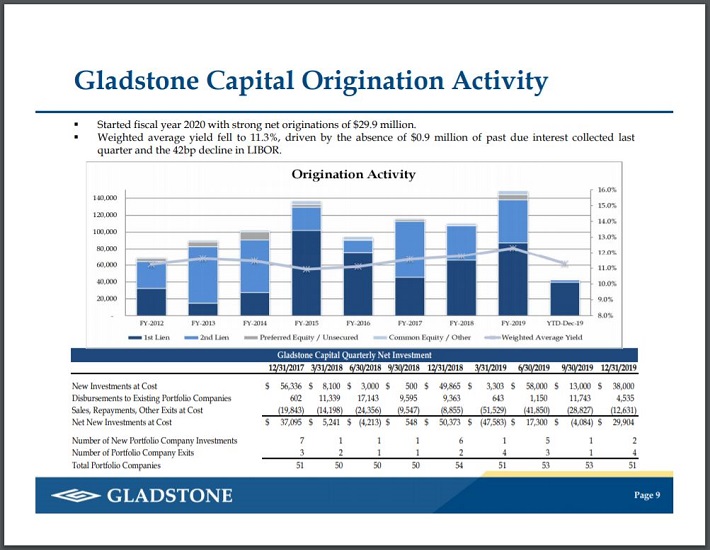

Source: Investor Presentation, slide 9

The company has made a habit of producing a relatively high number of new originations over time, which helps with portfolio and earnings growth.

In addition, its weighted average interest rate remains above 11%. Both of these tailwinds have helped Gladstone Capital in recent years and we believe these tailwinds will continue.

Dividend Analysis

Gladstone Capital pays a monthly dividend, which allows shareholders to receive 12 dividend payments per year, more frequent than four quarterly distributions. It recently declared its monthly dividend of $0.07 per share, which is where the payout has been since April 2009.

In other words, while the dividend hasn’t been cut, it has been more than a decade since it was increased. We believe it is unlikely that Gladstone Capital will raise its distribution in the near future. On an annual basis, Gladstone Capital continues to pay a dividend of $0.84 per share. Based on its current share price, this equates to a dividend yield of 12.1%.

Gladstone has made nearly 200 consecutive monthly cash distributions on its common stock. Before moving to a monthly dividend schedule, it had paid eight consecutive quarterly common stock cash distributions.

Therefore, Gladstone Capital has a solid track record of steady payouts, even during the Great Recession of 2008-2009. The company can maintain its high yield, thanks to its tax classification, and its favorable fundamentals. BDCs are required to distribute at least 90% of any taxable income. This eliminates income tax at the corporate level, allowing capital gains to be passed through to shareholders, similar to a REIT.

The company’s net investment income in Q1 was $0.21 per share, exactly the same amount as the dividend.

Its payout ratio is 100% as of today, implying a lower measure of safety than perhaps shareholders would like. BDCs will always have high payout ratios due to the tax rule of distributing nearly all of their income, but it is easy to see why Gladstone Capital hasn’t raised its payout for such a long time.

This is a tight payout ratio, which means the company may not be able to sustain a major economic downturn and maintain its dividend. As a result, were another significant financial crisis to occur, Gladstone Capital’s dividend could be in jeopardy. That said, assuming continued economic growth, its dividend appears to be sustainable. But the high payout ratio introduces relatively high risk to the sustainability of the dividend, particularly during a recession.

Final Thoughts

Investors should approach sky-high dividend yields with caution. High yields are commonplace in the BDC asset class, but many have cut their dividends over the past few years. For its part, Gladstone Capital management continues to believe the dividend is sustainable, and to be clear, we do not believe a dividend cut is imminent.

However, investors will need to pay close attention to the company’s future earnings reports. It has a very tight payout ratio and any significant deterioration in the performance of its investment portfolio could threaten the dividend.

With interest rates on the decline to begin 2020 and the likelihood of additional rate cuts this year, Gladstone Capital’s net interest income will likely remain challenged. While income investors may find the yield attractive, we rate shares as a sell due to the expected impact of lower interest rates.